Let's consider the features of accounting with a tax agent for VAT when purchasing services (work) from a foreigner, incl. electronic services on the Internet:

- What should you pay attention to when “importing” services and works?

- In what case does a Russian organization (IP) act as a tax agent for VAT?

- How to fulfill the duties of a VAT tax agent without errors?

- What rights and obligations does a tax agent have and what penalties awaits him if he fails to fulfill his obligations?

- Do VAT tax agents need any additional settings in 1C?

The term “import” of services and works is a colloquial option used in practice.

The concept of import is given in paragraph 10 of Art. 2 of the Federal Law of December 8, 2003 N 164-FZ “On the fundamentals of state regulation of foreign trade activities”:

“...import of goods is the import of goods into the Russian Federation without the obligation to re-export them”

Therefore, services and works are not imported, but simply purchased from a foreign counterparty.

Tax agent for VAT when purchasing services from foreigners

To understand who tax agents for VAT (hereinafter referred to as NA) are, we can draw an analogy with tax agents for personal income tax.

The tax agent for VAT, like the tax agent for personal income tax, calculates and withholds tax from the income that is paid to the foreigner. At the same time, the VAT authority must not only withhold tax, but also pay it to the budget simultaneously with the payment to the foreigner and submit a VAT return to the Federal Tax Service.

How to find out when a person is a VAT tax agent and when he is not?

Russian companies and individual entrepreneurs (including VAT defaulters) are tax agents for VAT if the following conditions are simultaneously met (clauses 1, 2 of Article 161 of the Tax Code of the Russian Federation):

- services (work) are purchased from a foreign organization that is not registered with the tax authorities of the Russian Federation as a taxpayer;

- The place of sale of services (works) is considered to be the territory of the Russian Federation.

All organizations and individual entrepreneurs can act as tax agents for VAT, incl. and VAT evaders.

The Tax Code of the Russian Federation does not provide exceptions for those who work under special regimes, for example, UTII, Unified Agricultural Tax, or Simplified Tax System (Clause 2 of Article 161 of the Tax Code of the Russian Federation).

What if this is a licensing agreement?

The exercise of rights under a license agreement on the territory of the Russian Federation is not subject to VAT in several cases:

- if the subject of the license agreement is exclusive rights to inventions, know-how, utility models, industrial designs, databases, etc.

- if the subject of the license agreement is the rights to use the above-mentioned results of intellectual activity.

If a Russian company, under a license agreement, acquires rights to the results of activities not listed above (clause 26, clause 2, Article 149 of the Tax Code) from a foreign supplier who is not registered with the tax authorities in the Russian Federation, it is recognized as a tax agent and must remit agency VAT to the budget of the Russian Federation.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Regulatory regulation when determining the place of sale of services

To determine the place of sale of services (works) purchased from foreign organizations, you should use different regulatory documents. Therefore, first of all, it is necessary to establish where the foreign seller is from.

| Contractor from non-CIS countries and the Russian Federation | Counterparty from the EAEU (Armenia, Belarus, Kazakhstan, Kyrgyzstan) |

| Art. 148 Tax Code of the Russian Federation Place of implementation of works (services) | Treaty on the EAEU dated May 29, 2014, Appendix No. 18, Section 1 General provisions and 4 Procedure for collecting indirect taxes when performing work or providing services |

When working with counterparties from non-CIS countries, taxpayers work according to the norms of the Tax Code of the Russian Federation.

The Tax Code of the Russian Federation does not apply to partners from the EAEU and has no legal force, therefore the requirements of the Treaty on the EAEU dated May 29, 2014 should be taken into account. At the same time, if the Treaty on the EAEU makes a reference to the local legislation of the EAEU member country, then we use it, incl. Tax Code of the Russian Federation.

The provisions of the Tax Code of the Russian Federation and the Treaty on the EAEU are very similar, but there are some differences, which can be learned from the article Determining the place of sale of services by foreigners

The place of implementation of services and work is determined according to the Tax Code of the Russian Federation / the EAEU Protocol, which is Appendix No. 18 to the Treaty on the EAEU dated May 29, 2014 (hereinafter referred to as the EAEU Protocol), and not only by where the services and work are physically provided.

What does it mean? In order to determine the place of sale of services (works), one must be guided precisely by the rule of law, and not just by common sense.

It may be that physically provided not in the Russian Federation, but the place of implementation is the Russian Federation and, accordingly, VAT obligations arise.

For example, the place of sale for consulting, legal, accounting, auditing, engineering, advertising, marketing services, information processing, R&D is determined by the place of activity of the buyer of services (clause 4, clause 1, article 148 of the Tax Code of the Russian Federation / clause 4, clause 29 of the Protocol EAEU).

If a Russian organization purchases such services from a foreign partner, then it will be a tax agent for VAT, even if the physical services are provided in another country.

It turns out that the services were provided in another country, and the place of implementation was the Russian Federation - it sounds strange, but nevertheless it is so.

The company leases property from authorities

When concluding a lease agreement for federal or municipal property, you need to carefully consider who the lessor is. If this is a government agency or a federal or municipal unitary enterprise (for example, a hospital or a train station), then the tenant will not have duties as a tax agent under this agreement. Organizations of these types pay their own taxes.

If the lessor is a city administration, municipality, state property management committee or similar body, then the tenant becomes a tax agent for VAT. It does not matter what kind of agreement is concluded: bilateral, that is, between the lessor and the tenant, or tripartite, between the balance holder, the lessor and the tenant. In any case, the company that rented the property will have to calculate VAT on the rent and pay it to the budget.

How the tax amount is calculated depends on what conditions are stipulated in this regard in the contract. If it indicates that VAT is included in the rental price, the tax is calculated at an estimated rate using the formula:

VAT = Rent x 18 / 118

If the contract specifies the amount of rent without VAT or there is no mention of tax at all, it is calculated at a rate of 18% above the rent. In this case, the tax is paid by the tenant out of his own pocket, increasing the cost of rent.

Responsibilities of a tax agent for VAT

The VAT tax agent is required to follow a number of steps. Let's consider them sequentially.

Establishing the moment of determining the tax base

The moment of determining the tax base is the date of payment to the supplier, including prepayment and settlements in kind (clause 16 of the Rules for maintaining the sales book, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

Determination of the tax base

The tax base is the amount of income received by the foreign partner, including VAT.

If settlements with a foreign counterparty are carried out in foreign currency, then at the time of determining the tax base, the currency amount must be converted into rubles (clause 3 of Article 153 of the Tax Code of the Russian Federation, clauses 1, 2 of Article 161 of the Tax Code of the Russian Federation).

The tax base in foreign currency is recalculated into rubles at the rate of the Central Bank of the Russian Federation on the day of payment of income to a foreigner (Letter of the Ministry of Finance of the Russian Federation dated November 1, 2010 N 03-07-08/303).

Calculation and deduction of VAT

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

When calculating VAT, you should be guided by clause 4 of Art. 164 of the Tax Code of the Russian Federation and apply the estimated tax rate of 18/118.

The VAT tax agent calculates and withholds VAT, i.e. funds must be transferred to the foreign counterparty minus the withheld VAT.

The organization entered into a contract with the French company BelleEpoque for the provision of services for organizing an exhibition in Paris in the amount of 1,180 EUR, the price includes VAT.

The place of sale of services is the Russian Federation (clause 4, clause 1, article 148 of the Tax Code of the Russian Federation), therefore, the Organization acts as a tax agent for VAT (clause 2, article 161 of the Tax Code of the Russian Federation).

The tax agent calculates the VAT amount 1,180: 118 x 18 = 180 EUR.

And transfers the remuneration to the foreigner minus VAT 1,180 – 180 = 1,000 EUR.

If the contract does not indicate VAT, this means that the price already includes the VAT amount and the calculated rate 18/118 should be applied (Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 N 33, clause 17).

Regardless of whether VAT is allocated under the terms of the agreement (contract) or not, the VAT authority is obliged to calculate and pay the tax (Letter of the Ministry of Finance of the Russian Federation dated 04/13/2016 N03-07-08/21231; Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 04/03/2012 N 15483/ eleven).

If the price in the contract is specified excluding VAT. For example, the contract price is 1,000 EUR excluding VAT, then VAT is calculated on top and a rate of 18% is applied (Letter of the Federal Tax Service of the Russian Federation dated 10/05/2016 N SD-4-3 / [email protected] ).

Issuing an invoice

When issuing an invoice by a tax agent (hereinafter referred to as SF), you should be guided by clause 3 of Art. 168 Tax Code of the Russian Federation. This means that general rules for issuing and processing invoices apply, taking into account some features:

- The SF is issued by the tax agent in one copy;

- The number and date of the payment order in the invoice is the number and date of the payment document for the payment of tax to the budget.

In line 5 of the SF “To payment and settlement document N”, the tax agent indicates the number and date of the payment order for the payment of VAT to the budget, and not for payment for the services of the supplier (clause 3, clause 1 of the Rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137; Letter of the Federal Tax Service of the Russian Federation dated August 12, 2009 N ShS-22-3/ [email protected] ).

Making an entry in the Sales Book

The tax agent registers the calculated tax in the sales book of the Federation Council when making payment, partial payment, incl. for non-cash payments (Rules for maintaining a sales book, clause 15, approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137).

VAT defaulters, who act as tax agents for VAT, also create a sales book and register invoices in it.

Transfer of VAT to the budget

The procedure and deadlines for paying VAT are established in clause 4 of Art. 174 Tax Code of the Russian Federation:

"4. ...tax payment is made by tax agents simultaneously with the payment (transfer) of funds to such taxpayers.”

Those. payment of VAT by the tax agent to the budget must be carried out simultaneously with the transfer of payment to the foreign seller, incl. when paying an advance.

The bank servicing the NA does not have the right to accept an order from him to transfer funds in favor of foreigners, if the NA has not also submitted to the bank an order to pay VAT from an account opened with this bank.

Conversion of the tax base from foreign currency into rubles and calculation of the VAT amount is carried out at the rate of the Central Bank of the Russian Federation on the day the income is paid to the foreigner. VAT is paid to the budget in rubles. (Clause 5 of Article 45 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated January 21, 2015 N 03-07-08/1467; Letter of the Ministry of Finance of the Russian Federation dated December 5, 2016 N 03-07-08/72092).

When issuing a payment order to pay VAT to the budget, code 02 “tax agent” is filled in field 101 “Status of originator”. PDF

Submitting a VAT return to the Federal Tax Service

VAT tax agents are required to submit a VAT return in the usual manner no later than the 25th day of the month following the expired tax period (clause 5 of Article 174 of the Tax Code of the Russian Federation).

VAT calculated by the tax agent is reflected in the VAT return.

In Section 2 “The amount of tax payable to the budget, according to the tax agent”:

- line 060 - the amount of calculated VAT according to the tax agent;

- page 070 - transaction code 1011712.

A separate Section 2 must be completed for each foreign person.

In Section 9 “Information from the sales book”:

- invoice issued by a tax agent. Operation type code "".

VAT defaulters who are tax agents are also required to submit a VAT return consisting of:

- Title page;

- Section 2;

- Section 9.

A VAT return can be submitted on paper only by a VAT evader if for the tax period he:

- did not issue invoices;

- was not a commission agent or agent (intermediary).

Tax base and tax rate

In accordance with paragraph 1 of Art. 161 of the Tax Code of the Russian Federation, the tax base is the amount of income of a foreign supplier, taking into account tax. This means that when transferring money to a foreign counterparty, a Russian company will have to withhold VAT and transfer it to the budget. This point must be taken into account and, so that there are no misunderstandings with the service provider later, it must be fixed in the contract, indicating a price for the service that, if VAT is withheld, would continue to suit the counterparty.

See also the article “How to determine the tax base for VAT (moment of determination)?” .

However, not all foreign companies may agree to this condition. In this case, you will have to pay tax in excess of the contracted amount (letters from the Ministry of Finance dated May 26, 2016 No. 03-07-13/1/30201, dated April 13, 2016 No. 03-07-08/21231, etc., resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 3 .2012 No. 15483/11).

Important! Recommendation from ConsultantPlus If it follows from the contract that the cost of goods (work, services) does not include VAT, then the tax will have to be transferred to the budget at your own expense. To do this, first increase the tax base... (for more details, see K+).

As for the tax rate, most service transactions are taxed at a rate of 20%. But there are situations when a 0% rate is applied (their list is given in clause 1 of Article 164 of the Tax Code of the Russian Federation) or the operation is exempt from VAT (clauses 2–3 of Article 149 of the Tax Code of the Russian Federation).

The amount of tax is determined based on the currency cost of the service recalculated at the Central Bank exchange rate (on the day of payment to the foreign supplier) (clause 3 of Article 153 of the Tax Code of the Russian Federation).

Acceptance of VAT for deduction by a tax agent

The procedure for accepting VAT for deduction

VAT paid by a tax agent to the budget when purchasing services (work) from a foreigner can be deducted by the VAT payer (clause 3 of Article 171 of the Tax Code of the Russian Federation).

VAT paid to the budget by a VAT evader cannot be deducted.

Taxpayers using the simplified tax system (income minus expenses) have the right to include in expenses the amount of VAT paid by them as tax on VAT (clause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Agency VAT is taken into account in expenses in the same way as the services (work) to which the tax relates. If services (work) are named in clause 1 of Art. 346.16 of the Tax Code of the Russian Federation, then VAT on them can be taken into account in expenses under the same item. And if they are not named, then VAT cannot be taken into account in expenses.

The right to deduct VAT arises when the following conditions are simultaneously met:

- services (works) purchased for activities subject to VAT;

- the correct SF issued by the NA itself is available;

- services (work) are accepted for accounting;

- VAT is paid by the tax agent to the budget.

VAT must be paid by the tax agent to the budget, and not offset (Letter of the Ministry of Finance of the Russian Federation dated August 12, 2010 N 03-07-11/355).

The regulatory authorities insist on this position; judicial practice is contradictory - the courts side with both the Federal Tax Service and taxpayers. Therefore, in this case, you should not take risks and offset VAT.

Tax agents have the right to deduct VAT in the tax period when the tax was actually paid (Letter of the Ministry of Finance of the Russian Federation dated October 23, 2013 N 03-07-11/44418; Resolution of the Federal Antimonopoly Service of the North-Western District dated January 28, 2013 N A56-71652/ 2011; dated 03/21/2012 N A56-38166/2011).

The VAT return regarding the transactions of the tax agent will be completed as follows:

In Section 3, page 180 “The amount of tax paid to the budget by the taxpayer as a buyer - tax agent, subject to deduction”:

- the amount of VAT to be deducted.

In Section 8 “Information from the purchase book”:

- invoice issued by a tax agent. Operation type code "".

VAT deduction by tax agent on advance payments

Can a tax agent claim a deduction for advance payments?

The Ministry of Finance of the Russian Federation believes that the RA does not have the right to claim a VAT deduction on advance payments. He can use it only after registering goods (services, works). Norms of paragraph 12 of Art. 171 of the Tax Code of the Russian Federation and clause 9 of Art. 172 of the Tax Code of the Russian Federation do not apply to tax agents.

Reason - there is no invoice issued by the seller, necessary for applying the VAT deduction (clause 1 of Article 172 of the Tax Code of the Russian Federation), which means that the standard procedure for applying deductions is not observed (Letter of the Ministry of Finance of the Russian Federation dated 04/06/2016 N 03-07-08/ 19500; Letter of the Ministry of Finance of the Russian Federation dated June 21, 2013 N 03-07-08/23545; Decision of the Supreme Arbitration Court of the Russian Federation dated September 12, 2013 N 10992/13).

Transfer of VAT deduction by tax agent

Can the tax agent defer the VAT deduction to a later period?

The tax agent cannot exercise the right to apply a VAT deduction for 3 years, which is provided for in clause 1.1 of Art. 172 of the Tax Code of the Russian Federation.

VAT deduction is applied only in the period when the conditions for applying the deduction are met (Letter of the Ministry of Finance of the Russian Federation dated November 17, 2016 N 03-07-08/67622).

VAT allocated in documents by suppliers from the EAEU

VAT is highlighted in the documents of the supplier from the EAEU, is it possible to apply a deduction?

VAT allocated in documents by suppliers from the EAEU when performing services (works) cannot be deducted.

VAT in this case is calculated and paid by the supplier from the EAEU to the budget of his state, and not to the budget of the Russian Federation. The budgets are different and the EAEU countries do not compensate each other for taxes. The supplier also issued an invoice in accordance with its legislation and its VAT rate. Such a document cannot be registered in the purchase book and be the basis for deducting VAT, because does not comply with the requirements of either the Tax Code of the Russian Federation or the Decree of the Government of the Russian Federation of December 26, 2011 N 1137.

On April 03, the Organization entered into a contract with the Belarusian company Belmashstroy to carry out work on the repair of movable property in the amount of EUR 5,900, including VAT.

The property of the Russian organization at the time of repair is located on the territory of Belarus.

The Russian Federation is not the place of implementation of work (clause 2, clause 29 of the EAEU Protocol), therefore, the Organization does not act as a tax agent for VAT.

On April 15, the counterparty Belmashstroy completed the work, issued a report and invoice to our Organization. The invoice highlights “Belarusian” VAT at a rate of 20%.

The amount of VAT that the Belarusian supplier allocated in his invoice is included in the cost of work and is not subject to deduction in the Russian Federation (Letter of the Ministry of Finance of the Russian Federation dated May 18, 2015 N 03-07-08/28428; Letter of the Ministry of Finance of the Russian Federation dated July 1, 2014 N 03-07 -08/31595; Letter of the Federal Tax Service of the Russian Federation dated 09/03/2013 N ED-4-3/ [email protected] ).

Should the NA exhibit SF if it purchases services (works) exempt from VAT, named in Article 149 of the Tax Code of the Russian Federation?

The Ministry of Finance of the Russian Federation believes that when carrying out transactions for the sale of goods (work, services) that are not subject to taxation (exempt from taxation), the tax agent has the right not to issue an invoice (Letter of the Ministry of Finance of the Russian Federation dated March 19, 2014 N 03-07-09/ 11822).

VAT amount when purchasing goods

When purchasing goods from foreigners, VAT is determined at the calculated rate. The cost of goods including VAT is multiplied by 20/120 (10/110).

The price of goods may include costs associated with their purchase. For example, the letter of the Ministry of Finance dated May 13, 2022 No. 03-07-08/38578 states that this may include the cost of travel and accommodation for specialists who will install and adjust the purchased equipment.

If the agreement does not provide for the amount of tax to be paid to the budget, then the cost of goods without VAT is increased by the amount of VAT. The result obtained is multiplied by the calculated rate of 20/120 or 10/110.

Read in the berator “Practical Encyclopedia of an Accountant”

How can a tax agent avoid conflict with his foreign partner?

Example. How to calculate agent VAT

According to the contract, the cost of goods purchased from a foreign company is 100,000 rubles, the amount of VAT is not indicated.

Sales are subject to VAT at a rate of 20%. The amount of tax that the agent must pay will be 20,000 rubles. ((RUB 100,000 + RUB 100,000 x 20% percent) x 20/120). VAT for a non-resident foreigner can be paid from one’s own funds (clause 3 of Article 171 of the Tax Code of the Russian Federation). The Russian buyer independently calculates the tax base, increasing the cost of goods (work, services) by the amount of VAT. And then accepts the tax as a deduction.

If a Russian company acts as an intermediary, then the amount of VAT it must pay for a foreigner is equal to the cost of the product without VAT, multiplied by the tax rate (20% or 10%).

Tax is calculated on the date of shipment.

Failure to fulfill the duties of a tax agent - fines and penalties

If the NA does not fulfill its obligations to withhold (transfer) taxes, then on the basis of Art. 123 of the Tax Code of the Russian Federation, a fine of 20% of the amount subject to withholding and (or) transfer is collected from him (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 3, 2012 N 15483/11 in case No. A72-5929/2010; Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30. 2013 N 57).

In case of delay in payment of VAT, the tax agent is obliged to calculate and pay penalties (Article 75 of the Tax Code of the Russian Federation).

From October 2022, penalties are calculated according to new rules using a scale (clause 4 of article 75 of the Tax Code of the Russian Federation). If payment is late:

- up to 30 days inclusive - 1/300 of the refinancing rate of the Central Bank of the Russian Federation, valid for a period of up to 30 calendar days;

- 31 or more days - 1/150 of the rate in effect from the 31st calendar day of delay.

Calculate penalties using the Penalty Calculator.

Payment of VAT to the budget

Payment of VAT by tax agents must be made in three equal installments no later than the 25th day of each month of the quarter following the reporting one. The exception is the purchase of works and services from a foreign company. In accordance with paragraph 4 of Article 174 of the Tax Code of the Russian Federation, in this case, VAT to the budget must be paid simultaneously with the payment of funds to the foreign supplier (performer). If, along with a payment order for the transfer of money for services (work), you do not submit a payment order for the transfer of VAT to the budget, the bank will simply not accept the documents from the buyer.

Tax agent for the purchase of electronic services (valid until 01/01/2019) (Article 174.2 of the Tax Code of the Russian Federation)

Who is the VAT authority when purchasing electronic services on the Internet?

From 01/01/2017, organizations (IPs) purchasing electronic services from foreign companies (advertising on the Internet, access to databases, content, etc.) must withhold VAT on these transactions as tax agents.

The list of taxable electronic services is given in paragraph 1 of Art. 174.2 Tax Code of the Russian Federation.

Foreign companies are required to report independently on electronic services provided to individuals (Clause 2 of Article 174.2 of the Tax Code of the Russian Federation).

Let's consider the transaction codes that are used by the tax agent when purchasing services from foreigners in electronic form.

The table is compiled on the basis of Appendix No. 1 to the Procedure for filling out a VAT tax return, approved. By order of the Federal Tax Service of the Russian Federation dated October 29, 2014 N ММВ-7-3/558.

| Transaction code (Section 2 of the VAT return) | Operations carried out by tax agents | Article 174.2 of the Tax Code of the Russian Federation |

| 1011713 | Provision of services by foreign organizations in electronic form, incl. on the basis of commission agreements, commission agreements, agency agreements, organizations and individual entrepreneurs (a Russian organization purchases services from a foreigner for itself) | clause 9 art. 174.2 Tax Code of the Russian Federation |

| 1011714 | Provision of services by foreign organizations in electronic form, incl. on the basis of commission agreements, commission agreements, agency agreements concluded with Russian organizations, individual entrepreneurs or separate divisions (the Russian organization is an agent of a foreign company and acts as an intermediary; it does not purchase services for itself) | clause 10 art. 174.2 Tax Code of the Russian Federation |

Features of determining the tax base when purchasing electronic services

The tax base for tax bases using transaction codes 1011713 and 1011714 will be different:

- NAs receiving services directly from a foreign supplier (code 1011713) determine the VAT base from the contract amount and the calculated rate of 18/118. The tax base includes the amount of VAT (clauses 1 and 2 of Article 161 of the Tax Code of the Russian Federation);

- NAs providing services from a foreign supplier to the end consumer, i.e. intermediaries (code 1011714) determine the VAT base as the cost of services excluding VAT (clause 5 of Article 161 of the Tax Code of the Russian Federation).

When purchasing electronic services on the Internet, a tax agent is subject to the same rules as a tax agent purchasing services (work) from a foreign partner.

The standard does not apply to suppliers from the EAEU (Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia), because So far it is contained only in the Tax Code of the Russian Federation. No changes were made to the EAEU Treaty dated May 29, 2014.

A Russian organization (IE) acts as a tax agent for VAT only when purchasing electronic services from suppliers not from EAEU countries.

When purchasing electronic services from partners from the EAEU, you should be guided not by the Tax Code of the Russian Federation, but by the Treaty on the EAEU dated May 29, 2014 and Appendix No. 18 to it.

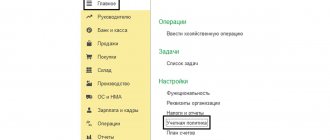

Settings in 1C for an organization that is a tax agent

Setting up functionality by a VAT tax agent

In order for the 1C program to be able to reflect the business transactions of a tax agent for VAT, it is necessary to enable the functionality: section Main - Settings - Functionality - Calculations tab - Tax agent for VAT checkbox.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Tax agent VAT when purchasing services from a foreigner Let's consider the features of reflecting transactions with a tax agent in 1C for...

- Tax agent for VAT when purchasing electronic services from a foreigner. Purchase in 2022, payment in 2022...

- Tax agent for VAT when purchasing electronic services from a foreigner. Payment in 2022, purchase in 2022...

- How to confirm the right to deduct VAT when purchasing electronic services from a foreigner The Federal Tax Service reminded about the procedure for applying VAT deductions when purchasing services in...