The concept of “implementation of work” in the Tax Code of the Russian Federation is separated from the similar concept of “sale of services”. Let's figure out why this happens and how to register in 1C for the work to be performed by a third-party contractor.

From the article you will learn:

- what is the difference between work and services?

- how to reflect the implementation of work in 1C;

- how to show income from the sale of work in accounting and financial accounting and what transactions are generated;

- why it is important to indicate the correct product groups and what is needed to automatically fill them in;

- in which lines of income tax and VAT declarations should income from the sale of work be reflected?

Step-by-step instruction

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

The organization entered into an agreement with the customer Armada LLC to perform work on setting up and laying an Internet network in the amount of 236,000 rubles. (including VAT 18%).

Direct costs for the work amounted to RUB 35,050:

- material costs - 2,500 rubles;

- wages - 25,000 rubles;

- insurance premiums - 7,550 rubles.

On October 15, the work on setting up and laying the Internet network was completed, and the certificate for the work performed was signed.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Implementation of work | |||||||

| October 15 | 62.01 | 90.01.1 | 236 000 | 236 000 | 200 000 | Proceeds from the sale of work | Sales (act, invoice) - Services (act) |

| 90.03 | 68.02 | 36 000 | VAT accrual on revenue | ||||

| Issuance of SF for shipment to the buyer | |||||||

| October 15 | — | — | 236 000 | Issuing SF for shipment | Invoice issued for sales | ||

| — | — | 36 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Writing off the actual cost of work performed as expenses | |||||||

| October 31 | 90.02.1 | 20.01 | 35 050 | 35 050 | 35 050 | Writing off the actual cost of work performed as expenses | Closing the month - Closing accounts 20, 23, 25, 26 |

Implementation of work

Regulatory regulation

The transfer of the results of work by one person to another person on a reimbursable basis is recognized as sales (Article 39 of the Tax Code of the Russian Federation). For the purpose of calculating income tax, organizations engaged in performing work take into account the income received and expenses incurred related to this work.

It is very important not to confuse concepts such as “work” and “service”. The performance of work differs from the provision of services in that the result of the work has a material expression (clause 4 of Article 38 of the Tax Code of the Russian Federation). Learn more Work and service: what is the difference?

Income:

- In the accounting system, revenue from the performance of work refers to income from ordinary activities (clause 5 of PBU 9/99) and is recognized at the time the customer accepts the work (signing the act) (clause 12 of PBU 9/99). It is reflected in the credit of account 90.01.1 “Revenue from activities with the main taxation system.”

- In NU, income is revenue from sales excluding VAT (Clause 1, Article 248 of the Tax Code of the Russian Federation). The date of receipt of income using the accrual method is the date of signing the act (Article 271 of the Tax Code of the Russian Federation).

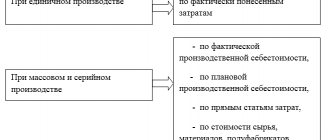

Expenses:

- In accounting, these are expenses the implementation of which is associated with the performance of work (clause 5, clause 9 of PBU 10/99). The composition of direct costs is determined by the technological process and type of activity. Accounting for work until its delivery to the customer is carried out mainly on the cost account 20.01 (Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n). At the time of delivery of the work to the customer, direct costs are written off to the debit of account 90.02.1 “Cost of sales for activities with the main taxation system.”

- In NU, the amount of expenses that reduce sales income includes direct expenses directly related to the implementation of these works (clause 1 of Article 253 of the Tax Code of the Russian Federation), subject to economic justification and the availability of supporting accounting documents (Article 252 of the Tax Code of the Russian Federation). Direct costs may include (Article 320 of the Tax Code of the Russian Federation): Costs of raw materials and materials used in the performance of work;

- Remuneration of employees for work performed (including insurance premiums);

- Depreciation of fixed assets directly related to the performance of work;

- Other expenses taken into account in the accounting system on account 20.01 “Main production”.

The composition of direct expenses must be fixed in the Accounting Policy

Accounting in 1C

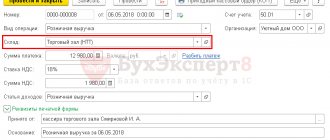

The execution of work is documented in the document Sales (act, invoice) transaction type Services (Act) in the section Sales – Sales – Sales (acts, invoices).

If for work it is necessary to automate the calculation of the cost of a unit of work, then you must use the document Provision of production services in the section Production - Production - Provision of production services.

Learn more Implementation of production work. Calculation of the cost of 1 unit of work

The header of the document states:

- Agreement - a document according to which settlements are made with the buyer, Type of agreement - With the buyer .

In our example, calculations are carried out in rubles, which is noted in 1C in the PDF contract. Therefore, in the Sales document (act, invoice) the following sub-accounts are automatically established for settlements with the buyer:

- Account for settlements with the counterparty - 62.01 “Settlements with buyers and customers”.

- Account for accounting of settlements for advances - 62.02 “Settlements for advances received.”

If necessary, accounts for settlements with the buyer can be corrected in the document manually or configured for the automatic insertion of other accounts for settlements with the counterparty.

The tabular part indicates the work performed from the Nomenclature directory with the Nomenclature Type Service . PDF

- Accounts are filled in the document automatically, depending on the settings in the Item Accounts .

Find out more about setting up item accounting accounts

- Income account - 90.01.1 “Revenue from activities with the main tax system.”

- Expense account - 90.02.1 “Cost of sales for activities with the main tax system.”

- VAT account - 90.03 “Value added tax”.

- Nomenclature groups —an item group related to completed work is selected from the Nomenclature Groups directory.

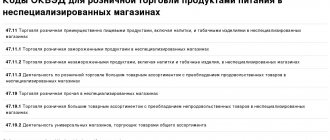

The nomenclature group related to the work performed must be indicated in the Nomenclature groups for sales of products and services PDF in the Main section - Settings - Taxes and reports - Income Tax tab - link Nomenclature groups for the sale of products and services. The correct completion of the income tax return depends on this setting.

Read more about Setting up accounting policies

Postings according to the document

When posting the Sales document (act, invoice), only income from the sale of work is recognized (Dt 62.01 Kt 90.01.1). Recognition of expenses for work performed (Dt 90.02.1 Kt 20.01) is carried out at the Closing of the month.

The document generates transactions:

- Dt 62.01 Kt 90.01.1 - revenue from the sale of work: in accounting accounting, including VAT;

- in NU excluding VAT.

Documenting

The organization must approve the forms of primary documents, including the document for registration of work performed. The following basic forms are used in 1C:

- Certificate of provision of services PDF

- Universal Transfer Document PDF

Forms can be printed by clicking the Print button - Certificate of provision of services and Print - Universal Transfer Document (UDD).

Income tax return

In the income tax return, the amount of revenue from the sale of services is reflected as income from sales:

Sheet 02 Appendix No. 1:

- p.010 “Proceeds from sales - total”, including: p. 011 “...revenue from the sale of goods (works, services) of own production.” PDF

Distribution option “Reflect on production costs”

Expense items with the distribution option Reflect on production costs are used to form production costs attributable to the cost of manufactured products.

The type of cost analytics determines the cost object, which can be a division, a production order, a selected type of other expenses, or operating objects.

Itemized costs can be allocated to production batches, left in work in progress, or redistributed to other expense items (asset/liability items). Rules for the distribution of itemized expenses are specified using elements of the directory Distribution Rules and Indicators and are specified during distribution. The distribution rule can be configured comprehensively, simultaneously specifying the distribution into batches and expense items and cost shares for each option.

Options for setting up costs for distribution of production batches:

- Manually - production batches ( Production Stages and Production Documents without Orders ) will be manually selected during distribution.

- According to the rule - expenses will be distributed between departments and outputs in departments according to the specified rule.

The rule defines:

- Which departments are the costs allocated to? The current, subordinate and superior division are determined relative to the cost division;

- distribution base between divisions and parties. When distributing according to a single base for all selected divisions, parties are determined between which costs are distributed according to the selected distribution option and selections. Screenings can be specified on quantitative and cost bases.

Figure 8 — Setting up rules for distributing costs by department

The inclusion of itemized expenses in products is carried out as the distribution base “enters” into products. For distribution bases associated with products (quantity, volume, weight of products), the moment of “entry” depends on the consumption itself, and therefore it can only be associated with the actual products released. In order to leave part of the itemized costs in work in progress and distribute them in the future to planned products, it is necessary to use the distribution bases “taking into account future outputs”.

Figure 9 — Setting up rules for distributing costs between product lots

The planned indicator (cost, volume, etc.) of products per batch is taken as the distribution base.

On the distribution base formed according to the rule, you can additionally impose selection by groups (types) of products. The selection can be specified in the settings of the rule itself or specified directly in the distribution documents Expense distribution in addition to the rule selected in them.

In cases where an expense item is distributed among other expense items, the distribution rules must include a list of expense items indicating the cost shares.

For expense items with the distribution option Reflect on production costs, you can specify a costing item for which these costs will be included in the cost (the Costing Item on the Main ).

It is possible to specify different distribution rules for an expense item in the context of accounting types, organizations and divisions using Distribution Settings , which can be accessed from the expense item using the hyperlink Configure distribution rules by organizations and divisions .

For income tax purposes, manufacturing costs are classified as direct or indirect. The classification of expense items with the distribution option Reflect on production costs as direct or indirect is determined by the value of the switch For the purpose of determining expenses of the current tax period on the Regulated accounting of the list item card Expense .

Issuance of SF for shipment to the buyer

The organization is obliged to issue an invoice within 5 calendar days from the date of shipment and register it in the sales book (clause 3 of article 168 of the Tax Code of the Russian Federation).

You can issue an invoice to the buyer by clicking the Issue an invoice document (act, invoice) .

Invoice data is automatically filled in based on the Sales document (act, invoice) .

- Operation type code : “Sales of goods, works, services and operations equivalent to it.”

Documenting

You can print the form of the completed invoice by clicking the button Print the document Invoice issued or the document Sales (act, invoice) . PDF

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

VAT declaration

The amount of accrued VAT is reflected in the VAT return:

In Section 3 p. 010 “Implementation (transfer on the territory of the Russian Federation...): PDF

- the amount of sales proceeds, excluding VAT;

- the amount of accrued VAT.

In Section 9 “Information from the sales book”:

- invoice issued, transaction type code "".

Writing off the actual cost of work performed as expenses

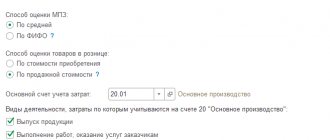

In 1C, to recognize direct expenses at the time of sale, you must set the following in the Accounting Policy : PDF

- checkbox Perform work, provide services to customers ;

- Costs are written off - Taking into account all revenue .

When performing work, direct costs are recorded in different documents depending on the type of cost, for example:

- Document Payroll PDF - to reflect the costs of remuneration of employees (insurance contributions) of employees performing work.

- Document Requirement invoice - for writing off the necessary materials when performing work. PDF;

- Document Receipt (act, invoice) transaction type Services (act) - to reflect expenses for services provided by third parties.

In order for costs to be taken into account when calculating the cost of work, they must be reflected in the same item group as sales.

The actual cost of work performed is written off as expenses using the operation Closing accounts 20, 23, 25,26 in the Month Closing procedure, section Operations – Period Closing – Month Closing.

Postings according to the document

The document generates the posting:

- Dt 90.02.1 Kt 20.01 - writing off as expenses the actual cost of work performed.

Control

In October, costs in the amount of RUB 35,050 were taken into account for the Network Setup , including: PDF

- wages - 25,000 rubles;

- insurance premiums (including from NS and PZ) - 7,550 rubles;

- material costs—RUB 2,500.

Let's generate a report Analysis of invoice 20.01 “Main production” for October in the section Reports – Standard reports – Invoice analysis.

From the report it is clear that for the product group Network Settings :

- There was no work in progress at the beginning of the month.

- At the end of the month, all expenses in the amount of 35,050 rubles. written off as the cost of work performed.

Income tax return

In the income tax return, the cost of work performed is reflected as direct expenses:

Sheet 02 Appendix No. 2:

- p.010 “Direct costs related to goods sold (work, services).” PDF

Test yourself! Take a test on this topic using the link >>

See also:

- Revenues from sales

- Receipt of payment from the buyer (advance payment)

- Document Implementation (act, invoice)

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Test No. 8. Implementation of work...

- Reinstatement of VAT when purchasing goods (works, services) through subsidies...

- When should the cost of equipment for the premises be amortized? This is what the court decided when considering a dispute between the Federal Tax Service and a rented property...

- Purchasing services (works) from foreigners from 2022...

Description and use of account 26

Account 26 “General business expenses” is used to collect information about costs for management needs not directly related to the production of products, performance of work, or provision of services.

Agents, brokers, dealers, forwarders, that is, organizations not related to production, use account 26 as the main one in conducting their activities, summarizing information on all their expenses on it and writing them off to the sales account.

Trading companies do not use account 26 in their activities and all expenses, without exception, are attributed directly to account 44 “Sales expenses”.

For information on the main components of costs accounted for in account 44 “Sales expenses”, read the article “Accounting entries for business expenses”.

Analytical accounting for account 26 is carried out directly by expense items and places of their occurrence.