Updated form

On May 30, Resolution of the Board of the Pension Fund of April 15, 2021 No. 103p comes into force, which approved a new form and instructions for filling out the SZV-M in 2022, and employers should use them when submitting the form for May.

The changes are technical, but the law obliges you to report to the Pension Fund only using current forms, otherwise the company or individual entrepreneur will be fined. IMPORTANT!

Despite the talk, the cancellation of SZV-M in 2022 is not planned. You will still have to report, but starting with the May form, using an updated template.

Use ConsultantPlus materials to fill out and submit the SZV-M.

Open instructions for filling out from ConsultantPlus experts

Procedure for filling out SZV-M for September 2020 - sample

The preparation of the report begins with entering information about the policyholder:

Registration number in the Pension Fund of Russia

It is assigned to each legal entity or individual entrepreneur upon registration with the Pension Fund and must be present on all reports sent to the fund. This is a 12-digit digital code, the correct filling of which can be checked, for example, on the Federal Tax Service website by requesting an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs.

Short name of the policyholder

Organizations take it from their constituent documents. If there is no “official” short name, the full name should be indicated.

Entrepreneurs indicate the abbreviation IP and their full name. An individual employer who is not an individual entrepreneur (for example, a lawyer or a notary) does not indicate anything other than his full name in this line.

TIN and checkpoint

Taken from the certificate issued by the Federal Tax Service. For a legal entity, a 10-digit TIN and a 9-digit KPP (reason code for registration) are used. Individual entrepreneurs and individuals who are not individual entrepreneurs indicate only a 12-digit TIN.

Reporting period

The month (in two-digit format) and year (in four-digit format) are indicated. For September 2022, “09” and “2020” are entered in this line, respectively.

Form type

One of the letter codes is displayed, depending on the version of the submitted report:

- “out” - if the form is submitted for the first time;

- “additional” - if the report includes information that supplements previously sent information;

- “cancel” - if the purpose of the submitted form is to cancel previously provided incorrect data.

Information about the insured persons

The report includes all employees with whom contracts related to the payment of remuneration were in effect during the reporting period (in this case, September 2022).

The data is presented in the form of a table consisting of 4 columns:

- Serial number. The order in which the insured persons are included in the report does not matter. This can be alphabetical, chronological (as contracts are concluded), or even random order.

- Full name of the insured person. We give it in the nominative case. Please indicate your middle name if available.

- ILS insurance number. We deposit on the basis of the SNILS certificate.

- TIN of an individual. This detail, unlike the previous ones, is not strictly mandatory and if the employer does not have this information, it may not be included in the report.

Next, information about the person signing the report is indicated and his personal signature is placed. For a legal entity, this is the head or the person performing his duties (in the latter case, indicate the details of the document confirming the authority of the representative). The individual entrepreneur or other individual employer signs the report personally. In this case, in the line “Name of manager’s position” the status of the individual is indicated - entrepreneur, notary, lawyer, etc.

Sample SZV-M for September 2022

SZV-M report: who submits it and when

Employers send monthly information about employees using the form “Information about insured persons” (SZV-M). But a complete list of who fills out information about the insured person is formed based on the concept of “insured persons” (see Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation”). These include employees with whom, during the reporting period, the following were concluded, continue to operate or were terminated:

- employment contracts;

- civil contracts, the subject of which is the performance of work, provision of services;

- copyright contracts;

- agreements on the alienation of exclusive rights to works of science, literature, and art;

- publishing licensing agreements;

- licensing agreements granting the right to use.

Thus, monthly reporting to SZV-M is provided by all insurers (organizations and individual entrepreneurs) in relation to insured persons who work under employment contracts and with whom civil contracts have been concluded, if insurance premiums are paid on their remuneration.

The current form, deadlines and rules for filling out SZV-M reports were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated April 15, 2021 No. 103p. Reporting is submitted monthly no later than the 15th day following the reporting month. If the deadline for submitting the form falls on a holiday or weekend, it must be submitted on the next working day. The current regulations do not prohibit taking it earlier, in the current month. But provided that the employer is sure that he will not hire a new employee until the end of the month. Otherwise, there will be a fine for providing incomplete information.

The deadlines for submitting SZV-M in 2022 for individual entrepreneurs with employees and organizations do not differ. Taking into account all transfers, the report should be prepared and submitted within the following deadlines:

| Reporting period (2021) | Deadline |

| January | 15.02.2021 |

| February | 15.03.2021 |

| March | 15.04.2021 |

| April | 17.05.2021 (date moved from holiday) |

| May | 15.06.2021 |

| June | 15.07.2021 |

| July | 16.08.2021 (date moved from holiday) |

| August | 15.09.2021 |

| September | 15.10.2021 |

| October | 15.11.2021 |

| November | 15.12.2021 |

| December | 17.01.2022 (date moved from holiday) |

Is it necessary to report if there are no employees or persons working under GPC agreements?

Those companies that do not have a single employee registered are also required to submit the SZV-M form. According to current legislation, the general director, like the founder, are also employees, the Pension Fund of the Russian Federation clarifies in a statement.

Results

The SZV-M form is submitted monthly no later than the 15th day of the month following the reporting month. It contains information about the employer: registration number in the Pension Fund of the Russian Federation, name, INN and KPP, as well as correct information about the full name, SNILS and INN of the insured persons with whom employment contracts were concluded, continued to be valid or terminated in the reporting month or GPC agreements.

You can fill out the SZV-M online for free in 2022 on commercial websites. But it is safer to use a special program from the Pension Fund or accounting programs used by most employers, which provide the opportunity to subsequently check the correctness of the entered data and generate a file for sending a report in electronic form.

Sources:

- Federal Law No. 27-FZ dated 04/01/1996 (as amended on 04/01/2019) “On individual (personalized) accounting in the compulsory pension insurance system”

- Resolution of the Board of the Pension Fund of 01.02.2016 No. 83p “On approval of the form “Information about insured persons”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

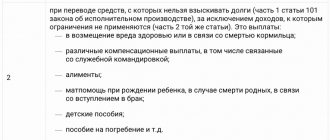

Who is exempt from reporting?

There are exceptions for certain categories of business entities and employees. The SZV-M report is not provided by:

- peasant farms where there are no hired workers;

- individual entrepreneurs, arbitration managers, privately practicing lawyers and notaries who pay fixed insurance premiums only for themselves;

- employers in relation to foreign citizens and stateless persons who are temporarily staying in Russia or working remotely, who are not covered by compulsory pension insurance;

- employers in relation to military personnel, employees of the Ministry of Internal Affairs and the Federal Security Service (with the exception of civilian employees), since compulsory pension insurance does not apply to them, and the state provides other guarantees for them.

Where and in what form to submit SZV-M

Pay attention to the procedure for where to submit the SZV-M: to the territorial body of the Pension Fund of the Russian Federation in which the policyholder is registered (Clause 1, Article 11 of Law No. 27-FZ). Each branch separately submits information about employees and persons who perform work (provide services) under civil contracts.

According to paragraph 2 of Art. 8 No. 27-FZ, a company with less than 25 insured persons has the right to provide reports in the form of documents in writing (on paper). For others, the rules on how to submit a SZV-M report to the Pension Fund are strict - exclusively in electronic form. And the Pension Fund fines organizations that do not comply with the format required by law for submitting reports by 1,000 rubles.

Form SZV-M

SZV-M is a form that appeared in the accounting world in 2016. The SZV-M report is accepted by PFR specialists. So far there are no plans to approve the new SZV-M form. The SZV-M form in 2022 is submitted on the same form.

The Pension Fund has developed a draft new form, which has not yet entered into force, so for now you need to report on the old form. We plan to make minor changes:

- Instead of a list of categories of persons, make a reference to Art. 7 of the law on compulsory pension insurance. It lists the persons who are classified as insured.

- remove the explanations from section 4 of the form.

- prescribe a separate procedure for filling out the SZV-M.

The project is currently undergoing public discussion. The effective date is not yet known.

How to fill out a report

It is convenient to fill out a monthly report quickly and free of charge in the special program “PU Documents 6”. It is available for download on the official website of the Pension Fund in the “Free programs for employers” section.

You can also fill out a report in online services on the websites of accounting software developers - My Business, Kontur, Nebo and others. Some sites allow you to do this freely, but usually the services require a fee (up to 1000 rubles).

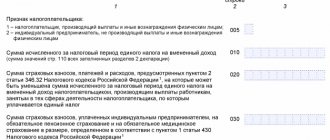

Instructions for filling out section I of the SZV-M

The form consists of 4 sections, each of which is required to be completed. Let us consider in detail how to fill out and submit the new SZV-M form for monthly reporting to the Pension Fund of the Russian Federation, starting with section 1. It should indicate the following details of the policyholder:

- registration number in the Pension Fund of Russia. It is indicated in the notification from the Pension Fund received upon registration. Upon request, it will be issued at the local branch of the Pension Fund of Russia, the tax office or on the website nalog.ru;

- name (short);

- in the “TIN” field, you should indicate the code in accordance with the received certificate of registration with the tax authority;

- Individual entrepreneurs do not fill out the “Checkpoint” field. When filling out the form, organizations indicate the checkpoint issued by the Federal Tax Service at their location (separate units indicate the checkpoint at their location).

IMPORTANT!

If a branch is reporting, then indicate the TIN of the main company, and the KPP - of a separate division.

Sample of filling out Section I of SZV-M

Instructions for filling out section II of SZV-M

Section 2 indicates the period for which the form is submitted. The reporting period code is a two-digit serial number of the month, the year consists of four digits.

Sample of filling out section II of SZV-M

Instructions for filling out section III of the SZV-M

In section 3, you must indicate the type code of the transmitted report. It can take 3 values:

- “output” - the original form that the enterprise submits for the specified reporting period for the first time;

- “additional” is a complementary form. This code is indicated if the original report has already been submitted, but it needs to be corrected. For example, a new employee appeared or incorrect data was submitted for him;

- “cancel” is a canceling form. This code is used if it is necessary to completely exclude any employees from the submitted initial report. For example, the report contains data on an employee who quit and no longer worked in the current period.

Sample of filling out section III SZV-M

Instructions for filling out section IV of the SZV-M

The last section is presented in the form of a table, which contains a list of employees who have concluded labor contracts at the enterprise in the current period, including GPC agreements. The table consists of four columns:

- the first one contains the serial number of the line;

- in the second - full name. employee in the nominative case. If the patronymic is missing, it is not indicated;

- in the third - SNILS (employee registration number in the Pension Fund of Russia). This is mandatory information;

- in the fourth - TIN (employee registration number with the Federal Tax Service). This column is filled in if the policyholder has the necessary information.

You can enter data into the table either in alphabetical order or randomly.

Sample of filling out section IV SZV-M

At the end, the report is signed by the general director or entrepreneur, indicating the position and full name. The date of compilation of the form is also indicated here and a stamp is affixed if it is used in the company. Since the SZV-M form does not provide for the possibility of signing the report by a representative of the policyholder, it must be submitted personally either by the director of the organization or by the entrepreneur.

A sample document completely filled out according to the instructions looks like this:

Who takes SZV-M for September 2020

The SZV-M report is submitted by:

- Employers for employees - with whom labor and civil law contracts have been concluded, as well as copyright and licensing agreements.

Individual entrepreneurs, lawyers, notaries do not rent SZV-M without employees.

- Organizations with several founders - if one of them is the CEO.

The report is submitted even when an employment contract has not been concluded with the director (Letter of the Ministry of Labor dated March 16, 2018 No. 17-4/10/B-1846).

- Companies with a single founder and director in one person.

The existence of an employment contract does not matter. Until March 2022, the Pension Fund allowed such companies not to submit SZV-M, citing the fact that there are no persons with whom labor and civil law contracts have been concluded, as well as payments accrued on their basis. And since there are no contracts and payments, then there is no need to submit a report (Letter of the Pension Fund of the Russian Federation dated July 27, 2016 No. LCH-08-19/10581).

But since March 2022, the Pension Fund has radically changed its position and obligated all companies, including those in which the only founder works as a director without an employment contract, to submit SZV-M. The reason is that labor relations without a properly executed contract arise when an employee is actually allowed to work (Letter of the Ministry of Labor dated March 16, 2018 No. 17-4/10/B-1846).

- SNT, DNT, HOA.

Submitted to the chairman if he is paid remuneration for the work performed. If the chairman works on a voluntary basis and does not receive anything for his work, the SZV-M does not need to be taken. But in this case, it is necessary to submit to the Pension Fund a charter that confirms the gratuitous activities of the chairman.

- Charity organisations.

They rent for volunteers, who are reimbursed for food costs in amounts exceeding the daily allowance if GPC agreements have been concluded with them.

- Separate units.

They rent out SZV-M only if they have a separate current account and pay their own salaries to employees. In this case, the SZV-M indicates the TIN of the parent organization and the checkpoint of the separate division.

Common mistakes when filling out SZV-M

| Error | It should be | How to fix |

| There is no information about the insured person | When filling out the form, you must indicate all employees with whom an employment contract or civil service agreement has been concluded (even if the person worked for only one day). Information is also submitted if there have been no accruals or payments to the employee at the Pension Fund of the Russian Federation, but he has not been fired. | Supplementary reporting is submitted, which indicates those employees who are not reflected in the original form. In the third section we put the form code “ADP”. |

| There is an extra employee present | The presence of records of redundant employees (for example, fired) is equivalent to false information. | A cancellation form must be provided indicating only the excess employees. In the third section we put the form code “OTMN”. |

| Incorrect employee tax identification number | Although the absence of the TIN itself when filling out the form is not an error, if it is indicated, enter it correctly. | Two forms are provided at the same time: a cancellation form - for an employee with an incorrect TIN, and along with it a supplementary one, in which the correct information is indicated. |

| Incorrect SNILS of an employee | The absence of a code, as well as incorrect information, is grounds for a fine. | If the report is not accepted, it must be corrected and resubmitted as outgoing. If only correct information is accepted, then corrections are provided to employees with errors in a supplementary form. |

| Incorrect reporting period | You must enter the correct month and year code. | It is necessary to re-submit the form with the status “outgoing”, correctly indicating the reporting period. |

SZV-M in 2022: errors, timing, features

Who is required to submit reports SZV-M

All companies and individual entrepreneurs that hire workers under a civil contract are required to submit a completed SZV-M form.

An employee being on vacation or maternity leave does not exempt him from filing reports. If an employee was dismissed during the reporting period, data on him is also submitted to the Pension Fund. Important:

Individual entrepreneurs who do not have hired employees are completely exempt from passing the SZV-M. There are no zero reports on this form.

Legal entities are required to take the SZV-M, even if they do not have employees. They must include the founder in their report. It doesn’t matter whether an employment contract has been concluded with him or not. It is necessary to surrender even if the company is at the stage of liquidation.

Deadlines and penalties for late payment

The report is submitted to the Pension Fund monthly no later than the 15th day of the month following the reporting month. Reports for April are submitted before May 15, for May - before June 15, etc. This is regulated by the resolution of the Pension Fund of the Russian Federation dated 02/01/2016.

For late submission of reports, the entrepreneur will be required to pay a fine of 500 rubles for each employee. The same fine is provided for submitting erroneous data. This is stated in Art. 17 of Law 27-FZ.

Thus, the total fine for a company with 15 employees is 7,500 rubles. If there are 150 employees, you need to pay 75,000 rubles.

What changes have been made to the deadlines?

The submission of a large number of reports was postponed due to the coronavirus pandemic. SVZ-M is not included in this list. Moreover, Pension Fund employees strongly recommend taking SVZ-M early to increase your chances of receiving a subsidy. Companies included in the register of small and medium-sized businesses can count on free assistance from the state. At the same time, the number of employees for a paid month must be at least 90% of the number of employees that was in March.

Important:

The Pension Fund of Russia recommends submitting reports electronically, regardless of the number of employees.

For companies with more than 24 employees, electronic submission of SZV-M was and remains mandatory. Fill out SZV-M

How to fill out SZV-M in 2022

The form includes a header and a table. The header contains information about the organization and the employee: the company’s registration number in the Pension Fund, INN, KP, full name of the enterprise, full name of the employee, his SNILS. The table contains information about personnel actions.

Typical errors in filling out SZV-M

Entrepreneurs working without an accountant often submit the SZV-M form with errors and do not know that the submission can be canceled or supplemented. If you found errors in filling out before the pension fund and corrected them yourself, no fine will follow. Check your document for these common errors:

- incorrect reporting period. The PF will consider such a typo to be a lack of change;

- wrong form type. For example, you accidentally specified the “cancellation” form instead of the “original” form;

- absence of an employee from the report. An employee must be indicated even if he did not receive any payments during the reporting period. The same applies to employees in self-isolation;

- inclusion of a self-employed person in the report. Self-employed workers should not be included in the report until they lose this status.

The data is checked and can be accepted, rejected or partially accepted. If the Pension Fund of Russia has marked your reporting with codes 10 and 20, then there is a minor error in it. The document has been accepted, but the organization needs to double-check the information provided. Error codes 30 and 40 mean that the form was partially accepted. To avoid a fine, the entrepreneur must make corrections before the reporting deadline.

To avoid mistakes when filling out the form and meet the deadline, use the Astral.Report 5.0 web service. He will remind you to submit reports and check the form for errors.

Sanctions and fines

For failure to submit the SZV-M form within the prescribed period, a fine of 500 rubles is provided. This amount will have to be paid for each employee for whom information has not been provided (Part 4, Article 17 of Law No. 27-FZ). The same fine is provided for submitting incomplete and/or false information in relation to each employee (Part 4, Article 17 of Law No. 27-FZ). In addition, for filing reports in the wrong form, the Pension Fund of Russia will fine the employer 1,000 rubles. In case of erroneous information, a fine can be easily avoided if you correct the inaccuracy yourself.