Classification of synthetic accounts based on the requirements of regulatory documents

The chart of accounts and instructions for its use, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n, contain a complete list of accounts that are used for accounting.

Based on the presence of subaccounts, they can be divided into three groups:

| Group | Synthetic accounts included in the group |

| Accounts that contain subaccounts designated in the chart of accounts | 08, 10, 19, 41, 50, 55, 58, 69, 73, 75, 76, 79, 90, 91, 98 |

| Accounts that need to be divided into subaccounts according to the recommended criteria | 01, 03, 04, 66, 67, 68, 86, 96, 97 |

| Accounts that are presented in the chart of accounts only in synthetic form | 02, 05, 07, 09, 11, 14, 15, 16, 20, 21, 23, 25, 26, 28, 29, 40, 45, 44, 45, 46, 51, 52, 57, 59, 60, 62, 63, 70, 71, 77, 79, 80, 81, 82, 83, 84, 94, 99 |

Some accounts also have specific requirements for the analytics they must contain. From this point of view, accounts can be classified as follows:

| Group | Synthetic accounts included in the group |

| The instructions for the chart of accounts contain requirements for account detailing, which must be implemented using subaccounts | 01, 02, 03, 04, 08, 10, 14, 16, 19, 41, 42, 50, 52, 55, 57, 58, 59, 60, 62, 63, 66, 67, 68, 69, 73, 75, 76, 79, 83, 84, 90, 91, 96, 97, 98 |

| The instructions for the chart of accounts contain requirements for account analytics, which can be implemented using other characteristics (for example, in accordance with inventory and warehouse accounting, using separate warehouses, orders, cost centers, etc.), but without using subaccounts | 01, 02, 03, 04, 05, 07, 09, 10, 11, 15, 20, 21, 23, 25, 26, 28, 29, 40, 41,43, 44, 45, 46, 51, 60, 62, 70, 71, 77, 80, 86 |

| There are no requirements for analytics in the instructions | 81, 82, 94 |

The balance sheet accounts highlighted in the table should be detailed not only at the subaccount level, but also object by object. For example, account 01 (fixed assets) must contain information about those objects that are in operation, stock, conservation, or lease. This can be implemented at the subaccount level. But at the same time, there should also be analytics for inventory items.

ATTENTION! From 01/01/2022, PBU 6/01 “Accounting for Fixed Assets” will no longer be in force, and accounting for fixed assets will be regulated by two new FAS 6/2020 “Fixed Assets” and 26/2020 “Capital Investments”. Read more about them here.

Find out what changes to make to the accounting policy in accordance with the new Federal Accounting Standards in ConsultantPlus. If you do not have access to the K+ system, you can get trial demo access to the system for free.

For information about what other applications, in addition to the working chart of accounts, may be required for the accounting policy, read the articles:

- “We draw up a regulation on the accounting policies of the organization”;

- “Appendices to accounting policies - sample.”

One of the applications to the accounting policy is the document flow schedule. From 2022, FSBU 27/2021 “Documents and document flow” will become mandatory. ConsultantPlus will help you prepare a document flow schedule. ConsultantPlus experts explained in detail how to organize document flow for accounting purposes under the new FAS 27/2021. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

What charts of accounts are in effect in 2022?

In fact, there are several charts of accounts for 2022 established by the legislation of the Russian Federation.

In the commercial segment the following are used:

- chart of accounts for accounting in commercial companies (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n);

- chart of accounts approved for banking structures;

- chart of accounts introduced for non-credit organizations.

According to the Ministry of Finance (letter dated March 15, 2001 No. 16-00-13/05), the plan approved by Order No. 94n is not of a regulatory nature, but is a recommendation document.

The state budget system has approved and applied:

- plans of accounts for autonomous, budgetary and government institutions;

- unified plan of budgetary entities (approved by order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n).

Let's study the specifics of the most common chart of accounts for accounting in 2022 - introduced by Order of the Ministry of Finance No. 94n.

invites you to a free webinar about everything new with digital signature for accountants and directors on September 16: you can sign up right now.

Paired accounts

We are talking about those accounts that are shown collapsed in the reporting: 01 and 02, 04 and 05, 10 and 14, 20, 21, 23 and 14, 43 and 14, 58 and 59.

If you look at the tables with classifications, you can see that the accounts that come second in the pair are presented in the chart of accounts only in synthetic form, although the instructions for use have requirements for detail. These accounts should have sub-accounts that will complement the first accounts in the pair. For example, if account 01 is detailed in accordance with the requirements of the instructions, and account 02 is maintained only by inventory numbers, then in order to obtain the residual value for any group, you will have to work hard. But if you open sub-accounts for account 02 by analogy with account 01, then the necessary information can be obtained at any time.

The situation is similar with reserve accrual accounts, which reduce the carrying value of inventories and financial investments. Thus, account 14 is used to accrue a reserve for reducing the cost of not only materials, but also work in progress and finished products. These are different balance lines. If you do not take this point into account when creating subaccounts for account 14, then you will have to collect this information additionally when drawing up a balance sheet.

Accounts 04, 08 and 97

Section I “Non-current assets” of the reporting form “Balance Sheet” must be filled out according to the approved indicators. Among them there are those that require the mandatory presence of subaccounts for some synthetic accounts.

The indicators “Intangible assets” and “Results of research and development” are taken into account in account 04. This means that when creating a chart of accounts, you need to take this into account, and not only for account 04, but also for the “paired” account 05.

“Tangible and intangible exploration assets” are separate balance sheet lines. According to PBU 24/2011, they must be accounted for in separate subaccounts to account 08. If an organization is developing, for example, deposits, then accounting must take this factor into account and provide separate subaccounts.

“Other non-current assets” are assets with a maturity of more than a year. This, for example, includes deferred expenses with a useful life of more than 12 months. This means that account 97 must have a corresponding subaccount.

Read about the composition of non-current assets in the material “What are non-current assets in accounting”.

Accounting on the management resource resource for the RAS chart of accounts in 1C:ERP

The 1C:ERP system also implements the ability to maintain management accounting on the Russian chart of accounts (RAS), which allows you to:

- maintain management simultaneously with regulated accounting;

- maintain accounting records in a different accounting currency;

- use standard reports.

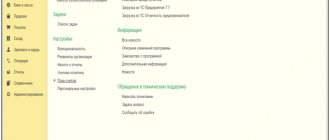

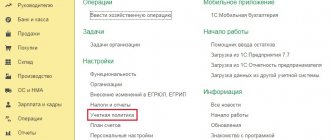

Let's go to the section “Reference data and administration” - “Regulated accounting”.

Fig. 12 Section “Reguchet” 1C:ERP

Let's check the appropriate box to activate the accounting feature, and also set up the currencies for management financial reporting.

Fig. 13 Management accounting settings

As a result, in documents and reports the amounts of the control will be highlighted as a separate line.

If you have previously kept records and set the settings later, you can generate balances for management accounting by clicking the button of the same name.

Fig. 14 Formation of initial balances according to the operating system

Let's consider an example of “turnover” on account 60 of Zimniy Sad LLC. In the “SALT” settings on the “Indicators” tab, the user can check the “UU (management accounting data”) checkbox.

Fig. 15 Setting up control indicators in OSV

Rows will appear in the report reflecting the control data. In this case, documents for the period must be reposted and re-recorded in accounting, otherwise the lines will be empty.

Fig. 16 OU in the SALT report

The document movement report shows that the amounts are reflected in both accounting and management accounting.

Fig. 17 CU in the document movement report

As a result, the data in the turnover will also be reflected in the lines of the operating system.

Fig. 18 CU data in the SALT report for the account in the system

Off-balance sheet accounts

In order to keep track of values that do not belong to the organization, but are temporarily in its possession, the chart of accounts provides for three-digit off-balance sheet accounts. Entries to off-balance sheet accounts are made only in debit (when valuables are received) or on credit (when valuables are disposed of).

Whether it is necessary to carry out an inventory of property recorded in off-balance sheet accounts, find out in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

The instructions for using the chart of accounts contain the analytics that off-balance sheet accounts must support. If necessary, you can and should open subaccounts for them.

For example, subaccounts “Leased fixed assets in Russia” and “Leased fixed assets outside the Russian Federation” can be opened for off-balance sheet account 001 “Leased fixed assets”. In off-balance sheet account 001, analytics are carried out for each fixed asset item in the valuation specified in the lease agreements.

In off-balance sheet account 002 “Inventory assets accepted for safekeeping,” purchasing organizations reflect assets accepted for storage. Also, on this off-balance sheet account, the buyer reflects received values, the ownership of which has not yet transferred to him, or defective values for which the buyer does not intend to pay.

Off-balance sheet account 002 can also be used by suppliers. For example, suppliers record in off-balance sheet account 002 inventory items paid for by buyers that are left in safekeeping, documented with safekeeping receipts, but not removed for reasons beyond the control of the organizations. Valuation of values reflected in off-balance sheet account 002 is carried out in prices, in prices stipulated in acceptance certificates or invoices, payment requests.

Materials accepted from the customer for subsequent processing and not subject to payment are reflected by manufacturing organizations in off-balance sheet account 003 “Materials accepted for processing.” Analytical accounting for off-balance sheet account 003 is carried out by customers, types, grades of raw materials and materials and their locations at the prices stipulated in the contracts.

To record strict reporting forms, use off-balance sheet account 006 “Strict reporting forms”. Analytical accounting on off-balance sheet account 006 should ensure the generation of information on the types of forms and places of their storage. It was established that strict reporting forms are taken into account in off-balance sheet account 006 in the conditional valuation. It is advisable to establish the procedure for conditional valuation by which forms will be taken into account in the accounting policy.

To reflect received obligations and payments, off-balance sheet account 008 “Securities for obligations and payments received” is used. Accounting in off-balance sheet account 008 is maintained for each collateral received, while the monetary valuation is made at the value of the obligation or the value specified in the contract.

An example of a working chart of accounts for an organization's accounting

Drawing up a working chart of accounts is subject to several rules. Unused accounts may not be included in the working chart of accounts. The number of accounts also matters. If there are too many of them, there is a possibility that when reflecting a business transaction, you may select the wrong account. If there are few of them, the necessary detail of reporting will not be achieved. That is why it is so important for every organization to find a “golden mean”.

In addition, if the accounting department needs to prepare any internal reports, for example, for making management decisions, then this also needs to be taken into account in the working chart of accounts.

Below is a chart of accounts most commonly used in organizations.

| Check | Subaccount | Name |

| 01 | 11 | Land plots in use |

| 01 | 21 | Buildings and structures in operation |

| 01 | 31 | Machines, equipment in operation |

| 01 | 41 | Other fixed assets in operation |

| 01 | 12 | Leased land plots |

| 01 | 22 | Buildings and structures leased |

| 01 | 32 | Machinery, equipment leased |

| 01 | 42 | Other fixed assets leased |

| 01 | 13 | Land plots under conservation |

| 01 | 23 | Buildings and structures under conservation |

| 01 | 33 | Machines and equipment for conservation |

| 01 | 43 | Other fixed assets for conservation |

| 01 | 50 | Disposal of fixed assets |

| 02 | 11 | Depreciation of land plots in operation |

| 02 | 21 | Depreciation of buildings and structures in operation |

| 02 | 31 | Depreciation of machinery and equipment in operation |

| 02 | 41 | Depreciation of other fixed assets in operation |

| 02 | 12 | Depreciation of leased land plots |

| 02 | 22 | Depreciation of buildings and structures leased |

| 02 | 32 | Depreciation of leased machinery and equipment |

| 02 | 42 | Depreciation of other leased fixed assets |

| 03 | 10 | Profitable investments |

| 03 | 20 | Income investments (disposal) |

| 04 | 01 | Intangible assets |

| 04 | 02 | Research and development |

| 04 | 03 | Business reputation |

| 05 | 01 | Depreciation of intangible assets |

| 05 | 02 | Amortization of research and development results |

| 05 | 03 | Amortization of acquired goodwill |

| 07 | Equipment for installation | |

| 08 | 01 | Purchasing an OS |

| 08 | 02 | OS construction |

| 08 | 03 | Investments in intangible assets |

| 08 | 04 | Carrying out research, development and technical work |

| 09 | Deferred tax asset | |

| 10 | 11 | Raw materials (purchased) |

| 10 | 12 | Raw materials and supplies (our own production) |

| 10 | 21 | Semi-finished products, parts, components (purchased) |

| 10 | 31 | Fuel |

| 10 | 41 | Tara |

| 10 | 51 | Spare parts (purchased) |

| 10 | 52 | Spare parts (our own production) |

| 10 | 60 | Other materials |

| 10 | 70 | Materials being processed by a third party |

| 14 | 10 | Reserve for reduction in cost of materials |

| 14 | 20 | Reserve for reduction in the cost of work in progress |

| 14 | 30 | Reserve for reduction in the cost of finished products |

| 15 | 10 | Procurement and acquisition of raw materials and materials |

| 15 | 20 | Procurement and acquisition of purchased semi-finished products, parts, components |

| 15 | 30 | Procurement and purchase of fuel |

| 15 | 40 | Preparation and purchase of containers |

| 15 | 50 | Procurement and purchase of spare parts |

| 15 | 60 | Procurement and acquisition of other materials |

| 16 | 10 | Deviation in the cost of raw materials and materials |

| 16 | 20 | Deviation in the cost of purchased semi-finished products, parts, components |

| 16 | 30 | Deviation in fuel cost |

| 16 | 40 | Deviation in the cost of packaging |

| 16 | 50 | Deviation in the cost of spare parts |

| 19 | 10 | VAT on the acquisition of fixed assets |

| 19 | 20 | VAT on acquired intangible assets |

| 19 | 30 | VAT on purchased inventories |

| 20 | Primary production | |

| 21 | Semi-finished products of our own production | |

| 23 | Auxiliary production | |

| 25 | General production expenses | |

| 26 | General running costs | |

| 28 | Defects in production | |

| 29 | Service industries and farms | |

| 41 | 10 | Products in stock |

| 42 | 10 | Trade margin (products in stock) |

| 42 | 20 | Trade margin (goods shipped) |

| 43 | Finished products | |

| 44 | Selling expenses | |

| 45 | Goods shipped | |

| 50 | 10 | Cash desk (in rubles) |

| 50 | 20 | Cash desk (in currency) |

| 51 | Checking account | |

| 52 | Foreign currency account | |

| 55 | 10 | Letters of credit |

| 55 | 20 | Deposits |

| 57 | 10 | Transfers on the way (rubles) |

| 57 | 20 | Transfers on the way (currency) |

| 58 | 10 | Stock |

| 58 | 20 | Loans provided |

| 58 | 30 | Other financial investments |

| 59 | 10 | Provision for impairment of shares |

| 59 | 30 | Provision for impairment of other financial investments |

| 60 | 10 | Settlements with suppliers and contractors for acquired non-current assets |

| 60 | 20 | Settlements with suppliers and contractors for purchased material assets |

| 60 | 30 | Settlements with suppliers and contractors for purchased goods |

| 60 | 40 | Settlements with suppliers and contractors for purchased works (services) |

| 62 | 10 | Settlements with buyers and customers for finished products |

| 62 | 20 | Settlements with buyers and customers for work performed (services) |

| 62 | 30 | Settlements with buyers and customers for sold material assets and goods |

| 63 | Provision for doubtful debts | |

| 66 | 10 | Settlements for short-term bank loans |

| 66 | 20 | Settlements for other short-term loans and borrowings |

| 67 | 10 | Settlements for long-term bank loans |

| 67 | 20 | Settlements for other long-term loans and borrowings |

| 68 | 10 | Income tax calculations |

| 68 | 20 | VAT calculations |

| 68 | 30 | Property tax calculations |

| 68 | 40 | Transport tax calculations |

| 68 | 50 | Calculations for other taxes |

| 69 | 10 | Social insurance calculations |

| 69 | 20 | Pension calculations |

| 69 | 30 | Calculations for compulsory health insurance |

| 70 | Payments to personnel regarding wages | |

| 71 | 10 | Payments to personnel for business trips |

| 71 | 20 | Settlements with personnel for the purchase of material assets, works, services in cash |

| 73 | 10 | Settlements with personnel for loans |

| 73 | 20 | Settlements with personnel for compensation of material damage |

| 73 | 30 | Settlements with personnel for other operations |

| 75 | 10 | Calculations for contributions to the authorized capital |

| 75 | 20 | Calculations for payment of income |

| 76 | 10 | Calculations for property and personal insurance |

| 76 | 20 | VAT on inventories shipped without transfer of ownership |

| 76 | 30 | Claims settlements |

| 76 | 40 | Settlements with individuals under civil contracts |

| 76 | 50 | Settlements with other debtors and creditors |

| 77 | Deferred tax liabilities | |

| 80 | Authorized capital | |

| 81 | Own shares | |

| 82 | Reserve capital | |

| 83 | Extra capital | |

| 84 | Retained earnings (uncovered loss) | |

| 90 | 11 | Revenue from sales of finished products |

| 90 | 12 | Revenue from sales of works and services |

| 90 | 13 | Revenue from sales of goods |

| 90 | 21 | Cost of finished products sold |

| 90 | 22 | Cost of work (services) sold |

| 90 | 23 | Cost of goods sold |

| 90 | 30 | VAT |

| 90 | 40 | Revenue from sales |

| 90 | 50 | Sales loss |

| 91 | 11 | Income from rental of fixed assets |

| 91 | 12 | Income from the sale of material assets |

| 91 | 13 | Other income |

| 91 | 21 | Expenses associated with leasing fixed assets |

| 91 | 22 | Cost of material assets sold |

| 91 | 23 | other expenses |

| 94 | Shortages and losses from damage to valuables | |

| 96 | 10 | Estimated liabilities for upcoming vacation pay |

| 96 | 20 | Estimated liabilities for upcoming vacation payments (insurance contributions) |

| 96 | 30 | Other provisions and estimated liabilities |

| 97 | 10 | Long-term deferred expenses |

| 97 | 20 | Short-term deferred expenses |

| 98 | revenue of the future periods | |

| 99 | Profit and loss | |

| Off-balance sheet accounts | ||

| 002 | Inventory accepted for safekeeping | |

| 003 | Materials accepted for recycling | |

| 006 | Strict reporting forms | |

| 008 | Securing obligations and payments | |

For information on how to record fixed assets on the balance sheet, read the article “Reflecting fixed assets on the balance sheet .

For more information about account 08, see the material “On which line should the balance of account 08 be reflected in the balance sheet?” .

Results

Every organization must have a working chart of accounts; it is approved simultaneously with the accounting policies. When forming this document, it is necessary to take into account the recommendations of the chart of accounts, instructions for its use, requirements of PBU, and features of the organization’s activities.

The word “working” in relation to the chart of accounts must be taken seriously: the better this document is developed, the easier it will be to draw up any reporting and provide the necessary information.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Chart of accounts of the MFP subsystem in 1C:ERP

To activate the ability to use the chart of accounts of the MFP subsystem, we will configure it in the section “Master data and administration” - “International financial accounting”.

Fig.7 Section “International financial accounting” in 1C:ERP

Let's check the box “International financial accounting”. The user can independently develop and configure an accounting model or download the supplied template - hyperlink “Download accounting model”.

Fig.8 Setting up international accounting (RU)

Here we will open “Settings and directories”.

Fig.9 Settings and references section in the system

The item “International” chart of accounts will become available here, with the ability to configure and add new accounts and subaccounts.

Fig. 10 International chart of accounts

The program allows you to create your own hierarchy of accounts with numbering up to 9 characters and detailing up to 3 sub-accounts.

Fig. 11 Grouping of management accounts in the system