Is it possible to lend without interest?

Civil legislation does not contain a ban on providing interest-free loans. Moreover, the lender has the right to receive interest from the borrower on the loan amount, unless otherwise provided by the agreement (Part 1 of Article 809 of the Civil Code of the Russian Federation). That is, when issuing an interest-free loan, this must be provided for in the contract. If there is no such clause, then by default the loan agreement is considered interest-bearing. In this case, interest is determined based on the key rate of the Central Bank of the Russian Federation, which is applied instead of the refinancing rate from January 1, 2016.

The Supreme Court explained when an interest-free loan agreement turns into an interest-bearing one

The defendant borrowed several million from the plaintiff for a month, but repaid the debt within 2.5 years. Although the loan agreement did not provide for the payment of interest, the court considered it to be interest-bearing and collected a penalty from the debtor for delaying the payment of the debt. The appeal took a different position: on the one hand, it upheld the decision to pay interest, on the other, it indicated that the debtor should not pay a penalty, since the agreement is interest-free. The case was dealt with by the Supreme Court.

Is it fair to collect a penalty?

In June 2011, Natalya M. lent her business partners Marina K. and her common-law husband several million rubles (the exact amount has been redacted from the documents). According to M., she had known the debtors since 2007, and when they asked to borrow money, she did not see anything unusual in it - this was not the first time this had happened, and before they had always fulfilled their obligations. According to M., the couple urgently needed to repay a bank loan, and they promised to repay the debt in one payment within a month after they sold their gas station. The woman took the requested amount from a friend and gave it to her partners, but this time they failed and violated the deadline. Then they began to return the money in installments, but the entire amount was never paid. M. did not give receipts for the amounts received, since they were not required.

Three years later, M. appealed to the Voskresensky City Court of the Moscow Region (case No. 2-2222/2014), demanding the return of the remaining debt amount of 2.84 million rubles, interest on the loan agreement - 206,996 rubles. and interest for late repayment - 122,123 rubles. Later, she changed the claims, increasing the amount of the penalty (to what exact amount was erased from the decision).

K. argued in court that she did not take money from M., since in fact the borrower was her common-law husband, who forgot his passport and asked her to draw up a loan agreement for himself. She was not present when he handed over the money and paid off the debt. The man who was interrogated at the meeting did not deny this. He did ask K. to “sign a receipt” for him, but claimed that neither he nor his common-law wife M. owed anything. After M. borrowed the required amount from a friend, she gave him only part of it, and appropriated the rest for herself, the man said. He insisted that he returned all the money he took, although not within a month, but in 2.5 years. And what was allegedly underpaid under the loan agreement is the very money that M. kept for her use.

Since no one denied the amount of the returned amount, judge Zoya Shikanova recovered a total of about 3.05 million rubles from K. – balance of debt and interest. She applied Part 1 of Art. 809 of the Civil Code (interest on a loan agreement), which states that if there is no provision in the loan agreement on the amount of interest, their amount is determined by the refinancing rate existing at the place of residence (location) of the lender on the day the borrower pays the amount of the debt or its corresponding part.

Shikanova decided that the plaintiff also has the right to receive interest for violation of the loan agreement (Part 1 of Article 811 of the Civil Code). However, the court considered the penalty that M. ultimately demanded (its exact amount could not be determined from judicial acts) to be too high and reduced it to 200,000 rubles. The appeal completely canceled the decision regarding the collection of the penalty, pointing out that there were no legal grounds for its collection, and also that the loan agreement concluded between the parties was interest-free.

When an interest-free agreement “turns” into an interest-bearing one

M., disagreeing with the ruling of the Moscow Regional Court, appealed it to the Supreme Court (case No. 4-КГ15-75). Vyacheslav Gorshkov, Sergey Astashov and Viktor Momotov did not support the position of their colleagues from the appeal. In their opinion, the contract cannot be called interest-free. In paragraph 3 of Art. 809 of the Civil Code states that a loan agreement is interest-free, unless it directly provides otherwise, when it is concluded between citizens for an amount not exceeding fifty times the minimum wage established by law, and is not related to the implementation of entrepreneurial activity by at least one of the parties. As of June 2011, the minimum wage was 4,611 rubles, therefore, the loan amount for the agreement to be considered interest-free should have been no more than 230,550 rubles. In fact, it exceeded several million, so the Supreme Court considered that the loan agreement was interest-bearing.

Also, the appeal erroneously refused to collect “penalty” interest, since they can be accrued regardless of whether the loan agreement is interest-bearing or interest-free. Since the court established the fact of delay, the defendant “had an obligation to pay the plaintiff interest on the loan amount (penalty) in the amount provided for in paragraph 1 of Art. 395 of the Civil Code from the day when it should have been returned until the day it was returned to the lender, regardless of the payment of interest provided for in paragraph 1 of Art. 809 of the Civil Code,” says the ruling of the Supreme Court, which sent the case for a new review to the Moscow Regional Court.

What the experts say

Experts interviewed by Pravo.ru agree with the position of the Supreme Court. In their opinion, the appeal made a “contradictory” decision where there is established jurisprudence.

“The Court of Appeal erred and its decision was clearly inconsistent. On the one hand, it indicates that the loan is interest-free, and on the other hand, it leaves in force the decision of the court of first instance regarding the collection of interest from the borrower for using the loan,” says lawyer Konstantin Savin from Pavlova and Partners . On the other hand, he noted that the definition of the Supreme Court does not form a new approach, but merely reproduces the legal position set out in paragraph 15 of the resolution of the Plenum of the Supreme Court and the Supreme Arbitration Court “On the practice of applying the provisions of the Civil Code of the Russian Federation on interest for the use of other people’s funds” dated October 8 1998, which is widely used by courts of general jurisdiction.

Svetlana Burtseva, chairman of the Lyubertsy Bar Association , does not entirely agree with her colleague who talks about a standard approach. “Interest is not accrued after the debtor’s delay, if the loan agreement does not directly indicate the payment of interest for the use of other people’s funds after a specified period - this is shown by an analysis of judicial practice,” Burtseva points out. The lawyer believes that in this case, the key point worth paying attention to was the loan amount exceeding fifty times the minimum wage, which made it possible to apply clause 3 of Art. 809 Civil Code.

“Borrowers should draft agreements carefully. Interest on the use of money under Art. 809 of the Civil Code will not be collected only if the agreement is named as interest-free,” recalls lawyer and partner of Forward Legal Olga Karpova . In her opinion, the Supreme Court correctly pointed out that it is necessary to distinguish between the interest provided for in Art. 395 of the Civil Code of the Russian Federation, and interest payable for the use of funds provided under the loan agreement. He also made the correct conclusion that the appellate court needs to assess the application of Art. 333 of the Civil Code of the Russian Federation on reducing the penalty for interest collected under Art. 395 of the Civil Code of the Russian Federation, since in March of this year the Plenum of the Supreme Court clarified that the rules for reducing the penalty for collecting interest under Art. 395 of the Civil Code of the Russian Federation cannot be applied, says Karpova.

- Supreme Court Collegium for Civil Disputes

- Debt collection, Courts and judges

- Supreme Court of the Russian Federation

- Civil Code of the Russian Federation

Borrower - organization

The question that worries organizations is: do they generate income in the form of material benefits when receiving “free” loans? For example, with a gratuitous lease, the user of the property must reflect non-operating income based on the market value of the lease. Doesn't a similar procedure apply when receiving interest-free loans?

No, it does not apply. When calculating income tax, organizations take into account income from sales and non-operating income (clause 1 of Article 248 of the Tax Code of the Russian Federation). In the list of non-operating income given in Article 250 of the Tax Code of the Russian Federation, the material benefit received by the organization from the interest-free use of borrowed funds is not named. Of course, this list is not closed, but in order for the amount of benefit to correspond to income, it is necessary that the possibility of its assessment be provided for in Chapter 25 of the Tax Code of the Russian Federation (Article 41 of the Tax Code of the Russian Federation). And Chapter 25 of the Tax Code of the Russian Federation does not contain a procedure for assessing income in the case under consideration.

This is also confirmed by officials, as evidenced, for example, by letters from the Ministry of Finance of Russia dated March 23, 2017 No. 03-03-RZ/16846, dated February 9, 2015 No. 03-03-06/1/5149.

Cheat sheet on the article from the editors of BUKH.1S for those who do not have time

1.

Civil legislation does not contain a ban on providing interest-free loans. But the fact that the loan is interest-free must be noted, since by default the loan agreement is considered interest-bearing.

2.

Organizations do not generate income in the form of material benefits when receiving “free” loans.

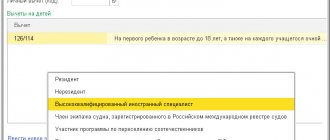

3. When receiving an interest-free loan, an individual borrower may

income arises in the form of material benefits from savings on interest, subject to personal income tax.

4. For a borrower who is an individual entrepreneur using the OSNO, simplified tax system and unified agricultural tax, income in the form of material benefits from savings on interest is subject to personal income tax.

5. With individual entrepreneurs using PSN or UTII, the situation is as follows: tax authorities and courts do not agree that when using an interest-free loan for business purposes, the obligation to tax personal income tax does not arise for material benefits from saving on interest. You will still have to pay tax.

Reflection of material benefits for 2022 in 6-NDFL.

Material benefits in 6-NDFL for 2022 are indicated in two sections of the old calculation, regulated by Order of the Federal Tax Service dated October 14, 2015 No. MMV-7-11/ [email protected]

In section 1, information is filled in on the following lines:

- line 020 – the amount of material benefit for the months of the reporting period in which the employee used an interest-free loan;

- line 040 – amount of accrued personal income tax on material benefits;

- line 070 – amount of personal income tax withheld from material benefits;

- line 080 – the amount of personal income tax on material benefits that could not be withheld. The line needs to be filled out only when submitting the annual report - in quarterly declarations this amount is not indicated on page 080. The information is filled in only if at the end of the year there remains an amount of personal income tax from the financial benefit that could not be withheld.

The amount on line 080 is formed as a cumulative total. Personal income tax on financial benefits is withheld only at the time the money is paid to the employee. If during the year the employee had a benefit, but there were no payments, then the employer does not have the obligation to withhold tax. Accordingly, therefore it is not indicated in quarterly 6-NDFL on page 080.

The fact that it is impossible to withhold personal income tax on financial benefits is determined only at the end of the year. The employer’s obligation to withhold personal income tax remains until the end of the tax period – the calendar year. If there are no payments from which tax can be withheld by the end of the year, the employer notifies the Federal Tax Service before March 1 of the following year about the fact that it is impossible to withhold personal income tax (clause 5 of Article 226 of the Tax Code of the Russian Federation). And this amount will be shown on page 080 of the annual calculation of 6-NDFL.

In section 2, information is filled in on the following lines for each month in which the employee used the loan:

- page 100 – last day of the calendar month;

- page 110 – the date on which personal income tax is withheld from material benefits for this month;

- page 120 – date no later than which the tax must be transferred;

- p. 130 – amount of material benefit;

- p. 140 – personal income tax amount for material benefits.

A situation is possible when material benefits are accrued in one quarter, and personal income tax is withheld in another. In this case, the lines of section 2 can be filled in like this:

- page 120 of the benefit accrual period – put “00.00.0000”;

- page 140 of the benefit accrual period – put “0”;

- Fill in the lines for the personal income tax withholding period again

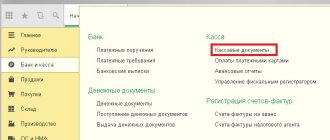

First Bit specialists in every city are ready to help compile a report on the questions from the article, as well as on other tasks related to reporting. For clients of 1C:ITS PROF there is a free personal account for working in the program, webinars on payroll accounting. You can also get a response from the auditor regarding a non-standard situation that has arisen in accounting.

Get a full set of tools for submitting reports correctly and on time from First Bit for only 2,818 rubles per month.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Borrower – individual

If the borrower is not a company, but an individual (for example, an employee of the lending organization), then he may have income in the form of material benefits from savings on interest, subject to personal income tax. Why can it? Yes, because it all depends on the purpose for which the loan is issued. If a loan is issued for the purchase (construction) of housing or land, then provided that the tax inspectorate confirms the right of the citizen-borrower to use the property tax deduction, the material benefit is exempt from taxation (paragraph 5, paragraph 1, paragraph 1, Article 212 of the Tax Code of the Russian Federation ).

Since when issuing an interest-free loan to a citizen, personal income tax is paid by the lending organization as a tax agent, it is to it that the “physician” must provide the appropriate confirmation. A document confirming the right to a property tax deduction may be:

- notification in the form approved by order of the Federal Tax Service of Russia dated January 14, 2015 No. ММВ-7-11/3, issued by the tax office for submission to the employer (tax agent);

- a certificate in the form given in letter No. BS-4-11/329 dated January 15, 2016, which can be issued by the tax office for presentation to other tax agents (other than employers).

In this case, the document must contain details of the loan agreement, on the basis of which the funds spent on the purchase of real estate, in respect of which a property deduction was provided, were provided. In the absence of relevant details, such a document cannot be the basis for tax exemption. This conclusion was made, in particular, in the letter of the Ministry of Finance of the Russian Federation dated September 21, 2016 No. 03-04-07/55231. It also states that a one-time submission of a supporting document is sufficient, that is, it is not necessary to submit a notification (certificate) annually in order to be exempt from personal income tax in subsequent years when repaying the issued loan.

But if the supporting document is issued not to the borrower directly, but to the spouse, then the exemption from personal income tax can no longer be applied. Officials from the Federal Tax Service of Russia drew attention to this in their letter dated June 23, 2016 No. BS-4-11/1120.

Now let’s talk about how to determine income in the form of material benefits from saving on interest. Since 2016, such income is determined on the last day of each month in which the loan (credit) agreement was valid, regardless of the date of receipt of such a loan (clause 7, clause 1, article 223 of the Tax Code of the Russian Federation). The income itself is calculated based on 2/3 of the Bank of Russia refinancing rate established on the date of receipt of income (clause 1, clause 2, article 212 of the Tax Code of the Russian Federation). In this case, personal income tax is calculated at a rate of 35 percent (clause 2 of Article 224 of the Tax Code of the Russian Federation).

If the borrower has cash income from which tax can be withheld (for example, salary), then no questions arise. If there is no such income, for example, if the loan was issued to a citizen who is not an employee, then there is no way to withhold tax. This means that the lender is limited to submitting a message to the Federal Tax Service about the impossibility of withholding tax. The message is submitted in the form of a 2-NDFL certificate indicating code “2” in the “Sign” field. In this case, the procedure for filling out a certificate with attribute “2” is similar to the procedure for filling out a certificate with attribute “1”. However, in section 3 “Income taxed at the rate of __%” you need to indicate only those incomes from which tax was not withheld.

Amount of material benefit

In what cases and in what amount can you receive income in the form of material benefits?

A material benefit arises if the loan rate is below the marginal rate equal to 2/3 of the refinancing rate. Currently, the refinancing rate is equal to the bank’s key rate – 4.25% (from December 18, 2022 to February 12, 2022). Accordingly, the marginal rate on loans issued from December 18, 2020 will be 2.83% (2/3 * 4.25%). Thus, if you now take out a loan at less than 2.83% per annum, then you will have a material benefit on which tax will be withheld.

The size of the material benefit is equal to the difference between the marginal rate and the rate under the loan agreement, multiplied by the loan amount and the loan term.

Material benefit = (marginal rate - contract rate) x loan amount x (loan term in days / 365 days)

The material benefit is calculated monthly throughout the entire lending period and when calculating it, you must take into account the refinancing rate that was in effect on the last day of the month (subclause 1, clause 2, article 212, subclause 7, clause 1, article 223 of the Tax Code of the Russian Federation).