Where can I get a free cash receipt order?

You can receive a cash receipt order (CPO) on our website:

We offer you free software in the 2 most common file formats - Word and Excel. In this case, the already completed form is presented in Excel, located below.

However, downloading a cash receipt order is not all; you should make sure that this is the current form of the document.

NOTE! As of August 19, 2017, new rules for conducting cash transactions are in effect, which you can read here.

The link through which you can use the PQR on our website will contain a document that meets all legal requirements. Let's look at them.

What requirements must the cash receipt order form meet?

On our website you can use the KO-1 form (corresponding to OKUD number 0310001), approved by Decree of the State Statistics Committee of the Russian Federation dated 08/18/1998 No. 88. Russian organizations are prescribed to use only this form by Bank of Russia Directive No. 3210-U dated 03/11/2011.

For more information about what standards primary documents must comply with, read the article “Primary document: requirements for the form and the consequences of violating it .

NOTE! Individual entrepreneurs who, in accordance with the legislation of the Russian Federation on taxes and fees, keep records of income or income and expenses and (or) other objects of taxation or physical indicators characterizing a certain type of business activity, may not draw up cash documents and a cash book (clauses 4.1, 4.6 of instruction No. 3210-U).

Found documents on the topic “in criminal law, a cash receipt order form is a document”

- Receipt cash order .

Form No. ko-1 Accounting and financial documents → Cash receipt order. Form No. ko-1 ... by the State Statistics Committee of the USSR dated December 28, 1989 no. 241 +-+ (enterprise, organization) cash code +-+ cash receipt order (enterprise, organization) +-+ date number correspondence code sumcode receipt document-composition-pondi-ana- mentality goal… - Receipt cash register order. Form No. ko-1

Accounting and financial documents → Cash receipt order. Form No. ko-1...USSR and the Ministry of Finance of the USSR October 12, 1973 no. 668. +-+ to cash receipt cash receipt order no. +-+ +-+ order no. date month taken from +-+- 20 +-+ base: +-+ corresponding- analytic code- ...

- Receipt cash register order (Unified form N KO-1)

Enterprise records management documents → Cash receipt order (Unified form N KO-1)The document “cash receipt order (unified form n to-1)” in word format can be obtained from the link “download file”

- Journal of registration of cash receipts and expenses documents. Form No. ko-3

Accounting statements, accounting → Journal of registration of incoming and outgoing cash documents. Form No. ko-3...cover sample +-+ (enterprise, organization) code by okud +-+ journal for registering incoming and outgoing cash documents for 20, using this sample, print all pages of the journal. +-+ incoming, money received (spent) noted...

- Journal of registration of cash receipts and expenses documents. Form no. Ko-3a

Accounting statements, accounting → Journal of registration of incoming and outgoing cash documents. Form no. Ko-3a...cover sample +-+ (enterprise, organization) code by okud +-+ journal for registering incoming and outgoing cash documents 20. The journal is kept at the discretion of the ministry (department) instead of the journal in the form no. co-3. according to this sample...

- Journal of registration of cash receipts and expenses documents (Unified form N KO-3)

Documents of the enterprise's office work → Journal of registration of incoming and outgoing cash documents (Unified form N KO-3)The document “journal of registration of incoming and outgoing cash documents (unified form n ko-3)” in excel format you can...

- Prikhodny order. Form No. m-4

Accounting and financial documents → Receipt order. Form No. m-4... by the resolution of the State Statistics Committee of the USSR dated December 28, 1989 no. 241 ++ _

- Prikhodny order. Form No. m-4

Accounting and financial documents → Receipt order. Form No. m-4... acceptance, the organization was approved by order of the Central Administration of the USSR dated December 14, 1972 no. 816 +-+ Okud code 0303004 2 +-+ +-+ receipt order no. +-+ “” 20 +-+ supplier corresponding account type +-+- operation warehouse registration tion account name,…

- Expendable cash register order. Form No. ko-2

Accounting and financial documents → Expenditure cash order. Form No. ko-2... by the State Statistics Committee of the USSR dated December 28, 1989 no. 241 +-+ (enterprise, organization) code for okud +-+ expense cash order +-+ date number correspondence code amount code document-composition-pondy-analytical-target mentality ru- gu- ic assigning...

- Accounting receipt and expense book form forms work book and insert in it

Documents of the enterprise's office work → Form of the receipt and expenditure book for recording the forms of the work book and the insert in it...2 to the resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69, receipt and expenditure book for recording forms and inserts in it...

- Expendable cash register order. Form No. ko-2

Accounting and financial documents → Expenditure cash order. Form No. ko-2...-2 approved by the Central Administration of the USSR in agreement with the State Bank of the USSR and the Ministry of Finance of the USSR on October 12, 1973 no. 668 expense cash order no. +-+ day month +-+- 20 +-+ +-+ correspondence code analysis code target account. tical sum g...

- Expendable cash register order (Unified form N KO-2)

Enterprise records management documents → Expense cash order (Unified form N KO-2)the document “cash expense order (unified form n ko-2)” in word format using the link “download file”

- Prikhodny order (Standard intersectoral form N M-4)

Enterprise records management documents → Receipt order (Standard interindustry form N M-4)... approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a, receipt order No. ...

- Sample of filling out the customs receipt warrants when placing goods under the temporary import regime (letter of the State Customs Committee of the Russian Federation dated July 1, 1996 No. 01-15-11722)

Accounting and financial documents → Sample of filling out a customs receipt order when placing goods under the temporary import regime (letter of the State Customs Committee of the Russian Federation dated 01.07.96 No. 01-15-11722)...e 3 to the letter of the State Customs Committee of the Russian Federation dated 07/01/96 no. 01-15/11722 customs receipt order +-+ +-1. type 2. additional 3. reference number of the order sheets 24400/19026/051653/ # 01 +-+- 4. payer 5. payment currency +- petrov i.i. 5.1. name...

- Sample of filling out the customs receipt information sheet warrants when placing goods under the temporary import regime (letter of the State Customs Committee of the Russian Federation dated July 1, 1996 No. 01-15-11722)

Accounting and financial documents → Sample of filling out a reference sheet for a customs receipt order when placing goods under the temporary import regime (letter of the State Customs Committee of the Russian Federation dated July 1, 1996 No. 01-15-11722)Appendix 3a to the letter of the State Customs Committee of the Russian Federation dated 07/01/96 no. 01-15/11722 reference sheet of the customs receipt order form dtpo +-+ +-1. method 2. additional sheet 3. reference number TPO variable...

How to fill out the PKO form

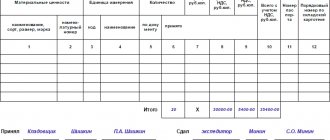

cash receipt order is the first stage of the task, and the next step will be to correctly fill out this document. A completed PQS sample may look like this:

A cash receipt order can be issued on paper or using technical means - data is entered on a computer, then the PKO is printed and signed. In addition, the receipt can be issued in electronic form, provided that it is protected from unauthorized access, distortion and loss of information. In this case, the PKO is signed with an electronic signature (clause 4.7 of instruction No. 3210-U).

You can print out the completed sample cash receipt order and place it on the cashier’s desk along with instructions for filling it out, which we will provide below.

Filling out the PKO form: nuances

There are a number of nuances that characterize the procedure for filling out a cash receipt order form. Let's look at them.

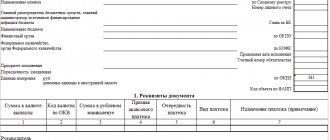

The “Structural unit” column should be filled out only if cash is accepted from an employee of the organization. If they are transferred by another legal entity or individual, then a dash should be placed in the corresponding paragraph of the form.

The “Debit” and “Credit” items contain the accounts of the Chart of Accounts (approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n) in accordance with the essence of the business operation.

The column “Purpose code” is filled in by organizations that use the appropriate coding system.

The column “Amount of rubles, kopecks” of the KO-1 form is filled in only with numbers, rubles and kopecks are separated by a comma (for example, “200.75”). In the “Amount in words” column, rubles are indicated in words (the first word is capitalized), and kopecks are indicated in numbers. You should also put a dash (if the document is filled out on a computer, then a continuous sequence of consecutive dashes) in the empty spaces of the corresponding column after indicating the amount in words.

If the company does not work with VAT, then in the “Including” column you should enter “Without VAT”. Otherwise, the corresponding VAT amount.

In the “Appendix” paragraph, you should record the primary documents that are the basis for entering figures into the PKO (for example, a cashier’s report).

In addition to the main part of the KO-1 form, you will also need to fill out a receipt, which is included in the structure of the PKO. The receipt will appear in the document on the same page as the main part of the form. As for affixing the seal, based on business customs, the seal is often affixed so that part of it is on the receipt, and the other part is on the PKO. Please note that in this case, claims from the tax authorities are possible. However, you can try to challenge them (see, for example, the decision of the Seventh Arbitration Court of Appeal dated 04/06/2010 No. 07AP-1517/10). In addition, today such disputes seem to us to be of little relevance, since in connection with the entry into force of the law of April 6, 2015 No. 82-FZ, the seal for organizations has ceased to be a mandatory requisite.

See also the material "Print is not a mandatory attribute of the primary document . "

The order must be signed by the cashier or other authorized person. The cashier checks the signatures of authorized persons on the PCO with the samples (except for the situation when the receipt is issued in electronic form). If the document is filled out by an individual entrepreneur and does not hire a cashier, then the appropriate authority to sign the document is assigned to him. A receipt is issued to the person who deposited funds into the cash register.

NOTE! If you fill out the PKO electronically and sign with an electronic signature, then you can send a receipt to the depositor of funds at his request by email (clause 5.1 of instruction No. 3210-U).

From 08/19/2017, the cashier can issue a general cash receipt order at the end of the day for the entire amount of cash receipts, confirmed by fiscal documents - cash receipts and BSO online cash register (clause 4.1 of instruction No. 3210-U).

Is it possible to issue a receipt for the PKO instead of a strict reporting form? The answer to this question was given by the experts of the ConsultantPlus system. Get a free trial of K+ and move on to trusted voices.

Receipt cash order (form KO-1)

Home / Cash discipline

| Table of contents: 1. Procedure and methods for registering PQS 2. Instructions for filling out a receipt order 3. Sample of filling out RKO 4. Fines for the absence and storage periods of PKO | PKO in excel or word format Download samples of PKO: Founder’s contribution, Return of account, Compensation for damage, Money from the bank for salary, LLC loan from the founder, According to the contract from the legal entity. persons, Retail revenue from individual entrepreneurs, LLC trading revenue |

A receipt order is a unified form that is filled out upon receipt of cash at the cash desk of an organization (IP).

The company is obliged to issue a PKO in the following cases:

- Contribution of funds to the authorized capital;

- Return of unused amounts of accountable funds;

- Compensation for damage by an employee;

- Sale of property owned by the company;

- Return or receipt of borrowed funds;

- Receipt of money from the company account;

- Receipt of cash revenue from business activities (at the end of the working day, one PQR is filled in for the entire amount of revenue).

Individual entrepreneurs are not required to draw up PKO, as well as other cash discipline forms (for example: cash register, cash book, etc.), but can use such documents on their own initiative for the purpose of accounting and control over the movement and expenditure of cash.

Procedure and methods of registration of PKO

The unified order form (No. KO-1) was approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

The document consists of two parts: a cash receipt order and a receipt for the PKO.

The order is issued in one copy. Numbering is carried out in order in chronological sequence, the reference date is January 1 of each new year.

The person whose responsibilities include filling out the receipt order may be:

- an employee of the organization (cashier, accountant, etc.), appointed by order of the head of the company;

- Chief Accountant;

- manager (if the company does not have a chief accountant or accountant on staff).

The PKO is signed by: the chief accountant (accountant or director) and the cashier.

If the head of the organization (IP) single-handedly carries out cash transactions and draws up primary documentation, only the signature of the head (IP) is placed on the PKO.

The form is completed:

1) Manually.

2) On a computer with subsequent printing:

- in a text or spreadsheet editor;

- using specialized programs and online services.

3) In electronic form. With this method of document management, cash forms must be certified by a qualified electronic signature.

Corrections and blots when filling out the PQS are strictly not allowed!

The receipt for the order is filled out simultaneously with the PKO, signed and sealed.

To affix a seal impression the following can be used:

1) The main round seal of the organization.

It should be noted that since the entry into force of the law dated 04/06/2015 No. 82-FZ, organizations have the right to refuse to use a round seal.

2) Simple (auxiliary) seals and stamps kept by company employees responsible for their safety and use.

The seal impression should be located entirely on the receipt and not go onto the receipt order itself.

The cashier who receives the completed form from the accounting department is obliged to:

- check all order data;

- check the document for erasures and corrections;

- verify the authenticity of the signature of the chief accountant (or other responsible person);

- check the availability of the specified applications.

If all the rules are followed, the cashier accepts the money. The documents attached to the order should be stamped or handwritten: “Received” (“Paid”) with the date.

The executed PKO remains in the organization and is filed with the cashier’s report (the second copy of the cash book sheet), and the receipt is handed over to the person who deposited the cash.

Information about the order is entered into the order registration journal (No. KO-3). A record of received funds is reflected in the company's cash book.

Instructions: how to fill out a cash receipt order

The unified form is filled out as follows:

- In the “Organization” field, the full name of the company is indicated in accordance with the constituent documents.

- In the “according to OKPO” window, the corresponding code is indicated according to the Rosstat notification.

- The line “Structural division” is filled in if the company has divisions and only in situations where money is handed over by an employee of the representative office.

- Next, fill in the serial number of the form and the current date.

- The “Debit” and “Credit” cells indicate accounting account numbers or codes (if the company uses coding).

Individual entrepreneurs do not fill out these cells.

Transactions on the receipt of cash into the organization are reflected in the debit of account 50 (you should also indicate a subaccount in accordance with the company’s working chart of accounts).

For a loan, a corresponding account is recorded - the source of cash inflow, for example:

- 51 (52) – receipt of cash from the company’s bank account;

- 60 – the supplier returned the advance;

- 62 (76) – money received from customers and buyers;

- 66 (67) – borrowed funds received;

- 73-1 (2) – the employee compensated for material damage;

- 75-1 – the owner contributed a share to the authorized capital;

- 90-1 – revenue was received from the sale of products (services, works).

- “Structural unit code” is filled in if the unit for which the order is issued has a code.

- “Analytical accounting code” – enter the analytics code of the corresponding account (if such codes are provided in the organization).

- The amount of cash received in numerical terms is recorded in the “Amount” cell.

- The “Purpose Code” cell is filled in if the company uses a coding system.

- Full name is entered in the “Accepted from” line. company employee. When making payments between counterparties, the company name and full name are indicated. the employee who handed over the money, using the preposition “through”. For example: Meridian LLC through K.M. Ivanov.

- The content of the operation is entered in the “Base” line.

- In the “Amount” line, the amount of funds received is deciphered in words, with kopecks indicated in numbers.

- The “Including” line records the VAT rate and amount. If the transaction is not subject to VAT, it is indicated: “Without VAT”.

- The “Attachment” field lists the names, numbers and dates of the attached documents.

When filling out printed forms by hand, you should put dashes in the empty cells. Also, after entering the amount in words, be sure to cross out the empty space on the line to avoid falsification of the document.

The PKO receipt contains information identical to the data on the receipt order.

Sample of filling out a cash receipt order 2022

Contribution of the founder to the authorized capital

Return of accountable funds

Compensation for damage by the guilty party

Receiving money from the bank to pay salaries

LLC loan from the founder

Payment under an agreement from a legal entity

Retail revenue from individual entrepreneurs

LLC trading revenue

Penalties for the absence of PKO and storage periods for the form

For the lack of primary documents (gross violation of accounting rules), inspectors may fine the company under Art. 120 Tax Code of the Russian Federation:

- For 10,000 – 30,000 rubles;

- Or 20% of the unpaid amount if the tax base is understated, but not less than 40,000 rubles.

There are no sanctions for incorrect execution of the PKO, but a form filled out with errors can be equated to the absence of a document.

The absence of a PKO receipt from the counterparty may lead to the inspectors’ refusal to recognize expenses taken into account when calculating income tax (single tax under the simplified tax system). In such a situation, the counterparty will incur additional costs for paying taxes, fines and penalties.

The organization is obliged to store primary documentation, which includes the cash receipt order, for 5 years after the end of the reporting year.

Read in more detail: Form KO-1

Did you like the article? Share on social media networks:

- Related Posts

- Payroll (form T-51)

- Order establishing a cash limit in 2022

- Advance report (form AO-1)

- Cash discipline in 2022

- Expense cash order (form KO-2)

- Sample of filling out form T-49

- Sample of filling out form T-51

- Cash book (form KO-4)

Discussion: there is 1 comment

- Victor:

01/03/2020 at 08:31The PKO is filled out as follows: - organization (above) - one name (not related to the operation) - seal - another organization - There is no order itself - The receipt is filled out after the seal has been affixed (the handwriting of the second person) To whom should I appeal about the nullity of this document?

Answer

Leave a comment Cancel reply

Results

A cash receipt order is a primary document drawn up on the unified form KO-1. The PQO is filled out when funds are received at the cash desk and can be in either paper or electronic form. In the latter case, the PCP is signed using electronic signatures.

Sources:

- Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 N 88

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Cash receipt order. Form No. ko-1”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |