In the previous publication about the self-employed, we found out who they are, what they can do, and how to register in this status. In this article we will figure out what tax should be paid by those who independently receive income without registering an individual entrepreneur.

Free tax consultation

Who are self-employed citizens?

These are individuals who receive income from activities in which there is no employer or employees hired under employment contracts.

These are also people who rent out their property. This income (rent) is called professional income. According to Federal Law No. 422-FZ dated November 27, 2018 (hereinafter referred to as the Law on the Self-Employed), these individuals can become payers of professional income tax (PIT). To do this, they must voluntarily register with the tax office and receive the appropriate status.

REFERENCE. Payment of NAP is an experiment that will last ten years: from January 1, 2022 to December 31, 2028 inclusive. At first, the experiment did not operate throughout Russia, but only in certain regions. And only from July 2022 it spread throughout the country.

Tax base and tax period

The tax base is the monetary expression of income received from the sale of goods or services, which is subject to taxation. It is determined separately by type of income, for which different tax rates are established.

In order to determine the tax base, income is taken into account on an accrual basis from the beginning of the tax period.

If the taxpayer returns amounts previously received as payment (advance payment) for goods or services, the income of the tax period in which the income was received is reduced by the amount of the refund.

A taxpayer may correct previously submitted information about the amount of settlements that lead to an overstatement of tax amounts in the following cases:

- if a refund is made of funds received as payment (advance payment) for goods or services;

- if the information is entered incorrectly.

The amount of overpaid tax is subject to offset against the taxpayer's upcoming payments, repayment of arrears, arrears of penalties and fines for tax offenses only for professional income tax or is subject to refund in the manner prescribed by Art. 78 Tax Code of the Russian Federation.

The tax period is a calendar month.

Who can become self-employed in 2022

Any citizen of Russia and other countries of the Eurasian Economic Union (Belarus, Armenia, Kazakhstan, Kyrgyzstan) has this right. The main thing is that he receives professional income in any of the constituent entities of the Russian Federation.

ATTENTION. A person who plans to pay tax on professional income does not have to register as an individual entrepreneur. But if you already have the status of an individual entrepreneur or want to acquire it, then the status of an individual entrepreneur will not become an obstacle to paying NAP.

Fill out documents for registering an individual entrepreneur in a special service

There is a limit on the amount of professional income. If its value since the beginning of the current calendar year has exceeded 2.4 million rubles, the special regime cannot be applied to the self-employed. We'll have to wait until next year when the countdown starts from scratch.

Can a self-employed person be an employee? Yes, he has the right to combine his business and work under an employment contract. He will receive professional income from entrepreneurial activity, and salary from hired work.

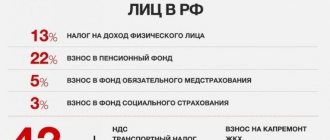

What taxes are self-employed people exempt from?

- Individual: from personal income tax, in relation to income that is subject to taxation on professional income tax;

- Individual entrepreneurs applying a special tax regime: from personal income tax on income that is subject to tax on professional income, from VAT (exception: VAT payable when importing goods into the territory of the Russian Federation and other territories under its jurisdiction), from fixed insurance premiums (however in other special regimes, insurance premiums are paid even in the absence of income).

If there is no income during the tax period, then there are no mandatory or fixed payments. At the same time, self-employed people participate in the compulsory health insurance system, so they can count on free medical care.

Types of activities for the self-employed in 2022

What can a self-employed person do? Tutoring, cleaning premises, preparing homemade baked goods, providing cosmetologist services, etc. Also, owners of apartments and rooms for rent often switch to paying NAP.

At the same time, there are types of business that do not give the right to become a professional tax payer. The black list includes:

- sale of excisable goods;

- sales of products subject to mandatory labeling (tobacco products, medicines, shoes, etc.);

- resale of goods, property rights (except for property that was used for personal, household and other similar needs);

- extraction and (or) sale of minerals;

- intermediary services on the basis of commission, commission or agency agreements (except for the situation when the intermediary uses cash register equipment registered by the principal, principal or principal);

- services for delivering goods and receiving money from the buyer (except for cases when cash register equipment registered by the seller of the goods is used).

How to become self-employed in 2022

Registration in the My Tax application

To become a tax payer, you must submit an application through the “My Tax” mobile application.

First you need to download this application for free from the Federal Tax Service website and install it on your smartphone, tablet or computer. Then, using the same device, take a scan of your passport and your photo. Then go through a simple registration procedure in the application. A paper application with the personal signature of a self-employed citizen is not required.

REFERENCE. You can register as self-employed in another way - through the taxpayer’s web account of the “Professional Income Tax”. In it you need to indicate the TIN and access code to the taxpayer’s personal account. In this case, you will not need any passport data, or a photo, or a paper application.

Tax officials will check the information provided. If everything turns out to be in order, the inspectors will send the citizen a notification about registration. It will come through the My Tax app.

Transition to self-employed from other tax regimes

It is possible that before the transition to the NAP, a person had already received professional income and paid another tax on it: a single tax according to the simplified tax system, a single agricultural tax, a tax according to the personal income tax or personal income tax. Then, by registering in the “My Tax” application, an individual is obliged to abandon the previous tax regimes. The corresponding application must be submitted to the Federal Tax Service at the place of registration or place of business. This must be done within one month from the date of registration as self-employed. If the deadline is missed, the inspectors will cancel the registration.

Submit a notice of refusal from the simplified tax system or unified agricultural tax via the Internet Submit for free

IMPORTANT. Is it possible to transfer only part of the business income to NAP, and leave the other part to the simplified tax system, unified agricultural tax, PSN or the main system? No you can not. Combining the professional income tax with the listed tax regimes is unacceptable (subclause 7, clause 2, article 4 of the Law on the Self-Employed). It’s another matter if an individual is engaged in business and at the same time works for hire. In this case, his salary will be subject to personal income tax, and professional income will be subject to NPT.

Who can switch to special mode

Almost any individual and even individual entrepreneur can obtain self-employment status. But it is necessary to meet a number of conditions.

The key requirement is to work independently, without a team . A self-employed person should not have employees. The maximum allowable annual income from personal professional activities on this system is 2.4 million rubles. Monthly amounts are not controlled.

As soon as the annual limit is exceeded, the person loses the right to use the special regime. In this case, it is necessary to register an individual entrepreneur or LLC and move to another system. For example, general, simplified or patent.

Self-employment is a privilege not only for the Russian Federation. The opportunity to obtain status with similar conditions is given to residents of the EAEU - Armenians, Belarusians, Kyrgyz, and Kazakhs. Registration for foreigners is carried out using a tax identification number , which is issued by local authorities.

From 2022, registration will be allowed from the age of 16. It is likely that persons under 18 years of age who register for self-employment in 2022 will be offered a deduction of 12,130 rubles in addition to the standard 10,000. This issue is currently being considered at the government level.

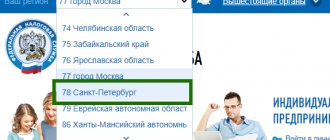

At first, the experiment with the special regime was carried out only in several regions of the country. Now you can apply for self-employment without any problems anywhere in Russia. The place of business is the region in which the taxpayer or his client is located. This information is provided during registration. The region may not coincide with the place of registration and actual residence of the self-employed. If necessary, it is adjusted, but not more than once a year.

The only tax that users of the regime need to pay is the NAP. 4% or 6% - depending on who transferred the payment. If the user does not receive funds during the billing month, then he will not have to pay. All transactions are recorded in the “My Tax” service, where the amount of the mandatory payment is calculated. Through this program the user interacts with the Federal Tax Service. Everything is simple and convenient.

Deregistration of a self-employed person

To deregister as an NPT payer, you need to submit an application through the “My Tax” application. This is done in one of the following cases:

- Professional income since the beginning of the year has exceeded 2.4 million rubles.

- The citizen began to engage in activities from the “black” list.

- A self-employed person now has hired workers.

- The citizen has lost the desire to be a NAP taxpayer.

Inspectors will deregister a self-employed citizen on the day the application is submitted.

It may happen that a person continues to consider himself self-employed, although his income has exceeded the limit, he has hired employees, or he has started running a business from the “black” list. If employees of the Federal Tax Service discover this, they themselves will stop registering an individual as an NPT payer, without waiting for an application from him.

Taxation for self-employed citizens in 2022

What income is taxed

NPA is paid on professional income received within one calendar month. There are two rates.

If the client is an individual without individual entrepreneur status, then the rate is 4%.

If the client is an organization or individual entrepreneur, then the rate is 6%.

When calculating tax, income is not taken into account:

- from the sale of: real estate, transport, personal property, securities, derivative financial instruments, shares and shares in the authorized capital;

- from the transfer of rights to real estate (except for rental housing);

- from activities under a simple partnership agreement or trust management of property;

- from the provision of services under a civil contract, if the customer is the contractor’s employer, or a former employer from whom the self-employed citizen left less than two years ago;

- from the assignment and assignment of rights of claim;

- received in kind;

- from the arbitration department, from the activities of a mediator, appraiser, private notary, lawyer.

How income is accounted for

Money from the sale of goods (works, services, property rights) are recognized on the day they are received.

Revenue received under a commission agreement (order, agency agreement), when the intermediary participates in the settlements, is recognized on the last day of the month in which the money is received by the intermediary.

Income that was previously taken into account under any tax system before the transition to NAP does not need to be reflected. This rule applies even if the money arrived after such a transition.

Tax deduction for self-employed

It is determined according to the following rule:

- if professional income is received from an individual, the deduction is equal to 1% of the amount of income;

- if professional income is received from an individual entrepreneur or organization, the deduction is equal to 2% of the amount of income.

The deduction amount, calculated on an accrual basis from the moment of switching to NAP, cannot exceed 10,000 rubles. for the entire period of activity as a self-employed person.

An individual who has lost the status of an NAP payer without spending all 10,000 rubles. deduction, retains the right to use the balance. It will be restored upon re-registration in this status. In a situation where 10,000 rub. have been spent, you cannot use the deduction again.

IMPORTANT. Temporary rules have been introduced in relation to NPA payable from 1 July to 31 December 2022. During the specified period of time, 12,130 rubles were added to the balance of the “regular” deduction. The received amount can be used unlimitedly, regardless of revenue. Due to the deduction, the debt on the NAP was paid off, and the remaining part was used to pay the current tax. The balance of the deduction was carried forward to 2022 within the limit: no more than the balance that was listed as of June 1, 2022. Anyone who became self-employed for the first time after June 1, 2022, could transfer no more than 10,000 rubles to 2022. (See “New “anti-virus” benefits: deduction for the self-employed, increase in child benefits, rent discount”).

How to calculate tax for self-employed people: example

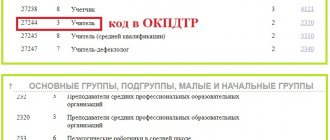

Teacher Alexandrov was registered as a NAP payer at the beginning of February 2022.

In February, he conducted classes at the training center and received payment in the amount of 150,000 rubles. In the same month, Alexandrov provided tutoring services to private clients, and earned 50,000 rubles from this.

The deduction amount is equal to RUB 3,500 ((RUB 150,000 x 2%) + (RUB 50,000 x 1%)).

The NPA payable for February 2022 amounted to 7,500 rubles ((150,000 rubles x 6%) + (50,000 rubles x 4%) – 3,500 rubles).

In the future, Alexandrov will be able to apply a deduction in the amount of no more than 6,500 rubles (10,000 rubles - 3,500 rubles).

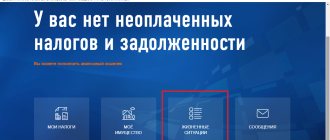

Paying tax for self-employed people

The tax authorities calculate the amount of NAP payable. Data for calculations is provided by a self-employed citizen. He must do the following:

- In the “My Tax” application, indicate how much professional income and from whom it was received in cash, credited to a bank account or to a card.

- Create a receipt and send it to the buyer electronically or in paper form. The receipt is generated in the “My Tax” application, so there is no need to buy cash register equipment. Deadline for transferring a check: for payments in cash or electronic means of payment - immediately after receipt of money; for other forms of payment - no later than the 9th day of the month following the month in which the money was received.

At the end of the month, inspectors will calculate the amount of NPA payable. They will report the result to the self-employed individual no later than the 12th day of the month following the end.

Tax must be paid no later than the 25th day of the month following the end. If the amount payable is less than 100 rubles, then it will be added to the tax for the next month. Overpayments can be returned or offset against future periods.

ATTENTION. When receiving professional income, the NPT payer is exempt from value added tax (except for VAT on imports), personal income tax and insurance premiums. But a self-employed person is required to pay taxes on personal property: land, transport and personal property taxes.

Submit a free notification and submit all declarations for individual clients

Official clarifications on the application of tax for self-employed people

State Duma deputy Andrei Makarov emphasizes that “the law provides a right, but does not impose obligations.” It “does not establish any additional tax audits or the possibility of catching anyone for tax evasion.” The existence of this law provides people with a convenient opportunity to fulfill their constitutional obligation to pay taxes and fees.

On the official website of the State Duma, Andrei Makarov gave explanations on numerous questions that come from citizens.

Are those who provide one-time assistance considered self-employed?

Do not apply. The fact of regular provision of services is fundamental: for example, you help people dig up their gardens and make money from it. However, if you once helped a neighbor dig up a garden, this will not be considered the provision of services.

Can an individual entrepreneur re-register as self-employed?

Maybe if he considers that this mode is more profitable for him. But the main goal of the law on self-employed people is to allow people who are not yet registered to leave the “gray zone”.

Will self-employed people be able to obtain income certificates to purchase government guarantees and benefits?

They can, like any citizen.

Where will the tax money go?

They will go to the regional budget at the location of the activity. Regions will be able to distribute them and send part of the income to municipalities.

“And this is very important for the regions. Because today the regions make payments to the Compulsory Health Insurance Fund for the non-working population. As soon as a person leaves the “gray” zone, 1.5% of the tax he paid will be credited to the Compulsory Medical Insurance Fund, and the region will no longer pay for it to the Compulsory Medical Insurance Fund,” notes Andrei Makarov.

Where should a self-employed person register if he operates in several regions?

He can choose the region most convenient for him to register. You do not need to register in all regions.

Explanations on this issue are also given in the Letter of the Federal Tax Service of the Russian Federation dated February 21, 2019 No. SD-4-3/ [email protected]

The designer works with foreign stock platforms. Does he fall under the self-employed law?

This type of business activity will also be subject to the new tax regime. The fact of performing work or providing services in favor of a foreign person does not matter for the purposes of calculating and paying income taxes, since the object of taxation is income from sales.

Depending on the characteristics of the final buyer of goods (works, services), taxpayers of the professional tax will be required to apply one or another tax rate (4% for sales to individuals and 6% for sales by organizations or individual entrepreneurs).

It should be noted that taxpayers of professional income tax when selling goods (works, services) using intermediary mechanisms should pay special attention to identifying the final buyer.

Hayk Safaryan Partner, Tax Practice, CMS, Russia

A benefit is provided for companies purchasing goods from self-employed people. How will it work?

The law provides that payments by organizations or individual entrepreneurs to individuals who are taxpayers of professional income tax for goods, works, and services sold, taken into account in the tax base, are not recognized as subject to insurance contributions.

Thus, corporate taxpayers will have the opportunity to reduce the base for taxation of insurance premiums when purchasing goods (works, services) from self-employed people.

Hayk Safaryan Partner, Tax Practice, CMS, Russia

Pros and cons of self-employment

Pros:

- low tax rate;

- simple, convenient and free registration;

- no need to purchase a cash register;

- there is no need to pay insurance premiums;

- There is no need to keep records and submit reports.

Minuses:

- You cannot hire employees;

- The period when a citizen pays NAP is generally not counted towards the insurance period. And only if a person voluntarily makes pension contributions, the time of “self-employment” is included in the length of service when assigning a pension;

- expenses do not reduce the taxable base;

- This regime is allowed to be applied as long as revenue from the beginning of the year does not exceed 2.4 million rubles.

Keep records and submit all individual entrepreneur reports via the Internet

The main differences between individual entrepreneurs and self-employment

Let's compare the most significant parameters in the work of a tax payer and an individual entrepreneur in a different mode (see table).

Comparison of the activities of a self-employed person and an individual entrepreneur in a different mode in 2022

| NAP payer | Individual entrepreneur in a different tax regime |

| Place of business | |

| All regions | PSN - regions where these special regimes have been introduced in relation to specific types of activities; OSNO, simplified tax system and unified agricultural tax - the entire territory of Russia. |

| Income restrictions | |

| 2.4 million rubles. year to date | Depends on the tax regime: “simplified” - 200 million rubles. since the beginning of the year (multiplied by the deflator coefficient); PSN - 60 million rubles. year to date; the rest - without restrictions. |

| Limitations on the number of employees | |

| You cannot hire a single employee under an employment contract | Depends on the tax regime: “simplified” - no more than 130 people; PSN - no more than 15 people; the rest - without restrictions. |

| Tax rate | |

| 4% of revenue received from individuals; 6% of revenue received from organizations and individual entrepreneurs | Depends on the tax regime. Under the basic system, personal income tax is 13% of the difference between income and professional deductions, VAT is 20% of the difference between accrued tax and deductions; with “simplification” - in the general case, 6% of income or 15% of the difference between income and expenses; for PSN - in general, 6% of potential income; for Unified Agricultural Tax - in general, 6% of the difference between income and expenses plus VAT on a general basis. |

| Payment of insurance premiums | |

| No need to pay | Need to pay: fixed contributions “for yourself”; contributions from employee salaries. |

| Reporting | |

| No need to introduce | You need to submit: — tax returns (for everyone except individual entrepreneurs with a patent); — reporting on insurance premiums from employee salaries; — reporting to the Pension Fund of the Russian Federation on insured persons and personnel activities (if there are employees); — statistical reporting (in some cases). |

| Record keeping | |

| No need to lead | Need to lead: — tax accounting; — personnel records (if there are employees). Accounting is carried out at will. |

| Cash register | |

| Not required | In general, PSN is not needed (with the exception of some types of business, for example, hairdressing services). Under other tax regimes, in most cases, it is needed by everyone who makes payments to individuals (except for delivery trade and a number of other exceptions). |

| Formation of insurance experience for a pension | |

| In general, there is no length of service. If a person voluntarily pays pension contributions (in 2022 - 32,448 rubles per year), then the length of service is formed. | Experience is being formed |

| Payment of sick leave benefits | |

| Not provided | In general, it is not provided. If an individual entrepreneur voluntarily pays social insurance contributions “for sick leave” (in 2022 - 4,452 rubles per year), then benefits are paid. |

Free calculation of contributions “for yourself”, tax according to the simplified tax system, fill out payments for taxes and contributions

Financial support

It includes:

- loans at preferential rates;

- subsidies, grants and budget investments;

- state and municipal guarantees for the obligations of the self-employed;

- microfinance loans through entrepreneurship support funds.

This is what a set of offers from banks looks like for obtaining a loan according to the parameters of interest in Moscow through Business Navigator:

In accordance with Russian Government Decree No. 739-r dated March 27, 2021, by the end of 2022, self-employed people will also have the opportunity to apply for a preferential loan through the State Services portal. Citizens will have access to loans of up to 1 million rubles for a period of up to 3 years (without collateral) or from 1 to 5 million rubles for a period of up to 5 years (with collateral) at a rate of 7.5%. The service is not yet available, but is already generating increased interest.

Another option for financial support is subsidies. Getting them to start your own business is not easy, but it is quite possible. In a number of regions, grants are allocated for socially significant areas of business (the main thing is to have time to submit an application and pass the competitive selection before the allocated funds run out).

In any case, a detailed report must be provided on the use of amounts received from the state. If it turns out that the support was not used for its intended purpose, the money will have to be returned.

To find out about financial support measures available in your region, contact your advisory office)

What to choose in the end - individual entrepreneur or self-employment?

A beginning businessman has a choice: obtain self-employed status or become an entrepreneur in a different mode. Each case is individual, and it is impossible to give universal advice.

In practice, the status of individual entrepreneurs and tax regimes not related to the payment of non-refundable income are chosen by those who plan to conduct business on a grand scale. Namely, to increase turnover, hire staff, expand the sales network, etc. But the self-employed in 2022, as a rule, are people for whom income is a side income. These are company employees who do something else in their free time (baking for sale, grooming animals, etc.). Another example is housewives. For them, the main thing is child care, and small business (selling handmade jewelry, cloth dolls, etc.) is an addition.

Please note: newly registered entrepreneurs can use the Kontur.Elba web service for free for a year, which allows you to conduct all necessary accounting and submit reports via the Internet.

Free education

Small business support centers conduct trainings, seminars, webinars, and training programs aimed at supporting small businesses. For example, training programs “ABC of an Entrepreneur” and “School of Entrepreneurship” are conducted for aspiring businessmen.

In some cases, prior training is a prerequisite for receiving financial assistance to start a business. That is, if a self-employed person has not completed the course and received a supporting document, then he will not receive the money.