Features of lending

A credit agreement or loan agreement is a bilateral agreement that stipulates the conditions for one party to provide a specific type of assets (money, property, intangible assets, etc.) that belong to this party for temporary use by the second party (organization, individual entrepreneur or employee).

Let us remind you that a loan can only be issued by a specialized organization that has the appropriate license. But borrowed funds can be obtained from a company, individual entrepreneur or individual. In addition, lending is carried out exclusively in money, that is, in cash. While loans can also be obtained in material form, for example, in the form of products, fixed assets, raw materials or any other property of the company.

Some companies can provide borrowed funds free of charge, that is, there is no need to pay additional fees for the use of borrowed assets (Clause 1, Article 809 of the Civil Code of the Russian Federation). However, most companies provide lending for a specific fee - they calculate interest on the loan, and the accrual entries reflect the occurrence of the borrower's debt to the lender.

The provision of borrowed funds in the accounting of the borrower and the lender differ significantly.

Written form of the contract: is it possible to limit it to a receipt?

As we can see, in most cases, loan agreements in which a legal entity and an individual entrepreneur participate are concluded in writing. At the same time, violation of the rule on the written form of an agreement will not make it invalid or unconcluded (for more details, see “When an agreement is considered concluded: correspondence and an invoice by e-mail, analogues of an electronic signature, drawing up a letter with an agreement”). However, in the event of a dispute, the parties will not be able to refer to witness testimony to confirm both the very fact of concluding a loan agreement and its terms (clause 1 of article 160 of the Civil Code of the Russian Federation, clause 1 of section I of the Review of judicial practice of the Supreme Court of the Russian Federation No. 1 (2016 ), approved by the Presidium of the RF Armed Forces on April 13, 2016).

What does the term “written form” mean? Is it necessary to have a single document called an “agreement” signed by both parties? It follows from paragraph 2 of Article 808 of the Civil Code of the Russian Federation that the written form of the loan agreement will be observed even if there is a receipt from the borrower or another document certifying the transfer by the lender of a certain amount of money to the borrower. At the same time, this receipt (other document) must confirm both the very fact of concluding the loan agreement and its terms - this directly follows from the wording of the norm in question. This means that the text of the receipt (other document) must contain an indication that the money was received on loan, that is, the borrower undertakes to return it to the lender within the prescribed period or at the request of the lender (determination of the Supreme Arbitration Court of the Russian Federation dated March 31, 2011 No. VAS-1827/11 on case No. A28-3935/2010-102/25). Also, the receipt (other document) must indicate the loan amount and make a note that the borrower has received this amount. If the listed provisions are not stated in the receipt (other document), then it will be almost impossible to prove that the money was transferred and transferred specifically under the loan agreement. This conclusion is confirmed by extensive judicial practice.

Exchange legally significant “primary data” with counterparties via the Internet. Free inbox.

For example, courts do not recognize the debtor’s accounting documents (including transcripts of the relevant balance sheet lines) as evidence of the conclusion of a loan agreement. Justification - such documents do not contain an indication of the borrowed nature of the relationship between specific persons (resolutions of the Federal Antimonopoly Service of the North-Western District dated 10.21.09 in case No. A13-1829/2009 and the FAS Central District dated 02.12.13 in case No. A35-11432/2010) . You also cannot use a reconciliation report. According to the courts, this document does not confirm the existence of a loan relationship between the parties, despite the fact that it contains their signatures (resolution of the Federal Antimonopoly Service of the Moscow District dated December 28, 2009 No. KG-A40/13537-09 in case No. A40-43264/09-47 -267, ruling of the Supreme Arbitration Court of the Russian Federation dated 02.02.12 No. VAS-214/12 in case No. A41-45367/10).

But even with the correct execution of the receipt (other document), there may still be problems with confirming the loan. For example, this can happen if the loan amount is large and there is no information confirming that the lender actually has this amount (for example, information that he withdrew funds from a bank account or indicated the loan amount in a tax return). In such a situation, even a correctly drawn up receipt will not be one hundred percent confirmation of the conclusion of a loan agreement (decision of the Supreme Court of the Russian Federation dated October 2, 2009 No. 50-B09-7). At the same time, we note that it is the lender who is obliged to prove the possibility of issuing a loan in such an amount, otherwise he will not be able to get his money back (resolution of the Arbitration Court of the Far Eastern District dated 06/09/18 No. F03-2065/2018 in case No. A51-3905/2017). We also note that there are no criteria for the “largeness” of the loan amount. Therefore, the court decides this issue each time taking into account the specific circumstances of the case. In particular, in the above court decisions, loans of 10 million rubles and 700 thousand rubles were recognized as large.

As we can see, to confirm the borrowing relationship, it is quite dangerous not to conclude a loan agreement in the form of a single document signed by the parties, but to limit it to only a receipt. Moreover, the risk arises not only from the lender, who may encounter difficulties in repaying the loan amount. Problems may also arise for the borrower. As is known, in tax accounting, amounts received under a loan agreement are not included in income (subclause 10, clause 1, article 251 of the Tax Code of the Russian Federation). However, if the court, when considering the dispute that has arisen, indicates that there are no grounds for recognizing the relationship between the parties as borrowed, then the received loan amount will have to be included in income.

Check the counterparty for signs of a shell company

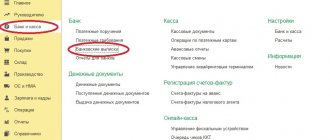

Accounting for lending from the lender

For the lending organization, accounting of transactions for calculating interest under a loan agreement, postings depend on the main type of activity. If lending is the main activity of the company, then records are compiled using account 90 “Sales” (Order of the Ministry of Finance dated October 31, 2000 No. 94n, clause 12 of PBU 9/99). For example, in the accounting of a credit or microfinance organization.

Companies for which issuing loans is not a key activity, when calculating interest on a loan, entries are made using account 91 “Other income” (clause 16 of PBU 9/99). Moreover, amounts for the use of loans are accrued for each reporting period, monthly or quarterly, in accordance with the terms of the concluded agreement.

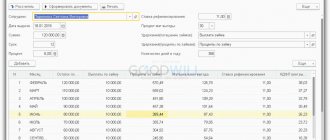

We reflect in the accounting entries for accrual of interest on the loan issued:

| Operation | Debit | Credit |

| Loan issued from current account | 58-3 or 76 - third party company 73-1 - to an employee of the enterprise | 51 |

| Calculated interest on loans issued, transactions | 58-3 73-1 | 91-1 |

| Received payment for the use of borrowed assets | 51 | 73-1 76 58-3 |

In the lender's accounting, accrued interest on a loan issued (entries) is reflected evenly in order to minimize the gap between accounting and tax accounting. Such recommendations were given by the Ministry of Finance in Letter No. 07-02-18/01 dated January 24, 2011.

When accrued, the amounts are included in non-operating income for the purpose of calculating income tax, in accordance with Article 250 of the Tax Code of the Russian Federation. Mandatory payments for the use of money under contracts are accrued at the end of each billing period, regardless of the date of receipt of payment.

Simple formula

Used when calculations are made on the entire loan. You must have the following information on hand:

- loan amount;

- interest rate;

- frequency of interest calculation (daily, monthly, annual);

- additional payments.

The last point is quite rare these days. This could be insurance or service charges. This is usually what banks do when issuing loans.

The formula looks like:

Payment amount = Loan amount* Interest rate per year/365 * length of payment period

365 − is the number of days in a year. If you are counting for a leap year, set it to a day longer.

Let's calculate using an example (hereinafter we consider monetary values without reference to currency).

A loan of 15,000 was taken out. The term was 10 days, 2% per day. The debt is returned in parts, daily.

CB = 15000 * 2% * 365/365 * 15

Total, CB = 4500.

This means you will repay the loan company 19,500.

If the agreement does not specify a percentage, the refinancing rate is used. In 2022 it is 7.25% per annum.

Let's consider an example when the amount of monthly charges is known.

- 100000

- 5% monthly

- Duration: 12 months

Annual rate = 5% *12

Daily = 60% / 365 = 0.16%

CB = 100000 *0.16%*365 = 58400

As a result, you will overpay the bank a little more than half of the money borrowed.

The published letter from the Russian Ministry of Finance is devoted to the procedure for recognizing expenses (income) in the form of interest under loan agreements using the accrual method.

Evenly at the end of each month

According to the Finance Ministry, interest on all types of borrowing should be recognized as part of non-operating income (expenses)

.

This must be done evenly

, namely

throughout the entire term of the loan agreement

and

at the end of each month of use

of the funds

provided (received) .

The day

on which the actual interest payment is due

is irrelevant

.

The amount of income (expense) in the form of interest on debt obligations is reflected in analytical accounting based on the profitability established for each type of debt and on the validity period

such

debt obligation in the reporting period

.

This is done on the date of recognition of income (expenses), which is determined in accordance with Articles 271-273 of the Tax Code of the Russian Federation (clause 1 of Article 328 of the Tax Code of the Russian Federation).

As of the date of recognition of income (expense)

in accordance with Chapter 25 “Organizational Profit Tax” of the Code,

interest

on credit agreements, loans and other similar agreements, other debt obligations, including securities (clause 3 of Article 328 of the Tax Code of the Russian Federation) is taken into account.

According to paragraph 4 of Article 328 of the Code, with the accrual method, the amount of income received or to be received in the reporting period (paid or to be paid in the mentioned period of time of expenditure), the taxpayer, taking into account the provisions of this paragraph, determines on the basis of:

- profitability established for each type of debt;

- the validity period

of such

debt obligation in the reporting period

.

In analytical accounting, the taxpayer must reflect as income (expenses) the amount of interest due to be received (paid) at the end of the month

. Moreover, he needs to do this on the basis of certificates from the responsible person who is entrusted with keeping records of income (expenses) on debt obligations.

Referring to the Decision of the Constitutional Court of the Russian Federation dated January 25, 2012 No. 63-О-О, the Ministry of Finance of Russia noted: the establishment in paragraph 8 of Article 272 and paragraph 4 of Article 328 of the Tax Code of the Russian Federation of the features of accounting for expenses associated with the execution of a loan agreement corresponds to the constitutional obligation to pay taxes . Therefore, the procedure for recognizing interest on loans must comply with the provisions of the Tax Code

RF and cannot be different.

Similar conclusions regarding the procedure for recognizing expenses (income) in the form of interest under loan agreements were made by the Ministry of Finance of Russia in letters dated January 21, 2013 No. 03-03-06/1/16, dated September 25, 2012 No. 03-03-06/1/500, dated 10/21/2011 No. 03-03-06/1/684, dated 03/05/2011 No. 03-03-06/1/122, dated 02/03/2011 No. 03-03-06/1/57 and dated 04/08/2010 No. 03-03-06/1/238.

Position of the tax department

The Tax Department supports the stated position of the Russian Ministry of Finance. This is evidenced, for example, by the letter of the Federal Tax Service of Russia dated March 17, 2010 No. 3-2-06/22. According to him, interest accounting

for debt obligations

during the entire term of the loan agreement corresponds to the general procedure for recognizing expenses and income

for profit tax purposes when applying the accrual method.

Accounting does not depend on

contractual

conditions regarding the date of settlement of the amounts

accrued for the period of use

of interest

. Conclusion of the Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 11200/09 dated November 24, 2009 that the period for recognizing interest on borrowed funds is associated with the moment the lender has the right to demand payment interest, and not with the moment of accrual, is based on the selective application of certain provisions of Articles 272 and 328 of the Tax Code of the Russian Federation. This decision contradicts other provisions of the same articles of the code, the application of which, in the opinion of the Federal Tax Service of Russia, requires uniform recognition of interest throughout the entire period of use of borrowed funds

.

Accounting for expenses within norms

When recognizing interest on debt obligations as non-operating expenses, it is necessary to take into account the provisions of Article 269 of the Tax Code of the Russian Federation. This article states that interest reduces the income tax base within certain limits. Interest is calculated in two ways.

The first method is to calculate the actual accrued interest. Moreover, they should be no more than the average interest that the company pays on debt obligations of the same type, received on comparable terms in the same quarter (month - for taxpayers who switched to calculating monthly payments based on actually received profits), increased by 1.2 times. This method is used when obtaining credits (loans) under several agreements on comparable terms.

In the second method, the maximum amount of interest recognized as an expense is assumed to be equal to (from January 1, 2011 to December 31, 2013 inclusive):

- the interest rate established by agreement of the parties, but not exceeding the refinancing rate of the Bank of Russia, increased by 1.8 times, when issuing a debt obligation in rubles;

- the product of the refinancing rate of the Bank of Russia and a coefficient of 0.8 for debt obligations in foreign currency.

Reference:

The start date of the interest accrual period is the next day after the loan is issued. The end date of the interest accrual period can be considered the date of debt repayment (Articles 191 and 192 of the Civil Code of the Russian Federation).

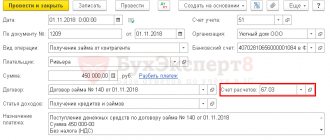

Example

On April 1, 2013, Gamma LLC received a loan from Sigma CJSC in the amount of 100,000 rubles at 12 percent per annum for three months. According to the terms of the loan agreement, the company must pay interest on the debt repayment date - June 30 of the same year.

The refinancing rate of the Bank of Russia for the period from April 1 to June 30, 2013 is 8.25 percent.

The taxable profit of Gamma LLC will be reduced by interest calculated based on the refinancing rate increased by 1.8 times.

This means that the interest rate that the company can take into account when taxing profits will be 14.85 percent (8.25% × 1.8). This figure is greater than the interest on the loan that the company must pay (14.85% > 12%). Consequently, Gamma LLC can include interest within 12 percent per annum in non-operating expenses.

As part of non-operating expenses, the company recognizes interest on the loan evenly. Namely, during the entire term of the contract and at the end of each month of use of the funds received. Thus, for profit tax purposes, Gamma LLC will accrue:

- April 30, 2013 – interest in the amount of RUB 953.42. (RUB 100,000 x 12%: 365 days x 29 days);

- May 31, 2013 – interest in the amount of RUB 1,019.18. (RUB 100,000 x 12%: 365 days x 31 days);

- June 30, 2013 – interest in the amount of RUB 986.30. (RUB 100,000 x 12%: 365 days x 30 days).

On June 30, 2013, Gamma LLC will pay Sigma CJSC interest accrued for 90 days of using the loan, that is, in the amount of RUB 2,958.90. (953.42 + 1019.18 + 986.30).