In what cases does the salary change?

The most common option for changing salary is increasing it. Usually it occurs when the employee’s labor productivity is high, his special services to the company, for the purpose of additional motivation, as well as due to some other general reasons.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Salary reductions also sometimes happen. Most often this is due to the financial problems of the organization or the ineffectiveness of a particular employee. In any case, such an unpopular measure must also be accompanied by writing an order to change the salary, even in cases where the reduction occurs by a not very significant amount.

Remember, an important rule to follow is that before reducing an employee's salary, he must be notified in writing at least two months in advance.

During this time, a person can decide for himself whether he will look for another, more financially suitable job or whether he is ready to remain in his previous position, but at a lower salary. It should be noted that the employee has every right to refuse those new financial conditions that are included in the order, without giving up his job.

In this case, by law, the employer is obliged to offer him in writing another position (higher or lower in rank, but corresponding to the level of qualifications and health). If it is not possible to reach an agreement, then you will have to seek a solution to the conflict in court.

What does it include?

It consists of the conditions by which the dimensions can be determined:

- salaries accrued to employees based on official salaries for time worked or work performed at piece rates;

- allowances and additional payments to salaries for professionalism, rank, length of service, etc.;

- payments related to working conditions;

- bonuses and rewards based on performance results;

- other types of payments.

Grounds for ordering a salary change

Any order, including this one, must have some basis. In this case, such a document may be a presentation or memo from the head of a structural unit, a change in the staffing table, etc. The basis must necessarily indicate

- the circumstances under which it is proposed to change the employee’s salary,

- brief description of the employee,

- and also the size of the current salary and the one that is proposed to be assigned is stated.

In this case, one nuance should be taken into account: if a salary increase in most cases must be accompanied by a written proposal from the head of the department in which the employee works, then for a reduction no documents from the line manager are needed.

Reduction of wages by agreement with the employee

If the employee is not against a reduction in wages with a simultaneous reduction in the volume of his work or the number of responsibilities, this can be formalized:

- transfer of an employee to a position with a lower salary (Article 72.1 of the Labor Code of the Russian Federation).

- transfer of an employee to a part-time work week or part-time work (Article 93 of the Labor Code of the Russian Federation).

In both cases, the employee must sign:

- additional agreement to the employment contract, which indicates the new reduced salary;

- order issued by the manager.

By agreement of the parties, part-time or part-time work may be established, including with the division of the working day into parts. Part-time work may be without a time limit and for any period, as agreed between the employee and the employer.

More on the topic:

How can you reduce employee salaries?

How to cut employee salaries

A salary reduction is one of the essential terms of the contract; this must be recorded in writing in an additional agreement, which becomes an integral part of the contract.

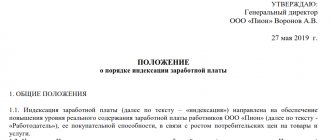

Rules for drawing up an order

There is no standard unified template for drawing up an order to change the salary, so the document can be drawn up in free form. Some organizations have specially developed, mandatory internal order templates (which must be registered in the enterprise's accounting policies). In any case, the document must contain a number of necessary information. These include :

- Company name,

- date of the order,

- text of the order,

- persons responsible for its implementation.

The order may concern either one employee or a number of employees, regardless of their status in the company and their affiliation with a particular structural unit. If several employees are entered into the order at once, then information about each of them must be indicated in a separate paragraph, entering into the document the position, the department in which the person works, as well as the new amount of his salary (in numbers and in words).

Additional payment up to the minimum wage: step-by-step instructions

When increasing the minimum wage, it is necessary before the new value comes into force (in this case, until 01/01/2022):

- Issue an order approving a new staffing table with a new employee salary corresponding to the new minimum wage.

The order must contain a provision on the abolition of the old staff from a certain date (optimally, on its abolition on the day the law on the new minimum wage comes into force, that is, from 01/01/2022).

See a sample order for changes to the staffing table in connection with an increase in the minimum wage in the Consultant Plus materials (free access).

- Conclude an additional agreement with the employee to change the terms of the employment contract.

In the text of the agreement:

- the new edition contains a clause in the employment contract establishing the salary amount;

- is recorded when the corresponding version of the specified paragraph comes into force (i.e., the day the law on the new minimum wage comes into force is 01/01/2022).

See a sample additional agreement to an employment contract on salary changes due to an increase in the minimum wage (free access).

It is important to correctly calculate the salary based on a salary in the amount of the minimum wage if the employee works night shifts and holidays in the billing month. Such processing is not included in the minimum wage.

The following are additional payments that are included in the salary, but are not included in the minimum wage:

| Pay | Base |

| Regional coefficient | Resolutions of the Presidium of the Armed Forces of the Russian Federation dated 02/07/2018 No. 4ПВ17, Constitutional Court of the Russian Federation dated 12/07/2017 No. 38-P |

| Percentage surcharge | |

| Additional payment for combining professions (positions) | Resolution of the Constitutional Court of the Russian Federation dated December 16, 2019 No. 40-P |

| Extra pay for overtime work | Resolution of the Constitutional Court of the Russian Federation dated April 11, 2019 No. 17-P |

| Extra pay for night work | |

| Additional pay for working on weekends and holidays |

How to place an order

There are also no strict rules for placing an order. It can be printed either by hand or on a computer, both on company letterhead and on a regular A4 sheet.

Mandatory condition: it must be certified by the signature of the head of the company, as well as those employees who are appointed persons responsible for its execution.

There is no need to certify it with a seal, since it relates to the company’s internal documentation; in addition, since 2016, legal entities have been exempted from the obligation to affix seals and stamps on their papers.

The order is usually drawn up in a single copy, and after it is executed, it is transferred for storage to the archive of the enterprise. There he should be kept for exactly the amount of time required for such documents.

It should be noted that this order is automatically accompanied by changes to the working conditions specified in the employment contract, so an entry about this should be made in the contract with the employee in the form of an additional agreement certified by both parties.

It is also necessary to reflect the necessary changes in the organization’s staffing table.

Types of calculation system

Salary

Most organizations use it. In this case, the worker receives a fixed salary provided that he has worked all the working hours assigned to him for the calendar month (for example, 8 hours a day and 40 hours a month).

Piecework

In this case, the employee receives wages depending on the amount of work performed per month. In this case, the cost of the manufactured unit is determined in advance. For example, a loan specialist is paid 300 rubles. for each concluded contract. The more loan agreements he concludes with clients, the more money he will receive.

Mixed

Some employers may use mixed payroll systems. For example, piecework-bonus or time-bonus. Information about this should be reflected in a local regulatory act or in an employment contract.

An example of drawing up an order to change the salary of an employee

Filling out the document header

At the beginning, the full name of the company is indicated, below in the center of the line they write the word “order” and its number according to the internal document flow of the enterprise. The next line contains the date the order was drawn up and the locality in which the company is registered.

Filling out the “body” of the document

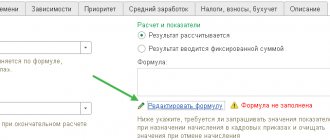

The basis for issuance is written into the “body” of the order, after which the actual essence of the order is drawn up.

- The first paragraph indicates the position of the employee, his last name, first name, patronymic, as well as the new official salary and the date from which it should be calculated.

- In the second, an order is given to a specific specialist in the accounting department to take the first point into service and ensure the implementation of the order in terms of its practical implementation.

- The third paragraph is similarly entered into by an employee of the personnel department, who must familiarize the interested employee with this order.

Can an employer reduce an employee's salary?

An employer has the right to reduce an employee’s salary, but only on the following grounds:

- the agreement reached with the employee is documented in writing;

- if the enterprise establishes a part-time working regime, in accordance with Art. 93 Labor Code of the Russian Federation;

- if an employee does not fully perform his job duties - Art. 155 Labor Code of the Russian Federation;

- in case of downtime due to the fault of the employer - Art. 157 Labor Code of the Russian Federation;

- in the event that an employee regularly produces defective products - Art. 156 Labor Code of the Russian Federation.

If an employer decides to reduce the earnings of a particular employee, he must remember that, in accordance with Art. 133 of the Labor Code of the Russian Federation, the monthly income received should not be lower than the minimum wage established at the federal level.

An employee's wages can be cut by reducing the previously established salary. But there are only 2 reasons for reducing the salary part of the salary:

- an agreement between the parties, drawn up in writing, signed by both parties;

- initiative of the employer, formalized according to established rules.

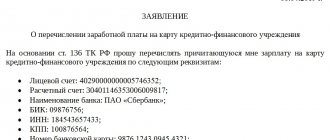

If the parties have agreed among themselves to reduce the salary, it is necessary to draw up a written agreement, which will be an addition to the employment contract.

The agreement specifies the calendar date from which the employee will receive a reduced salary. You also need to indicate the details of the employment contract, to which the agreement is an addition.

The document is signed by both parties - the employee and the manager. If necessary, it is certified by the seal of the organization. Since 2016, the obligation to use seals and stamps has been abolished.

According to Art. 74 of the Labor Code of the Russian Federation, the employer will be able to reduce the salary unilaterally if he no longer has the opportunity to comply with the organizational and technological working conditions that were previously prescribed in the employment contract. But the need must be justified or confirmed. Otherwise, the employer may be held liable.

We recommend reading: The correct procedure for reducing wages at the initiative of the employer.