Duration of the tax period for income tax

Based on Art.

216 of the Tax Code of the Russian Federation, the duration of the tax period is defined as a calendar year. After this period, it is necessary to make full payments and report to the state. The calendar year may not always be complete. Some features of the tax period are established by Art. 55 Tax Code of the Russian Federation. For example, a newly registered organization is required to report from the beginning of its activities to December 31. When registering an employer in December, the tax period for personal income tax becomes the period of time from the beginning of the creation of the organization until the end of the next year, etc. Individual entrepreneurs, whose responsibilities include paying personal income tax, also take the calendar year as a basis.

Reporting on accrued personal income tax by employers

After the end of the tax period, enterprises and individual entrepreneurs who are employers are required to provide reporting data to the tax office.

Firstly, as tax agents, they need to reflect the employee’s income received, income tax withheld and transferred in the 2-NDFL certificate. Reporting on employee income must be received by the Federal Tax Service by April 1 of the year following the tax period. For late submission of certificates, a fine of 200 rubles per unit of overdue document is imposed (in accordance with paragraph 1 of Article 126 of the Tax Code of the Russian Federation). Certificates are provided both in paper form and through electronic reporting.

You will learn everything about submitting this type of reporting from our section “Certificate 2-NDFL”.

The second personal income tax report that employers submit is the 6-personal income tax calculation. However, it has a different frequency of delivery - quarterly with the provision of a final calculation for the year. The deadline for submitting the annual form is the same as for 2-NDFL - April 1. The fine for failure to submit is 1000 rubles. for each full or partial month of delay.

Our section “Calculation of 6-NDFL” is devoted to this calculation.

On what income is tax paid?

In the simplest, but at the same time the most widespread version, personal income tax is withheld from wages by the employer’s accounting department. But income tax is taken not only from wages; taxes are also paid on bonuses and other payments to employees. In general, the Tax Code of the Russian Federation defines objects of taxation as income received by personal income tax taxpayers (Article 209):

- from sources in the Russian Federation and/or from sources outside the Russian Federation - for tax residents of the Russian Federation (clause 1);

- from sources in the Russian Federation – for tax non-residents of the Russian Federation (clause 2).

Thus, payers of personal income tax are both residents and non-residents of the Russian Federation. According to Part 2 of Art. 207 of the Tax Code of the Russian Federation, tax residents are individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months. The period of stay in the Russian Federation is not interrupted by the period of stay abroad for short-term (less than 6 months) treatment or training, as well as for work in offshore hydrocarbon fields. Regardless of the actual time spent in the Russian Federation, Russian military personnel serving abroad and government employees seconded to work abroad are recognized as tax residents of the Russian Federation (Part 3 of Article 207 of the Tax Code of the Russian Federation).

Other types of taxable income, except payments from employers to employees:

- from the sale of property;

- from renting out property, for example, an apartment or a car;

- from transactions with securities;

- received in the form of dividends;

- received in the form of winnings from gambling and lotteries.

The list is not exhaustive. By default, personal income tax is paid on all types of income except those for which such payment is not provided. It should also be borne in mind that personal income tax in the same situation may or may not be collected, depending on the specific situation, for example, on the status of the taxpayer. So, if an apartment is given to a close relative, then the recipient does not have to pay tax (clause 18.1 of Article 217 of the Tax Code of the Russian Federation), and if not to a close relative, then personal income tax will have to be paid.

What is not subject to personal income tax

Not all incomes of citizens are subject to taxes. The list of income not subject to personal income tax is given in Art. 217 of the Tax Code of the Russian Federation, and it is very extensive, containing several dozen positions. Such income, in particular, includes:

- state benefits (except for temporary disability benefits);

- pensions;

- monthly payments in connection with the birth (adoption) of the first and second child according to Federal Law No. 418-FZ of December 28, 2017;

- income of volunteers received under civil contracts for work and services under Federal Law No. 135-FZ of August 11, 1995;

- alimony;

- some categories of one-time payments, including financial assistance;

- rewards to donors for donating blood and breast milk.

In addition, income received in specific situations is not subject to taxation. Thus, in the previous section an example was given of donating an apartment to a close relative. An example of another situation when you do not need to pay personal income tax is the sale of an apartment that was owned for at least the minimum maximum period of ownership (Article 217.1 of the Tax Code of the Russian Federation) - 5 years (Part 4), during privatization, inheritance from a close relative, upon receipt ownership under a rental agreement – 3 years (Part 3).

Reporting on accrued personal income tax for individual entrepreneurs

The tax period for personal income tax is calculated by individual entrepreneurs on a general basis as a calendar year. They need to report on their income by April 30, by submitting a 3-NDFL declaration.

About it, see the selection of materials in the “Declaration (NDFL)” section.

Payment of income tax (clause 9 of Article 227 of the Tax Code of the Russian Federation) is carried out in several stages:

- 50% advance tax for January-June until July 15;

- 25% advance tax for July-September until October 15;

- 25% advance tax for October-November until January 15.

As for the 4-NDFL declaration, it is submitted by newly registered entrepreneurs within 5 days following the month of the first income received in order to calculate possible advance payments. Another reason for filing 4-NDFL is a change in the amount of estimated income of at least 50% in relation to the previous period (letter of the Ministry of Finance of the Russian Federation dated 01.04.2008 No. 03-04-07-01/47 “On the procedure for calculating advance payments for personal income tax persons"). Advance payments are subject to recalculation (clause 10 of article 227 of the Tax Code of the Russian Federation).

See the material “How to submit a declaration in form 4-NDFL in 2019?”

The fine for late submission of the 3-NDFL declaration is at least 1,000 rubles (Article 119 of the Tax Code of the Russian Federation). In case of missed deadlines for filing 4-NDFL reports, tax authorities can take measures in accordance with Art. 126 of the Tax Code of the Russian Federation.

Personal income tax: tax period, tax rates

Personal income tax : tax period, tax rates, procedure for calculating and paying tax, eliminating double taxation, tax return.

A tax period is a period based on the results of which the tax base must be determined and the amount of tax payable must be calculated (Clause 1, Article 55 of the Tax Code of the Russian Federation).

In addition, at the end of the tax period, personal income tax payers who are required to independently calculate and pay tax or wish to receive tax deductions submit tax returns to the tax authorities (clause 1 of Article 229, Articles 227, 227.1, 228 of the Tax Code of the Russian Federation). And tax agents, based on the results of the tax period, submit to the tax authorities information on the income of individuals and the amounts of accrued and withheld taxes (clause 4 of article 24, clause 2 of article 230 of the Tax Code of the Russian Federation).

For personal income tax, the tax period is the calendar year (Article 216 of the Tax Code of the Russian Federation).

Tax rates applied when calculating personal income tax are established by Art. 224 Tax Code of the Russian Federation. There are five such rates in total - 9, 13, 15, 30 and 35%.

If an individual is a tax resident of the Russian Federation, then the majority of his income will be taxed at a tax rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation).

In relation to certain types of income, Art. 224 of the Tax Code of the Russian Federation established special tax rates. These rates are 9, 15, 30 and 35%.

Taxation at the personal income tax rate of 9% is carried out in the following cases:

1) upon receipt of dividends (clause 4 of article 224 of the Tax Code of the Russian Federation);

2) upon receipt of interest on mortgage-backed bonds issued before January 1, 2007 (clause 5 of Article 224 of the Tax Code of the Russian Federation);

3) upon receipt of income by the founders of trust management of mortgage coverage. Such income must be received on the basis of the acquisition of mortgage participation certificates issued by mortgage coverage managers before January 1, 2007 (clause 5 of Article 224 of the Tax Code of the Russian Federation).

Dividends received from Russian organizations by individuals who are not tax residents of the Russian Federation are taxed at a rate of 15% (clause 3 of Article 224 of the Tax Code of the Russian Federation).

All income received by individuals who are not tax residents of the Russian Federation is taxed at a personal income tax rate of 30%. Basis - clause 3 of Art. 224 Tax Code of the Russian Federation.

The exceptions are:

1) income of non-residents in the form of dividends from equity participation in Russian organizations. Such income is subject to personal income tax at a rate of 15% (clause 3 of Article 224 of the Tax Code of the Russian Federation);

2) income of foreign workers - highly qualified specialists and foreigners working for individuals on the basis of a patent (Articles 13.2 and 13.3 of Law No. 115-FZ). A 13% rate is applied to the income of such employees, regardless of whether they have the status of a tax resident of the Russian Federation (clause 3 of Article 224 of the Tax Code of the Russian Federation).

The personal income tax rate of 35% is the maximum. It applies in the following cases:

1) when receiving winnings and prizes in ongoing competitions, games and other events for the purpose of advertising goods, works and services. Moreover, the tax is paid on the amount exceeding the value of such winnings and prizes of 4,000 rubles. (paragraph 3, paragraph 2, article 224, paragraph 28, article 217 of the Tax Code of the Russian Federation).

2) upon receipt of interest income on deposits in banks to the extent that they exceed the amount of interest calculated as follows (paragraph 3, paragraph 2, article 224, article 214.2 of the Tax Code of the Russian Federation):

— for ruble deposits — based on the refinancing rate of the Central Bank of the Russian Federation, increased by 5%. Moreover, for these purposes, the refinancing rate is taken that is valid during the period for which the specified interest is accrued;

- for deposits in foreign currency - based on 9% per annum.

This also applies to individuals who have the status of an individual entrepreneur (Letter of the Ministry of Finance of Russia dated November 11, 2008 N 03-04-05-01/416).

Interest income on time pension deposits is also taxed at a rate of 35% if it exceeds the specified limits. Moreover, regardless of when such deposits were opened (Letters of the Ministry of Finance of Russia dated 08/13/2008 N 03-04-05-01/294, dated 07/28/2008 N 03-04-05-01/274, dated 06/07/2008 N 03-04-06-01/161, dated 06/03/2008 N 03-04-05-01/187, dated 01/18/2008 N 03-04-05-01/6, Federal Tax Service of Russia for Moscow dated 01/17/2008 N 28-10/004172).

A rate of 35% is applied to interest on time pension deposits accrued since 2008. At the same time, for previous periods, calculated personal income tax on such income at this rate is not recalculated (Letter of the Federal Tax Service of Russia for Moscow dated June 24, 2008 N 28-11/ 059324).

3) when receiving income in the form of material benefits from savings on interest on borrowed (credit) funds (paragraph 4, paragraph 2, article 224 of the Tax Code of the Russian Federation). Moreover, the tax is paid on the following amounts (clause 2 of Article 212 of the Tax Code of the Russian Federation):

- for ruble loans (credits) - from the amount of excess interest calculated on the basis of 2/3 of the current refinancing rate established by the Central Bank of the Russian Federation on the date of payment of interest by the taxpayer, over the amount of interest calculated on the basis of the terms of the agreement (clause 3, clause 1, art. 223, paragraph 1, paragraph 2, article 212 of the Tax Code of the Russian Federation);

- for foreign currency loans (credits) - from the amount of excess interest calculated on the basis of 9% per annum over the amount of interest calculated on the basis of the terms of the agreement.

In most cases, taxpayers - individuals are not involved in calculating and paying personal income tax to the budget - tax agents (those who are the source of income, most often employers) do it for them (clause 1 of Article 226 of the Tax Code of the Russian Federation).

But in some situations, taxpayers themselves are required to calculate and pay taxes. Such requirements are established by the Tax Code of the Russian Federation and relate to:

— certain categories of taxpayers (Articles 227, 227.1 of the Tax Code of the Russian Federation);

— certain types of income, upon receipt of which personal income tax must be calculated and paid to the taxpayers themselves (Articles 214, 214.1, 228 of the Tax Code of the Russian Federation).

You must calculate the personal income tax amount based on the results of the tax period. The general rules for its calculation are established in Art. 225 Tax Code of the Russian Federation.

So, to calculate personal income tax you need:

1. Based on the results of the tax period, determine all your income that is subject to personal income tax and is recognized as received in this tax period (clause 3 of article 225, article 208, 209, 217, 223 of the Tax Code of the Russian Federation).

2. Determine which of the indicated incomes are taxed at a rate of 13%, which at a rate of 9%, and which at a rate of 35% (Article 224 of the Tax Code of the Russian Federation).

3. Determine the tax base (or tax bases if you received income that is taxed at different personal income tax rates).

You need to do it like this:

— you need to determine the tax base for income taxed at one rate (for example, at a rate of 13%) in total;

— tax bases for income that are subject to personal income tax at different rates, you need to determine separately (clause 2 of article 210 of the Tax Code of the Russian Federation).

4. Calculate the amount of tax from each tax base.

The tax base for personal income tax is the monetary expression of the taxpayer’s income. And if income is taxed at a personal income tax rate of 13%, then the monetary expression of income reduced by tax deductions (clauses 3, 4 of Article 210 of the Tax Code of the Russian Federation).

5. Round the calculated personal income tax amounts to full rubles. In this case, the amount is up to 50 kopecks. is discarded, and the amount of 50 kopecks. and more is rounded up to the whole ruble (clause 4 of article 225 of the Tax Code of the Russian Federation).

6. Add up the personal income tax amounts calculated for each rate separately and determine the total amount of personal income tax due for payment to the budget (clause 2 of Article 225 of the Tax Code of the Russian Federation).

The specifics of calculating personal income tax by entrepreneurs and persons engaged in private practice are established in Art. 227 Tax Code of the Russian Federation. Persons engaged in private practice include private notaries, lawyers who have established a law office, private doctors, detectives and other persons who have the right to conduct private activities without registering as an entrepreneur (paragraph 3, paragraph 1, article 2, article 23 of the Civil Code RF, Article 2, 8 of the Fundamentals of the legislation of the Russian Federation on notaries, approved by the Supreme Court of the Russian Federation on 02/11/1993 N 4462-1, Article 21 of the Federal Law of 05/31/2002 N 63-FZ “On advocacy and the legal profession in the Russian Federation” , Article 4 of the Law of the Russian Federation dated March 11, 1992 N 2487-1 “On private detective and security activities in the Russian Federation”, Article 56 of the Fundamentals of the legislation of the Russian Federation on the protection of the health of citizens, approved by the Armed Forces of the Russian Federation on July 22, 1993 N 5487-1).

If you are an individual entrepreneur or engaged in private practice, then you must pay personal income tax as follows (Article 227 of the Tax Code of the Russian Federation):

1. Based on the results of the six months, III and IV quarters, you make advance payments for personal income tax based on estimated, not actual income.

2. At the end of the tax period, based on the tax return, you adjust your obligations to the budget and make an additional payment of the tax amount or a refund.

Tax amounts actually paid by a taxpayer who is a tax resident of the Russian Federation outside the Russian Federation in accordance with the legislation of other states on income received outside the Russian Federation are not counted when paying tax in the Russian Federation, unless otherwise provided by the relevant treaty (agreement) on avoidance of double taxation (clause 1 of article 232 of the Tax Code of the Russian Federation).

In order to be exempt from paying tax, offset, receive tax deductions or other tax privileges, the taxpayer must submit to the tax authorities official confirmation that he is a resident of the state with which the Russian Federation has concluded an agreement valid during the relevant tax period (or part thereof) ( agreement) on the avoidance of double taxation, as well as a document on the income received and on the payment of tax outside the Russian Federation, confirmed by the tax authority of the relevant foreign state. Confirmation can be submitted both before paying tax or advance tax payments, and within one year after the end of the tax period, as a result of which the taxpayer claims to receive tax exemption, offset, tax deductions or privileges (clause 2 of Art. 232 of the Tax Code of the Russian Federation).

The tax return is submitted by taxpayers specified in Articles 227, 227.1 and 228 of the Tax Code of the Russian Federation (clause 1 of Article 229 of the Tax Code of the Russian Federation).

The tax return is submitted no later than April 30 of the year following the expired tax period, unless otherwise provided by Article 227.1 of the Tax Code of the Russian Federation.

Persons who are not required to submit a tax return have the right to submit such a return to the tax authority at their place of residence.

In the event of termination of the activities specified in Article 227 of the Tax Code of the Russian Federation and (or) termination of payments specified in Article 228 of the Tax Code of the Russian Federation, before the end of the tax period, taxpayers are required to submit a tax return on the actual income received within five days from the date of termination of such activities or such payments in the current tax period.

If, during a calendar year, a foreign individual ceases activities, income from which is subject to taxation in accordance with Articles 227 and 228 of the Tax Code of the Russian Federation, and leaves the territory of the Russian Federation, a tax return on income actually received during the period of his stay in the current tax period for territory of the Russian Federation must be presented to them no later than one month before leaving the territory of the Russian Federation.

Payment of tax accrued on tax returns, the procedure for submitting which is determined by paragraph 3 of Art. 229 of the Tax Code of the Russian Federation, is carried out no later than 15 calendar days from the date of filing such a declaration.

In tax returns, individuals indicate all the income they received during the tax period, the sources of their payment, tax deductions, tax amounts withheld by tax agents, amounts of advance payments actually paid during the tax period, tax amounts subject to payment (additional payment) or refund based on the results tax period.

Taxpayers have the right not to indicate in the tax return income that is not subject to taxation (exempt from taxation) in accordance with Article 217 of the Tax Code of the Russian Federation, as well as income upon receipt of which the tax is fully withheld by tax agents, if this does not prevent the taxpayer from receiving tax deductions provided for in Article 218 — 221 Tax Code of the Russian Federation.

Tags tax tax base tax rate tax resident letter from the Ministry of Finance payment of taxes elimination of double taxation

Reporting on accrued personal income tax by other persons

Other individuals who received income determined by clause 1 of Art. 228 of the Tax Code of the Russian Federation are required to report after the end of the personal income tax tax period, which is considered to be the previous calendar year. They also provide the 3-NDFL declaration until April 30. Tax obligations must be paid no later than July 15.

For the tax period for income tax for foreign citizens carrying out activities listed in paragraph 1 of Art. 227.1 of the Tax Code of the Russian Federation, the calendar year is accepted. These groups of persons do not submit declarations at the end of the reporting period, except for the cases listed in paragraph 8 of Art. 227.1 Tax Code of the Russian Federation.

Find materials that can help you prepare your declaration here.

The object of personal income tax taxation and its tax base. Tax deductions

The object of taxation is income received both in cash and in kind, as well as in the form of material benefits. An example of income in kind is the gratuitous receipt of property, goods, etc. Material benefits are recognized as an interest-free loan issued to an employee, payment by the employer for goods, utilities, food, recreation, and training of the employee.

Taxable income is listed in Art. 208 of the Tax Code of the Russian Federation and are divided depending on the place of their receipt into those received on Russian territory or received outside its borders. For example, income tax is imposed on dividends and interest, insurance payments, income from the use of copyright or related rights, income from the rental of property, remuneration for the performance of labor duties, etc.

It is important to note that the list of income subject to income tax is not exhaustive, since the legislator allows for the emergence of new sources of material wealth.

A significant list of income is not subject to personal income tax (Article 217 of the Tax Code of the Russian Federation). For example, state benefits (unemployment, maternity and childbirth), state pensions and scholarships, alimony received, all types of compensation payments, amounts of maternity capital, income of soldiers, sailors, sergeants and foremen, taxpayer income from the sale of personal farm-grown crops are exempt from taxation. farms of livestock, poultry, livestock products, crop production and beekeeping, etc.

For example, if the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in an amount not less than 1/300 of the amount in force at that time refinancing rates of the Central Bank of the Russian Federation from amounts unpaid on time for each day of delay, starting from the next day after the established payment deadline until the day of actual settlement inclusive (Article 236 of the Labor Code of the Russian Federation). These payments are of a compensatory nature and should not be subject to personal income tax (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 10, 2013 N 11031/13).

On the other hand, the sanctions provided for by consumer protection legislation are exclusively punitive in nature. Their collection does not pursue the goal of compensating for losses (real damage) of the consumer. Since the payment of amounts of such sanctions leads to the formation of property benefits for the consumer, they are included in the citizen’s income on the basis of the provisions of Art. 41, 209 of the Tax Code of the Russian Federation, regardless of the fact that the receipt of these amounts is due to a violation of the rights of an individual (clause 7 of the Review of the practice of consideration by courts of cases related to the application of Chapter 23 of the Tax Code of the Russian Federation (approved by the Presidium of the Armed Forces of the Russian Federation on October 21, 2015)).

The tax base for personal income tax is determined as the monetary expression of income. Therefore, income in kind and in the form of material benefits are subject to monetary valuation for the purpose of calculating income tax.

In addition to income that is not subject to taxation, tax legislation establishes various tax deductions.

Tax deductions, as well as withdrawals of a number of income from the object of taxation, are tax benefits. The only difference is that a tax deduction is a reduction in the tax base for income, which, in principle, is the object of taxation, and income that is not subject to taxation is not recognized as an object of taxation in principle.

Tax deductions can be: a) standard; b) social; c) property; d) professional; e) investment; f) deductions when carrying forward losses from transactions with securities and transactions with derivative financial instruments; g) deductions when carrying forward losses from participation in an investment partnership.

Standard tax deductions (Article 218 of the Tax Code of the Russian Federation) are established in fixed monetary amounts and are applied monthly to certain taxpayers. So, to deduct the amount of 3 thousand rubles. persons who received or suffered radiation sickness as a result of the accident at the Chernobyl nuclear power plant are entitled to monthly; persons directly involved in underground nuclear weapons testing; carrying out and ensuring work on the collection and disposal of radioactive substances; disabled people of the Second World War; persons who received disabilities, concussions, wounds or mutilations while defending the Fatherland, as well as other categories of citizens.

Tax deduction in the monthly amount of 500 rubles. provided, for example, to Heroes of the Soviet Union and Heroes of the Russian Federation; persons who survived the siege of Leningrad; concentration camp prisoners; disabled people since childhood, as well as disabled people of groups 1 and 2; citizens who fulfilled their international duty in the Republic of Afghanistan and other countries in which hostilities took place.

Monthly tax deduction in the amount of 1400 rubles. is provided to taxpayers who support a child under the age of 18 or a full-time student under the age of 24. If there are two minor children, a deduction is provided in the amount of 1,400 rubles. for each child. For the third and each subsequent child, as well as a disabled child, a deduction is provided in the amount of 3,000 rubles. The single parent is given a double deduction. However, this type of tax deduction is valid only if the taxpayer’s income does not exceed 350 thousand rubles.

Standard tax deductions are provided to the taxpayer by one of the tax agents who are the source of payment of income, at the taxpayer’s choice based on his written application and documents confirming the right to such tax deductions.

Social tax deductions (Article 219 of the Tax Code of the Russian Federation) are used to reduce the tax base of individuals in cases where they make socially significant expenses. This type of deduction, for example, includes amounts of income transferred by the taxpayer to charitable purposes; amounts of income paid by the taxpayer for his education or the education of his minor children; the amount of income spent by the taxpayer on treatment in a medical institution or on the purchase of medicines; spent on non-state pension provision.

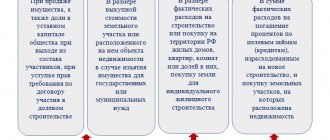

The amount of social tax deductions is limited by law. Thus, only amounts of expenses for charitable purposes that do not exceed 25% of income are subject to deduction, and in the case of expenses for the education of minor children of the taxpayer - no more than 50,000 rubles. for each child. Social tax deductions are provided when submitting a tax return to the tax authority at the end of the tax period. Tax deductions in the amount of amounts spent on training and treatment can be provided by the employer - tax agent upon a written application from the employee. Property tax deductions (Article 220 of the Tax Code of the Russian Federation) include amounts received by the taxpayer from the sale of their own residential houses, apartments, dachas, garden houses or land plots, as well as amounts spent by the taxpayer on new construction or the purchase of a residential house or apartment in Russia or aimed at paying off interest on mortgage loans.

The maximum amount of property tax deduction is limited by the Tax Code of the Russian Federation and is 1,000,000 rubles. for the sale of residential buildings, apartments, dachas, land plots, RUB 250,000. when selling other property, RUB 2,000,000. - when the taxpayer makes expenses for new housing construction or purchase of housing. The provision of a property tax deduction is associated with the legal fact of incurring expenses for the acquisition of real estate. If this property was subsequently sold by the taxpayer, then such sale does not change the fact that expenses were incurred for its acquisition. In order to receive a property tax deduction in this case, the taxpayer must submit a document confirming the fact that he owned this object.

Property tax deductions are provided when the taxpayer submits a tax return to the tax authorities at the end of the tax period. A deduction in the amount of expenses actually incurred for new housing construction, the purchase of apartments, land plots for housing construction, as well as repayment of interest on loans spent on the construction or acquisition of residential houses, apartments, land plots can be provided before the end of the tax period when the taxpayer applies to the employer - to the tax agent with a written statement.

Professional tax deductions (Article 221 of the Tax Code of the Russian Federation) are expenses associated with certain activities of the taxpayer. Thus, individual entrepreneurs have the right to receive professional tax deductions; private notaries and other persons engaged in private practice; taxpayers receiving income from the performance of work (provision of services) under civil contracts, as well as persons receiving royalties or remuneration for the creation, publication, performance or other use of works of science, literature and art.

As a general rule, actual and documented expenses incurred by the taxpayer for the purpose of generating income are subject to deduction. If an individual entrepreneur cannot document his expenses, a professional deduction is made in the amount of 20% of the total income from business activities. Cost standards as a percentage of the amount of accrued income are also established for income in the form of royalties. Taxpayers exercise the right to professional tax deductions by submitting a written application to a tax agent, and in the absence of one, by filing a tax return at the end of the tax period.

Investment tax deductions (Article 219.1 of the Tax Code of the Russian Federation) are provided to taxpayers who received income from the sale of securities, from transactions accounted for in an individual investment account, as well as in the case of depositing funds into an individual investment account.

A separate group is formed by tax deductions when carrying forward losses from transactions with securities and transactions with derivative financial instruments (Article 220.1 of the Tax Code of the Russian Federation) and tax deductions when carrying forward losses from participation in an investment partnership (Article 220.2 of the Tax Code of the Russian Federation) .