Supplement for citizens under 30 years of age

Until 2005, there was an additional benefit for young professionals. This category included citizens who came to work in the North before reaching the age of 30, while having a specialized higher or secondary education.

After 2005, this benefit was abolished, but an accelerated procedure for calculating bonuses for young specialists under 30 years of age was developed and approved. The allowance is calculated as follows:

- those working in areas belonging to the 1st and 2nd groups of climatic conditions begin their working career with a 20% bonus to their salary. Then it increases every six months by another 20% until it becomes 80% (60%) of the salary. The premium will reach its maximum of 100% and 80%, respectively, only after a year;

- those working in the 3rd and 4th groups of climatic conditions begin their working career with a 10% increase in salary. Every six months it increases by another 10% until it reaches a maximum of 50% and 30%, respectively.

The Letter of the Ministry of Health and Social Development of the Russian Federation dated August 17, 2005 No. 697-13 states that there are additional benefits for citizens who were born and lived in the Far North for at least 5 years as of December 31, 2004. Such citizens who get a job in the regions of the Far North or in regions that have a similar status have the right to receive a percentage increase in wages in full from the first day of work in these regions (including when concluding an employment contract after 12/31/2004).

As for young specialists who have not yet turned 30 years old, but who began their working career in the north after December 31, 2004 and have lived in the specified areas and localities for at least one year, they have the right to accrue the northern allowance on an accelerated basis in in accordance with paragraphs. “e” clause 1 of the Resolution of the Council of Ministers of the RSFSR dated October 22, 1998 No. 458 “On the streamlining of compensation to citizens living in the Northern regions.”

Conditions for the emergence of the right to the northern allowance

The right to receive a northern bonus for workers directly depends on the duration of their work in difficult natural conditions (Article 317 of the Labor Code of the Russian Federation).

The main documents regulating the procedure for establishing this guarantee are the instructions approved by orders of the Ministry of Labor of the RSFSR dated November 22, 1990 No. 2 (hereinafter referred to as Instruction No. 2) and No. 3 (hereinafter referred to as Instruction No. 3), resolutions of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions dated 04/06/1972 No. 255 and dated 01/09/1986 No. 53.

According to these documents, the employee’s northern bonus depends on:

- from the region where the citizen lives and works;

- age of the worker;

- the length of his work experience in the regions of the North;

- the period of his residence in difficult climatic conditions.

The maximum amount of the allowance established by law depends on the region where the work is performed:

- regions of the Far North – up to 100% ;

- other regions of the Far North – up to 80% ;

- areas equated to the Far North - up to 50% ;

- other regions of southern Siberia and the Far East - up to 30% .

IMPORTANT!

In order to determine the required northern charges, the actual place of performance of labor functions is taken into account, and not the territory where the employer is located.

The length of service taken into account when calculating bonuses includes both the time spent performing official duties and some other periods. Namely:

- advanced training with a break from work for up to 6 months;

- periods of study in educational institutions;

- time of military service, including alternative;

- periods of maternity and childcare leave.

entire working time is taken into account , regardless of the presence and duration of breaks in his work activity, as well as the reasons for dismissal. Moreover, if an employee is sent on a business trip to a region where there are no allowances, this period is not removed from the length of service for their accrual.

IMPORTANT!

does not take into account the entrepreneurial activity of a citizen (IP) and his employment under civil contracts, as well as periods of correctional labor and stay in places of detention.

During a business trip to the North, citizens living and working in areas without difficult climatic conditions are not awarded .

Supplement after 30 years

Citizens who are already 30 years old and who work in the north receive a bonus according to the general rules:

- for regions belonging to the 1st group - in the first 6 months of work, 10% of earnings are accrued, for each subsequent six months another 10% is accrued. And so on until it reaches its maximum - 100%;

- for regions belonging to the 2nd group - in the first 6 months of work, 10% of earnings are accrued, for each subsequent six months another 10% is accrued. And so on until it reaches its maximum - 80%;

- for regions belonging to the 3rd group - in the first 6 months of work, 10% of earnings are accrued, for each subsequent year of work another 10% is accrued. And so on until it reaches its maximum - 50%;

- for regions belonging to the 4th group - in the first 6 months of work, 10% of earnings are accrued, for each subsequent 2 years of work another 10% is accrued. And so on until it reaches its maximum - 30%.

Allowance for military personnel

But not only the civilian population works in the Far North. There are many military units that are located in places with such a difficult climate. How is the allowance calculated for military personnel?

Military personnel do not receive wages, but monetary allowances. The allowance is awarded to them in the same way as to the civilian population:

- for monetary allowance without taking into account the regional coefficient;

- depending on the region of service;

- depending on length of service.

If a serviceman is not yet 30 years old, then the rules for accelerated calculation of bonuses also apply to him.

Relocation allowance

The amount of the bonus depends on the length of service in such climate conditions. The amount of experience is taken into account cumulatively. Therefore, when an employee moves to another area, it is worth following this rule.

For example, a citizen worked in an area where the premium percentage is 80%, and then he moved to another area with less harsh climatic conditions. Now his bonus is a maximum of 30% of wages. But in terms of experience, he already has 80%! Therefore, he can count on the maximum salary increase - 100%.

Another situation. The citizen worked in the Far North for 5 years. Then he moved to a warmer climate and stopped giving raises. Then he returned to the North again. His northern experience has already been 5 years, and it is based on this experience that the accounting department will give him a bonus upon re-employment.

The essence of the allowance for work in the North

Citizens carrying out labor activities in the territories of the Far North of the Russian Federation (KS) and equivalent to them, in cases established by law, receive a salary:

- increased by a certain percentage in the form of a surcharge;

- multiplied by the regional coefficient (Article 315 of the Labor Code of the Russian Federation).

The bonus and coefficient are applied when calculating wages based on the fact that the person actually works in the North: the location of his employer (company head office) does not matter.

The territories of Russia related to the Far North and equated to it are determined mainly by Resolution of the USSR Council of Ministers dated January 3, 1983 No. 12. You will find the full list here.

ATTENTION! From 2022, the list of northern regions will be changed. See this post for details.

The amount of the “northern” premium depends on:

- length of work experience in the North;

- the length of time a person has lived in the North;

- employee age;

- places where work is performed - at the compressor station itself or in regions equivalent to it. It also matters in which specific northern regions of the Russian Federation labor activity is carried out.

Let's study what the value of the premium in question could be.

How is the northern allowance calculated?

In order to correctly understand how the northern allowance is calculated, you need to give several examples.

Example 1. For example, citizen R. is already over 30 years old, he has been working for 8 months in the Republic of Sakha. What amount will he receive in person if his salary is 37,000 rubles. Calculation: after 8 months he will receive a 20% increase in salary, and in hand 37,000 + (37,000 * 20%) = 44,400 rubles

Example 2. Citizen R. is a young specialist, he has not yet turned 30 years old. He has been working in the Komi Republic for 1 year and 6 months. His salary is 40,000 rubles. How much money will he receive? Calculation: since the employee is not yet 30 years old, accrual occurs according to an accelerated scheme. Komi is the 3rd climate zone, the maximum here is 50% of the salary. After 1.5 years he will have a 30% increase in salary. That is, in hand 40,000 + (40,000 * 30%) = 52,000 rubles.

If an employee receives a bonus, then it must be taken into account in the salary, and a bonus percentage must be added to it.

Is it necessary to include it in an employment contract?

Since an allowance (of any nature), according to the Labor Code, is considered an integral part of wages, it will need to be reflected in the employment contract. This applies to both collective agreements and individual employee agreements.

But there are certain nuances here. The specific amount of the bonus may not be reflected in the employment contract. You just need to provide a link to one of the company’s local regulations that discusses this point in detail. This may be a signed and entered into force Regulation on Remuneration.

Northern allowances and regional coefficient

The regional coefficient is also a measure of additional support for citizens who work in the Far North or in an area that has a similar status. This measure was introduced in order to further support citizens due to the fact that the cost of food and household services in the north is slightly higher than in the central region.

The regional coefficient is calculated depending on the region of residence and employment, and is also fully regulated by labor legislation.

The maximum coefficient is 2. It is set for:

- islands and seas of the Arctic Ocean, except for the islands of the White Sea;

- the Republic of Sakha, where enterprises and construction sites of the diamond mining industry are located, at the Aikhal and Udachnaya deposits, the Deputatsky and Kular mines;

- some districts of the Sakhalin region;

- Aleutsky district of Kamchatka region;

- Chukotka Autonomous Okrug.

In other regions, the regional coefficient is slightly lower.

The regional coefficient is calculated for the following payments:

- wage;

- directly related to wages. For example, additional payments for length of service;

- allowances that are related to wages. We are talking about tariff allowances, as well as allowances for an academic degree, skill and class of profession;

- compensation for harmful and dangerous working conditions;

- “thirteenth salary”;

- seasonal work and temporary employment relationships;

- on certificates of incapacity for work;

- persons who work part-time or part-time;

- Minimum wage.

The regional coefficient is not calculated for:

- vacation pay;

- remunerations and payments that are temporary or one-time in nature;

- northern allowances.

The effect of the district coefficient in 2016-2018 applies to pensions and benefits only at the time when a person lives in a given region. If you change your place of residence to a more favorable one, the premium will be reduced (or completely canceled).

What is the premium calculated for?

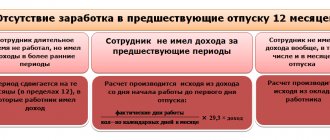

A percentage bonus must be accrued on all payments that have the nature of a salary, including payments for length of service (clarification of the Ministry of Labor of the Russian Federation dated September 11, 1995 No. 3). These include wages (including for night and overtime work, downtime, etc.) and bonuses from the salary fund.

Supplements are not awarded:

- on average earnings and payments calculated on its basis, since when calculating it, the amount of the bonus is already taken into account (clause 2 of the regulation, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922);

- regional coefficient (subparagraph “e” of paragraph 1 of the resolution of the Council of Ministers of the RSFSR dated October 22, 1990 No. 458);

- one-time payments made not from the salary fund and not provided for by the remuneration system (for example, dedicated to memorable dates or holidays), since they are not in the nature of wages, are not related to working conditions and working hours, and are not recognized as reducing the income tax base (Part 1 of Article 255 of the Tax Code of the Russian Federation);

- material assistance (letter of the Ministry of Labor of Russia dated July 22, 1999 No. 716-7);

- field allowance (part 1 of article 168 of the Labor Code of the Russian Federation, it is classified as compensation);

- remuneration for rationalization proposals and inventions, if they are not provided for in the employment contract (letter of the Ministry of Health and Social Development of the Russian Federation dated March 12, 2010 No. 559-19).

The accrual of bonuses begins when the employee becomes entitled to them, after which payments must be made monthly.

Will northern surcharges be abolished in the future?

Several years ago, the Government proposed to completely abolish or change the procedure for applying and calculating northern allowances and regional coefficients. But since this is an additional measure designed to compensate for difficult climatic conditions, such an initiative did not find support.

However, there are prerequisites for changing the accrual rules. These include:

- all regulations governing the procedure for applying and calculating allowances, developed and adopted back in Soviet times;

- for commercial enterprises this is an additional burden on accounting.

The unrest about the abolition of premiums and the coefficient is caused by the fact that the Government is going to pass a bill on the introduction of priority development areas. But in this law there is not a word about bonuses for northerners!

There is a possibility that amendments will be adopted to the Labor Code of the Russian Federation, which will allow replacing the amount and coefficient with monetary compensation, but only with the written consent of the employee.

Table of regional coefficients and northern surcharges

Allowances in 2015-2016

| The subject of the Russian Federation | Northern allowances in 2015-2016 |

| Amur region | |

| Skovorodninsky, Magdagachinsky, Shimanovsky districts | 30 |

| Zeysky, Selemdzhinsky, Tyndinsky districts | 50 |

| Tynda with the territory subordinate to the city administration | 50 |

| Arkharinsky, Blagoveshchensky, Bureyasky, Ivanovsky, Konstantinovsky, Mikhailovsky, Svobodnensky, Tambov districts, Blagoveshchensk (territory subordinate to the administration of the rural settlement of Belogorye) | 30 |

| The rest of the region, incl. Blagoveshchensk | 30 |

| Altai Republic | |

| Kosh-Agachsky and Ulagansky districts | 50 |

| Rest of the republic | 30 |

| Arhangelsk region: | |

| Leshukonsky district | 80 |

| Mezensky district | 80 |

| Pinezhsky district | 80 |

| Severodvinsk with the territory subordinate to the city administration | 80 |

| Solovetsky district | 80 |

| Novaya Zemlya Island; Franz Josef Land | 100 |

| Arkhangelsk and the rest of the region | 50 |

| The Republic of Buryatia | |

| Bauntovsky, Muisky and Severo-Baikalsky districts | 50 |

| The rest of the territory of the republic, incl. Ulan-Ude | 30 |

| Jewish Autonomous Region | 30 |

| Kamchatka region | |

| Aleutian region (Commander Islands) | 100 |

| The rest of the region, incl. Petropavlovsk-Kamchatsky | 80 |

| Republic of Karelia | |

| Belomorsky, Kalevalsky, Loukhsky, Kemsky districts and Kostomuksha | 50 |

| Rest of the republic | 50 |

| Kirov region | |

| Kosinsky, Kochevsky and Gainsky districts | 50 |

| Komi Republic | |

| Vorkuta with the territory subordinate to the city administration | 80 |

| Inta with the territory subordinated to the city administration | 80 |

| Izhemsky, Pechora, Ust-Tsilemsky districts, Usinsk with the territory subordinate to the city administration (except for the Ust-Lyzhinsky village council) | 80 |

| Vuktylsky, Troitsko-Pechorsky, Sosnogorsky, Udora districts, Ukhta, Vuktyl with the territory subordinate to the city administration (formerly Vuktylsky district), Usinsk (Ust-Lyzhinsky village council), Sosnogorsk with the territory subordinate to the city administration (formerly Sosnogorsky district) and Pechora with the territory subordinated to the city administration | 50 |

| Syktyvkar and the rest of the republic | 50 |

| Koryak Autonomous Okrug | 100 |

| Magadan Region | |

| Severo-Evensky district | 100 |

| Rest of the region | 80 |

| Murmansk region | |

| Murmansk-140 | 80 |

| village of Tumanny | 80 |

| The rest of the region, incl. Murmansk | 80 |

| Nenets Autonomous Okrug | |

| Korga Island; Kambalnitskie Koshki Islands; Kolguev Island; Sengeysky Island; Gulyaevskie Koshki Islands; o. Dolgiy; Lovetsky Island; Green Island; O.Pesyakov; o. Dolgiy; Vaigach Island | 100 |

| Rest of the district | 80 |

| Primorsky Krai | |

| Kavalerovsky district, Taezhny and Ternisty mines; | 30 |

| Dalnegorsky, Olginsky and Terneysky districts, Krasnoarmeysky district (Vostok village and territories subordinate to its administration, Boguslavetsky, Vostretsovsky, Dalnekutsky, Izmailikhinsky, Melnichny, Roshchinsky and Taezhnensky rural settlements) | 50 |

| Territories of township and rural administrations located in the 30-kilometer border zone | 30 |

| The rest of the region, incl. Vladivostok | 30 |

| The Republic of Sakha (Yakutia) | |

| On the islands of the Arctic Ocean and its seas | 100 |

| areas where enterprises and construction sites of the diamond mining industry are located at the Aikhal and Udachnaya deposits, the Deputatsky and Kular mines and enterprises and organizations of the Nizhnekolymsk region along the right bank of the Kolyma River from its mouth to the Bolshoi Anyui River, serving the gold mining industry of Chukotka Autonomous Okrug | 80 |

| The city of Mirny with the territory subordinate to the city administration, the territory of the Lensky district, located north of 61° north latitude | 80 |

| Abyisky, Allaikhovsky, Anabarsky, Bulunsky, Upper Vilyuysky, Verkhnekolymsky, Verkhoyansky, Vilyuysky, Zhigansky, Kobyaysky, Leninsky, Mirninsky (Aikhal and Udacha city councils), Momsky, Nizhnekolymsky, Oymyakonsky, Oleneksky, Srednekolymsky, Suntarsky, Tomponsky, Ust-Yansky and Zveno- Bytantai districts | 80 |

| Kangalassy village | 80 |

| The rest of the region, incl. Yakutsk | 80 |

| Sakhalin region | |

| North Kuril, Kuril, South Kuril regions (Kuril Islands) | 100 |

| Nogliki and Okha districts, Okha | 80 |

| The rest of the region, incl. Yuzhno-Sakhalinsk | 50 |

| Tyva Republic | |

| Mongun-Taiginsky and Todzhinsky districts, territory of the Shynaan rural administration of the Kyzyl district | 50 |

| Other areas, incl. Kyzylsky (except for the territory of Shynaan rural administration) and Kyzyl city | 50 |

| Chukotka Autonomous Okrug | 100 |

Regional coefficient in 2015-2016

| The subject of the Russian Federation | Regional coefficient in 2015-2016 |

| Amur region | |

| Zeya district | 1,3 |

| Selemdzhinsky district | 1,3 |

| Tyndinsky district (with the exception of Murtygitsky village council) | 1,3 |

| The city of Zeya and settlements subordinate to its administration | 1,3 |

| The city of Tynda and settlements subordinate to its administration | 1,3 |

| Altai Republic | |

| Kosh-Agachsky district | 1,4 |

| Ulagansky district | 1,4 |

| Arhangelsk region | |

| Leshukonsky district | 1,4 |

| Mezensky district | 1,4 |

| Pinezhsky district | 1,4 |

| Severodvinsk with the territory subordinate to the city administration | 1,4 |

| Solovetsky district | 1,4 |

| (the entire territory of the region with the exception of the area specified in clause 6) | 1,2 |

| The Republic of Buryatia | |

| Bauntovsky district | 1,3 |

| Muisky district | 1,3 |

| Severo-Baikalsky district | 1,3 |

| Severobaykalsk and populated areas subordinate to its administration | 1,3 |

| Transbaikal region | |

| Kalarsky district | 1,3 |

| Tungiro-Olekminsky district | 1,3 |

| Tungochensky district | 1,3 |

| Irkutsk region | |

| Bodaibo district | 1,3 |

| Bratsky district | 1,3 |

| Kazachinsko-Lensky district | 1,3 |

| Katangsky district | 1,3 |

| Kirensky district | 1,3 |

| Mamsko-Chuysky district | 1,3 |

| Nizhneilimsky district | 1,3 |

| Ust-Ilimsky district | 1,3 |

| Ust-Kutsky district | 1,3 |

| Bratsk and settlements subordinate to its administration | 1,3 |

| Bodaibo | 1,3 |

| Ust-Ilimsk | 1,3 |

| Ust-Kut | 1,3 |

| Kamchatka Krai | |

| (the entire territory of the region with the exception of the Aleutian region (Commander Islands) | 1,6 |

| Aleutian region (Commander Islands) | 2 |

| Republic of Karelia | |

| Belomorsky district | 1,4 |

| Kalevalsky district | 1,4 |

| Kemsky district | 1,4 |

| Loukhi district | 1,4 |

| The city of Kem and settlements subordinate to its administration | 1,4 |

| Kostomuksha | 1,4 |

| (the entire territory of the Republic with the exception of cities and areas specified in paragraphs 6, 7) | 1,15 |

| Komi Republic | |

| Vorkuta and settlements subordinate to its administration | 1,6 |

| Izhemsky district | 1,3 |

| Pechora district | 1,3 |

| Troitsko-Pechorsky district | 1,3 |

| Ust-Tsilemsky district | 1,3 |

| The city of Vuktyl and the settlements subordinate to its administration | 1,3 |

| Sosnogorsk and settlements subordinate to its administration | 1,3 |

| The city of Ukhta and settlements subordinate to its administration | 1,3 |

| The city of Usinsk and settlements subordinate to its administration | 1,3 |

| Pechora and the settlements subordinate to its administration | 1,3 |

| (the entire territory of the Republic with the exception of cities and areas specified in paragraphs 4, 5, 7) | 1,2 |

| Krasnoyarsk region | |

| Evenki Autonomous Okrug (south of the Lower Tunguska River) | 1,3 |

| Boguchansky district | 1,3 |

| Yenisei district | 1,3 |

| Kezhemsky district | 1,3 |

| Motyginsky district | 1,3 |

| Severo-Yeniseisky district | 1,3 |

| Turukhansky district (south of the Lower Tunguska and Turukhan rivers) | 1,3 |

| Yeniseisk | 1,3 |

| Lesosibirsk and settlements subordinate to its administration | 1,3 |

| Magadan Region | |

| (entire territory of the region) | 1,7 |

| Murmansk region | |

| Murmansk - 140 | 1,8 |

| village of Tumanny | 1,7 |

| (the entire territory of the region with the exception of cities and districts specified in paragraphs 2, 3) | 1,4 |

| Nenets Autonomous Okrug | |

| (entire territory of the Autonomous Okrug) | 1,5 |

| Perm region | |

| Gainsky district | 1,2 |

| Kosinsky district | 1,2 |

| Kochevsky district | 1,2 |

| Primorsky Krai | |

| Kavalerovsky district (village of Taezhny and Ternisty mines) | 1,4 |

| Kavalerovsky district (with the exception of the villages of the Taezhny and Ternisty mines) | 1,2 |

| Krasnoarmeysky district (township Vostok and Boguslavetskaya, Vostretsovskaya, Dalnekutskaya, Izmailikhinskaya, Melnichnaya, Roshchinskaya, Taezhnenskaya rural administrations) | 1,2 |

| Olginsky district | 1,2 |

| Terneysky district | 1,2 |

| Dalnegorsk city and settlements that were previously subordinate to its administration (formerly Dalnegorsk district) | 1,2 |

| The Republic of Sakha (Yakutia) | |

| Areas where enterprises and construction sites of the diamond mining industry are located, at the Aikhal and Udachnaya deposits, the Deputatsky and Kular mines | 2 |

| Islands of the Arctic Ocean and its seas (except for the White Sea islands and Dikson Island) | 2 |

| Lensky district (north of 61° north latitude) | 1,7 |

| The city of Mirny and settlements subordinate to its administration | 1,7 |

| village Kangalassy | 1,5 |

| (the entire territory of the Republic with the exception of cities and districts specified in paragraphs 1, 3, 4, 5) | 1,4 |

| Sakhalin region | |

| Severo-Kurilsky district | 2 |

| Kurilsky district | 2 |

| South Kuril region (Kuril Islands) | 2 |

| Nogliki district | 1,6 |

| Okha district | 1,6 |

| Okha | 1,6 |

| Tyva Republic | |

| Mongun-Taiginsky district | 1,5 |

| Todzhinsky district | 1,5 |

| Kyzyl district (territory of Shynaan rural administration) | 1,5 |

| (the entire territory of the Republic with the exception of the areas specified in paragraph 5) | 1,4 |

| Tomsk region | |

| Alexandrovsky district | 1,5 |

| Verkhneketsky district | 1,5 |

| Kargasok district | 1,5 |

| Kolpashevo district | 1,5 |

| Parabelsky district | 1,5 |

| Chainsky district | 1,5 |

| Kolpashevo | 1,5 |

| Kedrovy | 1,5 |

| Strezhevoy | 1,5 |

| Bakcharsky district | 1,3 |

| Krivosheinsky district | 1,3 |

| 1,3 | |

| Teguldet district | 1,3 |

| Tyumen region | |

| Uvatsky district | 1,5 |

| Khabarovsk region | |

| Okhotsk region | 1,6 |

| Ayano-Maisky district | 1,4 |

| Vaninsky district | 1,4 |

| Verkhnebureinsky district (north of 51° north latitude) | 1,4 |

| District named after P. Osipenko | 1,4 |

| Nikolaevsky district | 1,4 |

| Sovetsko-Gavansky district | 1,4 |

| Solnechny district (Amgunskaya and Dukinskaya rural administrations) | 1,4 |

| Tuguro-Chumikansky district | 1,4 |

| Ulchsky district | 1,4 |

| Nikolaevsk-on-Amur | 1,4 |

| Sovetskaya Gavan and settlements subordinate to its administration | 1,4 |

| Amursky district (town of Elban and settlements subordinate to its administration, Achanskaya, Voznesenskaya, Dzhuenskaya, Omminskaya, Padalinskaya rural administrations) | 1,2 |

| Verkhnebureinsky district (south of 51° north latitude) | 1,2 |

| Komsomolsky district | 1,2 |

| Solnechny district (with the exception of Amgun and Dukinsky rural administrations) | 1,2 |

| Amursk | 1,2 |

| Komsomolsk-on-Amur | 1,2 |

| Khanty-Mansiysk Autonomous Okrug | |

| (north of 60° north latitude) | 1,5 |

| (south of 60° north latitude) | 1,3 |

| Yamalo-Nenets Autonomous Okrug | |

| (entire territory of the Autonomous Okrug) | 1,5 |

| Chukotka Autonomous Okrug | 2 |