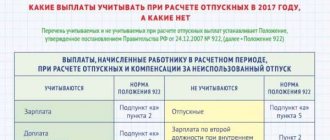

Calculation period for 2022 To correctly calculate vacation, you need the Regulation from the resolution

A separate division is a special structural part of a legal entity that carries out activities outside

How does a penalty differ from a fine? These are two different types of penalties. They both require a fee

How to organize accounting of the volume of work performed in food shops? What forms of documents should I use? How

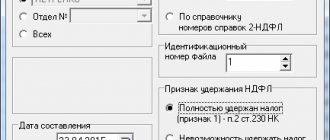

Where to start To fill out the 2-NDFL report in the “Taxpayer Legal Entity” to enter a certificate of

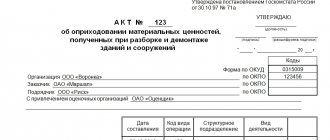

The obligation to use form M-35 to draw up a capitalization act Since recent times, the obligation to use many

Among tax payers for personal vehicles, it is quite a common occurrence when payment deadlines are not met.

The concept of “total length of service” (GTS) cannot be found in the current legislation of the Russian Federation. This is a certain

Do you need an advance invoice? An invoice (hereinafter also referred to as invoice) is a document confirming: Moment

On January 20, companies must provide the tax office with information on the average number of employees. What