Compensation for damages income tax

Moreover, the order to recover damages from the guilty employee must be issued no later than within one month from the day when its amount is finally established (Part 1 of Article 248 of the Labor Code of the Russian Federation). Such a day can be considered the date of execution of a document drawn up based on the results of an official investigation (act, conclusion, decision of a specially created commission, etc.)

In accordance with the agreement on targeted financing, the customer-developer (hereinafter referred to as the Enterprise) receives from the executive authority (State Customer) federal budget funds to pay exclusively rental payments under lease agreements for forest and land plots that are used for the construction of linear facilities.

Compensation for damages income tax

In a letter dated October 13, 2010, No. 03-07-11/406, the Ministry of Finance of Russia expressed the same opinion, but additionally emphasized that the injured party should not issue an invoice for the cost of the damage to be compensated.

Real damage refers to the expenses that a person whose right has been violated has made or will have to make to restore the violated right, as well as loss or damage to his property (Clause 2 of Article 15 of the Civil Code of the Russian Federation). Lost profits are considered lost income that a person would have received under normal conditions of civil transactions if his right had not been violated (Clause 2 of Article 15 of the Civil Code of the Russian Federation)

Lost profits: interesting situations from practice for 2022 - 2022

The most important and difficult thing is to confirm the lost income. Let's consider what the courts took into account when the plaintiffs demanded to recover lost profits due to violation of exclusive rights, withholding of payment under the contract, and illegal actions of local authorities. Read about these and other examples in the review.

A competitor sells a counterfeit product - the copyright holder must still prove lost profits

The company violated the company's exclusive right to a utility model, manufactured counterfeit products and received income from their sale. The company went to court to recover lost profits in the amount of these incomes.

Two instances did not satisfy the claim. They emphasized that the company had not proven a real opportunity to make a profit.

The cassation did not agree and noted: the introduction of counterfeit goods to the market naturally reduces the income of the copyright holder; there is no need to prove lost profits.

The RF Armed Forces did not support this approach. Contracts for the sale of products were concluded using competitive procedures. In one of the competitions, the price of the copyright holder was not the lowest after the price of the defendant, and in the other he did not participate at all. It turns out that the plaintiff in any case could not receive income in the declared amount. The fact that it was spent on production does not matter.

As a result, the RF Supreme Court upheld the acts of first instance and appeal.

The court may not recover lost profits if it is justified by lost interest on the deposit

The buyer did not pay for the delivered goods on time, but placed the money in deposit accounts at interest.

The supplier wanted to recover lost profits - the income that he could have received if he had kept the money on deposit.

The first instance agreed. The appeal reasoned differently, as it did not see a cause-and-effect relationship between the violation and lost income. The plaintiff was a wholesaler of chemical products. It was not proven that the money in dispute was pure profit, and he would inevitably give it to banks at interest.

The Arbitration Court of the Ural District supported the conclusions of the appeal. The RF Supreme Court did not reconsider the case.

A similar approach was encountered in the practice of the Volga-Vyatka Autonomous District.

To confirm lost profits, OKVED codes are important

The plaintiff reclaimed his forklift from someone else's illegal possession and wanted to recover lost profits from a failed rental. The first instance upheld it, but the appeal decided not to award damages.

She took into account that they had not confirmed:

- real possibility of renting;

- demand for equipment;

- interest of potential tenants.

Moreover, rental services for self-propelled vehicles were not included in the company’s activities according to the extract from the Unified State Register of Legal Entities.

In the appeal, the legal entity noted: the right to engage in this or that activity does not depend on the presence of an OKVED code. The AC of the North Caucasus District rejected this argument. Lost profits were assumed but not proven. The RF Supreme Court did not reconsider the case.

In a similar situation, another plaintiff had the necessary OKVED codes and contracts with third parties. The courts recovered lost profits, since the real opportunity to provide services and receive income was confirmed.

There is a chance to recover lost income from the sale of an object even at the initial stage of construction

The society was going to build a building on rented land. Due to illegal decisions of municipal authorities (in particular, refusal to issue a construction permit), the project was delayed. By the end of the lease, only the foundation had been erected. The lease was not renewed for a new term.

In court, the company demanded to recover more than 33.5 million rubles from municipal authorities. lost profits. This is exactly how much it expected to receive from the sale of the constructed facility.

The first instance refused. She did not see a direct connection between illegal decisions of local governments and lost profits from the sale of the facility. Construction was hampered not only by the above decisions, but also by the expired lease.

The appeal did not support the findings. She believed that it was precisely because of the decisions of municipal authorities that the society was unable to build the facility. It made all the necessary preparations: concluded contracts, attracted financing, etc.

According to the expert’s calculations, the lost profit amounted to about 11 million rubles. The appeal awarded it to the company, the conclusions were upheld by the AS of the West Siberian District. The RF Armed Forces agreed with them.

In another case, the administration illegally refused to issue a town planning plan to the society. Among other things, it demanded recovery of lost profits - lost profits from the operation of the hotel after construction. However, it did not prove the cause-and-effect relationship and the reality of receiving income (necessary preparations, agreements with counterparties, etc.).

The courts did not support the requirements. The AC of the North-Western District agreed with them.

Expenses for compensation of damage caused tax profit

1 tbsp. 15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount. Losses are understood as expenses that a person whose right has been violated has made or will have to make to restore the violated right, loss or damage to his property (real damage), as well as lost income that this person would have received under normal conditions of civil circulation if his right was not violated (lost profits) (p.

The Plenum of the Supreme Court of the Russian Federation No. 6 and the Plenum of the Supreme Arbitration Court of the Russian Federation No. 8 in the Resolution of 01.07.1996 explained that the actual damage includes not only the expenses actually incurred by the relevant person, but also the expenses that this person will have to make to restore the violated right (p. .

Compensation for lost profits

According to Article 15 of the Civil Code of the Russian Federation, a person whose right has been violated may, as a rule, demand full compensation for the losses caused to him, which should be understood as:

- real damage. That is, the expenses that the person whose right was violated made (will have to make) to restore the violated right, loss or damage to his property;

- lost profit. In other words, the lost income that this person would have received under normal conditions of civil legal relations if his right had not been violated.

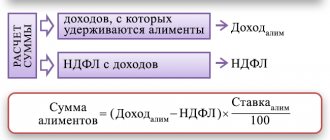

As mentioned above, in accordance with subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, for the purpose of taxing the profits of organizations, expenses for compensation for damage caused, and not for compensation for losses, are accepted. In addition to actual damage, they include lost profits. Expenses for compensation of lost profits cannot be taken into account when forming the base for the said tax. Such clarifications are given in the letter of the Ministry of Finance of Russia dated July 4, 2013 No. 03-03-10/25645.

Reference:

receipts in the form of fines, penalties and (or) other sanctions for violation of contractual obligations recognized by the debtor or payable by the specified person on the basis of a court decision that has entered into legal force, as well as amounts of compensation for losses or damages, are non-operating income. The date of their receipt is recognized as either the date of recognition by the debtor, or the date of entry into legal force of the court decision (clause 3 of Article 250, subclause 4 of clause 4 of Article 271 of the Tax Code of the Russian Federation). In accounting, they are reflected as part of other income in amounts awarded by the court or recognized by the debtor in the reporting period in which the court decision on collection was made, or they were actually recognized by the debtor (clauses 7, 10.2 and 16 of PBU 9/99 ).

Commented document: Letter of the Ministry of Finance of the Russian Federation No. 03-03-06/1/4678 dated 02/06/2014 “Income tax: accounting for expenses in the form of fines for violation of discipline by employees.”

Tax consultant I.N. Novikov

, for the magazine “Normative Acts”

Income tax from A to Z

A complete guide for the income tax accountant. Using this berator, you will easily cope with calculations, overcome discrepancies between accounting and tax accounting, will not be afraid to apply PBU 18/02, and also fill out the declaration without errors and submit it to the tax office on time.

Find out more >>

If you have a question, ask it here >>

Compensation for damages income tax

In relation to the rules provided for by Chapter 59 of the Civil Code of the Russian Federation, employees are citizens performing work on the basis of an employment agreement (contract), as well as citizens performing work under a civil law contract, if they acted or were supposed to act on the instructions of the relevant legal entity or a citizen and under his control over the safe conduct of work.

Subsequently, a breakthrough occurred and one of the premises was flooded. The tenant of this office recovered damages from the owner of the building in court. Referring to the above clause of the contract, the customer (the owner of the office building) appealed to the arbitration court, which ordered the contractor to pay compensation for the customer’s expenses to compensate for material damage to the tenant.

We recommend reading: Sample Agreement concluded by a Branch

Compensation for damages income tax

We will tell you in this article how such payments are taken into account in the tax accounting of the parties to the proceedings. The debtor is obliged to compensate the creditor for losses caused by non-fulfillment or improper fulfillment of the obligation (clause

3 tbsp. 129 of the Tax Code of the Republic of Belarus (hereinafter referred to as the Tax Code of the Republic of Belarus). However, if the culprit is found and he agrees to compensate for the shortage, loss or damage to assets without trial, then the amount of such deficiency is not included in non-operating expenses and is not taken into account when calculating income tax (we will call it an ordinary shortage).

Lost or damaged property due to the fault of the employee

At the same time, the organization has the right to take into account losses caused by the employee when forming the corporate income tax base.

Thus, it is possible to recognize the cost of lost property (reimbursable by the employee) as part of non-operating expenses on the basis of paragraphs. 20 clause 1 art. 265 of the Tax Code of the Russian Federation (as other justified expenses).

This position is supported by financiers (see Letter of the Ministry of Finance of Russia dated August 27, 2014 No. 03-03-06/1/42717).

In this case, the following conditions must be met:

- the amount of damage is compensated by the employee;

- the costs incurred by the organization in connection with damage caused to it correspond to the criterion set out in paragraph 1 of Art. 252 of the Tax Code of the Russian Federation (that is, they are justified, documented, carried out to carry out activities aimed at generating income).

This point of view is set out in Letters of the Ministry of Finance of Russia dated 01/15/2018 N 03-03-06/1/1023, dated 04/25/2016 N 03-03-06/1/23667.

Expenses for compensation of damage caused tax profit

The Tax Code of the Russian Federation does not establish the obligation of the person compensating for damage to carry out any mandatory measures to investigate the causes of the loss of goods, identify those responsible and recover damages from them. In this regard, the question arises: Is it possible, in accordance with paragraphs. 13 clause 1 art. 265 of the Tax Code of the Russian Federation attributing to non-operating expenses the claim of the bailor recognized by the custodian for the recovery of damage due to the failure to ensure the safety of goods in the warehouse, if the custodian did not take measures to identify the perpetrators and recover damage from them? Answer: The Department of Tax and Customs Tariff Policy has reviewed the letter and reports the following.

Tax Code of the Russian Federation to recalculate with the budget. Accounting for compensation of losses In accounting, compensation for losses caused by the organization to third parties is classified as other expenses, and is reflected in account 91 “Other income and expenses”, subaccount 2 “Other expenses”, in correspondence with the corresponding settlement accounts. It is important to determine the date of reflection of such expenses in accounting. In our opinion, they should be reflected in the organization’s accounting either on the date of their recognition or on the date of the court decision. Situations are possible when expenses are recognized on both dates (example 1). Example 1. Limited liability company “A” received on October 5, 2022 from CJSC “B” a letter demanding to pay off losses that, in the opinion of the plaintiff, in connection with the failure of LLC “A” to fulfill contractual obligations. The amount of the claim of ZAO “B” is 413,000 rubles. Management of LLC “A” November 11, 2022

Compensation for damages in income tax

Accounting", 2022, N 4 COMPENSATION OF DAMAGE BY AN ORGANIZATION: WHAT AN ACCOUNTANT SHOULD KNOWIn the course of business activities, situations may arise when an enterprise voluntarily or unwittingly causes damage to third parties. Let's consider how business transactions arising in connection with this are reflected in accounting and tax accounting. Damage caused to the person or property of a citizen, as well as harm caused to the property of a legal entity, are subject to compensation in full by the person who caused them. The person whose right is violated may demand full compensation for losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount.

- report the theft to the police;

- reflect the fact of property theft in accounting and tax records;

- obtain from the police department a document confirming the fact of theft and the failure to identify the perpetrators;

- reflect the financial result from the consequences of the theft.

General Audit Department on the issue of recognition of damage compensation for income tax purposes

Answer In accordance with Article 1 of the Civil Code of the Russian Federation, civil legislation is based on the recognition of the equality of participants in the relations regulated by it, the inviolability of property, freedom of contract, the inadmissibility of arbitrary interference by anyone in private affairs, the need for the unhindered exercise of civil rights, ensuring the restoration of violated rights, and their judicial protection.

Citizens (individuals) and legal entities acquire and exercise their civil rights of their own will and in their own interest. They are free to establish their rights and obligations on the basis of the contract and to determine any terms of the contract that do not contradict the law.

Civil rights may be limited on the basis of federal law and only to the extent necessary in order to protect the foundations of the constitutional system, morality, health, rights and legitimate interests of other persons, to ensure the defense of the country and the security of the state.

According to Article 421 of the Civil Code of the Russian Federation, citizens and legal entities are free to enter into an agreement.

The parties may enter into an agreement, either provided for or not provided for by law or other legal acts.

The terms of the contract are determined at the discretion of the parties, except in cases where the content of the relevant condition is prescribed by law or other legal acts (Article 422).

In connection with the above, in our opinion, organizations A and B had the right to include in the contract a condition for party A to compensate party B for costs (losses) that arose at the initiative of party A.

Let's consider the possibility of recognizing this compensation for income tax purposes.

As follows from the question, company B was forced to pay, in connection with the termination of the contract, the amount of compensation for the contractor’s expenses associated with entering the construction site, curtailing construction work and lost economic benefits.

Since Company A initiated the termination of the contract, Company B and Company A signed an agreement to compensate Company B for expenses incurred.

In accordance with Article 15 of the Civil Code of the Russian Federation, a person whose right has been violated may demand full compensation for the losses caused to him, unless the law or contract provides for compensation for losses in a smaller amount.

Losses are understood as expenses that a person whose right has been violated has made or will have to make to restore the violated right, loss or damage to his property (real damage), as well as lost income that this person would have received under normal conditions of civil circulation if his right was not violated (lost profits).

In the case under consideration, the parties signed an agreement according to which company A compensates company B for damages within 3 percent of the cost of construction and installation work, i.e. 50 percent real damage.

In accordance with subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation, non-operating expenses not related to production and sales include reasonable costs for carrying out activities not directly related to production and (or) sales. Such expenses include, in particular, expenses in the form of fines, penalties and (or) other sanctions for violation of contractual or debt obligations recognized by the debtor or payable by the debtor on the basis of a court decision that has entered into legal force, as well as expenses for compensation for damage caused.

At the same time, these expenses are recognized for income tax purposes provided that they comply with the requirements of Article 252 of the Tax Code of the Russian Federation.

According to paragraph 1 of Article 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses

carried out by the taxpayer.

Justified expenses mean economically justified expenses

, the valuation of which is expressed in monetary terms.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were incurred, and (or) documents indirectly confirming the expenses incurred. expenses (including customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

Any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

.

Thus, the necessary conditions for recognizing expenses for the purpose of calculating income tax are:

— economic feasibility;

- focus on generating income;

— availability of documentary evidence.

Economic feasibility and focus on generating income.

First of all, we note that the concepts of economic feasibility and focus on generating income are not clearly defined. The criteria for classifying expenses as justified and aimed at generating income are subjective in nature and are assessed based on the specific circumstances of the case. In connection with this, disputes often arise with the tax authorities on this issue.

The Constitutional Court in its Determinations dated December 16, 2008 No. 1072-O-O, dated June 4, 2007 No. 320-O-P and dated June 4, 2007 No. 366-O-P explained the main points related to the interpretation of the concepts of justification and economic justification and application norms of Article 252 of the Tax Code of the Russian Federation:

1. Expenses are justified and economically justified if they were incurred to carry out activities aimed at generating income. In this case, only the purpose and direction of such activity matters, and not its result.

(paragraph 7, 8 paragraph 2 of Definition No. 1072-O-O, paragraph 3, 4 paragraph 3 of Definition No. 320-O-P, paragraph 3, 4 paragraph 3 of Definition No. 366-O-P).

2. The economic justification of expenses cannot be assessed based on their feasibility, rationality, efficiency or the result obtained (paragraph 9, paragraph 2 of Definition No. 1072-O-O, paragraph 5, paragraph 3 of Definition No. 320-O-P, paragraph 5 clause 3 of Definition No. 366-O-P).

Only the taxpayer alone has the right to evaluate the expediency, rationality, and efficiency of financial and economic activities

. Thus, based on the principle of freedom of entrepreneurial activity, the courts are not called upon to check the economic feasibility of business decisions made by the taxpayer (paragraphs 9, 10 paragraph 2 of Definition No. 1072-О-О, paragraphs 5, 6 paragraph 3 of Definition No. 320- O-P, paragraph 5, 6 clause 3 of Definition No. 366-O-P, Determination of the Supreme Arbitration Court of the Russian Federation dated August 12, 2008 No. 9783/08).

4. All expenses incurred by the organization are initially assumed to be justified. It is the tax authorities who must prove their groundlessness (paragraph 11, 13 paragraph 2 of Definition No. 1072-O-O, paragraph 7, 9 paragraph 3 of Definition No. 320-O-P, paragraph 7, 9 paragraph 3 of Definition No. 366-O-P).

In addition, according to the regulatory authorities, the focus on generating income arises in the case when expenses are directly related to activities aimed at generating income, while this circumstance does not mean that the Organization should actually receive income - Letters of the Ministry of Finance of the Russian Federation dated 05.09. 12 No. 03-03-06/4/96, dated 12/19/11 No. 03-03-06/1/833, dated 08/25/10 No. 03-03-06/1/565, dated 04/21/10 No. 03-03 -06/1/279, dated 07.17.08 No. 03-03-06/1/414, Federal Tax Service of the Russian Federation for Moscow dated 10.19.10 No. 16-15/ [email protected]

.

From the foregoing, we can conclude that, until the opposite is proven by the tax authorities, expenses are recognized as economically justified. Moreover, since the taxpayer has the right to assess the expediency, rationality, and effectiveness of expenses solely based on the risks of his business activities, such assessments by the tax authorities cannot be the basis for recognizing expenses as unreasonable.

The focus on generating income is evidenced by the direct connection of expenses with the entrepreneurial activities of the organization. The fact that there is no economic benefit in connection with the amount of expenses incurred cannot be a basis for refusing to recognize such expenses.

In the case under consideration, in our opinion, the tax authority may express doubts about the economic justification of expenses due to the following.

As follows from the question, the contract with company B was terminated due to poor quality work and violation of deadlines.

Under a construction contract, the contractor undertakes, within the period established by the contract, to build a certain object on the customer’s instructions or to perform other construction work, and the customer undertakes to create the necessary conditions for the contractor to carry out the work, accept their result and pay the agreed price (clause 1 of Article 740 of the Civil Code of the Russian Federation).

The work contract specifies the start and end dates for the work. By agreement between the parties, the contract may also stipulate deadlines for completing individual stages of work (interim deadlines).

Unless otherwise established by law, other legal acts or provided for by the contract, the contractor is liable for violation of both the initial and final, as well as intermediate deadlines for the completion of work (clause 1 of Article 708 of the Civil Code of the Russian Federation).

The quality of the work performed by the contractor must comply with the terms of the contract, and in the absence or incompleteness of the terms of the contract, with the requirements usually applied to work of the corresponding type. Unless otherwise provided by law, other legal acts or a contract, the result of the work performed must, at the time of transfer to the customer, have the properties specified in the contract or determined by the usually imposed requirements, and within a reasonable period of time be suitable for the use established by the contract, and if such use is not provided for the normal use of the result of work of this kind (clause 1 of Article 721 of the Civil Code of the Russian Federation).

In accordance with paragraph 1 of Article 754 of the Civil Code of the Russian Federation, the contractor is responsible to the customer for any deviations from the requirements provided for in the technical documentation and in the building codes and regulations binding on the parties, as well as for failure to achieve the indicators of the construction project specified in the technical documentation, including such , as the production capacity of the enterprise.

When reconstructing (updating, rebuilding, restoring, etc.) a building or structure, the contractor is responsible for the reduction or loss of strength, stability, reliability of the building, structure or part thereof.

According to Article 723 of the Civil Code of the Russian Federation, in cases where the work was performed by the contractor with deviations from the work contract that worsened the result of the work, or with other shortcomings that make it unsuitable for the use specified in the contract, or in the absence of a corresponding condition in the contract of unsuitability for normal use, the customer has the right, unless otherwise provided by law or contract, at his own discretion to require from the contractor:

- elimination of deficiencies free of charge within a reasonable time;

-a proportionate reduction in the price set for the work;

- compensation for their expenses for eliminating defects, when the customer’s right to eliminate them is provided for in the contract (Article 397).

The contractor has the right, instead of eliminating the deficiencies for which he is responsible, to perform the work again free of charge with compensation to the customer for losses caused by the delay in performance. In this case, the customer is obliged to return the previously transferred work result to the contractor, if the nature of the work makes such a return possible.

If deviations in the work from the terms of the contract or other shortcomings in the result of the work have not been eliminated within a reasonable period established by the customer or are significant and irreparable, the customer has the right to refuse to perform the contract and demand compensation for losses caused.

Thus, the Civil Code of the Russian Federation provides for liability for violation by the contractor of the deadlines for completing work, as well as its quality. At the same time, termination by the customer of the contract in connection with claims against the contractor is possible only if we are talking about violation of the deadlines for correcting deficiencies by the contractor, as well as if the deficiencies are significant and irreparable. In this case, the customer has the right to demand compensation for losses caused.

Accordingly, if the contract was terminated for the above reasons, in our opinion, there were no grounds for Company B to pay compensation to Company C.

Further compensation of expenses by Company A for damages to Company B, in our opinion, is also not justified, since Company B was not obliged to compensate Company B for losses.

In this regard, the question of the economic justification of the expenses under consideration, in our opinion, is controversial and may lead to claims by the tax authority against both company A and company B.

Regarding the recovery of compensation from company A through the court, we note the following.

As follows from the question, the parties signed an agreement on compensation by Company A for losses incurred by Company B. Accordingly, Company A assumed an obligation to pay compensation.

Consequently, company B may file a lawsuit in court if company A does not fulfill its obligations within the prescribed period. In this case, the date of occurrence of the obligation will be the date of signing the agreement.

In this regard, on the date of signing the agreement, company A recognizes expenses for income tax purposes (subject to their economic justification), and company B recognizes income (subparagraph 8 of paragraph 7 of Article 272, subparagraph 4 of paragraph 4 of Article 271 of the Tax Code of the Russian Federation).

The court's decision to collect from company A the obligation arising from the signed agreement, in our opinion, will not have any impact on the recognition of expenses for income tax purposes.

Taking into account the above, in our opinion, the recognition by company A of expenses in the form of compensation for income tax purposes may lead to claims from the tax authority. Moreover, if company A decides to defend its position in court, it is not possible to predict the outcome of such proceedings.

Recognizing compensation as an expense by Company B may also entail tax risks. In this case, the compensation received from company A will need to be included in income for income tax purposes.

.

Answers to the most interesting questions on our telegram channel knk_audit

Back to section

Income tax refund

Not always and not all of our citizens strive to artificially reduce the tax burden; sometimes situations arise when the taxpayer exceeds his obligations. Overpayment of tax can occur for a variety of reasons, but in any case the payer has the right to a refund of overpaid or overcharged payments.

The general meaning of the income tax accounting methodology defined by IFRS is as follows: income tax is an expense item reflected in the income statement, which is divided into two components - current tax and deferred tax.

Compensation for Damage to Income Tax Expenses

Delivery must be made within three days after the seller receives the application. The supplier has repeatedly violated the delivery deadlines for construction materials. The buyer decided to file a claim with the supplier for compensation for losses incurred as a result of late delivery of construction materials. A claim was made for damages in the amount of RUB 250,000.

- report the theft to the police;

- reflect the fact of property theft in accounting and tax records;

- obtain from the police department a document confirming the fact of theft and the failure to identify the perpetrators;

- reflect the financial result from the consequences of the theft.

Accounting for damages

The company has the right to demand full compensation for losses from the culprit, unless the law or contract provides for compensation in a smaller amount.

Losses may arise during work with counterparties, through the fault of employees, unidentified persons, or as a result of emergency circumstances. Let's consider the accounting and tax aspects of accounting for compensation of losses 08/03/2015 Author: Tatyana Kakovkina, General Director, business consultant, Ph.D.

n. The company's activities are associated with the risk of various events, including those leading to losses.

It is legislatively established that in the event of losses, a company has the right to demand full compensation, unless the law or contract provides for compensation in a smaller amount (Article 15 of the Civil Code of the Russian Federation). In this case, losses should be understood as expenses that the company has made or will have to make to restore the violated right, including loss or damage to property (real damage), as well as lost income that the company would have received under normal trading conditions if its right was not violated (lost profits).

The Civil Code provides that the debtor is also obliged to compensate the creditor for losses caused by non-fulfillment or improper fulfillment of an obligation (Article 393 of the Civil Code of the Russian Federation). In the event of loss or damage caused by government services or local government services, they must reimburse and compensate them (Article 16, 16.1 of the Civil Code of the Russian Federation).

Compensation for losses when the culprit is a legal entity

In most cases, a company's losses may arise as a result of its work with counterparties under contracts for the supply of goods, performance of work, or provision of services. In this regard, we will consider the algorithm for compensation of losses using the example of a contract for the supply of goods.

1. Conditions for compensation of losses can be provided for in the contract itself. As a rule, the parties, when concluding a contract, determine the following:

- grounds for compensation of losses;

- limitation of damages.

It is possible to limit compensation both in terms of composition and amount of losses. That is, the contract can determine that lost profits are not subject to compensation, and also that the amount of compensation for losses cannot exceed a certain amount.

In addition to those conditions that may be specified in the contract, the Civil Code defines the following grounds for compensation for losses (see tables 1, 2).

Table 1. Compensation for losses by the supplier (seller)

Table 2. Buyer's compensation for losses

2. When cases occur when the company suffers losses, the following actions must be taken:

- determine the amount of actual damage and lost profits;

- draw up an act to determine the amount of damage;

- make a claim.

3. If the counterparty acknowledges the claim, the company makes the necessary entries in accounting and tax records.

4. If the counterparty does not recognize the claim, then an application to the court should be prepared.

5. Execution of a court decision:

- if the court found the plaintiff to be right, then, based on the decision, the company’s accounting department makes entries in the accounting and tax records;

- if the court rejects the claim, then the company recognizes the actual damage (loss) that it received.

EXAMPLE

The company entered into an agreement for the purchase of building materials in the amount of 11,800,000 rubles. (including VAT - RUB 1,800,000) with deliveries in various batches as orders are received from the buyer. Ownership passes to the company upon receipt of materials from the supplier in its warehouse.

Delivery is carried out by the latter. Delivery must be made within three days after the seller receives the order.

The supplier repeatedly violated the delivery deadlines for construction materials. The buyer decided to file a claim with the supplier for compensation for losses incurred as a result of late delivery of construction materials. A claim was made for damages in the amount of RUB 250,000. recognized by the supplier and paid.

The purchasing company makes the following entries in accounting:

DEBIT 76 CREDIT 91 subaccount “Other income”

— 250,000 rub. — the claim is recognized by the supplier;

DEBIT 51 CREDIT 76

— 250,000 rub. — funds were received to compensate for the damage (loss) caused.

In tax accounting, the company took into account the amount of compensation as non-operating income.

The supplier company makes the following entries in accounting:

DEBIT 91 subaccount “Other expenses” CREDIT 76

— 250,000 rub. - the claim is accepted;

DEBIT 76 CREDIT 51

— 250,000 rub. — funds were transferred to compensate for the damage (loss) caused.

In tax accounting, the supplier will take into account the amount of compensation as a non-operating expense (subclause 13, clause 1, article 265, subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation). The following can serve as a documentary justification for this expense (Article 252 of the Tax Code of the Russian Federation):

— an agreement describing the terms of compensation;

— act on determining the amount of damage;

- claim.

Compensation for losses when the culprit is an employee

In addition to losses arising from relationships with counterparties, the company's employees themselves (from ordinary employees to the general director) can cause losses.

EXAMPLE

The company driver, while driving a company car during working hours, violated traffic rules (hereinafter referred to as traffic rules) by driving into oncoming traffic. This violation was recorded by a video surveillance camera. A fine of 5,000 rubles was sent to the company's address by mail. The company decided, based on the norms of the Labor Code, to oblige the driver to reimburse the amount of the fine (Article 238, 239, paragraph 6 of Article 243 of the Labor Code of the Russian Federation; letter of Rostrud dated October 19, 2006 No. 1746-6-1).

The following entries were made in the accounting records:

DEBIT 91 subaccount “Other expenses” CREDIT 76

— 5000 rub. — the fine for violating traffic rules is included in expenses;

DEBIT 76 CREDIT 51

— 5000 rub. — payment of a fine for violating traffic rules;

DEBIT 73 CREDIT 91 subaccount “Other income”

— 5000 rub. — the driver’s debt to reimburse a fine for violating traffic rules is reflected;

DEBIT 50 CREDIT 73

— 5000 rub. — the driver paid off his debt to pay the fine through the cash register.

In tax accounting, the company does not take into account the amount of the fine paid for violating traffic rules as expenses for tax purposes (clause 2 of Article 270 of the Tax Code of the Russian Federation). At the same time, the fine reimbursed by the driver is non-operating income (clause 3 of Article 250, subclause 4 of clause 4 of Article 271 of the Tax Code of the Russian Federation).

Cases where claims for damages are brought against directors and general managers require special consideration. This issue was discussed in detail in the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation No. 62 (post. Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 62). According to it, the director is obliged to act in the interests of the company in good faith and reasonably (clause 3 of article 53 of the Civil Code of the Russian Federation). In case of violation of this obligation, he must, at the request of the founders, compensate for all losses caused to the company, on the same basis as an ordinary employee.

It should be taken into account that the negative consequences that occurred for the company during the period of time when the director was in charge do not in themselves indicate bad faith and unreasonableness of his actions (inaction). A director cannot be held liable for losses caused in cases where his actions (inactions) that resulted in losses did not go beyond the limits of ordinary business risk.

Therefore, the plaintiff must prove the existence of circumstances indicating bad faith and unreasonable actions (inaction) of the director, which entailed adverse consequences for the company (clause 5 of Article 10 of the Civil Code of the Russian Federation).

If the plaintiff has provided evidence, the director can provide explanations regarding his actions (inaction) and indicate the causes of losses, for example: unfavorable market conditions, dishonesty of his chosen counterparty, employee or representative of a legal entity, unlawful actions of third parties, accidents, natural disasters and other events - and present your evidence.

Compensation for losses when the culprit is not found

The company may also suffer losses as a result of unlawful actions of third parties. In such situations, it is most often difficult or even impossible to identify the guilty party and, therefore, the resulting losses will not be compensated. For example, this can happen in the event of theft of company property (loss of office equipment, goods or materials from a warehouse, etc.).

If a theft is detected, the following actions should be taken:

- report the theft to the police;

- reflect the fact of property theft in accounting and tax records;

- obtain from the police department a document confirming the fact of theft and the failure to identify the perpetrators;

- reflect the financial result from the consequences of the theft.

EXAMPLE

In March 2014, the company purchased construction materials to carry out contract work. The initial cost of building materials is RUB 2,500,000. These materials were delivered to the construction site and placed in a warehouse for temporary storage.

The loss of construction materials was discovered on 06/06/2014.

The following entries were made in the accounting records:

DEBIT 94 CREDIT 10

— 2,500,000 rub. — the cost of stolen materials is written off.

Thus, the first actions of the accounting service are to write off stolen materials from the organization’s property. The basis for write-off will be a theft statement registered at the police department (copy) or a coupon notification of acceptance of such a statement, inventory results and an act on write-off of stolen building materials.

To write off stolen materials, you must wait for the results of the work of law enforcement agencies. In most cases, unfortunately, it is not possible to find those responsible for the theft and the missing property. Therefore, after the period allotted for the investigation, it is necessary to take a copy of the decision to suspend the criminal proceedings due to the absence of the person to be charged as an accused. At the date of the ruling, the company may include the value of the stolen materials as an expense.

DEBIT 91 subaccount “Other expenses” CREDIT 94

— 2,500,000 rub. — stolen construction materials are recognized as other expenses.

In tax accounting, based on documents received from law enforcement agencies, the company has the right to take into account the cost of stolen property when taxing profits as non-operating expenses.

Force Majeure

It also happens that losses may arise as a result of force majeure circumstances such as fire or natural disaster. If they occur, the company may receive real damage in the form of destruction of its assets.

In the event of a fire (natural disaster), an inventory is mandatory. Based on its results, the actual cost of damaged or missing assets is written off as part of shortages and losses from damage to valuables in the reporting period when the inventory was carried out, with the subsequent allocation of this amount to other expenses of the organization.

EXAMPLE

As a result of a fire (natural disaster), the company's warehouse was damaged. During the inventory, a shortage of building materials in the amount of 1,000,000 rubles was established.

DEBIT 94 CREDIT10

— 1,000,000 rub. — materials damaged as a result of fire (natural disaster) are written off;

DEBIT 91 subaccount “Other expenses” CREDIT 94

— 1,000,000 rub. — the cost of materials damaged as a result of a fire (natural disaster) is included in other expenses.

In tax accounting, the cost of written-off materials damaged as a result of a fire (natural disaster) is taken into account as a non-operating expense (subclause 6, clause 2, article 265, subclause 4, clause 4, article 271 of the Tax Code of the Russian Federation).

The following can serve as a documentary justification for the loss (Article 252 of the Tax Code of the Russian Federation):

— inventory results;

— a certificate received from an authorized government body about the occurrence of an emergency event (territorial body of the Ministry of Emergency Situations, fire department).

It is always unpleasant for a company to receive losses, especially when they cannot be reimbursed or compensated. To minimize the risks associated with losses, we recommend:

- in case of economic activity - specify the conditions for compensation of losses in the contract;

- for force majeure circumstances (fire, theft, natural disasters) - insure your risks.

Current accounting

Post:

Comments

Compensation for damages in income tax

In the second half of the premises there was a warehouse for construction materials. As a result of careless handling of fire by workers, a fire broke out, which, before the firefighters arrived, destroyed the partition, some construction materials and the finishing of the premises of another tenant. The cost of the burnt goods is 165,200 rubles. The damage caused to the premises was estimated at RUB 68,298.40. agreed to voluntarily compensate for the damage caused. The parties agreed that they would provide building materials to replace those that were burnt, and also pay for repairs. The following entries were made in the accounting: D-t. 91-2 “Other expenses” Set of accounts.

Therefore, for tax accounting purposes, we will distinguish the actual compensation for damage and compensation for lost profits. The fact is that the tax authorities do not have any questions regarding the recognition of amounts of compensation for real damage in tax accounting. Another thing is compensation for lost profits. The Russian Ministry of Finance in Letter dated September 14, 2022 N 03-03-06/1/580 expressed the following opinion: the costs of compensation for damage caused only mean compensation for material damage.

Legal assistance

It should be taken into account that the negative consequences that occurred for the company during the period of time when the director was in charge do not in themselves indicate bad faith and unreasonableness of his actions (inaction). A director cannot be held liable for losses caused in cases where his actions (inactions) that resulted in losses did not go beyond the limits of ordinary business risk. Therefore, the plaintiff must prove the existence of circumstances indicating bad faith and unreasonable actions (inaction) of the director, which entailed adverse consequences for the company (clause 5 of Article 10 of the Civil Code of the Russian Federation).

In this case, we proceed from the assumption that the organization recognizes in non-operating expenses both the amount of damage caused (1,500,000 rubles) and the amount of lost profits (500,000 rubles), reimbursed by the organization to a third party. When using the accrual method in tax accounting, these expenses are recognized on the date of entry into force of the court decision - in March (clause 8, clause 7, article 272 of the Tax Code of the Russian Federation). Under the cash method, these expenses are recognized after actual payment - in this case, also in March (clause 3 of Article 273 of the Tax Code of the Russian Federation). Application of PBU 18/02 In January, when an expense is recognized in accounting in the amount of an estimated liability, the organization has a deductible temporary difference (DTD) and a corresponding deferred tax asset (DTA) (p.p.

We recommend reading: What benefits are available to those living in the socio-economic zone

Tax accounting of income and expenses

Amounts of compensation for losses payable by the debtor on the basis of a court decision are recognized as non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation).

Meanwhile, the very appearance of income is due to the loss of property. Its cost must be reflected as part of non-operating expenses on the date of entry into force of the court decision (subparagraph 20, paragraph 1, article 265, subparagraph 8, paragraph 7, article 272 of the Tax Code of the Russian Federation). After all, without recognition of expenses, taxation loses its economic basis (Clause 3, Article 3 of the Tax Code of the Russian Federation).

As a result, the approach set out in paragraph 1 of the commented letter does not meet with objections.

E.Yu. Dirkova

, for the magazine “Regulatory Acts for Accountants”

Guide for the simplified tax system

With this e-book, you will easily understand all the intricacies of the simplified taxation system, competently draw up a balance sheet and financial statements. You will receive the electronic edition immediately after payment to your email. Find out more about the publication >>

If you have a question, ask it here >>

Compensation for damages income tax

In this case, the salary is taken into account taking into account all allowances and increasing factors. The Federal Tax Service proposes to allow you to pay taxes for close relatives. What if you have lost your certificate of registration and assignment of a TIN? Or did you discover that you have two Taxpayer Identification Numbers?

• The fact that the culprit has not been found must be documented by a representative of the government authority. If goods are stolen, insurance compensation for damage is possible; income tax does not take it into account.

Compensation for damage by passengers income tax

Korn-Audit LLC It is known that vehicles with a permissible weight of over 12 tons (hereinafter referred to as “heavy trucks”) cause damage to roads. A fee is paid to compensate for this damage. In this situation, accountants often have a question: can this fee be taken into account as an expense in tax accounting? Composition of expenses For profit tax purposes, in particular, other expenses associated with production and (or) sales can be taken into account (Article 264 of the Tax Code of the Russian Federation). Consequently, the payment for compensation for damage caused to roads by heavy-duty vehicles can be taken into account as expenses for the purpose of calculating income tax on the basis of clause 49, part 1, art. 264 of the Tax Code of the Russian Federation (as other expenses associated with production and (or) sales).

- Payments by court: assessing the tax consequences Is it possible to take into account for income tax purposes the amount of damage caused to the environment collected by court decision?

- April 20, 2022The amount of compensation for damage caused to the environment can be recognized as expenses

What will change in accounting for property damage transactions?

Source: Journal “Payment in state (municipal) institutions: accounting and taxation”

An order has been posted on the website of the Ministry of Finance, which prepared changes to Instruction No. 157n[1]. Explain what changes will be made to the accounting of property damage transactions.

Yes, indeed, Order No. 89n (it is currently being registered with the Ministry of Justice), which prepared changes to Instruction No. 157n . This order is applied when forming indicators of accounting objects on the last day of the reporting period of 2014, unless otherwise provided by the accounting policy of the institution. The transition to the application of accounting policies, taking into account the provisions of this order in terms of the working Chart of Accounts of accounting of state (municipal) institutions, is carried out according to the organizational and technical readiness of accounting entities.

The new order is a fairly large document. They make many different amendments, additions and changes, in particular to the accounting of transactions for property damage, which are reflected in account 209 00 “Calculations for damage and other income” (new name).

Currently, in accordance with clause 220 of Instruction No. 157n account 209 00 “Calculations for property damage” is intended to account for calculations:

- according to the amounts of identified shortages, thefts of funds and other valuables;

- by the amount of losses from damage to material assets;

- other amounts of damage caused to the property of the institution, subject to compensation by the guilty parties in the manner established by the legislation of the Russian Federation.

In the new version of this paragraph, account 209 00 will also be used to reflect other transactions, in particular:

- for amounts of advance payments not returned by the counterparty in the event of termination of contracts (other agreements), including by court decision;

- for amounts of debt of accountable persons that were not returned in a timely manner (not withheld from wages), including in the case of challenging the deductions;

- on the amount of debt for unworked vacation days upon dismissal of an employee before the end of the working year for which he has already received annual paid leave;

- on the amounts of excessive payments made;

- on the amounts of forced seizure, including compensation for damage in accordance with the legislation of the Russian Federation (in particular, in the event of insured events);

- on the amount of damage caused as a result of the actions (inaction) of officials of the organization;

- for the amount of damage subject to compensation by a court decision in the form of compensation for expenses associated with legal proceedings (payment of legal costs);

- for other damages, as well as for other income arising in the course of the institution’s economic activities, not reflected in the analytical accounts of account 205 00 “Calculations for income”.

Due to the fact that account 209 00 will have a wider scope of economic and financial transactions, reflecting calculations for damage to property and other income, the analytical grouping of this account has been changed. Paragraph 221 of Instruction No. 157n is set out in a new edition.

New groups of income have been added to it: – 209 30 “Calculations for cost compensation”;

– 209 40“Calculations on the amounts of forced seizure.”

As before, settlements for damage to non-financial assets will be reflected according to the analytical code of the synthetic accounting group of account 209 70 “Calculations for damage to non-financial assets”:

– 209 71“Calculations for damage to fixed assets”;

– 209 72“Calculations for damage to intangible assets”;

– 209 73 “Calculations for damage to non-produced assets”;

– 209 74“Calculations for damage to inventories.”

Calculations for damage to other property will be reflected in the account containing the analytical code of the synthetic account group 209 80 “Calculations for other income”:

– 209 81“Calculations for cash shortages”;

– 209 82“Calculations for shortages of other financial assets”;

– 209 83“Calculations for other income.”

Account 209 83 will reflect settlements for other income arising in the course of the business activities of the institution, not reflected in the settlement accounts of account 205 00 “Settlements for income”.

Further, it should be noted that according to the changes being made, when determining the amount of damage caused by shortages and theft, one must proceed from the current replacement cost of material assets on the day the damage was discovered. In this case, the current replacement cost is understood as the amount of money that is necessary to restore the specified assets. This adjustment is due to the fact that, in accordance with Art. 246 of the Labor Code of the Russian Federation, the amount of damage caused to the employer due to loss and damage to property is determined by actual losses. They are calculated based on market prices prevailing in a particular area on the day the damage was caused, but not lower than the value of the property according to accounting data, taking into account the degree of depreciation of this property.

Currently, the amount of damage is determined from the market value of material assets on the day the damage was discovered. Market value refers to the amount of cash that can be obtained from the sale of specified assets.

Next, let us remind you what an accountant should know about the procedure for compensating damage caused to the institution’s property by an employee.

According to Art. 238 of the Labor Code of the Russian Federation, the employee is obliged to compensate the employer for direct actual damage caused to him. Lost income (lost profits) cannot be recovered from the employee.

Towards graying

Direct actual damage in this case should be understood as:

- real deterioration in the condition of the company car, the need for its repair;

- the need for the employer to incur expenses to compensate for damage to an injured third party (in the case where the insurance company did not have enough funds to reimburse expenses).

If the employee agrees to voluntarily compensate for the damage caused, a written agreement must be signed between the parties. It reflects the amount of damage and the method of repayment: depositing cash into the institution’s cash desk (to a personal account) or deduction from the employee’s salary. In accordance with Art. 248 of the Labor Code of the Russian Federation , by agreement of the parties to the employment contract, compensation for damage by installments is allowed.

In this case, the employee submits to the employer a written obligation to compensate for damages, indicating specific payment terms. In the event of dismissal of an employee who gave a written commitment to voluntarily compensate for damage, but refused to compensate for this damage, the outstanding debt is collected in court. With the consent of the employer, the employee may transfer equivalent property to compensate for the damage caused or repair the damaged property.

Let's look at a few examples of reflecting damage caused to property.

Example 1.

The property of the budgetary institution was damaged - the tonometer for measuring blood pressure was broken. The book value of the property is 5,500 rubles, the expenses for its acquisition were made from funds received from income-generating activities.

Based on the order of the manager, the damage was compensated based on the purchase price of the new tonometer. 6,100 rubles were spent on the purchase. The damage is fully compensated by the employee to the institution's cash desk.

In the accounting of a budgetary institution, in accordance with Instruction No. 174n [2], the following entries were made:

| Contents of operation | Debit | Credit | Amount, rub. |

| The shortage of tonometer attributed to the perpetrators is reflected | 2 209 71 560 | 2 401 10 172 | 5 500 |

| The write-off of the tonometer is reflected: | |||

| – in the amount of residual value | 2 401 10 173 | 2 101 34 410 | 0 |

| – in the amount of accrued depreciation | 2 104 34 410 | 2 101 34 410 | 5 500 |

| Received funds from the financially responsible person to compensate for the shortage | 2 201 34 510 | 2 209 71 660 | 6 100 |

After recording the tonometer shortage operation in the accounting records, it is necessary to make an entry in the funds and settlements card (f. 0504051) indicating the last name, first name and patronymic of the employee, the position of the person responsible, as well as the date the debt arose and the amount of the shortage.

Example 2.

In an autonomous institution, damage to new sets of workwear, previously purchased through a subsidy for the implementation of a state task, in the amount of 5,000 rubles, was discovered. The person responsible for damaging property is an employee of the institution.

RUB 8,300 was spent on purchasing new kits. Based on the order of the manager, the cost of damage was determined based on the actual costs associated with the purchase of protective clothing. With his written consent, the amount of damage was withheld from wages accrued as part of the execution of the state task.

In the accounting records of an autonomous institution in accordance with Instruction No. 183n [3], these transactions will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| The amount of damage caused is reflected (at the market value of the workwear) | 2 209 74 000 | 2 401 10 172 | 8 300 |

| Damaged workwear written off (at actual cost) | 4 401 10 172 | 4 105 35 000 | 5 000 |

| The amount of damage was withheld from wages | 4 302 11 000 | 4 304 03 000 | 8 300 |

| The repayment of the damage caused is reflected, the amount was accrued within the framework of another type of financial security (from KVFO 4 to KVFO 2) * | 4 304 03 000 | 4 304 06 000 | 8 300 |

| 2 304 06 000 | 2 209 74 000 |

In accordance with the explanations given in

the Letter of the Ministry of Finance of the Russian Federation dated October 18, 2012 No. 02-06-10/4354 , proceeds from compensation by guilty persons for damage caused to the property of an autonomous institution are recognized as the institution’s own income, therefore they are reflected in the accounting records indicating 18- m category of account numbers code type of financial security (KVFO) – 2.

Example 3.

A book with a book value of 10,000 rubles, acquired by an autonomous institution using funds received from income-generating activities, and included in the list of especially valuable movable property of the institution, was lost. The commission decided that this happened due to the negligence of the librarian; the employee admitted his guilt. In exchange, an equivalent book worth 11,000 rubles was accepted from the librarian.

In accordance with clause 5.4 of the Procedure for recording documents included in the library collection , approved by Order of the Ministry of Culture of the Russian Federation dated October 8, 2012 No. 1077 , compensation by readers for damage is allowed in the form of replacing a lost object of the library collection with an equivalent one.

When a reader compensates for damage, the market value of lost documents is established by an expert commission for assessing documents from the library collection. If rare and valuable books are lost, to determine their value, the commission can involve relevant experts in its work, as well as use materials from scientific and methodological centers, book auctions and fairs.

The write-off of a lost book is carried out on the basis of an act on the write-off of excluded objects of the library collection (f. 0504144) with a list of lost publications attached, as well as a document confirming their loss (an explanatory note).

In the accounting records of an autonomous institution in accordance with Instruction No. 183n , these transactions will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Damage caused to property is reflected (at the replacement cost of the lost book) | 2 209 71 000 | 2 401 10 172 | 11 000 |

| Lost book written off (at actual cost) | 2 104 27 000 | 2 101 27 000 | 10 000 |

| An equivalent book was accepted from the employee to replace the lost one. | 2 101 27 000 | 2 401 10 172 | 11 000 |

| Compensation for damages by the employee in kind is reflected | 2 401 10 172 | 2 209 71 000 | 11 000 |

As for the compulsory collection procedure, one should refer to the provisions of the above

Art. 248 Labor Code of the Russian Federation .

By virtue of its provisions, the recovery from the guilty employee of the amount of damage caused, not exceeding the average monthly earnings, is carried out by order of the employer. The order can be made no later than one month from the date of final determination by the employer of the amount of damage caused by the employee. If the month period has expired or the employee does not agree to voluntarily compensate for the damage caused to the employer, and the amount of damage caused to be recovered from the employee exceeds his average monthly earnings, then recovery can only be carried out through the court.

Example 4.

The official car of a government agency, which has the separate powers of a revenue administrator to accrue and record payments to the budget, was damaged as a result of an accident. According to the conclusion of the traffic police authorities, the driver of the institution, who was driving the specified car at the time of the accident, was found guilty of committing the accident. The cost of restoring the car amounted to RUB 34,600. According to the court decision, the amount of damage to be compensated by the employee was determined to be 25,300 rubles, the amount of legal costs was 5,300 rubles. Both amounts were paid by the employee to the institution's cash desk. The funds are transferred to budget revenues.

In accounting, taking into account the amendments made by Order of the Ministry of Finance of the Russian Federation dated August 29, 2014 No. 89n , these transactions will be reflected as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Reflects the damage caused to property attributed to the culprit - the driver | 1 209 40 560 | 1 401 10 140 | 25 300 |

| Costs associated with legal proceedings are reflected (payment of legal fees) | 1 209 83 560 | 1 401 10 180 | 5 300 |

| The driver deposited funds into the institution's cash desk to pay off the damage caused. | 1 201 34 510 1 201 34 510 | 1 209 40 660 1 209 83 660 | 25 300 5 300 |

| Revenue is included in budget income from the institution's cash desk | 1 303 05 830 | 1 201 34 610 | 30 600 |

| Reflects settlements with the budget revenue administrator, who exercises certain powers to administer cash receipts to the budget, on the basis of a notice (f. 0504805) | 1 304 04 130 | 1 303 05 730 | 30 600 |

| The costs of repairing a company car are reflected on the basis of a certificate of completion of work signed by the contractor | 1 401 20 225 | 1 302 25 730 | 34 600 |

| Repair work paid for | 1 302 25 830 | 1 304 05 225 | 34 600 |

Postings reflecting damage caused to property are shown using new accounts and are currently by Instruction No. 162n [4].

In conclusion, we note that in addition to the above changes and additions made to paragraph 220 of Instruction No. 157n , a paragraph has been added regarding the accounting of debtors' debts for damage and other income in foreign currencies. In particular, the amounts of such damage must be reflected simultaneously in the relevant foreign currency and the ruble equivalent as of the date of accrual of debt (revenue recognition).

Revaluation of payers' settlements for damage and other income in foreign currencies is carried out on the date of transactions for payment (return) of settlements in the corresponding foreign currency.

In this case, positive (negative) exchange rate differences that arose when calculating the ruble equivalent are attributed to the increase (decrease) in calculations of income in foreign currency, with exchange rate differences being attributed to the financial result of the current financial year from the revaluation of assets.

[1] Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

[2] Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

[3] Instructions for the use of the Chart of Accounts for accounting of autonomous institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

[4] Instructions for the use of the Chart of Accounts for Budget Accounting, approved. By Order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Compensation for damages income tax

- causing damage intentionally or while intoxicated;

- shortage of valuables entrusted to the employee on the basis of a special written agreement or received by him under a one-time document;

- causing damage as a result of an administrative offense established by the relevant government body.

Real damage refers to the expenses that a person whose right has been violated has made or will have to make to restore the violated right, as well as loss or damage to his property (Clause 2 of Article 15 of the Civil Code of the Russian Federation). Lost profits are considered lost income that a person would have received under normal conditions of civil transactions if his right had not been violated (Clause 2 of Article 15 of the Civil Code of the Russian Federation)

25 Jul 2022 jurist7sib 221

Share this post

- Related Posts

- When Purchasing New Constructions You Have To Pay Tax

- Honored Worker of the Ministry of Health of the Republic of Tatarstan Benefits

- What things bailiffs do not have the right to describe

- Added Pensions for Disabled Children 2022

Lost profits: how to calculate and recover

October 8, 2020

Sometimes a company receives less income due to the fault of its counterparties. But in order to prove lost profits, she needs to confirm a complex of facts and circumstances. Together with experts and lawyers, we figure out how this should be done to achieve a positive result. Practice shows that courts willingly satisfy claims related to lost profits if the position of entrepreneurs is justified by specific facts and supported by strong evidence. According to Part 2 of Art. 15 of the Civil Code of the Russian Federation, lost profits are a type of loss. In particular, these are lost income that would have been received under normal conditions if not for the violation of the law. Executive Director and Chief of Staff of the Ryazan Regional Branch of the Russian Bar Association Lyubov Larina

notes that in judicial practice, lost profits are understood more broadly - this is lost income by which a person’s property mass would have increased if his rights had not been violated (clause 14 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 23, 2015 No. 25).

“ Entrepreneurship is always associated with financial risks, but if the profit was lost due to the fault of third parties, the legislator gives the entrepreneur a chance to compensate for lost profits

,” says Lyubov Larina.

The expert notes that it is important not to confuse lost profits and real damage, which refers to the costs of an entrepreneur to restore a violated right, lost or damaged property. According to Evgenia Sokolova,

head of the “Arbitration Dispute Resolution” legal department, in Russia damages in the form of lost profits are not recovered so often.

The reasons are clear - the alleged amount is difficult to prove, and it is equally difficult to understand that it was the behavior of the offender that led to the losses of the victim. Despite this, the number of claims satisfied by the courts is gradually growing. Frequent situations related to lost profits

Lawyer Lyubov Larina gives a typical example of the renovation of an office building.

“ The owner of an office building entered into a contract with a contractor to renovate the building for one month. He also made additional agreements with tenants that they would not pay rent for that month. During the repairs, the network cable was damaged, the owner suffered additional losses, and the repairs dragged on for another month.” What will be the actions of the building owner in connection with the events?

Firstly, he may demand compensation for the costs of repairing the damaged cable - these will be losses in the form of real damage.

Secondly, the owner has the right to demand compensation for lost profits, which consists of rental payments for the month during which the repairs were delayed. The possibility of recovering lost profits is enshrined in some legislative acts: in Art. 18 Federal Law dated March 26, 2003 No. 35-FZ; in Art. 77 Federal Law of January 10, 2002 No. 7-FZ; in Art. 38 of the Federal Law of March 13, 2006 No. 38-FZ. The expert shares the most common situations when a company may not receive income. The product cannot be used for its intended purpose

. Details are in the Appeal ruling of the Voronezh Regional Court dated February 28, 2017 in case No. 33-1488/2017.

Situation

A citizen filed a lawsuit against a car dealership demanding replacement of goods of inadequate quality and recovery of lost profits.

Previously, he bought a truck and transferred it under a lease agreement to an individual entrepreneur for cargo transportation. During the warranty period, the engine caught fire and the truck was almost completely destroyed. Experts determined that it caught fire due to a technical malfunction. The truck owner calculated the amount of lost profits based on the amount of the rent and the period during which he could not receive it: 50,000 rubles. × 9 months = 450,000 rub. The claims were satisfied in full. Obligations under the lease agreement were not fulfilled

. Details are in the Appeal ruling of the Moscow Regional Court in case No. 33-18925/2015.

Situation

The owner of a non-residential premises and a legal entity entered into a lease agreement.

The owner was supposed to reconstruct the building before it was leased, but was unable to do this because part of the premises was occupied by a previous tenant whose lease had expired. The owner did not intend to renew or enter into a new contract and continued to use the premises despite the owner's notifications. The owner filed a claim to recover lost profits from the unscrupulous tenant in the amount of rent for the disputed premises for the period of delay. Authorities and officials are acting illegally. The Federal Customs Service of Russia issued an order (later declared illegal) limiting the places for declaring scrap ferrous metals exported from the Russian Federation. As a result, the export of these goods from the ports of Primorsky Krai was prohibited. A legal entity with a license to export only within the Primorsky Territory was unable to fulfill contracts and suffered losses. The exporting company's claim against the Federal Customs Service for actual damages and lost profits was satisfied. An example of a difficult situation

from the legal profession, Evgenia Sokolova, cites a case from practice when an appellate court, based on the results of an examination, overturned the first court decision and partially satisfied the stated requirements.

Situation

The contractor and the customer entered into three contract agreements for the development of design documentation from December 2014 to May 2015.