Purpose, procedure for specifying UIN

UIN is a digital code that was introduced in order to track all fees coming into the country’s budget system from individuals and legal entities. It is part of the State Information System (on state municipal payments) (GIS GMP).

The UIN is established for all types of payment for funds that are redirected to state income. Thanks to the UIN, cash payments are identified by the GIS and are received at their destination.

The rules approved by the relevant order of the Ministry of Finance and prescribing how data must be designated in the structure of payment orders sending money to the country’s budget came into force on February 4, 2014.

One of the requirements is that the UIN code must be indicated in payment documents.

By the beginning of April 2014, it was placed in a cell marked with the words “Purpose of payment.” Then, to this day, all UIN numbers are entered in the “Code” field, conventionally designated by the number 22. Since last year, there has been an order according to which the UIN code must be indicated in payment orders. Without it, it is impossible to transfer funds to institutions that are financed from the budget.

Why do you need a UIN?

To implement the tasks set by Federal Law No. 210-FZ, the Procedure for maintaining the State Information System on state and municipal payments, approved by Order of the Treasury of the Russian Federation dated November 30, 2012 No. 19n, came into force on January 1, 2013 (hereinafter referred to as the Procedure).

The order determines:

- rules for access to GIS GMP;

- a list of information necessary to pay for state and municipal services and make payments, the procedure for receiving and providing it;

- a list of information on payment for state and municipal services and making payments, the procedure for receiving and providing it.

Participants in the GIS GMP can be:

- money transfer operator;

- organization of federal postal services;

- territorial body of the Treasury of the Russian Federation, another body that opens and maintains personal accounts in accordance with the budget legislation of the Russian Federation;

- local administration;

- bank payment agent;

- bank payment subagent;

- payment agent;

- payment subagent;

- operator of the Unified portal of state and municipal services (functions);

- operator of the regional portal of state and municipal services (functions);

- multifunctional center for the provision of state and municipal services;

- budget revenue administrator, state (municipal) budgetary or autonomous institution (accruals administrator);

- the chief administrator of budget revenues, including being the administrator of budget revenues, having in charge the administrators of budget revenues and (or) exercising the powers of the founder in relation to administrators of accruals - state (municipal) budgetary and autonomous institutions, as well as the state authority of the subject determined by the subject of the Russian Federation RF (local government body), providing information interaction between the GIS GMP operator and accrual administrators.

Information interaction of participants (with the exception of the Treasury of the Russian Federation) with the operator of the GIS GMP is carried out after completing the registration procedure only in electronic form through a unified system of interdepartmental electronic interaction (SMEI), provided for by Decree of the Government of the Russian Federation of September 8, 2010 No. 697, using an enhanced qualified electronic signature participant in accordance with the formats for interaction of the GIS GMP with the information systems of participants established by the Treasury of the Russian Federation and posted on the website of this department on the Internet.

Participants' access to the GIS GMP is provided around the clock. The GIS GMP uses two types of identifiers:

- payer identifier (IP);

- unique accrual identifier (UIN).

The order of formation of identifiers and acceptable identifiers are determined by interaction formats.

Payer ID (IP). A notice of accrual, a notice of cancellation of an accrual, a notice of clarification of an accrual sent by a participant to the GIS GMP operator must contain an IP.

A notice of acceptance for execution of an order, a notice of cancellation of information about acceptance for execution of an order, a notice of clarification of information about acceptance for execution of an order, sent by a participant to the operator of the GIS GMP, must contain an individual entrepreneur if it is available. If the IP is not available, zeros (“0”) are entered in the corresponding fields of the specified notices.

IP includes an identifier for information about an individual or an identifier for information about a legal entity.

The following are used as identifiers of information about an individual:

- insurance number of the individual personal account of the insured person in the PFR personalized accounting system (SNILS);

- taxpayer identification number (TIN);

- series and number of the identity document;

- driver's license series and number;

- series and number of the vehicle registration certificate with the Ministry of Internal Affairs;

- registration code of the Federal Migration Service;

- other identifiers of information about an individual, used in accordance with the legislation of the Russian Federation.

One of the following identifiers is used as an identifier for information about a legal entity:

- taxpayer identification number (TIN) together with the reason code for registering a legal entity with the tax authority (KPP);

- code of a foreign organization (FIO) together with the code of the reason for registration with the tax authority (KPP) of a legal entity.

Unique accrual identifier (UIN).

A notice of accrual, a notice of cancellation of an accrual, a notice of clarification of an accrual sent by the participant to the GIS GMP operator must contain the UIN. A notice of acceptance for execution of an order, a notice of cancellation of information about acceptance for execution of an order, a notice of clarification of information about acceptance for execution of an order, sent by the participant to the operator of the GIS GMP, must contain the UIN (if available). If the UIN is not available, zeros (“0”) are entered in the corresponding fields of the specified notices.

Application of identifiers. The corresponding explanations are given in the Letter of the Ministry of Finance of the Russian Federation No. 02-04-05/7491, the Treasury of the Russian Federation No. 42-7.4-05/5.4-147 dated March 12, 2013 “On the State Information System on State and Municipal Payments.”

For payers who are legal entities, it is recommended to indicate identifiers taking into account the following.

As for individual entrepreneurs, the taxpayer identification number (TIN) together with the reason code for registration with the tax authority (KPP) or the code of a foreign organization (FCI) together with the reason code for registration with the tax authority (KPP) is indicated in the details of the "TIN" order. and the payer's checkpoint.

The UIN (if the payer has it) is indicated in the order details “Purpose of payment” after indicating the text information provided for by Regulation No. 383-P.

It is recommended to reflect the UIN in the “Purpose of payment” details of the order, taking into account the following features:

- to highlight information about the UIN after indicating the text information provided for by Regulation No. 383-P, the symbol “///” is used;

- The UIN is indicated without spaces in the following order: “UINX...X”, where X...X is the UIN value (20 characters);

- if the author of the order does not have information about the UIN, the value “0” is entered, for example: “///UIN0”.

For payers - individuals and individual entrepreneurs, it is recommended to use identifiers taking into account the following.

IP is applied as follows:

- if the payer indicates a taxpayer identification number (TIN), the individual entrepreneur is indicated in the “TIN” details of the payer of the order;

- If the order does not contain the value of the payer’s “TIN” detail, another individual entrepreneur provided for by the Procedure, it is recommended to reflect the order in the “Purpose of payment” detail after indicating the text information established by Regulation No. 383-P.

- The UIN (if the payer has it) is indicated in the “Purpose of payment” detail of the order after specifying the text information defined by Regulation No. 383-P.

It is recommended to indicate identifiers in the “Purpose of payment” details of the order, taking into account the following features:

- to highlight information about identifiers after reflecting the text information provided for by Regulation No. 383-P, the symbol “///” is used;

- a semicolon (“;”) is used as a separator between UIN and individual entrepreneur, for example: “UIN...;IP...”;

- identifiers are indicated without spaces in the following sequence: “UINX...X;IPZZ;Y...Y”, where X...X is the value of UIN (20 characters), ZZ can take one of the values given below in the table (presented in abbreviated form), and Y...Y is the PI value (the number of characters in the corresponding document, but not more than 20 characters).

| Type (ZZ) | Meaning |

| 01 | Passport of a citizen of the Russian Federation |

| 05 | Serviceman's military ID |

| 13 | Passport of a citizen of the USSR |

| 14 | Insurance number of the individual personal account of the insured person in the PFR personalized accounting system (SNILS) |

| 22 | Driver's license |

| 23 | Registration code of the Federal Migration Service |

| 24 | Certificate of registration of the vehicle with the Ministry of Internal Affairs |

- a semicolon (“;”) is used as a separator between the value of the document type (in accordance with the table above) and the series and number of the document, for example: “ПЗZ;Y…Y”;

- in an individual entrepreneur, the series and number of the document (for example, 01 – passport of a citizen of the Russian Federation) are indicated without a space, for example: “///UIN0; IP01;0201251245";

- if the originator of the order does not have information about any of the identifiers, the value “0” is indicated instead of the missing identifier, for example: “///UIN0;IPZZ;Y...Y”, “UINX...X;IP0”;

- if the order contains the payer’s “TIN” details, the individual entrepreneur is not indicated, for example: “UINX...X” or

- "///UIN0";

- if the order does not contain the value of the payer’s “TIN” details and the author of the order does not indicate information about any of the identifiers, the value “0” is entered, for example: “///UIN0;IP0”.

How and where to get a UIN - step-by-step instructions

To pay the required amount and indicate the UIN in the payment document, an enterprise or individual entrepreneur must:

| Steps | Content |

| 1. | Receive an official request from the relevant organization, which indicates the need to pay a penalty, fine or arrears |

| 2. | Find the UIN in the document |

| 3. | Carefully transfer all the numbers to the payment slip: cell 22 “Code”. The corresponding field is located at the bottom of the payment document |

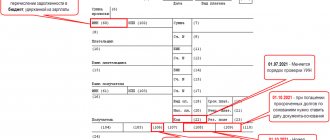

Each field of the payment slip is assigned a conditional numeric number. In the excerpt from the payment slip below, they are highlighted in black. The UIN field is marked in red. The corresponding part of the payment order looks like this:

| PAYMENT ORDER No. | |||||||||||||||

| Type of payment | (18) | Payment due date | (19) | ||||||||||||

| Payment name | (20) | Sequence of payments | (21) | ||||||||||||

| Recipient (16) | Code | 22 | R. field | (23) | |||||||||||

| (104) | (105) | (106) | (107) | (108) | (109) | (110) | |||||||||

Important! The UIN code cannot be found in any table or directory. There are no lists where it is indicated. The name of the code indicates that the UIN is unique. This means that it is not repeated and each specific payment is assigned its own set of numbers.

The UIN is contained in the payment request, which comes from a certain regulatory authority. Thus, to determine the UIN, you must carefully study the receipt or notice; the code must be present in this document.

What is indicated in field number 22

There are only two options:

- If the request received from certain authorities contains a UIN, it must be transferred number by number to the payment slip (field 22).

- When the UIN is missing, the number 0 (without quotes) is entered in field 22.

If there is a UIN on the payment:

- the money will go exactly to the specified address;

- recipients of the payment will be able to correctly identify it and record it in the relevant documentation.

If the payer is an ordinary person, and his payment is not related to business, it is enough to present a notice to the operator at the bank, deposit the specified amount and receive a receipt confirming its payment.

UIN: what is it and where to get it

To use the online service for finding fines, you must enter a unique code in the required field. A combination of twenty numbers (or twenty-five) can be found in the resolution issued by the traffic police inspector. The resolution is issued in two cases:

How is the payment number generated?

On a note! There are no lists or tables that contain all the UINs of a particular organization. For each payment, its own unique combination of symbols is developed, which is never repeated.

- The inspectorate assessed penalties for non-payment of taxes . If there was a beneficial request from the payer to offset the amount paid, then you should additionally ask the tax office to recalculate the accrued penalties. If the tax office refuses to do this, going to court will most likely allow for a recalculation (there is a rich case law with similar precedents).

- The BCC does not correspond to the payment specified in the assignment . If the error is “within one tax”, for example, the KBK is indicated on the USN-6, and the payment basis is indicated on the USN-15, then the tax office usually easily makes a re-offset. If the KBK does not completely correspond to the basis of the payment, for example, a businessman was going to pay personal income tax, but indicated the KBK belonging to the VAT, the tax office often refuses to clarify, but the court is almost always on the side of the taxpayer.

- Due to an error in the KBK, insurance premiums were unpaid . If the funds do not reach the required treasury account, this is almost inevitably fraught with fines and penalties. The entrepreneur should repeat the payment as quickly as possible with the correct details in order to reduce the amount of possible penalties. Then the money paid by mistake must be returned (you can also count it against future payments). To do this, an application is sent to the authority to whose account the money was transferred erroneously. Failure to comply with a request for a refund or re-credit is a reason to go to court.

- The funds entered the planned fund, but under the wrong heading . For example, the payment slip indicated the KBK for the funded portion of the pension, but they intended to pay for the insurance portion. In such cases, contributions are still considered to have been made on time, and you must proceed in the same way as under the usual procedure. The court can help with any problems with a fund that refuses to make a recalculation, and an illegal demand for payment of arrears and the accrual of penalties.

- scroll a little higher - most of them have been published by us;

- at the State Treasury (by calling, sending a request or making a visit);

- Order of the Ministry of Finance No. 65N contains all the information about the BCC;

- When making payments online on many services, BCCs are entered automatically.

We recommend that you read: Transport tax 2022 Kazakhstan

What are the consequences of an error in the KBK?

Each group of characters corresponds to an encrypted meaning determined by the Ministry of Finance. Let's consider the structure of the profitable BCC, since they are the ones that entrepreneurs mainly have to use (expense codes can be found mainly when returning funds under any government program).

A unique identification number is used to transfer fiscal payments (taxes, fees, contributions, fines, penalties), state fees for public services, as well as when making payments to the federal and municipal budgets (fees for kindergarten and school). If the number is incorrectly specified, the listed funds will be incorrectly identified and “stuck” as unknown.

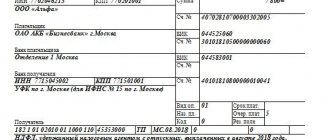

UIN in a payment order, sample

In the sample payment below, the UIN is located in cell 22, where it should be.

Sample of filling out a payment order:

| PAYMENT ORDER No. 520 | 18.10.2016 | 03 |

| date | Payment type |

| Suma in cuirsive | Twenty thousand rubles 00 kopecks | ||||||||||

| TIN 8203183654 | Gearbox 8202230822 | Sum | 20 000,00 | ||||||||

| LLC "Sladkoezhka" | |||||||||||

| Account No. | 40125600000802156877 | ||||||||||

| Payer | |||||||||||

| Bank "Ogonyok" | BIC | 048321658 | |||||||||

| Account No. | 30101018060000007586 | ||||||||||

| Payer's bank | |||||||||||

| Department 4 Yekaterinburg | BIC | 048385002 | |||||||||

| Account No. | 10501832100000023584 | ||||||||||

| payee's bank | |||||||||||

| TIN 7785687879 | Gearbox 778680203 | Account No. | |||||||||

| UFK for the city of Yekaterinburg (Inspectorate of the Federal Tax Service of Russia No. 25 for the city of Yekaterinburg) | |||||||||||

| Type of payment | 02 | Payment deadline. | |||||||||

| Purpose of payment | Next pl. | 5 | |||||||||

| Recipient | Code | 18210102012211001457 | R. field | ||||||||

| 18201204561459654873 | 45331478 | TP | MS.09.2016 | 0 | 0 | ||||||

| Tax penalty on request No. 55 dated October 17, 2016 | |||||||||||

The sample payment slip shows that the UIN occupies two lines, since it does not fit in one. The Bank of the Russian Federation allowed this way to fill out the document. The font can be reduced so that all twenty digits of the UIN fit in the cell.

As noted above, in the absence of a resolution or decision, payment can be made independently. In cell 22 you must enter the number 0. The payment will be sent to the address and will not get lost in the ocean of other documents.

Important! Field 22 cannot be left empty (unfilled). It must contain either 20 digits of the UIN or a zero (0).

What is UIN when paying state duty?

If an entrepreneur planning to make a payment to the tax authority works according to the “simplified” system, when generating a payment order, he must indicate a zero UIN value. In this case, in field 104 you should indicate the code in accordance with the current KBK directory.

Most Russians, faced with the need to fill out documents to pay state fees, are wondering where to get the UIN for a payment order? Such code cannot be found in any reference books. As mentioned above, it is formed only by the tax authorities and the traffic police. Other budget recipients, as a rule, do not assign a code to completed payment transactions. That is why zero values are usually entered in the UIN field of the payment slip.

We recommend reading: Removing a House from Cadastral Registration Based on a Court Decision Claim

Decoding the code in the UIN data

The UIN contains four parts:

| Code numbers | Decoding |

| From 1 to 3 | Indicates the recipient of the payment: the administrator of budget revenues, the executive authority. For example, for the tax office – 182 |

| 4 | This code number is not yet used. For this reason, a zero is placed in place of the fourth digit |

| From 5 to 19 | A specific payment number is hidden under fifteen digits. They act as a document index |

| 20 | This is a control number calculated using a special algorithm |

Important! The UIN and index are identical only when the latter contains 20 digits.

UIN and UIP in payment: the difference

The main thing is that the UIP/UIN code in 2022, when generating a payment order, has a unique composition of symbols. This will allow the money not to get stuck in the payment system and reach the recipient on time. And the most important thing: the administrator of this payment (for example, the Tax Service of the Russian Federation) will understand exactly what debt to the treasury or sanction is covered by the funds sent by the person.

In practice, in a decree for a tax or other payment, it is usually the accrual identifier that is indicated, and when you see the payment slip in front of you, there is no detail with the accrual identifier, but only the payment identifier. What should I do?

Where and in what cases is the UIN indicated?

The code should be indicated when filling out payment orders for transferring funds to budget organizations. A whole field is allocated for the UIN in the payment document, designated conventionally as “22”. With the help of the UIN, payments of business entities and ordinary citizens, directed to the country’s budget, are recorded.

This year, the code is required in a payment order for payment made at the request of the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund, and the State Traffic Safety Inspectorate:

- Arrears.

- Peni.

- Fine.

- State duties.

UIN assignment

UIN (unique accrual identifier) is a number assigned by the fiscal authority (payee) and indicated in the payment request.

It serves to speed up the process of recognizing the sender of funds using specialized software that records the receipt of money for payment of taxes and fees. Field “22” of the payment document is intended for entering UIN numbers, and filling it out has become mandatory since 2022. When there is no data to fill in a field, it should contain a zero.

The tax service argued that the UIN number is useless, since the taxpayer can be identified by his TIN, which must be entered into the payment order. However, the bank whose services you use to make payments will refuse to transfer money if field “22” is empty, based on the relevant Regulations of the Central Bank of the Russian Federation.

UIN: how to find out where to indicate and what it is needed for

- If taxes are transferred by an individual entrepreneur or a legal entity. These payers prescribe the KBK code. If you need to specify additional data for payment, then the following is written: “UIN0///. (necessary information for identification)".

- An individual pays property tax. The identifier is the document index.

- When paying for medical services. If there is no information on this matter on the official website of the medical institution, then in the “UIN” column of the payment document, simply put the number “0”.

- Non-cash payments sent by entrepreneurs. Here, too, in the field for entering this identifier, it is enough to enter “0”.

This number greatly simplifies the distribution of remittances to the state budget. After its introduction, the share of unidentified revenues—tax, customs, etc.—reduced significantly. The code must be specified when:

If UIN is specified, is KBC needed?

The only difference between these two codes is the organizations that assigned them. UIN is an identifier of payments received only to the budget (it is assigned by the tax office, pension fund, social insurance, traffic police, etc.), while the UIP code can be assigned by ordinary organizations - recipients of payments, which thus encrypt information about the payment by agreement.

We recommend reading: Part-time job collecting pens at home

The introduction of the UIN number has speeded up the time it takes for payments to be received by the budget, since the received “budget” amount is credited immediately using this unique code, and there is no need to waste time checking other payer details (TIN/KPP).

What is a budget classification code

The basic principle of operation is hidden in the structure of this code. To understand, you need to know the decoding and designations of each number. Knowing these tricks, looking at the code, you can determine what the payment is for.

- on the official websites of government agencies;

- on websites intended for filling out payment documents;

- come to the tax office or other organization and ask for payment details on paper;

- see order of the Ministry of Finance No. 65n.

Kbk And Win Are The Same

If a company transfers a payment that it has calculated itself (for example, an advance on income tax on a due date), it does not have a UIN. In this case, the payment is identified by KBK, INN and KPP. But the banks still demanded that field 22 be filled in in this case as well.

The UIN is indicated in the inspection request. And the payer must transfer this TIN to his payment slip. If the request does not contain a UIN, you must enter 0 on the payment slip (clause 10 of Appendix No. 4 to Order of the Ministry of Finance No. 107n). For all current payments, this field must be entered - 0 (FSS letter dated 02.21.14 No. 17-03-11/14-2337).

Unique accrual identifier

When receiving a request to pay taxes (contributions) from a tax or other fund, you must pay attention to whether this document contains a 20-digit unique identifier code (UIN). If it is available, then when generating a payment document, the UIN must be entered in the “Code” field. For example, UIN 98765432109876543210. If the UIN code is not specified, then, just like with a voluntary payment, you must enter zero in this field.

In the absence of notification from the tax authority, individuals have the opportunity to independently generate a payment document. There is an Internet service on the website of the Federal Tax Service of Russia that allows the taxpayer to generate receipts for payment, and the document index (UIN) is assigned automatically.

How to find out the budget classification code? What is KBK

If suddenly parents need to find the school’s budget classification code when paying for meals, how can they find it out? Very simple. All receipts provided have a separate field indicating the BCC of a specific organization.

Thanks to this block, called a program or subprogram and consisting of four numbers, the types of payments that go to the revenue side of the state budget are detailed. For example, the code “2000” means penalties and interest, “1000” means taxes, “3000” means fines.

Kbk and win are the same thing or not

Speaking about the features of the unique accrual identifier, it is worth emphasizing once again that this parameter is unique. At the same time, the UIN code is formed only by budget authorities. Under no circumstances does the payer have the right or opportunity to independently come up with this code. By specifying an invented code, the payer risks that his payment may not reach its destination. Accordingly, it will be considered imperfect.

When paying taxes, the payer does not necessarily need to indicate the UIN code if the payment is carried out on time and completely independently. In such a situation, the completed payment can be identified in a different way, and if the payer independently transfers current contributions and payments, he can also enter a zero value in the field for this code.

UIN in the payment code details, field 22

And the Central Bank of the Russian Federation issued Directive No. 3025-U dated July 15, 2013 On amending the Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds”, which introduced its own unique identifier - a unique identifier payment - UIP, which is affixed to payments in cases where it is appropriated by the recipient of funds. The unique payment identifier is communicated by the recipient of funds to the payer in accordance with the agreement. The Bank established that “In orders for the transfer of funds to the budget system of the Russian Federation

a unique payment identifier is indicated in accordance with the requirements of regulatory legal acts adopted by federal executive authorities jointly or in agreement with the Bank of Russia.” And this identifier will be indicated in a special field of the payment order.

Interesting: Is it possible to tow a CVT?

Kbk and win are the same thing or not

This form contains the checkpoint and TIN of the recipient, the address of the intermediary company through which the payment passes, and the personal data of the payer. But recently, payment of fines can also be made through online services, which allow you to fill out all the fields without leaving your home, and you do not need to physically be in the bank, waiting for your turn.

We recommend reading: What benefits are available to a military veteran of federal significance?

The Ministry of Finance decree that this indicator must be indicated in payment documents was adopted at the beginning of 2022. After this resolution came into force, a unique identifier was entered into form 0504510 “Receipt” as a mandatory detail.

What is UIN in Sberbank online: payment code

A unique payment identifier is generated by the budgetary institution independently. It is necessary to carry out correct accounting of each transfer to a state budgetary authority, including: tax, customs authorities, preschool children's institutions, etc. What is a UIN in Sberbank Online in this case is the index of the document required to indicate when paying:

- In your personal account, enter payment information.

- Activate the "Information" field.

- Receive a check with a 20-digit “Payer Identifier” indicated.

- In Sberbank Online, when filling out payment data in the “UIN” field, indicate the payer’s ID from the check.

- For each payment you need to get your code by going through the whole process again.