Offsetting is the repayment of debt obligations in which there is no movement of funds. This operation is possible if the companies have obligations to each other with the same amount.

For example, you have a debt to the Beta organization in the amount of 100,000 rubles. But we also have obligations to Alpha in a similar amount. When offset, there is, in fact, annulment of mutual claims. There is no movement of money during the process. This operation involves the use of appropriate transactions.

Question: Does an organization need to use cash register systems when offsetting mutual claims with an individual purchasing goods (work, services) from it? View answer

Terms of netting

Settlement is not, according to the law, a transaction. Its implementation requires compliance with the following conditions:

- Enterprises initiated at least two transactions, which resulted in their debts to each other.

- Obligations are counter-obligations. That is, each participant in the netting is both a debtor and a creditor.

- The requirements are similar. That is, the amount of one debt is equal to the amount of another debt. However, debts are often not completely homogeneous. In this case, offset occurs for the amount of the smallest debt. The balance of the larger debt can be paid in cash. The amount payable is calculated on the basis of the Settlement Reconciliation Report.

How to offset counterclaims based on a unilateral notification?

IMPORTANT! If the debt to the company is paid by providing goods for a similar amount, such a transaction will not be offset. This is barter, which involves a different accounting procedure.

ATTENTION! Settlement does not apply to compensation for damage or payment of alimony.

Let's consider the basic rules of offset:

- Using the method under consideration, it is possible to repay debts with different repayment periods: due, not due, indefinite. If the debt payment deadline has passed, it is required to cover it within a week after submitting the claim.

- Typically there are two parties involved in the transaction. However, three or more companies can take part in the offset. In this case, there are circular requirements.

Accounting is carried out depending on the nuances of a specific mutual settlement.

How to arrange a settlement ?

Question answer

Question No. 1. 08/17/17 Smart LLC shipped a consignment of goods to Korpus JSC (payment in US dollars at the exchange rate on the date of shipment). 08/28/17 “Korpus” performed contract work for “Smart” (payment in euros at the exchange rate on the date of drawing up the certificate of completion). As of 09/01/17, neither party had paid for the goods received or services provided, and therefore the parties agreed to offset mutual claims. On 09/04/17, the parties offset the amount, which was calculated in rubles at the exchange rate on the date of offset. Smart transferred the rest of the debt to Korpus in a non-cash form. Are the actions of the parties described in this situation legal?

The parties did not have the right to offset, since in this case the rule of homogeneity of the claim was violated, namely, it is impossible to offset payment obligations expressed in different currencies. In general, you can offset amounts expressed in the same currency (rubles, euros, dollars, pounds sterling, etc.).

Also, obligations are subject to offset if they are expressed in conventional units, and the value of the unit for each party is equal to each other.

Question No. 2. According to the requirement, Kort JSC undertakes to compensate for the damage caused to Kompleks LLC in the amount of 12,330 rubles. At the same time, “Complex” is a debtor of “Kort” (the amount of debt is 10,540 rubles). Based on the settlement agreement, Cort compensated the damage in the amount of 1,790 rubles. (RUB 12,330 – RUB 10,540), the balance of the amount was recognized by the parties as offset. Are the actions of the parties described in this situation legal?

According to current legislation, amounts paid as compensation for harm and/or damage caused are not subject to offset. Thus, the agreement on netting between JSC Kort and LLC Kompleks is declared invalid.

Forms of offset

The following forms of mutual settlement can be distinguished:

- One-sided . The initiating party draws up an application indicating the proposal for mutual offset. The document is sent to the company's creditor. The application is drawn up in free form, but it must contain a list of mandatory information: details of the organization, name of the application, date of execution, operation as a result of which the debt arose. The date of offset can be considered the day on which the application was received by the creditor.

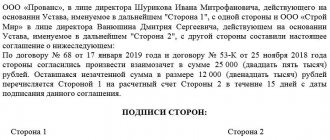

- Double-sided . A bilateral agreement on the offset is drawn up. Representatives of both companies put up their murals. The document is also drawn up in free form, it indicates details and information about the parties to the offset. The bilateral form is considered preferable, since the document concluded between the companies is a reliable confirmation of the consent of the parties to carry out the transaction. In the future, the creditor will not be able to challenge the fact of his consent.

The procedure is carried out on the basis of an Act of Settlement of Mutual Claims. The law does not stipulate the form of this document, and therefore it can be developed by the enterprise itself.

Offsetting between organizations: registration

To carry out offset the following documents are required:

- an application from one counterparty sent to the other party, or the conclusion of an agreement between the parties to offset mutual claims;

- agreements valid between the parties;

- act of mutual settlement signed by all partners.

A similar package of documents is required both for bilateral transactions and when preparing documents when there are three or more partners. Only the number of drawn up acts of offset varies - each of the participants must receive a document signed by all parties.

Despite the fact that there is no standard form of the act, practice and the law “On Accounting” have developed certain criteria for its content. It states:

- Date and place of compilation;

- Names of participating organizations or their representatives (full names, positions and powers);

- Information about each obligation repaid by offset, indicating the status of the counterparty (creditor or debtor);

- Conditions on the size (full/partial) and amount of repayment;

- The effective date of the agreement;

- Signatures of the parties' representatives.

Let's look at how netting is carried out in practice.

Accounting entries

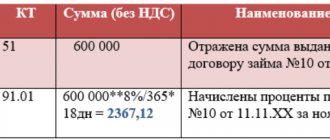

In accounting, the transaction performed is recorded after the Certificate is issued. In this case, postings to accounts 60, 62 and 76 are used.

Example

entered into a contract with the organization “Health” for 25,600 rubles. VAT amounted to 3,905 rubles. The costs of carrying out contract work are 14 thousand rubles. The Health organization previously entered into an agreement for the supply of goods in the amount of 11,800 rubles with Vita. The tax amounted to 1,800 rubles. The cost of goods is 6,500 rubles. The organizations decided to offset each other.

Postings performed:

- DT 60 CT 62. Explanation: fixation of mutual obligations. Amount: 11,800 rubles. The document on the basis of which accounting is kept: accounting certificate.

- DT 60 CT 51. Explanation: transfer of the amount for the remaining obligations. Amount: 13,800 rubles. Primary documentation: payment order.

- DT 68 CT 19. Explanation: tax deductible. Amount: 3,905 rubles. Primary documentation: book of acquisitions.

Postings performed:

- DT 60 CT 62. Explanation: fixation of mutual obligations. Amount: 11,800 rubles. Primary documentation: accounting.

- DT 68 CT 19. Explanation: tax deductible. Amount: 1,800 rubles. Primary documentation: book of acquisitions.

- DT 51 CT 62. Explanation: fixation of the amount of funds paid under the contract. Amount: 13,800 rubles. Primary documentation: extract from a banking institution.

Any transaction in accounting must be confirmed by a primary document. Otherwise, the reflected actions will raise questions from the tax authorities.

An example of netting using the simplified tax system

Let's look at the reflection of offsets in accounting and tax accounting using an example.

Yasen LLC applies a simplified “income” taxation system. From April 5, it leased the production premises to Lipa LLC for a period of 11 months. And on April 10, an agreement was concluded that Lipa LLC would provide transport services for the period until December 31 of the current year.

In June, the enterprises decided to offset mutual claims and found out that, according to the agreements, the accounts payable of Yasen LLC amounted to 42,000 rubles. (under the contract for the provision of transport - 58,000 rubles (under the lease agreement). On June 15, an act of offset was signed in the amount of 42,000 rubles.

For 3 months (April, May, June), the accountant of Yasen LLC did the following for each wiring transportation service:

Dt 44–Kt 76/2 - transport costs are reflected.

As a result, as of June 15, Yasen LLC accumulated accounts payable to Lipa LLC on account 76.

As well as Yasen LLC revenue was recognized:

Dt 62/3–Kt 90/1 (revenue from renting out production premises) - 58,000 rubles.

After signing the netting act, the accountant of Yasen LLC made the following entry:

Dt 76/2–Kt 62/3 (offset of claims in accordance with the act dated June 15, 2021) - 42,000 rubles.

Since the company “Yasen” LLC is on the simplified tax system “income”, when filling out the book of income and expenses, the accountant reflected in the income the revenue in the amount of partial write-off of mutual claims.

After Lipa LLC deposited the balance of the debt into the settlement account, the accountant of Yasen LLC reflected it in his accounting with the entry: Dt 51–Kt 62/3 - 16,000 rubles, and also included it in income when calculating the single tax under the simplified tax system.

Sample act of offset

Act No.__

on carrying out mutual settlement between Yasen LLC and Lipa LLC.

Ulyanovsk June 15, 2022

As of the date of drawing up this act, there are mutual obligations between the parties:

- LLC "Lipa" (tenant) has before LLC "Yasen" (lessor) under an agreement dated 04/05/2021 No. __ (act of acceptance and transfer of production premises dated 04/05/2021 No. __) in the amount of 58,000 rubles.

- Yasen LLC (customer) has before Lipa LLC (contractor) under contract dated 04/10/2021 No. __ (Acceptance and transfer certificates for services rendered dated 04/15/2021 No. __, dated 05/15/2021 No. __, dated 06/15/2021 No. __) in the amount of 42,000 rubles.

The parties agreed to mutually offset the debt in the amount of 42,000 rubles, thereby fully repaying the obligations of Yasen LLC to Lipa LLC.

Yasen LLC Lipa LLC

_______________ _____________

M.P. M.P.

The article “Which object under the simplified tax system is more profitable - “income” or “income minus expenses”?” will help you make the right choice of taxation system under the simplified tax system.

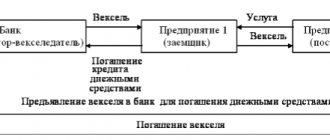

Triple netting

The offset can be made between three or more organizations. However, such an operation does not comply with all the conditions of mutual offsets stipulated in Article 410 of the Civil Code of the Russian Federation. In any case, multilateral offset can be carried out in accordance with Article 421 of the Civil Code of the Russian Federation. It is carried out on the basis of a contract. A document is drawn up based on the general requirements for contracts. However, it should not contradict the specifics of a multilateral transaction, as specified in paragraph 4 of Article 420 of the Civil Code of the Russian Federation. Typically, companies draw up an agreement for mutual settlements. Its form is not established by law. When compiling, you must be guided by the general provisions for primary accounting documentation.

How to reflect netting in accounting

Offsetting mutual claims is one of the methods of settlements between organizations. The offset is possible subject to a number of conditions defined by civil law.

Since the offset of mutual claims reflects only the fact of payment for received or transferred assets (repayment of receivables or payables), it does not lead to the emergence of income or expenses in accounting (clause 2 of PBU 9/99, clause 2 of PBU 10/99). The article: “what is credit in simple words” describes the terms debit, credit, balance using simple examples.

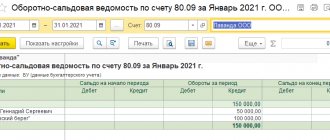

In accounting, the offset of mutual claims is reflected in subaccounts opened for each counterparty to accounts 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 76 “Settlements with various debtors and creditors”.

When performing offsets, make the following entries:

Debit 60 (76) Credit 62 (76) – reflects the termination of the counter obligation to pay for goods (works, services) by offsetting mutual claims.

Situation: is it possible to carry out netting between several organizations?

Yes, you can.

As a general rule, repayment of mutual obligations between several organizations does not fall under the concept of offset. The fact is that offset is possible only if there are counter claims of the same type (Article 410 of the Civil Code of the Russian Federation). In the situation under consideration, this condition is not met, because either party has receivables from a transaction made with one organization, and accounts payable from a transaction made with another organization.

Despite this, in practice, organizations can carry out multilateral netting of obligations. This right is provided for by the provisions of Article 421 of the Civil Code of the Russian Federation. It says that the parties can enter into an agreement, either provided for or not provided for by law or other legal acts. At the same time, general provisions on the contract apply to agreements concluded by more than two parties, unless this contradicts the multilateral nature of such agreements (clause 4 of Article 420 of the Civil Code of the Russian Federation).

As a rule, in multilateral offsets an agreement is concluded on mutual settlements. Such an agreement is not a unified accounting document, so it can be drawn up in any form in compliance with the requirements for primary accounting documents.

Advice: when conducting a multilateral offset, follow the rules for offset of counterclaims:

- offset can only be carried out if each of the parties to the offset has reached the deadline for fulfilling the obligation;

- in case of unequal debts, offset is carried out for the amount of the least of them;

- the offset agreement must contain information reflecting the circumstances of the offset.

An example of reflecting mutual offsets between three organizations in accounting. Organizations apply a common taxation system

On January 12, Torgovaya LLC shipped goods to Alfa CJSC in the amount of 100,000 rubles. (including VAT – RUB 15,254). According to the terms of the agreement, Alpha must pay for the goods supplied on January 15.

On January 13, Alpha shipped materials worth 120,000 rubles to Proizvodstvennaya OJSC. (including VAT – 18,305 rubles). According to the terms of the agreement, the “Master” must pay for the materials on January 16.

On January 15, “Master” performed work for “Hermes” under a contract. The cost of work is 90,000 rubles. (including VAT – 13,729 rubles). According to the terms of the agreement, Hermes must pay for the work on January 16.

As of February 1, none of the listed obligations to pay for goods, materials and work performed have been fulfilled. Thus, Hermes is simultaneously a creditor of Alpha and a debtor of Master. In this case, “Master” is a debtor of “Alpha” and a creditor of “Hermes”, and “Alpha” is a debtor of “Hermes” and a creditor of “Master”.

The parties agreed to carry out mutual settlements and drew up a corresponding agreement.

Organizations offset the amount of the smallest debt, the amount of which is 90,000 rubles. (including VAT – 13,729 rubles). Transactions related to the emergence and repayment of mutual obligations are reflected in the accounting of organizations as follows.

The following entries were made in the Hermes accounting.

January 12:

Debit 62 subaccount “Settlements with ZAO Alfa” Credit 90-1 – 100,000 rubles. – revenue from the sale of goods is reflected;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 15,254 rubles. – VAT is charged on proceeds from the sale of goods.

January 15:

Debit 26 Credit 60 subaccount “Settlements with OJSC “Proizvodstvennaya” - 76,271 rubles. – reflects the cost of work performed by the contractor;

Debit 19 Credit 60 subaccount “Settlements with OJSC “Proizvodstvennaya” - 13,729 rubles. – reflected “input” VAT on work performed;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 13,729 rubles. – accepted for deduction of “input” VAT on work performed.

1st of February:

Debit 60 sub-account “Settlements with OJSC “Proizvodstvennaya” Credit 62 sub-account “Settlements with CJSC “Alfa””

– 90,000 rub. – reflects the repayment of receivables and payables on the basis of an agreement on mutual settlements.

After the offset: – Alpha’s outstanding receivables amounted to RUB 10,000. (including VAT – 1525 rub.); – accounts payable to “Master” have been repaid in full.

Alpha transferred the balance of the debt to Hermes to the bank account.

Debit 51 Credit 62 “Settlements with CJSC Alfa” - 10,000 rubles. – payment has been received for shipped goods.

The following entries were made in Alpha's accounting.

January 12:

Debit 41 Credit 60 subaccount “Settlements with Trading LLC” – 84,746 rubles. – purchased goods are capitalized;

Debit 19 Credit 60 subaccount “Settlements with Trading LLC” – 15,254 rubles. – reflected “input” VAT on purchased goods;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 15,254 rubles. – accepted for deduction of “input” VAT on purchased goods.

13th of January:

Debit 62 subaccount “Settlements with OJSC “Proizvodstvennaya” Credit 90-1 – 120,000 rubles. – revenue from the sale of materials is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 18,305 rubles. – VAT is charged on proceeds from the sale of materials.

1st of February:

Debit 60 subaccount “Settlements with LLC “Torgovaya”” Credit 62 subaccount “Settlements with OJSC “Proizvodstvennaya” - 90,000 rubles. – reflects the repayment of receivables and payables on the basis of an agreement on mutual settlements.

After settlement:

- accounts payable to Hermes amounted to 10,000 rubles. (including VAT – 1525 rub.);

- Master's receivables amounted to 30,000 rubles. (including VAT - 4576 rubles).

The parties repaid the remaining debts to each other in cash:

Debit 60 subaccount “Settlements with Trading LLC” Credit 51 – 10,000 rub. – the balance of debt for purchased goods is listed;

Debit 51 Credit 62 subaccount “Settlements with OJSC “Proizvodstvennaya” - 30,000 rubles. – payment for shipped materials has been received.

The following entries were made in the Master's accounting.

13th of January:

Debit 10 Credit 60 subaccount “Settlements with CJSC Alfa” - 101,695 rubles. – purchased materials are capitalized;

Debit 19 Credit 60 subaccount “Settlements with CJSC Alfa” - 18,305 rubles. – reflected “input” VAT on purchased materials;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,305 rub. – accepted for deduction of “input” VAT on purchased materials.

January 15:

Debit 62 subaccount “Settlements with Trading LLC” Credit 90-1 – 90,000 rubles. – revenue from the sale of completed work is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 13,729 rubles. – VAT is charged on proceeds from the sale of work performed.

1st of February:

Debit 60 subaccount “Settlements with ZAO Alfa” Credit 62 subaccount “Settlements with LLC Torgovaya” - 90,000 rubles. – reflects the repayment of receivables and payables on the basis of an agreement on mutual settlements.

After settlement:

- Hermes receivables have been repaid in full;

- accounts payable to Alfa amounted to 30,000 rubles. (including VAT - 4576 rubles).

“Master” transferred the balance of the debt to the account of “Alpha”:

Debit 62 subaccount “Settlements with ZAO Alfa” Credit 51 – 30,000 rubles. – the balance of debt for purchased materials is listed.