Payment form and its details

The payment order form (OKUD 0401060) was approved by Bank of Russia Regulation No. 762-P dated June 29, 2021.

This is one of the key changes in payment orders: from October 1, 2022, fields 101, 106, 108 and 109 are filled out in a new way, and from September 10, 2022, a new payment form is used. It is allowed to prepare the PP on paper or online, for example, using a special service of the Federal Tax Service or accounting programs. Whatever method the payer uses, the filling rules will not change. The only thing is that the programs fill in some of the details automatically, which significantly speeds up the process.

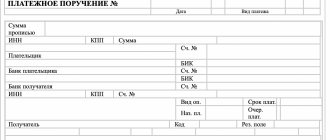

To make it easier to understand the order in which each field is filled out, it is assigned a number. This is a sample of the fields in a payment order in 2022:

The rules for filling out the payment form are given in Order of the Ministry of Finance No. 107n dated October 12, 2013. And Order of the Ministry of Finance No. 199n dated September 14, 2020 made adjustments to the procedure for filling out payment slips from October 1, 2022 - changed the order of filling out fields 101, 106, 108 and 109 (Federal Tax Service letter No. KCH-4-8 / [email protected] dated September 20, 2021 ).

Significant errors

A standard form is provided for the payment order.

Payments for the transfer of tax payments are filled out in a special order.

Two significant errors in payment orders for the payment of taxes that entail the accrual of financial sanctions are recognized: incorrect indication of the recipient's account (treasury) and the name of the bank (clause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

In this case, the payment is considered unfulfilled and must be transferred again. At the same time, there will be penalties for late payment of taxes or insurance contributions.

Failure to fulfill the obligation to pay tax is the basis for the application of measures of forced execution of the obligation to pay tax provided for by the Tax Code (Clause 6, Article 45 of the Tax Code of the Russian Federation).

Step-by-step instructions for filling out a payment order

First of all, the payer must indicate the type of payment in the payment order in 2022, the number and date of the document. Next, the executor writes down his own name and the name of the recipient, account numbers and certain codes, which will make it clear who transferred the money, how much and for what.

Let's look at some fields in detail.

Fields 3, 4, 5: number (in accordance with the internal numbering of payment documents), date, type of payment (possibly bank code).

In fields 6 and 7 indicate the amounts that the payer sends to pay taxes or pay for goods, in words and then in numbers. The words “ruble” and “kopecks” in the required form should not be abbreviated.

Examples of correct entries for fields 6 and 7:

in words: fifteen thousand two hundred and forty rubles, in numbers: 15,240.00; in words: three hundred eighty rubles 35 kopecks, in numbers: 380-35.

In the details of codes 11 and 14, it is necessary to use the BIC Directory. Its current version is available on a separate page of the Central Bank of the Russian Federation. Errors in the BIC will lead to “stuck” payments, since cash settlement centers will not be able to identify the recipient. In some cases, users will receive a payment return code 40.

Field 21 is intended to clarify the order of debiting funds from your bank account - from 1 to 5. It must always be filled out, even if there is enough money in the account to carry out all operations. Based on Article 855 of the Civil Code of the Russian Federation, the payer indicates the corresponding value:

- 1 - when paying compensation for harm, alimony;

- 2 - when paying severance pay to employees and remuneration to authors;

- 3 - when transferring funds for salaries, taxes, fees and insurance premiums;

- 4 - upon satisfaction of other monetary claims under executive documents;

- 5 - for other payments, including payments for goods or services, when fulfilling obligations on the basis of instructions from the tax authorities (see Letter of the Federal Tax Service of Russia No. GD-4-8/12408 dated July 11, 2016).

Field 22 is used to indicate a unique payment identifier. The code consists of 20 or 25 digits and is assigned only to payments in favor of government agencies. The UIN is entered only if it was established by the recipient of the funds and communicated to the payer. If you enter it incorrectly, the bank has the right to reject the payment. And if there is no such number, then you need to put “0”.

Details 24 “Purpose of payment” must contain information that makes it easy to identify what the money is being sent to. The same field specifies whether VAT is included in the payment amount.

Example entries:

To pay for services under contract No. 110 dated January 20, 2022. Without VAT.

Advance payment for office equipment under contract No. 120 dated January 25, 2022. NDS is not appearing.

Additional payment under supply agreement No. 100 dated January 17, 2022. Including VAT (20%) 2100-00.

If VAT is indicated at mixed rates, you may not specify the tax rate.

IMPORTANT!

Fields 101, 104–109 must be filled out only in case of payment of taxes, fees, and other obligatory payments to the budget system.

From 01.01.2021, the bank accounts of the Treasury in the divisions of the Central Bank of the Russian Federation have changed. The Federal Tax Service reported this in letter No. KCh-4-8/ [email protected] dated 10/08/2020. Now the bank account number of the recipient of the funds is part of the single treasury account (UTA) and is one of the required payment details. It is indicated in field 15.

To determine the updated account of their Federal Tax Service, taxpayers must use the table in which the Federal Tax Service indicated for territorial divisions (letter No. KCH-4-8 / [email protected] dated 10/08/2020):

- BIC;

- name of the recipient's bank;

- account number as part of the Unified Tax Code;

- recipient's account number (treasury account number);

- number of the current bank account of the Treasury authority.

To generate a payment order to the tax office, you must indicate the payer status in field 101. Persons performing duties to pay taxes and fees for other payers must indicate in the details the 101 code provided for their category.

IMPORTANT!

From 10/01/2021, some were excluded from the list of statuses in field 101: 09 (taxpayer-individual entrepreneur), 10 (taxpayer-notary), 11 (taxpayer-lawyer) and others. And a change was made to status 13. Now it is called “taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - an individual, an individual entrepreneur, a notary engaged in private practice, a lawyer who has established a law office, the head of a peasant (farm) enterprise.” All current statuses for field 101 are presented in Appendix No. 5 to Order of the Ministry of Finance No. 107n.

We described in detail how to fill out field 101 in a separate article.

In the details of fields 102 and 103, indicate the checkpoint of the payer (individual entrepreneurs put “0”) and the recipient (the Federal Tax Service code where the payment is sent). Current information is available on the department’s website in the section “Address and payment details of your inspection.” If errors are made in the 9-digit codes, the payment will be sent to the list of unknowns, and the bank will refuse to accept it. This is stated in Order of the Ministry of Finance of Russia No. 66n dated April 13, 2020.

Field 104 is intended for BCC (budget classification code) of a tax or contribution. They change frequently, so you need to monitor information from the Ministry of Finance. Current codes are available in Order of the Ministry of Finance of Russia No. 75n dated 06/08/2021.

Detail 105 requires the indication of OKTMO at the payer's address. Check the code using the online service “Find out OKTMO”, developed by the Federal Tax Service.

Field 106 - basis of payment. Field 106 corresponds to the following values:

- “0” - if the value zero (“0”) is indicated in detail 106 of the order to transfer funds, the tax authorities, if it is impossible to clearly identify the payment, independently attribute the received funds to one of the above payment grounds, guided by the legislation on taxes and fees;

- “TP” - if the amount is paid for the current period;

- “ZD” - when the payer repays the debt;

- “RS” - the overdue debt is repaid;

- “OT” - payment is drawn up to pay off deferred debt;

- “RT” - the amount is used to pay off the restructured debt;

- “PB” - the debtor repays the debt during bankruptcy proceedings;

- “IN” - the person pays the investment tax credit;

- “TL” - the founder (participant) or owner of the debtor’s property, another third party repays the debt during the bankruptcy case;

- “ZT” - the payment is sent to pay off the current debt in the bankruptcy case.

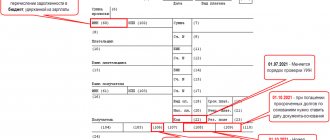

The Ministry of Finance of Russia, by Order No. 199n dated September 14, 2020, amended the Rules for filling out payment slips, approved by Order of the Ministry of Finance No. 107n. From 01/01/2021, taxpayers, when paying off debts at the request of the tax authority to pay taxes (fees, insurance contributions), must indicate in field 106 of the payment slip (basis of payment) not the codes “TR”, “AP”, “PR” and “AR”, but new code "ZD".

Field 107 specifies the period for which the payment is made, in the format XX.YY.YYYY. The first two characters are always letters:

- "MS" - month;

- "KV" - quarter;

- "PL" - half a year;

- "GD" - year.

The next two characters are always numbers that indicate the reporting period: month (01 to 12), half-year (01/02) or year (00). The combination “YYYY” is always replaced by the year.

Examples of correct entries:

- MS.01.2022 - when making monthly personal income tax payments;

- KV.01.2022 - when paying VAT for the first quarter of 2022;

- GD.00.2022 - if the individual entrepreneur pays contributions to pension insurance.

When payment is made at the request of regulatory authorities, the date specified in the request document is indicated. If the payer makes a payment according to an inspection report or a writ of execution, then he puts “0”.

We wrote in detail about filling out field 107 in the article “Tax period in a payment order, or How to fill out field 107.”

Detail 108 is filled in if there is a payment basis document, for example, a writ of execution. According to the rules, in field 108 in the payment order for the writ of execution, the number is simply indicated. If a business entity pays the current amount of tax, fee or contribution, then it indicates “0”.

As of October 1, 2021, the rules for filling out field 108 (document number) have been changed. It should now indicate (letter of the Federal Tax Service No. KCH-4-8/ [email protected] ):

- TR0000000000000 - number of the tax authority's request for payment of tax (fee, insurance contributions);

- PR0000000000000 - number of the decision to suspend collection;

- AP0000000000000 - number of the decision to prosecute for committing a tax offense or to refuse to prosecute for committing a tax offense;

- AP0000000000000 - the number of the enforcement document and the enforcement proceedings initiated on the basis of it.

The document number is indicated after the letter value of the document type and must clearly correspond to the values and number of characters specified in the corresponding requirement, decision or executive document.

Other values for cell 108:

- RS - number of the decision on installment plan;

- OT - number of the decision to defer;

- RT - number of the decision on restructuring;

- PB - number of the case or material considered by the arbitration court;

- ID - number of the decision to provide an investment tax credit;

- TL - number of the arbitration court ruling on the satisfaction of the statement of intention to pay off the claims against the debtor;

- ZD - number of the tax authority's request for payment of tax.

In field 109 of the payment order in 2022, the date from the payment basis document is also indicated: inspection report, requirement, executive documents. The date of the payment basis document consists of 10 characters: the first two indicate the calendar day (values from 01 to 31), the 4th and 5th characters indicate the month (values from 01 to 12), the 7th to 10th characters indicate year, a dot is placed in the 3rd and 6th digits as dividing marks.

For payments of the current year (the basis for the TP payment), the document date indicator indicates the date of the tax return or calculation (the date the report was signed by the taxpayer). If the debt for expired tax periods is repaid voluntarily, then in the absence of a document indicating the basis for payment (the basis for the payment of the tax), 0 is indicated in cell 109.

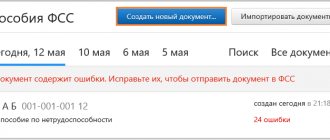

Current example of filling out a payment order for taxes from 10/01/2021:

How to fill out a payment order for a third party

In November 2016, it became possible to pay taxes and fees for another person. But for this it is important to fill out the payment form correctly. The actual payer is required to provide information about himself only in the following fields:

- name of the payer (detail 8);

- purpose of payment (detail 24) - first, TIN and KPP separated by two slashes (//), then information about who needs to actually pay and for what.

All other data must be obtained and entered for the payer for whom the required amount of tax, fee or contribution is being paid.

What is checkpoint in the payer's details?

What is a checkpoint?

The Civil Code stipulates that all transfers are carried out on the basis of a document such as a payment order, which is sent to the bank by the owner of the funds for transfer to organizations or other persons. According to the data provided in the order, the bank makes transfers to the recipient's account.

Payment orders were specially created by the Central Bank. All fields and details are filled in in them, and without them the translation is simply impossible. These include KPP - the reason code for tax registration.

Filling out must be done in the manner explained in the Central Bank documentation. The checkpoint is usually indicated in the following lines of payments:

- The transfer recipient's checkpoint is entered in line 102

- Line 103 contains the sender code

- KPP is used in tax accounting to display the data on the basis of which it is carried out. The presented code consists of 9 digits.

They allow you to find out information such as:

- Region of registration (first two digits)

- Tax office number - next two digits

- Registration code number - two more digits

- The last three digits reflect the record number