Sick leave during quarantine: receipt and payment

In order to receive sick leave during quarantine (insert link), an employee arriving from another country needs to send an application to the Social Insurance Fund in electronic form, for example, through the State Services website. It must also be accompanied by electronic copies of documents confirming the fact of arrival from another country.

An electronic sick leave certificate will be issued by an authorized medical organization, and it will be issued immediately for 14 days. Sick leave benefits will be paid from the Social Insurance Fund and entirely at its expense. The first part of the benefit must be paid within the first 7 days, and the second part - no later than one day after the end of the sick leave.

Attention! The employer does not pay for electronic sick leave during quarantine, but must transfer to the Social Insurance Fund the information necessary to calculate the benefit for the certificate of incapacity for work.

If an employee received a paper sick leave certificate rather than an electronic one and submitted it to the accounting department, then it will be paid for by the employer (with a credit system) or the Social Insurance Fund (with the participation of the region in the Social Insurance Fund pilot project).

What should an employee do?

The employee logs into the service recipient’s personal account on the Social Insurance Fund website and creates an application for remote opening of sick leave.

To work in your personal account on the FSS website, you need to be registered on the government services portal. But Government Decree No. 294 dated March 18, 2020 allows that, with the consent of the insured, another person can file an application for him.

If the application is not submitted by the insured person himself, in the form immediately under the heading you need to check the box “Consent to submit an application for the issuance of an electronic certificate of incapacity for work for another person not registered in the Unified Identification of Affiliation”. Otherwise, the form will automatically include the data of the person who logged in to the site, and not the insured person.

Not all clinics will issue such sick leave: there may be no more than three of them in the region. Therefore, a medical organization will need to be selected from the list, regardless of where the employee is usually treated.

The following documents must be attached to the completed application:

- scan of the international passport: the first page with a photo and a page with marks about crossing the Russian border;

- if there is no such mark in the international passport - copies of other documents that will confirm that the employee was abroad;

- electronic travel ticket;

- if an employee goes into quarantine due to cohabitation with a person who has returned from abroad, a scan of a document confirming cohabitation.

An application with attached documents must be sent to the FSS. If any problems arise and you cannot send an application through your personal account, call the territorial FSS office.

If anything is unclear, please refer to the detailed instructions.

Sick leave for employees over 65 years of age during quarantine

Sick leave for employees aged 65 years and older (date of birth before April 7, 1955) is issued if they are in quarantine and comply with the imposed self-isolation regime. Sick leave is not issued to such employees if they work remotely or are on annual leave.

In this case, the certificate of incapacity for work is issued through a medical organization authorized by the Ministry of Health - that is, not at the employee’s registration address, but through the institution that is responsible for issuing electronic sick leave certificates in the conditions of coronavirus.

Important! If an employee over 65 years of age receives sick leave and then violates the quarantine conditions, he will have to compensate the damage to the fund.

When and how is quarantine declared?

Quarantine due to coronavirus infection differs from normal quarantine due to ARVI.

The sick person and people in contact with him undergo two weeks of isolation: in a hospital under the supervision of doctors or at home. Mandatory quarantine is announced for those who returned from countries with an unfavorable epidemiological situation, and for those with whom these citizens came into contact after their return. Here's what these countries are:

- China;

- South Korea;

- Italy;

- Spain;

- Germany;

- France;

- Iran.

These are the main geographic foci of the disease. Tests for coronavirus are taken from everyone arriving from these countries. Now that the situation has worsened, all Russians arriving from abroad are immediately checked at airports (at least their temperature is measured).

IMPORTANT!

The Ministry of Labor in letter No. 14-2/B393 dated 04/09/2020 clarified: if an employee is sent into two-week isolation after visiting abroad, but these days coincide with paid leave, then sick leave is not issued or paid to him. In this case, the benefit is not accrued. And paid leave is not extended or postponed due to quarantine days.

Sick leave for employees during quarantine in kindergarten or school

An employee whose child goes to a kindergarten that is currently closed for quarantine has the right to issue a sick leave. To do this, he needs to get a certificate from an epidemiologist at a children's clinic serving a closed kindergarten. It will confirm the fact of quarantine and the duration of its introduction. Then you need to apply for sick leave from the pediatrician.

Important! Only one of the parents can receive sick leave on this basis. A sick leave cannot be issued if the child goes to kindergarten but is already 7 years old.

Parents of schoolchildren cannot issue sick leave due to quarantine, regardless of the child’s age.

If an employee cannot take sick leave in such a situation, he has the right to ask for a part-time working regime (if the child is under 14 years old). In this case, the employer does not have the right to refuse the employee.

How long does sick leave last?

The duration of temporary disability depends on the cause:

- contact persons who did not develop suspicious respiratory symptoms during their stay in quarantine will be issued a document for 14 days;

- patients with active coronavirus infection are given sick leave for the entire period of home and/or hospital treatment until the doctor declares the person healthy, which takes on average 3-6 weeks;

- The parent is issued a certificate of incapacity for work for the entire period of caring for the sick child.

Payment of sick leave

At the webinar “HR accounting and payroll during the period of self-isolation. Electronic work books" told how to reflect and generate payment using examples in the 1C program: Salary and personnel management ed. 3.1. Get entry

If an employee has issued an electronic sick leave due to quarantine, it will be paid for by the Social Insurance Fund. In order for the fund to calculate benefits, the employer must provide it with the following documents:

1. when transmitting documents on paper:

- application from the employee for payment of benefits;

- a certificate in form No. 182n about the amount of earnings;

- application for replacement of years (if required);

- inventory of transferred documents;

2. when transferring

electronic sick leave

:

- register of information for the appointment and payment of benefits;

- register of employees over 65 years of age who are in self-isolation (full name, date of birth, address of residence, SNILS).

Attention! Documents must be submitted within 2 business days from the date of receipt of the request from the Social Insurance Fund or the employee’s notification of the electronic sick leave number.

If an employee has issued a sick leave certificate in paper form, he transfers it to the employer, who calculates the benefits independently. In this case, payment is made in the usual manner - for the entire time of absence from work due to quarantine. The limitation on the payment period for sick leave for child care does not apply in this situation.

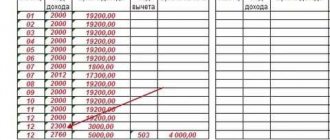

The amount of the benefit is determined based on the employee’s insurance record and payments for the previous two years (or in some cases, the minimum wage). In this case, it is necessary to take into account Art. 1 of Federal Law dated April 1, 2020 No. 104-FZ, namely:

If during the period from April 1 to December 31, 2022, the amount of the benefit calculated for a full calendar month is less than the minimum wage, it must be paid in the amount calculated on the basis of the minimum wage.

To calculate benefits for a certificate of incapacity for work you need:

- determine the amount of daily benefit for each month of incapacity:

Minimum wage / number of calendar days. days in a month of incapacity.

* The minimum wage must be increased by the regional coefficient if it is applied in the region

- calculate the benefit amount for all days:

amount of daily benefit * number of calendar days of incapacity for work

Features when calculating temporary disability benefits:

- if an employee works part-time, the amount of the benefit is calculated in proportion to the length of working time;

- the amount of benefit per day is limited to the maximum value: 2301.37 rubles. with 8 years of experience or more, 1841.10 rubles. with experience from 5 to 8 years; RUB 1,380.82 with less than 5 years of experience;

- the amount of benefit per day is limited to the minimum value: for the period until March 31, 2022 - 398.79 rubles. with 8 years of experience or more, RUB 319.04. with experience from 5 to 8 years; RUB 239.28 with less than 5 years of experience; in the period from April 1, 2022 to December 31, 2022 - RUB 404.33. (in April, June, September, November), 391.29 rubles. (in May, July, August, October, December);

- quarantine sick leave benefits are paid in full from the Social Insurance Fund, starting from the first day of incapacity for work;

- Personal income tax must be withheld from the benefit amount;

- There is no need to pay insurance premiums on the benefit amount.

Important! The employer has the right, on his own initiative and at his own expense, to increase the amount of benefits to the actual average earnings. To do this, you need to calculate the amount of additional payment according to the procedure established in the company’s local documentation. The additional payment must be subject to personal income tax and insurance contributions.

Do all employers accept electronic sick leave?

Not all employers can accept electronic sick leave. The main thing is that the medical institution and the employer are registered in the Social Insurance Unified Insurance System .

. In addition, the enterprise must have the ability to electronically manage documents with the Social Insurance Fund. To do this, you can use different software for the preparation and presentation of accounting and tax reporting.

Registration of a personal account in the UIIS

occurs through an authorized account of the enterprise on the Gosuslugi.ru website.

It is worth noting that if the employer is not registered in the UIIS, then he simply will not be able to track the issuance of electronic sick leave. The FSS did not explain the situation as to how the employer would be informed in this case. But there are 2 possible options:

- The employee independently reports the electronic sick leave number and asks the employer to provide the regional office of the Social Insurance Fund with information for calculating temporary disability benefits.

- The Social Insurance Fund will independently inform the employer. In this case, everything depends on the employees of the fund branch.

- The employer can fill out the data for calculating benefits in his personal account in the Unified IIS “Sotsstrakh” or through the electronic document management program.

Sick leave during quarantine in 1C:ZUP

To generate sick leave in 1C: ZUP, calculate benefits for it and pay it to the employee, you must perform the following actions:

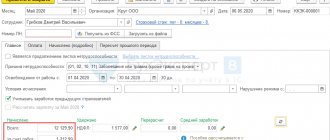

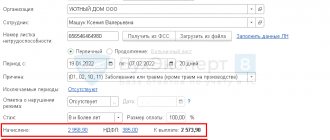

- create a new sick leave in the program. In the “Salaries and Personnel” tab, go to the “All accruals” section, click on the “Create” button and then “Sick leave”;

- in the new document indicate the accrual period, date, employee and sick leave number;

- Click on the “Receive from FSS” or “Load from file” button. Since quarantine sick leave is issued only in electronic format, it is impossible to enter its data manually. Even if you select the cause of disability - quarantine, the “Coronavirus quarantine” flag

cannot be set; - After loading the sick leave data, the “Cause of disability” field will be filled in automatically with code 03 – quarantine. If this quarantine is related to the coronavirus, then the “Coronavirus quarantine” flag must be set manually;

- Resolution of the Government of the Russian Federation No. 294 states that such certificates of incapacity for work are paid directly by the Social Insurance Fund, as in the pilot project. Therefore, the “Accrued (detailed)” tab does not contain the calculated amount due to the employee.

After completing the document, you must go to the “Pilot Project” tab. Let us remind you that it will appear in the document regardless of whether you are in the region of its application or not. If in your organization the average number of individuals to whom accruals are made for the previous billing period is 25 people or less, then you have the right to submit documents to the Social Insurance Fund on paper. In this case, only the “Employee’s Application for Payment of Benefits” should be completed on the sick leave certificate. It is filled in automatically, some fields are editable. For example, you can change the payment method, add sick leave details, or clarify the calculation of average earnings. After checking the completion, the application is printed and signed by the employee.

Next, go to the “Reporting, certificates” section and select the “Transfer information about benefits to the FSS” item.

Click on the “Create” button and select “List of employee applications for benefits” from the drop-down list.

It is filled in automatically with all applications that were entered and not transferred to the FSS when you click on the “Fill” button.

If the average number of employees in the previous period exceeded 25 people, then on the sick leave, in addition to the application, you must also fill in the data for the register of information transmitted to the Social Insurance Fund, since the information must be submitted in electronic format.

After completing the sick leave, go to “Reporting, certificates”, select the item “Benefits at the expense of the Social Insurance Fund” and click “Create a register”. The register will be filled in automatically.

All that remains is to send the register using the “Send” button if you have the 1C-Reporting service connected, or upload it for further sending using the provider.

Do you have any questions about taking sick leave in 1C: ZUP? Or do you need help updating or setting up the program? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Regular illness or coronavirus quarantine - what's the difference?

An electronic sick leave for a regular acute respiratory viral infection or acute respiratory infection is issued in the presence of an illness and a doctor’s examination - that is, like a regular paper sick leave, according to the standard procedure. But after the coronavirus problem arose and thousands of people quarantined at home, it was necessary to change the procedure. Now an electronic certificate of incapacity for work under quarantine is issued in 2 cases:

- if a citizen of the Russian Federation came from another country

where cases of the disease were registered; - for those living together

with those infected or potentially infected with the COVID-19 virus.

In other words, everyone who came from a country with confirmed cases of coronavirus and their family members have the right to sick leave. There are already more than 200 thousand such people in Russia, and writing out sick leave for everyone after a doctor’s visit would be too difficult and would require unnecessary labor costs.

In addition, by decision of the regional authorities, other persons may also receive quarantine sick leave..

For example, according to Decree of the Mayor of Moscow dated 03/05/2020 No. 12-UM, local

residents over 65 years of age

also have the right to apply for an ELN for quarantine. That is, they may not go to work and take sick leave simply because of their age - even if they have never been abroad and have not had contact with those who returned from another country. Similar measures were taken in the Moscow region.

The main difference between electronic sick leave for quarantine and for a common illness is that the electronic sick leave due to coronavirus is issued remotely

when submitting an application, and for a regular ARVI - only after examination by a doctor and recovery. That is, if a Russian gets sick, he goes to the clinic for an appointment or calls a doctor. In this case, the patient indicates that he wants to issue a sick leave electronically. He will be given sick leave only after recovery.

An electronic certificate of incapacity for work under quarantine due to COVID-19 is issued on the day the application is submitted

. The quarantine period is always strictly 14 days (it is believed that during this period a patient with coronavirus will definitely develop symptoms). Since the quarantine period is known, and there is no need to examine the patient, an electronic sick leave is issued immediately after the application.

New rules for issuing electronic sick leave due to the coronavirus pandemic came into force on March 20, 2020

. They will be valid until July 1, 2022 in accordance with Decree of the Government of the Russian Federation of March 18, 2020 No. 294.