Tutorial 1C: Accounting 8

In the last lesson, you and I learned how to arrive at inventory items, extras. expenses and services. In this lesson we will continue the topic of acquiring material assets and look at how fixed assets are received by the company. Let's learn how to put them into operation.

We will begin our study of the fixed asset accounting block in the 1C Accounting 8 program with the main reference books related to fixed assets. This is the directory “Fixed Assets” - which contains a list of fixed assets and the directory “Methods of reflecting expenses”, which contains the rules for calculating depreciation on enterprise expenses. Let's get acquainted with other directories in the section related to fixed assets. We will perform the basic operations of purchasing fixed assets that do not require installation. Let's put them into operation. Let's get acquainted with the calculation of depreciation in the 1C Accounting 8 program. At the end, we will complete a practical task.

Directory "Fixed assets".

Let's start studying fixed asset accounting in the 1C Accounting 8 program with reference books. Let's go to the "Reference books" section, "OS and intangible assets" group. Let’s select the directory “Fixed Assets”.

The directory is intended to store a list of fixed assets and information about them.

Information about the fixed asset is filled in upon acceptance for accounting and may change during operation.

The directory has a multi-level, hierarchical structure. To classify fixed assets, you can create groups and subgroups.

When you enter a fixed asset, an inventory number is automatically assigned.

On the Basic Information , you can manually fill in the data:

- Full name - the name of the main tool for filling out printed forms.

- Manufacturer, serial number, passport number, date of manufacture (construction).

- Fixed asset accounting group - category of fixed asset, for example, Buildings, Structures, Transfer devices, etc.

- Type of fixed asset - type of fixed asset: direct fixed asset or capital investment in leased property.

- Depreciation group - depreciation group of a fixed asset.

- OKOF , Code according to ENAOF .

- The Motor transport checkbox is set for motor vehicles.

- Location address and region code.

The Accounting and Tax Accounting tabs contain information on accounting and tax accounting of fixed assets. This information is filled in automatically after the fixed asset is accepted for accounting and put into operation.

You can register the acceptance of a fixed asset for accounting on the Accounting using the hyperlink Enter a document of acceptance for accounting .

An inventory card of a fixed asset (form OS-6) can be generated by clicking the Form OS-6 .

You can add a group of fixed asset objects of the same type, differing only in inventory numbers, to the directory by clicking the Group addition .

In the form that opens, you must indicate:

- The code from which numbering will begin is

- Number of elements created,

- Name of fixed assets.

You can also fill in other information that is common to the objects you are adding.

The number of added objects is limited by the bit depth of the code. For example, specifying the start code 01 means that no more than 99 directory entries can be added automatically. If you want to add more elements in batches, you must add enough bits to the initial code.

Group addition of directory elements is done by clicking the Add . All elements will have the same names and contain the information specified in the fields of the group addition form.

To quickly fill out documents with similar fixed asset objects that have the same names, you need to enter at least one such object into the tabular section. The list of fixed assets will be filled with objects that have the same name as the one originally entered, by clicking the Fill - By name command panel of the tabular section.

Reflection of the transfer of property from account 21 to 1C: BGU 8

To restore the balance of fixed assets accounted for in off-balance sheet account 21, use the document Write-off of fixed assets, intangible assets, legal assets with the type of write-off Write-off of own fixed assets in oper. accounting (21) and the flag enabled: Restore to balance . the Restore on balance flag, the Restore on balance tab appears .

On the Fixed Assets, Intangible Assets, Regulatory Assets , fixed assets are selected that are written off from off-balance sheet account 21. On the Balance Restoration , data on fixed assets that are written off from off-balance sheet account 21 are indicated.

On the Accounting transaction , select the standard transaction Write-off of fixed assets with restoration on the balance sheet and in the additional details indicate the full working account 401.10.172. The gratuitous transfer of a fixed asset is formalized by the document Transfer of fixed assets, intangible assets, legal acts with the type of transfer - Transfer of own fixed assets, intangible assets, legal acts on the balance sheet (101, 102, 103) and the standard transaction Gratuitous transfer to organizations of fixed assets, intangible assets, legal acts (401.20.280) .

More on the topic: How to correctly enter new income codes in payment orders for public sector organizations

Published 05/19/2021

Directory "Methods of reflecting expenses."

The directory is located in the “Directories” section, the “Income and Expenses” group.

The directory is intended to store a list of possible ways to reflect depreciation expenses (repayment of cost) in the costs of the enterprise.

The method of reflecting depreciation expenses is indicated when accepting a fixed asset for accounting, when accepting an intangible asset for accounting, when indicating the purpose of use of work clothes and special equipment.

When entering a method for reflecting depreciation expenses, you must specify the accounting and tax account and the corresponding analytics according to which the depreciation amount should be distributed.

Depreciation costs can be distributed in a certain proportion across several cost items and analytical objects, for example, across several divisions of the organization. To do this, you need to set the values of the distribution coefficients in the K . When calculating the amount of depreciation, the values of the specified coefficients are summed up, and then the amount of depreciation is distributed proportionally to the value of each coefficient.

By default, several elements have already been created in it and note that they are called Depreciation (account 20.01), Depreciation (account 26), Depreciation (account 44).

Decommissioning of OS

To write off fixed assets, we use a document with the same name.

Let's create a new document and fill in its header. In the “Organization” field, select an organization if the database keeps records of several. We will indicate the reason for the write-off. The default write-off account is proposed 91.02 “Other expenses”. In the “Other income and expenses” field, select the required expense item.

We will fill out the tabular part of the document with a list of fixed assets to be written off using the “Add” or “Select” buttons.

After filling it out, we submit the document. An example of generated transactions is shown in the figure below:

Analysis of the transactions shows that the following operations were performed:

- depreciation was calculated in the last month of using the OS;

- the initial cost of the fixed asset was written off to the OS disposal account 01.09;

- previously accrued depreciation was written off to account 01.09;

- the residual value of the fixed assets is written off to account 91.02.

Other reference books and documents from the section “Fixed Assets”

They may be hidden by default. If the directory is not displayed in the navigation panel, use the “Navigation settings” command in the right corner. In the left window we present available reference books. On the right are directories that are displayed in the navigation panel. Let's find the "OS and Intangible Materials" group and move all the directories to the right window. Now in the navigation panel in the “OS and intangible assets” group I have significantly more reference books presented. Let's get to know them.

Construction objects - the directory is intended to store a list of fixed assets under construction (modernized, reconstructed, installed).

Information register “OKOF depreciation groups” - the register sets the applied depreciation groups for the OKOF classifier element.

The directory “Annual fixed asset depreciation schedules” is intended for storing depreciation schedules for fixed assets in organizations with a seasonal nature of production.

The use of a depreciation schedule is indicated when accounting for a fixed asset.

The use of a depreciation schedule after accepting a fixed asset for accounting or a change in the depreciation schedule is registered in the document Change of fixed asset depreciation schedules.

When entering a schedule, you need to specify the distribution coefficients of the annual depreciation amount by month. The distribution coefficient will be taken into account when performing a routine depreciation operation.

The ENAOF directory contains a classifier of fixed assets for which standard codes and annual depreciation rates are established.

This directory classifies fixed assets for which depreciation is calculated according to ENAOF.

For motor vehicles, depreciation rates are used as a percentage of the cost of the car per 1000 km.

Code for ENAOF is indicated for fixed assets in the Code for ENAOF .

The OKOF directory contains an all-Russian classifier of fixed assets.

The directory is used to classify fixed assets when accepted for accounting to determine the depreciation group.

The OKOF code is indicated for the fixed asset in the OKOF .

The directory “Parameters for the production of fixed assets” is intended for storing a list of natural indicators, in proportion to the volume of which depreciation of fixed assets can be calculated.

The directory “Reasons for writing off fixed assets” is intended to store a list of reasons for writing off fixed assets.

Directory “Events with fixed assets” - is intended for storing a list of events with fixed assets of the organization, for example, acceptance for accounting, relocation, modernization, etc.

For each event, you must select Event Type .

When registering fixed asset accounting documents, a value from the reference book is selected in the Event .

The document “Receipt (act, invoice)” is intended to reflect various operations for the receipt of goods and services.

Document “Receipt of additional expenses" - is intended to reflect the services of third-party organizations, the costs of which are included in the cost of goods.

The document “Transfer of equipment for installation” is intended to include the cost of equipment and components requiring installation in the costs that form the initial cost of fixed assets.

The document “Receipt (act, invoice)” is intended to reflect various operations for the receipt of goods and services.

The document “Acceptance for accounting of fixed assets” is intended to reflect the acceptance for accounting of fixed assets.

The document “Movement of fixed assets” is intended to reflect the movement of fixed assets to another division and (or) to another financially responsible person.

The document “OS Modernization” is intended to reflect the modernization (reconstruction) of fixed assets.

The document “Inventory of fixed assets” is intended to reflect the results of the inventory of fixed assets.

The document “Write-off of fixed assets” is intended to reflect the write-off of fixed assets.

The document “Preparation for the transfer of fixed assets” is intended to reflect preparation for the transfer of ownership of fixed assets if the sale transaction is subject to state registration.

The document “Transfer of fixed assets” is intended to reflect the sale of fixed assets.

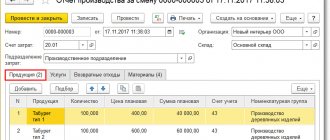

The document “Production of fixed assets” is intended to register the volume of produced products (work performed) for calculating depreciation of fixed assets.

The document “Changing depreciation schedules of fixed assets” is intended for changing depreciation schedules of fixed assets in organizations with a seasonal nature of production.

The document “Changing the special coefficient for calculating depreciation of fixed assets (tax accounting)” is intended for changing the special coefficient for calculating depreciation of fixed assets in tax accounting.

The document “Changing the methods of reflecting expenses for depreciation of fixed assets” is intended to change the method of reflecting expenses for depreciation of fixed assets - cost accounts and analytics, which include expenses for depreciation of fixed assets.

The document “Changing the parameters for calculating depreciation of fixed assets” is intended for changing the parameters for depreciation of fixed assets.

The document “Change in the state of fixed assets” is intended to suspend or resume the calculation of depreciation on fixed assets.

The document “Registration of payment for fixed assets and intangible assets for the simplified tax system” is intended for registration in the tax accounting of the simplified tax system of information on payment to the supplier of fixed assets, intangible assets and modernization costs.

The document “Registration of payment for fixed assets and intangible assets (IP)” is intended for registration in the accounting of individual entrepreneurs of information on payment to the supplier of fixed assets and intangible assets.

The report “Fixed assets depreciation sheet” is intended for analyzing data on fixed assets. In the report, you can analyze accounting and tax accounting data, set a selection by materially responsible person, display the date of acceptance for accounting, etc.

The report “Inventory book of fixed assets” - an inventory book of accounting for fixed assets in the OS-6b form (approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7) is used by small enterprises to record the availability of fixed assets, as well as their movement within the organization. The inventory book is kept in the accounting department of the organization in one copy.

Receipt of fixed assets

Let's move directly to accounting for fixed assets and create the first document related to the receipt of fixed assets in our company.

Go to the “OS and Intangible Materials” section of the “Equipment Receipts” magazine. Let's create our first document:

We receive equipment from the supplier:

- Invoice 1501 dated 01/15/2015, invoice 1501 dated 01/15/2015

- Supplier LLC "KVADROKOM" INN/KPP: 5027147377/ 770301001

- OGRN: 1095027003367

- Address 123242, Moscow, Sadovaya-Kudrinskaya street, building No. 11, building 1, apartment Room 2P-14

- Automatic striping machine. EXS 108 1 pc. RUB 1,180,000.00 each

Total: RUB 1,180,000.00 incl. VAT 180,000.00

Documentation of disposal of fixed assets

To register the disposal of fixed assets, the following forms of primary documents are used (the use of one form or another depends on the reason for the disposal):

- Certificate of acceptance and transfer of OS (OS-1);

- Certificate of acceptance and transfer of the building (OS-1a);

- Act on acceptance and transfer of groups of OS objects (OS-1b);

- Act on write-off of an asset (OS-4) for all assets, except transport;

- Act on decommissioning of vehicles (OS-4a);

- Act on write-off of groups of fixed assets (OS-4b).

Important! In certain cases, a consignment note (TORG-12) is also used for the disposal of fixed assets, for example, when selling fixed assets or exchanging them.

Acceptance for accounting of fixed assets that do not require installation

Now we need to put the acquired fixed asset into operation. To do this, a document “Acceptance for accounting of fixed assets” is created in the 1C Accounting 8 program. You can create it in the journal of documents of the same name.

We will formalize the acceptance for accounting of the OS:

- Date: 01/31/2015

- MOL: director

- Location: Production workshop

- Equipment: Automatic striping machine. EXS 108

- Main tool: Automatic striping machine. EXS 108 OS accounting group: Machinery and equipment (except office)

- Depreciation group: Fourth group (over 5 years up to 7 years inclusive)

- Manufacturer: Factory

- Serial number: 1111

- Passport number (registration): 222

- Release (construction) date: 01/01/2015

- Method of receipt: Purchase for a fee

- The procedure for including cost in expenses: Calculation of depreciation

Question from life

From our VKontakte group we learned that the business transaction of transferring property to a branch is not as simple as it seems at first glance.

Here's what one of our subscribers wrote:

The situation is this: the organization holds the OS received from the supplier on account 08 and is waiting for them to be sent to branches. They were not put into operation. How to reflect correctly? From which subaccount should I enter?

Let’s say right away that the balance in account 08 “Investments in non-current assets” reflects the amount of the organization’s investments in unfinished construction and unfinished transactions for the acquisition of fixed assets. Their cost can be written off to the debit of account 91 “Other income and expenses upon sale, transfer for free and other investments.

In our situation, the OS needs to be transferred to a branch. Postings involving account 08 cannot be made. That is, first the company must put the property into operation as fixed assets, assign it an inventory number, establish a useful life, determine how depreciation will be calculated and, if necessary, begin accruing it.

Note that the colleague’s question does not contain very important information on which the answer to the question depends. OP may or may not be allocated to a separate balance sheet. Both accounting and the procedure for transferring property from the parent company depend on this.

Therefore, we will consider both options.

There is always something to discuss. Let's solve problems together. Join the VK Bukhgalteriya.ru group

Depreciation calculation

Depreciation is calculated using the document “Regular operation” with the type of operation “Depreciation and depreciation of fixed assets”. It is intended to reflect period-closing transactions. Period closing operations are carried out once a month. It is important to follow the sequence of performing routine operations. The Month End Assistant will perform all the necessary month end operations in the correct sequence. As a rule, it is not necessary to create documents manually.

At this point, the consideration of fixed assets can be considered complete. Proceed to the practical task.

Practical task

Register the receipt of equipment:

- Supplier: KVADROKOM LLC

- Agreement: 1601 dated 01/16/2015

- Invoice 1601 dated 01/16/2015, Invoice: 1601 dated 01/16/2015

- Equipment: Automatic striping machine. Ergonomic pallet strapping system ErgoPack 725E – 1 piece for 720,000 rubles.

TOTAL: 720,000.00 incl. VAT 109,830.51

Register the OS for registration:

- Date: 01/31/2015

- MOL: director

- Location: Production workshop

- Equipment: Automatic striping machine. Ergonomic pallet strapping system ErgoPack 725E

- Main equipment: Automatic striping machine. Ergonomic pallet strapping system ErgoPack 725E OS accounting group: Machinery and equipment (except office)

- Depreciation group: Fourth group (over 5 years up to 7 years inclusive)

- Method of receipt: Purchase for a fee

- The procedure for including cost in expenses: Calculation of depreciation

Register the receipt of equipment:

- Supplier: LLC "COMMERCIAL VEHICLES - GAZ GROUP" INN/KPP: 5256051148/ 525601001

- OGRN: 1045207058687

- Address: 603004, Nizhny Novgorod region, Nizhny Novgorod, Ilyich Ave., building No. 5

TOTAL: 680,000.00 incl. VAT 103,728.81

Register the OS for registration:

- Date: 01/31/2015

- MOL: director

- Location: Administration

- Equipment: GAZelle NEXT

- Fixed asset: GAZelle NEXT Fixed asset accounting group: Vehicles

- Depreciation group: Third group (over 3 years up to 5 years inclusive)

- Motor transport: Yes

- Vehicle registration: Vehicle type code: 51004

- Identification number (VIN): 4564134

- Make: GAZelle NEXT

- Registration plate: а777кв77

- Engine power: 120.00 hp

- Tax rate: 45.00

- Method of receipt: Purchase for a fee

- The procedure for including cost in expenses: Calculation of depreciation

Calculate depreciation for the month of January.

Next Previous

These features are available to both users of local versions and cloud solutions, for example 1C:Fresh, 1C:Ready Workplace (WWW) . To purchase boxed versions or rent the 1C:Accounting 8 program in the cloud, please call +7(499)390-31-58, or e-mail: [email protected]

We recommend that you read the sections

Fixed Asset Accounting

| Preparing to work with 1C Accounting |

| Cash accounting in 1C Accounting |

| 1C Accounting setting up accounting parameters |

| Personnel accounting. Calculation of wages, taxes and contributions from salary |