Accounting (accounting) is a specialty that is quite difficult to study. It contains many terms, operations, and instructions that are not always easy for a beginner to master. However, this does not prevent the use of self-study, both online and with the help of tutorials. This allows you to understand the details of the theory, but a lot of practice is required. You can learn accounting for dummies at one of the special educational institutions, of which there are quite a few. Learning accounting from A to Z requires a lot of practical experience. It is acquired in the process of work. Accountants who prefer remote work are able to run several companies at the same time, and still have a lot of free time.

What it is?

The accounting course is for beginners; its basics involve studying the presented specialty. It is an orderly system for collecting, recording and summarizing data that is indicated in monetary equivalents. The specified data stores information about the property, obligations of the company and their movements using continuous, continuous and documentary accounting of all business transactions.

Self-paced course “accounting for beginners”

Important! In simple language, accounting for dummies implies all movements of funds in an account, their receipt and debiting, accounting for movable and immovable property, which are displayed in special documents.

Simple accounting in the organization is carried out in accordance with the law. The functions are performed by the following persons:

- chief accountant who works for the company according to an employment contract;

- general director, if the chief accountant is absent;

- an accountant who is not the main accountant;

- a hired company that provides accounting services.

In the process of activity, the main thing that every accountant needs to know is the accounting objects, obligations and business transactions that are carried out by companies in the course of their work.

Note! Accounting Basics for Beginners is a step-by-step course that anyone can begin.

There are many private businesses and educational institutions that offer good training courses.

Accounting is called upon to solve all sorts of problems in creating and providing reliable and complete information or reporting about the work of the company and its property status. This information is required by internal users of reporting, for example, owners, shareholders, managers. External users, such as creditors, investors, partners and other persons, also have the right to access it. The documentation and data presented therein help in the following cases:

- if necessary, prevent negative results of the enterprise’s economic activities;

- determine on-farm reserves to obtain financial stability of the enterprise;

- monitor compliance with laws and regulations during the management of business operations;

- ensure verification of the feasibility of certain business transactions;

- check the presence and movement of liabilities and property;

- check the use of labor, financial and other material resources;

- check the compliance of the work in accordance with approved estimates, standards and regulations.

“Tutorial on accounting” G.A. Ponomareva: ed. "Prior"

This little paperback book once helped me relearn accounting.

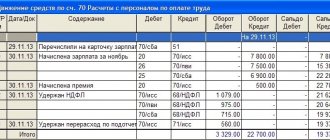

This is my favorite accounting book. The best guide for students, beginners and self-studying accounting. In the tutorial, using the example of a certain enterprise, the accounting of business transactions for the reporting period is fully disclosed. The theory is given and immediately practical application with filling out all the necessary documents. Accounting entries cover the period from the beginning of the enterprise's activities and the formation of the authorized capital to the conclusion of the final financial result. The connection is very well explained and the path between primary documents and accounting registers is spelled out. Wonderful register tables are provided.

I studied basic transactions, theory, and filling out accounting forms using the Self-Teacher.

Thanks to this small tutorial, I quickly mastered the chart of accounts and posting typical business transactions of an enterprise. In addition, at the enterprise where I was hired as an accountant after technical school, initially there was no accounting program and I made most of the forms for keeping records in Excel. The basis was precisely Ponomareva’s self-instruction manual.

Profession

The profession of an accountant implies an employee who is obliged to monitor the profits and losses of an enterprise and prepare the appropriate financial documentation. An employee of this specialty is present in any private or public company and organization.

Main functions

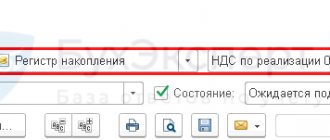

Accountants' activities today are carried out in electronic systems, for example, 1C. With their help, a specialist can collect and organize the necessary data and perform the required calculations.

The main responsibilities of the profession are as follows:

- performing calculations of production costs and income received;

- control over financial discipline;

- registration of wages for company personnel;

- working with tax organizations;

- creating and sending financial reports.

The number of representatives of the profession at each enterprise depends on its size, number of employees, area of work and other factors. Small companies can be content with the services of a freelance accountant, while large companies have a whole staff of representatives. In the latter case, each individual specialist is required to perform a specific set of tasks. This may include issuing wages, monitoring and calculating expenses for the period.

Important! Regardless of the size of the company, the services of an accountant are necessary for it.

After its introduction in 2013, the specialty became one of the most in demand. Even small business owners must have an employee who is responsible for tax and financial reporting.

Specialists studying accounting for dummies must be prepared for monotonous work, which involves a large amount of documentation. Communication skills, resourcefulness and stress resistance will not hurt. Attentiveness must be at the highest level. Often, the success and reputation of an enterprise depends on the quality activities of a specialist in this field. Good professionals are worth their weight in gold and have a high income.

“Restoration of accounting or how to “reanimate” a company” S.A. Utkina, M: Eksmo, ed.

Organizations often encounter situations where they need to restore accounting at the enterprise.

The reasons for this may be different: the accountant left, records were not kept for some time, there were changes in legislation. Accounting restoration is one of the individual services that auditors and accounting firms typically provide. But these services are not cheap.

Let’s assume that the head of the organization decided to assign the restoration of accounting to a new accountant. What should he do in such a situation? Experienced accountants will quickly understand what needs to be done and what steps to take. If the accountant is young and not experienced, it will be more difficult for him.

Most likely, a newbie will turn to accounting forums for help, where they will most often tell him what to do. There is another way out that will allow you to see possible errors and methods for solving them in one place - the book by S.A. Utkina “Restoration of accounting or how to “reanimate” a company.” As the author writes: “Most importantly, don’t despair.”

The author explains in detail where to start restoring records, which authorities should be contacted and why. The procedure for restoring accounting and mistakes that should be avoided are described. Separately, the following is considered: the procedure for identifying and correcting errors in transactions in various sections of accounting, correcting errors in tax registers and possible liability for loss of documents.

A large section of the book is devoted to the author’s recommendations on how to check the correctness of record keeping in order to prevent a situation involving the restoration of records.

The book contains many different tables and completed document forms that allow you to more fully and comprehensively use the author’s recommendations.

This book deserves to be in the library of every specialist interested in maintaining and restoring records.

Concepts

A specialty implies the presence of a large number of special definitions, terms and definitions that a person not involved in finance cannot understand.

Users

The basics of assets and liabilities of the balance sheet for benefits “for dummies” can be learned from scratch. You should start by learning the following basic terms:

- A balance sheet asset represents the company's property reserves, which are divided into current and non-current. The former include finished goods, raw materials and other things that generate profit. The second includes investments and company property.

- A liability represents the funds that create an asset.

- The debtor is the debtor organization.

- The creditor is the company that lent money to the company.

- A penalty is a fine that is collected as a result of failure to fulfill certain obligations or conditions of companies that are parties to an agreement or contract.

- Trading profit, which indicates the difference between revenue and cost of production.

- Book profit is the number resulting from all profits received from the sale of a company's products, property and assets.

- A non-resident is a person who works on the territory of the Russian Federation, however, they are registered in another state.

- The authorized capital is the amount of funds that was invested by the owners of the enterprise for creation.

Not all terms and concepts that are present in the profession are presented.

What knowledge does a beginner need?

A novice accountant must know mathematics at a good level. Although calculations and other activities are performed automatically, using electronic programs, knowledge of mathematics is necessary.

Concepts

This brings up the need for knowledge and ability to work with a computer and a basic set of office programs. It is required to create statements and reports, as well as send them to special organizations, in electronic form.

It is also better to have basic knowledge in finance and economics, since you will have to deal with a large number of special terms and definitions.

Where can I study from scratch?

As of 2022, accounting can be studied independently, using online training, in a specialized training center. There are many courses that help improve your skills. You can learn a profession at a higher education institution or college of economics.

In domestic conditions, the most in demand are specialists who know all the latest business methods. This level of education can only be provided by educational institutions that are located in the central part of the Russian Federation (best of all, in the capital or other large cities).

Education can be obtained at the following universities:

- University of Humanities and Economics;

- International Academy of Management and Business;

- Institute of Business and Law;

- MATI;

- MNEPU.

Note! The highest quality educational institutions in the capital are listed.

It is often best to major in finance or a similar one. The list of subjects includes accounting. After graduating and receiving a diploma, you can work as an accountant.

For people who plan to engage only in the activities presented, it is better to take online courses. This will take a small amount of time and money, and will then allow you to begin activities in your specialty. However, a high-quality approach to study is required, since employers value university graduates more.

Creating an accounting policy

An accounting policy is an internal organizational document that regulates the principles of accounting and tax accounting. The UP must be drawn up and approved within 90 days from the date of state registration of the company. It describes all the accounting features in your business.

As a rule, the CP is created and applied consistently from year to year and does not change. Adjustments may be made in connection with the opening of a new direction in the company’s activities or when legislative norms change.

It is worth noting that the UE is often necessary when passing inspections.

The accounting policy states:

- the chosen accounting method and responsible persons;

- accounting form;

- developed charts of accounts;

- classification of income and expenses;

- approved forms of primary documents;

- methods for revaluation of OS;

- procedure for assessing inventories;

- approved document flow schedule;

- techniques for individual operations.

The policy must be approved by the manager by appropriate order.

Where is the best place to start?

You should start with long-term reflection and thinking about whether you are ready to subsequently work with a “bunch” of papers and routine. It may be better to choose a more active focus.

Schematic definition of specialty

If the decision is made, the candidate can choose one of two directions:

- the process of obtaining education at a university or college. You can get a full-fledged higher education or go to study after finishing the ninth grade of school. Employers clearly prefer to hire specialists with higher education. If you want to work and study, you can enroll in a correspondence course;

- Remote education. Today there are many options for this type of training. These could be webinars, online courses, self-study of books and articles. It is necessary to study the work in basic accounting programs. Now there are many resources on the Internet that offer to go through the study process; choosing a good one is not a problem.

In the case of independent education, maximum effort is required. Industrial practice and advanced training courses that teach the latest accounting management techniques will also be a good plus. Employers are still quite skeptical about people who have received distance education, therefore, the skills listed above are simply necessary to get a job.

With the right level of desire and assertiveness, you can become a good specialist on your own. However, it should be understood that competitors with a diploma have more advantages. Therefore, it is still recommended to obtain a full-fledged higher education and ensure a stable career.

Instructions

The step-by-step plan for self-study consists of the following points:

- education online or using specialized literature with practical tasks;

- books for more detailed training and practical experience in taxation, accounting, auditing;

- taking special courses to improve qualifications;

- testing acquired skills and knowledge by completing online tests;

- Internship;

- apparatus employed.

“Accounting self-teacher” by N.P. Kondrakov (years of publication and publishing house are different)

Kondrakov is a classic author of books on accounting.

Many modern specialists studied from his books. Kondrakov has repeatedly been on the lists of literature recommended for preparation for passing the audit exam. Many accounting articles list his books in their reference lists. The tutorial provides a practical problem that concerns many sections of accounting, up to the financial result.

I once read that the language of Kondrakov’s books is academic, classical. But the author reveals the accounting sections in detail and talks very thoroughly about the nuances.

Kondrakov's books have been republished several times. Of course, I recommend Kondrakov for study and use. Especially for students, for completing various coursework and writing a diploma.

Deadlines

The duration of training depends on primary education. After ninth grade, you will have to study in college for almost four years. After high school, acquiring college skills will take almost three years. You can get a higher education in economics, which will take five years.

Homeschooling depends on the individual's background knowledge and abilities. For some, a year may be enough, while others will have to spend three or more years.

Learning to become an accountant is quite easy. Modern teaching methods make it possible to receive education online. There are specialized educational institutions from which you can graduate with a diploma. Depending on the chosen path, you will have to study for a certain time. The main thing is readiness to obtain the presented specialty, perseverance and perseverance.