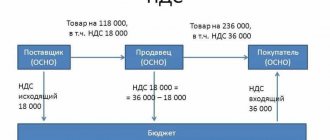

VAT included in the taxpayer's accounting When purchasing goods (work, services), the taxpayer receives primary

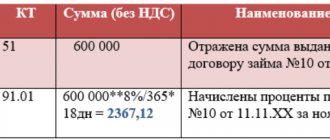

How to reflect granted loans in accounting? We already know how to maintain CREDIT ACCOUNTING

Due to the emergence of new forms of ownership, increasing complexity of production processes and changes in the economic

A very specific account 09 “Deferred tax assets” (DTA) occupies line 1180 in the first section

An on-site tax audit (ATA) is a lengthy and not very pleasant event. Verification period -

Document approval deadlines There is an opinion that accounting policies must be approved at the end of each calendar year.

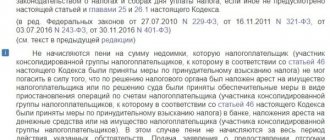

Let's start with the fact that the obligation to pay tax and contribution is considered fulfilled from the moment

When to pay personal income tax when dismissing an employee in 2020 If he has unused days left

Liquidation of an LLC is the termination of the existence of a limited liability company without the transfer of its rights

After registering an individual entrepreneur with the tax office, you not only receive the right to conduct business, i.e.