How to fill out a document: general rules

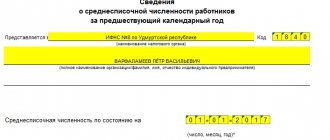

The certificate has a number of fields in which you must enter the appropriate information:

- TIN field - requires entering a unique number assigned to the taxpayer;

- checkpoint field - requires specifying a nine-digit code, which is the basis for registering the company at the place of registration;

- field “Submitted to”, code - it should indicate the name of the tax authority to which this document is sent, and the code of this authority;

- field “Organization (IP)” - the name of the enterprise should be entered in it, as it is indicated in the constituent documents, while the individual entrepreneur enters his own passport data;

- field “Average headcount as of” - it requires you to indicate a quantitative indicator of the number, and it must be given as of the first of January of this year, but if the enterprise arose only this year, then you should write the indicator for the first of January of the month following by when it was formed;

- field “Manager, signature and date” - in it you must indicate the full name of the general director or another manager, enter his signature and confirm the document with a seal, and also write the day on which the signature was affixed;

- field “For individual entrepreneurs, signature and seal” - there the individual entrepreneur needs to enter the relevant details;

- field “Representative” - in it you must indicate information about the authorized person if the document is written by a person other than the head of the company.

To correctly indicate the number of employees you need:

- determine their number on all calendar days;

- add these indicators together;

- divide these indicators by the number of calendar days in a given month;

- Round the resulting figure to a whole number.

In the same time:

- during the calculation, it is necessary to determine the number of employees who worked part-time on all calendar days related to the period being calculated;

- persons who have worked an incomplete number of hours on the basis of sick leave or vacation are indicated the number of hours they worked in previous days.

Shape and features (knd 1110018)

When drawing up a certificate of the number of employees, you need to write down the number of employees who were at work on the previous day every time you need to indicate their number for a weekend or a holiday. If the company has a single employee (in particular, who is its director), indicate the number 1 (one).

In accordance with this regulatory act, information on the number of personnel must be provided no later than January 20 of the year following the one for which this document is being submitted.

Persons are not included in the staff when they issue a certificate of headcount:

- business owners who also work for the company, but do not receive wages;

- employees who undergo off-the-job educational training;

- external part-time workers in a given organization, that is, employees who work full time in another legal entity and additional hours in this enterprise;

- workers who went on maternity leave;

- persons who perform work at the enterprise on the basis of civil contracts.

The document must be drawn up in two copies. One of them is accordingly submitted to the tax office, and the second is handed over to the taxpayer himself, indicating the date and time of submission of this paper.

Sample letter about the number of employed employees

Marina [e-mail hidden] Russian Federation, Moscow #10[255261] September 9, 2011, 13:24 MPB wrote: Veta wrote: And if one of the employees is at 0.5 pay, then write - full-time employees - 17.5? The employee must be shown as a whole unit, i.e.

full-time employees - 18. I agree I want to draw the moderator's attention to this message because: A notification is being sent... #11[281353] January 12, 2012, 12:00 Hello! I am newbie.

and I received a request to make a certificate of the number of employees for the 4th quarter of 2011. I can’t understand in what form it is done. Should I list them separately for each month? people quit and were hired in the quarter more than once. I would be very grateful if you show me the form.

I want to draw the moderator's attention to this message because: A notification is being sent...

Vote:

You can view a sample resume for a manager and what his responsibilities include here.

- Information on the average number of individual entrepreneurs is submitted at the place of registration of the individual entrepreneur.

- Enterprises submit a report at the place of registration of their legal address.

A certificate of the number of employees, the form of which is presented on our portal, is not submitted for separately located divisions of the organization. Information on the average headcount does not apply to declarations, therefore failure to submit may result in fines for the organization and its management:

- in the amount of 300 - 500 rubles - per official.

- in the amount of 200 rubles – for a legal entity or entrepreneur;

In addition, certificates of headcount in any form may be needed by banks, credit institutions, company owners and other users.

| “For individual entrepreneur” “Signature” “Date” | When filling out the individual entrepreneur form, they must sign and indicate the date of signing. |

| “Representative” “Signature” “Date” “MP” “Name of document...” | If the form is filled out by a representative, then in this section you need to indicate information about him. |

Headcount

Form and example of filling out the average number of employees according to the form KND 1110018

Before you figure out what the average number of employees is, you need to understand who is included in the payroll. According to the Directives of Rosstat (order No. 711 dated November 27, 2019), the payroll includes those hired under an employment contract, including the founders of the company if they receive a salary. The duration of the employment contract does not matter; even those who worked for only one day are taken into account. Moreover, the calculation includes not only those who actually showed up for work, but also those who were absent from work for certain reasons.

The Rosstat Instructions provide a list of employees who are included in the payroll and those who are not.

| Included in the roster | Not included in the list |

|

|

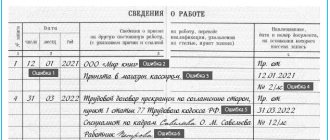

To determine the number of payrolls, it is necessary to keep a time sheet every day, noting in it those who showed up for work and those who are absent for any reason. The forms of the report card are established by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1:

- T-12 – universal option;

- T-13 – for enterprises where automatic turnstiles are installed to record attendance.

When filling out a timesheet daily for each employee, hours worked and a symbol are indicated, for example:

- daytime - I;

- night time - N;

- overtime hours – C;

- business trip - K;

- annual basic paid leave - OT;

- maternity leave – P;

- temporary disability – B;

- failure to appear due to unknown circumstances – NN.

Next, based on the timesheet data, you need to calculate the average number of employees per month.

Sample letter for a bank about full-time employees

“Sick leave” benefit: is it necessary to pay for sick days worked? In the case when on the day the employee was issued a certificate of incapacity for work, he was at work and received a salary for that day, “sick leave” benefit for that day is not accrued.

True, the information published by various branches of the Pension Fund of Russia has some differences.

Taxpayers - companies and individual entrepreneurs are required to submit information about their employees to the tax office.

Certificate of number of employees

Important If the result is a small digital indicator, leave one sign after the decimal point. Average number = average number + civil servants + external part-time workers. Calculation nuances When calculating the number of employees, you should take into account some features of the procedure:

- If an organization/entrepreneur operates for less than a full month, the number of calendar days per month is taken when calculating the number. This situation is possible for a new enterprise, or for an enterprise operating seasonally.

Example: an enterprise was registered on September 18 with 20 employees. Headcount for September = (20 people x 13 days) / 30 days.

Attention Representative" "Signature" "Date" "MP" "Name of the document..." If the form is filled out by a representative, then in this section you need to indicate information about him. If the representative is an individual, indicate his data: first name, last name and patronymic according to his passport.

If the taxpayer's representative is an organization, the signature of the head of this organization, certified by a seal, indicating the date of signing must be affixed here. At the end of the form, you must enter the name of the document that confirms the authority of the representative. A copy of this document must be attached to the form.

All fields of the certificate of staffing levels are filled in by the taxpayer. The bottom right section is the only one that does not need to be filled out. It will be filled out by a tax official.

A letter that will exclude the bank’s claims against the company

- persons located abroad;

- employees sent to other enterprises and not receiving payment for their work;

- employees who submitted a letter of resignation and stopped working earlier than the appointed date or without warning the administration;

- employees working under contracts with state-owned enterprises;

- external part-time workers.

A certificate of the average number of employees looks like this: Sample certificate of the average number of employees Included in the payroll:

- regular employees;

- seconded employees while maintaining wages, including employees sent abroad for a short period of time;

- sick employees;

- employees with government powers;

- truants;

- employees registered for part-time or part-time work. The operating time is taken proportionally.

How to calculate the average number of employees

Certificate of employment form: sample for 2022

TSS for the year is calculated using the formula: TSS year = (TSS for January + TSS for February + ... + TSS for December) / 12.

To calculate the monthly average of employees, add up their daily payroll number and divide the resulting value by the number of calendar days in a particular month. At the same time, do not forget that on weekends and holidays the total number of employees will be equal to the number of employees on the previous working day.

When calculating the SCH, follow the rules: an employee working under an employment contract is a whole unit, even if in fact he is on sick leave, on a business trip or does not work full time; The SSC does not include employees working under a GPC contract, hired on a part-time basis, as well as co-owners of the company who are not paid a salary by the company. Employees who have not worked full time are counted in proportion to the time they worked.

Example. Polis LLC has the following indicators of the monthly average:

- January - 1,

- February - 1,

- March - 3,

- April - 3,

- May - 5,

- June - 7,

- July - 7,

- August - 5,

- September – 4,

- October – 4,

- November – 4,

- December - 4.

TSS at the end of the year = (1 + 1 + 3 + 3 + 5 + 7 + 7 + 5 + 4 + 4 + 4 + 4) / 12 = 48 / 12 = 4.

Important! From the beginning of 2022, all employees who are on maternity leave or parental leave, but continue to work part-time or at home, while maintaining the right to receive social benefits, must be included in the calculation of the SSC (clause 79.1 of the Rosstat instructions No. 772)

SCN of part-time workers = ∑ (Employee hours worked per day / standard hourly duration of a working day * number of days worked) / number of working days in a month.

Example. Three employees at Bereg LLC worked part-time in October:

- one of them worked 2 hours a day for 21 working days. He is counted daily as 0.25 people (worked 2 hours / 8 hours according to the norm);

- three workers worked 4 hours a day for 15 and 10 working days. They count as 0.5 people (4/8).

TMR of part-time workers = (0.25 x 21 + 0.5 x 15 + 0.5 x 10) / 22 working days in October = 0.81. The company will take this value into account when determining the employees’ average wage

If an employee works part-time and is required by law to do so, count them as a full-time employee.

Some employees are not included in the SSC:

- women who were on leave due to pregnancy and childbirth;

- persons who were on leave to adopt a newborn directly from the maternity hospital, as well as on parental leave;

- employees studying at institutions of the Ministry of Education and who were on additional leave without pay, as well as those planning to enter these institutions;

- employees who were on leave without pay while taking entrance exams.

What does the number of employees affect?

An indicator such as the number of employees can have a direct impact on some aspects of the enterprise’s activities, for example:

- If we are talking about organizations that apply a simplified taxation system. In this case, subject to a number of certain conditions, the company will indeed have the legal right to pay tax in accordance with the current simplified system. The main condition includes the following: the average number of employees for the last annual period should not exceed 100 people. In this case, even if the company has not previously applied the simplified taxation system, it will be able to switch to it. To do this, she will need to collect certain documents and contact the local tax authority.

- If we are talking about organizations that pay UTII or just want to switch to this regime. These actions can also be carried out by companies, but subject to certain conditions. In particular, the main one will still be the fact that the number of employees does not exceed 100 people.

- If we are talking about organizations that have separate divisions and pay income tax established by the state. In this case, the average headcount indicator will be involved in a procedure such as calculating advance payments that will need to be paid for separate units.

- If we are talking about organizations whose authorized capital consists entirely of public contributions. This may include companies that employ employees with disabilities. In this case, the company will be able to qualify for a number of different benefits and certain privileges. However, here you need to remember some important conditions that must always be met. In particular, the organization must have at least 50% of its total employees with disabilities. In addition, the total share of remuneration for people with disabilities must be at least 25% of the total capital of the organization.

Certificate of number of employees - sample

Headcount Calculator 2.0

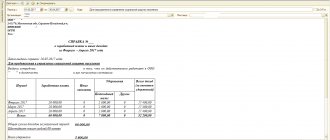

When generating the form, the taxpayer company enters data in all lines except the table in the lower right corner. This section is intended to be completed by tax professionals. The number of personnel obtained as a result of calculations is indicated with rounding, that is, in full units of number. The calculation of information is carried out according to personnel and accounting data. In this case, the accountant may need time sheets for recording work hours, orders for personnel movements, personal personnel cards, statements, etc.

Let’s assume that an accountant needs to create a certificate form for 2017. The company was created back in 2015, so the data is submitted to the tax authorities on January 1st until January 22, 2018. The company’s payroll for this period is:

- From January to February – 20 people.

- From March to August – 22 people.

- From September to December – 30 people.

Annual average = (20 x 2 + 22 x 6 + 30 x 4) / 12 = 24.3 rounded to 24 people.

Note! For failure to submit a certificate on time, the taxpayer will be fined 200 rubles. according to standards

1 stat. 126. But control authorities will not be able to block bank accounts, because this form is not recognized as a tax return. Additionally, it should be noted that individual entrepreneurs without hired specialists are not required to report on the certificate of average assets.

Certificate of headcount – download form here:

Certificate of staffing levels – sample download here:

If you find an error, please select a piece of text and press Ctrl+Enter.

Letter on the number of employees in the organization

CJSC "Mars", hereinafter referred to as the "Addresser", represented by the General Director of OOOOOOO SHCHSHCHSHCH LLLL, acting on the basis of the Charter, provides non-residential premises with a total area of 12 sq.m.

as the address (location) of the permanent governing body (Presidium) of the Regional public organization, the sports club “GRASSHECHIK” at the following address: 000000. RUSSIA, Moscow, st.

Direct, house 00, apt. 000.

Thirdly, in accordance with the Federal Law on Combating Money Laundering, banks may refuse to open a bank account for a legal entity if the organization is not located at its location. For these purposes, bank employees can go to the address of a legal entity and verify its location at the specified address.

Letter on staffing levels for a bank

After summing up the results for each month, the resulting amount must be divided by the number of months in the year (12). Even if the company took breaks in the work process and did not function for several months, the formula does not change and the number of months in the year should appear in the divisor. You can view a sample resume for a manager and what his responsibilities include here.

The same as we were taught at school: we need to find the sum of values for all 12 months (from January to December inclusive) and divide the found figure by 12. So, the principle is simple: when the number after the decimal point is 4 or a smaller value, we simply remove decimal places. Let's say, 2.3 is rounded to 2. If the decimal point is followed by the number 5 or a greater value, we add one to the whole number.

How to draw up a certificate of the number of employees of an organization

If the number of workers does not exceed one hundred people, then reports can be submitted in paper form; if more, the reception is carried out in electronic format.

By law, since 2008, all employers have an obligation to submit reports for the previous working year on the personnel composition of their organization.

Documents listing the composition are submitted when opening or closing, as well as when reorganizing the work of an enterprise.

This calculation does not take into account the owners of the company, who will not receive compensation. These include students, lawyers, military personnel, employees under civil contracts, persons located abroad, working at other enterprises and therefore not receiving a salary, collaborating with authorities and external part-time workers.

A report on the number of employees must be submitted, even if there are no employees (letter from the Ministry of Finance of Russia)

What I don’t understand is why I, an entrepreneur, should provide information about the presence of employees if I am not registered as an employer?! Tax officials, it turns out, are neither a social security fund nor a pension fund, not a decree and not an authority? Do they need further confirmation?

Source: https://urist-yslugi.ru/test_category/pismo-o-chislennosti-rabotnikov-v-organizatsii

Basic principles of filling

Filling out the form is not difficult: in addition to general data about the enterprise, you need to enter only one figure - the value of the average number of employees as of the corresponding reporting date. Typically, such a report is submitted by companies and individual entrepreneurs that have employees once a year - before January 20. The document includes data for the previous year. But sometimes they have to resort to filling it out in the middle of the year. This applies to those organizations that have just registered (the deadline for submission is the 20th day of the month following the date of registration). It is also filled out upon liquidation of the company.

The main questions taxpayers usually have are related to calculating the average headcount. A detailed description of how the report is prepared and the rules for calculating the average number of employees of an enterprise as of the reporting date can be found in the article dedicated to this form.

We formulate the general requirements for filling out the document, as for all tax reporting, as follows:

- data is entered on the basis of documents confirming their accuracy;

- errors and corrections are unacceptable;

- The form can be filled out on a computer or by hand in black or blue ink;

- each familiar place has a separate meaning;

- the space designated for filling by a tax authority employee should not be filled in;

- the signature of the manager or authorized person confirms the authenticity of the document and the correctness of the data entered in it and is a necessary requisite. Documents without a signature will not be accepted, and if sent by mail, they will be considered undelivered.

INN, KPP and tax authority codes

Each company has its own accounting features. When filling out the tax payer identification number field (abbreviated as TIN), which is assigned to legal entities and individuals, start entering the code numbers from the leftmost square cell. The “Checkpoint” column is intended only for organizations. Individual entrepreneurs do not need to fill out this field.

Please note! If your code has fewer numbers than cells, you must first enter zeros and then the digital values of the TIN. The tax office code for your area always consists of four digits.

Tips for filling out the form

The tax office accepts reports with legible data entered in black ink. Forms filled out with other color variations will not be considered. Write information in cells and rows as legibly as possible. Tax professionals should not feel like graphologists.

If you are an advanced computer user, feel free to fill out the form using editing software. Tax officials accept printed forms filled out in 18 Courier New font.

Details and data

The following information about the taxpayer must be included in the report:

- TIN and checkpoint;

- surname, name and patronymic of an individual entrepreneur or name of a legal entity (indicate the full name with a decoding of the organizational and legal form);

- the name of the Federal Tax Service of the Russian Federation to which the report is sent, and its code (the necessary information is available on the official website of the Federal Tax Service of the Russian Federation);

- actual data on the average number of employees;

- date of information provided on the number of employees (on what date the calculation was made, usually January 1 of the current year, there are special features for a newly created or reorganized organization - the first day of the month following the month in which such an organization was created or reorganized);

- date of submission of the report.

Other Important Details

About the population indicator. The only calculated figure in the report may be the headcount indicator for the average list for the previous year. It must be entered in whole numbers. To accurately calculate data, use the example of calculating the average number of employees.

We put down the date. The completed form must be submitted strictly before the twentieth of January of the current year. Be sure to indicate in the report that the data is submitted as of January 1st. Don't be fooled by the actual date of your report. In the case where the company is going through a reorganization process, the report is submitted by the twentieth day of the next month after completion of all processes. For example, if your company was reorganized in March, the headcount report must be submitted by April 20.

We fill out only our fields. The taxpayer should not go into the blocks intended for the inspection representative.

What else to download on the topic “Information”:

- What should a properly drafted employment contract be like? An employment contract defines the relationship between employer and employee. The compliance of the parties with the rights and obligations provided for by it depends on how thoroughly the terms of the relationship between the parties who entered into it are taken into account.

- How to competently draw up a loan agreement Borrowing money is a phenomenon that is quite characteristic and widespread in modern society. It would be legally correct to issue a loan with subsequent documented repayment of funds. To do this, the parties draw up and sign a loan agreement.

- Rules for drawing up and concluding a lease agreement It is no secret that a legally competent approach to drawing up an agreement or contract is a guarantee of the success of the transaction, its transparency and security for counterparties. Legal relations in the field of employment are no exception.

- Guarantee of successful receipt of goods - a correctly drawn up supply agreement. In the course of business activities of many companies, the supply agreement is most often used. It would seem that this document, simple in its essence, should be absolutely clear and unambiguous.

- All contracts

- All forms

- Author's agreement, author's order

- Agency, subagency agreement and agreement

- Lease, sublease agreement: real estate, property

- Bank account, deposit, service agreement

- Marriage agreement, contract, family

- Agreement for free use and provision of services

- Contract for paid services

- Warranty and warranty service agreement

- Gift agreement, donations

- Trust management agreement

- Loan agreement, interest-free loan

- Agreement of deposit, advance payment

- Pledge agreement for real estate, property, rights

- Commission agreement, subcommission for purchase, sale

- Concession and franchising agreement

- Contract of sale and purchase of goods, property, shares

- Leasing, subleasing, financial lease agreement

- License, sublicense agreement

- Contract of exchange, barter, exchange

- Lease agreement, sublease of residential premises

- Contract for performance of work, provision of services

- Contract of training, internship, retraining

- Debt transfer agreement

- Contract, subcontract

- Contract of agency, contract of guarantee

- Contract for the supply of goods, products, equipment

- Representation agreement: legal, commercial

- Agreement on joint activities

- Insurance and reinsurance agreement

- Agreement on assignment of claims, assignment agreement

- Agreement on storage of goods, property

- Employment contract, contract, agreement

- Certification inscription

- Other agreements

- Act

- Questionnaire

- Rent

- Belstat

- Accounting

- Budget

- Statement

- State Property Committee

- Power of attorney

- Job description

- Complaint

- Housing and communal services

- Magazine

- Salary

- Statement

- Healthcare

- Instructions

- Statement of claim

- Contract

- Ministry of Health

- Ministry of Transport

- Ministry of Justice

- Ministry of Emergency Situations

- Report

- Reporting

- Position

- Order

- Protocol

- Working instructions

- Receipt

- Council of Ministers

- Agreement

- Reference

- Work

- Notification

- Charter

- Form

- Petition

- Economy

- Entity

KND report form 1110018 2022: what information should I provide?

The form consists of only one sheet. What the current form of information on the average number of employees for 2022 looks like can be found here:

The report form must reflect the following data:

Date of determining the average number of employees:

- January 1, 2022 – to provide information for the 2020 calendar year;

- The 1st day of the month following the month of creation (reorganization) - for the organization.

Indication of the average number of employees.

After the report is generated, it is signed by the individual entrepreneur or the head of the organization.

The completed document must be submitted:

- Individual entrepreneur – at the place of residence;

- organizations - at the place of registration.

Please note that if an organization has separate divisions, then the document must be submitted in one form throughout the organization

How to fill out a document

Who fills it out and where to submit it?

- All fields of the certificate of number of employees are filled out by the taxpayer, except for the lower right section, which will be filled out by a tax authority employee.

- The completed form on the number of workers can be submitted to the Federal Tax Service either in person or sent by mail, describing the attachment. You can also submit data electronically.

- The document is submitted to the tax office at the place of registration of the enterprise or at the place of residence of the individual entrepreneur. Companies with separate divisions provide a form at the place of registration of the head office.

Design rules

Each field must contain relevant information.

- TIN field – a unique taxpayer number is entered;

- KPP field – indicates the nine-digit code of the basis for registration at the place of registration of the enterprise;

- field “Provided in”, code – you need to enter the full name of the tax authority and its code;

- field “Organization (IP)” - indicate the name of the enterprise in accordance with the constituent documents, and the individual entrepreneur fills in his passport data;

- field “Average headcount as of” - write down the numerical value of the headcount. The calculation must be current as of the 1st day of January of the current year. If the enterprise is new, then the value is indicated on the first day of the month following the month the organization was created.

- field “Manager, signature and date” - fill in the full name of the manager, affix the signature and seal of the company, and also indicate the date at the time of signing;

- field “For individual entrepreneurs, signature and date” - the entrepreneur must affix his signature and seal;

- field “Representative...” - fill in information about the authorized representative if the document is not drawn up by the manager.

Shape and Features

The form for KND 1110018 was established by the Order of the Federal Tax Service of the Russian Federation dated March 29, 2007. The last day for providing information on the number of employees is January 20 of the following year.

- When filling out the form on the number of employees, when making calculations in relation to weekends and holidays, you must indicate the number of employees that occurred on the previous working day.

- If the company has only a director, then the number 1 must be indicated.

Who is not included in the personnel when calculating the number:

- owners of an enterprise who are not paid a salary;

- workers undergoing off-the-job training;

- external part-time workers;

- employees on maternity leave;

- citizens working under civil law agreements.

The document must be prepared in two copies. One of which is given to the tax office, and the other is given to the taxpayer with a marking of the date and time of submission of the report.

Instructions for filling

To correctly indicate the number of employees you must:

- take the number of employees of each calendar day;

- add up data for a whole month;

- divide by the number of calendar days;

- Round the resulting value to a whole number.

Wherein:

- When calculating, it is necessary to establish the number of employees for each calendar day who work part-time.

- For working citizens who have an incomplete number of hours due to illness or vacation, the hours worked for the previous day are recorded.

Sample

-A sample of a certificate of the number of employees of an enterprise can be found here.

An example of filling out a certificate of the number of employees of an organization

Information about the average number of employees in the form of a certificate - the topic of the video below:

Letter on the number of employees

The value of the composition of employees on a specific date and date.

When calculating, all workers on a permanent or temporary basis with official employment are taken into account. Owners receiving wages are also taken into account. Persons who have entered into a contract or other agreements are not taken into account. When determining the indicator, both citizens who report to the workplace and employees who are absent for a number of reasons are taken into account. . Number of employees for a particular period.

The calculation is made by adding the number of employees on the payroll for each day of the month.

If the employee is employed part-time, then the actual time worked is taken into account when calculating.

Appearance room. A certain number of employees who must attend work every day. Regulatory.

Sample letter about the number of employed employees

Important Online cash register: who can take the time to buy a cash register Individual business representatives may not use online cash register until 07/01/2019.

>

Attention So who has the right to work without a cash register until the middle of next year? [/textbox]

Certificate of human resources - sample

This includes employees working in the organization, but not directly related to the implementation of the contract for this competition. The table looks similar.

| Group of specialists | Staffing, people |

| Management personnel | |

| Engineering and technical personnel | |

| Workers and support staff |

At the bottom of the certificate, the position, full name and signature of the authorized person with the seal of the organization (blue) must be indicated.

An example of a certificate on the number of employees at the enterprise

However, these reporting forms are list-based, i.e.

contain information about all employees.

This means transferring a copy of such a report to one employee means disclosing the personal data of other employees. NCT USSR 04/30/1930 No. 169). but sometimes these 11 months are not so spent.> Attention to the Head of the State Unitary Enterprise of the city.

Certificate of average number of employees: sample

The manager must sign and certify it with the company seal. The date of signing is also indicated.

If the representative is an individual, his details are indicated: first name, last name and patronymic according to his passport.

If the taxpayer's representative is an organization, the signature of the head of this organization, certified by a seal, indicating the date of signing must be affixed here.

At the end of the form you need to enter the name of the document that confirms the authority of the representative.

How to draw up a certificate of the number of employees of an organization?

This reason appears most often in practice.

These are the rules of current legislation.

Tax authorities, on the basis of such certificates, determine which specific organizations or simply entrepreneurs must subsequently submit reports in paper form, and which can do this in electronic format. If the number of workers does not exceed one hundred people, then reports can be submitted in paper form; if more, the reception is carried out in electronic format.

By law, since 2008, all employers have an obligation to submit reports for the previous working year on the personnel composition of their organization.

Documents listing the composition are submitted when opening or closing, as well as when reorganizing the work of an enterprise.

The average number of workers in an enterprise is needed to obtain the simplified tax system when calculating the amount of UTII for specific services.

Dear heads of construction organizations

Based on the results of the inspection of the organization of the work process, the commission draws up an inspection report, which provides a conclusion on the applicant’s ability to perform work that meets the requirements of technical regulations, as well as the applicant’s ability to ensure a stable level of quality of the work performed. If the results of the inspection reveal non-compliance with the requirements established above, the commission issues a “Sheet of Non-Conformities”.

For all non-conformities noted by the commission during the inspection of the organization of the work process in the “List of Non-Conformities”, the applicant develops a plan of corrective measures to eliminate them, indicating the deadlines agreed with the certification body.

Upon expiration of the established deadlines, the applicant submits a report to eliminate all inconsistencies. If the identified inconsistencies cannot be eliminated within 2 months, the certification body decides to refuse further certification work.

Certificate of number of employees of the organization - sample

If the calculation results in an incomplete number, it must be rounded in accordance with mathematical rules.

The date on which the indicator was calculated and is current.

For long-established companies, this is the first of January of the current year, and for newly registered companies, this is the first day of the month following the month of registration. Full name of the head of the company, as well as his personal signature and company stamp, or the full name of a private businessman and his personal signature. In both cases, the date of formation and signing of the document is indicated.

If a representative is filling out the certificate, information about him must be indicated. Also, the number and name of the document confirming his rights is indicated, and a photocopy of it is attached.

The taxpayer must fill out all fields of the certificate himself.

How to issue a certificate of number of employees - sample and rules

In the case of an LLC, even those companies where the only employee is the only founder are required to report.

But an individual entrepreneur who uses exclusively his own labor is exempt from submitting a certificate of staff numbers, since he does not have one. The certificate can be submitted in paper and electronic form.

The paper document is submitted to the Federal Tax Service office in person or through a representative, sent by mail, registered mail with an inventory. The electronic version is filled out on the tax service portal.

Sometimes it is necessary to submit a certificate both on hard media and in electronic form.

The entrepreneur submits a report on the number of employees on a special form. This single form has number 11100181. You can download the template from the official tax service portal or below.

Source: https://domzalog.ru/pismo-o-kolichestvennom-sostave-sotrudnikov-66644/

Sample certificate of composition and number of employees for a bank

Rules for counting list data:

- All persons registered under employment contracts are included.

- Owners are hired and paid for their labor.

- Both present and absent persons are taken into account.

- The data must match the data in the timesheets.

Average Average number is used in calculating various activity coefficients: labor productivity, average pay level. The average number also includes:

- Persons entered into under civil contracts. They are considered as ordinary employees hired into the organization for full time. The exception is entrepreneurs.

- External part-time workers. They are considered as part-time employees.

To the head of the State Unitary Enterprise of Moscow Trest Mosotdelstroy No. 1 Sorokin Yu.P. from the head of the HR department B.A. Prigozhin S P R A V K A about the number of employees and persons involved, including under civil contracts as of October 12, 2009 As of October 12, 2009 in the State Unitary Enterprise of the city.

Moscow trust Mosotdelstroy No. 1 has the following strength, including under civil contracts:

- Full-time employees – 56 people

Of these: Management staff – 4 people Engineering and technical staff – 3 people Maintenance personnel – 17 people Support staff – 13 people Production personnel – 22 people

- Involved – 53 people.

Head of HR Department B.A.

Certificate on the number of employees of the organization

About a month is given to prepare the information: it is submitted by the 20th day of the second month of work to the Federal Tax Service at the place of registration. In addition, the number of employees must be reported annually: based on the results of the previous year - before January 20 of the following year. Violation of deadlines will result in a fine of 200 rubles.

This is what a correctly compiled sample of filling out a certificate of average number of employees looks like. The picture shows an example for an LLC, which employed 15 people at the end of last year. But a certificate of the number of employees of less than 15 people is prepared according to the same rules.

Let's look in detail at how to fill out a report for tax authorities:

Indicate the name of the Federal Tax Service inspection where you are sending the form

Please note that separate departments do not have to report such information separately.

How to draw up a certificate of the number of employees of an organization?

How to fill out a certificate? The certificate according to which you need to provide information about your employees was approved by Order of the Federal Tax Service of the Russian Federation dated March 29, 2007 N MM-3-25/174. (forms according to KND 1180011) - full name of the tax authority; — tax authority code. The entrepreneur indicates his passport data: first name, last name, patronymic.

Attention

The calculation must be current as of January 1 of the current year. Instructions on how to calculate the average number of employees In order to obtain this denominator, you must follow a similar formula.

After summing up the results for each month, the resulting amount must be divided by the number of months in the year (12). Even if the company took breaks in the work process and did not function for several months, the formula does not change and the number of months in the year should appear in the divisor.

Certificate of average number of employees: sample

A copy of this document must be attached to the form. All fields of the certificate on the average number of employees are filled in by the taxpayer.

The only section that does not need to be filled out is the bottom right one. It is filled out by a tax official.

The average number of employees of the company is calculated in accordance with the Guidelines approved by Rosstat Order No. 498 dated October 26, 2015.

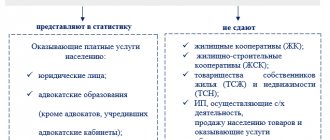

A certificate of average headcount is submitted:

- for all organizations - no later than January 20;

- if the company has just been created (reorganized), then the management must submit such information no later than the 20th day after the month in which this company was created.

The number of employees reflected in the information on the form described affects the collection or waiver of certain fees. This indicator is also important when choosing a taxation system.

Certificate of staffing - sample

Important

NKT USSR 04/30/1930 No. 169). But sometimes these 11 months are not so spent.

But be careful: the procedure for paying for “children’s” sick leave remains the same!

Sample certificate of average number of employees

Therefore, the main organization reports, indicating the total number of persons, including those employed in branches and representative offices.

Write the name of the reporting entity - company or individual entrepreneur.

Sample form of certificate of human resources 2022

- About us Our certificates and partners

- Structure and departments

- Press about us

- Vacancies

- For partners

- Tenders and government procurement

Order a free consultation

And we will help you resolve your issue

Submit an application Often in the tender documentation, the Customer stipulates the requirement that a certificate of human resources must be attached to the application for participation.

Sometimes the documentation includes a corresponding sample for completion, but in some cases it is missing, and the certificate must be drawn up by the participant independently. 1. What should a certificate of human resources contain?2. Table 1. Key human resources example 3. Table-2. Other personnel 4.

-instructions on how to prepare documents for the tender

As a rule, this is a table on the official letterhead of the enterprise, which consists of the following columns:

- Serial number

- Full name of the employee

- Education

- Job title

- Work experience

Having difficulties filling out documents?

Order competent assistance in filling out documents from our specialists, with payment for results

Contact specialists

Table 1. Key human resources example

| No. | Last name, first name, patronymic of the specialist | Education (which educational institution you graduated from, year of graduation, specialty obtained) | Job title | Work experience in this or similar position, years |

| Management level (manager and his deputies, chief accountant, chief economist, chief lawyer) | ||||

| 1 | ||||

| 2 | ||||

| … | ||||

| Specialists (including product specialists, purchasing managers, sales managers, warranty service managers) | ||||

| 1 | ||||

| 2 | ||||

| … | ||||

| Other personnel (including forwarders, drivers, loaders, security guards, etc.) | ||||

| 1 | ||||

| 2 | ||||

| … |

A table with other personnel is also possible. This includes employees working in the organization, but not directly related to the implementation of the contract for this competition. The table looks similar.

Table 2. Other personnel

| Group of specialists | Staffing, people |

| Management personnel | |

| Engineering and technical personnel | |

| Workers and support staff |

At the bottom of the certificate, the position, full name and signature of the authorized person with the seal of the organization (blue) must be indicated.

Features of SSC for individual entrepreneurs

Against the backdrop of the fight against administrative pressure on business, the question of whether an individual entrepreneur without employees rents out the average number of employees has disappeared. Just 7 years ago, even new LLCs and registered individual entrepreneurs were required to submit this form to the Federal Tax Service. In establishing this obligation, the legislator proceeded from the assumption that if there are currently no employees on staff, then during the reporting period (year) they could be employed and resign.

Fortunately, the tax inspectorate is no longer interested in a certificate of the average number of individual entrepreneurs without employees, the indicator in which is always equal to zero. The table below shows the changes made to the Tax Code of the Russian Federation, thanks to which the need to submit an SSC report to entrepreneurs who do not use hired labor has disappeared.