Composition of the budget chart of accounts

Accountants of budgetary institutions must be guided by the Chart of Accounts and Instructions for its application, which are approved by Order of the Ministry of Finance of the Russian Federation of December 16, 2010 No. 174n (as amended and supplemented by December 31, 2015).

The budget chart of accounts contains approximately 2,000 accounts. But, in essence, most of them are subaccounts. Of course, accountants do not use all accounts, but, just like in commercial structures, they develop a working chart of accounts. Actually, those accounts that are most actively used in the activities of public sector employees are included in the following sections, there are only five of them:

1. Non-financial assets.

This includes fixed assets and intangible assets, as well as all related transactions, such as depreciation. This section also includes inventories, finished goods and capital investments.

2. Financial assets.

The name speaks for itself and covers the funds and financial investments of the institution, such as securities, deposits, shares. In addition, financial assets also include all types of receivables, including settlements with debtors for income, settlements with accountable persons, etc.

3. Commitments.

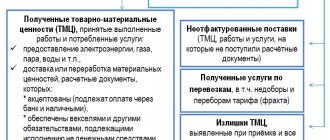

The section is similar to the concept of obligations in the commercial sphere and implies any forms of accounts payable, such as settlements with suppliers and contractors, settlements for taxes and fees, settlements for debt obligations...

4. Financial result.

The section contains information on financial results not only for the current year, but also for previous years of activity of institutions. It also contains information on cash execution of the budget and future income.

5. Authorization of budget expenditures.

Perhaps the most radically different section from commerce. The accounts included in it keep track of budget allocations and limits on budget obligations.

Similar to the general chart of accounts, the budgetary one contains off-balance sheet accounts that reflect values temporarily located in the institution and not belonging to it.

Receipt of funds in fulfillment of budgetary assignments of PFHD

When funds are actually received into the institution’s personal account (when the income indicator reflected in the plan is met), an entry is made in the accounting (clause 206 of Instruction No. 183n, clause 177 of Instruction No. 174n):

Account debit 0 508 00 000 “Financial collateral received” Account credit 0 507 00 000 “Approved amount of financial collateral”

Example 3.

A healthcare institution has entered into an agreement for the provision of paid medical services in the current year in the amount of 25,000 rubles. As part of its execution, this amount was credited to the institution’s personal account within the established time frame.

In the accounting authorization accounts, income received to the institution’s personal account will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Reflects the amount of income received by the institution, approved by the Pension Fund for the corresponding year. | 2 508 10 131 | 2 507 10 131 | 25 000 |

Please note that the amount of returns of previously received income (receipts) of the institution made in the current year is reflected in the “red reversal” method on the debit of account 0 508 00 000 “Financial security received” and the credit of account 0 507 00 000 “Approved amount of financial security” .

Scheme of operation of budget accounts

I cannot draw attention to one nuance regarding changes in the assets and liabilities of public sector institutions. The fact is that when the same type of assets or liabilities moves in the accounting of public sector employees, different accounts are used, i.e. when

an accounting subject

increases, the Debit of one

account, and when it decreases, accordingly, according to

the Credit of another

.

For example, if it increases

the cost of materials, then the accountant generates a posting:

If the cost of materials decreases

, the posting will be different:

Accounting for operations for the production of finished products in “1C: Accounting of a budgetary institution”

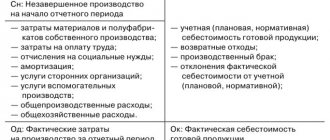

When manufacturing products, organizations use accounts to account for costs. 109, which is needed to take into account operations to form the cost of finished products, as well as work performed and services provided.

The costs described above are divided into direct and overhead.

Direct costs are all costs that relate to the cost of producing a finished product, performing work or providing a service. Such costs are taken into account. 109.61.

Let's try to look at this process with an example. Let’s say an organization produces printed products; 3 pieces of printing paper are used to produce a unit of finished product. and printing ink 1 pc.

We should write off the submitted materials to production on the account. 109.61 using the document “Write-off of inventories”.

Here it is worth paying attention to the fact that in the document you need to select the owner. operation “Write-off to the cost price of NFA”. In the debit account we indicate the account. 109.61. This account has a subaccount nomenclature. In this case, “printed products” should be indicated as the nomenclature (this is an element of the “Nomenclature” directory). The type of this item can be “Nomenclature group” or “Products”.

A product group is a collective type of product that includes several items of homogeneous final products. The product group has a composition that includes the final manufactured product.

Our case is a nomenclature group; on the “Group Composition” tab we will indicate the type of operation “assembly”, in addition we will make a note of what our printed products will consist of (album and advertising booklet).

On the “Materials” tab of the “Write-off of MH” document, it is worth indicating the consumables that were required for the manufacture of products.

Finished products are credited to account type 105.xx as they are produced during the month at the planned cost and without division by type of cost and KEK. To post finished products to the warehouse from production, the “Product Release” document is used.

In this document we indicate the production account 109.61 and fill out the tabular part “finished products”, in which we indicate the range of costs and, accordingly, the products that we have obtained. We indicate the planned cost as the amount.

Account 109.61 closed.

Ultimately, there may be costs that cannot be attributed to a specific item. In this case, it is necessary to use part 109.71 - overhead costs for finished production. It is necessary that in the accounting policy in the “Production accounting” section there is a checkbox “Distribute production overhead costs”

It is necessary to indicate “Methods for the distribution of indirect costs of the institution, prescribed in the accounting policies.”

In 1C:BGU 8, overhead costs are distributed in one of the following ways:

- in proportion to direct labor costs;

- proportional to material costs;

- in proportion to other direct costs;

- in proportion to the volume of revenue from sales of products (works, services).

Let’s add to our example: this month we paid the organization 6 thousand rubles for utilities.

In the program we will create a document “Third Party Services”. Since we do not know what specific type of product the costs of utility bills relate to, the cost account in this case will be 109.71.

In addition, as a result of such a process, general business expenses may arise, which are charged to the account. 109.81.

The accounting policy should also have a checkbox: “Distribute general business costs” and indicate the method for distributing these costs.

Let's add an example: this month we paid a transport company for delivery services in the amount of 2 thousand rubles.

In the program we will create a document “Third Party Services”. The cost account in this case will be 109.81.

And the last step in our production process will be the document “Closing Production Accounts”.

The regulatory document is intended for calculating production accounts and closing them at the end of each month.

Main functions:

- closing general (indirect) cost accounts. General production (109.71) and general business (109.81) costs are distributed to direct production costs (109.61) in the context of product items for which costs were collected on the main production account (109.61) during the month;

- adjustment of the turnover of finished products generated during the month at planned prices to the actual cost, calculated based on the results of production operations for the month and according to the data of work in progress balances specified in the document “Inventory of work in progress”;

- closing production accounts (N20, N25, N26) in tax accounting, as well as distribution cost accounts N44.

To close accounting accounts, you must enable the “Close accounts” checkbox in accounting.

To close tax accounting accounts, you must enable the “Close accounts” checkbox in tax accounting.

At the end of the month, general production and administrative costs are distributed to the direct costs of manufactured products. As a result of the distribution, the general cost accounts are reset to zero.

After the distribution of total costs, the turnover of finished products formed at the planned cost and without taking into account types of costs is adjusted to the turnover at the actual cost in the context of cost types.

The following speeds are adjusted:

- Dt 105.xx, Kt 109.61 Turnover of finished products;

- Dt xxx.xx, Kt 105.xx Turnover of write-off of finished products for all reasons;

- Dt 109.61, Kt 109.71 Turnover for the distribution of overhead costs. They are adjusted if during the month the products manufactured in the current month were written off;

- Dt 109.61, Kt 109.81 Turnover for the distribution of general business expenses. They are adjusted if during the month they were written off for products manufactured in the current month.

Adjustment of finished product turnover is based on calculation of the cost of production of manufactured products.

The document supports cost calculation:

- multi-process production. Multi-process production means the possibility of writing off products (semi-finished products) produced during the month for production costs in the same month. The number of redistributions is not limited. In this case, finished products (semi-finished products) can be written off both as direct costs of the current month and as total costs;

- assembly operations;

- cutting operations.

The document should be entered at the end of the month, after all production operations have been completed.

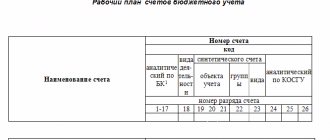

Account number structure

The account structure consists of 26 digits, each of which carries information about the organization. To make it easier to remember, let’s put the account structure into a table. Now let’s try to decipher the encoding of a budget account using an example. Obviously, budget accounting seems particularly difficult at first glance. A little theory and practice is enough to independently conduct budget accounting. And to do this, you need to enroll in a unique course “Accounting in state and municipal institutions using 1C: Accounting for a government institution 8.3,” which is built on the simultaneous study of theory and in-depth practice using documents from a real organization. Upon completion of the course, you will be able to safely work as an accountant in state and municipal institutions.

Planned assignments for expenses reflected in the financial statements

As we have already said, the plan is drawn up in accordance with the justifications (calculations) of the planned indicators of receipts and payments.

The amounts of expenses (payments) of the institution approved by the Pension Fund for the corresponding financial year are reflected in accordance with clause 171 of Instruction No. 174n, clause 200 of Instruction No. 183n on the debit of account 0 504 00 000 “Estimated (planned, forecast) assignments” and the credit of account 0 506 00 000 “Right to assume obligations.”

Changes in the estimated indicators for expenses (payments) of the institution approved in the current financial year are recorded in a similar entry. In this case, the amount of reductions in estimated assignments is reflected in the reverse correspondence of accounts.

Example 4.

The PFHD of the institution for 2022, within the framework of income-generating activities, approved the following payments (conditional figures).

Indicators for institution payments for 2022

| Indicator name | Line code | Budget classification code | Amount of financial support, rub. |

| Payments for expenses, total | 200 | X | 4 543 600 |

| including: | |||

| staff payments, total | 210 | 2 543 600 | |

| of them: | |||

| wages and accruals for wage payments | 211 | 2 343 600 | |

| - salary | 111 | 1 800 000 | |

| – accruals for wage payments | 119 | 543 600 | |

| – other payments to personnel, with the exception of the wage fund | 212 | 112 | 200 000 |

| Expenses for the purchase of goods, works, services | 260 | 244 | 2 000 000 |

In the accounting accounts, the amounts of expenses (payments) of the institution approved by the Pension Fund for the corresponding financial year are reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| The institution's planned payments are reflected in terms of: | |||

| – wages | 2 504 10 211 | 2 506 10 211 | 1 800 000 |

| – accruals for wage payments | 2 504 10 213 | 2 506 10 213 | 543 600 |

| – other payments to personnel, with the exception of the wage fund | 2 504 10 214 | 2 506 10 214 | 200 000 |

| – expenses for the purchase of goods, works, services | 2 504 10 226 | 2 506 10 226 | 2 000 000 |

Reflection of the transfer of property from account 21 to 1C: BGU 8

To restore the balance of fixed assets accounted for in off-balance sheet account 21, use the document Write-off of fixed assets, intangible assets, legal assets with the type of write-off Write-off of own fixed assets in oper. accounting (21) and the flag enabled: Restore to balance . the Restore on balance flag, the Restore on balance tab appears .

On the Fixed Assets, Intangible Assets, Regulatory Assets , fixed assets are selected that are written off from off-balance sheet account 21. On the Balance Restoration , data on fixed assets that are written off from off-balance sheet account 21 are indicated.

On the Accounting transaction , select the standard transaction Write-off of fixed assets with restoration on the balance sheet and in the additional details indicate the full working account 401.10.172. The gratuitous transfer of a fixed asset is formalized by the document Transfer of fixed assets, intangible assets, legal acts with the type of transfer - Transfer of own fixed assets, intangible assets, legal acts on the balance sheet (101, 102, 103) and the standard transaction Gratuitous transfer to organizations of fixed assets, intangible assets, legal acts (401.20.280) .

More on the topic: VAT accounting by budgetary institutions from 2022

Published 05/19/2021