When an entrepreneur registers as an individual entrepreneur, he has a month to choose a tax regime. Otherwise

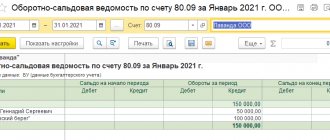

Companies on OSNO use an invoice (SCF) for VAT accounting. Universal transfer document (UDD)

It often happens at an enterprise that during the next inventory check, things that are included in the inventory are missing.

5.00 5 Reviews: 0 Views: 13060 Votes: 1 Updated: n/a File type Text document

Understanding the Form, Who Files Form 12-F is a document that every organization must file.

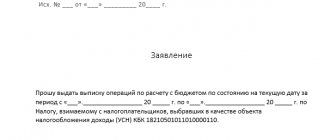

Extracting transactions for settlements with budgets - what is it? Statement of transactions for settlements with

Home / Taxes / What is VAT and when does it increase to 20 percent?

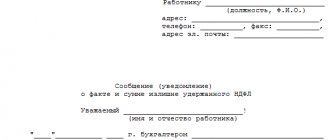

Overpayment of personal income tax: what to do? According to paragraph 1 of Art. 231 of the Tax Code of the Russian Federation personal income tax amounts,

for managers business development 01/28/2021 Author: Academy-of-capital.ru Add a comment Rating: (Votes: 2, Rating: 4.5)

Application for withdrawal To leave the LLC, the founder (participant) must submit to the organization a written