Credit debt obligations of the enterprise to the budget

Accounting for settlements with the budget for value added tax 1) on the sale of goods (work, services) on the territory of the Russian Federation, including the sale of collateral and transfer of goods (results of work performed, provision of services) under an agreement on the provision of compensation or novation, and also on the transfer of property rights;

2) for the transfer of goods on the territory of the Russian Federation (performance of work, provision of services) for one’s own needs, the costs of which are not accepted for deduction (including through depreciation charges) when calculating corporate income tax; Budgetary institutions are VAT payers only when they are engaged in entrepreneurial activities. Input VAT account The amount of VAT for transfer to the budget can be reduced by the amount of tax accepted for offset.

In particular, this should be done if previously the cash expense was made by an institution in the status of a recipient of budget funds (before changing the type) at the expense of the limits of budget obligations or budget allocations. Debt to the budget account Location debt to the budget 68 Section 5 of the Balance Sheet, form 1, line code 626. The amount on line 626 is equal to the balance on accounts 68 and 69 in terms of the Unified Social Tax.

To account for accounts receivable, accounts are provided in the section Financial assets. Government institutions after 01/01/2012 are obliged to pay the established amounts to the budget. 19.3 10 7 Transferred from the current account to pay off debts to the budget 66 51 8 Finished products arrived at the warehouse from production 43 20 9 Repaid from the current account.

Offsetting in 1C:BGU 8

There is no specialized document to reflect debt offset in 1C:BGU 8. Therefore, transactions can be reflected using the Transaction (accounting) .

In the Transaction (accounting) , you need to clear the Use standard transactions . A new line is created using the Add . The tabular section indicates the corresponding entry for debt offset.

After posting the document, you can print the Accounting Certificate (f. 0504833).

More on the topic: Expenses from compulsory health insurance funds: what can and cannot be paid to the institution

Published 06/30/2021

How are budget debts paid off?

Debt is an organization's obligation to another business entity, an organization issuing loans, and the budget. It is displayed in the liabilities of the balance sheet on line 1520.

However, it makes no absolute difference whether the company pays taxes for itself or acts as a tax agent. Each tax debt owed to a creditor is shown in this account:

- by debit it can correspond with the following accounts: 19, 50, 51, 55, 66, 67;

- For a loan, the account can be reflected in the following positions: 08, 10, 11, 15, 20, 26, 29, 41, 44, 51, 55, 70, 90, 91, 98, 99.

The task of tax accounting is to calculate income tax in order to then pay it to the budget

VAT accounting

Accounting for VAT on account 19 is quite complicated. To account for such debt on purchased materials and other products, which are then shown for deduction, accounts 20, 23, 29 are initially used.

| Wiring | Description |

| D 90 (91) K 68 | Accrual of VAT on goods sold of your own production |

| D 19 K 68 | Submission of VAT for deduction |

| D 99 (91) K 68 | Transfer of VAT on income from goods sold |

| D 68 K 51 (52) | Transfer of VAT to the budget |

| D 91 K 68 | Tax debt transferred to the budget |

| D 68 K 51 | Transferred from the current account to pay off tax debts to the budget |

The above part of the transactions shows the main points of accrual and write-off of debt. When recognizing, claiming or paying each debt to legal entities and individuals, it is considered important to carefully record it and correctly fill out documents.

Repayment of accumulated debt leads to the withdrawal of a significant part of working capital, which can affect the company's financial condition. That is why timely repayment of debt should be an accountant’s primary task.

VAT accounting involves not only reflecting transactions in tax registers, but also reflecting them in accounting accounts

Land tax

The transfer of land tax payments to the budget depends on the cadastral price of land. It is determined by finding and using the site. It is because of this that when accounting for such a tax, together with account 68, accounts are used that take into account expenses incurred on such land plots.

For example, organizations involved in agriculture have an account of 20. If the land is not used in any production, posting is carried out with an account of 91.

D 20 (23, 91) K 68 - calculation of land tax.

READ MORE: Settlements with accountable persons postings

D 68 K 51 - transferring it to the budgetary sector.

State duty

State duty is charged to the budget for various operations, for example, for registering ownership of fixed assets, analyzing a case in court, and acting as a notary. Such payables will be accounted for in account 68 along with accounts 91 and 08.

D 08 (91) K 68 - assessment of duties.

D 99 K 68 - sanctions for incomplete calculation of tax deductions.

D 68 K 51 - repayment of accounts payable under sanctions.

All companies have to face the need to pay state duties. In different cases, its size and payment terms are individual.

It often happens that taxes, fines and penalties of an organization are paid untimely or not in full. This can happen not only due to the fault of the company itself, but also due to the negligence of inspectors, whose duties include the timely implementation of accruals. To avoid such situations, it is necessary to monitor loan debts within the organization on your own at all times.

Budget institutions

It is possible to spend the received funds (return of receivables) if the sources were:

- income from paid activities;

- funds from a subsidy for the implementation of a state task;

- funds from targeted subsidies. A prerequisite is the decisions of the founder.

In all these situations, funds from the return of receivables for previous years are credited to the personal accounts of the budgetary institution. The reflection procedure is approved by the financial authority, the Federal Treasury or the financial authority of a separate constituent entity of the Russian Federation, provided that the institution is serviced by it.

Transactions of receipt into the personal account of a budgetary institution, the indicated amounts of receivables in accounting are reflected according to the same analytical sections by which it was formed. The value is selected depending on which code the expense was reflected by. In this case, simultaneously with the increase in turnover in the debit of account 201 “Institutional funds”, it is necessary to make an entry on off-balance sheet accounts 17 “Cash receipts” or 18 “Cash outflows”.

Operations for the receipt of receivables from previous years from the return of a previously transferred advance to the supplier at the expense of a subsidy for the implementation of a state task are reflected by correspondence:

- Dt 4 209.34 Kt 4 206.XX - a demand was made to return the advance.

- Dt 4 201.11 Kt 4 209.34 – funds were received to the institution’s personal account. Dt 17.01

If the state task is not completed by the institution in full, then part of the subsidy received must be returned to the administrator. Operations to return unused amounts of subsidies from previous years to the budget account are reflected by correspondence:

- Dt 4 205.82 Kt 4 303.05 – amounts were accrued to return the balance of the subsidy for the implementation of the state task to the budget account;

- Dt 4 303.05 Kt 4 201.11 – the balance of the subsidy is transferred Kt 18.01

Consider the case of receiving and not fully spending subsidies for other purposes provided for in the Agreement between the institution and the founder. Such funds are subject to refund. Operations to return unused subsidies for other purposes are reflected in correspondence:

- Dt 5 401.40 Kt 5 303.05 – accrual for return to the budget

- Dt 5 303.05 Kt 5 201.11 – funds transferred to the founder

Arrears of payments to the budget account

Other creditors” (line 625) shows the organization’s debt for settlements, data on which is not reflected in other items of the “Accounts payable” group. Reflecting debts on the balance sheet But the matter does not end with mutual confirmation of the amount of debt. It is important to correctly reflect debt on the balance sheet.

Especially during periods of non-payment. Accounts receivable are the debts of buyers, customers, borrowers, accountable persons, etc. that the organization plans to receive. In addition, accounts receivable also include the amount of advances issued to suppliers and contractors. The basis for the formation of the accounts receivable indicator is the separate reflection of data on long-term and short-term debt.

To account for it, account 19 is used, which summarizes information on the amount of VAT on purchased values issued by suppliers. This account is quite interesting. On the one hand, it can be considered as a receivable, because it is used in settlements with suppliers to allocate the amount of VAT to be reimbursed from the total cost of goods received and accepted works/services.

Line 1520 of the balance sheet - Accounts payable This line of the form reflects the amount of the company's accounts payable, which was formed as of December 31, 2015. In this case, line 1520 includes debts whose repayment period is equal to or less than 12 months. If the repayment period of the debt exceeds 12 months, then its amount is indicated as part of long-term liabilities on line 1450 “Other liabilities”.

This expense item reflects debt for all types of payments to the budget (VAT, income tax, property tax, personal income tax, etc.).

For each tax that must be paid to the budget, open a separate sub-account for account 68 “Calculations for taxes and fees”. Reflect the accrual of taxes in the credit of the subaccounts of account 68, and the payment of taxes to the budget or reduction of this obligation on another basis - in the debit of the corresponding subaccounts.

To reflect debt on taxes and fees in the balance sheet, use the credit balance on account 68, not repaid as of the reporting date.

The concept of accounts payable in the budget and its reflection in accounting

Accounts payable are the obligations (debts) of a legal entity to other business entities, credit organizations, the budget and extra-budgetary funds.

It is reflected in the liabilities of the balance sheet on line 1520 and includes calculations:

- With buyers;

- With suppliers;

- With a budget;

- With extra-budgetary funds (for various types of social insurance);

- With employees on wages;

- With founders and participants (for payment of dividends, interest and other income);

- With accountable persons;

- With creditors and debtors for other debts (for example, for advances received under contracts).

Accounts payable to the budget include obligations for taxes and fees. Moreover, this can be either an overdue accounts payable or a current one, the payment deadline for which has not yet arrived. Read here how to write off accounts payable.

To reflect the situation with the payment of taxes and fees, active-passive account No. 68 is used. His loan takes into account the amount of taxes and fees accrued and indicated in the declarations (“debts” to the budget). For example, posting Debit 99 Credit 68 (hereinafter referred to as D and K, respectively) means that income tax has been accrued. A D 70 K 68 - personal income tax (NDFL).

The debit of the account reflects taxes and fees paid (debt repayment). In particular, posting D 68 K 51 means payment of any tax from the current account of the enterprise.

- The credit balance at the end of the reporting period means that a legal entity is indebted for taxes and fees.

- Debit - indicates budget debts to an enterprise (company) or - overpayment of tax payments.

Debt on taxes and fees: accounting account

Almost every modern enterprise operates not only at the expense of its own funds or profits, but also through the use of borrowed money.

This leads to the emergence of debt to the budget, and they can be formed not only in the process of interaction with various banking institutions, but also in the process of paying taxes or other cooperation with government bodies, so debt arises.

Important! Debt to the budget appears for various reasons, but it is imperative to repay it on time and promptly, since otherwise overdue debt arises, for which fines and penalties are charged, and if a significant debt accumulates, other methods of influence may be used, up to the closure of the company.

There are two major reasons why debt to the state arises. These include:

- Economic. They are associated with the crisis situation in the country, with the uneven development of various industries, with the company receiving low income and other problems related to the company’s profits and losses. Often, a company simply does not have the funds to pay off all taxes and fees, so it is forced to develop debts, which often turn into overdue debts.

- Organizational and legal. This includes the misunderstanding by many entrepreneurs of various laws. They think differently than what is assumed in norms and acts. Due to regular changes in various laws and regulations, certain difficulties arise in understanding these laws, so entrepreneurs do not pay taxes due to their low economic literacy.

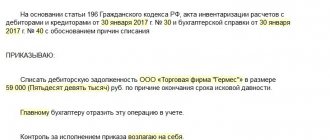

READ MORE: Internal memo on writing off accounts receivable

AttentionAs representatives of the tax service in the Altai Territory told reporters, the small debt to the budget that this taxpayer has accumulated is a penalty that arose due to late payment of tax.

At the same time, according to the law, Federal Tax Service inspectors must complete the debt collection procedure by January 1, 2022, regardless of the amount. Important: By the way, it was not necessary to pay the commission until the debt was transferred for enforcement.

The taxpayer could pay his kopeck for free in the “Taxpayer’s Personal Account” on the Federal Tax Service website. However, the citizen himself did not even suspect that he owed 1 kopeck until he received a decree from the bailiffs to open enforcement proceedings.

Info The organization has the right to dispose of accounts payable at its own discretion, but at the time of payment it is obliged to repay or return that part of the property to which the creditors have rights.

In other words, accounts payable are defined both as part of the property fully owned by the enterprise with the right of ownership to it, and as the debts of the enterprise to its creditors, who are authorized to claim or collect the debt from the specified part of the property.

The company transfers funds to various accounts on a daily basis. The calculation procedure, tax rates, and sources of payment for virtually all taxes are different.

They are determined by the relevant Instructions of the State Tax Service of Russia (STSS). Accounting for settlements with the budget for various types of taxes is kept on account 68 “Settlements with the budget”.

For the loan, the account corresponds with the following positions:

- 08 - investments in non-current assets (funds);

- 10 - materials;

- 11 - animals being fattened and raised;

- 15 — purchase (procurement) of material assets;

- 20 (23) - main (auxiliary) production;

- 26 — expenses for general economic needs;

- 29 - service industries;

- 41 - goods;

- 44 - sales expenses;

- 51 (52) - current (currency) account;

- 55 - special bank account;

- 70 (75) - settlements with employees for wages (with founders for income paid to them);

- 90 - sales;

- 91 - other income and expenses;

- 98 - future income;

- 99 - profit and loss.

Payment of taxes and fees is reflected in active-passive account No. 68.

Non-payment of taxes by different companies certainly leads to the use of various measures of influence by the state. They can be presented in three types:

- administrative involves influencing the company through various notifications and fines, and forced suspension of activities can also be used;

- tax consists of applying significant sanctions to the taxpayer, for example, fines or penalties;

- Criminal is used for malicious defaulters who have not paid taxes for a long time, therefore a significant debt has arisen, and it consists of detention and imprisonment, and the entrepreneur will be obliged to eliminate all the consequences of his unlawful actions to the state.

In companies, directors and founders of companies, as well as the chief accountant and other officials of organizations are held accountable. Important! The statute of limitations for debts to the budget is usually three years.

If the amount of tax was calculated incorrectly, but this was not done intentionally, then the fine will be equal to 1/5 of the unpaid amount. If this was done intentionally or the taxpayer evades paying the funds, then the fine is equal to 40% of the amount of the debt.

If in the latter case they were used to hide the income of a shell company, then the director of the organization will be prosecuted.

Tax debt is repaid in the following ways:

- payment at bank branches using a cash register or ATM with the issuance of relevant receipts, or receiving them at the territorial tax office;

- transferring money through online applications of banks that are partners of the tax authority;

- using the government website services through online payment by bank card;

- using funds in the virtual wallet.

The repaid budget debt for taxes is reflected by posting to account 68. Its credit shows the cost of tax payments and fees listed and indicated in the declaration.

For example, posting D 99 K 68 indicates that income tax is accrued, and D 70 K 68 reflects the transfer of personal income tax.

The debit of account 68 indicates that the income tax debt has been repaid - entry D 68 K 51.

READ MORE: Agreement on debt repayment between individuals

Reflection of income tax in accounting occurs in two stages. The accountant must first calculate the “accounting income tax” and then adjust it to arrive at the amount of tax reported on the tax return.

“Tax on accounting profit (loss)” is called a conditional income tax expense (income). It is calculated using the formula.

Debit 99, subaccount “Conditional income tax expense (income)” Credit 68, subaccount “Calculations for income tax”—conditional income tax expense accrued

Debit 68, subaccount “Calculations for income tax” Credit 99, subaccount “Conditional expense (income) for income tax”—conditional income for income tax is accrued.

In PBU 18/02, the income tax payable to the budget is called “current income tax”. It is reflected in the income tax return. The relationship between the current income tax and the conditional income tax expense (income) is reflected by the formula.

If the current income tax turns out to be negative, then it is taken equal to zero.

EXAMPLE 1. HOW TO CALCULATE INCOME TAX

The accounting profit of JSC Aktiv for the fourth quarter of the reporting year amounted to 1,000,000 rubles.

— entertainment expenses exceeded the permissible standard by 4,000 rubles;

- depreciation charges in accounting amounted to 7,000 rubles, of which only 4,000 rubles. taken into account for tax purposes;

— dividends from equity participation in a foreign company have been accrued but not received – RUB 8,000.

| Type of expense/income | In accounting, rub. | In tax accounting, rub. | Differences, rub. |

| Entertainment expenses | 36 000 | 32 000 | 4000 (constant difference) |

| Amount of accrued depreciation | 7000 | 4000 | 3000 (deductible temporary difference) |

| Dividends | 8000 | – | 8000 (taxable temporary difference) |

Let us remind you: dividends received from foreign organizations are subject to income tax at a rate of 0 or 13% (clause 3 of Article 284 of the Tax Code of the Russian Federation). Dividends are recognized as part of non-operating income on the date of receipt of funds into the organization's current account. We will assume that a rate of 13% is applied to dividends, and all other income of “Active” is taxed at a rate of 20%.

Debit 99, subaccount “Conditional income tax expense (income)” Credit 68—RUB 199,440. ((RUB 1,000,000 – RUB 8,000) × 20% RUB 8,000 × 13%) – a conditional income tax expense has been accrued;

Debit 99, subaccount “Permanent tax liability” Credit 68—800 rub. (RUB 4,000 × 20%) – a permanent tax liability is reflected (the conditional income tax expense has been additionally accrued);

Debit 09 Credit 68—600 rub. (RUB 3,000 × 20%) – a deferred tax asset is reflected (the conditional income tax expense has been additionally accrued);

Debit 68 Credit 77— 1040 rub. (RUB 8,000 × 13%) – a deferred tax liability is reflected (the contingent income tax expense is written off).

As a result, the current income tax will be 200 thousand rubles. (199,800 = 199,440,800,600 – 1040).

If your company does not apply PBU 18/02 (which should be reflected in its accounting policies), then tax is calculated based on the income tax return. In this case, the amount of the current income tax corresponds to the amount of the calculated income tax reflected in the declaration.

EXAMPLE 2. HOW TO RECORD INCOME TAX BASED ON A DECLARATION

Debit 99 Credit 68—5140 rub. (RUB 25,700 × 20%) – income tax is reflected based on the tax return.

Debit 68, subaccount “Calculations for income tax” Credit 51—the amount of income tax has been paid to the budget.