Report on the intended use of funds received or Form 6: which is correct?

As part of the current forms of annual financial statements recommended for use (approved by order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n), there is a document called a report on the intended use of funds.

It is often also called Form 6, despite the fact that the serial numbering of the forms for reports given in Order No. 66n is not used, and only five report forms are given in this document. Where did the name come from, referring to the form number, and is its use legal? The origin of the name, Form 6 of the report on the intended use of funds, is due to Order No. 67n of the Ministry of Finance of Russia dated July 22, 2003 - a document that is no longer in force, which, before Order No. 66n came into force (and it became mandatory for use in reporting for 2011), approved recommendations for use accounting forms. Order No. 67n contained 6 report forms, and in each of them, under the official text name, there was an indication of the serial number of the form. The numbers were distributed as follows:

- No. 1 - balance sheet;

- No. 2 - profit and loss statement;

- No. 3 - statement of changes in capital;

- No. 4 - cash flow statement;

- No. 5 - appendix to the balance sheet;

- No. 6 - report on the intended use of the funds received.

The forms approved by Order No. 66n do not have an indication of the form number, and only five forms themselves are given in this document: the form corresponding to the appendices to the balance sheet is excluded from them. However, for accountants who compiled reports for the years preceding 2011, the use of numbering of the compiled forms, which simplifies the indication of their name, remained common. However, such a reference can only be used informally, since the current document approving the accounting forms does not contain report numbers.

IMPORTANT! When preparing reports for 2022, keep in mind that from 2019, accounting forms, incl. Forms 6 have changed. Key differences: reporting can only be prepared in thousands of rubles; millions can no longer be used as a unit of measurement. OKVED has been replaced by OKVED 2. For other changes, see here.

Cash flows from investment operations

This section of the 2022 cash flow statement includes receipts and payments associated with the acquisition, creation or disposal of non-current assets. In addition, cash flows from investments may include receipts of income from financial investments (except for those acquired for resale in the short term, as well as those that are cash equivalents).

The section is formed by analogy with the section for reflecting cash flows from current operations.

Line 4210 “Total receipts” represents the total value (sum) of receipts from investments reflected in the lines:

- 4211 – the line reflects the amount of proceeds from the sale of fixed assets, intangible assets, R&D results, capital investments in non-current assets (including in the form of construction in progress), etc. These proceeds are reduced by the amount of VAT, the amount of which is shown in the ODDS collapsed ;

- 4212 – the line reflects the receipts of cash and cash equivalents from the sale of shares of the JSC and shares in the authorized capital of the LLC.

If shares/shares were purchased for resale in the short term (usually within 3 months), then income from the sale is not included in line 4212 (this is not an investment, but a financial activity).

- 4213 – the line reflects proceeds from the return of interest-bearing loans, payment of debt securities (bills, bonds), payment for assigned rights of claim, if these rights were previously also acquired by the organization forming the ODDS;

The exception for the data entered in line 4213 is the same as for line 4212 - it does not include amounts for debt securities and claims that were purchased for resale in the short term.

- 4214 – the line includes data on receipts of dividends and similar amounts of distributed income from participation in other organizations, interest actually received in the reporting year from debt financial investments (bonds, bills, loans issued, etc.);

Exceptions for line 4214: Interest on commercial loans accrued on accounts receivable is not reflected in line 4214, but is classified as income from current operations. Interest on debt financial investments acquired for the purpose of resale in the short term does not form the line indicator 4214. Cash flows on them are classified as current activities.

- 4215 – 4218 – lines for decoding significant amounts of income that were not reflected in the previous lines of the section. For them, when filling out, exceptions apply, similar to lines 4213 and 4214;

- 4219 – reflect information that is not included in the top lines of the section and is not considered significant.

Line 4220 “Total payments” reflects in the ODDS the total amount of expense payments made as part of investment activities. The value in this row is the sum of the rows:

- 4221 – here reflects outgoing payments sent to suppliers, contractors and employees of the organization related to the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets (excluding financial investments), including R&D costs. These payments are reduced by the amount of VAT, the amount of which is shown in the gross income tax;

- 4222 – the line reflects payments in connection with the acquisition of shares of a JSC and shares of an LLC with the same exceptions as for their sale;

- 4223 – record outgoing cash flows and equivalents in connection with the acquisition of debt securities, rights to claim funds from other persons and the provision of interest-bearing loans. The exceptions are the same as for line 4213;

- 4224 – line is intended to reflect amounts used to pay interest on debt obligations paid in the reporting year and subject to inclusion in the value of the investment asset in accordance with clause 9 of PBU 15/2008;

Interest included in current expenses does not fall within the period 4224, but is reflected on line 4123 in the “Cash flows from current operations” section of the ODDS.

- 4225-4228 – additional lines in which it is necessary to separately disclose significant amounts of payments related to investment operations and not included in the already listed lines;

Examples of transactions subject to disclosure in additional lines “Payments in total” for investment activities:

- amounts allocated for the acquisition of an enterprise as a property complex;

- to pay for R&D in connection with the acquisition, creation, modernization and preparation for use of non-current assets, if the organization decided to report this indicator separately and not on line 4221.

- 4229 – line to reflect immaterial amounts that occurred in the reporting period, but are immaterial and are not disclosed in other lines of the section.

Line 4200 reflects the amount of the resulting cash flow from investment operations. Determined by calculation as the difference between the indicators of lines 4210 and 4220. If the subtraction results in a negative value (cash outflow), it is indicated in parentheses.

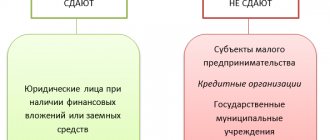

Reporting on the intended use of funds: who submits it?

So who is required to submit a report on the intended use of funds?

In Order No. 67n, the answer to this question was unambiguous: Form 6 was recommended to be drawn up by non-profit organizations (clause 4 of the instructions on the scope of accounting forms). A similar recommendation (albeit with a slightly different wording, referring to public organizations that do not conduct entrepreneurial activities) was also in the original version of Order No. 66n (subparagraph “c”, paragraph 1). But at present (Order of the Ministry of Finance of Russia dated December 4, 2012 No. 154n) there is no indication in the text of Order No. 66n as to who is affected by the preparation of a report on earmarked funds. Thus, this form must be drawn up by all recipients of targeted funding, i.e. not only non-profit structures, but also commercial organizations receiving targeted funds.

Organizations that do not receive targeted funds do not prepare a report on them, since they do not have the data to fill it out.

If you use the simplified tax system, find out from ConsultantPlus which forms of accounting in addition to Form 6 you need to submit to the Federal Tax Service. If you do not have access to the K+ system, get trial online access to the system for free.

Options for a report form on the intended use of funds

The report form recommended for use on the use of targeted funds does not exist in a single version. Order No. 66n approved two of its forms:

- complete, given in Appendix No. 2.1;

- simplified, contained in Appendix No. 5.

Simplification implies a reduction in the number of lines in the report by combining data on a number of indicators (subparagraph “a”, paragraph 6 of Order No. 66n) and the absence in the form of a column intended to indicate the number of explanations.

The simplified form can be used by persons who have the right to simplify accounting and the formation of simplified accounting records. These persons include (Clause 4, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- small businesses that meet the criteria specified in the law “On the development of small and medium-sized businesses...” dated July 24, 2007 No. 209-FZ;

- non-profit organizations subject to the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ;

- participants of the Skolkovo project who received this status in accordance with the law “On the Skolkovo Innovation Center” dated September 28, 2010 No. 244-FZ.

The simplified form 6 can be downloaded from ConsultantPlus. To do this, just get a trial demo access to the K+ system. It's free.

Simplification of reporting is not available (Clause 5, Article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ):

- for legal entities required to audit their accounting records;

- housing and housing-construction cooperatives;

- credit consumer cooperatives and microfinance organizations;

- public sector organizations;

- political parties;

- associations of lawyers and notaries, legal consultations;

- non-profit structures acting as a foreign agent.

Procedure for filling out the intended use report

The procedure for filling out a report on the intended use of funds is not separately described anywhere. The logic for entering data into it follows from the content of the report itself and the notes available under the main table.

The main table is preceded by data about the reporting entity (its name and codes characterizing basic information about it: OKPO, INN, OKVED, OKOPF, OKFS), as well as information about the year for which the report is being prepared, the date of creation and the applied unit of measurement of the entered indicators.

The purpose of filling out the main table is to reflect, taking into account the analytics of receipts and disposals, the process of changing the balance of target financing funds accounted for in the organization (when applying the chart of accounts of accounting, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, they are shown on account 86). In this case, a comparison of data from the current and previous years is provided.

The top and bottom rows of the table indicate information about fund balances, respectively, at the beginning and end of the year. Intermediate lines are divided into two groups: with information about receipts and about the expenditure of funds received. For each of the groups, the forms given in Order No. 66n offer a specific breakdown of analytical lines, focused on the most frequently occurring reasons for receipts and expenditures. In full form, for these reasons, the following are highlighted:

- in receipts - lines: for entrance, membership and target fees;

- voluntarily contributed funds;

- income resulting from the activities of the reporting entity;

- other funds received;

- for the purposes for which the legal entity received appropriate funding, highlighting information about expenses for charity and social assistance, informational events, and other procedures;

In a simplified form, revenues combine data on contributions and voluntarily contributed funds, and in expenditures there is no detailing of the four main groups of lines. In addition, the simplified form is distinguished by the absence of total figures related to income and expenses.

At the same time, if necessary, the report writer can supplement the form proposed by Order No. 66n with the required number of lines (clause 3 of Order No. 66n).

Explanations and an example from ConsultantPlus will help you fill out the new Form 6. If you do not yet have access to this legal system, sign up for a free trial.

Cash flows from financial transactions

Cash flows from financial transactions include receipts and payments associated with the organization’s attraction of financing on a debt or equity basis, leading to a change in the size and structure of the organization’s capital and borrowed funds (clause 11 of PBU 23/2011).

Interest on debt obligations (loans, bills, bonds) is not reflected in the “Cash flows from financial transactions” section. They are included either in the indicator of payments for current transactions on line 4123 of the cash flow tax liability insurance, or in the composition of payments for investment transactions on line 4224 of the cash flow tax liability insurance policy.

The section is structured in the same way as the previous ones.

Line 4310 “Total receipts” shows the total amount of receipts from financial activities disclosed in the lines:

- 4311 – received loans and borrowings, including interest-free;

- 4312 – cash deposits of owners and participants;

- 4313 – proceeds from the issue of shares and increase in participation interests;

Note! To navigate lines 4312 and 4313 of the ODDS, you need to determine whether the receipt is related to a change in the authorized capital. If money (cash equivalents) is received on an irrevocable basis from shareholders (participants) and the capital has not changed, this is line 4312. If the value of the capital has been increased and the funds received represent payment for this increase, this is line 4313.

- 4314 – the line reflects proceeds from the issue of bonds, issuance of own bills, and other proceeds of borrowed funds associated with the emergence of debt obligations issued by securities;

- 4315-4318 – additional lines, the purpose of which is similar to such lines in other sections. They reflect significant amounts not reflected in the previous lines;

- 4319 – line to reflect insignificant amounts received in connection with financial activities and not received anywhere else.

Line 4320 “Payments in total” records the total value of the indicators included in the lines:

- 4321 – here they reflect the outflow of cash (and equivalents) in connection with the payment by the JSC organization of its own shares purchased from shareholders, in connection with the payment by the LLC organization of the actual value of the share to the participant (his creditors, heirs or legal successor);

- 4322 – the line records the amounts of payments related to the organization’s payment of dividends and other amounts of distributed profit to owners (participants). Moreover, line 4322 includes both personal income tax and income tax, which the organization withheld from profits as a tax agent;

- 4323 – this includes the amount of funds used to repay borrowed obligations, including repayment (redemption) of bills of exchange, redemption of bonds;

The amount of interest paid on borrowed obligations does not fall into line 4323. It is reflected either in line 4123 of the “Cash flows from current operations” section, or in line 4224 of the “Cash flows from investment operations” section.

- 4324-4328 – additional lines for entering into the ODDS significant amounts for transactions that are not included in the already described section lines;

- 4329 – line for entering into the ODDS amounts for financial transactions that took place in the reporting year, but are not recognized as significant and are not disclosed as a separate line.

The resulting balance of cash flows from financing transactions is calculated and presented on line 4300 of the 2022 cash flow statement. It is calculated as the difference between lines 4310 and 4320. If after subtraction a negative value is obtained, it is placed in parentheses.

An example of filling out a report on intended use

Let's look at an example of filling out a report on the intended use of funds using specific figures.

Example

For the Nadezhda charitable foundation, which is engaged in helping people who find themselves in difficult life situations, the main source of funds that allows them to carry out the activities provided for in the charter are voluntary donations from legal entities and individuals. The balance of unused funds at the beginning of the year amounted to 30,000 rubles. For 2022, the fund received 7,000,000 rubles as voluntary donations.

In addition, the foundation organizes educational events that generate income from the sale of entrance tickets to them. The net profit from this activity for 2022 amounted to RUB 1,000,000.

The expenses incurred by the fund in 2022 were as follows:

- for charitable payments to people who find themselves in difficult life situations - 6,400,000 rubles;

- for wages, taking into account insurance premiums accrued on the amount of the employee’s income - 1,400,000 rubles;

- for business trips to check the reality of difficult life circumstances for people who need help - 70,000 rubles;

- for cosmetic repairs of premises occupied by the foundation on a lease basis - 100,000 rubles.

The situation was similar in 2022. That is, there were two types of income: voluntarily donated amounts (5,500,000 rubles) and profit from business (900,000 rubles). Funds were used for charitable payments to people in need (5,200,000 rubles), wages and insurance premiums (1,100,000 rubles) and business trips (80,000 rubles). Unused funds at the beginning of the year amounted to 10,000 rubles.

In the main table of the report, fund balances at the beginning of the year will be shown in line with code 6100, and balances at the end of the year - in line 6400. In this case, the data in line 6100 for 2022 (at its beginning) and line 6400 for 2022 (at its end ) must be the same.

Receipts will be reflected in lines 6230 (voluntary donations) and 6240 (profit from business). Their total amount will appear in line 6200.

In relation to expenses for targeted activities, lines 6310 will be used (it will show their total value) and 6311 (it is intended for expenses in the form of charitable assistance).

As for the costs of maintaining the fund itself, lines 6320 will be used (their total amount will be reflected here), 6321 (expenses related to wages), 6323 (travel expenses) and 6325 (property repair expenses).

The total amount of expenses incurred, equal to the sum of lines 6310 and 6320, will fall into line 6300.

The balance of funds at the end of each year is calculated from the amount of their balance at the beginning of the year by adding the total amount of receipts and subtracting the total amount of expenses from this term, i.e. according to the formula (if compiled using report line codes): 6100 + 6200 - 6300 = 6400.

Please see the completed report on our website.

Cash flows from current operations

This section shows cash flows from operations related to ordinary activities. As a rule, they are associated with the formation of profit (loss) of the organization from sales (clause 9 of PBU 23/2011). Exceptions to the rule are cash flows not related to ordinary activities, but reflected as part of flows from current operations:

- payment of interest on debt obligations, except for interest included in the cost of investment assets;

- receipt of interest on receivables from buyers (customers);

- rental income, royalties, commissions and similar payments recognized as other income;

- cash flows on financial investments acquired for the purpose of resale in the short term (within 3 months);

- payments for profit tax (income);

- receipt of interest under a bank account agreement.

In addition, cash flows that cannot be unambiguously classified are reflected in the Cash Flow Statement as cash flows from current operations (clause 12 of PBU 23/2011).

Line 4110 “Receipts – total”. This line reflects the amount of cash and cash equivalents received in connection with the current activities of the organization. The indicator of this line is the sum of lines 4111 – 4119:

- 4111 – proceeds from sales;

- 4112 – rent payments, royalties, commissions, etc.;

- 4113 – proceeds from the resale of financial investments;

Line 4113 does not reflect:

- proceeds from the sale of securities (claims against other persons), if they were not acquired for the purpose of resale in the short term. Such receipts are classified as cash flows from investment operations;

- receipts in connection with the acquisition and disposal of financial investments recognized as cash equivalents. Such receipts and payments are not recognized as cash flows.

- 4114-4118 – additional lines intended to reflect indicators that are not included in lines 4111-4113, but are nevertheless significant and subject to disclosure. For example, the lines may reflect targeted financing received by the customer-developer from investors, VAT amounts returned by suppliers along with a refund for goods (work, services), etc.;

- 4119 – for this line in the ODDS they also reflect what was not included in lines 4111-4113, but at the same time is unimportant. For example, returns from employees for unspent accountable amounts, benefits from the exchange of some cash equivalents for others.

If an interest-free loan is repaid by an employee (in whole or in part) in the same reporting period in which it was issued, then in the ODDS on line 4119 the issued and returned amounts are shown collapsed. That is, they indicate only the outstanding part of the loan issued in the reporting period (clauses 16, 17 of PBU 23/2011). If the unused balance of funds issued for reporting in the reporting period is returned in the same reporting period, then in the ODDS the amounts issued and returned are shown collapsed. That is, they indicate only the amount spent by the accountable person (clauses 16, 17 of PBU 23/2011).

Line 4120 “Payments - total” is intended to reflect the disposal of cash and cash equivalents within the framework of current activities (correlated by the principle of filling with line 4110). The line indicator is the sum of the indicators in lines 4121-4129:

- 4121 – payment to suppliers (contractors) for raw materials, materials, work, services;

Please note that on this same line, customer-developers show funds allocated for the construction of facilities intended for investors, since for them this activity is current and not investment.

- 4122 – remuneration of employees;

Payments to employees in connection with the acquisition, creation, modernization, reconstruction and preparation for use of non-current assets, including costs of research, development and technological work, are not reflected in this line, since they relate to cash flows from investment activities (subparagraph “d” clause 9, subparagraph “a” clause 10 PBU 23/2011).

- 4123 – payment of interest on debt obligations;

Interest on borrowed funds raised for the purpose of creating investment assets is shown in the group of articles “Cash flows from investment operations”. Dividends and other similar amounts of distributed profit paid to shareholders (participants) are reflected in the ODDS as part of cash flows from financial transactions.

- 4124 – payment of income tax (including amounts that the company cannot clearly classify);

If in 2022 an organization paid income tax (advance payments thereon) in connection with investment or financial activities, then such amounts are not formed in line 4124, but are shown in the section “Cash flows from investment operations” or “Cash flows from financial operations” " respectively. For example, cash flows from financial transactions reflect the tax calculated on the amount of profit distributed in favor of the owners (participants).

- 4125-4128 – additional lines to reflect significant expenses that are not included in the lines specifically intended for a certain type. In most cases, if there are indicators in lines 4114-4118, then, in accordance with the presence of significant income, it is necessary to enter the ODDS and related expenses in lines 4125-4128.

In addition, the “expense” additional lines of the ODDS include the amounts of VAT, other taxes and fees. Let us remind you that in the ODDS the sums of VAT are indicated:

- received as part of receipts from buyers and customers;

- listed to suppliers and contractors;

- transferred to the budget;

- returned from the budget.

Thus, the line “VAT” can be in the group of items “Payments - total”, provided that in the reporting year the amount of VAT transferred to suppliers, contractors and the budget exceeds the amount of VAT received from buyers, customers and the budget.

- 4129 – outgoing cash flows from core activities that are considered immaterial for individual disclosures. The principle of forming a line indicator is the same as for line 4119.

Line 4100 reflects the interim total of ODDS - the balance of cash flows from current operations.

The line indicator is determined by calculation as the difference between the indicators of lines 4110 and 4120. If the subtraction results in a negative value, it is indicated in the ODDS in parentheses.

Results

A report reflecting information on the dynamics of targeted financing funds is generated if the reporting entity has such funds. When creating it, the form recommended by the Ministry of Finance of Russia is usually used, which has two forms (full and simplified) and, if necessary, can be supplemented with the necessary lines. Simplification of the report is achieved by combining indicators and is not available to all users of this form. There are no special instructions for filling out the current form, so you need to enter data into it based on the logic of the report form itself.

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.