for managers business development

28.01.2021

Author: Academy-of-capital.ru

Add a comment

Rating:

| (Votes: 2, Rating: 4.5) |

From this material you will learn:

- Employee costs

- Taxes and insurance premiums

- Indirect costs for employees: benefits package, training, etc.

- Creating comfortable working conditions

- Possible losses

- Estimation of company costs for employees

- 7 stages of personnel cost planning

- 10 ways to reduce employee costs

- Illegal saving methods

Employee expenses are a very significant part of any company's expenses. Therefore, when allocating a new staffing position, the business owner needs to clearly understand how much it will cost him. There are situations when it is better to make do with existing labor reserves.

After all, in addition to wages, there will be a need to allocate funds for taxes and insurance contributions, providing a social package and comfortable working conditions, training and various types of compensation. The amount will eventually accumulate to be considerable.

Employee costs

Employee wage costs consist of several items, which are generated from different sources and include several types of basic payments.

Pay for time worked:

- payments according to accepted tariffs, salaries, piece rates; percentage of the profit;

- the amount of remuneration in kind, cash bonuses, incentive payments, regular payments for length of service and length of service;

- compensation in connection with working hours and working conditions;

- payment of travel expenses for employees;

- compensation for work breaks;

- payment of the difference in wages for temporary substitution, part-time labor and other non-staff personnel;

- commission (to insurance agents, brokers).

Payment for unworked time, namely:

- payment for vacations every year and for studies;

- payment of preferential time and time for performing government duties, donors;

- one-time bonuses based on year-end results;

- money for unused vacations.

Financial assistance provided for in the agreement

As mentioned above, Part 1 of Art.

255 of the Tax Code of the Russian Federation establishes that the taxpayer’s expenses for wages include any accruals to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to working hours or working conditions, bonuses and one-time incentive accruals, expenses associated with the maintenance of these workers, provided for by the norms of the legislation of the Russian Federation, labor or collective agreements. However, in accordance with paragraph 23 of Art. 270 of the Tax Code of the Russian Federation, when determining the tax base, expenses in the form of amounts of financial assistance to employees are not taken into account.

From the literal interpretation of the above provisions of the Tax Code of the Russian Federation, we can conclude that, as a general rule, an organization does not have the right to classify one-time financial assistance paid to its employee as income tax expenses.

Meanwhile, the payment of financial assistance may be due to various circumstances. And the possibility of including financial assistance in the income tax base depends on the reasons for their occurrence.

For example, a company may pay financial assistance when providing annual leave. Let's consider the position of the official bodies on this issue.

Thus, the letter of the Ministry of Finance of the Russian Federation dated 02.09.2014 No. 03-03-06/1/43912 explains that one-time payments to employees when they are granted annual leave, if:

- such payments are provided for in the employment contract or if the employment contract contains an indication of a collective agreement;

- depend on the size of wages and compliance with labor discipline,

that is, they are associated with the performance by an individual of his labor function, and therefore are an element of the remuneration system, then they are not recognized as material assistance within the meaning of Article 270 of the Tax Code of the Russian Federation.

Such one-time payments to employees of an organization can reduce the tax base for income tax in accordance with Article 255 of the Tax Code of the Russian Federation. A similar position is supported in letters of the Ministry of Finance of the Russian Federation dated May 15, 2012 No. 03-03-10/47, dated April 28, 2012 No. 03-03-06/1/211, dated September 3, 2012 No. 03-03-06/1/461. Thus, for income tax purposes, financial assistance for vacation can be taken into account as part of labor costs only if it is provided for in an employment and (or) collective agreement and is related to the performance of job duties. In other cases, financial assistance for vacation cannot be taken into account in expenses.

Taxes and insurance premiums

The employer bears expenses for employees not only in the form of salaries, sick leave and vacation pay, but also in the form of monthly payments to the state. This should also include the personal income tax, which is 13% (although, strictly speaking, these are the costs not of the company, but of the employees themselves, but the established practice of calculations allows us to talk about this tax as a cost of the enterprise, more on this below).

The personal income tax of employees and the costs of contributions are transferred by the employer, or, in other words, by the tax agent. It’s easier for government agencies. Otherwise, each person would calculate his own tax, send it to the regulatory authorities, and the staff of the tax service would have to be significantly increased.

Usually, during an interview, the applicant is interested in the net salary that he will receive in hand on a monthly basis, already with the deduction of all fees. The employer has to draw up the salary fund with an increase in expenses by 13 percent in order to provide for all tax deductions.

For example, the advertisement for applicants indicates a salary of 70,000 rubles. The entrepreneur's expenses increase. We calculate this way - 70,000 / 0.87 = 80,459.77 rubles. Personal income tax is 10,459.77 rubles. The employee receives 70,000 rubles.

The responsibilities of business owners also include sending contributions to insurance funds for each employee, relations with whom are regulated by an employment contract or civil law agreement. Information about the amount of such transfers reflected in pay slips is not available to employees. Every month the employer must transfer:

- To the pension insurance fund - 22%. When the limit of all cash payments is reached, the amount of the mandatory transfer for a businessman is reduced to 10%.

- To the compulsory health insurance fund (MHIF) – 5.1%. There are no limits.

- To the Social Insurance Fund (FSS) - 2.9%, as well as contributions from accidents. The maximum amount for these payments is 865,000 rubles for the current year.

- Financial contributions in case of employee injuries to the Social Insurance Fund - from 0.2 to 8.5%. When implementing a civil contract, such fees are not provided. The amount of the contribution is individual in each case and depends on the specifics of the profession: more where the work is more dangerous.

How much will a businessman incur per employee per month? For a salary of 70,000 rubles, insurance premiums are calculated based on the full amount - 80,459.77 rubles. Naturally, all payments are reflected in the entrepreneur’s costs:

- to the Pension Fund of the Russian Federation - 22% of 80,459.77 - 17,701.15 rubles;

- to the compulsory health insurance fund - 5.1% of 80,459.77 - 4,103.45 rubles;

- to the Social Insurance Fund - 2.9% of 80,459.77 - 2,333.33 rubles;

- in the Social Insurance Fund “for injuries” - 0.2% of 80,459.77 - 160.91 rubles.

After all the calculations, it turns out that the employee spends 24,299 rubles more than the manager receives on the card. The total expense item is 94,299 rubles per employee. All these are so-called direct costs.

Employee compensation costs

Firms using the simplified tax system with the object “income minus expenses” recognize labor costs in the manner established for income tax payers, that is, in accordance with Article 255 of the Tax Code (clause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). According to this article, expenses for remuneration of employees include any types of expenses in their favor, if they are provided for in an employment or collective agreement.

List of labor costs

Such expenses include, in particular:

- salaries accrued to the company's personnel;

- bonuses for performance;

- additional payments related to working hours and working conditions (for night work, multi-shift work, for combining professions, etc.);

- labor costs during forced absence;

- compensation for unused vacation;

- average earnings retained by the employee in cases provided for by labor legislation;

- accruals to employees released due to the reorganization of the company, as well as reduction of its staff;

- one-time rewards for length of service;

- regional coefficients and allowances for work in difficult climatic conditions;

- expenses for remuneration of employees who are not on the company's staff for performing work under civil contracts (for example, a contract or an assignment);

- payments under compulsory and voluntary insurance contracts for employees;

- reimbursement to employees of the cost of paying interest on loans (credits) for the purchase or construction of housing, but not more than 3% of the amount of labor costs.

The standard for recognizing interest on voluntary health insurance is 6% of the amount of labor costs.

Payment of wages in goods

Employers can pay wages not only in cash, but also in kind (products or goods) (Article 131 of the Labor Code of the Russian Federation). But such payment should be no more than 20% of accrued wages.

Issued goods are considered sold; they are simply paid not in money, but through offset (remuneration for labor). Expenses on purchased goods that were sold in this way can be taken into account for taxation (clause 23, clause 1, article 346.16 of the Tax Code of the Russian Federation). This means that remuneration in kind can be reflected as part of “simplified” expenses.

Advance payment of wages

Employees must be paid wages at least every half month (Article 136 of the Labor Code of the Russian Federation). There are two options for accounting for salary advances as expenses.

- Advances on wages are reflected in expenses on the date of payment from the cash register or transfer to employee accounts. Since simplifiers recognize labor costs at the time of debt repayment, then by issuing an advance, the company pays off its debt for the first half of the month. Tax authorities agree with this accounting option (letter of the Federal Tax Service of the Russian Federation for Moscow dated December 31, 2004 No. 21-14/85240).

- The salary advance is taken into account in expenses on the last day of the month. Since wage arrears arise only after wages are accrued, advances issued to employees are recognized as expenses on the day the wages are accrued (the last day of the month).

Since both options for accounting for advances on wages do not contradict the norms of the Tax Code, the company has the right to choose the option that is more convenient for it.

Personal income tax from employee income

Organizations and entrepreneurs with the object “income minus expenses” have the right to take into account personal income tax withheld from employee income as part of the accrued amounts of wages. This opinion was expressed by the Ministry of Finance in a letter dated November 9, 2015 No. 03-06/2/64442.

The fact is that “income-expenditure” simplifiers can write off as expenses the amounts of taxes and fees paid in accordance with the legislation of the Russian Federation (clause 22, clause 1, article 346.16 of the Tax Code of the Russian Federation).

At the same time, the Tax Code does not exempt simplifiers from the duties of tax agents when paying remuneration to individuals (clause 6 of Article 346.11 of the Tax Code of the Russian Federation). In particular, when paying income to their employees, they are obliged to withhold the accrued amount of personal income tax from the income of employees (Article 226 of the Tax Code of the Russian Federation).

Moreover, personal income tax must be withheld from any funds that are paid to individuals or on their behalf to third parties. But paying personal income tax at the expense of the tax agent’s own funds is unacceptable.

Consequently, personal income tax from the income of employees cannot be reflected as part of the expenses of the simplified tax system of the company (entrepreneur) on the basis of subparagraph 22 of paragraph 1 of Article 346.16 of the Tax Code.

However, the provisions of subparagraph 6 of paragraph 1 and paragraph 2 of Article 346.16 of the Tax Code allow “simplified workers” to take into account labor costs when calculating the single tax according to the rules of Article 255 of the Tax Code. That is, in the manner prescribed for calculating income tax.

In turn, Article 255 of the Tax Code states that labor costs include any accruals to employees provided for by the laws of the Russian Federation, labor agreements (contracts) and (or) collective agreements.

And since personal income tax is taken into account as part of accrued wages, the Ministry of Finance concludes that the amount of this tax can also be taken into account as part of labor costs.

Let us note that in its earlier letter dated February 22, 2007 No. 03-11-04/2/48, the Ministry of Finance already stated that personal income tax from employee salaries can be taken into account in “simplified” labor costs.

Arbitration practice also confirms this position. For example, the Federal Antimonopoly Service of the Moscow District, in resolution dated February 22, 2005 No. KA-A41/775-05, invalidated the decision of the tax authorities to hold the company accountable for including personal income tax in expenses. The arbitrators indicated that the payment of the tax was a labor expense because it was withheld from the wages accrued to employees. A similar conclusion was made by the judges of the Federal Antimonopoly Service of the Moscow District in a resolution dated December 17, 2009 No. KA-A40/13654-09.

Also, a simplifier can take into account as expenses payments under civil contracts (for example, under a work contract) to employees who are not on the payroll (clause 21 of Article 255 of the Tax Code of the Russian Federation).

Entrepreneur salary

Entrepreneurs using the simplified tax system cannot act as employers in relation to themselves. Therefore, they do not have the right to accrue and pay wages to themselves and, therefore, do not have the right to include the costs of paying them into “simplified” expenses (letter of the Ministry of Finance of Russia dated January 16, 2015 No. 03-11-11/665).

Employee compensation

Is it possible for a “simplified” person to take into account subscription costs if such costs are not listed in the closed list? If the accounting literature is issued in the name of the accountant, then the company can pay for it as compensation for the use of the employee’s personal property for business purposes. Moreover, the payment can be taken into account as part of labor costs. Neither personal income tax nor contributions to extra-budgetary funds are paid from it.

In order for a company to take into account compensation for employee expenses (for the use of property), the following must be provided:

- in the employment contract with the accountant, indicate in detail the expenses for which literature he will be compensated for;

- issue an order for the company with a list of literature, the cost of which the company will compensate the employee.

The amount of compensation for the employee's expenses, of course, should not exceed the cost of the subscription. And this cost must be confirmed by subscription receipts paid by the employee.

One-time payment of financial assistance

Amounts of one-time payment of financial assistance to employees of an organization for annual leave, provided for in an employment contract, reduce the base for the “simplified” tax. This was confirmed by the Russian Ministry of Finance in a letter dated September 24, 2012 No. 03-11-06/2/129. Financiers pointed out that the provisions of subparagraph 6 of paragraph 1 of Article 346.16 of the Tax Code allow “simplified workers” to take into account, in particular, labor costs. In this case, you should be guided by the procedure prescribed in Article 255 of the Tax Code (clause 2 of Article 346.16 of the Tax Code). In turn, this norm establishes that labor costs include any types of expenses incurred in favor of the employee, if they are provided for in an employment contract or collective agreement.

The exception is the costs listed in Article 270 of the Code. According to officials, financial assistance for vacation, provided for by an employment or collective agreement, the amount of which depends on the employee’s salary and compliance with labor discipline, is an element of the remuneration system. After all, these payments are directly related to the individual’s performance of his labor function.

The position of the financial department is confirmed by judicial practice. In particular, the Presidium of the Supreme Arbitration Court of the Russian Federation came to the same conclusion in Resolution No. 4350/10 dated November 30, 2010.

Indirect costs for employees: benefits package, training, etc.

Social package. If the company has such a privilege as a social package, the column of expenses per employee will increase by the amount of payments for it. Financial payments for meals or a fitness club will be added, as well as contributions for voluntary health insurance, which is practiced in all decent companies. Socially significant payments also include:

- benefits for labor veterans retiring, which is paid once at the expense of the enterprise;

- expenses for trips to sanatoriums;

- reimbursement of fees for kindergartens and nurseries for children of company employees;

- partial payment of parental leave for women;

- financial compensation for employees who received physical injuries, injuries and illnesses while performing professional duties, payments upon the death of an employee to his dependents, compensation for moral damage, if such a decision is made by the court;

- reimbursement of travel expenses for employees;

- payment for staff meals;

- financial assistance in difficult life circumstances;

- assistance in the construction or purchase of housing space, expenses for gifts to employees.

Employee training. Spending on training and advanced training is necessary. It is important for employees of the accounting department to understand the information system, to know about all changes in legislation, as well as the requirements of tax services when preparing reports and declarations. Each entrepreneur must calculate how much he will have to spend on training his employees, including attending various trainings and conferences.

Keeping employees working remotely. In this case, the businessman does not need to spend money on paying for premises, furniture, or travel for employees, but he will have to take care of providing remote employees with everything they need. This expense item may include payment of tariffs for the Internet, equipment, etc.

How to make payments in the program: consider an example

Let's look at the interaction of registers using an example:

- Advance paid to employee 4000

- The employee's salary was accrued in the amount of 10,000 and a bonus of 5,000 is not accepted for the simplified tax system.

- Paid to employee 6000

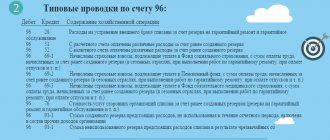

| № | date | Operation | Document 1C | Dt | CT | Sum | Register “Other settlements” + income - expense | Register "Expenses under the simplified tax system" | Reflection in KUDiR, Reflection in the declaration under the simplified tax system |

| 1 | 25.01.2018 | Advance payment | Cash withdrawal | 70 | 50 | 4000 | + | ||

| 2 | 31.01.2018 | Payroll | Payroll | 26 | 70 | 6980 | — | + | |

| Calculation of Insurance premiums | Payroll | 26 | 69 | 3020 | — | + | |||

| Calculation of non-taxable bonus | Payroll | 26 | 70 | 5000 | — | + — The expense occurs due to the offset of the advance payment | |||

| 3 | 10.02.2018 | Payroll issuance | Cash withdrawal | 70 | 50 | 6000 | + | — | |

Advance payment

When an advance is paid, the amount of the advance goes into KUDiR, in the Total Expenses column. This means that there will be a record of the advance in KUDiR, but we cannot accept it as an expense yet, because there has been no salary accrual. For this reason, an entry is not created in the Expenses register under the simplified tax system.

Also, when paying an advance, an incoming movement in the Other settlements (+) register is generated for the amount of payment to the employee according to the “Cash issuance” settlement document.

Payroll

Let's set up charges:

- Salary (10,000 rubles) is accepted for the purposes of the simplified tax system

- The bonus (5,000 rubles) is not accepted for the purposes of the simplified tax system

When accruing salary, no entry is created in KUDiR, even though the condition “Salary accrued and paid” worked for us. We will get the answer to the question why this happened by analyzing the Expenses register under the simplified tax system, entries in which are created when the salary is calculated.

- Two incoming entries are created in the register by type of expense Salary

with different statuses of reflection in the NU "

Accepted

" (salary accepted in the simplified tax system - 10,000 - 13% personal income tax = 8,700) and "

Not accepted

" (bonus not accepted in the simplified tax system - 5 000 - 13% personal income tax = 4,350). - Receipt records are generated by type of expense Taxes

. - An expense record is created for the amount of the advance paid. When the advance is offset, the part of the salary that is not accepted is closed first.

It turns out that we have received credit for part of the salary that is not accepted in the simplified tax system, so we cannot accept anything as expenses and an entry in KUDiR is not created.

Also, when calculating wages, the expense movement of the register Other calculations is formed according to the payment documents “Issuance of cash...” and “Accrual of salaries...”. These records will be used to control payment and determine the tax base.

From the universal report on the simplified tax system register, it is clear that 350 rubles remain to be credited (paid). for the non-accepted part of the salary, credit 8,700 for the accepted part in the simplified tax system.

Payment to employee

We pay the employee 6,000 rubles.

An entry is created in KUDiR, the amount goes to expenses. because the salary has been accrued and paid.

The question arises

Why did the entire payment amount end up in KUDiR, if we still have 350 rubles. not paid regarding the non-accepted salary. That is, logically, only 5,650 (6,000 - 350) should be accepted, since the salary that is not accepted is counted first, and then the salary that is accepted into the simplified tax system. But in the program at the moment the logic is completely different:

- If we pay the advance, then the first step is to close the non-accepted RFP.

- If we close a debt, then the accepted part is read off first, then the non-accepted part.

We wrote to the developers on this issue. They agreed that this logic can confuse the user, and in the coming releases they will change the situation regarding the offset of advances and debts in the simplified tax system.

In the Expenses register under the simplified tax system, an expense record is created with the expense type Salary. Accepted as expenses 6,000

In the register Other calculations, a credit entry is made according to the settlement document “Payroll calculation...”

Creating comfortable working conditions

When equipping a room for work, each entrepreneur himself determines what he needs. Therefore, it is impossible to calculate the exact cost of the costs. You just have to look at what expense items there may be.

- Employee's place of work

For the normal functioning of hired managers, it is necessary to organize the workspace. In the expense item of the enterprise budget, you need to include money for the purchase of a computer, software, office furniture, rent of premises, as well as employee communication costs, Internet traffic and electricity. Do not forget that you will regularly need to maintain equipment, buy stationery, etc.

We recommend

“Control of employee performance: the most effective methods” Read more

- Service staff

In addition to the specialists on whom the company’s work directly depends and thanks to whom the business thrives, employees should be hired to do accounting and clean the premises. This is the bare minimum for service personnel. To save money, you can invite a remote accountant to submit reports. To ensure the cleanliness of the premises, it will be cheaper to hire a retired cleaner than to seek the services of a cleaning company.

- Related costs

Here you can note what makes the employees’ work in the office comfortable: a water cooler, a coffee machine, tea, cookies, as well as voluntary medical insurance, expenses for employee meals, compensation for visiting the fitness center.

Let's try to calculate the approximate costs of maintaining one manager's workplace per month. For example, a chair, table and computer have already been purchased previously.

- Software - 5,000 rubles.

- Stationery - 1,000 rubles.

- Payment for rent of the premises and utility bills (money is divided among all employees) - 5,000 rubles.

- Personnel for cleaning the premises and maintaining accounting (costs are divided among all managers) - 2,000 rubles.

- Water and coffee - 300 rubles.

It turns out another 13,300 rubles. Taking into account the fact that for one employee who earns 70,000 rubles, another 13,300 rubles need to be budgeted for expenses, the total will be 94,299 rubles + 13,300 rubles = 107,599 rubles.

Possible losses

When organizing a business, unforeseen expenses may arise, which are worth remembering, and try to include compensation in the enterprise budget in advance.

- Simple All people are living beings; it is not always possible to work in the same way all the time. Sometimes circumstances arise such that an employee requires unscheduled leave or a day off without pay. Banal absenteeism, tardiness, early leaving the workplace, as well as the use of production time for other purposes (smoking breaks, social networks, conversations with colleagues) negatively affect the efficiency of the enterprise and its income.

Let’s say that in a month two employees came to the office late and lost 20 hours of useful time, and there was also 46 hours of downtime due to smoking breaks. If we calculate how many working days were lost, we get - (66: 2: = 4.125. Translated into money for the entrepreneur, the loss for an employee salary of 70,000 rubles amounted to 70,000: 23 × 4.125 = 13,174 rubles for each person.

Loss of employee working time threatens the entrepreneur with losses. To avoid misunderstandings, it is worthwhile to specify in the labor regulations the exact hours of work and rest for employees, as well as to indicate what awaits managers for violating discipline. Employees must sign that they have read the document.

- Unsatisfactory organization of the labor process

To effectively use working time and achieve your goals, you need to properly organize the work process. It is worth creating comfortable conditions for staff, clearly setting goals and indicating deadlines for their implementation, prioritizing tasks, paying attention to obtaining results, and developing a step-by-step plan for completing major tasks. This approach in business ensures the achievement of main goals and helps not to make mistakes.It's worth giving an example. According to your calculations, it takes 4 hours to complete one task, but the employee was able to complete it only in 6 hours due to his lack of organization. There were 20 similar tasks per month, and 40 hours of working time were lost, that is, 5 full working days. Let's calculate the losses in monetary terms for these 5 working days with the same initial data: 70,000: 23 × 5 = 15,217 rubles.

- Insufficient production

It happens that the actual results of an enterprise’s activities do not coincide with its profit plans. This leads to negative consequences. Often the company does not have the ability to compensate for insufficient production.For example, 1 hour of a manager’s work costs the company 2,000 rubles. He was given a task that took 50 hours to complete. As a result, the employee spent 80 hours on work, the financial losses of the enterprise in this case amounted to 30 × 2000 = 60,000 rubles.

This attitude towards work harms the entire company, as its reputation suffers. Additionally, there is a possibility of losing money because the customer may demand compensation for being late.

- Negative attitude of employees towards performing their duties

To understand how negligent attitude towards the performance of official duties by employees has a negative impact, we can consider the following examples. The salesperson in the store did not show attention to the client and did not offer additional products. As a result, he sold few products and the company lost profits.Using a company car for personal needs, the driver causes damage to the company, as it consumes government fuel and increases the depreciation of the vehicle.

The sales manager was unable to call clients on time because he was busy watching his social media feed, which is why the profit plan was not met.

When submitting the quarterly report, the accountant made a mistake and a fine was imposed on the company. Every person can make a mistake, but this is fraught with consequences for the financial sector.

The company loses money without making a profit and missing out on real opportunities. All this happens due to poor motivation of employees and violation of job descriptions.

Estimation of company costs for employees

Employee expenses are calculated in several ways. There are standard methods based on the ROI (Return On Investment) principle:

- By share of gross revenue . In this case, all costs for employees are subtracted from the volume of product sales.

- Based on average cost per employee . To calculate, the entire amount of costs is divided by the number of employees of the enterprise. Then they compare the resulting number with the company's profit.

- The price of one hour of work, which characterizes the cost of 1 hour of staff labor . To calculate it, take the total amount of expenses for all employees and divide by the number of hours for a certain period. When determining the profitability of a company, this indicator is also taken into account.

To determine how effectively the salary fund is spent in a company, you need to compare the average costs per manager and the profit of the enterprise in different time periods.

Let's select a few examples to illustrate how the method works. The best formula for determining effectiveness is:

Result/Expenses

Expenses include labor costs, and results include income or production volume.

Let's try to calculate ROI for one quarter for a furniture manufacturing company. Labor costs include the number of workers and the time it takes to complete a task. Let all workers have the same number of working days. Then we will include the average number of employees as labor costs, namely 21 people.

Products worth 10,400,000 rubles were produced. Let's divide the entire amount by the average number of people: 10,400,000 / 21, it turns out 495,240 rubles. This is exactly how much one employee of the enterprise produces in monetary terms per quarter.

This is only part of the calculations. Then it is worth determining how much profit the employee brings for each ruble paid, that is, what is the financial return on labor costs. You can calculate it like this:

Production volume (in rubles) / payroll

For trading companies, the results will refer to the profit received rather than the total amount of sales. The ratio of gross profit to wages is also used. Let's look at the data from the previous example for a furniture shop. With a production volume of 10,400,000 rubles. for the quarter, the payroll amount is 2,745,000 rubles. We divide the total amount of 10,400,000 by 2,745,000 and get 3.79 rubles. Based on the calculation, every ruble spent on an employee brings 3.79 rubles in income for the company.

It is recommended to conduct an analysis for each individual position of the enterprise to determine how effectively wages are calculated. Let's find out whether the payment for the work of a sales manager is adequate. With a salary of 70,000 rubles, he sells products worth 1,000,000. Net profit from sales is 300,000 rubles. By simple calculations, we find that the profit for each ruble paid to an employee is 4.29 rubles (300,000: 70,000).

To assess the effectiveness of payroll costs, a common method called “benchmarking” is used. At the same time, they compare the salary of their specialist with the income of workers in a similar position in other companies, regions and the average in the industry.

Purpose of the method of reflecting wages in accounting

The method of recording in accounting can be specified for a separate document, accrual, or employee. However, it is necessary to take into account the priority in reflecting salaries. For example, when the reflection method in the “Organization” directory is specified differently from the reflection method in the “Employee” directory, the program will “transfer” to “1C: Accounting 8” the reflection method specified for the employee, since the priority of this method of reflecting salaries is higher.

Let's consider the purpose of the reflection method in order of increasing priority:

- For an organization (section “Salary accounting”

via the link

“Accounting and payment of salaries”

on the

“Accounting policies and other settings”

in the

“Organizations”

(section

“Settings”

-

“Organizations”

). - For a division (section “Settings”

-

“Divisions”

). - For the territory (section “Settings”

-

“Territories”

). - For an employee (section "Personnel"

—

"Employees"

, chapter

"Payroll Accounting"

, link

"Payments"

, cost accounting in the employee card). - For the accrual type (section “Settings”

-

“Accruals”

, section

“Accounting”

, tab

“Taxes, contributions, accounting”

of the accrual type form). - For the planned accrual of an employee in the documents “Assignment of planned accrual”

,

“Combination of positions”

. - In some settlement documents, such as "Prize"

,

"Contract (work,

,

“Accrual of other income”

. - By employee and accrual. The setup is carried out by the document “Employee Accruals Accounting”

in the

“Salary”

-

“Employee Accruals Accounting”

.