Home • Blog • Blog for entrepreneurs • Minimum salary in 2021

November 19, 2021

723

2

The minimum wage in 2022 for an employee who has worked a certain standard, as in previous years, has a fixed established amount, in accordance with Article 133 of the Labor Code of the Russian Federation. Thus, if an employer for some reason does not pay an employee an amount earned above the established minimum wage in a country or region, penalties may be imposed on him. Depending on the form of business registration, the size of fines varies: from 10,000 rubles (for individual entrepreneurs) and from 30,000 rubles (for enterprises). We will tell you in more detail about all aspects and features of wage payments to employees of enterprises, as well as about methods for calculating wages in this article.

A new method for determining the size of the minimum wage

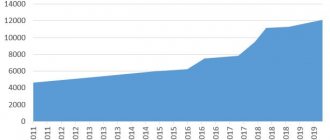

The approach to determining the minimum wage has changed significantly: from January 1, 2021, the calculation criterion is not the subsistence level of the population, but a more accurate indicator - the median salary.

In this regard, the minimum wage in the Russian Federation today is 12,792 rubles.

Median per capita income is an indicator according to which the same number of people receive income above and below a given value. This indicator is approved on the basis of collected statistical information from Rosstat.

For 2022, the percentage ratio of the minimum wage and median income is set at 42%. At the same time, the percentage value is planned to be revised every five years, taking into account the state of the economy and social sphere.

The calculation of sick leave, maternity and child benefits depends on the size of the minimum wage (see more details New rules for calculating sick leave)

Note: This article does not discuss changes regarding the minimum wage for individual industries.

If the employees’ salary for the fully worked December 2020 was lower than this indicator (before personal income tax withholding), then they are entitled to indexation of earnings.

Old method of calculating the minimum wage

In 2022, the minimum wage in force in the Russian Federation was 12,130 rubles; it was calculated based on the subsistence level of the working-age population based on the results of the second quarter of 2019.

If the minimum wage were calculated according to the old method, then its size in 2021 would be 12,392 rubles, which is exactly the cost of living that was established based on the results of the second quarter of this year.

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2022

Online cash register for dummies

Did you like the article? Share it on social networks.

- Marina Zhukova 09.13.2021 18:22

Comment: The cleaning company receives money from the customer from m2 and pays the employee for 4 hours. that is, 9400 rubles per 1000 m2. but according to the Decree of the State Labor Committee of December 29, 1990 No. 469, washing floors with an average clutter of 300 m2 takes 2 hours and 52 minutes. and the company puts 8 hours on the employee report card. The question is how should wages be calculated?Answer

Maxim 09.20.2021 15:50Comment Good afternoon! We find it difficult to answer your question; we recommend that you contact a specialized specialist with an accounting education.

Add a comment Cancel reply

Also read:

Digital platform for small and medium-sized businesses in 2021

The Russian Ministry of Economic Development will launch a digital platform for small and medium-sized businesses by the end of 2022.

The project is currently being tested, but the final version will be launched by the end of December this year. Thanks to the development of a digital platform for business, entrepreneurs and enterprises will be able to gain access to ordering the necessary services using this platform: searching for purchases, obtaining preferential lending conditions, receiving subsidies, as well as... 678 Find out more

Economic census of small businesses - new report to Rosstat in 2021

The economic census of small businesses, according to government decree, should be conducted again in 2022.

Rosstat will conduct continuous static monitoring of all enterprises that fall under the category of small and medium-sized businesses. This means that all individual entrepreneurs, small and micro organizations are required to submit reports to the Federal State Statistics Service containing certain information about their enterprises collected for 2022. Open a current account for… 760 Find out more

Business inspections in 2022: what inspections await individual entrepreneurs, plan

Business inspections in 2022 will take place according to a plan that was drawn up in advance by the Prosecutor General’s Office.

This plan was formed to control the activities of legal entities, as well as individual entrepreneurs. You can familiarize yourself with the contents of the drawn up plan on the official website of the prosecutor's office. There you can see whether your company is included in the list of those being inspected. The service is quite thoughtful and convenient; to clarify the necessary information, you need to enter your Taxpayer Identification Number... 1046 Find out more

How the tax office will check online cash registers. Fines in 2021

Tax checks on cash registers resumed in 2022 - the moratorium imposed due to the sudden outbreak of the Covid-19 virus pandemic has ended and from now on control activities will take place as usual. The main goal of these checks, as before, is to motivate entrepreneurs and organizations to use online cash registers when making payments to consumers, as well as to increase the amount of incoming tax payments. If violations are detected during inspections, the Tax Service will...795 Find out more

Consequences of paying wages below the minimum wage

Let us remind you that in accordance with Art. 133 of the Labor Code of the Russian Federation, the minimum wage of an employee who has worked fully for a month must correspond to the level of the minimum wage .

However, on the basis of Art. 129 of the Labor Code of the Russian Federation allows that wages less than the minimum wage can be established only for personnel who work part-time or part-time.

If, taking into account all the allowances and payments, the employee’s salary for a full month does not reach the minimum wage, then additional payment must be made .

The employer must be aware that if he does not adhere to the minimum wage when forming the wage fund, then the Labor Inspectorate may apply the following penalties against him based on Part 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation:

| Case of finding of violation | Penalties, rubles | |

| for officials | for a legal entity | |

| Primary | 10,000 – 20,000 rub. | 30,000 – 50,000 rub. |

| Repeated | 20,000 – 30,000 rub. | 50,000 – 100,000 rub. |

In this case, for officials, a fine may be replaced by the following measures:

- a warning may be issued ;

- Repeated violation may result in disqualification from one to three years .

Regarding the wages of part-time workers, Rostrud specialists note that here it is also necessary to adhere to the minimum wage, only the calculation must be carried out in proportion to the time worked .

Are additional payments taken into account when calculating the minimum wage?

The new edition of the Labor Code does not contain instructions regarding the mandatory inclusion of compensation and incentive payments (additional payments for length of service, incentive bonuses, etc.) in the minimum wage.

Here, only the condition is stipulated about the payment of a minimum wage not lower than the minimum wage when the norm of hours worked is fulfilled.

Such a statement of the rules for calculating wages does not provide a clear answer to questions about the legality of including various payments in the total amount of monthly earnings.

According to the Labor Code, salary is considered a remuneration, the payment of which takes into account the volume, quality and conditions of work. The previous edition of the Labor Code clearly stated that compensation and incentive additional payments are included in total earnings.

Therefore, some employers believe that it is possible, as before, to assign employees a salary of 10,000 rubles, and then bring it up to the minimum wage with the help of various additional payments.

The approach to calculating the minimum wage has changed

The Constitutional Court of the Russian Federation made adjustments to the understanding of this issue, and specifically pointed out payments that are not included in the minimum wage, but are assigned in the form of additional amounts.

According to the decisions of the Constitutional Court (which employers are obliged to strictly implement), excess payments include:

- Compensatory additional payments for overtime, work on non-working holidays and weekends, as well as at night.

- Additional payments for performing work in place of a temporarily absent employee, part-time work, or servicing excess units of production equipment.

- Allowances taking into account regional coefficients when working in the Far North.

The Resolution of the Supreme Council of the Russian Federation regarding incentive payments (bonuses) states that they should also not be included in the amount of the minimum wage (Resolution of the Supreme Council of the Russian Federation dated February 10, 2020 No. 65-AD20-1).

Thus, all basic compensation and incentive payments are currently not included in the minimum wage . In order not to violate the new rules, employers must control the amount of salaries included in employment contracts, taking into account the impossibility of bringing earnings to the minimum wage through incentive payments and compensation.

Level adopted for 2020

Now in Russia the minimum wage is 11,280 rubles. From January 1, 2020, the fixed rate will be increased to 12,130 rubles. Employees cannot receive monthly income below a fixed amount if all work time standards for the specified period have been met.

The minimum income does not include:

- Coefficients that were adopted by region and other regional allowances. They are paid if the employee works in certain climatic zones. In particular, in the Far North or in regions equivalent to it, including in the highlands and desert areas.

- Additional payments for work above the allotted norm: at night, on holidays and weekends.

The new minimum wage indicator is set annually from January 1. The Labor Code of the Russian Federation stipulates that the minimum wage should not be lower than the subsistence level. But it also says that the exact indicator of income is established in the Federal Law. This is what made it possible to take advantage of the shortfall until 2022 and accept a minimum wage below the subsistence level. In 2022, these figures are equal.

5 / 5 ( 1 voice )

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Minimum wage for branch employees

Sometimes situations arise when the head office of a company (organization, LLC) is located in one region, and a branch in another. Since the minimum wage may vary in regions, the question arises: which one should we focus on when forming the wage fund?

In accordance with Art. 133.1 of the Labor Code of the Russian Federation, when determining the wage fund for personnel, it is necessary to adhere to the value of the minimum wage that is established in the region where the employee actually performs his job duties .

But! This provision does not apply to institutions whose activities are supported by the federal budget.

Consequently, when determining the wage fund for branch employees, it is necessary to adhere to the regional minimum wage established at the location of the branch.

In what cases can the minimum wage be lower than the minimum wage?

This situation is possible when working part-time or when paying people who combine work and study.

Experts from the Federal Service for Labor and Employment explain that the earnings of people in such categories are also calculated in accordance with the established minimum wage in the country, but it is calculated taking into account the time worked . Specific criteria for calculating wages for part-time jobs are specified in the employment contract (for example, payment is made in proportion to production output).

The part-time worker’s earnings must not be lower than the minimum wage, proportional to the time actually worked.

Example: A student combines work in a company with studying at a university.

With a 40-hour work week, her monthly earnings would be 13,000 rubles. However, according to the contract, she works only 30 hours a week, so she receives 9,750 rubles. (13000: 40 x 30 = 9750).

The same principle is used to pay for the work of part-time workers, as well as people who worked part-time due to illness or being on vacation. Earnings are compared with the minimum wage, taken in proportion to the time worked.

The value of the regional minimum wage

In accordance with the current rules of Art. 133.1 of the Labor Code of the Russian Federation, regions can set their own minimum wage in accordance with the current economic and social situation.

At the same time, the regional minimum wage cannot be less than the federal value . Consequently, the authorities of a constituent entity of the Russian Federation may assign an increased size or exactly the same.

If the employer does not want to adhere to the regional minimum wage, then he must inform the territorial labor inspectorate of the relevant decision within thirty days. If the refusal is not sent, it will be regarded as consent.

Table with regional minimum wage values (current as of 03/01/2021).

It is worth noting that in Moscow and St. Petersburg the highest values are set: 20,589 rubles. and 19,000 rub. respectively.

However, in St. Petersburg, the minimum wage at the federal level is set at 12,792 rubles for public sector workers.

Minimum wage in Moscow for 2022

The minimum wage in Moscow is set at the subsistence level of the working population of the city - 20,589 rubles.

Reason: “Moscow tripartite agreement for 2022 - 2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations” (Concluded in Moscow on October 1, 2018 N 77-1094).

Minimum wage in the Moscow region for 2022

The minimum wage in the Moscow region for employees of legal entities and individuals (with the exception of employees of organizations financed from the federal budget) is set at 15,000 rubles. “Agreement on the minimum wage in the Moscow region” dated October 31, 2019 N 243.

Minimum wage in St. Petersburg for 2022

The minimum wage in St. Petersburg for employees of non-budgetary organizations is set at 19,000 rubles. In this case, the tariff rate of a worker (employee) of the 1st category, the salary (official salary) of the employee should not be less than 14,300 rubles.

For public sector employees, the minimum salary is set at 12,792 rubles.

Basis: “Regional agreement on the minimum wage in St. Petersburg for 2022” (Concluded in St. Petersburg on December 27, 2019 N 343/19-C).

How the minimum salary is set in different regions

Since the cost of living differs in different subjects of the federation, regional authorities can determine the minimum salary in Russia in a certain area for citizens living there. The minimum wage at the regional level is specified in a tripartite agreement:

- governments of the constituent entities of the Russian Federation;

- union associations;

- Union of Industrialists and Entrepreneurs.

From the moment the agreement is officially published, all organizations and companies automatically participate in the adopted program. But employers may not join the regional minimum wage program in Russia established for a given region. To refuse to participate in the agreement, you must present documents within 30 days from the date of publication of the agreement.

It is impossible to refuse to join the agreement at your own request without giving reasons. In order not to participate in the program, you must provide a compelling reason. Objective arguments include:

- starting a business;

- financial problems in the company;

- emergencies.

But the reason for the refusal must be proven documented - with statements from the accounting department or certificates from the Ministry of Emergency Situations.

Some minimum wage indicators adopted by region:

| Territory | Set level |

| Murmansk region | 25,675 rubles including additional payments for work in the North |

| Nenets Autonomous Okrug | 18,567 rubles for commercial companies and 12,130 for budgetary organizations |

| Moscow region | 14200 rubles |

| Moscow | 20195 rubles |

| Leningrad region | 12130 rubles |

| Saint Petersburg | 17,000 rubles, taking into account the fact that the salary of a 1st category worker cannot be less than 13,500 rubles, and for state employees - 12,130 rubles. |

| Basic minimum wage in Russia, set for 2022 | 11280 rubles |

Requirements for setting the regional minimum wage in Russia:

- the lowest income in the region cannot be less than the federal minimum wage;

- The minimum salary is determined taking into account the local cost of living and other living conditions in a particular region.

The regional government determines the minimum salary in the Russian Federation for all institutions and companies, except those where funding comes from the federal budget.