Despite economic difficulties, housing construction is gaining momentum, returning to pre-crisis levels. To finance the construction of an apartment building, developers raise funds from citizens under agreements for participation in shared construction. The legal basis for such activities is established by Federal Law No. 214-FZ of December 30, 2004 (hereinafter referred to as Law No. 214-FZ).

For accountants, the application of this law raises many questions. Among them: how to keep records if the developer is building a house on his own? The situation is very common, especially in the regions. But in terms of taxation it is ambiguous. Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 11, 2011 No. 54 “On some issues of resolving disputes arising from contracts regarding real estate that will be created or acquired in the future” (hereinafter referred to as Resolution No. 54) did not add clarity.

The explanations of the “highest” judges apply to tax disputes. This is evidenced by the letter of the Federal Tax Service of Russia dated September 22, 2011 No. SA-4-7/15581. It instructs tax inspectorates to use Resolution No. 54 in their work. And indeed, they begin to refer to it. However, so far without success. An example of this is the resolution of the Federal Antimonopoly Service of the East Siberian District dated April 15, 2013 in case No. A78-3003/2012.

We will try to apply Resolution No. 54 (clause 11) and we, as taxpayers, in our own interests. It says: the provisions of Law No. 214-FZ are special in relation to the provisions of the Civil Code of the Russian Federation on the purchase and sale of a future thing.

We take this thesis (Article 431 of the Civil Code of the Russian Federation) “for service.”

Combining functions is a fallacy

Based on Law No. 214-FZ (clause 1, article 4), under an agreement for participation in shared construction, the developer undertakes to build an apartment building on his own and (or!) with the involvement of other persons. After receiving permission to put the house into operation, the developer must transfer the shared construction object to the participant in shared construction (in common parlance - the shareholder).

When a developer engages a general contractor for construction, its taxation does not cause any particular controversy.

But let’s assume that the developer has chosen a different path: he intends to build a house “in an economic way.” To do this, certificates of admission to types of work that affect the safety of capital construction projects are required (Clause 2, Article 52 of the Civil Code of the Russian Federation). Of course, he acquired such documents.

From the contract, shareholders may not know exactly how the developer plans to build the house. But information about the list of contractors carrying out basic construction, installation and other work must be reflected in the project declaration (clauses 1 and 4 of Article 19, subclause 10 of clause 1 of Article 21, Law No. 214-FZ). That is, “you can’t hide an awl in a bag.”

If the developer does not enter into construction contracts, but carries out construction and installation work independently, then he does not have contractors. How to indicate its status?

There is a widespread opinion that in this case the developer acts as a contractor (clause 1 of Article 740 of the Civil Code of the Russian Federation) “part-time”. That is, it combines two functions in the construction process. But this formulation is incorrect...

There is a widespread opinion that in this case the developer acts as a contractor (clause 1 of Article 740 of the Civil Code of the Russian Federation) “part-time”. That is, it combines two functions in the construction process. But this formulation is incorrect. Firstly, the developer cannot enter into a contractual relationship with himself. And secondly, he did not conclude contracts for construction work with shareholders.

This is where Resolution No. 54 comes to our aid. Based on the explanations of representatives of the Supreme Arbitration Court of the Russian Federation, it is permissible to assert that under such circumstances, a transaction with a shareholder can be considered as a contract for the sale and purchase of a future property. Namely, Article 455 of the Civil Code states: a contract can be concluded for the purchase and sale of not only goods available to the seller at the time of conclusion of the contract, but also goods that will be created by the seller in the future, unless otherwise follows from the nature of the goods. In this case, the goods are shared construction objects, that is, premises in an apartment building.

Please note: the fact that the seller created the goods does not transfer him to the category of contractor. Therefore, there are two different ways to obtain goods that do not exist on the date of the transaction:

- under a purchase and sale agreement;

- under a contract.

Developer services for DDU wiring

Alexander DEMENTYEV, General Director of Audit-Escort LLC

The main thing in the article

- The first method is safe if you keep track of construction expenses on account 08

- The second method is reliable, but risky, if you take into account construction costs in account 20 and reflect the proceeds from the sale of objects

The developer transfers apartments and non-residential premises in an apartment building to individual shareholders. The developer's services are not specified in the contract.

The developer's procedure for shared construction

The financial result is defined as savings - the difference between the amount of funds received from shareholders and construction costs. In such a situation, the developer has two options for accounting transactions. Which one suits you, choose for yourself. But keep in mind that the first is safe, and the second is more reliable from an accounting point of view.

Method one is safe

The developer reflects the funds received from shareholders on the loan of account 76. These funds are used to cover the costs of building a house. In this case, the developer accounts for expenses in the debit of account 08.

Upon completion of construction, the developer closes account 08 to the debit of account 76 and determines the savings. It is reflected as revenue from the credit of account 90 in correspondence with the debit of account 76.

The developer does not reflect the sale of transferred shared construction projects, since he does not formalize ownership of the constructed objects before transferring them to shareholders.

This means that there is no formal transfer of ownership from the developer to participants in shared construction for these objects.

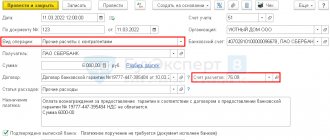

Accounting entries:

| DEBIT 51 CREDIT 76 – received funds from equity holders to cover the costs of constructing an apartment building; |

| DEBIT 51 CREDIT 62 – received funds from shareholders to pay remuneration to the developer for services; |

| DEBIT 08 CREDIT 10, 70, 60... - reflected the costs of building a house; |

| DEBIT 20 CREDIT 70, 60... - reflected expenses associated with the provision of services to shareholders; |

| DEBIT 62 CREDIT 90 – reflected revenue from the sale of services to shareholders; |

| DEBIT 90 CREDIT 20 – expenses related to the provision of services to shareholders were written off; |

| DEBIT 76 CREDIT 08 – reflected the transfer of shared construction objects (residential and non-residential premises) to shareholders; |

| DEBIT 76 CREDIT 90 – reflected the savings of equity holders. |

Method two is risky

In tax accounting, the developer takes into account funds received from shareholders as earmarked funds.

This approach is applied by the developer if he is guided by the conclusions of paragraph 11 of the resolution of the Plenum of the Supreme Arbitration Court of July 11, 2011.

No. 54 “On some issues of resolving disputes arising from contracts regarding real estate...” It is based on the assertion that the transfer of a shared construction project within the framework of a shared construction agreement is a type of purchase and sale transaction.

Thus, in accounting, the developer reflects the proceeds from the sale of transferred objects within the framework of shared-equity construction.

Accounting entries:

| DEBIT 51 CREDIT 76 – reflected the funds of shareholders received under share agreements; |

| DEBIT 20 CREDIT 60 – reflected the costs of construction of the facility; |

| DEBIT 19 CREDIT 60 – reflected VAT presented by suppliers and contractors; |

| DEBIT 43 CREDIT 20, 19 – formed the cost of finished construction products; |

| DEBIT 76 CREDIT 90 – reflected the proceeds from the sale of shared construction projects in the amount of the entire amount of funds received from shareholders to finance construction costs; |

| DEBIT 90 CREDIT 43 – sold finished construction products were written off. |

With this approach in accounting, the developer does not need to separately account for the sale of its services. But tax risks are possible. Let's look at why.

In tax accounting, the developer takes into account the funds received from shareholders as earmarked funds (Clause 14, Article 251 of the Tax Code of the Russian Federation).

The developer has the right to spend funds from shareholders only for those purposes provided for in paragraph 1 of Article 18 of the Federal Law of December 30, 2004.

No. 214-FZ “On participation in shared-equity construction of apartment buildings...” The company does not recognize received funds from targeted financing as revenue, and construction costs are not recognized as expenses when calculating income tax.

If, under the terms of the contract, the developer does not return the savings to shareholders, then he takes them into account in non-operating income or as part of revenue from the sale of services.

If, under the terms of the contract, the developer does not return the savings to shareholders, then he takes them into account in income

Shareholders' funds may not be enough to cover construction costs. If the developer covers the difference with his own funds, then he will not be able to take the overexpenditure into account for profit tax purposes. At the same time, the developer determines savings and overruns for the construction project as a whole.

If the developer uses the second approach to accounting within the framework of shared construction, the question of VAT arises. Is it necessary to charge this tax on proceeds from the sale of shared construction projects? It all depends on how to qualify these operations.

On the one hand, operations for the sale of non-residential premises and parking spaces are subject to VAT. On the other hand, the taxpayer has the right to interpret all ambiguities in his favor (Clause 7, Article 3 of the Tax Code of the Russian Federation).

Sales of goods (works, services) are subject to VAT taxation. But sales mean the transfer of ownership of goods, works, and services (Article 39 of the Tax Code of the Russian Federation).

In our case, there is no formal transfer of ownership. After all, the developer does not formalize ownership until the property is transferred to the participant in shared construction.

This means that the object of taxation does not arise.

In addition, funds received from shareholders are earmarked and are not reflected as proceeds from sales.

However, tax authorities may think differently, since the developer will reflect the proceeds from sales in accounting. Therefore, disputes with tax authorities on this issue are likely.

Shared construction: accounting and taxation

After receiving permission to put the facility into operation, the developer transfers the shared construction projects to its participants.

From the moment the participant pays in full the funds under the agreement and the parties sign the transfer deed or other document on the transfer of the shared construction project, the obligations of the developer and the participant under the agreement are considered fulfilled (Article 12 of Law No. 214-FZ). The following entry is made in the records of the developer:

D-t 86, K-t 08-3 - capital costs were written off from the funding received.

The amounts of recorded VAT are also written off from the funding received, and the invoice is transferred to the organizations that own the constructed facilities.

The financial result from the implementation of an investment project is defined as the difference between the target financing received and the amount of capital costs associated with construction.

Accounting for the developer

The following entries are made in the developer's accounting:

D-t 86, K-t 91-1 - reflects the amount of savings (income) received;

D-t 91-3, K-t 68, subaccount “Calculations for VAT” - VAT is charged;

D-t 91-9 “Balance of other income and expenses”, K-t 99 “Profits and losses” - the amount of profit is reflected;

Dt 99, Kt 68, subaccount “Calculations for income tax” - the amount of income tax has been accrued to the budget.

The developer’s income also includes the amount of remuneration for services for the execution of the contract, which is included in the price of the contract in accordance with Part 1 of Art. 5 of Law No. 214-FZ.

Funds received from participants for remuneration are taken into account in advance in subaccount 2 “Settlements for advances received” of account 62 “Settlements with buyers and customers”.

VAT is calculated on the amounts of advances received.

The costs of maintaining the developer can be taken into account on account 20 “Main production” and listed as work in progress until the end of construction.

In tax accounting, these expenses can be written off in the reporting (tax) period to reduce income from the sale of services without distribution to the balances of work in progress (Article 318 of the Tax Code of the Russian Federation as amended by Federal Law No. 58-FZ of 06.06.2005).

VAT related to the costs of maintaining the developer is deductible in the generally established manner.

Source: https://buh-experts.ru/uslugi-zastrojshhika-po-ddu-provodki/

What are the services of the developer?

If we interpret the developer’s transactions with shareholders as the purchase and sale of future apartments, then it is unclear what his services consist of. After all, the activity of a developer is to create a product. In addition, trade in the provision of services is not considered.

The services of the developer are stated in paragraph 1 of Article 5 of Law No. 214-FZ: for their provision, a separate remuneration may be provided for in the agreement with the shareholder.

However, the issue of services interests us not in the abstract, but in connection with the VAT benefit for the developer provided for in subclause 23.1 of clause 3 of Article 149 of the Tax Code. For tax purposes, one must proceed from the definition of services given in the Tax Code (Clause 1, Article 11 of the Tax Code of the Russian Federation). So, a service is recognized as an activity, the results of which do not have material expression, are sold and consumed in the process of carrying out this activity (Clause 5 of Article 38 of the Tax Code of the Russian Federation). This characteristic in no way corresponds to the activity, the result of which will be the creation of a thing, that is, a product. Let us remind you that a product is any property intended for sale (clause 3 of article 38, clause 1 of article 39 of the Tax Code of the Russian Federation). True, instead of sale (transfer of ownership of the goods), we have a specific purchase and sale.

position of the Ministry of Finance

The regulatory authorities take the position that the construction work of the developer is subject to value added tax in the same way as the work of the contractor.

As a result, we will have to admit: if the developer carries out construction on his own and the amount of his remuneration is not specified in the agreement with the shareholders, subclause 23.1 of clause 3 of Article 149 of the Tax Code cannot be applied.

Strictly speaking, a developer who independently built a house does not sell goods, works (for the reason that the method of construction is not an essential condition of the agreement for participation in shared construction), or services to shareholders. Decree No. 54 encourages us to make product choices.

Accounting for the developer

The developer's accounting depends on the method of construction. The main one is the contract method. As a rule, the developer does not carry out construction himself, but engages contractors.

If a developer builds a residential building using a contract method, then he performs only the functions of a developer. From shareholders he receives funds:

- to finance construction;

- for the maintenance of the developer (remuneration of the developer for services in organizing construction).

Account funds for construction financing in a separate subaccount to account 76, for example, “Settlements with equity holders.” When you receive them, make the following entries:

Debit 51 Credit 76 subaccount “Settlements with equity holders” - funds were received from the equity holder for the construction of the facility.

The amount of the developer's remuneration for construction organization services should be reflected in a separate subaccount to account 62, for example, “Settlements with equity holders.”

Accounting for construction costs

Reflect construction costs as they arise and accumulate them in the debit of account 08-3 on an accrual basis from the beginning of construction. In this case, the developer makes the following entries:

Debit 08-3 Credit 60 – the cost of work performed by the contractor is taken into account as part of construction costs;

Debit 19 Credit 60 – VAT claimed by the contractor is taken into account.

Input VAT on the cost of contract work is included in the costs of constructing a residential building:

Debit 08-3 Credit 19 - taken into account as part of construction costs, input VAT on the cost of work performed by the contractor.

The developer reflects the costs of providing services to shareholders in accounting in the general manner according to the rules of PBU 10/99 as the costs of maintaining the developer's service (clause 5 of PBU 10/99). The developer recognizes all costs in the periods in which they arose (clauses 16–18 of PBU 10/99).

Accounting for these expenses is usually kept on account 26 “General expenses”, to the debit of which are written off the direct and indirect expenses of the developer himself associated with the provision of construction organization services:

Debit 26 Credit 02 (10, 23, 25, 68, 69, 70, 76, 60...) – reflects the developer’s expenses for organizing construction;

Debit 19 Credit 60 (76) – input VAT on expenses for the provision of developer services for organizing construction is taken into account.

Developer services under agreements for participation in shared construction are not subject to VAT (subclause 23.1, clause 3, article 149 of the Tax Code of the Russian Federation). Therefore, input VAT on costs associated with the provision of this service is included as expenses.

Debit 26 Credit 19 – charged to the costs of input VAT on expenses for the provision of services to the developer in organizing construction.

Accounting for construction income

When constructing a residential building by contract, the developer’s income is remuneration for his services (clause 5 of PBU 9/99). The amount of remuneration is determined by the terms of the agreement for participation in shared construction. For example, the contract can establish the following methods for determining remuneration:

- fixed amount;

- percentage of the share contribution;

- the amount of savings of target funds that remain at the disposal of the developer after completion of construction.

The developer recognizes revenue from the sale of construction organization services if the following conditions are simultaneously met:

- the developer has the right to receive this revenue, which is confirmed by an agreement or other document;

- the amount of revenue can be determined;

- the developer received payment for the work performed or he has confidence in receiving payment. For example, the developer has documents (contract, acceptance certificate for work performed, letter of guarantee, etc.), on the basis of which he can demand payment for work performed;

- the service is provided;

- the expenses that have been or will be incurred in connection with this operation can be determined.

This follows from the provisions of paragraph 12 of PBU 9/99.

The period for recognizing revenue in accounting depends on the duration of the agreement for participation in shared construction:

- after the transfer of the constructed facility to the shareholders, if the agreement is short-term in nature (less than 12 months);

- as soon as it is ready, if the contract is long-term in nature or its start and end dates fall in different years.

This follows from the provisions of paragraphs 12 and 13 of PBU 9/99 and paragraphs 1, 2 and 17 of PBU 2/2008.

For short-term contracts, reflect revenue on the date of drawing up the acceptance certificate (subparagraph “d”, paragraph 12 of PBU 9/99, article 9 of the Law of December 6, 2011 No. 402-FZ). If the developer’s services are considered provided as they are ready, reflect revenue at the reporting date according to the same principle as contractors (clauses 2, 17 and 23 of PBU 2/2008).

If the amount of the remuneration can be determined, reflect the revenue at the time of its recognition by posting:

Debit 62 subaccount “Settlements with equity holders” Credit 90-1 – revenue from the sale of developer services for organizing construction is reflected.

In this case, the developer’s expenses are written off from account 26 “General business expenses” to the debit of account 90-2. If the advance received for the payment of remuneration was previously taken into account, make the following entry:

Debit 62 subaccount “Advances received” Credit 62 subaccount “Settlements with shareholders” - the advance previously received from shareholders for the payment of remuneration is credited.

If the amount of remuneration is determined as savings of target funds of shareholders, reflect the proceeds at the time of transfer of apartments to shareholders. At the same time, make an entry in your accounting:

Debit 76 subaccount “Settlements with equity holders” Credit 90-1 – the amount of savings recognized as the developer’s remuneration is reflected in income.

Reflect the transfer of the constructed object to the shareholders with the following entries:

Debit 76 subaccount “Settlements with equity holders” Credit 08-3 – the constructed facility was transferred to the equity holders.

If there were no shareholders for some of the apartments or the developer initially kept some of the apartments for himself for the purpose of their further sale, then in relation to such apartments he is also an investor.

In such a situation, the income from the sale of these apartments will be the proceeds from the sale of finished products.

Reflect the revenue on the credit of account 90-1 at the time of transfer of ownership of the apartment to the buyer (subject to the fulfillment of other conditions for recognizing revenue in accounting). At the same time, make the following entries in your accounting:

Debit 62 Credit 90-1 – revenue under the apartment purchase and sale agreement is reflected;

Debit 90-2 Credit 43 subaccount “Apartment No...” - the cost of the sold apartment is written off;

Debit 51 Credit 62 – the buyer paid the cost of the apartment under the purchase and sale agreement.

Source: https://www.BuhSoft.ru/article/1030-buhgalterskiy-uchet-u-zastroyshchika

VAT on the purchase and sale of premises

If we adhere to the interpretation of the Plenum of the Supreme Arbitration Court of the Russian Federation, then the money received from shareholders is an advance payment for apartments. These amounts are not subject to VAT on the basis of subparagraph 22 of paragraph 3 of Article 149 of the Tax Code (taking into account paragraph 5 of paragraph 1 of Article 154 of the Tax Code of the Russian Federation). Simultaneously with the apartments, the shareholders are transferred a share in the ownership of the common property of the apartment building (Clause 1 of Article 290 of the Civil Code of the Russian Federation). But this operation is also exempt from VAT - by virtue of subparagraph 23 of paragraph 3 of Article 149 of the Tax Code.

When creating goods that are not subject to VAT, the developer does not have the right to apply tax deductions (subclause 1, clause 2, article 170 of the Tax Code of the Russian Federation).

These elementary considerations make it possible to exempt a developer who builds a house on his own from VAT taxation.

The benefit does not apply to non-residential premises, including parking spaces. Consequently, VAT on these items is calculated in accordance with the generally established procedure. And if an apartment building contains non-residential premises (for example, office premises), then the developer will have to keep separate VAT records for taxable and non-taxable transactions (clause 4 of Article 170 of the Tax Code of the Russian Federation).

If the content of the services cannot be established, what then is the remuneration for the developer’s services specified in the contract? This is just a component of the total price of a shared construction project, isolated for the purpose of restrictions on the expenditure of shareholders’ funds established by Article 18 of Law No. 214-FZ.

However, if the amount of the agreed remuneration is subject to VAT according to the rules of subclause 23.1 of clause 3 of Article 149 of the Tax Code (despite the fact that the content of the services is unclear), then the amount of calculated tax will change only in relation to parking spaces.

Let us note that we relied on Resolution No. 54 out of necessity. Using it in matters directly regulated by tax legislation (when the developer does not carry out construction work) will not lead to success. This confirms the determination of the Supreme Arbitration Court of the Russian Federation dated October 18, 2013 No. VAS-9937/13 (letter of the Ministry of Finance of Russia dated November 7, 2013 No. 03-01-13/01/47571).

What does the Ministry of Finance offer?

The regulatory authorities take the position that the construction work of the developer is subject to VAT in the same way as the work of the contractor. This point of view is presented in letters: Federal Tax Service of Russia dated August 2, 2005 No. MM-6-03/632, Ministry of Finance of Russia dated July 7, 2009 No. 03-07-10/10, dated June 8, 2011 No. 03- 07-10/11, dated October 26, 2011 No. 03-07-10/17. It is indirectly confirmed by letters from the Ministry of Finance of Russia dated March 25, 2008 No. 03-07-10/02 and dated November 20, 2012 No. 03-07-10/29.

Financiers explain: if a developer undertakes to build a property on his own, that is, directly performs construction and installation work, then the funds received from participants in shared construction are included in the tax base as advance payments received for the upcoming work. The basis is subparagraph 1 of paragraph 1 of Article 162 of the Tax Code.

This approach implies the application to contracts of participation in shared construction of the approach adopted for construction contracts. He was supported without hesitation by the judges of the Ninth Arbitration Court of Appeal in their ruling dated September 16, 2013 No. 09AP-26940/2013-AK.

Important

The economic benefit of the developer is the remuneration specified in the agreement with the shareholder, as well as the savings of the shareholders in the implementation of construction costs provided for in the project documentation.

But this opinion was formed long before the adoption of Resolution No. 54. It contains a different conclusion. Despite the fact that we are talking about creating a thing, the main guideline remains the rules of purchase and sale. As you know, a “classical” contractor does not sell the thing he creates.

Now let’s try to imagine the consequences of deviations from the ministry’s recommendations. If a tax dispute about the procedure for taxing VAT moves to court, then the arbitrators will not be able to object to the legal position of the Plenum of the Supreme Arbitration Court of the Russian Federation. This is not allowed by paragraph 2 of Article 13 of the Federal Constitutional Law of April 28, 1995 No. 1-FKZ “On Arbitration Courts in the Russian Federation.”

What was and is

From the beginning of the 90s, when this whole epic began, until 2005, and to be more precise, until 04/01/2005, the legal status of organizations engaged in housing construction, as well as the taxation of their activities, were not regulated in any way.

And organizations became as sophisticated as they could. A wide variety of agreements were concluded with persons who wished to purchase an apartment in a new building, the meaning of which was not completely clear to the lawyers (or who considered themselves such) who developed them. In use were: investment agreements, agreements on joint activities (or on joint construction), preliminary agreements for the purchase and sale of real estate, etc., etc., etc. And sometimes, when the developer did not have from the very beginning intentions to collect money from the suckers and flee to distant warm countries, the residents, some earlier and some later, moved into new apartments.

But much more often, those who wanted to purchase a new apartment entered into some kind of cleverly named agreement and paid a significant amount of money. After a while, he learned that he would not have an apartment and no money either. And there is no one to file a claim with. Either the company he paid to has already closed, or, judging by the agreement, it doesn’t owe anyone anything.

And to stop this legal chaos, on December 30, 2004, Federal Law No. 214-FZ “On participation in shared-equity construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation” was signed, which came into force on April 1, 2005.

This Federal Law attempted to establish at least some order in the field of housing construction.

First of all, they limited the circle of persons who have the right to build multi-apartment residential buildings and attract, even at the construction stage, money from citizens and organizations to finance it. Such organizations were ordered to be called “developers.”

Thus, in the very first edition (clause 1 of Article 2 of Law No. 2014-FZ), the developer of an apartment building could be a legal entity (of any organizational and legal form) or an individual entrepreneur who owned (or leased) a land plot and there was permission to build a multi-apartment residential building on this site.

This definition of a developer did not contradict (and does not contradict now, when the requirements for such a company have become significantly stricter, and individual entrepreneurs are expressly prohibited from engaging in such activities) the definition of a developer given in the Town Planning Code of the Russian Federation (hereinafter referred to as the GSK RF).

According to the Civil Code of the Russian Federation, a developer is a person who has rights (including the right to lease) to a land plot and ensures the construction of a real estate property on it (Clause 14, Article 1 of the Civil Code of the Russian Federation).

There is a general rule (the definition of a developer in the Civil Construction Code of the Russian Federation), and a special one (the definition of a developer in Law No. 214-FZ), which does not contradict the general one, but somewhat limits it in connection with a certain type of activity. So everything is in order here, and no claims have arisen and do not arise against the developers of Law No. 214-FZ, as well as against the interpretation of this definition.

And later, when the specified paragraph 1 of Art. 2 of Law No. 214-FZ began to change in the direction of ever greater requirements and restrictions for developers - first they prohibited individual entrepreneurs from engaging in such activities (since July 2006), and then completely left only large players on the market who already had positive experience in housing market - neither lawyers nor financiers have any confusion or ambiguous interpretations.

There are also no complaints about the wording of the definition of a shared construction object (clause 2 of Article 2 of Law No. 214-FZ), which means residential or non-residential premises included in an apartment building. In other words, this is a piece of real estate that is part of a larger and separate piece of real estate, that is, its share. This is where the term “shared construction” came from. Although some still interpret “shared construction” as “joint”. But it is not the developer and shareholders who are building using the public construction method. The construction of the house, including at the expense of the shareholders, is carried out by the developer, who most often hires professional organizations for this - from designers to subcontractors specializing in one or another type of construction work.

But this is given in Art. 4 of Law No. 214-FZ, the definition of an agreement for participation in shared construction (DUDS), which they stubbornly continue to call DDU (that is, an agreement for shared participation), began to be interpreted, including by officials of the financial department, in a very unique way.

So, under an agreement for participation in shared construction, the developer undertakes to build a multi-apartment residential building, that is, a separate property, within the period stipulated by the agreement. Moreover, this object can be erected by the developer either independently or with the involvement of other persons. After the house is erected, which must be confirmed by the issuance of a commissioning permit, he is obliged to transfer the shared construction object specified in the DUDS, that is, an apartment or non-residential premises, to the shareholder. The latter, in turn, assumes the responsibility for timely payment of the cost of the apartment stipulated in the contract and, after issuing permission to the developer to enter, accept this premises by signing the acceptance certificate.

Both at seminars and in discussions (sometimes turning into polemics) on accounting forums, no one has yet given me an answer to the question: - How, apart from some philological differences in wording, does an agreement for participation in shared construction differ from a construction contract?

My arguments.

Under a work contract (clause 1 of Article 702 of the Civil Code of the Russian Federation), the contractor undertakes to manufacture (create) the thing specified in the contract and, after completion of the work, transfer it to the customer.

So the developer, as a person who has undertaken the obligation to construct (manufacture) an apartment (or other premises) on the instructions of another person (participant in shared construction) and, after completion, transfer it to the latter, may well be recognized as a contractor.

That is, from the point of view of the Civil Code of the Russian Federation, a participant in shared construction can be recognized as a customer, and the developer of an apartment building can be considered a contractor, regardless of whether he will build this house (and this apartment) on his own or will involve co-contractors (subcontractors). The right to engage subcontractors (even without notifying the customer) is expressly provided for in Art. 706 of the Civil Code of the Russian Federation. More precisely, the developer should be recognized as a general contractor.

Moreover, the shareholder (like any other customer), after accepting the apartment, registers the emergence of ownership rights to it.

The fact that, in accordance with both Law No. 214-FZ and the above-mentioned paragraph 14 of Art. 1 of the Civil Code of the Russian Federation, the rights to a land plot, up to the transfer of apartments to shareholders, belong to the developer, and do not contradict the Civil Code of the Russian Federation. The only difference that I found: in the contract concluded, the initiative and the palm belong to the customer. He finds a general contractor under his own conditions.

In DUDS it's the other way around. The general contractor (developer) begins to construct the property (or prepare for its construction) and only after that begins to search for customers (shareholders). Yes, and the second difference. In the DUDS, there will be quite a lot of customers (shareholders) per general contractor (developer).

And the two most interesting answers that I was given to the question asked:

1. Yes to everyone!

2. The contractor’s goal is to make a profit, that is, commercial, while the developer’s main goal is to transfer apartments to shareholders, that is, social*.

*In the morning I spread the sandwich,

Immediately I thought - what about the people?

Shortly before the entry into force of Law No. 214-FZ (from 01/01/2005) in paragraph 3 of Art. 149 of the Tax Code of the Russian Federation was introduced sub-clause. 22, according to which the sale of residential buildings, apartments, and shares in them was exempt from VAT.

And if officials had then agreed that the transfer of an apartment under the DUDS is its sale, then the developer would have no problems with accounting and tax accounting, that at the stage of building a house, when transferring apartments, as well as non-residential premises, to shareholders both then and up to the present time.

At that time we proposed the following scheme.

The developer (in accounting and tax accounting - the general contractor) is building a residential building.

Sources of financing: - own funds, bank loans, funds of equity holders. The funds actually received by shareholders are reflected as advance payment. He collects all the costs of building a house on account 20 “Main production”, where he has the opportunity to determine the cost of each shared construction project, as well as those objects for which no contracts have been concluded. The developer, after completion of construction, will take ownership of such premises as finished products and will sell them under sales and purchase agreements.The transfer of apartments (residential premises) about DUDS is not subject to VAT, the transfer of non-residential premises is subject to VAT.

And further changes to Law No. 214-FZ, and there were many of them, and there will probably be more, did not and cannot affect the proposed scheme.

But for some reason the officials did not like this scheme, which was too simple and understandable to everyone: “There are no difficulties that need to be heroically overcome.”

Even before the entry into force of the said sub-clause. 22 clause 3 art. 149 of the Tax Code of the Russian Federation, the Federal Tax Service of Russia, having agreed its opinion with the Ministry of Finance, published a letter dated December 9, 2004 No. 03-1-08/2467/ [email protected]

It explicitly stated that the VAT exemption applies only to contracts for the sale and purchase of apartments or residential buildings, in which the transfer of existing ownership rights from the old owner to the new one is registered. to the construction of new apartments for which the new resident acquires ownership rights.

- Why?

- And that’s how we see it.

So, from 05/01/2005, when Law No. 214-FZ came into force, and developers became obliged to raise citizens’ money only under equity participation agreements, it turned out that the benefit granted by legislators, which, in the opinion of its authors, was supposed to reduce the prices of new apartments, through the efforts of high-ranking officials of financial departments, does not work.

And, based on the ancient postulate that the boss is always right, or you simply misunderstood his wise instructions, the Ministry of Finance of Russia (letter of the Ministry of Finance of Russia dated July 12, 2005 No. 03-04-01/82, brought to the attention of the tax authorities by letter of the Federal Tax Service of Russia dated 08/02/2005 No. MM-6-03/632) proposed a very clever accounting scheme.

The authors of this opus, having read Art. 5 of Law No. 214-FZ, which defined the price of a contract for participation in shared construction, came to a very interesting conclusion. More precisely, they said a new word in taxation!

First, let us recall that the developer, who received permission to build an apartment building before July 1, 2018, had the right, in the agreement concluded with the shareholder, to indicate the price of the apartment as the amount of money to reimburse the costs of its construction plus the cost of the developer’s services. This phrase was excluded from paragraph 1 of Art. 5 of Law No. 214-FZ Federal Law of July 29, 2017 No. 218-FZ for contracts concluded after July 1, 2018.

The wording is rather vague and purely theoretical, since it is quite difficult to determine at the stage of concluding a contract how much the direct participants in construction (from surveyors to subcontractors) will demand from the developer. Moreover, it is copied almost verbatim from paragraph 2 of Art. 709 of the Civil Code of the Russian Federation, according to which the price in the contract includes compensation for the contractor’s costs and the remuneration due to him.

So, in the above letter, absolutely stunning conclusions were made (why its authors did not interpret the taxation of an ordinary contractor in the same way is not entirely clear).

Developers were ordered to be divided into two categories:

The first are those organizations that have construction divisions on their staff and are directly involved in the construction of a house.

The second is the so-called “pure” developers, who are only engaged in finding shareholders, concluding a contractual agreement with them and receiving money from them. The house is being built by other specialized companies hired by this “pure” developer.

The first category of developers (performing any work on the construction of a house), thus, performs work under a contract, that is, they keep records according to the scheme we proposed above, except that the price of the contract includes VAT.

But the second category , it turns out, acts as something like an agent who has entered into an agreement with the equity holder according to the model of a commission agreement.

But the supervisory state (municipal) bodies and participants in shared construction do not see the difference between these two categories of developers, and cannot see it even in theory.

A plot of land for construction (regardless of whose employees will work there) is purchased or leased only by the developer. Only can obtain a building permit in his own name . In the same way, he then receives permission to enter. The agreement with the shareholder, as well as the acceptance deed, is then signed only by the developer’s representative.

Yes, in the project declaration (Article 19 of Law No. 214-FZ), which a future participant in shared construction has the right to review, all organizations participating in the construction of the house must be indicated. But the fact that the developer will be listed there, for example, as a general contractor, or, according to the law, is not allowed to do so (there are no necessary specialists on staff), neither for the terms of the contract, nor, by and large, for the cost of 1 sq. m. m. in the future apartment (that is, the contract price) will not affect, and cannot affect in any way.

But no. Like in that ancient army joke: Comrade soldiers, you will be loading luminium. And whoever doesn’t like aluminum will load cast iron.

So it was proposed to conduct accounting and taxation for these two categories as follows.

For the first (who build themselves). The amount of funds received by the developer from equity holders must be taken into account as an advance payment, regardless of whether the contract is concluded for an apartment or non-residential premises. VAT must be calculated from it (on the date of receipt). Further, upon completion of construction, the transfer of the apartment to the shareholder must be recognized as the implementation of construction and installation work for its construction, which is not exempt from value added tax.

For the second category (that is, “pure” developers) . The receipt of money from developers must be divided into two parts - received as compensation for construction costs (which are not subject to VAT), and for payment for the so-called “services” of the developer, which were subject to VAT.

It was in this letter that the concept of “developer services” was mentioned for the first time, the definition of which is still not contained in any legislative act of the Russian Federation.

But a letter signed by the Deputy Minister of Finance and agreed upon with the Deputy Head of the Federal Tax Service was enough to introduce a new term into the practice of accounting and taxation, without bothering with changes to legislative acts or regulations*.

*Emperor Nicholas I once wisely remarked: “The state is governed not by me, but by three hundred department heads.”

At the stage of building a house and receiving money from shareholders, again guided only by vague and often contradictory explanations of the Russian Ministry of Finance, most developers, by default, did not charge VAT at all. Or they did so, if local tax authorities required it, based on some standard, for example, advance payment, and not targeted financing (subclause 14, paragraph 21, article 270 of the Tax Code of the Russian Federation) recognized 5% (or 7%) of the amount received from the shareholder of funds. VAT was extracted from this amount.

At the stage of transferring the apartment to the shareholder, “the services of the developer”, by analogy with the income of the agent (commission agent), they recognized, and still recognize, the actual difference between the amount of costs (submitted by the general contractor directly or through the technical customer) for the construction of the house, including a specific apartment, and the amount of funds received from the shareholder. Until September 30, 2010, it included value added tax. After this date (from 01.10.2010, sub-clause 23.1 of clause 3 of Article 149 of the Tax Code of the Russian Federation came into force, according to which the services of the developer were exempted from VAT on the basis of the concluded DUDS (except for the services of the developer provided during the construction of industrial facilities).

However, this term is still not explained either in the Tax Code of the Russian Federation, or in other legislative acts, or in court decisions.

Funds received to pay for the costs of building a house, guided by sub. 14 clause 1 art. 251 of the Tax Code of the Russian Federation, it is proposed to consider it as targeted financing. Indeed, funds received from equity holders, whether considered prepayment or targeted financing, can in no case be recognized as income (revenue) either in accounting registers or for tax purposes. The contract has not yet been executed, the apartment has not been transferred to the shareholder. And it is possible that the shareholder will terminate the contract, and the developer will be obliged to return the funds previously received to him.

But from this, officials concluded* that the funds that the developer will spend on paying for the work and services of other organizations directly involved in the construction of the apartment (more precisely, the building in which this apartment is located) are not taken into account when calculating the developer’s profit.

*There are a lot of such letters, so we won’t give a link to them here.

Further, it is imperative to mention the letter of the Ministry of Finance of the Russian Federation dated May 18, 2006 No. 07-05-03/02.

It concerned the procedure for reflecting in the accounting registers the costs of constructing a property. It proposed to collect these costs on balance sheet account 08 “Investments in non-current assets”, regardless of the purpose for which this object was initially built.

To some extent we agree with this letter.

Let us assume that the developer initially intends, after completion of construction, to register the emergence of ownership rights for the object under construction and intends for its further operation or rental. That is, this property from the developer will eventually be recognized as an object of fixed assets. Reflecting construction costs on account 08 in this case is absolutely legal and does not raise any questions or complaints.

Let’s assume that already at the construction stage of the facility a decision was made to transfer part of the facility (not “for thanks,” of course, but for a certain amount of money) to another person. Until 2011, each developer called such an agreement as he pleased. In use were: investment agreements, joint activity agreements, joint construction agreements, etc., etc., etc.

But the Plenum of the Supreme Arbitration Court of the Russian Federation, in its resolution No. 54 dated July 11, 2011, rightly noted that in the overwhelming majority we are talking about concluding an agreement for the purchase and sale of real estate that will be built in the future.

And the developer, after completing the construction of the object, will receive permission to put the object into operation and register the emergence of ownership rights to it, transferring this right to it (most often, to part of it) to another person. And this person (co-investor, participant in joint construction, etc.) paid all or most of the money in advance.

Consequently, already at the stand stage it will be known that some part of the object is being built not for oneself (as an OS), but for another person. That is, we are dealing with the production of finished products, albeit real estate. In the accounting registers, the costs of producing finished products (current assets) are recorded on balance sheet account 20, and the products themselves awaiting sale are recorded on account 43. But usually such a decision - selling part of the building to another person - is made after construction has begun. And the developer’s accounting department absolutely correctly keeps records of all costs in account 08. There is no point in changing the cost accounting after this, especially since it is usually still unknown exactly which specific part of the constructed object will be sold. Therefore, it is absolutely logical for the developer to continue to record costs on account 08.

And after the construction is completed and the developer (already the seller) finally decides which part of the property he will transfer (or rather, sell) to the co-investor (that is, the seller), and the posting specified in the letter will be made:

Debit account 43 Credit account 08*.

*This entry, although not provided for in the Instructions for using the chart of accounts, and scratches the eye of a more or less qualified accountant, in the described situation has a right to exist.

In this part, we have no complaints against the actual authors of the letter.

But then complete confusion begins.

If a developer is building (or at least planning to build) an apartment building and concluding agreements for participation in shared construction, then he does not intend to retain a single square meter of space in this building. He will not have any fixed assets in this house. That is, we have a process for producing current assets, initially intended for transfer to other persons for a fee.

However, even in this case, the authors of this letter propose to keep records of these costs on balance sheet account 08 “ Investments in non-current assets ”.

- Why?

— A clear answer has not yet been received from anyone.

I just had suspicions that the actual authors of the letter took as a basis the old Soviet recommendations, according to which all residential buildings were owned either by city executive committees or industrial enterprises, as fixed assets for non-productive purposes. The costs of their construction were then accounted for in account 08.

Those times are long gone, but it turns out that the recommendations are being applied.

Moreover, at the beginning of the letter there is a reference to the Regulations on the accounting of long-term investments, approved by letter of the Ministry of Finance dated December 30, 1993 No. 160.

But I would like to immediately note that this Regulation (approved by letter , and not by order of the Russian Ministry of Finance, and not even submitted for registration to the Russian Ministry of Justice) cannot be recognized as a normative legal act. This is the first thing.

Secondly, this Regulation concerns the accounting of long-term investments, that is, non-current durable assets (over one year) not intended for sale (clause 1.2 of this Regulation).

Thus, using it as a guide to accounting for the costs of creating current assets is, at a minimum, not entirely correct.

But, nevertheless, guided by the above letters, the Federal Service for Financial Markets of Russia, by its order dated November 30, 2006 No. 06-137/pz-n, approved the Instruction on the procedure for calculating standards for assessing the financial sustainability of a developer’s activities, which obligated developers of multi-apartment residential buildings (who they will not be listed as fixed assets) to reflect the costs presented by direct participants in construction only on account 08.

Thus, the Federal Financial Markets Service of Russia, by its regulatory legal act, without having the authority to do so, obliged organizations to prepare financial statements according to their requirements. Moreover, these requirements (reflection of the costs of creating current assets as part of non-current assets) contradicted the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”* in force at that time, as well as the current accounting provisions*.

*In the accounting of organizations, current costs of production and capital investments are taken into account separately (Clause 6, Article 8 of Law No. 129-FZ)

**Regulations on maintaining accounting and financial statements in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n

Accounting Regulations Accounting for Inventories" PBU 5/01, approved by Order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n

Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n.

Also, in 2022, with the introduction of further amendments to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137, which approved the forms and rules for filling out (maintaining) documents used in calculating value added tax, developers of multi-apartment residential buildings in terms of registration and filling invoices, sales book, purchase book, journal of received and issued invoices, equated to agent, commission agent, forwarder.

Although, we repeat once again, such an unambiguous conclusion cannot be drawn from any legislative act.

Thus, the existing system of cost accounting for the construction of multi-apartment residential buildings, built primarily on letters from high-ranking officials, mostly contradicts both current legislation and regulations. However, at the very least, until recently it worked.

And, relatively recently, competent lawyers for developers, taking advantage of the ambiguous wording of Law No. 214-FZ and sub.

23.1 clause 3 art. 149 of the Tax Code of the Russian Federation, turned them to their advantage. Let us remind you once again that developer services are exempt from VAT when transferring shared construction projects to shareholders, with the exception of industrial facilities.

These, as also mentioned in this subclause, include objects intended for use in the production of goods (performance of work, provision of services).

In modern apartment buildings, the first floors (also called basements) are most often non-residential. After completion of construction, they are given over to small shops, offices, beauty salons, etc.

However, the apartment building itself (as a building as a whole) is an object of non-industrial (residential) purpose, regardless of the presence or absence of non-residential premises in it. Thus, industrial facilities cannot be located in an apartment building. Consequently, when transferring such non-residential premises, the developer’s services are also not subject to value added tax. The Supreme Court of the Russian Federation also came to this conclusion (Determination No. 302-KG16-11410 dated September 21, 2016 in case No. A78-10467/2015, brought to the attention of the tax authorities by letter of the Federal Tax Service of Russia dated December 23, 2016 No. SA-4-7/ [email protected ] ).

Later, the Russian Ministry of Finance (letter dated April 24, 2019 No. 03-07-11/30014) also agreed with this.

What does judicial practice say?

In civil proceedings, the reference to Resolution No. 54 “works” unconditionally. But in a tax dispute, the author was surprised to discover the opposite. The ruling of the Fourth Arbitration Court of Appeal dated July 11, 2013 in case No. A78-10830/2012 states “in black and white” that the relations developing between the developer and the shareholders do not fall under the legal regulation of Chapter 30 of the Civil Code and cannot be qualified as a relationship under a purchase and sale agreement. In the old fashioned way, judges are closer to the idea of the investment nature of equity participation agreements. However, this “played into the hands of the taxpayer.”

It remains to add that the above-mentioned letters dated July 7, 2009 No. 03-07-10/10 and dated October 26, 2011 No. 03-07-10/17 contain an encouraging “loyalty clause.” It sounds in a standard way: we inform you that this letter does not contain legal norms or general rules specifying regulatory requirements, and the opinion sent does not prevent one from being guided by the norms of the legislation on taxes and fees in an understanding that differs from the interpretation set out in the letter.

Shared construction accounting – main points

Under the concept of “shared construction”

is understood as a form of investment activity in the field of construction, during which the developer (represented by an investment or construction company) plans the construction of real estate objects (equity-shared construction projects) and for these purposes engages in attracting funds from organizations and individuals (shareholders, participants in shared construction). The completed construction project, according to the share participation agreement, after its commissioning becomes the property of the shareholders.

Before delving into the instructions regarding accounting, you should pay attention to the text of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 11, 2011 No. 54. It contains some conclusions that will help to understand the validity of the requirements regarding the reflection of records of business transactions with the developer. The Resolution states that any agreement (including agreements for participation in shared construction) related to investments in the construction sector, in which it is planned to transfer to the investor a financed share in real estate, cannot be considered as a separate type of agreements. It is necessary to build on the concepts provided for by the Civil Code of the Russian Federation.

Thus, an agreement for participation in shared construction is close in essence to the contracts for the sale and purchase of a future property mentioned in the Civil Code of the Russian Federation.

Based on this statement, the agreement we are considering will be considered as a special purchase and sale agreement with an individual procedure for registering ownership rights - directly to the buyer, without the participation of the seller-developer.

The rules for calculating income tax do not change

The developer calculates income tax based on the rules on targeted financing. Funds from shareholders accumulated in the developer’s accounts are considered targeted financing, regardless of how the developer builds the house (subclause 14, clause 1, article 251 of the Tax Code of the Russian Federation). Of course, VAT amounts related to settlements with the budget are not taken into account when determining the tax base for income tax. Let’s simplify our task by considering that the house does not contain non-residential premises.

The legislator regulated the taxation of developer profits in an exhaustive manner. Therefore, there is no need for any additional interpretations of the developer’s transactions (Clause 6, Article 3 of the Tax Code of the Russian Federation). That is, there is no reason to involve Resolution No. 54 at the stage of calculating income tax.

Important

Funds from shareholders accumulated in the developer’s accounts are considered targeted financing, regardless of how the developer builds the house (subclause 14, clause 1, article 251 of the Tax Code of the Russian Federation).

Let us emphasize once again: the developer does not cease to remain such if he carries out construction on his own (Clause 1, Article 11 of the Tax Code of the Russian Federation). The Tax Code does not contain definitions of a developer, so one must proceed from the wording of Law No. 214-FZ (clause 1, article 2).

As a result, all developers form a tax base according to a single scheme. The economic benefit (Article 41 of the Tax Code of the Russian Federation) of the developer is the remuneration specified in the agreement with the shareholder, as well as the savings of shareholders in the implementation of construction costs provided for in the project documentation (clause 1 of Article 18 of Law 214-FZ).

This position is fully supported by the previously mentioned letter dated October 26, 2011 No. 03-07-10/17.

Shared construction accounting

The legislative framework and practice of reflecting transactions related to shared construction in accounting accounts have not been fully developed at the moment. Accountants of organizations that are customers in shared construction often experience difficulties in reflecting the relevant business transactions in accounting.

So, as has already become clear, an agreement for shared participation in the construction of an object is a type of purchase and sale agreement. Then it can be argued that the transfer of commissioned objects to the shareholder is an operation for the sale of finished residential premises (construction products). But here the fact of transfer of ownership from the seller to the buyer is not revealed, which means that the sale transaction cannot be opened in the developer’s sales accounts (clause 12 of PBU 9/99).

Then the accountants decided to reflect transactions for the sale of finished products (houses, apartments, parking spaces, non-residential premises), since it can be assumed that special conditions may be provided for by Law No. 214-FZ.

Important!

Based on the results of the posting, the savings of the shareholders’ funds are not determined, because the cost of the contract (not taking into account the developer’s remuneration) is reflected in full as proceeds from the sale of the completed construction project.

| Operation | DEBIT | CREDIT |

| Reflection of funds of participants in shared construction (shareholders) | 51 | 76 |

| Accounting for construction costs | 20 | 60 |

| Reflection of VAT presented by contractors and suppliers | 19 | 60 |

| Formation of the cost of finished construction products (apartments, parking spaces, non-residential premises) | 43 | 20 (19) |

| Reflection of turnover on the sale of construction projects in the amount of the total amount of funds received from equity holders | 76 | 90 |

| Write-off of sold finished construction products | 90 | 43 |

Misappropriation of funds

Let's raise another burning question - about determining the developer's savings.

There is an opinion that the costs of maintaining the developer, included in the consolidated estimate, are a targeted expenditure of the shareholders' funds. However, this point of view is refuted by the letter of the Ministry of Finance of Russia dated July 22, 2011 No. 03-11-06/2/109. It states that developers must take into account cost savings for the construction of real estate in the form of the difference between the contractual cost of the objects and the actual costs of constructing these objects, which do not include the costs of maintaining the developer’s service.

The problem of financing becomes even more acute when the developer carries out construction on his own. Roughly speaking, in addition to the costs of the developer’s service, the costs of maintaining the general contractor are added. But the Russian Ministry of Finance remains adamant (letter dated March 19, 2013 No. 03-11-06/2/8421).

According to the author, disputes with regulatory authorities on this topic have no prospects. You should be guided solely by legislation. And subparagraph 1 of paragraph 1 of Article 18 of Law No. 214-FZ states with full certainty that the funds of shareholders are to be used by the developer only for construction in accordance with the project documentation. The definition of project documentation contains paragraph 2 of Article 48 of the Town Planning Code. It determines architectural, functional-technological, structural and engineering solutions to ensure construction.

As you can see, organizational and administrative measures are not provided for in the project documentation. Consequently, it is unlawful to pay administrative and managerial expenses from the funds of shareholders. Only the amounts of remuneration allocated in the price of the contract can be allocated for these purposes (clause 2 of article 18 of Law No. 214-FZ).

Prospects

The few tax disputes surrounding VAT show that inspectors understand Resolution No. 54 in their own way, focusing on the creation of real estate (clause 2 of Article 455 of the Civil Code of the Russian Federation). In this regard, they insist on a contract scheme for the developer’s activities, which allows them to refer to the relevant letters from the Russian Ministry of Finance. Such a dispute is presented in the resolution of the Federal Antimonopoly Service of the Ural District dated May 17, 2013 No. F09-3499/13. However, the tax authority lost because the arbitrators classified the developer’s activities as investment. According to the author, both the plaintiff and the arbitrators are wrong. The latter simply ignored Resolution No. 54.

Let's summarize. There are no taboo topics for discussion. The main thing is the correct argumentation of professional judgments. And it is worth remembering that all irremovable doubts are interpreted in favor of the taxpayer (Clause 7, Article 3 of the Tax Code of the Russian Federation).

The author did not find any tax disputes in which taxpayers referred to Resolution No. 54. Apparently, this is explained by the fact that the courts still recognize investment relations in construction as an independent activity.

Elena Dirkova,

Director of LLC "Incubator for Accountants", for the magazine "Practical Accounting"

Berator VAT from A to Z

All the necessary information for convenient and comfortable work. Absolutely all issues are considered: the procedure for calculating and paying VAT, recording, reporting, inspections, etc. Find out more >>