How to calculate additional costs from the cost of individual elements?

In the example just discussed, travel costs were calculated on the assumption that 15 people would work for 8 days. This calculation is in no way related to the content of the local estimate; arbitrary values were indicated in the formula.

But in reality, the number of workers and the time it takes to complete the work depends on the volume of the work. Here, at the end of our document, we see the resulting final values of the labor costs of the main workers and machinists according to the local estimate in man-hours.

Of course, we could now use these numerical values in the travel cost formula, but there is a better way.

For a moment, let us recall the situation when a correction factor is applied to an estimate item in order to take into account the conditions for the production of work from the technical part of the collection, from a reference book, or manually - the coefficient is set according to the elements of direct costs. Please note the column designations: PZ

- these are direct costs,

OZP

- basic wages,

EM

- operation of machines,

ZPM

- wages of drivers and

MAT

- materials.

These are standard identifiers by which we can access the corresponding totals in the estimate. Additionally, there are standard identifiers for the labor costs of the main workers and machinists - these are TK

and

TZM

, for overhead costs -

NR

, for estimated profit -

joint venture

and so on.

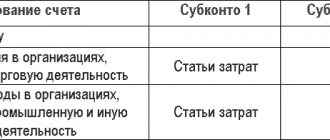

We list here all the built-in identifiers that can be used in the GRAND-Smeta PC when calculating limited costs in the form of a formula:

| Name | Return value |

| TOTAL | Estimated cost before calculating limited costs |

| C or CP | Cost of construction work according to estimate |

| M or MR | Cost of installation work according to estimate |

| construction and installation work | The cost of construction and installation work according to the estimate = the amount of construction and installation work |

| O or OB | Cost of equipment according to estimate |

| P or PR | Cost of other works according to estimate |

| PZ | Direct costs according to estimate |

| Payroll | Payroll fund according to estimate |

| OZP | Basic salary (worker wages) according to estimate |

| EM | Estimated cost of operating machines |

| ZPM | Salary of drivers according to estimate |

| MAT | Cost of materials according to estimate |

| TK | Labor costs of workers according to estimates |

| TZM | Labor costs for drivers according to estimates |

| HP | Amount of overheads calculated in the "standard" way |

| JV | The amount of estimated profit calculated in the “standard” way |

| NRZPM | The amount of overhead costs calculated from the ZPM (used only when calculating using the TSN method) |

| SPZPM | The amount of estimated profit calculated from the ZPM (used only when calculating using the TSN method) |

| NRALL | Amount of NR + NRZPM |

| SPVTOME | Amount of SP + SPZPM |

| memory | The amount of winter cost increases calculated according to individual standards for different works in the estimate (section Limited costs - Winter in the window with estimate parameters) |

| RETURN | Estimated cost of return materials |

| MATZAK | Cost of customer materials according to estimate |

| OBZAK | Cost of customer equipment according to estimate |

And when working in the GRAND-Estimates PC, this table can be seen in the reference information for the program - in the paragraph where options for calculating limited costs in the local estimate are considered.

Now let's adjust the calculation of travel costs in our example so that it depends on the final number of man-hours received in the estimate. Open the Limited Costs

in the window with the estimate parameters and enter a new formula in the

Value

for the line with travel expenses.

Let us sum up the labor costs of the main workers and machinists in brackets - the result will be the total amount of labor costs according to the estimate. But this value is in man-hours, and we need to find out how many working days it will take us to complete the work according to the estimate. Therefore, we additionally divide the amount in brackets by the number of working hours per shift. In our case it is 8

.

Surely after division you will get a fractional value, but we would like to use the number of days as an integer in the calculation - so we add the standard mathematical function ROUND UP

, which performs the operation of rounding a number to the nearest higher value and returning the rounded number.

In connection with this example, we note that every time the GRAND-Smeta PC allows the ability to calculate some value in the form of a formula, any standard mathematical functions from Microsoft Excel can be used in this formula - along with the calculation of limited and additional costs Based on the results of the local estimate, formulas are most often used when calculating the volume of work. The main of these functions are described in the reference information for the program - in the paragraph where automation of the calculation of the volume of work in the estimate is discussed.

We complete the calculation of travel expenses in our example by multiplying the resulting total number of working days by the amount of daily travel expenses in rubles (400

).

Now the calculation of travel costs based on the results of the local estimate depends on the volume of work in the estimate.

If the mathematical expression itself with the calculation does not need to be shown in the document, in the settings of this line in the list of limited costs in the window with estimate parameters, you must check the Hide formula in totals

.

Another situation that may arise when working with limited costs is the need to calculate the value of the final data not for the estimate as a whole, but for any one section of the estimate. For example, if in our example we need to add travel expenses after the local estimate only for work from the 4th section of the estimate.

The GRAND-Smeta PC provides such an opportunity. Firstly, to do this you must first open the Calculation

, subsection

Totals

, and check the box

Separate calculation of totals by sections

.

Only when this option is enabled, the program allows you to subsequently obtain the corresponding value from a specific section of the local estimate for any of the built-in identifiers listed above: first write the keyword SECTION

, then indicate the serial number of the section, put a dot, and then add the required identifier.

For example, SECTION1

.

HP

returns the overhead amount from the first section.

the Limited Costs section in the window with the estimate parameters.

and adjust the formula for the line with travel expenses: before the

TK

, add the text

SECTION4

with a dot, and then add this text in the same way before the labor costs of the drivers. To avoid errors in the formula, you should correctly indicate standard notations and enter all characters one after another without spaces.

As a result, when calculating the full cost of work according to the estimate, the new value of travel costs will now be taken into account.

Let us also remind you about the Expand formulas

in the toolbar on the

Document

, which allows you to replace identifiers with actual numeric values when displaying formulas in a document. A similar option is available when printing documents.

Of course, the values of all built-in identifiers are returned depending on which calculation method is currently set for the local estimate - calculation in base prices without using indexes, base-index or resource calculation. In addition, it should be remembered that if an index to construction and installation work is used in the estimate to convert to current prices, then all elements of direct costs (wages, machine operation, materials), as well as overhead costs and estimated profit, remain at base prices.

www.grandsmeta.ru

Questions and answers

| How to calculate travel expenses in the estimate when a team of installers and adjusters travels to a site in another city. In the local estimate for construction and installation work, travel expenses are not taken into account. A separate calculation is made at the current level. According to clause 9.6. MDS81-35.2004 costs associated with sending workers to perform construction, installation and special construction work are determined by calculations based on the PIC, based on the Decree of the Government of the Russian Federation dated 02.10.02 No. 729. If the transportation of workers is carried out by the construction organization's own or leased transport, travel costs are not included in travel expenses, but are taken into account as the costs of transporting workers of construction and installation organizations by road, determined by calculations based on the PIC, taking into account the supporting data of transport enterprises. Travel expenses take into account the costs of travel to the site under construction and back and accommodation, i.e. payment for a hotel or rented apartment, as well as daily allowance. First you need to determine the required number of workers performing a particular job. This value can be determined based on the data of their estimated labor intensity, which are given in local estimates, regardless of how they were compiled - according to unit prices or the resource method at current prices. For example, with budget financing: Calculation No. 1 of travel expenses not taken into account by overhead standards for workers performing commissioning work s. Name of construction: Name of object: Foundation: 1. Costs of sending employees, rub.

Back to list | |||||||||||||||||||||||||||||||||||||||||||

www.lilies72.ru

Question:

How to calculate travel expenses in the estimate when a team of installers and adjusters travels to a site in another city. Answer:

In the local estimate for construction and installation work, travel expenses are not taken into account. A separate calculation is made at the current level. According to clause 9.6. MDS81-35.2004 costs associated with sending workers to perform construction, installation and special construction work are determined by calculations based on the PIC, based on the Decree of the Government of the Russian Federation dated 02.10.02 No. 729. If the transportation of workers is carried out by the construction organization's own or leased transport, travel costs are not included in travel expenses, but are taken into account as the costs of transporting workers of construction and installation organizations by road, determined by calculations based on the PIC, taking into account the supporting data of transport enterprises. Travel expenses take into account the costs of travel to the site under construction and back and accommodation, i.e. payment for a hotel or rented apartment, as well as daily allowance. First you need to determine the required number of workers performing a particular job. This value can be determined based on the data of their estimated labor intensity, which are given in local estimates, regardless of how they were compiled - according to unit prices or the resource method at current prices. For example, with budget financing:

Calculation No. 1 of travel expenses not taken into account by overhead standards for workers performing commissioning work

s.

Name of construction: Name of object: Foundation:

| 1. Costs of sending employees, rub. | ||

| business trip #1 | Number of business travelers, persons. | 1 |

| Duration of business trip, days | 10 | |

| payment of daily allowance for each day of a business trip; (Resolution of the Government of the Russian Federation of October 2, 2002 No. 729) | 100 | |

| payment for rent of residential premises per day, excluding VAT; (Resolution of the Government of the Russian Federation of October 2, 2002 No. 729) | 550 | |

| Total daily allowance costs, RUB | 1000 | |

| Total costs for renting residential premises, RUB | 5500 | |

| Total expenses for business trips of employees, rub. | 6500 | |

| Total total costs for business trips, RUB | 6500,00 | |

| 2. Transportation costs, rubles (costs of travel of employees to the place of business trip and back to the place of permanent work) | ||

| business trip #1 | Cost of travel to the place of business trip, for one employee one way, excluding VAT; | 1694,92 |

| Total total costs for transportation costs, rub. | 3389,83 | |

| 3. Travel expenses, rub. | ||

| business trip #1 | ||

| Total total costs for travel expenses, RUB | 9889,83 | |

| VAT=18% | 1780,17 | |

| Total with VAT=18%, rub | 11670,00 | |

| Compiled by: _____________ | ||

| Checked: _____________ | ||

Admin

Back to list

Travel expenses in repair estimates

Paragraph 2 of Article 153 of the Tax Code of the Russian Federation establishes the following rule for determining the tax base for VAT: revenue from the sale of goods (work, services) is determined based on all income of the taxpayer associated with settlements for payment for the specified goods (work, services) received by him in monetary and (or) in kind, including payment in securities. At the same time, there are also the provisions of subparagraph 2 of paragraph 1 of Article 162 of the Tax Code of the Russian Federation, which prescribe that any funds received by the taxpayer be included in the VAT tax base if their receipt is associated with settlements for payment for goods (work, services).

Taking into account the above, the regulatory authorities are of the opinion that the funds received by the contractor from the customer for reimbursement of expenses should be considered as part of the contractor’s revenue from the provision of services and should be included in the VAT tax base. Thus, the Ministry of Finance of Russia in Letter No. 04-03-11/75 dated September 19, 2003 indicated that the amount of compensation for travel expenses received by the organization in accordance with the terms of the agreement should be included in the VAT tax base, regardless of the fact that these expenses are indicated in the concluded agreements separately from the cost of repair work performed.

A number of experts agree with this point of view. In support, they point out that the establishment in the contract of the customer’s obligation to reimburse the contractor for expenses associated with business trips only indicates that part of the price of the service is not fixed (directly stated

in the contract), but a variable depending on the travel expenses actually incurred by your organization. Consequently, both amounts are the revenue of the performing organization from the provision of services under the contract. Therefore, the tax base for VAT in the situation under consideration consists of the cost of work performed (excluding VAT) and the amount of compensation for the costs of the contractor organization (excluding VAT).

Based on what is stated in the contract, you can indicate travel expenses and these expenses are not taxed because this is not income from work performed, but costs paid by the customer.

www.9111.ru

Travel expenses in the estimate

A sample of travel expenses in the estimate is shown in Figure 1. However, in this case, it should be taken into account that such a calculation can be included in the estimate form only on the basis of a written agreement between the customer and the contractor, which bears the costs associated with the travel of personnel.

Figure 1. Sample travel expenses in the estimate

There are several regulating documents on how to take travel expenses into account in the estimate. First of all, this is Decree of the Government of the Russian Federation No. 729 of October 2, 2002. This Resolution describes in detail all cost items and tariffs that must be taken into account in cases of expenses associated with business trips.

In addition, there are instructions on how to take into account travel expenses in the estimate in the construction methodological document MDS81-35.2004. Further in the text, the provisions from the documents mentioned above will be considered in more detail.

Calculation of average earnings for a business trip - online calculator 2020

ClubTK Login/registration category

- Current

- Announcements

- Archival storage

- Sick leave

- Accounting in personnel

- Military personnel

- Military registration

- Guarantees and compensation

- Civil service

- Office work

- Treaties

- Document flow

- Job Descriptions

- Legislation

- Disabled people

- Foreign workers

- Labor safety instructions

- Interview

- Personnel officers advise

clubtk.ru