10/08/2018 When purchasing used property that is depreciable, an organization asks itself the question of how to properly

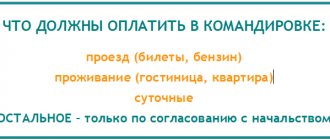

Where is it said about payment for a business trip? The general rules for payment of days off to a posted employee are regulated by the Labor Code

Obligation to make entries in the book Both companies and individual entrepreneurs are required to make entries in

What refers to intangible assets Intangible assets are a special category of non-current assets of an organization,

SZV-STAZH - what kind of reporting is this? Previously, the functions of the new report were performed by the RSV-1 form, which

Educational program for those who want to understand this profitable tax system. Moreover, soon

If the employment relationship is officially terminated, the resigning citizen must receive all the necessary documentation confirming his

Who should report for the 4th quarter of 2016 Report on the RSV-1 form for 4

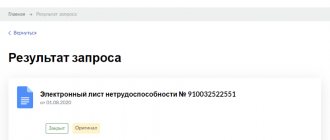

Why do you need a gateway? Each employer submits reports to the Social Insurance Fund: Quarterly, Form 4-FSS.

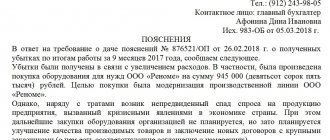

Why write an explanation? Quite often, based on the results of reports submitted by a tax agent, tax authorities receive