Labor Code of the Russian Federation: on the concept of days off

High-quality, long rest affects work.

They refuse to perform duties when the following circumstances arise:

- rest between shifts, breaks every day;

- holidays, end of week;

- long breaks, when the salary is retained or not.

Article 111 of the Labor Code of the Russian Federation provides an explanation of the concept. Rest every week, continuous - this is what is called the weekend.

Article 110 of the same code establishes a minimum duration of rest. 42 hours is the value under any conditions. For specific industries, the duration is set differently. 24 hours is the required minimum for communication workers if they have a shift schedule. 42 hours equals total rest every seven days.

The provision applies not only to communications employees. It also applies to other areas - only when the correct system is organized with such accounting. The local act contains a detailed description of the system used.

Non-working days regime: nuances and regulatory gaps

By Decree of the President of the Russian Federation of October 20 No. 595, the country established a regime of non-working days from October 30 to November 7, 2022. At the same time, constituent entities of the Russian Federation can increase this period. Although this is not the first time that such restrictive measures have been introduced in Russia due to the worsening epidemiological situation, businesses still have many questions about how to comply with the new requirements without breaking the law.

By default, non-working days are set for all employers, without exception. In March and April 2022, decrees of the President of the Russian Federation on non-working days1 did not apply to employees of some organizations (continuously operating, medical, pharmacy, providing the population with food and essential goods, performing urgent work in emergency circumstances, etc.). The new Decree does not contain such reservations; it only establishes that authorities and organizations must determine the number of employees and workers who ensure the functioning of these authorities and organizations on non-working days2.

This raises the question: can an organization establish that it requires all employees to function? It seems that no, since formally this would be a violation of the provisions of Decree No. 595.

Also puzzling is the lack of reference in the document to the need to determine the number of employees who continue to work by employers - individual entrepreneurs (individuals). Does this mean that employees of such employers cannot, in principle, continue to work on non-working days under any circumstances? In my opinion, the existing gaps in regulation are a shortcoming of those who prepared the draft of the relevant decree, and its provisions regarding determining the number of employees must be interpreted broadly - meaning not only government bodies and organizations, but also other employers.

In fact, the current situation is similar to what it was in May 2021, therefore, I believe, we can be guided by the recommendations of the Russian Ministry of Labor on non-working days in that period3. Then the ministry, in particular, explained that:

- authorities and organizations (employers) independently determine the number and composition of workers necessary to ensure the functioning of the relevant bodies and organizations, including the possibility of remote work;

- these decisions are formalized by order (instruction) of the relevant body, local regulatory act of the organization (employer).

It is interesting that the Ministry of Labor also did not mention employers other than government agencies and organizations in its recommendations.

Regarding payment for work, I note that employees’ salaries on non-working days remain the same. This means that the presence of non-working days in October and November 2022 is not grounds for a salary reduction.

As explained by the Ministry of Labor (clause 2 of the Explanations), employees are paid the salary stipulated by the employment contract in the same amount as if they had fully worked non-working days - fulfilled the standard working time for time-based payment or the standard of labor for piecework payment.

There are also nuances. So, in 2022, October 30 and 31, as well as November 6 and 7 are days off (with a five-day work week), November 4 is a non-working holiday, and November 5 is a day off (due to the transfer of the day off from Saturday, January 2) .

The publication of Decree No. 595 introduced uncertainty into the status of these days off and non-working holidays, since they are all called non-working days with continued pay. The situation was aggravated by the presence in Decree No. 595 of a reference to the fact that it was adopted in pursuance of Art. 112 of the Labor Code of the Russian Federation on non-working holidays. I believe this is another mistake made by the developers of the draft document.

It seems that November 4 has not ceased to be a non-working holiday, since it is one by virtue of Art. 112 of the Labor Code of the Russian Federation, which has greater legal force compared to Decree No. 595. In the same way, weekends remained the same by virtue of Art. 111 of the Code.

If we rely on the given recommendations of the Ministry of Labor, we can draw the following conclusions about how to pay for disputed days: if the employee was supposed to work on October 30 and 31, as well as from November 4 to 7, 2022, then he must be paid a salary according to the rules of Art. 153 of the Labor Code of the Russian Federation, according to which work on a weekend or a non-working holiday is paid at least double the amount.

Non-working days from November 1 to November 3, those released from work are paid at the usual rate, not at an increased rate. At the same time, in order to determine the size of the average salary under Art. 139 of the Labor Code of the Russian Federation for those who did not work in connection with the Decree, non-working days from November 1 to 3 and retained wages for this period are not taken into account.

Thus, employees must be paid wages in the same amount as if they worked during non-working days, taking into account their schedule, even despite the presence in the disputed period of days off and a non-working holiday, called non-working days in Decree No. 595.

As for the remuneration of employees ensuring the functioning of government bodies and organizations, during the period of non-working days from November 1 to November 3, 2022, it is made at the usual, and not increased, rate. In this case, the employer can set increased pay for self-employed workers.

Salaries are paid within the terms established by the employer. On non-working days, employees must receive it no later than the dates specified by the employer. If the payment deadline coincides with non-working days, the Ministry of Labor recommends paying wages before they begin.

If we are guided by the provisions of Art. 136 of the Labor Code of the Russian Federation, then formally there are no grounds for postponing the salary payment day, since payment is made the day before only if the payment day coincides with a weekend or non-working holiday, which are not non-working days according to Decree No. 595. However, in my opinion, it is better to play it safe and be guided by the position of the Ministry of Labor.

If an employee is on vacation during non-working days, vacation for the period of non-working days, according to the Ministry of Labor (clause 3 of the clarifications), is not extended. This position can be considered justified, but not in relation to November 4, 2022, since according to the law, non-working holidays falling during the vacation period are not included in the number of calendar days of vacation (Part 1 of Article 120 of the Labor Code of the Russian Federation).

In addition, according to Rostrud, an employer declaring downtime during the suspension of an organization’s activities while maintaining workers’ salaries is not allowed. Downtime during non-working days is possible if introduced before Decree No. 5954 comes into force.

To summarize, I will list the employer’s priority actions:

- determine in the order (instruction) or local regulatory act the list and number of employees who will continue to work on non-working days to ensure the functioning of the employer;

- pay wages to employees released from work before the start of the period of non-working days, if the payment day falls on non-working days in accordance with Decree No. 595;

- Do not forget to follow the acts of regional authorities, since constituent entities of the Russian Federation can expand the period of non-working days, as well as make their own adjustments to the rules of operation of companies.

1 Decrees of the President of the Russian Federation dated March 25, 2022 No. 206 “On declaring non-working days in the Russian Federation” and dated April 2, 2022 No. 239 “On measures to ensure the sanitary and epidemiological well-being of the population in the Russian Federation in connection with the spread of the new coronavirus infection (COVID-19).”

2 At the same time, such reservations should be taken into account by regional authorities who are taking “anti-Covid” measures related to restricting the work of organizations (see paragraphs 1, 4 of the Decree of the President of the Russian Federation of May 11, 2022 No. 316 “On determining the procedure for extending the validity of measures ensuring the sanitary and epidemiological well-being of the population in the constituent entities of the Russian Federation in connection with the spread of the new coronavirus infection (COVID-19)."

3 Information from the Ministry of Labor of Russia “Recommendations for employees and employers on non-working days in May 2022” to the Decree of the President of the Russian Federation of April 23, 2022 No. 242 “On the establishment of non-working days in the territory of the Russian Federation in May 2022.”

4Response of Rostrud to question No. 155883 dated October 21, 2022

Non-working holidays in the Russian Federation

There are 14 days off associated with holidays. These are New Year holidays and Christmas, Defender of the Fatherland Day, International Women's Day, Spring and Labor Day, Victory Day, Russia Day, National Unity Day.

Other days without work are set by specific entities.

Religious organizations can send appeals to authorities. Then they formalize requests for a separate day off. Final decisions are made after consideration of applications by government agencies.

January holiday calendar

Traditionally, two public holidays are celebrated in the first month:

- New Year (01.01);

- Christmas (07.01).

But the holidays are not limited to these two. The second month of winter is rich in interesting dates and memorable days, but they are not weekends, for example:

- 12 - Prosecutor's Day;

- 13 — Russian Press Day;

- 14 - Old New Year;

- 19 - Baptism;

- 21 — Engineering Troops Day;

- 25 - Tatiana's Day, Students' Day;

- 27 - anniversary of the lifting of the siege of Leningrad;

- 31 - International Jeweler's Day.

Comments

What if a day off and a holiday coincide?

The ban on work on weekends and holidays is precisely established by the Labor Code of the Russian Federation. The rule has only a couple of exceptions. If a weekend and a holiday coincide, current laws provide for two transfer options:

- One option is to adjust the January holiday. We are talking about holidays for Christmas and New Year. In this case, the Government of the Russian Federation is responsible for the transfer. The population is informed on which days the weekends are postponed. The issuance of special notices is mandatory. It is published at least before November 1 of the previous year.

- For other holidays, a solution has also been developed. After the holidays, the next weekdays are taken to replace them with weekends. Working time standards currently in force are subject to mandatory recording.

January weekends and weekdays

Let's figure out which days are considered holidays in January 2022. This is the period of New Year holidays from 01.01 to 08.01 inclusive. Then there is a calendar day off, Sunday 01/09/2022. After which, from January 10, 2022, you will have to get back to work, as normal workdays will begin for both a five-day and a six-day workweek.

After this, Russians will only have calendar days of rest provided for by law (Saturdays and Sundays in a five-day week). In the first month, we will rest on 9, 15, 16, 22, 23, 29 and 30. The first working day of January 2022 is Monday, so the first shortened week is not expected.

According to the 2022 production calendar approved by the government, 16 working days await us in the first month. There are so few of them because of the New Year holidays according to Art. 112 Labor Code of the Russian Federation. 01/07—Christmas Day is highlighted separately. How many working days in January depends on the organization’s operating hours:

- with a five-day week - 16;

- with a six-day week - 19.

Let's figure out what holidays are in January 2022:

- 1 (Saturday) - New Year;

- 2 (Sunday) - calendar rest;

- 3 (Monday) - vacation day;

- 4 (Tuesday) - vacation day;

- 5 (Wednesday) - vacation day;

- 6 (Thursday) - vacation day;

- 7 (Friday) - Nativity of Christ;

- 8 (Saturday) - last day of vacation.

According to the Labor Code of the Russian Federation, if a holiday falls on a calendar non-working day, it is transferred to the following Monday or any other suitable date. Considering that 01.01 is Saturday, which is a non-working day during the five-day week, the government moved it to Tuesday 03.05. Similarly, the day of rest was moved from Sunday 02.01 to Tuesday 10.05 (see Decree of the Government of the Russian Federation No. 1564 of 09.16.2021).

In addition to holidays, legal days of rest are assumed on Saturdays and Sundays. Non-working days in January 2022 in Russia fall on the 9th, 15th, 16th, 22nd, 23rd, 29th and 30th.

ConsultantPlus experts looked at how weekends that coincide with holidays are handled. Use these instructions for free.

Work on weekends in accordance with the Labor Code of the Russian Federation

You cannot be involved in work without written consent given in advance. Refusal to overwork is the right of citizens.

Go through the following steps to resolve the issue:

- First, obtain consent in writing.

- Next, they study the conditions under which tasks are performed. You will also be informed about the right to refuse.

- A separate notification is sent to trade union bodies, if available.

- They issue an order describing the work itself and information about subordinates, the duration of such a schedule and the reasons.

- Only certain types of circumstances exempt consent. This usually applies to emergencies due to natural disasters, terrorist attacks or the risk of property damage.

- Even emergency circumstances do not give the right to employ pregnant women. In the case of disabled people, minors and other similar categories, consent is required.

Weekend

In essence, weekends are a short weekly vacation, usually given at the end of the working week.

The work week itself can be either five days, respectively, with two days off, or six days and one day for rest.

Sunday is considered an all-Russian day off ; it is also the same for people who have to work six days of the week.

As for five-day workers, in accordance with current legislation, the employer has the right to give employees a second day off either on Saturday or Monday, but the requirement remains that the days off are directly adjacent, in other words, to recuperate, the employee needs at least 42 hours of continuous rest .

Of course, this procedure also applies to people whose activities are carried out in shifts, in accordance with the established schedule.

Information about days off in a particular organization is reflected in the internal regulations, collective agreement or other regulatory documents governing labor activities.

According to current legislation, one of the parents of a child under the age of 16 working in the Far North or equivalent areas can apply for an additional unpaid day off once a month.

Four paid days off each month can be provided to one of the parents (guardians) of a child with disabilities under the age of 18.

It is important to understand that working on weekends is unacceptable, except in cases permitted by the Labor Code.

The following employees may be required to work on a day off:

- preventing natural disasters, disasters and accidents;

- designed to prevent accidents, destruction, and damage to property;

- involved in unforeseen work, on the implementation of which the fate of the enterprise will depend.

In addition, it is allowed to attract specialists from the field of culture, art, cinematography, media and other categories to work on weekends, in accordance with the list approved by the government.

Naturally, work on weekly rest is possible only with the written consent of the employee and on the basis of an order issued by the management of the enterprise or organization.

A kind of compensation for extracurricular work is the obligation to pay at least double the amount for work on a day off.

At the same time, double piece rates are established for piece workers, citizens working by day or hour - in the amount of two daily or two hourly rates, respectively.

When calculating salaries, it is taken into account whether the employee met or exceeded the monthly work rate, based on which either one daily rate is calculated (at the standard) or double (if working hours are exceeded).

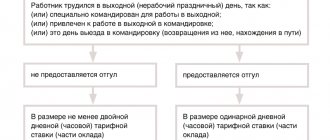

If an employee wants to use time off for working on a weekend, then work on a weekend is paid at a single rate.

Cash compensation for holidays, official days off

Article 153 of the Labor Code of the Russian Federation describes that a double payment rate is applied for any extracurricular work. This applies to any type of remuneration for work - both piecework and hourly. The rule applies to any tariff rates.

A fixed monthly salary suggests two options for calculating extracurricular work:

- When the standards are not exceeded, they issue one daily rate and another fixed amount.

- With double rates when labor is higher than normal.

An application is given when an employee has taken a day off, but has not decided on a specific day. Such documents will not interfere with receiving compensation.

Cash payments are in many ways more profitable than additional break days. The main thing is to do the calculations correctly.

It is easiest to calculate payments for those employees who performed their duties without incident in previous periods. Then compensation is guaranteed despite exceeding the norms.

Fulfillment of obligations under the contract: beginning and end of the period

According to the national standard of the Russian Federation GOST R 7.0.8-2013 “System of standards for information, library and publishing. Record keeping and archiving. Terms and definitions”, the fulfillment by the parties of their obligations under the concluded contract must be carried out within the period established by the regulatory legal act.

There are two options for calculating the start of performance of duties when the deadline is determined by a period of time.

- According to Article 191 of the Civil Code of the Russian Federation , the beginning of fulfillment of obligations begins the next day after the established date or the occurrence of an event that determines its beginning.

- The period of time with which the Labor Code of the Russian Federation associates the emergence of labor rights and obligations begins from the day on which their beginning is determined.

Accordingly, one should be guided by the norms of the Labor Code of the Russian Federation to begin fulfilling obligations under an employment contract and the norms of the Civil Code of the Russian Federation in all other cases.

The time frame within which, according to the contract, a product must be delivered, a service provided, or money transferred, may be determined by a specific date or period during which the task must be completed. In the second case, calculation in calendar days is often used.

Features of remuneration calculation

Each organization sets production rules in its own way. Labor is paid in several schemes:

- piece-rate prices;

- hourly rates;

- salary agreement.

The salary system means compensation for hours. Days worked, weekends and holidays are not taken into account. The situation with the hourly rate is different. Payment is received for time actually worked. Schedules are developed in advance.

Receiving the same amounts every month is the basic rule of salary. In the case of hourly rates, the calculations are different. Working days are different for each month. The piecework scheme assumes that payment is calculated according to the number of products created over specific periods of time.

General rules

The Labor Code will help you figure out whether March 5, 2022 is a pre-holiday or not: Article 112 of the Labor Code of the Russian Federation lists all non-working holidays, and according to Art.

95 of the Labor Code of the Russian Federation, the working day on the eve of the holiday is reduced by 1 hour. Since March 8 in 2022 is Tuesday, what is the pre-holiday day? The same article answers the question. 95 of the Labor Code of the Russian Federation: in the definition of the pre-holiday day, the words “immediately preceding” are used. This means Monday is pre-holiday and shortened. But the authorities decided that it would be wiser to make changes to the existing work and rest schedule. Based on the Decree of the Government of the Russian Federation dated September 16, 2021 No. 1564, the 5th, Saturday, was made a working day, and for which day we work on March 5 - for the 7th, the Monday preceding International Women's Day. Thanks to this transfer, not Monday will be shortened, but Saturday.

See other holidays and shortened days in the production calendar for the current year. It is available for free in the special service PPT.ru.

As for payment, according to the law, pre-holiday days are paid in full. Although the employee will actually work 7 hours, the employer pays him for a full eight-hour shift.

If the operating mode is normal

Public institutions are characterized by a five-day working week. This is especially true for banks and shops. This means that the salary is calculated according to the salary system, the workload is at least 40 hours. That is, the remuneration for work is the same, the number of working days does not matter.

Such circumstances are the simplest for calculating compensation for overtime work. Follow these simple steps:

- Work rewards are calculated per hour.

- The time worked over the weekend is multiplied by the result.

- The result is multiplied by two.

When citizens refuse compensation in a fixed amount, employment is paid at standard rates. Then choose another day of rest.

The concept of time off and dismissal on a day off

Time off is time for employees to rest, provided to them as compensation for being involved in work activities outside of working hours. For working on a general day off, you must be given time off in the next two weeks. If it is impossible to provide time off, work performed on a general day off must be compensated with a payment, calculated in double amount.

Also, time off can be provided if the employee wishes if the standard working time per month is exceeded instead of additional payment.

Dismissal on a weekend can be carried out if an employee falls ill, and the day of his dismissal, according to a written application, falls on a weekend. However, more often the dismissal is carried out on the last working day, even if the actual date of dismissal falls on the next day off.

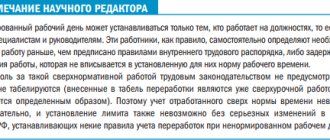

Shift work mode

The 40-hour weekly norm should not be violated under any circumstances. But it is not easy to comply with this norm when the following conditions are met:

- the schedule consists of a series of shifts;

- rotating break days;

- conditions may be met one week, but not the next.

For such situations, a scheme with a summarized accounting option is provided. It assumes that the hours actually worked over a certain period are added up. This is convenient to comply with the norms not for a week, but for another time, for example, a month.

It is normal for such payment systems that the amounts for each month are different.

Government regulations specifically state that holidays are also the norm for the month.

About design features

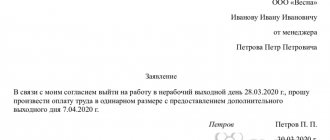

Documentation is required for any work that exceeds the norm.

Before taking actions, department heads draw up reports and memos. Based on these documents, the head of the enterprise issues an appropriate order. Describe all the characteristics of the time of attraction to work.

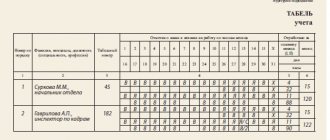

The terms of compensation must be specified in a separate clause. The signature of the subordinate must be present, who thus confirms that he has read the order. Reflecting information is important for timesheets.

Fill out the column dedicated to the day off. They do not put “B”, but a number indicating the hours spent at the workplace. Payroll calculation is based on timesheets and orders.

Everyone has a day off, but you have work according to schedule

If your schedule is rotating, forget that holidays usually fall on the weekend. This may turn out to be this way, or it may turn out to be different - it all depends on how the schedule was planned. If Saturday or Sunday turns out to be intended for work, nothing can be done; this is a feature of the sliding schedule. They are considered normal workdays and are paid accordingly. An additional day of rest is not provided. The employee has no right to refuse to go to his workplace on this day.

FOR YOUR INFORMATION! Certain types of employees, such as mothers of children under three years of age, have advantages regarding work schedules. But not in cases where their signature is on the consent to a rotating schedule: there are no exceptions for them, that is, they will have to work on any day of the week that turns out to be working according to the schedule.

What else is important to know?

The manager issues the appropriate order after familiarizing employees with the information regarding the performance of duties. There is no general form for the document. In some cases, it is decided that orders are not needed. One of the situations is when there is no desire to separately take into account work over the weekend. Such a scheme increases the likelihood of negative consequences.

If a conflict arises, in the future the courts will often side with their subordinates. Proof of work over legal holidays is easy to obtain. You can use different tools to show your position:

- oral instructions from employers;

- witness statements;

- documents and so on.

Typically, the proceedings end with additional fines being applied to the manager. Therefore, it is important to complete all documents correctly and in a timely manner.

How to choose between time off or compensation?

In many situations, it is easier for management when break days are paid at a single rate, and then employees are given rest at other times, while maintaining their wages. Only in some cases do they opt for double salaries. Disputes with control authorities and negative consequences will not arise if such decisions are made. Budgetary provision causes the most problems in this situation.

In such organizations, preference is given to time off rather than compensation. Time off is added to the amount of annual paid leave.

The choice of individual schemes is acceptable in the absence of specific rules. Sometimes it is prescribed in advance in collective labor agreements.