Accounting for Subscription Costs

In accordance with Article 2 of Law No. 176-FZ, users of postal services are citizens, government bodies of the Russian Federation, government bodies of constituent entities of the Russian Federation, local government bodies and legal entities using postal services.

According to OKVED, the list of communication services (code 64) includes other postal services.

This group includes: subscription to newspapers, magazines, books and other printed publications (code 64.11.14), forwarding and delivery of newspapers, magazines and other printed publications (code 64.11.14), sale of postage stamps, marked cards (postcards) and envelopes (code 64.11.14) and the like. When carrying out business activities, almost every organization uses postal services, concluding subscription agreements for periodicals. Let's consider the procedure for recording transactions related to subscriptions to periodicals.

Accounting Let us recall that organizations, when reflecting expenses in accounting, are guided by the standards 10/99.

According to paragraph 2 of PBU 10/99, expenses arise for an organization when assets are disposed of or liabilities arise. If an organization transfers funds to pay for a subscription, then the fact of disposal of assets does not occur, because in this case one asset is replaced by another: funds are withdrawn, but receivables arise. In this case, no new obligations arise; accordingly, the organization has no expenses at this moment.

In accordance with paragraph 3 of PBU 10/99, the following assets are not recognized as an expense of the organization for accounting purposes:

- “in the order of advance payment of material and industrial supplies and other valuables, works, services;

- in the form of advances, deposits for payment of material and industrial supplies and other valuables, works, services”;

Consequently , from the point of view of PBU 10/99, the transfer of funds for a subscription is nothing more than an advance payment for the upcoming receipt of periodicals.

The procedure for prepayment is regulated by Article 487 of the Civil Code of the Russian Federation, according to which prepayment means the buyer’s obligation to pay for the goods in full or in part before the seller transfers the goods.

When subscribing to periodicals, the organization pays immediately for all publications that will be received in future reporting periods. The calculation is made in the reporting period in which the subscription is issued.

Thus, for accounting purposes, subscription costs will not be recognized as expenses of the organization until the organization begins to receive copies of subscription publications.

So, the transferred funds for the subscription are taken into account by the organization not as part of deferred expenses, but as part of the prepayment.

In accordance with the Chart of Accounts for accounting of financial and economic activities of organizations and Instructions for its application, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n “On approval of the Chart of Accounts for accounting for financial and economic activities of organizations and Instructions for its application,” transfer prepayments for periodicals are reflected by the following posting:

Debit account 60 “Settlements with suppliers and contractors” Credit account 51 “Settlement accounts”.

After receiving periodicals, the organization's accountant needs to determine whether they are included in fixed assets or not.

Let us recall that according to the All-Russian Classifier of Fixed Assets OK013-94, approved by the Decree of the State Standard of the Russian Federation of December 26, 1994 No. 359 “On the adoption of the All-Russian Classifier of Fixed Assets”, periodicals are classified as fixed assets (code 19 0001112).

In accordance with paragraph 4 of PBU 6/01, when accepting assets for accounting as fixed assets, the following conditions must be simultaneously met:

- use in the production of products, in the performance of work or provision of services, for the management needs of the organization or for provision by the organization for a fee for temporary possession and use or for temporary use;

- use for a long time, that is, a period lasting more than 12 months or the normal operating cycle if it exceeds 12 months;

- the organization does not intend to subsequently resell this object;

- the ability to bring economic benefits (income) to the organization in the future.

If the above conditions are met, then the periodical is recognized as the main medium.

We remind you that Order No. 147n amended PBU 6/01.

Thus, if the previous version of paragraph 18 of PBU 6/01 contained a paragraph according to which organizations had the opportunity to write off purchased books, brochures and similar publications as expenses at the time of their release into production, then from January 1, 2006 this provision was excluded.

True, since January 1, 2006, the organization has the opportunity to take such publications into account as part of the MPZ. This allows you to do paragraph 5 of PBU 6/01, according to which:

“Assets in respect of which the conditions provided for in paragraph 4 of these Regulations are met, and with a value within the limit established in the organization’s accounting policy, but not more than 20,000 rubles per unit, may be reflected in accounting and financial statements as part of inventories . In order to ensure the safety of these objects in production or during operation, the organization must organize proper control over their movement.”

If an organization uses this opportunity, then by securing this provision in the organization’s accounting policies, it is possible to write off the periodical as an expense at the time it is put into production.

Let us note that if the cost of a publication purchased by an organization exceeds 20,000 rubles (which, of course, is unlikely, but it is possible, for example, a reference book), then the existing accounting legislation is silent about whether depreciation should be charged on the specified publication or not.

According to the authors of this book, in relation to such periodicals, tax accounting rules can be used.

Subclause 6 of Article 256 of the Tax Code of the Russian Federation determines that for profit tax purposes purchased publications (books, brochures and other objects) are not subject to depreciation, while their cost is included in other expenses associated with production and sales in full at the time of acquisition of these objects . Therefore, an organization can establish in its accounting policies the procedure used for tax purposes. Note that a similar point of view can be seen in the Letter of the Ministry of Finance of the Russian Federation dated May 15, 2006 No. 07-05-06/116 “Taxpayer expenses for the purchase of accounting literature.”

We remind you that for each fixed asset item an inventory card is created in the OS-6 form, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7 “On approval of unified forms of primary accounting documentation for accounting of fixed assets.”

Example 1

Organization “A” paid for an annual subscription to the monthly magazine “Taxes and Law”. The cost of an annual subscription was 3,300 rubles, including VAT (10%) 300 rubles.

For accounting purposes, the organization’s accounting policy states that the “Taxes and Law” journal will be used for more than 12 months. At the same time, the accounting policy stipulates that assets that meet the conditions of paragraph 4 of PBU 6/01 and cost less than 20,000 rubles are taken into account by the organization as inventory and written off as expenses at the time of release into production.

Accounting for organization “A” is maintained using subaccounts:

60-1 “Advances issued”,

60-2 “Settlements with the post office.”

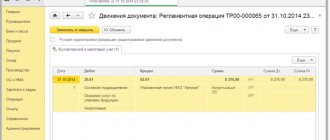

Transactions related to subscription in the organization’s accounting are reflected as follows:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| 60-1 | 51 | 1 500 | Paid subscription to the magazine |

| 08 | 60-2 | 250 | The cost of the first magazine by subscription is reflected (upon receipt of the first magazine) 3,000/12 |

| 19 | 60-2 | 25 | VAT reflected |

| 60-2 | 60-1 | 275 | Part of the advance payment for the subscription has been written off |

| 10 | 08 | 250 | The journal is taken into account as inventory |

| 68 | 19 | 25 | Accepted for VAT deduction |

| 26 | 10 | 250 | The cost of the first magazine subscription has been written off |

In accordance with subparagraph 3 of paragraph 2 of Article 164 of the Tax Code of the Russian Federation, VAT is assessed at a tax rate of 10% on the sale of periodical printed publications, with the exception of periodical printed publications of an advertising or erotic nature, book products related to education, science and culture, with the exception of book products advertising and erotic nature;

In order for an organization to deduct from the budget the amount of VAT paid for a subscription, it is necessary that representatives of the post office issue an invoice. We remind you that in order for a taxpayer to exercise the right to deduction, he must meet the following conditions:

- the periodical to which the organization subscribes must be used in taxable activities;

- the periodical must be accepted for registration;

- The taxpayer must have a properly executed invoice in hand.

If an organization, for accounting purposes, has established in its accounting policies the useful life of purchased periodicals to be less than 12 months, then these publications are not taken into account as part of fixed assets.

In this case, the receipt of periodicals and their acceptance for accounting will be reflected in the debit of account 10 “Materials”, subaccount 10-9 “Inventory and household supplies”.

Example 2

Organization “A” in November of this year subscribed for the first half of next year to the “Taxes and Law” magazine. The magazine is published once a month.

The cost of an annual subscription is 3,300 rubles, including VAT 10% -300 rubles.

The accounting policy of the organization establishes that the useful life of the received journal is 6 months. Income and expenses for the purpose of calculating income tax are determined by the organization using the accrual method.

The following entries will be made in the accounting records of organization “A”:

| Account correspondence | Amount, rubles | Contents of operation | ||

| Debit | Credit | |||

| November | ||||

| 60-1 | 51 | 1 650 | Paid subscription to the magazine | |

| January | ||||

| 10-9 | 60-2 | 250 | The first magazine by subscription was accepted for accounting (upon receipt of the first magazine) | |

| 19 | 60-2 | 25 | VAT of the first magazine subscription is reflected | |

| 68 | 19 | 25 | Accepted for VAT deduction of the first magazine by subscription | |

| 60-2 | 60-1 | 275 | Part of the advance payment for the subscription has been written off | |

| 26 | 10-9 | 250 | The cost of the first magazine subscription has been written off | |

End of the example.

If a subscriber organization has subscribed to periodicals that are not related to its business activities, then the costs for it will be reflected in accordance with paragraph 12 of PBU 10/99, according to which non-operating expenses are: “transfer of funds (contributions, payments, etc.) related to charitable activities, expenses for sporting events, recreation, entertainment, cultural and educational events and other similar events.”

Example 3

Let's use the condition of the previous example, but assume that organization “A” has subscribed to a sports magazine.

In the accounting records of organization “A”, the costs of subscribing to a sports magazine will be reflected in the following entries:

| Account correspondence | Amount, rubles | Contents of operation | |

| Debit | Credit | ||

| November | |||

| 60-1 | 51 | 1 650 | Paid subscription to the magazine |

| January | |||

| 10-9 | 60-2 | 250 | The first magazine by subscription was accepted for accounting (upon receipt of the first magazine) |

| 68 | 19 | 25 | Accepted for VAT deduction of the first magazine by subscription |

| 60-2 | 60-1 | 275 | Part of the advance payment for the subscription has been written off |

| 91-2 | 10-9 | 250 | The cost of the first magazine subscription has been written off |

| 91-2 | 19 | 25 | The VAT amount is written off as non-operating expenses |

Tax accounting

In accordance with paragraph 1 of Article 256 of the Tax Code of the Russian Federation :

“For the purposes of this chapter, depreciable property is property, results of intellectual activity and other objects of intellectual property that are owned by the taxpayer (unless otherwise provided by this chapter) and are used by him to generate income and the cost of which is repaid through depreciation. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 10,000 rubles.”

In other words, if the cost of a printed publication is more than 10,000 rubles, then for the purposes of Chapter 25 “organizational profit tax” of the Tax Code of the Russian Federation it is recognized as depreciable property. However, depreciation is not accrued on it, since subparagraph 6 of paragraph 2 of Article 256 of the Tax Code of the Russian Federation establishes that:

“The following types of depreciable property are not subject to depreciation:

6) purchased publications (books, brochures and other similar objects), works of art. At the same time, the cost of purchased publications and other similar objects, with the exception of works of art, is included in other expenses associated with production and sales in full at the time of acquisition of these objects.”

Consequently, the cost of such periodicals will be included in other expenses associated with production and sales in full at the time of purchase of the publications (Article 264 of the Tax Code of the Russian Federation).

Based on paragraph 1 of Article 252 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation).

The date of occurrence of expenses using the accrual method is determined in accordance with Article 272 of the Tax Code of the Russian Federation. Expenses are recorded in the period to which they relate based on the terms of the transaction. Expenses are distributed by the taxpayer independently if the transaction does not contain such conditions and the connection between income and expenses cannot be clearly defined or is determined indirectly.

Value added tax

The procedure for calculating and paying VAT is established by Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation.

According to subparagraph 3 of paragraph 2 of Article 164 of the Tax Code of the Russian Federation , VAT at a rate of 10% is imposed on the sale of:

“3) periodicals, with the exception of periodicals of an advertising or erotic nature;

book products related to education, science and culture, with the exception of book products of an advertising and erotic nature;For the purposes of this subclause, a periodical printed publication means a newspaper, magazine, almanac, bulletin, or other publication that has a permanent name, current issue and is published at least once a year.

For the purposes of this subclause, periodical printed publications of an advertising nature include periodical printed publications in which advertising exceeds 40 percent of the volume of one issue of the periodical printed publication.”

Thus, when selling periodicals, with the exception of periodicals of an advertising or erotic nature, VAT is assessed at a tax rate of 10 percent.

The amount of VAT paid by an organization to a post office when subscribing to periodicals can be deducted in the tax period in which the publications were received. of Articles 171 and 172 of the Tax Code of the Russian Federation must be simultaneously met .

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Source:

The materials were prepared by a group of consultants and methodologists "BKR-Intercom-Audit"

Heading:

Taxes, fees, duties

print version

A selection of useful events

Post

We justify the need to purchase books and printed publications

To begin with, it is important to determine how books, magazines and other printed publications are related to your production activities.

For example, the following costs can be considered quite reasonable:

- for magazines (newspapers) and books on accounting and taxes, for example, the “General Ledger” magazine, since the accountant needs them for proper accounting;

- books on management, as they are needed for better personnel management;

- a collection of building standards if the company is engaged in construction;

- “Rossiyskaya Gazeta”, since it publishes laws and regulations;

- glossy magazines (for example, “Vogue”, “Cosmopolitan”, “Shape”, etc.) in a situation where your clients are forced to sit waiting for their turn (for example, in hairdressers, beauty salons);

- second-hand books on jurisprudence, if your profile is legal services;

- other literature, which is “informational” support necessary for conducting activities.

It will be very problematic to prove that you need publications for work that were purchased to create the interior of an office or to be placed in the director’s office in order to create a certain image of the company, for example:

- series of books “The Lives of Remarkable People”;

- Russian and foreign classics;

- Encyclopedia of Arts;

- beautiful art albums.

EXPLAIN TO YOUR MANAGER

It is better to purchase books and magazines that are in no way related to the company’s activities using net profit. Otherwise, during the audit, the tax authorities will most likely remove from expenses the costs of non-productive literature, and will charge additional taxes, as well as penalties and fines.

This also applies to subscriptions to non-production publications, for example to the Argumenty i Fakty newspaper.

If it is difficult to justify the need to purchase any literature, then it should be taken into account as follows.

In accounting, such literature cannot be taken into account either as fixed assets or as inventories. The most correct thing would be to attribute its cost (together with VAT) to other expenses and reflect it on account 91 “Other income and expenses”, subaccount 91-2 “Other expenses”.

When calculating income tax, the costs of purchasing such non-production literature cannot be taken into account.

It will also not be possible to accept VAT for deduction, since one of the mandatory conditions for applying the deduction is not met: the literature will not be used in activities subject to VAT.

This accounting method is the most secure. If you decide to take into account the costs of such literature when calculating your income tax and deduct VAT on it, the tax authorities are unlikely to agree with you. In particular, they always considered the costs of interior items purchased for the office to be unreasonable. You will have to prove your case in court, but the court may take your side. For example, when considering a case on the validity of the costs of maintaining aquariums, the court sided with the taxpayer, indicating that the costs were aimed at creating a favorable environment. There is also a decision in which the court recognized production costs for interior items, since they are aimed at creating a favorable impression on external visitors.

Now let's look at the procedure for accounting for literature that can be classified as production.

We reflect business literature in accounting

Although the book has been in use for more than a year, its cost is unlikely to exceed 20,000 rubles. (or another lower limit on the cost of fixed assets established by your accounting policy). Therefore, in accounting, we take business literature into account as part of the inventory on account 10 “Materials” and write it off as expenses for ordinary activities when transferred to the department that will use it (to accounts 20, 26, 44, etc.).

For income tax purposes, business literature, regardless of cost, is not subject to depreciation. The costs of its acquisition are included in other expenses in full at the time of acquisition.

VAT on books can be deducted if:

- literature has been received and registered;

- literature is used for activities subject to VAT;

- there is a correctly executed invoice.

Waiting for deduction

Since the sale of periodicals is subject to VAT, the publisher will have to send you an invoice with the allocated amount of tax, which in turn can be deducted. More precisely, it will be at least two invoices: advance and upon shipment. Accordingly, the organization will also be able to deduct the “input” tax at least twice: on an advance payment (with subsequent restoration) and upon completion of shipment.

Let's look at each situation in more detail.

So, within five days from the date of payment for the subscription, the publisher will issue you an “advance” invoice in the amount of the transferred advance payment. As a rule, we are talking about 100% of the subscription cost. Moreover, such an obligation will have to be fulfilled by the publishing house even if the obligation under the contract on its part is fulfilled in the same quarter (letter of the Federal Tax Service of Russia dated February 15, 2011 No. KE-3-3/354). Please note that the justification for the right to deduct tax on prepayment, in addition to (but not instead of) the invoice, is also payment documents confirming the actual transfer of the advance (letter of the Ministry of Finance of Russia dated March 6, 2009 No. 03-07-15/39).

Deduction for “advance” VAT is the right of buyers, and the subscriber is not at all obligated to use it. In particular, this is not relevant if the publisher fulfills its duties in full in the same quarter. However, if these events occur in different tax periods, the right to an advance deduction is a very beneficial event for the company, since it allows you to reduce VAT in the quarter when the payment occurred, without waiting for shipment.

Upon completion of shipment, the publishing house will present an invoice for the completion of services. In this case, the tax previously accepted for deduction will have to be restored to the budget and the tax taken as a deduction as a whole for the shipment. Since we will be talking about the same amount each time, there will be no need to “drive” money back and forth.

In this case, it is worth paying attention to one very significant nuance. The legislation does not have a clear definition of what is considered a shipment. Therefore, in practice, it is sometimes difficult to determine exactly when to issue invoices: for each magazine sent or at the end of the subscription period (for example, semi-annual - for a six-month subscription). The organization faces a dilemma when to restore the tax and deduct it again.

Taking into account the position of the Ministry of Finance of Russia (letter dated July 2, 2008 No. 03-07-09/20), an invoice for shipment must be issued within five days from the date of provision of services in the amount specified in the contract, which, we recall, is invoice (offer). In turn, issuing invoices before the provision of services, according to the Ministry of Finance, is not provided for by the Tax Code.

Thus, if the invoice states that payment is made, for example, for six magazines, then the subscriber organization can count on receiving invoices and invoices upon receipt of each copy of the publication in terms of their cost. If an organization has exercised the right to reduce VAT under “advance” VAT, the tax for magazines received in a given quarter will have to be restored to the budget. For example, if during the tax period the company received three copies of the magazine, it will be necessary to restore half of the prepayment tax accepted for reduction and the same amount can be deducted for VAT on shipment; two copies - in the amount of 1/3 of the payment; one magazine - 1/6.

Alternative option: when a subscription fee is provided. The full scope of work stipulated by the contract is a semi-annual (quarterly, annual) subscription, rather than sending each copy of the magazine. By the way, this will also be visible from column 3 of the invoice, where “1” is entered, which means “service in the amount of one piece.” There is no need to make any extra calculations in this situation, since we are talking about 100 percent prepayment. In addition, by taking advantage of the right to an “advance” deduction, the company has already saved money, thereby reducing the tax payable.

If the amount of “input” VAT on prepayment turns out to be greater than the total amount of VAT in the quarter of advance payment, the resulting difference can be reimbursed from the budget: offset against upcoming tax payments or simply returned from the treasury.

Example 1

On March 18, 2011, Elita LLC subscribed for the 2nd and 3rd quarters (from April to September) to the Practical Accounting magazine, transferring 6,048 rubles to the account of the Berator publishing house. (including VAT - 549.82 rubles). On the invoice for payment. On March 21, the publisher issued an invoice for prepayment.

Journal numbers were received on the dates of April 4, May 4, June 6, July 4, August 4 and September 5. At the end of nine months of the year, Berator LLC issued an invoice and delivery note to Elite.

Thus, Elite will be able to deduct tax on prepayment by calculating the tax for the period until April 20, 2011 for the first quarter. The deduction amount will be 549.82 rubles.

The tax will need to be restored and deducted only based on the results of the second quarter by October 20, 2011. The same amount of 549.82 rubles will need to be restored and deducted.

Please note: even if the publisher, with such wording in the offer, issues an invoice for shipment before issuing the initial (invoice for payment) and posting the entire service (including the last issue of the magazine for the six months), the organization will not accept the “input” tax as a deduction will succeed (letter of the Ministry of Finance of Russia dated February 17, 2011 No. 03-07-08/44).