Types of registers

In fact, accounting registers are order journals and various cards, certificates and statements, for example, the most important one is the balance sheet (“chessboard”), based on the data of which a balance sheet is compiled. Therefore, it is logical that accounting registers are divided into:

- systematic;

- chronological;

- combined (synchronistic).

The first ones are maintained according to certain accounting accounts and an example of them can be called the balance sheet or the general ledger. Systematic documents also include cards in which the accountant records any events in economic life. Chronological ones are used to record events of economic activity for a certain period of time, most often a month. This is how most order journals are maintained. These two types of accounting registers complement each other; there is even the so-called Mendes rule:

The sum of turnovers in chronological registers is equal to the turnovers in the debit or credit of systematic registers.

Therefore, in practice, for the convenience of accountants, combined type registration documents are often used. For example, a journal is a general ledger common in small companies.

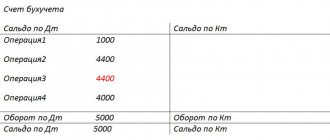

According to the degree of information generalization, there are analytical and synthetic accounting registers. A striking example of synthetic accounting documents is the same balance sheet. In it, the accountant records information for each synthetic account for a certain period about balances at the beginning and end of the period, as well as turnover for the period. This document looks like this:

The accountant records analytical information, that is, not only the transaction details, but also a summary of its contents, in special statements or cards. For example, this could be accounting for materials, goods, fixed assets, or settlements with counterparties. It will show what accounting registers are, an example of an analytical unified inventory card of fixed assets:

Cards of accounting accounts by counterparty for the tax office

During a counter-inspection, the Federal Tax Service does not have the right to request account cards as confirmation of transactions with the inspected counterparty. The Ministry of Finance of the Russian Federation has clarified that only documents related to the activities of the counterparty can be requested. The cards contain information about the company, therefore, it has the right not to present them.

Example

During the counter check, the company is required to provide documents confirming the transactions:

- invoices;

- contract;

- payment order;

- PKO;

- acceptance certificate for the contract;

- extract from the sales book;

- accounting cards 62, 90.

Read more: Military schools of secondary vocational education

The company, having prepared documents directly related to transactions with the counterparty, refused to provide the cards, citing in the accompanying note the unreasonableness of the requirement for their presentation, since they do not serve as the basis for the calculation and payment of taxes of the audited partner (clause 11 of article 21 of the Tax Code of the Russian Federation).

The Federal Tax Service assessed the company’s actions as a refusal to provide data and fined it (Article 129.1 of the Tax Code of the Russian Federation). The company initiated a procedure for pre-trial settlement of the dispute, but the higher authority (UFTS) sided with the inspectorate.

The proceedings continued in court, ending with a decision in favor of the company. The court decided that accounting cards 62 and 90, requested by the Federal Tax Service, in the situation under consideration cannot be recognized as documents that the company is obliged to submit to the Federal Tax Service for checking the counterparty.

The court based its conclusions on the fact that account cards 62 and 90, being company accounting documents:

- do not relate to the activities of the counterparty;

- are not related to the calculation and payment of taxes, i.e., not being primary documents or accounting registers, they do not confirm the NU data.

The information contained in the cards cannot be considered information required to be submitted to the Federal Tax Service for the tax control of the partner, and since the account cards are not mandatory for NU purposes, the applicant company is not responsible for their failure to submit them. (Decision of the Administrative Court of the Republic of Buryatia dated 03/05/2013 No. A10-2526/2012).

To reflect non-cash transactions related to the receipt and expenditure of funds, account 51 is used in the accounting of a business entity.

In practice, there is often a need to conduct an in-depth analysis of non-cash transactions in order to determine the amounts, sources of income and directions for writing off funds for specific periods of time.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

The successful solution of the task becomes possible thanks to the preparation of the 51 account card.

What such a card is, what information it contains, how it is filled out - all these questions require more detailed study.

Forms

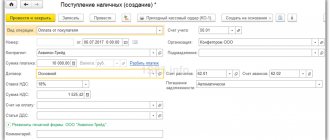

Since ledgers in accounting are used to record information about all current transactions, they can be maintained in either paper or electronic form. Electronic documents can be printed as needed. To prepare them, specialized accounting programs are usually used, which allow you to automate the process of posting information among accounts, and therefore among order journals and statements directly from the primary document.

Currently, organizations can use both unified forms of any accounting documents and develop them independently. There are no restrictions in this matter. The main thing is to consolidate the form used in the accounting policy. The list of accounting registers for accounting policies in appearance can be divided into:

- books - consist of several pages sewn together, which must be numbered, laced and sealed with the signature of the responsible person and the seal of the organization, if applicable;

- cards - separate sheets for the names of accounting units (goods, contractors, accountable persons, fixed assets, etc.), made in the form of a table and containing the most complete information about the object;

- magazines - similar to books, but contain fewer pages and do not need to be laced;

- sheets or statements - separate documents made both in the form of a table and in the form of text (accounting certificate, for example);

- electronic media - any documents that are created using special computer programs in electronic format. They can be certified by electronic qualified signatures of authorized persons, or they can simply be ready for printing at the end of the reporting period or for verification by the Federal Tax Service.

It should be noted that individual sheets must be filed in folders, and their data must be entered into special registers. A similar rule applies to cards.

Types and forms of accounting registers

ACCOUNTING FORMS AND PROCEDURES

Accounting registers and their importance in accounting

After checking, taxation and accounting processing of documents, their data must be registered and reflected in a certain sequence, grouping business transactions according to their economic content. Such registration is carried out in special accounting tables called accounting registers or accounting registers.

Accounting registers are a set of specially divided tables adapted for recording and grouping business transactions according to accounting accounts.

Accounting registers are one of the most important means of constructing and maintaining accounting records. In them, the content of documents is grouped according to homogeneous characteristics in the context of established accounting indicators. Recording business transactions in accounting registers is called accounting registration.

Thus, accounting registers are intended to systematize and accumulate information contained in primary accounting documents accepted for accounting, for reflection in accounting accounts and financial statements.

Reflection of business transactions by registering them in accounting registers has an important control value. Accounting registers make it possible to monitor the safety of documents accepted for accounting. The correct reflection of business transactions in accounting registers is ensured by the persons who compiled and signed them. The contents of accounting registers are a trade secret. Therefore, for its disclosure, the relevant persons bear responsibility established by the legislation of the Russian Federation.

Accounting registers, among other things, are important in creating an information base for managing the organization’s activities. Correct use of accounting registers allows you to provide an organization's management system with analytical and synthetic information for a certain period of time. This makes it possible to timely make appropriate management decisions to regulate individual processes in order to increase the efficiency of production of products (works, services).

According to accounting registers, organizations prepare accounting (financial) statements to provide information to external users, as well as for internal management.

Accounting registers accumulate information about business transactions in a dynamic and static manner, which makes it possible to control and analyze the economic and financial activities of the organization, individual processes, cost and income cycles, sales and financial results, etc.

Accounting registers can be kept in special books (magazines), on separate sheets and cards, in the form of machine diagrams obtained using computer technology, as well as on computer storage media. When maintaining accounting registers on computer media, it must be possible to output them to paper media.

Forms of accounting registers are developed and recommended by the Ministry of Finance of the Russian Federation, bodies that are granted the right to regulate accounting by federal laws, or federal executive authorities, organizations, subject to their compliance with the general methodological rules of accounting.

When storing accounting registers, they must be protected from unauthorized corrections. Correction of an error in the accounting register must be justified and confirmed by the signature of the person who made the correction, indicating the date of the correction.

Types and forms of accounting registers

Accounting registers differ in structure, purpose and other characteristics. Therefore, they are classified into the following groups: by appearance, by the nature of the records, by the volume of content of the operations and by structure (Fig. 8.1).

| Accounting registers | By appearance (external form) | Accounting books | ||

| Cards | ||||

| Free Sheets | ||||

| The nature records | Chronological | |||

| Systematic | ||||

| Combined | ||||

| By volume of operations content | Synthetic accounting | |||

| Analytical accounting | ||||

| According to the structure and form of graphene | Unilateral | |||

| Double sided | ||||

| Polygraphic | ||||

| Quantitative-total | ||||

| Quantitative | ||||

| Contractual | ||||

| Chess |

Rice. 8.1. Classification of accounting registers

According to their appearance (external form), registers are divided into ledgers, cards and free sheets.

Accounting books are bound accounting tables (sheets of paper) designed to record transactions. It is impossible to remove sheets from books and replace them. Therefore, they are not suitable for mechanization and automation of records and complicate the division of labor of accounting workers. They are used to record inventories and other valuables at their storage locations, as well as to record certain types of calculations. All pages in the accounting book are numbered, and at the end of the book the signature of the chief accountant is placed and the number of pages is indicated.

The disadvantages of book registers include: the inability to group accounts opened in them in a different sequence; with a large volume of operations, books become bulky; in the books, excess consumption of sheets is allowed due to the need to reserve space in each book in case of opening new accounts.

Cards and loose sheets are more convenient in this regard.

Cards are separate tables printed on separate sheets of thick paper or cardboard of a standard size.

The cards are divided into the necessary sections (taking into account the nomenclature numbers of values, groups, stamps, etc.) in alphabetical or other order, for example, by codes or names of accounts, etc., which ensures that they are quickly found in the card index for recording or reconciling transactions and etc.

To register cards, a special register is created, where each card is assigned its own serial number. This makes it possible to check the availability of all cards.

The use of cards contributes to the introduction of mechanization and automation of accounting processes, since entries in them, summing up and grouping of accounting data can be done not only manually, but also using computer technology.

Cards used in accounting practice are: current (have debit and credit columns); material (have columns for receipt, expense and balance, highlighting quantity and amount); multigraph (contain several columns).

Free sheets are tables containing a large number of details. They are stored in special folders (registers). Records of transactions on them can be kept by several accountants, since they can be retrieved from folders at any time for recording, counting, sampling, etc.

Free sheets can be filled in using computer technology. Separate sheets are used in the form of order journals, statements and machine diagrams.

Based on the nature of the entries in them, accounting registers are divided into chronological, systematic and combined.

Chronological registers are designed to reflect data on business transactions in calendar sequence as documents are received and processed, but without grouping them. An example of chronological registers are business transaction logs, journals or registers for recording various documents. Their purpose is to ensure control over the safety of documents received by the accounting department, and they are also used for making inquiries, drawing up preliminary entries and checking them before posting transactions to accounting accounts.

Systematic registers are designed to record data from homogeneous business transactions, grouped according to their economic content according to accounting accounts, that is, by type of property and sources of economic funds. An example of a systematic register is the General Ledger, which is maintained in accounting to group transactions and summarize them into synthetic accounts.

Combined ledgers are ledgers in which transactions are recorded simultaneously in a chronological and systematic manner. They are used in simplified forms of accounting and in journal-order forms of accounting. These include the Journal - Main, accumulative statements, and order journals.

Based on the volume of content of transactions or accounts, registers of synthetic and analytical accounting are distinguished.

Synthetic registers are opened for maintaining synthetic accounts, that is, entries in synthetic registers are made in a generalized form in cost units of measurement. These include the General Ledger, Journal–Main, and journals—orders.

In analytical registers, data is recorded according to analytical accounts. Analytical registers indicate a summary of transactions and provide links to primary and summary documents on the basis of which entries were made. Accounting in analytical registers is carried out both in cost and in natural and labor units of measurement. This makes it possible to widely use analytical accounting data in the information system for control, analytical and management purposes.

According to the structure and form of graphing, accounting registers are divided into one-sided, two-sided, multi-graph, quantitative-total, quantitative, account-accountable, and chess.

One-sided registers are various cards for recording calculations and material assets, in which indicators are located on one side and separate columns of debit and credit entries are combined.

Double-sided registers are basically book-shaped registers where the account is opened on two unfolded pages - debit on the left side, credit on the right. They are used in synthetic and analytical accounting in the memorial-order form of accounting.

Multigraph registers are designed to record transactions, the amounts of which must be taken into account for individual elements, divisions, sections, warehouses, etc.

Multigraph registers include registers of analytical accounting of costs for production of products and material assets, etc.

For inventories, accounting is carried out simultaneously in physical and monetary terms. To do this, registers of quantitative and quantitative-sum forms are used. Quantitative accounting registers include warehouse accounting cards, a warehouse accounting book, and a book for recording the movement of livestock and poultry on the farm. Registers of quantitative and total accounting include a book of accounting for product sales, a book of accounting for costs and output (release) of products, etc.

The contract form is a table, on the left side of which there are columns for the date, number and text of the entry (contents of the business transaction), on the right side there are columns for the amounts of debit and credit of accounts. Contract form registers are used to record settlements with debtors and creditors, with accountable persons, and to account for funds. In the contract form register, transactions are taken into account only in monetary terms.

Chess registers are used to reflect the amounts in the debit of one account and the credit of another account. Each amount is written in them in a checkerboard pattern, that is, at the intersection of a row and a column. An example of forms of chess registers are journals-orders, statements for them and the General Ledger in the journal-order form of accounting.

ACCOUNTING FORMS AND PROCEDURES

Accounting registers and their importance in accounting

After checking, taxation and accounting processing of documents, their data must be registered and reflected in a certain sequence, grouping business transactions according to their economic content. Such registration is carried out in special accounting tables called accounting registers or accounting registers.

Accounting registers are a set of specially divided tables adapted for recording and grouping business transactions according to accounting accounts.

Accounting registers are one of the most important means of constructing and maintaining accounting records. In them, the content of documents is grouped according to homogeneous characteristics in the context of established accounting indicators. Recording business transactions in accounting registers is called accounting registration.

Thus, accounting registers are intended to systematize and accumulate information contained in primary accounting documents accepted for accounting, for reflection in accounting accounts and financial statements.

Reflection of business transactions by registering them in accounting registers has an important control value. Accounting registers make it possible to monitor the safety of documents accepted for accounting. The correct reflection of business transactions in accounting registers is ensured by the persons who compiled and signed them. The contents of accounting registers are a trade secret. Therefore, for its disclosure, the relevant persons bear responsibility established by the legislation of the Russian Federation.

Accounting registers, among other things, are important in creating an information base for managing the organization’s activities. Correct use of accounting registers allows you to provide an organization's management system with analytical and synthetic information for a certain period of time. This makes it possible to timely make appropriate management decisions to regulate individual processes in order to increase the efficiency of production of products (works, services).

According to accounting registers, organizations prepare accounting (financial) statements to provide information to external users, as well as for internal management.

Accounting registers accumulate information about business transactions in a dynamic and static manner, which makes it possible to control and analyze the economic and financial activities of the organization, individual processes, cost and income cycles, sales and financial results, etc.

Accounting registers can be kept in special books (magazines), on separate sheets and cards, in the form of machine diagrams obtained using computer technology, as well as on computer storage media. When maintaining accounting registers on computer media, it must be possible to output them to paper media.

Forms of accounting registers are developed and recommended by the Ministry of Finance of the Russian Federation, bodies that are granted the right to regulate accounting by federal laws, or federal executive authorities, organizations, subject to their compliance with the general methodological rules of accounting.

When storing accounting registers, they must be protected from unauthorized corrections. Correction of an error in the accounting register must be justified and confirmed by the signature of the person who made the correction, indicating the date of the correction.

Types and forms of accounting registers

Accounting registers differ in structure, purpose and other characteristics. Therefore, they are classified into the following groups: by appearance, by the nature of the records, by the volume of content of the operations and by structure (Fig. 8.1).

| Accounting registers | By appearance (external form) | Accounting books | ||

| Cards | ||||

| Free Sheets | ||||

| The nature records | Chronological | |||

| Systematic | ||||

| Combined | ||||

| By volume of operations content | Synthetic accounting | |||

| Analytical accounting | ||||

| According to the structure and form of graphene | Unilateral | |||

| Double sided | ||||

| Polygraphic | ||||

| Quantitative-total | ||||

| Quantitative | ||||

| Contractual | ||||

| Chess |

Rice. 8.1. Classification of accounting registers

According to their appearance (external form), registers are divided into ledgers, cards and free sheets.

Accounting books are bound accounting tables (sheets of paper) designed to record transactions. It is impossible to remove sheets from books and replace them. Therefore, they are not suitable for mechanization and automation of records and complicate the division of labor of accounting workers. They are used to record inventories and other valuables at their storage locations, as well as to record certain types of calculations. All pages in the accounting book are numbered, and at the end of the book the signature of the chief accountant is placed and the number of pages is indicated.

The disadvantages of book registers include: the inability to group accounts opened in them in a different sequence; with a large volume of operations, books become bulky; in the books, excess consumption of sheets is allowed due to the need to reserve space in each book in case of opening new accounts.

Cards and loose sheets are more convenient in this regard.

Cards are separate tables printed on separate sheets of thick paper or cardboard of a standard size.

The cards are divided into the necessary sections (taking into account the nomenclature numbers of values, groups, stamps, etc.) in alphabetical or other order, for example, by codes or names of accounts, etc., which ensures that they are quickly found in the card index for recording or reconciling transactions and etc.

To register cards, a special register is created, where each card is assigned its own serial number. This makes it possible to check the availability of all cards.

The use of cards contributes to the introduction of mechanization and automation of accounting processes, since entries in them, summing up and grouping of accounting data can be done not only manually, but also using computer technology.

Cards used in accounting practice are: current (have debit and credit columns); material (have columns for receipt, expense and balance, highlighting quantity and amount); multigraph (contain several columns).

Free sheets are tables containing a large number of details. They are stored in special folders (registers). Records of transactions on them can be kept by several accountants, since they can be retrieved from folders at any time for recording, counting, sampling, etc.

Free sheets can be filled in using computer technology. Separate sheets are used in the form of order journals, statements and machine diagrams.

Based on the nature of the entries in them, accounting registers are divided into chronological, systematic and combined.

Chronological registers are designed to reflect data on business transactions in calendar sequence as documents are received and processed, but without grouping them. An example of chronological registers are business transaction logs, journals or registers for recording various documents. Their purpose is to ensure control over the safety of documents received by the accounting department, and they are also used for making inquiries, drawing up preliminary entries and checking them before posting transactions to accounting accounts.

Systematic registers are designed to record data from homogeneous business transactions, grouped according to their economic content according to accounting accounts, that is, by type of property and sources of economic funds. An example of a systematic register is the General Ledger, which is maintained in accounting to group transactions and summarize them into synthetic accounts.

Combined ledgers are ledgers in which transactions are recorded simultaneously in a chronological and systematic manner. They are used in simplified forms of accounting and in journal-order forms of accounting. These include the Journal - Main, accumulative statements, and order journals.

Based on the volume of content of transactions or accounts, registers of synthetic and analytical accounting are distinguished.

Synthetic registers are opened for maintaining synthetic accounts, that is, entries in synthetic registers are made in a generalized form in cost units of measurement. These include the General Ledger, Journal–Main, and journals—orders.

In analytical registers, data is recorded according to analytical accounts. Analytical registers indicate a summary of transactions and provide links to primary and summary documents on the basis of which entries were made. Accounting in analytical registers is carried out both in cost and in natural and labor units of measurement. This makes it possible to widely use analytical accounting data in the information system for control, analytical and management purposes.

According to the structure and form of graphing, accounting registers are divided into one-sided, two-sided, multi-graph, quantitative-total, quantitative, account-accountable, and chess.

One-sided registers are various cards for recording calculations and material assets, in which indicators are located on one side and separate columns of debit and credit entries are combined.

Double-sided registers are basically book-shaped registers where the account is opened on two unfolded pages - debit on the left side, credit on the right. They are used in synthetic and analytical accounting in the memorial-order form of accounting.

Multigraph registers are designed to record transactions, the amounts of which must be taken into account for individual elements, divisions, sections, warehouses, etc.

Multigraph registers include registers of analytical accounting of costs for production of products and material assets, etc.

For inventories, accounting is carried out simultaneously in physical and monetary terms. To do this, registers of quantitative and quantitative-sum forms are used. Quantitative accounting registers include warehouse accounting cards, a warehouse accounting book, and a book for recording the movement of livestock and poultry on the farm. Registers of quantitative and total accounting include a book of accounting for product sales, a book of accounting for costs and output (release) of products, etc.

The contract form is a table, on the left side of which there are columns for the date, number and text of the entry (contents of the business transaction), on the right side there are columns for the amounts of debit and credit of accounts. Contract form registers are used to record settlements with debtors and creditors, with accountable persons, and to account for funds. In the contract form register, transactions are taken into account only in monetary terms.

Chess registers are used to reflect the amounts in the debit of one account and the credit of another account. Each amount is written in them in a checkerboard pattern, that is, at the intersection of a row and a column. An example of forms of chess registers are journals-orders, statements for them and the General Ledger in the journal-order form of accounting.

Details and rules of conduct

Although the legislation does not currently provide for the mandatory use of unified forms by business entities, there is a list of mandatory details that accounting documentation must contain:

- the name of the document itself;

- name of the organization that keeps records;

- document maintenance period;

- the procedure for classifying accounting objects;

- currency and units of measurement;

- FULL NAME. and the position of the person responsible for maintaining.

All information reflected in the documentation must be certified with the signature of the authorized person who made these entries. Unlike primary documents, corrections of identified errors and shortcomings are allowed in accounting registers. To do this, you need to cross out the incorrectly written information with one line, write the correct information above and certify the correction with a signature. In addition, you can use the reversal method, that is, correct the data by making another entry in red ink. It is not recommended to use a corrector or erase errors.

Storage order

Accounting documents must be stored in a specially designated room on shelves or in cabinets. Storage periods are stated in two main legal acts:

- Article 29 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” - storage for periods established in accordance with the rules for organizing state archival affairs, but not less than 5 years after the reporting year.

- In paragraphs 8 clause 1 of Article 23 of the Tax Code of the Russian Federation - taxpayers are required to ensure the safety of accounting and tax accounting data and other data necessary for the calculation and payment of taxes, including accounting registers confirming the receipt of income, expenses, and payment (withholding) taxes, unless otherwise provided by the Tax Code of the Russian Federation.

In this case, the period of 4 years established by the Tax Code of the Russian Federation begins after the reporting (tax) period in which the documentation was last used to prepare tax reports, calculate and pay taxes, confirm income received and expenses incurred. In addition, a longer retention period may be established for certain types of registers. For example, payroll records must be kept for 75 years.

Therefore, the organization is obliged to ensure the safety of some registers throughout the entire period of activity, and then transfer them to the archive for storage.

Sample forms of accounting registers - 2022 can be downloaded below.

Turnover balance sheet

Legal aspects

Art. 31 of the Tax Code of the Russian Federation defines a set of forms that the Federal Tax Service has the right to request - these are documents that serve as the basis for calculating taxes and confirm their accuracy, as well as the timeliness of payments. The right to demand them from the enterprises subject to inspection is determined by Art. 93 of the Tax Code of the Russian Federation, and information about the work of the company being inspected may be requested from its partners or other persons (Article 93.1 of the Tax Code of the Russian Federation).

The Tax Code of the Russian Federation does not provide an exact list of documents required to be submitted; it only states that taxes are calculated on their basis (Clause 6, Article 23 of the Tax Code of the Russian Federation). The list of documents that inspectors have the right to request is open. However, this does not mean that the Federal Tax Service can refer to the need for any documents, and the company automatically has an obligation to submit them.

Read more: How to staple the minutes of a general meeting of LLC participants

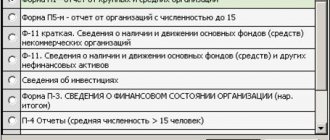

The following are considered to confirm tax accounting information (TA) and are mandatory for submission to the Federal Tax Service (Article 313 of the Tax Code of the Russian Federation):

3) calculations of the tax base.

The accounting card is not included in this list, but often the Federal Tax Service requires it along with other accounting forms.