In what cases can VAT be refunded from the budget?

VAT payable is the difference between input and output tax. That is, between the VAT that you charged on your goods and services, and the VAT that you yourself paid to your suppliers. You can read more about the VAT mechanism here.

In most cases, the accrued tax will be greater than the input tax. But in some cases the opposite may be true.

- You bought an expensive fixed asset or a large batch of goods. In this case, you can immediately deduct VAT from the entire purchase amount. And if there were few sales this quarter, then the accrued VAT will be less than the deductions.

- You work at preferential rates of 0% or 10%. However, if suppliers charge you input VAT at the usual rate of 20%, the deductions may be higher.

In such situations, you will pay more VAT to suppliers than you receive from customers. This means that you can return from the budget the difference between incoming and accrued VAT.

VAT refund: what is it and what are its features?

The question of VAT refund arises if, at the end of the tax period, the amount of VAT deductions turns out to be greater than the amount of tax calculated for payment to the budget on sales and other transactions carried out during this period that require the calculation of tax.

This picture is reflected in the declaration. Moreover, VAT refund for legal entities and VAT refund for individual entrepreneurs are based on the same rules. In the very essence of the situation where a return arises, there are 2 main points that require the person preparing the declaration to have at the same time:

- VAT payer status;

- rights to apply tax deductions.

For more information about VAT payers and non-payers, as well as who can exercise the right to deduction, read the article “Who is a VAT payer?”

VAT payer status is the lot of those who work for OSNO. They are required to charge VAT on sales and other transactions subject to this tax, issue invoices, maintain books of purchases and sales, and submit VAT returns. And they have the right to apply deductions in the amount of tax imposed by suppliers and arising in certain other operations (for example, on capital investments made in-house).

In certain cases, VAT defaulters have the obligation to charge VAT for payment and submit a declaration in relation to the accrued tax, but they never have the right to deduct.

Read about when a VAT evader has an obligation to charge this tax.

VAT refund implies the sequential implementation of a number of specific actions, upon completion of the chain of which the taxpayer receives the amount of tax from the budget into his current account.

What to do to return VAT

First of all, fill out the declaration and submit it to the Federal Tax Service.

If the deductions are greater than the accruals, then submit an application for VAT refund along with the declaration. You can send the application later, but then you will receive the money later. The return application form can be downloaded from the Federal Tax Service portal.

Before tax authorities make a decision on a refund, they will conduct a desk audit of the declaration. And be prepared for the fact that your tax return will be checked especially carefully.

A desk audit of a VAT return generally lasts up to 2 months, but inspectors have the right to extend the period up to 3 months (Clause 2 of Article 88 of the Tax Code of the Russian Federation).

If at this time you submit an updated declaration, the deadline will begin again. It is necessary to submit an amendment only if it does not contain the necessary information, or errors have led to an underestimation of the tax amount. Therefore, for minor violations, for example, a typo in the invoice number, it is better to simply provide an explanation.

Typically, desk inspections are carried out at the inspection premises, but if the report states the amount to be reimbursed, or inconsistencies are identified during the inspection, the inspectors have the right to inspect your premises (Clause 1 of Article 92 of the Tax Code of the Russian Federation).

Most likely, during the inspection, inspectors will have questions and will ask you for clarification and additional documents. All exchange of information when checking a VAT return must be carried out electronically. If you send a response to the tax authorities on paper, it will be considered unsubmitted.

Upon receipt of a request from the Federal Tax Service, send a receipt confirming the receipt of documents within 6 days, and respond to the request itself within 5 days.

If you violate the deadlines, there will be fines:

- if you miss the deadline for sending the receipt by more than 10 days, tax authorities may block your accounts (clause 1.1, clause 3, article 76 of the Tax Code of the Russian Federation);

- If you violate the deadline for responding to a request, you will be fined 5,000 rubles (Clause 1 of Article 129.1 of the Tax Code of the Russian Federation).

And most importantly: if the tax authorities do not receive explanations that suit them, they will refuse a VAT refund.

During a desk audit, you may be called to the so-called “tax base legalization commission.” The general goal of such events is to convince the taxpayer to increase payments to the budget, and in our case, to refuse VAT refunds.

Remember that if the declaration is completed without errors and all supporting documents are in order, the tax authorities have no legal grounds for refusing a VAT refund. But the manager or employee of the company who goes to the commission must have psychological stability to withstand the pressure.

If you do not want unnecessary attention from tax authorities, you can change the declaration so that the amount to be reimbursed is not included. To do this, transfer a large deduction to the following periods or break it into parts. You have the right to use the deduction within three years after the registration of material assets or services (clause 1.1 of Article 172 of the Tax Code of the Russian Federation).

But it is not always possible to transfer or split deductions. If you bought a fixed asset or an intangible asset, then the deduction must be declared in full in the period when you registered the object. You also cannot carry forward deductions for advances issued or for amounts paid as a withholding agent. The Ministry of Finance of the Russian Federation points to this in its letters dated 04/09/2015 No. 03-07-11/20290 and 03-07-11/20293.

What can guarantee a VAT refund?

Most often, the situation of VAT refund is faced by exporters who apply a 0% rate for export shipments (clause 1 of Article 164, Article 165 of the Tax Code of the Russian Federation) and have the right to deduct the tax paid to suppliers when purchasing goods, works, and services from them related to sales abroad. For them, the question of VAT refund when exporting from Russia, depending on the share of export sales in total sales, may arise quarterly.

ConsultantPlus experts explained how to apply a zero VAT rate when exporting. To do everything correctly, get trial access to the system and go to the Ready solution. It's free. In addition, the taxpayer has the right to refuse to apply the 0% rate. Go to this ready-made solution and find out all the nuances of the procedure.

You can learn more about VAT refunds on exports by reading our section “VAT on exports of goods in 2022 - 2021 (refund)”.

Let us immediately note that the mere excess of the amount of deductions over the amount of accrued VAT for the tax period does not yet guarantee a VAT refund. To return VAT, you must go through the procedure established at the legislative level.

A key place in it is occupied by a desk audit conducted by the Federal Tax Service after filing a declaration with the amount of tax to be reimbursed. For this check, the taxpayer is requested to provide a fairly voluminous package of documents, which for the exporter are divided into 2 groups:

- confirming the right to apply a 0% rate on sales;

- justifying the amount of deduction.

ATTENTION! Since October 2022, the Federal Tax Service has launched a pilot project, within which the period for verifying a VAT return (not in the application form) has been reduced to 1 month from the date of submission of the declaration or clarification. Read more about the pilot project in the publication “The Federal Tax Service speeds up inspections and VAT refunds.”

ConsultantPlus experts explained in detail what the benefits and risks are for a business that decides to refund VAT as part of the pilot project. Get free demo access to K+ and go to the review material to find out all the details of the innovations.

See also: “What is the procedure for refunding VAT from the budget?”

When will VAT be refunded?

If tax officials find no violations, the desk audit will last no more than 2 months. Then, within 7 days, the head of the Federal Tax Service must make a decision on tax refund. The law gives the Treasury another 5 days to transfer funds.

To receive money within these deadlines, you must submit a VAT refund application in advance, preferably along with your declaration. If on the day the decision on reimbursement is made, the tax authorities do not have such an application, then you will receive the money a month after you submit the application (clause 11.1 of Article 176 of the Tax Code of the Russian Federation).

If you have arrears on VAT or other federal taxes, the inspectors will first pay off this debt. You will receive the amount remaining after closing the debt to your current account (clause 4 of Article 176 of the Tax Code of the Russian Federation).

If inspectors find violations when filling out the declaration, the VAT refund period will be more than doubled. The table below shows the maximum periods provided for by the Tax Code of the Russian Federation. Theoretically, each stage can go faster. But usually, when returning funds from the budget, tax authorities fully use all the time limits established by law.

When will VAT be refunded?

If you find violations and the amount to be reimbursed changes, do not forget to write a new application for a refund. It is convenient to submit it along with objections to the act.

The right to a VAT refund - who has it?

Everyone knows that VAT payers not only have the obligation to calculate tax and pay it to the budget, but also the right to reduce the calculated amount at the expense of VAT paid to sellers as part of the cost of purchased resources, the so-called input VAT (clause 1 of Article 171 of the Tax Code RF).

Read more - Incoming and outgoing VAT: what is it and what is the difference? " .

Let us remind you that a VAT deduction can be applied only if the conditions established by Art. 171–172 Tax Code of the Russian Federation.

Read about the main conditions in the material What are VAT tax deductions? " .

The amount of deductions taken during the tax period may exceed the amount of calculated tax. In this case, the right to a VAT refund from the budget arises, that is, the opportunity to regain the difference between deductions and tax payable (clause 2 of Article 173, clause 1 of Article 176 of the Tax Code of the Russian Federation).

Features of VAT refund for exporters

For many exporters, the VAT refund procedure will be even more complicated. We are talking about those who sell raw materials abroad, the list of which was approved by Government Decree No. 466 dated April 18, 2018. These are oil and oil products, metals, wood, etc.

Exporters of primary goods cannot declare input tax based on invoices alone, like all other VAT payers. They must attach to the VAT return documents confirming exports: contracts, customs declarations, invoices, etc. (Article 165 of the Tax Code of the Russian Federation). Therefore, for them, the VAT refund period will increase by the time required to collect all the documents.

Results

The amount to be reimbursed from the budget in the VAT return arises when the amount of applied deductions exceeds the amount of tax calculated for payment. A desk audit by the Federal Tax Service Inspectorate of such a declaration is usually carried out with a request for primary documents confirming the correctness of the figures shown in the report.

Reimbursement itself can occur in 2 ways:

- declarative (can be used only under certain conditions), when the tax is reimbursed before the start of the desk audit;

- general, in which tax refund is carried out after a desk audit.

Using the refundable amount, the Federal Tax Service will independently repay the taxpayer’s debts on payments to the budget of various levels before it is returned.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who and how can return VAT in an accelerated manner?

Some businessmen can return VAT from the budget much faster than described above (Article 176.1 of the Tax Code of the Russian Federation). The following taxpayers are eligible for an accelerated refund.

- Large taxpayer organizations. We are talking about legal entities that over the previous three years have paid income tax, excise taxes, VAT and mineral extraction tax for a total amount of at least 2 billion rubles.

- Residents of the territory of rapid socio-economic development or the free port of Vladivostok. The management company of the territory or port must vouch for the businessman.

- Any taxpayers who have provided a surety or bank guarantee, if the legal requirements for a surety or guarantor are met. The guarantor, in particular, must transfer to the budget at least 2 billion in taxes over the last three years, and the guarantor bank must have an authorized capital of at least 1 billion rubles.

You can return VAT from the budget in an accelerated manner within 15 days, that is, you do not need to wait for the results of a desk audit. The process looks like this.

- Within five days after filing the return, the taxpayer submits an application for an accelerated refund.

- Tax officials make a decision within five days.

- Within five days, the treasury transfers the money.

But the declaration will still be checked. If it turns out that the tax was reimbursed unreasonably, it will have to be returned to the budget. During the use of budget funds, you will need to pay penalties at double the refinancing rate of the Central Bank of the Russian Federation (clause 17 of Article 176.1 of the Tax Code of the Russian Federation).

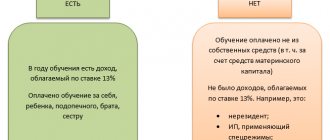

What taxes is an individual entitled to return in Russia?

The rules are prescribed in the Tax Code of the Russian Federation. It follows from them that there is no scheme for returning VAT to your card in 15 minutes. For those who are not registered as individual entrepreneurs, there is only one legal way to return part of the money paid to the budget - a personal income tax refund. The taxpayer is provided with tax deductions:

- on the citizen himself;

- for children;

- for education;

- for treatment;

- for the purchase of housing;

- to pay mortgage interest.

For details on the rules for obtaining a personal income tax refund, see the article “Tax deduction: ways to return part of the taxes paid.”

What to do if tax authorities violate refund deadlines

If you did everything as it should, but still don’t have the money, contact the inspector who conducted the inspection. It is possible that there was a technical error and the money will arrive soon.

If you were unable to resolve the issue with the inspector, send a letter to the head of the Federal Tax Service. Well, if this doesn’t help, write to a higher tax authority. If you are unable to reach an agreement with the tax authorities at all levels, your only option is to go to court.

If the VAT refund deadline was violated unreasonably, you have the right to receive not only the principal amount, but also interest during the delay, based on the Central Bank refinancing rate (clause 10 of Article 176 of the Tax Code of the Russian Federation).

Sample application for VAT refund by transfer to a bank account

Order of the Federal Tax Service of the Russian Federation dated February 14, 2017 No. ММВ-7-8/ [email protected] approved the application form for the refund of taxes, fees, insurance premiums, penalties and fines. From October 23, 2021, this form is used as amended by the Federal Tax Service order dated August 17, 2021 No. ED-7-8/ [email protected]

This statement can be downloaded for free by clicking on the image below.

You can download samples of filling out VAT refund applications from October 23, 2021, depending on the situation, in ConsultantPlus. You can get trial online access to K+ for free by clicking on the required link below.

| Return type | Link to trial online access to K+. For free |

| Refundable VAT refund | Sample application from K+ |

| Refund of overpaid VAT | Sample application from K+ |

| Refund of overcharged VAT | Sample application from K+ |

How long can I claim VAT refund?

In accordance with clause 1.1 of Art. 172 of the Tax Code of the Russian Federation, the right to deduction can be used within 3 years after the goods (work, services) are accepted for registration. This provision in the Tax Code of the Russian Federation appeared on January 1, 2015; before that, only some clarifications from the Ministry of Finance made it possible to exercise this right (letters dated 04.03.13 No. 03-07-11/6418 and 01.03.13 No. 03-07-11/6112), as well as judicial practice (decrees of the Federal Antimonopoly Service of the Moscow District dated December 7, 2012 No. A40-135284/11-20-556, the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 15, 2010 No. 2217/10 and March 11, 2008 No. 14309/07). However, the Ministry of Finance and some arbitrators were sometimes opponents of such a transfer (letters from the Ministry of Finance dated January 15, 2013 No. 03-07-14/02 and October 31, 2012 No. 03-07-05/55, court decisions of the Federal Antimonopoly Service of the Eastern Military District dated June 7, 2010 No. A79-5798 /2009 and 02/26/2010 No. A82-4790/2009-37, Federal Antimonopoly Service of the North-West District dated 11/14/2008 No. A21-6798/2007).

Thus, the taxpayer can claim a refund, both in connection with the export shipment and due to the excess of deductions over the accrued VAT, within a 3-year period.

See also our material “What is the procedure and features of “input” VAT refund?”

How to refund VAT if the 3-year period has expired

The issue regarding the timing of VAT refunds has always been controversial. The 3-year period established by Art. 78 of the Tax Code of the Russian Federation does not regulate a clear interval between the beginning and end of the specified period. In order to accurately determine at what point to begin counting the specified period - from the date established for submitting a VAT return to the tax authority, or from the date of the end of the tax period - we suggest that you familiarize yourself with the material in which the position of arbitration courts is presented - “It is possible Is it possible to extend the three-year period for VAT refund by 25 days (until December 31, 2014 - until the 20th)?” .

And the issue of calculating the deadlines for export VAT refunds is discussed in detail in the material “From what date does the calculation of the three-year period for VAT refunds on export goods begin?” .

As you can see, the process of tax refund is a very difficult step in the relationship between taxpayers and the tax authority. Compliance with all its features, discussed in our “ VAT Refund ” section, will help to carry out tax refunds competently and without unnecessary complaints from regulatory authorities.

So, what kind of tax is this and how can you get money into your current account?

This is the value added tax - the most disliked tax by many accountants. But, as they say, any troubles are compensated by the number of banknotes.

The mechanism for paying VAT to the budget is as follows: if the amount of tax calculated on sales is more than what was received from suppliers, then the difference must be paid to the budget. Accordingly, if the accrued tax is less than the “input” tax, then your finest hour has come - the difference can be returned from the budget . And if the suppliers are “good uncles and aunts” and gave you a deferment in payment for the goods, works, and services purchased from them, then a miracle has happened: the state will return your tax, and you have not yet spent a single ruble!

Every VAT taxpayer can experience such wonderful moments in life in the following cases:

- bought expensive equipment, fixed assets or a large batch of goods. VAT on them can be immediately taken as tax deductions. And if during the tax period the entire batch of goods could not be sold, then the amount of the tax deduction will exceed the amount of accrued VAT.

- manufactures products that are subject to VAT at a rate of 10%, and purchases raw materials for these products at a rate of 20%. In such a situation, the accrued VAT may also be less than what is received.

- sells goods for export and applies a VAT rate of 0%. And suppliers charge VAT at rates of 20% and (or) 10%. Here, in general, you can get a thrill every quarter - there is never accrued VAT, but only deductions.

To replenish your current account at the expense of the state by refunding VAT, there are two ways:

- Long . This is the usual (general) way - VAT refund is carried out based on the results of a desk audit (Article 176 of the Tax Code of the Russian Federation);

- Fast . A tax refund can be obtained by application under certain circumstances before the completion of a desk audit (Article 176.1 of the Tax Code of the Russian Federation).

But, as they say, soon the fairy tale is told, but not soon the deed is done. Not everyone can take the fast route, as “certain circumstances” are required. Therefore, taxpayers mainly follow the first path. Accordingly, the road along the first path is wide and straight, and along the second path it is small and winding.

It is more convenient to maintain accounting and tax records in cloud 1C. Rent 1C: Accounting 8 from 760 rubles per month and use the service without leaving your home. Manage several organizations at once, create books of purchases and sales, send declarations directly from the program using 1C-Reporting.

What is VAT refundable for an ordinary taxpayer?

Based on Art. 171 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the tax base for the following transactions:

- acquisition of goods, works, services;

- import of goods into the territory of the Russian Federation;

- performing the functions of a tax agent;

- return of goods (work, services) to the seller;

- travel and entertainment expenses;

- prepayment for goods (work, services) - both from the seller and the buyer;

- performing construction and installation work;

- export in the absence of supporting documents;

- a change in the cost of goods (work, services) towards an increase - for the buyer, a decrease - for the seller.

The procedure and conditions for applying the deduction are provided for in Art. 172 of the Tax Code of the Russian Federation. The main criteria, according to it, are:

- availability of an invoice issued in accordance with current legislation;

- registration of goods (works, services);

- payment of VAT (on deductions applied by tax agents and on customs VAT);

- use of goods (works, services) in activities subject to VAT.

Please note that the main document for deducting VAT is an invoice. The procedure for issuing invoices for certain operations is regulated by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. At the same time, clause 7 of Art. 168 of the Tax Code of the Russian Federation for retail payments provides for the replacement of an invoice with a cash register receipt. However, the Ministry of Finance of Russia, in letters dated 08/03/2010 No. 03-07-11/335 and 03/09/2010 No. 03-07-11/51, insists that the document confirming the deduction must be an invoice.

In judicial practice, there is a widespread opinion that a cash register receipt, if there is a VAT amount allocated in it, can still be a substantiating document (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 13, 2008 No. 17718/07, FAS West Siberian District dated July 20, 2009 No. F04 -4134/2009, FAS Moscow District dated 08/23/2011 No. F05-6832/11, Constitutional Court of the Russian Federation dated 06/03/2014 No. 17-P). Meanwhile, if the tax in the CCP check is not separately allocated, the deduction will be denied (resolution of the Federal Antimonopoly Service of the North-Western District dated September 3, 2013 in case No. A56-4764/2013 (determined by the Supreme Arbitration Court of the Russian Federation dated December 26, 2013 No. VAS-18613/13 refusal to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation)).

For each operation related to the application of a VAT tax deduction, the list of documents justifying its application may change. For example, using separate accounting, if an organization has VAT transactions (both taxable and non-taxable), the taxpayer must submit in addition to the standard package of documents (invoices, purchase/sale books, primary documents, accounting registers) to confirm these deductions. following:

- accounting policy, which provides for the procedure for maintaining separate accounting (letter of the Ministry of Finance of the Russian Federation dated June 27, 2012 No. 03-07-08/163, resolution of the Federal Antimonopoly Service of the Moscow District dated July 18, 2006);

- certificates of calculations of VAT accepted for deduction and included in the price (Resolution of the Federal Antimonopoly Service of the North-Western District dated January 19, 2007 No. A56-41230/2005);

- explanatory notes on maintaining separate VAT accounting (resolutions of the Federal Antimonopoly Service of the Moscow District dated January 30, 2006 No. KA-A40/62-06 and March 30, 2006 No. KA-A40/2399-06);

- accounting cards and journal of entries for account 19 (Resolution of the Federal Antimonopoly Service of the Moscow District dated October 4, 2006 No. KA-A40/9529-06).

However, there are arbitrators who do not adhere to such a list of documents due to the fact that these documents are not specified in Articles 165 and 172 of the Tax Code of the Russian Federation (resolution of the FAS Moscow District dated November 24, 2005 No. KA-A40/11609-05, FAS Moscow District dated March 23 .2005 No. KA-A40/2015-05).

Safe VAT deduction in your region: where to look

All necessary information is published on the websites of regional tax authorities.

We strongly recommend that you check the percentage of deductions in your organization's tax bill against the average for your region (read on to learn why this is important). As of November 1, 2021, the Federal Tax Service has updated regional statistics on deductions. Current data on the safe percentage of VAT deductions is shown in the table below:

| Region | Safe share of deductions as of 11/01/2021 | Safe share of deductions as of 08/01/2021 | Safe share of deductions as of 05/01/2021 | Safe share of deductions as of 02/01/2021 | Safe share of deductions as of 01/01/2021 | Safe share of deductions as of 11/01/2020 | Safe share of deductions as of 08/01/2020 |

| Republic of Adygea | 84,4 | 85,3 | 85,5 | 87,4 | 84,5 | 84,6 | 85,3 |

| Altai Republic | 89,2 | 88,0 | 88,9 | 90,0 | 88,8 | 88,9 | 90,9 |

| Republic of Bashkortostan | 92,4 | 92,5 | 93,3 | 93,1 | 91.4 | 91,4 | 92,2 |

| The Republic of Buryatia | 95,1 | 95,7 | 92,6 | 93,1 | 97,0 | 97,3 | 97,5 |

| The Republic of Dagestan | 85,6 | 84,1 | 84,4 | 85,4 | 83,4 | 82,9 | 83,6 |

| The Republic of Ingushetia | 94,7 | 93,9 | 93,6 | 95,7 | 93,0 | 92,9 | 92,3 |

| Kabardino-Balkarian Republic | 91,7 | 92,0 | 91,5 | 90,8 | 90,4 | 90,7 | 89,6 |

| Republic of Kalmykia | 71,7 | 77,3 | 87,0 | 116,3 | 79,5 | 79,5 | 84,5 |

| Karachay-Cherkess Republic | 90,1 | 89,7 | 88,6 | 91,0 | 89,9 | 90,1 | 91,3 |

| Republic of Karelia | 70,6 | 70,4 | 70,2 | 71,3 | 78,8 | 79,0 | 79,9 |

| Komi Republic | 73,3 | 75,3 | 77,0 | 80,0 | 78,5 | 78,4 | 79,4 |

| Mari El Republic | 89,3 | 89,4 | 90,4 | 89,6 | 88,5 | 88,4 | 87,9 |

| The Republic of Mordovia | 89,5 | 90,6 | 90,4 | 89,3 | 89,0 | 89,1 | 89,7 |

| The Republic of Sakha (Yakutia) | 85,0 | 90,2 | 87,2 | 86,9 | 94,3 | 94,4 | 93,4 |

| Republic of North Ossetia–Alania | 88,3 | 88,3 | 87,9 | 86,6 | 86,2 | 86,7 | 86,6 |

| Republic of Tatarstan | 90,7 | 90,9 | 91,3 | 92,0 | 90,8 | 90,8 | 90,8 |

| Tyva Republic | 86,6 | 86,7 | 88,9 | 81,3 | 81,0 | 81,5 | 80,7 |

| Udmurt republic | 79,4 | 80,6 | 79,4 | 82,3 | 80,7 | 80,7 | 80,1 |

| The Republic of Khakassia | 84,8 | 84,4 | 84,5 | 85,6 | 87,0 | 87,0 | 88,0 |

| Chechen Republic | 96,2 | 95,0 | 95,1 | 96,8 | 96,9 | 96,5 | 97,7 |

| Chuvash Republic | 85,1 | 84,6 | 84,6 | 82,4 | 83,5 | 83,6 | 83,2 |

| Altai region | 89,0 | 88,3 | 88,1 | 89,0 | 89,5 | 89,6 | 90,5 |

| Transbaikal region | 100,3 | 99,6 | 99,3 | 98,0 | 91,3 | 91,4 | 91,0 |

| Kamchatka Krai | 94,1 | 96,6 | 95,9 | 91,3 | 92,7 | 92,7 | 94,0 |

| Krasnodar region | 91,6 | 91,8 | 91,8 | 91,6 | 90,7 | 90,7 | 90,9 |

| Krasnoyarsk region | 83,0 | 83,9 | 81,6 | 83,4 | 76,5 | 76,5 | 74,2 |

| Perm region | 78,3 | 79,5 | 81,5 | 86,3 | 86,9 | 86,9 | 87,1 |

| Primorsky Krai | 96,2 | 96,0 | 96,3 | 97,7 | 94,2 | 94,2 | 94,1 |

| Stavropol region | 90,6 | 91,0 | 91,7 | 93,5 | 90,0 | 90,0 | 89,6 |

| Khabarovsk region | 91,4 | 89,5 | 89,1 | 90,8 | 90,4 | 90,4 | 90,0 |

| Jewish Autonomous Region | 87,8 | 86,5 | 83,3 | 86,2 | 82,9 | 82,7 | 82,5 |

| Nenets Autonomous Okrug | 152,3 | -* | 108,0 | 110,8 | 148,9 | 149,2 | 142,6 |

| Khanty-Mansiysk Autonomous Okrug – Yugra | 56,0 | 56,8 | 60,4 | 66,8 | 67,0 | 67,0 | 67,7 |

| Chukotka Autonomous Okrug | 161,2 | 158,8 | 149,4 | 124,11 | 132,8 | 136,5 | 137,2 |

| Yamalo-Nenets Autonomous Okrug | 66,6 | 67,9 | 69,7 | 75,9 | 72,6 | 72,4 | 72,4 |

| Tver region | 90,3 | 89,8 | 87,8 | 87,2 | 88,8 | 88,7 | 87,7 |

| Tomsk region | 75,8 | 75,0 | 74,5 | 73,6 | 80,7 | 80,6 | 79,8 |

| Tula region | 97,7 | 97,1 | 96,3 | 96,8 | 95,9 | 95,8 | 96,0 |

| Tyumen region | 79,5 | 81,8 | 82,2 | 84,2 | 84,8 | 84,6 | 85,3 |

| Ulyanovsk region | 89,4 | 89,4 | 90,0 | 88,0 | 88,4 | 88,5 | 88,5 |

| Chelyabinsk region | 89,5 | 89,0 | 89,8 | 89,9 | 90,0 | 90,0 | 90,5 |

| Yaroslavl region | 89,0 | 89,2 | 89,3 | 86,5 | 86,6 | 86,7 | 90,1 |

| Moscow | 89,6 | 89,5 | 89,4 | 88,8 | 89,0 | 88,9 | 89,1 |

| Saint Petersburg | 90,4 | 89,6 | 88,4 | 88,4 | 87,8 | 87,9 | 88,1 |

| Amur region | 133,9 | 133,3 | 137,1 | 143,9 | 130,7 | 131,2 | 131,7 |

| Arhangelsk region | 89,9 | 88,1 | 91,2 | 85,4 | 85,0 | 85,0 | 91,1 |

| Astrakhan region | 73,7 | 74,7 | 76,6 | 78,5 | 76,0 | 76,5 | 74,3 |

| Belgorod region | 86,2 | 87,4 | 88,6 | 90,0 | 92,0 | 92,0 | 92,6 |

| Bryansk region | 88,8 | 88,9 | 90,1 | 89,3 | 93,7 | 93,8 | 94,5 |

| Vladimir region | 85,9 | 84,7 | 83,6 | 86,1 | 84,9 | 84,9 | 84,4 |

| Volgograd region | 84,8 | 85,9 | 87,7 | 93,6 | 91,6 | 91,6 | 92,9 |

| Vologda Region | 100,2 | 100,8 | 102,2 | 99,7 | 98,7 | 98,7 | 100,0 |

| Voronezh region | 92,1 | 92,1 | 91,7 | 91,2 | 92,8 | 92,9 | 93,0 |

| Ivanovo region | 91,6 | 91,5 | 91,6 | 91,5 | 91,3 | 91,3 | 91,3 |

| Irkutsk region | 79,5 | 79,0 | 79,7 | 78,9 | 78,4 | 78,4 | 78,1 |

| Kaliningrad region | 67,0 | 64,8 | 64,3 | 63,9 | 64,4 | 64,3 | 64,3 |

| Kaluga region | 89,8 | 90,0 | 89,3 | 88,3 | 87,3 | 87,3 | 88,0 |

| Kemerovo region - Kuzbass | 91,5 | 92,5 | 92,6 | 93,9 | 94,1 | 94,1 | 94,3 |

| Kirov region | 87,0 | 86,5 | 85,4 | 84,8 | 88,3 | 88,3 | 89,3 |

| Kostroma region | 88,3 | 87,9 | 87,7 | 87,7 | 85,0 | 85,2 | 85,8 |

| Kurgan region | 84,7 | 84,6 | 85,1 | 85,2 | 85,1 | 85,2 | 85,1 |

| Kursk region | 90,1 | 91,8 | 91,7 | 94,5 | 93,4 | 93,5 | 94,0 |

| Leningrad region | 92,2 | 91,9 | 91,8 | 90,2 | 88,9 | 88,4 | 88,9 |

| Lipetsk region | 103,5 | 103,1 | 104,2 | 104,3 | 104,3 | 104,2 | 104,8 |

| Magadan Region | 102,2 | 104,0 | 103,4 | 100,5 | 102,5 | 103,0 | 104,3 |

| Moscow region | 89,8 | 89,5 | 88,9 | 88,3 | 88,5 | 88,5 | 88,5 |

| Murmansk region | 148,3 | 147,7 | 161,9 | 185,7 | 188,8 | 188,8 | 193,3 |

| Nizhny Novgorod Region | 88,4 | 89,0 | 90,2 | 92,5 | 90,4 | 90,4 | 91,2 |

| Novgorod region | 97,8 | 97,7 | 97,8 | 96,2 | 96,6 | 96,6 | 96,0 |

| Novosibirsk region | 89,3 | 89,3 | 89,1 | 88,6 | 88,9 | 88,9 | 88,9 |

| Omsk region | 83,1 | 83,3 | 84,1 | 88,2 | 84,9 | 84,9 | 84,6 |

| Orenburg region | 70,4 | 71,3 | 72,1 | 75,4 | 74,3 | 74,3 | 74,1 |

| Oryol Region | 91,4 | 90,5 | 89,4 | 88,1 | 91,6 | 91,6 | 91,8 |

| Penza region | 87,5 | 87,0 | 86,9 | 87,6 | 88,7 | 88,8 | 89,2 |

| Pskov region | 92,0 | 91,6 | 91,5 | 92,1 | 89,6 | 89,7 | 90,3 |

| Rostov region | 94,9 | 94,5 | 95,2 | 95,0 | 92,5 | 92,7 | 92,0 |

| Ryazan Oblast | 88,5 | 88,4 | 88,4 | 88,3 | 82,0 | 82,0 | 81,8 |

| Samara Region | 81,3 | 82,0 | 82,9 | 84,3 | 84,2 | 84,0 | 82,4 |

| Saratov region | 85,9 | 86,5 | 86,8 | 86,8 | 68,4 | 84,6 | 85,2 |

| Sakhalin region | 96,5 | 96,2 | 92,8 | 91,9 | 95,2 | 95,0 | 94,9 |

| Sverdlovsk region | 91,6 | 91,3 | 91,6 | 91,6 | 90,9 | 91,0 | 91,2 |

| Smolensk region | 93,8 | 93,6 | 92,7 | 91,1 | 92,6 | 92,8 | 92,7 |

| Tambov Region | 94,4 | 94,0 | 93,6 | 95,2 | 95,5 | 94,9 | 95,3 |

| Republic of Crimea | 85,8 | 86,9 | 86,4 | 87,8 | 86,1 | 86,5 | 86,8 |

| City of Sevastopol | 81,9 | 82,3 | 81,9 | 83,1 | 81,0 | 81,2 | 81,4 |

| Baikonur city | -* | -* | 72,5 | 75,2 | 65,1 | 62,1 | 71,7 |

*The Federal Tax Service reports contain zero figures for the Nenets Autonomous Okrug and Baikonur.

How to calculate your share of deductions? You can find out about this in ConsultantPlus. The experts not only gave the formula and comments on it, but also gave an example of the calculation. Get trial access to K+ for free and go to the Ready-made solution.