Business lawyer > Accounting > Remuneration > What is included in the daily allowance: explanations on all issues

A person sent to carry out a business trip is provided with a sum of money for various expenses. This type of cash payment has a peculiarity: in fact, it is not documented anywhere. Because of this, nuances arise that require clarification. This article provides detailed information regarding the regulation of payment and the amount of daily allowance. Information is current as of 2022.

Business travel expenses

A business trip is an employee’s trip by order of the employer outside the place of permanent work to carry out an official assignment (Article 166 of the Labor Code of the Russian Federation).

Only full-time employees, that is, those with whom employment contracts have been concluded, can be sent on a business trip. It does not matter where the employee works: in the office or at home. Business trips of freelancers are not business trips, and expenses for them are accepted in a completely different manner.

The employer is obliged to maintain the employee’s job and average earnings for the seconded employee, as well as reimburse him for expenses associated with the business trip:

- Travel to the place of business trip.

Such costs include tickets for all types of transport (except taxis), ticket booking fees, insurance, etc.). The possibility of reimbursement of taxi expenses is determined by the employer based on the internal documents of the organization.

- Accommodation during a business trip.

Expenses for accommodation in a hotel, private sector or rented apartment are subject to reimbursement. But the procedure for taking into account such costs depends on the employee’s availability of primary documents confirming the fact of renting housing.

- Daily allowance.

Per diem - funds allocated to an employee for current expenses during a business trip. The employee does not have to report for them, as for all other expenses. The amount of daily allowance is not limited by law, but there is a certain limit beyond which these payments are subject to personal income tax and insurance contributions.

- Other expenses.

The employer determines their list independently depending on the type and duration of the business trip, the employee’s position and other factors. The composition of such expenses, as a rule, includes the cost of a taxi or Aeroexpress, mobile communications, a VIP lounge at the airport, and entertainment expenses.

For all the above costs, the employer gives the employee an advance, for which he will be required to account for upon returning from a business trip.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Tax accounting for travel expenses 2020

An employer can take into account travel expenses as expenses for income tax and the simplified tax system (the object “income minus expenses”). The procedure for accounting for such costs for the simplified tax system and for the OSNO is similar.

Main features of tax accounting for travel expenses:

- Economic feasibility and documented cost exposure.

Costs incurred by an employee on a business trip are taken into account only if they are economically justified and confirmed by primary documents. An exception is made only for daily allowances: the employee is not required to confirm them and report on them. In the absence of supporting documents, it will not be possible to take costs into account, even if they are justified.

- Expense recognition date.

Travel expenses are recognized on the date of approval of the advance report. If on a business trip an employee paid expenses from his own funds and the company reimbursed him for them, then the date of recognition of expenses should be considered the day the funds were issued from the cash register. We will consider the date of recognition of expenses incurred in foreign currency below, in the section on foreign business trips.

- VAT on travel expenses.

Individual entrepreneurs and organizations on OSNO have the right to deduct VAT, provided that travel expenses are paid by the organization or employee and there is an invoice for them. We will consider the features of accepting VAT for deduction on certain types of travel expenses below.

- Personal income tax and insurance premiums

For most travel expenses, personal income tax and insurance premiums are not required. Personal income tax and insurance premiums are charged in excess of the established limit on daily allowances.

Let's take a closer look at the features of tax accounting for certain types of travel expenses.

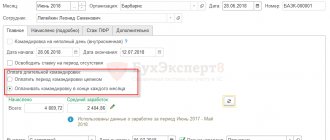

Daily allowance: tax accounting

Per diem - employee expenses incurred on a business trip related to living outside their place of permanent residence. In most cases, per diem is allocated to an employee for meals during a business trip.

The amount of daily allowance is not limited by current legislation, but there is a limit beyond which personal income tax and insurance premiums must be charged for these expenses. This limit is 700 rubles for trips within Russia and 2500 rubles. - for abroad. The employer sets the daily allowance amount independently, and it may vary depending on:

- employee position (for management employees they may be higher, for ordinary employees - within the limit);

- tasks assigned on a business trip;

- business trip locations, etc.

You can learn more about the specifics of calculating, accruing and paying daily allowances in the following articles:

- Payment of daily allowances for business trips in 2022: features;

- Payment of daily allowances for the day of departure and for the day of arrival;

- Payment of daily allowances for weekends;

- Daily allowance for a business trip to your place of permanent residence.

You can write off your daily allowance as expenses in full, without restrictions. As for one-day business trips, they are not eligible for per diem allowance. This is due to the fact that the employee does not incur living expenses on such a trip and returns home on the same day.

The Ministry of Finance proposed to attribute such costs to other expenses, and not to travel expenses (Letter dated May 17, 2018 No. 03-15-06/33309). And if the employee has provided supporting documents, then there is no need to charge personal income tax and insurance premiums for the entire amount of such expenses. If there are no documents, then personal income tax and contributions should be charged in an amount exceeding the limit (700 rubles for business trips within Russia and 2,500 rubles for business trips abroad).

The employee is not required to report on daily allowance, and therefore the employer has no right to demand from the employee supporting documents on daily allowance.

Per diem and taxation

On daily allowances the amount of which exceeds the undeclared amount of 700 and 2,500 rubles (for local and foreign trips, respectively), personal income tax payments are paid. Per diem cannot be considered employee income. For this reason, daily allowances cannot be considered income taxable under personal income tax. Payments for daily allowances in excess of the duty-free allowance will be taken into account when the tax base is determined.

Taxes

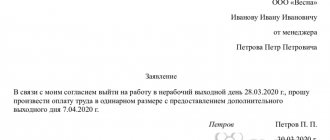

Payments issued instead of daily allowances are also not subject to tax within the limits of the law. For example, during a one-day one-time business trip, the employer can pay employees a monetary remuneration instead of daily allowance.

When compiling the tax base, you need to remember that daily allowances paid to employees for any needs are an accountable amount. Until the manager's final approval of the expense report, per diem is not an expense of the employer. Accordingly, until the report is signed, tax payment for excess daily allowance cannot be made.

Personal income tax payments from overtime daily allowance cannot be recovered from the employee. All unspent money is given back to the cash desk of the organization that issued it.

Many organizations, when sending their employees on a foreign business trip, give other monetary compensations instead of daily allowances. At the same time, personal income tax is withheld in full from the entire amount, not only in regulatory norms. This is a risky approach for the employer and is recommended to be used as rarely as possible. During a tax audit, this will be noted as a violation and a fine will be issued. The fact is that Government Decree No. 749 directly states that it is necessary to give the employee daily allowances.

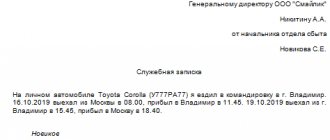

Payment for travel to the place of business trip: features of cost accounting

Travel expenses to the place of business trip can be included in expenses in full (subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation). There is no need to charge personal income tax and insurance premiums for such expenses. To accept travel expenses for accounting, the employee must provide supporting documents:

- when traveling by regular transport - a travel ticket with the details, signature and seal of the carrier;

- when traveling by taxi - an order for the provision of a vehicle for transporting passengers and luggage and a receipt for payment for taxi services;

- for air travel - a ticket and boarding pass. If the ticket is electronic, then you will additionally need to provide an itinerary receipt;

- when traveling by railway transport - railway ticket, control coupon, electronic ticket, boarding pass;

- when traveling by personal or official transport - a waybill, check, receipts for the purchase of fuel and lubricants and other accounting documents confirming the employee’s location on the road;

- when driving a rented vehicle (car sharing) - a car rental agreement and documents confirming the expenses incurred and the fact of using the car for business purposes.

If an employee has lost travel documents, you can confirm expenses:

- a duplicate of the document;

- a copy of the ticket left with the transport company;

- a certificate from the transport company indicating the details allowing to identify the person who made the trip, his route, the cost of the ticket and the date of the trip.

Reimbursement for accommodation on a business trip

Costs for accommodation on a business trip are also subject to inclusion in expenses under the simplified tax system (the object “income minus expenses”) and income tax, subject to their documentary confirmation. These travel expenses are not subject to personal income tax and insurance contributions. Accommodation costs can also include services provided by hotels, except for saunas and fitness centers, bars and room service.

Documents confirming the employee's expenses for accommodation on a business trip:

- cash receipt or BSO - when staying at a hotel;

- an apartment rental agreement, a receipt for payment of rental payments and other supporting documents - when an employee lives in a rented apartment.

In the absence of supporting documents, it will not be possible to take into account living expenses. They will also need to charge personal income tax and pay insurance premiums from them:

- Personal income tax is charged on expenses exceeding 700 rubles. for business trips in Russia and 2,500 rubles. - for business trips abroad;

- Insurance premiums must be charged on the entire amount of expenses.

Calculation example

Travelers Eduard Antipovich was sent on business for 20 calendar days in April 2022.

Its calculated data for the period February 2022 – March 2022:

| Indicators | Periods, days | Charges, rubles |

| Total number of days | 254 | 900 000,00 |

| Sick leave | 41 | 150 000,00 |

| Annual leave | 28 | 90 000,00 |

| Total | 185 | 660 000,00 |

Average daily earnings: 660,000 / 185 = 3,567.57 rubles.

Payment for a business trip based on average earnings: 3567.57 × 20 days. = 71,351.40 rubles.

For information about which accounting entries to reflect these transactions in accounting, read the article “How to keep records of travel expenses in a budget organization.”

Paying for food on a business trip: tax accounting

Payment of food expenses on a business trip is at the discretion of the employer. Neither the Labor Code of the Russian Federation nor the regulations on business trips mention such costs. Accordingly, the employer is not obliged to pay for them.

By default, food must be paid for by the employee from the daily allowance, but at its discretion, the employer can additionally compensate the employee for such costs.

Food costs are not taken into account as expenses under the simplified tax system and income tax; personal income tax must also be charged on them and insurance premiums must be paid on them.

An exception is the situation when food costs are included in the cost of accommodation. But if the cost of food in the check is highlighted as a separate line, then these expenses cannot be included in the income tax costs (Letter of the Ministry of Finance of Russia dated May 20, 2015 No. 03-03-06/2/28976).

Cancellation of daily allowances in Russia

Conversations that daily allowances will finally be completely abolished and they will no longer be paid for business trips in Russia have been going on for a long time. But the Ministry of Finance’s resolution number 749 seems to put an end to this story. The daily allowance remains only for trips abroad. Budgetary organizations will be able to cut costs and save money, because previously they always had to pay daily allowances to everyone.

The attitude of workers and management to this news is ambiguous. On the one hand, the daily allowance could already be replaced with other monetary compensation, and the employee would not be left without money at all. On the other hand, in companies where this point is quite clearly stated in the regulations, the employee is completely deprived of his daily allowance. Rewriting regulations to accommodate a new regulation will take time and cost.

Top

Write your question in the form below

Accounting for travel expenses under other tax regimes

Individual entrepreneurs on the simplified tax system “income” and entrepreneurs on a patent cannot take travel expenses into account as expenses. This is due to the fact that individual entrepreneurs on PSN do not keep track of expenses and cannot reduce the cost of a patent by any costs other than insurance premiums.

Although individual entrepreneurs on the simplified tax system must keep “income” in KUDiR, they enter into it (in addition to income) only data on one expenses - paid insurance premiums for themselves and employees. Despite this, the Ministry of Finance believes that simplifiers at an income facility in general should draw up primary documents for business trips, including expenses incurred, including an advance report (Letter of the Ministry of Finance of Russia dated October 30, 2013 No. 03-11-11/46198). The reason, according to the financial department, is that for simplifiers, regardless of the object used, the current procedure for conducting cash transactions is maintained.

According to this procedure, the accountable person is obliged, within a period not exceeding 3 working days after the expiration date for which cash was issued on account, or from the day the employee goes to work, to present to the chief accountant (accountant) or manager an advance report with attached supporting documents (p 6.3 The procedure for conducting cash transactions, approved by Directive of the Bank of Russia dated March 11, 2014 No. 3210-U).

The Tax Code of the Russian Federation does not make any exceptions for the preparation of primary expenditure documents for travel expenses for simplifiers at the “income” facility. This means that they, along with others, must prepare these documents, although they cannot take such costs into account as expenses.

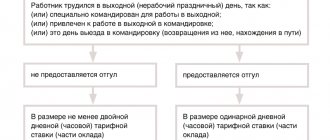

How a business trip on a day off is paid: legal norms

When sending an employee on a business trip, the employer must be guided by the main legislative act in the field of labor relations - the Labor Code.

In ch. 24 of the Labor Code of the Russian Federation provides basic concepts, as well as employee guarantees and conditions for reimbursement of costs associated with a business trip. This is stated in the letter of the Ministry of Labor of Russia “On remuneration of workers” dated December 25, 2013 No. 14-2-337. In addition, the sending of employees on business trips and their payment are regulated by other regulatory documents:

- Decree of the Government of the Russian Federation “On the peculiarities of sending employees on business trips” dated October 13, 2008 No. 749. For more details, see here .

- Decree of the Government of the Russian Federation “On the specifics of the procedure for calculating average wages” dated December 24, 2007 No. 922.

Find out about calculating average earnings for a business trip in this publication.

In addition, in Art. 139 of the Labor Code of the Russian Federation establishes some rules for calculating an employee’s average earnings for various purposes, including payment for a business trip on a day off. At the same time, Art. 167 of the Labor Code of the Russian Federation guarantees that an employee, when sent on a business trip, will retain his position, as well as average earnings, as stated in paragraph 9 of Regulation No. 749.

NOTE! Average earnings are retained by the employee only on those days that are officially approved in the schedule of the sending enterprise, as well as days on the road (including during forced stops).

Accounting for travel expenses of individual entrepreneurs without employees

According to the Ministry of Finance, accounting for travel expenses of individual entrepreneurs on the simplified tax system without employees is also unreasonable. The tax authority explains its position by the fact that a business trip is a trip by order of a manager to perform an official task. The individual entrepreneur with whom he has an employment relationship does not have an employer, and therefore the individual entrepreneur cannot send himself on a business trip (Letter of the Ministry of Finance of Russia dated August 16, 2019 No.

There is no judicial practice on this issue yet, and therefore it is impossible to predict which side the court will take. Therefore, it is better not to take risks and it is better not to include the costs of a business trip for an individual entrepreneur without employees as part of the expenses for the simplified tax system “income minus expenses”.

What is included in the concept of daily allowance and why are they needed?

Daily allowance is money given to an employee by an organization, the amount of which is calculated based on the estimated expenses per day. Per diems are part of travel expenses. The interpretation of the term is given and enshrined in the Supreme Court.

Business trip

The employer provides funding for additional expenses that an employee will need while on a business trip. Employees receive daily allowances for each business trip; this is regulated by law. Simply put, it is pocket money that is given to employees by their employer while they are on a business trip.

These additional costs include:

- purchasing tickets for public transport

- money to buy food

- other personal needs of the employee

Accounting for expenses for business trips abroad

Accounting for expenses for foreign business trips has its own characteristics:

- The daily allowance limit for business trips abroad is: 700 rubles. when moving across the territory of the Russian Federation and 2,500 rubles. – when crossing the Russian border;

- daily allowances issued in foreign currency are converted into rubles at the rate in effect on the day the funds were issued to the employee;

- if daily allowances are issued in rubles, and expenses are made in foreign currency, they are converted into rubles at the rate in effect on the day the currency was purchased. If the document on the purchase of currency is lost, the rate in effect on the day the advance was issued to the employee is taken;

- the balance of the advance payment returned to the cash desk is recalculated into rubles on the date of refund;

- overexpenses paid in foreign currency are reimbursed to the employee in rubles, recalculated as of the date of approval of the advance report;

- if the primary documents confirming expenses are drawn up in a foreign language, they must be translated into Russian;

- the part of the daily allowance exceeding the limit for the purpose of paying personal income tax must be recalculated into rubles at the rate on the last day of the month in which the advance report was approved.

Accounting for travel expenses: postings

The issuance of an advance to an employee for travel expenses is accompanied by the following posting:

- Dt 71 Kt 50 - if the advance was issued in cash;

- Dt 71 Kt 51 - if the advance is transferred to the employee’s bank card.

When writing off travel expenses, the purpose of the trip is key:

- Dt 20 Kt 71 - the employee is sent on a business trip to perform work on the instructions of the customer;

- Dt 44 Kt 71 - business trip is associated with the sale of goods;

- Dt 08 Kt 71 - business trip is related to the acquisition of property for the company;

- Dt 28 Kt 71 - the employee goes on a business trip to return the defect.

If the company applies OSNO and VAT is separately allocated as an expense, the following entries are applied:

- Dt 19 Kt 71 - VAT is included in travel expenses;

- Dt 68 Kt 19 - VAT is included as part of the tax deduction.

If an employee on a business trip spent his own funds and the employer reimbursed him for them, the following entries are made:

- Dt 71 Kt 50 - if funds were issued to the employee in cash;

- Dt 71 Kt 51 - when transferring funds to the card.

If an employee spent less than he was allocated, a posting is selected depending on how the refund occurs:

- Dt 70 Kt 71 - debt is withheld from the employee’s salary;

- Dt 50 Kt 71 - the employee returned the money to the cash register;

- Dt 51 Kt 71 - the employee returned the money to the employer’s bank account.

Results

The rules for issuing accountable amounts to employees of budgetary institutions are generally similar to similar rules in force for other economic entities, but are subject to their own special documents, which, as of August 19, 2017, have a number of discrepancies with the regulations applied by legal entities in the non-budgetary sector.

Differences in accounting arise due to the specifics of accounting among public sector employees. In addition, the limits on travel expenses that can be reimbursed from the budget are set by law at a fairly low level, but the difference can be covered using funds from commercial activities or through budget savings. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.