A simple partnership (SP) is formed on the basis of an agreement. This is a form of subject to which special requirements are imposed.

Question: How are the receipt of an object of fixed assets (PE) as a contribution to a simple partnership and its return to the partner (participant) upon termination of the joint activity reflected in the separate accounting of transactions in a joint activity? A comrade who conducts general affairs applies the simplified tax system. The monetary value agreed upon by the participants for the specified fixed assets (production equipment), received from a participant applying the general taxation system, is 180,000 rubles, which is equal to the residual value of the object according to the accounting and tax records of this participant. Established by the partner conducting common affairs, the useful life of the fixed asset for accounting and tax accounting purposes is 36 months (taking into account the useful life of the participant - the previous owner). Depreciation in accounting and tax accounting is calculated using the straight-line method. After one year, due to the termination of joint activities, the fixed assets object is returned to the participant. View answer

The concept and goals of a simple partnership

A simple partnership is formed between two or more parties. In this case, a legal entity is not formed. In the process, the contributions of the participants are combined. Let's consider the goals of organizing a simple partnership:

- Conducting joint activities.

- Making profit.

- Cost optimization.

- Tax optimization.

- Other purposes that do not contradict the law.

Question: Is it necessary to restore VAT when transferring property under a simple partnership agreement (clause 3 of Article 170 of the Tax Code of the Russian Federation)? View answer

The listed points, as well as the definition of PT, are set out in Article 1041 of the Civil Code of the Russian Federation. Let's look at the basic features of a simple partnership:

- Two or more participants.

- Pooling contributions from participants, which can include money, property, and even professional experience. As a rule, the parties' contributions are equal. However, they may be unequal if the corresponding condition is included in the contract. All conditions for the use of property are also established by agreement. All aspects relating to common property are set out in Article 1043 of the Civil Code of the Russian Federation.

- Joint activities of all participants. This aspect is regulated by Article 1044 of the Civil Code of the Russian Federation. One participant can act on behalf of the entire entity.

- The purpose of forming a simple partnership is to make a profit. If the purpose of the existence of the PT is precisely this, the agreement must provide for the conditions for the distribution of funds. If the document does not stipulate specific conditions for the distribution of funds, profits are distributed among the participants in equal shares.

How to take into account transactions under a simple partnership agreement in tax and accounting ?

FOR YOUR INFORMATION! The procedure for covering losses of the PT, on the basis of Article 1046 of the Civil Code of the Russian Federation, is stipulated in the agreement. If nothing is specified in it, participants cover losses in proportion to their contributions. The document cannot stipulate that one of the parties is not liable for losses. If such a condition is specified, the agreement is considered void.

IMPORTANT! The parties to a simple partnership can only be individual entrepreneurs or legal entities.

Property of a simple partnership

Deposits and property in PT have a very close relationship. For this reason, it makes sense to analyze these concepts together. Contributions of all participants are considered equal. An exception is an actual inequality of contributions or a corresponding clause included in the agreement. The concept of a contribution within a simple partnership is set out in Article 1042 of the Civil Code of the Russian Federation. This is a fairly broad concept. Deposits can be understood as:

- physical property;

- financial resources;

- skills and professional abilities;

- professional connections.

How to draw up a simple partnership agreement (partnership agreement)?

Non-physical objects (skills, connections, etc.) constitute intellectual property and are regulated by Article 138 of the Civil Code of the Russian Federation. Let's look at the basic features of deposits:

- The assessment of contributions is carried out by the PT participants themselves. Experts and appraisers are not invited for this purpose. That is, the assessment of contributions is quite subjective. In this aspect, participants will act at their own discretion.

- Parties to a simple partnership may make unequal contributions.

- The shares of the parties may be determined not on the basis of an agreement, but on the basis of law. For example, PT participants purchased real estate. Property is distributed in accordance with the contributions of the parties.

- The agreement must specify the size of the shares. If there is no corresponding clause, the contract can be considered void on the basis of Article 167 of the Civil Code of the Russian Federation.

- The product of the PT's activities is considered joint property, unless otherwise specified by agreement.

Question: Can a participant in a simple partnership apply the same income tax benefits as when carrying out their own activities (Article 278 of the Tax Code of the Russian Federation)? View answer

IMPORTANT! A participant in a simple partnership can contribute not only his own property, but also objects belonging to him under the right of lease, agreements for gratuitous use.

Advantages and disadvantages

A simple partnership is characterized by the following advantages:

- Ease of organization.

- Expansion of financial opportunities.

- Joint business management.

- Pooling financial resources, skills and business connections.

- No redundant procedures when registering a partnership.

- Risk reduction.

However, a simple partnership also has disadvantages:

- The likelihood of disagreements occurring between participants.

- Each participant is liable for the debts of the partnership, regardless of who caused them.

- Responsibility for PM's misconduct.

- Difficulty in dividing property upon liquidation of a partnership.

It makes sense to create a simple partnership only if the goals of all participants are agreed upon. The highest risk when forming a PT is the emergence of disagreements and conflicts.

Partnership financial statements

The partnership's financial statements include a balance sheet, cash flow statement, profit and loss statement, and statement of equity.

The profit and loss statement is in the form of a table reflecting the distribution of profits and losses between partners.

In the report of a partnership, in comparison with the report of a sole-owned enterprise, the section “Net profit” is added to the “Profit” section.

Example. Trading at the end of 200... has the following income statement.

Profit and loss statement at the end of 200...

| 1. Total sales | 600 000 | |

| 2. Cost of goods sold | (360 400) | |

| 3. Gross profit | 239 600 | |

| 4. Operating expenses, including: | ||

| trading | 100 000 | |

| administrative | 80 000 | (180 000) |

| 5. Net operating profit | 59 600 | |

| 6. Other income (% on securities) | 400 | |

| TOTAL: net profit | 60 000 |

Distribution of net profit.

| A | B | Total | |

| 1. Interest | 2400 (1/3) | 4800 (2/3) | 7200 |

| 2. Salaries | 26 000 | — | 26 000 |

| 3. The balance is divided equally | 13 400 | 13 400 | 26 800 |

| 4. Net profit | 41 800 | 18 200 | 60 000 |

The posting for the distribution of net profit will be as follows:

| December 31 | |

| Profit amount | 60 000 |

| Partner A, capital | 41 800 |

| Partner B, capital | 18 200 |

Statement of capital flows. The statement of capital movements indicates all movements in the Capital account of each owner, i.e. separately all withdrawals, additional investments and distributed net profit, as well as the total account balance.

Partnership balance. The partnership balance sheet differs only in the breakdown of the “Equity Capital” account into separate capital accounts according to the number of partners. The remaining records and current accounting are kept in the same way as in an individual farm.

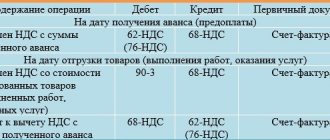

Taxation of a simple partnership

The current activities of a simple partnership will be subject to VAT according to the rules set forth in Article 174.1 of the Tax Code of the Russian Federation. The participant responsible for the conduct of general affairs must keep records on the basis of which VAT is calculated. If a simple partnership includes a non-resident, records must be kept by a person with Russian citizenship. A person must generate invoices for transactions on which VAT is charged. The partnership receives the right to tax deduction of VAT amounts on objects that are purchased for joint activities. This point is specified in paragraphs 2 and 3 of Article 174.1 of the Tax Code of the Russian Federation.

VAT is calculated in the standard manner. Accounting is divided. That is, property and transactions that relate to the activities of education must be reflected on the autonomous balance sheet. The procedure for organizing separate accounting is determined by the participants independently. The agreements reached must be included in the order on accounting policies. The easiest way to separate accounting is to organize it in an autonomous database. The declaration must be submitted by the person who must organize the accounting.

The creation of a tax base is stipulated by Article 278 of the Tax Code of the Russian Federation. For the purpose of calculating taxes, the transfer of property by parties in the form of a contribution is not considered a sale. Income generated as a result of the company's activities must be included in non-operating income. Taxes are deducted from them. Losses will not be taken into account when calculating taxes.

Basic terms of the contract.

Let's note the key features

simple partnership with the development of our illustration.

- A simple partnership is an agreement. Regulated by Chapter 55 of the Civil Code of the Russian Federation. It is not registered anywhere and a separate organization is not created. Do not confuse a simple partnership with a “full partnership,” which is precisely a legal entity.

- Parties to a simple partnership agreement concluded for the purpose of carrying out entrepreneurial activities (making profit) can only be commercial organizations and individual entrepreneurs.

- The purpose of creating a simple partnership can be any: conducting production, trading activities, construction, development, farming and may not be related to making a profit;

- By uniting, partners make contributions in the form of: property and property rights (including cash and securities), skills, abilities, knowledge, experience, business connections, business reputation, rights to use intellectual property, etc. The size, type and value of the contribution made by each partner is determined by the specific goals of the joint activity, the capabilities of each of the partners and their agreements among themselves.

- In the agreement, the partners must determine the shares in the profits of each of them. They can be either proportional to the size of the deposit or set in other quantities.

- By participating in a simple partnership agreement, each of the partners is free to simultaneously conduct both joint and usual business activities: concluding contracts, performing work, providing services, carrying out production and/or selling goods not in the interests of the partnership. And even participate in another simple partnership agreement.

- A simple partnership agreement can also handle the opposite situation, when “by default” any activity of the partners is regarded as joint in the common interest.

- For third parties, nothing changes: the participants of a simple partnership may not publicly advertise the conclusion of such an agreement (an unofficial partnership, which is noted in the agreement itself) and even by their agreement directly prohibit each other from disclosing the existence of joint activities. Therefore, third parties may not know that the organization acts not only in its own interests, but also in the interests of its comrades. A special feature of a private partnership is that the partner who entered into the relevant agreement is responsible for obligations to counterparties. Even if the counterparty subsequently learns about the existence of joint activities, he cannot directly make claims against other partners. Resolution of the Federal Arbitration Court of the North Caucasus District of June 30, 2004 No. F08-2750/04 This does not save from abuse and does not exclude subsequent distribution obligations between them.

- Partners are jointly and severally liable for general obligations, regardless of the basis for their occurrence. Against the backdrop of the established practice of subsidiary liability, this is already a common business risk.

- In the case of simultaneous activities in his own interest and in the interests of the partnership, a participant in a simple partnership must ensure separate accounting of income and expenses, property. To fulfill this requirement in relation to non-cash funds, we recommend that each partner open a separate current account to record income and expenses within the framework of joint activities. Make a corresponding reservation in the Accounting Policy.

- The partners must stipulate in the terms of the contract what will be included in the expenses of the joint activity. That is, what costs will be deducted from the joint revenue of the partnership in order to determine the financial result. Everything that relates to joint activities should be here: goods, raw materials, rent, utilities, wages, etc.

- By distributing the profit of a simple partnership at least once a quarter, its participants may not transfer it to their current account. By doing this, they actually invest property in joint activities. This condition must be specified in the text of the contract.

- We strongly recommend that the agreement also provide for its preservation in the event of death, liquidation or bankruptcy of one of the partners. Otherwise, the contract is terminated, the partners must distribute the common property.

- Since everything that the partners contributed to the joint activity and all the property of the partnership is common shared property, foreclosure on this property occurs in a special manner. Articles 255 and 1049 of the Civil Code of the Russian Federation It’s just not possible to write off money from the current account. See. Decisions of the Arbitration Court of the Tula Region in case No. A68-4663/2011 dated July 12, 2011, Resolution 20 AAS dated May 10, 2013 No. 20AP-1045/13 and Resolution of the Federal Antimonopoly Service of the Central District in case No. A68-9966/2008 dated August 28, 2009 , Resolution of the Federal Arbitration Court of the North-Western District of October 3, 2000 No. A05-4350/00-202/22 If the partners do not want to allocate to the creditors the share of a fellow debtor, further foreclosure is possible only through public auction, the lot at which will be “ share in the common property of a simple partnership.”

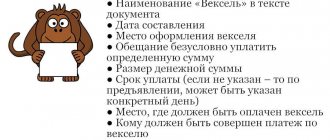

Contents of a simple partnership agreement

As mentioned earlier, a PT is formed on the basis of an agreement. Let's consider the main points that are specified in the agreement:

- Responsibilities of participants for making deposits, maintaining property, and maintaining accounting records.

- The rights of participants to use property, participate in business management, and familiarize themselves with documents. The agreement can indicate the right of one of the legal entities to conduct business.

- The contribution of each party and its assessment.

- Responsibility for debts and actions of PT.

Based on the agreement, the participant may be granted the right to conclude transactions on behalf of the entity.

Change in partnership composition

If an existing partnership is replaced by a new one only due to a change in the composition of the partners, then the so-called formal liquidation , i.e. All accounting documentation is retained.

Reporting is carried out, the fact and reason for the appearance of a new partner are documented.

The new partner can:

- Buy the rights to participate in a partnership of one or more partners. In this case, the assets and liabilities in the partnership do not change, and the entries in the accounts replace the name of the old partner with the name of the new one.

- Invest in a partnership. Purchase and sale is a personal matter and is not reflected in accounting. But investing additional funds naturally causes a change in assets and equity.

When a new partner is introduced, his profit subsequently depends on the level of profit. If a new partner enters into a partnership that has consistently high profits, then the “old” partners have the right to demand an increase in their shares when dividing profits.

For example, if the store brought a lot of profit, then the previous partners may demand 40% each, but the “newbie” will be given only 20%, and at the end of the year, when distributing net profit, this will be reflected.

Termination of the activities of a simple partnership

PT ceases to operate under certain circumstances:

- Declaring one of the parties to the PT incompetent.

- Recognition of a participant as missing.

- Declaring one of the legal entities bankrupt.

- Death of one of the parties.

- Liquidation or reorganization of a legal entity.

- Participant's refusal from PT.

- Expiration of the duration of the agreement.

If a participant refuses an indefinite document, a corresponding application must be drawn up no later than 3 months. It must be provided to other participants. You need to prepare for the exit procedure in advance. In general, stopping educational activities is quite simple.

VAT when transferring the results of joint activities to partners

The transfer of objects received as a result of joint activity to the participants of the partnership as a result of division upon termination of joint activity within the limits of their initial contribution in accordance with subparagraph 6, paragraph 3, article 39 of the Tax Code of the Russian Federation is not recognized as a sale, and accordingly, an invoice is not issued.

At the same time, if the value of the property transferred to the participant exceeds the amount of the initial contribution, the transfer of property in part of the excess is recognized for tax purposes as a sale and is subject to VAT in the generally established manner. In this case, an invoice is issued to the partner for the cost of the object in the part exceeding the amount of his down payment, and, accordingly, a tax deduction is provided to the partners for this amount in the generally established manner.

Who can create a simple partnership?

Of course, an ordinary person who has no legal status cannot be part of a simple business partnership. Each member of this union must be an individual entrepreneur or the head of a commercial organization.

Non-profit organizations and institutions cannot be members of a community whose main goal is to make a profit. By the way, the main direction of the partnership’s work is also indicated in the contract.

If the point of your activity is not to generate income, then the union can include virtually any participants, and everyone has the right to be a member of several associations at once.

For more information about who can join a partnership and how to correctly draw up an agreement, read the second paragraph of Article 1041 of the Civil Code of the Russian Federation.

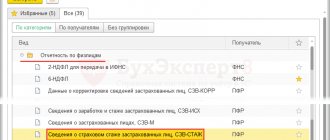

Features of taxation

Article 19 of the Tax Code of the Russian Federation establishes that organizations and citizens must pay taxes and fees. A simple partnership is not an organization, which means it does not have to pay taxes. However, this does not mean that you can forget about tax issues.

Taxes that participants pay themselves

These include income tax, single tax and unified social tax, land tax, property tax and transport tax. The last three, as a rule, do not raise questions, and we will not dwell on them.

Income received from joint activities is distributed among the partners in proportion to their contributions. They take it into account as their non-operating income and tax it. Under the “simplified regime” it will be a single tax, under the general regime it will be an income tax. Thus, a participant conducting general business does not have to submit an income tax return. Partners independently fulfill their obligation to pay this tax.

In accordance with paragraph 1 of Article 236 of the Tax Code of the Russian Federation, the object of taxation under the Unified Social Tax is payments to citizens under employment contracts. These can also be civil contracts for the performance of work (services) and copyright agreements. The exception is remuneration paid to individual entrepreneurs.

Payments and remunerations to employees must be calculated by the partner who entered into contracts with them. He also calculates and pays taxes on these payments. All these amounts will be considered his contribution to the joint activity.

Rights and obligations of a comrade

Rights:

- the right to act on behalf of all partners, if the simple partnership agreement does not establish that business is carried out by individual participants or jointly by all participants of the simple partnership agreement (Clause 1 of Article 1044 of the Civil Code of the Russian Federation);

- the right to demand compensation for expenses incurred by him at his own expense for transactions made on behalf of all partners, in respect of which his right to conduct the common affairs of the partners was limited, or concluded in the interests of all partners on his own behalf, if there were sufficient grounds to believe that these transactions were necessary in the interests of all comrades (clause 4 of Article 1044 of the Civil Code of the Russian Federation);

- the right to demand compensation for losses incurred as a result of transactions provided for in the previous paragraph (clause 4 of Article 1044 of the Civil Code of the Russian Federation);

- the right to get acquainted with all documentation on the conduct of business (Article 1045 of the Civil Code of the Russian Federation);

- the right, upon termination of a simple partnership agreement, to demand in court the return to him of an individually determined thing that he contributed to the common property, subject to the interests of the remaining partners and creditors (paragraph 4, paragraph 2, article 1050 of the Civil Code of the Russian Federation);

- the right to demand termination of the contract in relations between oneself and the other partners for a good reason with compensation to the other partners for real damage caused by the termination of the contract (Article 1052 of the Civil Code of the Russian Federation).

Responsibilities: The responsibilities of partners for the maintenance of common property and the procedure for reimbursement of expenses associated with the performance of these duties are determined by the simple partnership agreement (clause 4 of Article 1043 of the Civil Code of the Russian Federation).

Unspoken partnership

A simple partnership agreement may provide that its existence is not disclosed to third parties (tacit partnership).

The rules on a simple partnership agreement are applied to such an agreement, unless otherwise provided by these rules or follows from the essence of the private partnership (clause 1 of Article 1054 of the Civil Code of the Russian Federation). A distinctive feature of this form of partnership is its secrecy: only one main comrade participates in relations with third parties, acting on his own behalf, but at the common expense of his own and the secret comrade standing behind him.

The latter remains hidden from circulation, but he is bound by an obligatory relationship with a public comrade.

In relations with third parties, each of the participants in a secret partnership is liable with all his property for transactions that he entered into on his own behalf in the common interests of his partners (Clause 2 of Article 1054 of the Civil Code of the Russian Federation).

In relations between partners, obligations arising in the course of their joint activities are considered general (clause 3 of Article 1054 of the Civil Code of the Russian Federation).

Participants in a silent partnership cannot form common property, since this contradicts its very essence. However, in the event of the insolvency of a public partner, despite the fact that in business transactions he acted on his own behalf, the private participant in the partnership cannot be exempted from participating in covering general expenses or losses, since such an agreement of the parties, according to Art. 1046 of the Civil Code must be considered void.

Expenses and losses of comrades

The procedure for covering expenses and losses associated with the joint activities of partners is determined by their agreement (Article 1046 of the Civil Code of the Russian Federation).

In the absence of such an agreement, each partner bears expenses and losses in proportion to the value of his contribution to the common cause (Article 1046 of the Civil Code of the Russian Federation). This presupposes the obligatory monetary valuation of the contributions of comrades.

If the contributions of the partners are assumed to be equal, as is allowed by paragraph 2 of Art. 1042 of the Civil Code, then both expenses and losses will be divided equally between them, i.e. based on personal rather than property principles.

An agreement that completely exempts any of the partners from participating in covering common expenses or losses is void (Article 1046 of the Civil Code of the Russian Federation).

General information

Under a simple partnership agreement (joint activity agreement), two or more persons (partners) undertake to pool their contributions and act together without forming a legal entity to make a profit or achieve another goal that does not contradict the law (Clause 1 of Article 1041 of the Civil Code of the Russian Federation).

According to paragraph 1 of Art. 1041 of the Civil Code of the Russian Federation, in order to form a simple partnership, the following condition must be met - to conclude an agreement that establishes the obligations of the parties to each other in relation to: a) pooling their contributions, b) acting together to make a profit or achieve another goal that does not contradict the law . The elements that form the basis of the concept of a simple partnership by law distinguish it from other types of associations of persons. A simple partnership agreement (joint activity agreement) is not recognized as such if it lacks at least one of the above elements.

Since the law qualifies a simple partnership as an agreement, only an agreement can be its sole basis. This general consent is necessary not only for the formation of a partnership, but also for any subsequent change in the content of an already established agreement (for the admission of new members, for changing the purpose of the partnership, for increasing or decreasing common property, etc.), except for those cases when the agreement on the formation of a simple partnership does not include a special clause on resolving these issues in a different way.

Unlike other types of partnership associations recognized by the Civil Code, a simple partnership does not form a legal entity. The participants included in its composition are connected with each other both by a common goal and by the community of property that forms the capital of the partnership.

All general provisions of the Civil Code, both on transactions and those relating to obligations in general and, above all, to obligations arising from contracts, are applicable to a partnership as a contract.

Without recognizing a simple partnership as a legal entity, the law did not grant it the right to act on a common behalf (the right to a company name). Therefore, in relations with third parties, it is considered as a group of individuals acting under their own names, or through representatives representing them as individually identified persons. From this point of view, the assignment of a symbolic name to itself by a simple partnership has no legal significance.

The law’s indication that “two or more persons (partners)” are obligated under a simple partnership agreement means that the number of participants in this agreement is unlimited.

The Code does not prescribe a special form for concluding this agreement. This means that the contract is subject to the general rule of Art. 158 of the Civil Code, if its participants are individuals. If the participants of a simple partnership are legal entities or legal entities and citizens, as well as if the total property of a simple partnership exceeds at least ten times the minimum wage established by law, then, according to paragraphs. 1, 2 p. 1 art. 161 of the Civil Code, such agreements must be concluded in simple written form. Participants can independently determine the form of a simple partnership agreement, providing not only a written form, but also notarization.