What are the features of accounting for pawnshops? In what order are the accounting (financial) statements of pawnshops prepared?

The activities of pawnshops are regulated by Federal Law No. 196-FZ of July 19, 2007 “On Pawnshops” (hereinafter referred to as Law No. 196-FZ). A pawnshop is a legal entity - a specialized commercial organization, the main activities of which are providing short-term loans to citizens and storing things (Clause 1, Article 2 of Law No. 196-FZ).

The most common type of pawnshop is a jewelry pawnshop (the type of collateral is Gold and jewelry made of precious metals).

The pawnshop, at its own expense, is obliged to insure in favor of the pledgor the items accepted as collateral in the full amount of their value. The valuation is established by the pawnshop at the time the item is accepted as collateral. The pawnshop does not have the right to use and dispose of the pledged items (clause 3 of Article 358 of the Civil Code of the Russian Federation).

FEATURES OF PAWNSHOP OPERATIONS

PAWNSHOP: FEATURES OF THE PROGRAM FOR ACCOUNTING

Basics of pawnshop operation in modern conditions

For a long time, there was no such organization as a pawnshop in the country. Now she doesn't seem as exotic as before. Pawnshops are commercial specialized organizations that perform the following types of activities:

- issuing short-term credits (loans) to clients (individuals only);

- ensuring storage of property serving as collateral.

Organizations are also allowed to inform the client and provide advisory services. In addition to the main types of work, a pawnshop carries out one-time transactions for the sale of fixed assets and surplus inventory. This organization acts as a legal entity and is not permitted to carry out any other business activities other than those specified above.

A commercial enterprise operates based on the Civil Code and legislation, in particular the federal law “On Pawnshops”. Since pawnshops are engaged in short-term lending, the regulation of their functions in providing loans is entrusted to the Bank of Russia. But licensing for such activities is not provided.

The pawnshop is allowed to carry out some banking operations; it stores valuables and is responsible for their safety.

Pawnshop as a business

Keeping records and calculating taxes is impossible without understanding the legal basis of the company's activities. Therefore, let us turn to the Federal Law of July 19, 2007 No. 196-FZ “On Pawnshops”. But we warn you right away – this is not an easy business.

A pawnshop is prohibited from engaging in any other business activity other than providing short-term loans to citizens, storing things, and providing consulting and information services. But a pawnshop can make one-time transactions for the sale of fixed assets and surplus inventories.

Only a legal entity can be a pawnshop. An individual entrepreneur does not have the right to carry out this activity. Pawnshops operate under the general taxation regime. They cannot apply the “simplified tax” (paragraph 7, paragraph 3, article 346.12 of the Tax Code of the Russian Federation), and in connection with the provision of household services to the population, they are not threatened with UTII (paragraph 7, article 346.27 of the Tax Code of the Russian Federation).

The pawnshop issues loans to individuals exclusively on the security of property (Clause 1, Article 7 of Law No. 196-FZ). The loan agreement is made in writing and is considered concluded from the moment the loan amount is transferred to the borrower and the item being pledged is transferred to the pawnshop. The income from this activity is interest on the loan. The pawnshop, although it conducts cash payments with borrowers, does not use cash registers. He uses strict reporting forms.

A necessary expense item for a pawnshop is insurance of items accepted as collateral in the full amount of their valuation (clause 3 of Article 358 of the Civil Code of the Russian Federation).

Items pledged do not become the property of the pawnshop. If the borrower fails to fulfill his obligations under the loan agreement, the pawnshop has the right to foreclose on the pledged (unclaimed) item. In other words, sell it. After the sale of such an item, the pawnshop’s claims against the borrower are repaid, even if the amount received from the sale is not sufficient to fully satisfy them. But it may happen that the amount of proceeds turns out to be higher than the amount of the borrower’s obligations or the amount of the property’s valuation. In this case, the pawnshop is obliged to return part of the money to the citizen.

Pawnshops are classified as organizations whose operations fall within the scope of the Federal Law of August 7, 2001 No. 115-FZ “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism.” For this reason, they are subject to registration with Rosfinmonitoring and are required to interact with it in the prescribed manner. In particular, the pawnshop must develop appropriate internal control rules.

Documentary registration of a loan issued against property collateral

Money is lent to clients only on the security of liquid property provided by them. An employee of a commercial organization fills out a deposit ticket (PO) in a form that complies with the recommendations of the Ministry of Finance. ST is a document of strict reporting. It contains data about:

- The amount of valuation of the property provided as collateral.

- The size of the loan issued to the client.

- The date of the operation, its timing.

- The percentage to be paid to the client.

The first copy of the LO (original) is issued to the client, the second is kept by the creditors. When property is assessed and deposited, it is necessary to issue a safety receipt (personalized). If the property is sold, the pawnshop pays off its claims against the client who borrowed money from him. This is also true when revenue is not enough to cover expenses.

This commercial enterprise is under the constant supervision of law enforcement agencies and interacts with the federal financial monitoring service.

Pawnshop operating rules

The pawnshop operation scheme is structured as follows:

- The client approaches the institution with personal valuables and a passport.

- The appraiser announces the amount he is willing to pay. It averages from 40 to 80% of the market value.

- With the client's consent, a storage agreement is drawn up. Most often these are periods that are multiples of months. Minimum period 1 day, maximum 365.

- The terms and conditions stipulate the interest rate on borrowed funds. It varies from 0.2 to 10% per day. The basic amount for calculating the amount starts from 1 thousand rubles.

- At the end of the term, the client pays the accumulated interest and the total amount of the deposit. If there is no money to repay the loan, but you don’t want to part with the value, it is possible to enter into an additional agreement with a pawnshop. In this case, you will only need to pay interest, and transfer the total amount of debt for a certain period.

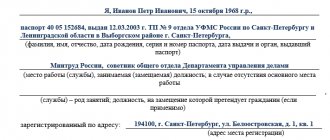

The collateral loan sheet contains the following information:

- personal data of the person to whom the cash is given;

- who issues;

- loan amount;

- date and address of the point;

- description of the value pledged;

- the interest rate for the use of borrowed funds.

In a situation where the client does not repurchase a personal item after the expiration of the pledge agreement, the pawnshop has the right to sell this property. Institutions sell the item themselves or resort to auctions. Products costing more than 30 thousand rubles are often sold at an open auction for the maximum amount offered.

How to record property provided by clients as collateral

In order to prevent work at a loss, the pledged items must be highly liquid. Therefore, the main types of collateral are jewelry made from expensive materials such as gold, platinum, and silver. When valuables are not purchased by clients, they can be sold in bulk to procurement companies as scrap.

The state strictly regulates everything related to the handling, accounting and storage of jewelry. If pawnshops do not comply with the established procedure, they cannot avoid administrative liability. An accountant working with “jewelry” needs to keep records of it as part of the rest of the goods pledged, both by weight, and by quality, and by cost. A complete census of precious goods should be carried out twice a year.

The movement of inventory items, which are handed over by clients as collateral, is reflected in accounting as follows:

- Dt 002 or 008 - reflects the value of the pledged property after its assessment.

- Dt 58 or 76 Kt 50 – a sum of money was transferred to the client against property collateral.

The pawnshop cannot become the owner of those items that clients leave as collateral, even if they did not buy them back on time. Collateral property should be accounted for separately from the property of the organization itself.

VAT on pawnshop services

Most pawnshops receive only interest income on cash loans, not subject to VAT (clause 15, clause 3, article 149 of the Tax Code of the Russian Federation). And although they do not pay VAT, they submit zero tax returns on a general basis.

VAT on fees for storing collateral

If the pawnshop charges a fee for storing collateral items (for example, in case of late repayment of a loan), VAT will have to be paid on these amounts.

Example.

VAT on the fee for storing items pledged on September 11 to citizen A.A. Petrova.

on the security of the ring, valued by the parties at 10,000 rubles, the pawnshop issued a loan in the amount of 7,000 rubles. for a period of one month. For using the loan under the terms of the agreement Petrova A.A. must pay the pawnshop a fee of 10% of the amount received. In addition, work to determine the value of the valuation of the collateral is 0.5% of the valuation amount, storage services - 3% of the valuation amount. Let's assume that on October 10 Petrova A.A. bought the ring. In the pawnshop's accounting records, these business transactions will be reflected as follows: September 11 DEBIT 002

- 10,000 rubles.

— the cost of the ring is reflected in the agreed estimate; DEBIT 76 “Settlements with various debtors and creditors” Credit 50

- 7000 rub.

— a loan was issued secured by the ring; DEBIT 76 Credit 90-1

- 50 rub.

(RUB 10,000 x 0.5%) - a fee has been charged for the assessment of the collateral; DEBIT 90-3 Credit 68 subaccount “VAT calculations”

- 8.33 rubles.

- VAT charged (50 rubles: 120% x 20%); October 10 DEBIT 76 Credit 90-1

- 700 rubles.

(RUB 7,000 x 10%) - interest accrued for using the loan; DEBIT 76 Credit 90-1

- 300 rub.

(RUB 10,000 x 3%) - a fee has been charged for storing the ring; DEBIT 90-3 Credit 68 subaccount “VAT calculations”

- 50 rubles.

(RUB 300: 120% x 20%) — VAT is charged on storage services; DEBIT 50 Credit 76

- 8050 rub.

(7000 rub. + 50 rub. + 700 rub. + 300 rub.) - the loan amount, interest due, cost of valuation and storage services are returned to the cash desk; Credit 002

- 10,000 rub. — the value of the returned collateral is written off.

Accounting for the costs of insuring collateral left by clients

Pawnshops need to insure property that the client provides as collateral or leaves for storage. This is produced:

- in favor of the client acting as the borrower;

- at the expense of the pawnshop.

The collateral is insured for the entire period while it is in the storage facility of a commercial organization. Insuring such items based on the full value of their valuation is a mandatory expense. Costs are taken into account in account 20. To do this, you should open a sub-account called “Costs for storing collateral.” Payments are included in the cost of services provided by the credit institution.

Pros and cons of going to a pawnshop

Going to a pawnshop involves some risks, although it has a number of advantages.

| Advantages | Flaws |

| The cash withdrawal period is minimal. The decision to accept collateral is made in a couple of minutes | The interest rate is calculated for each day of use of borrowed funds. It is higher than in a bank, but lower than in an MFO |

| No checking of the borrower’s credit history and no communication with collectors when the item is not redeemed | Risk of losing personal property. If there are no funds available on the date of redemption of the collateral, the client may lose rights to it. In the event of force majeure, when the owner was unable to redeem the item on time, it will be sold at a pawnshop or auction |

| Minimum documents. It is enough to take your passport with you. The pawnshop will not require any marriage certificates or other papers. | The amount given in cash is less than the actual value of the item. The pawnshop insures itself against unscrupulous clients and sets the price at which it can definitely sell the collateral. But for the borrower this situation is unprofitable |

| A large selection of things that can become collateral. If you couldn’t pawn an item at one pawnshop, another might accept it more readily | Collateral requirements. If the product has lost its marketable appearance or original properties, the appraiser can reduce the amount of cash issued to 5-25% of the market value |

| The amount that a pawnshop gives out is limited only by the actual value of the item itself. If a rare painting worth a million rubles is pledged, then the client has the right to claim 400-800 thousand, depending on the appraiser’s decision | Contract time. If the original version states that the contract cannot be extended, then if there is a delay of even one day, you will not be able to redeem your value |

| Availability of pawn shops. In large cities, institutions of this type are located within walking distance. A number of organizations even have a 24-hour work schedule | Risk of deception. You can distinguish a legal pawnshop from a second-hand shop or an underground purchase only if you read the charter or other constituent documents. Not all institutions provide such information in the public domain. |

Taxation of pawnshop activities

Payment of taxes is carried out by pawnshops in the general mode. They cannot introduce simplification. UTII is also inaccessible to them, because organizations provide household services to the population. Taxation has certain features.

Payment of VAT when issuing loans

Depending on the type of specific work, the issue of paying VAT is decided.

- Tax is not paid when providing short-term cash loans to clients.

- Revenue for services provided for the safety of inventory, advisory or information regarding the assessment of collateral should be subject to VAT in the generally established manner.

- The sale of property pledged is another type of pawnshop activity. The VAT tax base is determined as follows:

The amount of the claim against the client-mortgagor is subtracted from the income received by the pledgee. The result is subject to VAT only when it is not returned to the client.

Income tax - how it is calculated

The amount of interest on debt obligations is non-operating income received by the organization. They act as the basis for determining and paying income tax and are recognized as having already been received:

- on the last day of each month;

- on the date of full repayment of the loan.

Income from services provided for the storage of expensive inventory items is also taxed. How exactly its amount is recognized depends on the period of the contract. Revenue from consulting services provided is recognized on the date of acceptance by the client. If inventory items are handed over for long-term storage (more than one reporting period), the amounts of income received are independently and evenly distributed.

Income from the sale of property not purchased by the client becomes such only after three years. And then, provided that its former owner did not turn to the pawnshop for the proceeds due to him. Cash converted into pawnshop income is classified as non-operating income. If, after unclaimed inventory items are sold and a loss is incurred, it is recorded as non-operating expenses and is not recovered from the debtor.

| Types of services | VAT | Income tax |

| 1) Short-term loans | – | + |

| 2) Preservation of inventory items. Consultations and information provision | + | + |

| 3) Sales of inventory items (unpurchased) | + | + |

Storage costs are subject to VAT. The accountant should carry out separate accounting of transactions, the amounts for which are subject to or are not subject to VAT.

Transition of pawnshops to a unified chart of accounts (USC) and industry accounting standards (ASBU)

The final transition of pawnshops to the new unified chart of accounts (USC) and industry accounting standards (ASBU) was planned before January 1, 2022. This was stated in paragraph 19 of Regulation No. 486-P dated September 2, 2015 “On the Chart of Accounts for Non-Credit Financial Institutions and the Procedure for its Application.”

The transition is now scheduled for January 1, 2022.

and the first reports under the new rules will need to be submitted in the first quarter of 2023 for the first quarter of 2022. The transition applies to microfinance market entities listed in paragraph 1 of Bank of Russia Directive No. 5616-U dated November 10, 2020 “On the application of certain Bank of Russia regulations on accounting and accounting (financial) reporting issues.”

Also, some activists are now writing to the central bank to postpone the transition to the ENP for an even longer period.

The main difficulties for the transition are as follows:

- the high cost of accounting programs for the ENP - you won’t be able to use the already purchased 1C Accounting and will have to buy a new, expensive program and pay for its maintenance. We offer an affordable option that supports EPS - read more.

- lack of knowledge among accountants who service pawn shops - many of them simply do not have information at the moment and are not ready for the transition; at the moment it is simply physically difficult to find an accountant who is ready to take on this.

Large pawnshops will not have the opportunity to use a simplified reporting format, unlike small and medium-sized ones. Let's consider a scheme for introducing a new reporting system, consisting of 4 steps.

- Formation and approval of a plan for the transition to a new reporting system by each pawnshop. Completion date: summer 2016.

- Direct implementation of the new accounting system.

The Bank of Russia offered its assistance to pawnshops in training staff, in addition, it was possible to contact other organizations with this issue. In 2016, it was planned to analyze new forms of accounting statements, pawnshops were not informed and did not prepare properly. The standards are still under development and it is not known when they will be fully developed.

Software determines the performance of an organization. One of the main solutions for automating accounting and reporting for pawnshops is the 1C-Rarus product: Pawnshop 4. The program reflects all operations carried out by a pawnshop with accounting, tax and management accounting.

The crisis gave pawnshops the opportunity to maximize their business; they actually took the place of banks that refused express lending. Some organizations keep records in two programs: accounting for transactions in one, reports without regulations and general business transactions in the other. In this case, there are two options:

- apply new rules for both programs

- or switch to software that will solve both issues.

- The test period began on January 1, 2022. Companies from the test list began to report and keep records as part of the innovations. According to OSBU teachers, the process will look like this: “Urgent inventory of all assets, as well as liabilities, by December 31, 2017; the process of forming the opening balance as of 01/01/2018 for all accounts provided for by the UPS. A balance sheet should be prepared for 2022; carry out updated accounting entries, taking into account the previous chart of accounts and the formation of the opening balance by December 31, 2018.”

- It was planned that pawnshops would have to fully implement the EPS and OSBU by 01/01/2019. However, the deadline for the transition of pawnshops to the EPS and OSBU was postponed to January 1, 2022. Now, non-credit financial organizations, as part of the test regime, according to the plan for the transition to the Chart of Accounts and OSBU for non-financial financial institutions, must submit to the Bank of Russia:

- Balance sheet;

- Income statement;

- Statement of changes in equity;

- Cash Flow Statement;

- notes as part of the accounting (financial) statements of an NFO containing data for the reporting period without including comparative data for previous reporting periods.

The transformation poses a number of challenges. Accountants are concerned about the small number of training materials, despite the fact that even in the context of a postponement of the transition, they must urgently adapt to the new requirements.

Stanislav Boronin, general director of the federal chain Fianit Pawnshop, noted that small organizations will not be able to afford expenses of this level.

Mikhail Unksov, president of the League of Pawnshops and general director of the large network of pawnshops “Your Pawnshop,” said: “This plan is unviable due to the fact that 75% of pawnshops in Russia simply do not have such capabilities and will soon be forced to close their business. Reporting needs to be differentiated and made more accessible to market participants of all sizes.”

It is also worth paying attention to what program the pawnshop uses and whether this program supports a unified chart of accounts. 1C-Rarus: Pawnshop 4 has a version with EPS, which contains:

- new chart of accounts,

- financial results reports,

- postings to EPS accounts,

- preparation of reports for submission to the Central Bank of the Russian Federation in accordance with current legislation.

Date of material update: May 2022.

You may also be interested in:

- Pawnshop reporting

- Online cash registers for pawnshops

- Blockchain for pawnshops

Additional products for Pawnshops:

- Programs 1C-Rarus: Pawnshop 4 and 1C-Rarus: Pawnshop EPS 4

- 1C-Rarus: Pawnshop website

- Mobile application Pawnshop: Personal account

- Uconto mobile application: Manager reports

Five most frequently asked questions

Question No. 1. How is the amount of interest on money lent calculated?

Interest should be accrued from the next day after the loan is issued until the last day of its repayment, inclusive. But the contract also allows for a different procedure. For example, you can provide a fixed percentage.

Question No. 2. The situation when a client does not redeem the item he pledged occurs frequently. Will it be enough to state in the order on the organization’s accounting policy that after the end of the period for returning the collateral, it is necessary to stop accruing interest?

This should be stated not only in the order on accounting policies, but also in the ST. The basis is the current general rule, according to which interest can only be accrued up to and including the day the loan is repaid.

Question No. 3. When does the loan agreement come into force?

It begins to operate from the very moment when the citizen received the money, and the organization received the pledged property.

Question No. 4. What document is used to document the loan?

The client receives a ST, the form of which is standard. One more copy remains in the organization.

Question No. 5. Does the amount of unclaimed property fall under the concept of UTII?

No, because the organization is not its owner.

Legislation

"Financial newspaper", 2015, N 39

The taxation procedure for pawnshops has a number of features due to the specific nature of this activity. Therefore, before considering tax aspects, it is necessary to have a clear understanding of the principles of operation of pawnshops and the types of permitted activities.

The activities of pawnshops are regulated by the norms of the Federal Law of July 19, 2007 N 196-FZ “On Pawnshops” (hereinafter referred to as Law N 196-FZ) and the Civil Code of the Russian Federation.

As follows from the provisions of paragraph 1 of Art. 2 of Law N 196-FZ, only a legal entity - a specialized commercial organization, i.e. can be a pawnshop. An individual entrepreneur does not have the right to carry out pawnshop activities.

The main activities of pawnshops are:

— providing short-term loans to citizens;

- storage of things.

Pawnshops are prohibited from engaging in any other types of business activities other than those listed and providing consulting and information services (Clause 4, Article 2 of Law No. 196-FZ).

Thus, the main contracts that an accountant deals with when accounting for pawnshop transactions are loan and storage agreements.

Under a loan agreement, the pawnshop (lender) transfers the loan on a repayable and reimbursable basis for a period of no more than one year to a citizen (individual) - the borrower, and the borrower, who is also the mortgagor, transfers to the pawnshop the property that is the subject of the pledge (Clause 1, Article 7 of the Law N 196-FZ).

The loan agreement is formalized by the pawnshop issuing a pledge ticket to the borrower (clause 4 of article 7 of Law N 196-FZ), which is a strict reporting form (SRF). A pawn ticket is the main primary accounting document in the activities of pawnshops.

According to paragraph 5 of Art. 7 of Law N 196-FZ, the security ticket must contain the following information:

— name, address (location) of the pawnshop;

— last name, first name, patronymic of the borrower;

— name and description of the pledged item;

— the cost of assessing the pledged item;

— loan size;

— interest rate on the loan;

— date and term of the loan, indicating the date of its repayment;

— the possibility and procedure for early (including in parts) repayment of the loan;

— the borrower’s consent or disagreement that in the event of his failure to fulfill the obligation stipulated by the loan agreement, foreclosure on the pledged item is carried out without a notary’s writ of execution;

- other information.

The question arises, can a pawnshop independently order the production of BSO by printing, observing the mandatory details?

The Letter of the Ministry of Finance of Russia dated June 29, 2015 N 03-01-15/37230 “On the BSO form “Deposit Ticket”” explains that for organizations providing lending services to citizens secured by things they own and for storing these things, the Order of the Ministry of Finance of Russia dated 01/14/2008 N 3n the BSO forms “Deposit Ticket” and “Safe Receipt” were approved, which are used when providing services by pawnshops.

Decree of the Government of the Russian Federation dated May 6, 2008 N 359 approved the Regulations on the implementation of cash payments and (or) settlements using payment cards without the use of cash register equipment (hereinafter referred to as the Regulations), which establishes the procedure for making such payments in the case of providing services to the population at the condition of issuing a document drawn up on a strict reporting form, which is equivalent to a cash receipt, as well as the procedure for approval, accounting, storage and destruction of these forms.

The details that the BSO must contain are given in clause 3 of the Regulations. Consequently, an organization providing services to the public, in order to carry out cash payments and (or) payments using payment cards without the use of cash register equipment (CCT), has the right to use an independently developed document, which must contain the established details, i.e. The form of such a document is not required to be approved by the Russian Ministry of Finance.

However, clauses 5 and 6 of the Regulations provide for some exceptions that apply to organizations providing services to the public for which SSBs have been approved:

— the Ministry of Finance of Russia in the period from 04/12/2005 to 05/19/2008 (during the validity of the old Regulations approved by Decree of the Government of the Russian Federation of 03/31/2005 N 171);

- other authorized departments - in the period until May 19, 2008.

Such organizations may use approved forms rather than develop others on their own. Accounting programs (for example, 1C: Enterprise 8. VDGB: Lombard 3) used in pawnshops provide BSO forms approved by Order of the Ministry of Finance of Russia N 3n.

The amount of the borrower's obligations to the pawnshop includes (clause 1 of Article 8 of Law No. 196-FZ) the amount of the loan provided and interest for its use. In this case, interest is accrued for the period of actual use of the loan in accordance with the interest rate established in the loan agreement. The period of actual use of the loan is considered to be the time from the date of provision of the loan until the date of its return and payment of interest for the use of the loan (or the sale of the pawned item by the pawnshop).

Under a storage agreement, a citizen (individual) - the depositor gives the pawnshop an item belonging to him for storage, and the pawnshop undertakes to store the accepted item on a reimbursable basis (Clause 1, Article 9 of Law No. 196-FZ).

The storage agreement is certified by the issuance of a personal safety receipt to the depositor, another copy of which remains in the pawnshop. The safety receipt is also a BSO.

Thus, the use of strict reporting forms (pledge ticket and safety receipt) allows pawnshops to keep track of funds without using cash registers.

Choosing a tax system

Based on paragraphs. 7 clause 3 art. 346.12 of the Tax Code of the Russian Federation, pawnshops do not have the right to use the simplified taxation system. Regarding the application of the taxation system in the form of UTII for certain types of activities when selling an unclaimed item, the following should be noted.

In paragraph 5 of Art. 358 of the Civil Code of the Russian Federation determines that in the event of failure to repay the loan amount secured by the pledge of things within the established period, the pawnshop, after the expiration of the grace period of one month, has the right to sell this property in the manner prescribed by Law N 196-FZ.

In accordance with the provisions of Art. 13 of Law N 196-FZ, the purpose of selling an unclaimed item is to satisfy the pawnshop’s claims to the borrower or depositor in the amount determined in accordance with the terms of the loan agreement or storage agreement on the day of sale of the unclaimed item.

Since the funds received by the pawnshop after the sale of an unclaimed item are received to repay the borrower’s obligation to repay the loan and pay interest, transactions for the sale of pledged property are a cumulative part of the services provided by pawnshops.

The taxation system in the form of UTII for certain types of activities can be applied, including in relation to retail trade carried out through shops and pavilions with a sales area of no more than 150 square meters. m for each object of trade organization (clauses 6 and 7, clause 2, article 346.26 of the Tax Code of the Russian Federation).

Retail trade is a business activity related to the trade of goods on the basis of retail sales contracts (Article 346.27 of the Tax Code of the Russian Federation). However, operations for the sale of unclaimed items in pawnshops, regardless of the forms of such sales, are not retail purchases and sales and, therefore, are not subject to UTII taxation.

Thus, according to the legislation on taxes and fees, pawnshops do not have the right to apply the taxation system in the form of UTII, including when selling unclaimed collateral. Arbitration practice confirms the legitimacy of these conclusions (Resolution of the Arbitration Court of the East Siberian District dated 02.02.2015 N A19-10766/2014).

Value added tax

As noted, the main activity of a pawnshop is the provision of short-term loans to citizens, transactions for which are not subject to VAT on the basis of paragraphs. 15 clause 3 art. 149 of the Tax Code of the Russian Federation. Therefore, income in the form of interest from the provision of loan services is also not subject to VAT.

The corresponding transactions are assigned code 1010292, which is given in Appendix No. 1 to the Procedure for filling out a VAT tax return, approved by Order of the Federal Tax Service of Russia dated October 29, 2014 N ММВ-7-3/ [email protected]

Operations to provide short-term loans to citizens are reflected by pawnshops in section. 7 VAT returns.

As follows from paragraph 6 of Art. 88 of the Tax Code of the Russian Federation, when conducting a desk tax audit, taxpayers are required to submit documents confirming the right to apply tax benefits. This raises the question of the legality of the tax authorities requesting such documents.

As noted in paragraph 14 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 N 33, in the case of applying this norm, it is necessary to use the concept of “tax benefit” in the sense defined in paragraph 1 of Art. 56 of the Tax Code of the Russian Federation, according to which tax benefits are recognized as advantages provided to certain categories of taxpayers compared to other taxpayers.

In other words, under clause 6 of Art. 88 of the Tax Code of the Russian Federation, those listed in Art. 149 of the Tax Code of the Russian Federation, transactions exempt from taxation, which by their nature correspond to the concept of a tax benefit.

At the same time, documents cannot be requested for transactions that are not subject to taxation on the basis of clause 2 of Art. 146 of the Tax Code of the Russian Federation or exempt from taxation in accordance with Art. 149 of the Tax Code of the Russian Federation, if the purpose of the exemption was not to provide a certain category of persons with advantages over other persons performing the same transactions.

Let's analyze some court decisions regarding the pawnshop's operations, which are assigned code 1010292 “Loan operations in cash and securities, including interest on them, as well as repo operations, including amounts of money payable for the provision of securities under repo operations.”

Resolution of the AS of the Ural District dated February 24, 2015 N A71-6132/2014

Since in paragraphs. 15 clause 3 art. 149 of the Tax Code of the Russian Federation (loan transactions in cash and securities, including interest on them, as well as repo transactions) provides for special rules for taxation of relevant transactions, and not rules on the exemption of a certain category of persons from paying tax, then the applicant used tax benefits in tax returns were not, and therefore the tax authority did not have the right to demand from the applicant the documents specified in the requirements.

Decision of the Arbitration Court of the Rostov Region dated June 30, 2014 N A53-7421/2014

In Sect. 7 of the VAT return, the tax base is declared under transaction code 1010292 “Loan transactions in cash and securities, including interest on them, as well as repo transactions, including amounts of money payable for the provision of securities under repo transactions.” Such sales, which are not recognized as subject to VAT, are not taken into account when forming the tax base for the specified tax, while tax benefits, according to Art. 56 of the Tax Code of the Russian Federation, apply only to certain categories of taxpayers.

Thus, the courts support taxpayers’ right not to submit documents under code 1010292, since the applied benefit is not intended only for a certain category of persons.

Pawnshops can provide storage, consulting and information services, although in practice these are not widespread. Such services are subject to VAT in the general manner on the basis of paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation.

In other words, if a pawnshop simultaneously carries out operations to provide short-term loans to citizens (not subject to VAT) and provides storage services (subject to VAT), then it is necessary to keep separate records of VAT taxable and non-taxable transactions (clause 4 of Article 170 of the Tax Code of the Russian Federation).

Complex questions arise regarding the taxation of VAT on transactions involving the sale of unclaimed items in a pawnshop.

In case of failure to repay the loan amount secured by the pledge of things within the prescribed period, the pawnshop, after the expiration of a month, has the right to sell this property in the manner established by Law No. 196-FZ (clause 5 of Article 358 of the Civil Code of the Russian Federation).

After the sale of unclaimed items, the pawnshop’s claims against the pledgor are extinguished, even if the amount of proceeds from the sale of the pledged property is insufficient to fully satisfy the claims. It must be remembered that the pawnshop does not have the right to use and dispose of the pledged items, since the ownership of the pledged items does not pass to the pawnshop (clause 3 of Article 358 of the Civil Code of the Russian Federation, clause 5 of Article 2 of Law No. 196-FZ). In such cases, transactions are not subject to VAT, since the sale of goods is a transfer of ownership of them on a reimbursable basis, which does not occur when selling unclaimed items (Clause 1, Article 39 of the Tax Code of the Russian Federation).

However, in practice, the opposite situation may arise: after the sale of an unclaimed item, the amount of the borrower’s (bailor’s) obligations to the pawnshop may be lower than the amount received from the sale of this item (or the amount of its valuation). In this case, the pawnshop is obliged to return the corresponding difference to the borrower (depositor) (clauses 4, 5, Article 13 of Law No. 196-FZ). If within three years from the date of sale of the unclaimed item the borrower (bailor) has not applied for the funds due to him, they turn into the income of the pawnshop.

Considering such situations, representatives of the financial department have repeatedly noted that funds in the amount of the specified difference are included by the pawnshop in the VAT tax base. This is fair, since according to paragraph 1 of Art. 156 of the Tax Code of the Russian Federation, in the event that the pledgee sells, in accordance with the procedure established by the legislation of the Russian Federation, the subject of an unclaimed pledge belonging to the pledgor, the tax base is determined as the amount of income received by him in the form of remuneration (any other income).

Otherwise, the difference between the amount of income received by the pledgee and the amount of the claim secured by the pledge against the pledgor, if the specified difference is not returned to the latter, is subject to VAT (Letters of the Ministry of Finance of Russia dated November 25, 2014 N 03-07-11/59769, dated October 12, 2012 N 03-07-07/101). At the same time, the pawnshop, along with other organizations, has the right to be exempt from fulfilling taxpayer obligations related to the calculation and payment of VAT. In order to take advantage of this exemption, the pawnshop’s total revenue from the sale of goods (work, services) excluding VAT for the three previous consecutive calendar months must not exceed a total of 2 million rubles. (Article 145 of the Tax Code of the Russian Federation).

Income tax

For pawnshops, profit is income reduced by the amount of expenses incurred, which are determined in accordance with Chapter. 25 of the Tax Code of the Russian Federation (clause 1 of Article 247 of the Tax Code of the Russian Federation). Income includes:

— income from the sale of goods (works, services) and property rights;

— non-operating income (clause 1 of article 248 of the Tax Code of the Russian Federation).

When providing short-term loans to citizens, pawnshops generate income in the form of interest received under loan agreements. Such income for the purpose of calculating profit tax is classified as non-operating (clause 6 of Article 250 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated December 7, 2011 N 03-03-06/1/811, Federal Tax Service of Russia for Moscow dated November 22, 2011 N 16-15/ [email protected] ).

In accordance with paragraph 6 of Art. 271 of the Tax Code of the Russian Federation, when using the accrual method, income in the form of interest (under loan agreements, the validity of which falls on more than one reporting period) is recognized as received and is included in the corresponding income monthly on the last day of the corresponding reporting period, regardless of the actual receipt of payment for them cash or other property (Letter of the Ministry of Finance of Russia dated December 7, 2011 N 03-03-06/1/811).

When providing information and consulting services, pawnshops also generate taxable income. If the accrual method is applied, the date of receipt of such income is the date of sale of goods (work, services, property rights) regardless of the actual receipt of funds (other property (work, services) and (or) property rights) in payment for them (clause 1 of Art. 271 of the Tax Code of the Russian Federation).

Income is also the money received by the pawnshop after the sale of an item unclaimed by the borrower to repay the borrower’s obligation to repay the loan (pay interest) or as a reward for storing the item.

As a general rule, income in the form of funds (or other property) received under loan agreements, as well as received to repay such borrowings, is not recognized as income subject to corporate income tax (clause 10, clause 1, article 251 of the Tax Code of the Russian Federation) . At the same time, funds converted into pawnshop income (based on clause 5 of Article 13 of Law No. 196-FZ) are taken into account when calculating corporate income tax as part of non-operating income (clause 18 of Article 250 of the Tax Code of the Russian Federation).

Funds received by a pawnshop after the sale of an unclaimed item, in part allocated to pay the borrower’s interest under a loan agreement, are considered non-operating income and are subject to corporate income tax (clause 6 of Article 250 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated April 23, 2012 N 03-11-09/30).

However, in practice, there are often situations when the funds from the sale of the collateral are not enough to repay the borrower’s debt to the pawnshop. In such cases, a loss arises in tax accounting, which is recognized as a non-operating expense of the pawnshop (clause 2 of Article 266, clause 2 of clause 2 of Article 265 of the Tax Code of the Russian Federation).

I. Starodubtseva

Auditor-expert

A universal tool for automating all types of accounting in a pawnshop

The program implements accounting of all operations carried out by the pawnshop with accounting for the unified social network, tax and management accounting.

The system allows you to use any tax regimes (STS, UTII, regular taxation system, individual entrepreneurs) and switch from one tax regime to another in the working database in a few minutes. Work with online cash registers has been set up in accordance with 54-FZ.

The program has a built-in block that helps the pawnshop manager monitor the organization’s activities from anywhere in the world. The necessary data is displayed not only on the 1C desktop, but also in the Uconto: Manager's Reports mobile application. The manager has access to a huge range of reports, data summaries and statistical information. All information can be presented in the form of visual graphs.