Income from main activities

The company prescribes the main activities in its charter.

If a specific type of activity is not specified in the charter, then it must be checked according to the criterion of materiality. That is, the main type of activity can be considered any work or services if the proceeds from their sale are at least 5% of its total amount. Otherwise, such income is classified as other income.

Income from ordinary activities may also include income from leasing property, participating in the authorized capital of other organizations, granting rights to intellectual property for a fee, etc.

If the main activity of the company is participation in the authorized capitals of other organizations, dividends are included in revenue. They are reflected net of income tax, which is withheld by the tax agent upon payment.

Book of the Year!

Everything you need to submit a report that will satisfy both the director and the tax office. “Annual report edited by V.I. Meshcheryakov” is already on sale. There are several purchasing options: just a book, a package of information publications for accounting, and with a subscription to the press.

Companies whose investment of funds for the purpose of receiving interest is part of ordinary activities, then revenue is all interest on any types of debt obligations: loans, bills and bonds, deposits (clauses 7 and 18 of PBU 9/99). Such companies include, for example, pawn shops.

The amount of revenue is determined based on the price established by the contract, taking into account all discounts: both those that change the price of the product and those that do not affect the price (clauses 6.1, 6.5 of PBU 9/99).

Thus, according to paragraph 6 of PBU 9/99, revenue is the amount of receipts of money, other property or receivables. Regardless of the amount of payment received from customers (full, partial or zero), reflect the revenue in accounting based on the full cost of shipped products, works or services.

Example. How to reflect revenue on line 2110 of the income statement

In the reporting year, Aktiv JSC sold goods worth RUB 1,200,000. The company is not a VAT payer. For the shipped goods, buyers transferred only 800,000 rubles to Aktiva. In the accounting records of “Asset” the following entries were made: DEBIT 62 CREDIT 90-1

– 1,200,000 rubles.

– the debt of buyers for shipped goods is reflected; DEBIT 51 CREDIT 62

– 800,000 rub. – partial payment has been received from buyers. In the financial results report for the reporting year on line 2110, the accountant must reflect revenue in the amount of 1,200 thousand rubles.

For VAT purposes, sales also include the gratuitous transfer of ownership of goods, works and services. For example, distributing samples of goods for advertising, giving holiday gifts to company employees, etc. However, during such operations the company does not receive revenue. Therefore, in such a situation, no entries are made on line 2110 of the report.

Read in the berator “Practical Encyclopedia of an Accountant”

How to determine revenue using the accrual method

Registration

The Recommendations for conducting an audit of the annual financial statements of organizations for 2013 (letter of the Ministry of Finance of Russia dated January 29, 2014 No. 07-04-18/01) stated that the asset recognized in accounting according to PBU 2/2008 is “Not presented for payment” accrued revenue" in the balance sheet is reflected in current assets as a separate indicator detailing the group of items "Receivables".

The Recommendations for conducting an audit of the annual financial statements of organizations for 2014 (letter of the Ministry of Finance of Russia dated February 6, 2015 No. 07-04-06/5027) explain that in the case where stages of work are highlighted in a construction contract, the proceeds from such an agreement is recognized both for completed stages and for stages not completed and not accepted by the customer at the reporting date. Since, in accordance with paragraph 17 of PBU 2/2008:

- revenue and expenses under a construction contract are recognized on an “as ready” basis if the financial result (profit or loss) from the execution of the contract as of the reporting date can be reliably determined;

- The “as ready” method provides that revenue under the contract and expenses under the contract are determined based on the degree of completion of the work under the contract confirmed by the organization as of the reporting date and are recognized in the income statement in the same reporting periods in which the relevant work was completed, regardless of whether , whether they should or should not be presented to the customer for payment before the complete completion of the work under the contract (the stage of work provided for by the contract).

That is, this standard covers both contracts that do not provide for stages, and those that contain a condition for the stage-by-stage delivery and acceptance of work (we are talking about contracts whose duration is more than one reporting year (long-term in nature) or start dates and the end of which falls on different reporting years (clause 1 of PBU 2/2008)).

Consequently, revenue under a “long-term” or “rolling” contract is recognized at the time of completion of each stage, as well as at each reporting date for stages that are not completed and not accepted by the customer.

Let us recall that if, according to the accounting policy, the organization reflects accrued revenue not presented for payment in account 46-2, the following correspondence of accounts is used:

Debit 46-2 Credit 90-1

— reflects the amount of accrued unreported revenue (as of the reporting date);

Debit 90-2 Credit 20

— the amount of expenses recognized under the contract is written off (as of the reporting date);

Debit 62 Credit 46-2

— interim invoices were issued to the customer for payment for work performed (based on the terms of the contract).

In addition, you need to remember that revenue under the contract, recognized in the “as ready” method, until the work (stage) is fully completed, is accounted for as a separate asset - “accrued revenue not presented for payment” (clause 26 of PBU 282008).

Regulatory legal acts on accounting do not establish methods for determining the degree of completion as of the reporting date of products, services, and work other than work under a construction contract.

Meanwhile, in accordance with paragraph 7 of PBU 1/2008, if accounting methods are not established for a specific issue in regulatory legal acts, then when forming an accounting policy, the organization develops an appropriate method, based on this and other accounting provisions, as well as International Financial Reporting Standards. At the same time, other accounting provisions are applied to develop an appropriate method in terms of similar or related facts of economic activity, definitions, recognition conditions and procedures for assessing assets, liabilities, income and expenses.

Thus, this procedure can be applied not only by construction organizations, but also by all others that perform work, provide services, and sell products with a long manufacturing cycle.

That is, when recognizing in accounting revenue from performing specific work, providing specific services, selling products as they are ready, it is advisable to develop a method for determining the degree of completion of work, services, products as of the reporting date based on PBU 2/2008 (regarding the method for determining the degree of completion of work under a construction contract).

What is not included in the company's income?

The following receipts are not income and are not reflected in the report:

- amounts of value added tax, excise taxes and export duties received as part of revenue;

- money that does not belong to the company, received through intermediary transactions (commission agreements, commissions, agency agreements);

- advances received as payment for products (works, services);

- deposit amounts;

- the amount of the pledge, if under the agreement the pledged property is transferred to the pledgee;

- amounts received to repay a loan or loan.

VAT and excise taxes to determine revenue are subtracted from total income.

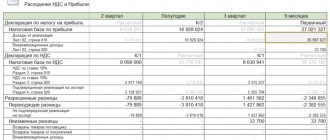

Calculation of line 2410 “Statement of financial results”

The choice of method for forming the amount of consumer goods is recorded in the company’s accounting policy. In any case, the indicator in this line must coincide with the amount of NNP. The presence of PNO/PNA and ONO/ONA is reflected in the amount of consumer goods by the necessary corrections. To do this, in line 2421 of the report, information about PNO and PNA is indicated as reference information.

In accounting, PNO is indicated on the debit of the account. 99/PNO-PNA from credit account. 68/NNP, accordingly PNA is reflected on the credit account. 99/PNO-PNA.

Page 2421 = D/rev 99/PNO – K/rev 99/PNA

Exceeding the credit amount indicates the presence of PNA; it is written on page 2421 without brackets.

Transformations of IT are recorded on page 2430. This is the difference between the turnover on credit and debit of the account. 77, corresponding to the account. 68/NNP.

Page 2430 = K/rev 77 – D/rev 77

If the credit turnover is greater than the debit amount, then the excess amount is indicated in the line in parentheses.

Changes in ONA are calculated between debit and credit turnover on the account. 09.

Page 2450 = D/rev 09 – K/rev 09

An excess of debit turnover indicates the presence of ONA and in the report this amount is added to the conditional expense for NNP, and the excess of credit turnover is recorded in the line in brackets.

Let's consider how to reflect the value of consumer goods in the “Report on Financial Results” using the example of a company filling out a report based on the proposed initial accounting data.

Conditions for recognizing revenue in accounting

Revenue is reflected in the income statement based on the total credit turnover of subaccount 90-1 “Revenue”, reduced by the total debit turnover of subaccounts 90-3 “Value Added Tax” and 90-4 “Excise Taxes”.

Revenue is reflected in the income statement if the following conditions are met:

- the company has the right to receive this revenue (this can be confirmed, for example, by an agreement);

- the amount of revenue and the expenses associated with its receipt (for example, cost of goods sold) can be determined;

- there is confidence that this or that business operation will increase the economic benefits of the company;

- ownership of the product (goods) has passed to the buyer, the work has been accepted by the customer or the service has been provided.

If these conditions are not met, then the accounting records reflect not revenue, but accounts payable. That is, show the funds received from the buyer as part of advances received or deferred income.

Read in the berator “Practical Encyclopedia of an Accountant”

How to record revenue if the buyer is provided with a commercial loan

When determining the amount of revenue, you must first of all proceed from the contract price of the products (works, services) sold. If it is not specified, then to determine the amount of revenue, use the price of similar goods (work, services) that are sold under comparable conditions.

Example. How to determine the amount of revenue

In the reporting year, Passiv LLC renovated the warehouse premises. The cost of repair work is not specified in the contract, but it is described in detail in the specification. “Passive” performed work similar in scope and list for other organizations for 480,000 rubles. (including VAT - 80,000 rubles). Upon completion of the work, the following entries were made in the liability account: DEBIT 62 CREDIT 90-1

– 480,000 rubles.

– revenue from repair work is reflected; DEBIT 90-3 CREDIT 68 SUBACCOUNT “VAT CALCULATIONS”

– 80,000 rubles. – VAT is charged on revenue. In the financial results report of Passive for the reporting year, line 2110 reflects revenue in the amount of 400 thousand rubles. (480,000 – 80,000).

Read in the berator “Practical Encyclopedia of an Accountant”

How to determine revenue using the cash method

Line 2410 of the “Income Statement” - transcript

Line 2410 reflects the TNP equal to the amount of tax calculated for payment and recorded on page 180 of Sheet 02 of the income tax return (TNP). In the OFR it is indicated in parentheses, since this value is deductible.

You can calculate line 2410 of the “Income Statement”:

- Based on accounting data. Moreover, the value of consumer goods must be equal to the amount of goods recorded in the declaration. TNP is calculated based on the amount of conditional expense/income for NTP, adjusted by the amount of permanent tax liabilities/assets (PNO, PNA) and transformations in the amount of deferred tax liabilities/assets (ONO, ONA). The conditional expense for the tax return is the amount of tax established by multiplying the accounting profit by the current rate, and, conversely, the conditional income is the estimated tax amount obtained by multiplying the amount of the loss by the rate of the tax rate. This amount is indicated on the account. 99 separately (often accompanied by relevant analytics). If there are no adjustments arising from permanent or deferred liabilities/assets in the company for the reporting period, then TNP, equal to the tax accrued for payment, corresponds to the conditional expense for TNP;

- Based on the data from the declaration on NNP, taking into account the existing PNO/PNA and ONO/ONA.