Income tax: payment order in 2022 All organizations carrying out business activities are required to

We will continue to talk about: From what (advance, deposit or security payment) VAT is calculated

Accounting for financial results of transactions is reflected through a set of records made throughout the reporting period.

Control over the calculation and payment of insurance premiums from 2022 is largely carried out by the Federal Tax Service.

The essence of the transport tax is contained in the name itself: it is a tax on transport. Collection of this tax

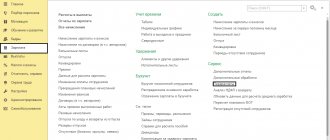

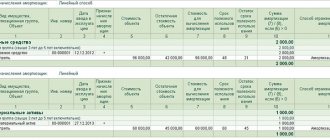

To automatically include losses from the sale of fixed assets in expenses in 1C: Accounting 8

What is a power of attorney for the right to sign documents, and what types exist? The Civil Code states:

Loan from the founder of an LLC If the organization has financial problems and does not have enough own funds

Upon termination of the employment relationship, in addition to the salary for the work done, the employee may be required to give a number of

Legislative framework When an organization acquires a plot of land, it is reflected in accounting in