Types of monetary support

Russian legislation guarantees monetary payments in favor of citizens who have undertaken to pay the costs of organizing the funeral process of a deceased relative or loved one.

Not only relatives, but also unrelated citizens have the right to receive financial assistance upon the death of a close relative in 2021. The money is paid to the person who bears the funeral expenses. Such conditions are enshrined in Federal Law No. 8 of January 12, 1996. One-time payment:

- state benefit - money guaranteed by current legislation;

- financial assistance for the funeral of a relative at the expense of the employer;

- financial support from the employer for the funeral of a deceased employee.

IMPORTANT!

Close relatives are spouses (husband and wife), parents and children, sisters and brothers, grandparents in relation to grandchildren (Article 2, 14 of the RF IC).

Please note that financial assistance in connection with the death of a close relative from the employer is paid exclusively from the company’s funds. And the state benefit is transferred from an extra-budgetary fund - it is formed from the Social Insurance Fund. These concepts should also be distinguished because the amount of government payments is strictly limited. The amount of financial assistance from the employer depends on the financial capabilities of the enterprise, but has no specific restrictions.

Who can claim payments?

Only his immediate relatives can apply for social benefits in the event of the death of a military serviceman or law enforcement officer: the husband/wife of the deceased, his parents and minor children, as well as any relatives who were supported by him.

The circumstances under which the family of a military serviceman or law enforcement officer is entitled to monetary compensation are specified in the life insurance contract. This document must be signed by any person entering the service. If his death falls under the terms of the insured event, his relatives will be paid money. In almost any of the above structures, the following situations are considered such:

- Death occurred as a result of injury or illness received during service.

- The death of the employee occurred as a result of injuries, injuries or illnesses received in the service no more than 12 months after dismissal.

Depending on the place of service of the deceased, the nuances of insurance claims may vary. To avoid possible complications, you should carefully study the relevant federal laws: obtaining financial compensation will require knowledge of the letter and spirit of the insurance document, not to mention overcoming bureaucratic red tape and resolving legal issues.

It should also be noted that the types and rules for receiving any payments due in this case may vary from department to department. In particular, this concerns sets of necessary documents: depending on the case and type of payment, you will need to prepare the appropriate package of papers.

Special rules are established for reimbursement of funeral expenses and installation of a gravestone. Not only relatives, but any citizen who took upon himself the organization and payment of the funeral ceremony can apply for compensation. To do this, you will need to provide checks, receipts and any other financial documents indicating payment for funeral services and goods.

Amount of payments from the state

The specific amount of financial assistance for the death of a close relative from an employer in 2022 depends on its type and local standards. For example, public funds are limited by current legislation. In 2022, the funeral benefit for a relative is 6,424.98 rubles.

IMPORTANT!

If a territorial (district) coefficient is established in the region, then the amount of financial assistance increases by this increasing coefficient.

Note that some regions of Russia have approved higher values for financial assistance. So, for example, in Moscow the additional payment to the state allowance is 12,046 rubles. This depends on the financial and economic level of the constituent entity of the Russian Federation.

Amount of posthumous payments and compensations in 2022

The final amount of benefits is determined by federal laws that regulate social guarantees for employees in the relevant department. A short list of them is given at the beginning of this article.

Compensation for funeral expenses

- Ministry of Internal Affairs, Russian Guard - up to 28,174 rubles (Moscow and St. Petersburg); up to 20,350 rubles (other regions).

- Fire protection and the RF Armed Forces – up to 27,016 rubles (Moscow and St. Petersburg); up to 19,511 rubles (other regions).

Compensation for the costs of installing the monument (regardless of the region)

- Ministry of Internal Affairs and the National Guard (regardless of the region) - up to 35,171 rubles;

- Fire protection and the Armed Forces of the Russian Federation (regardless of the region) - up to 33,721 rubles;

One-time benefit (regardless of region)

- Ministry of Internal Affairs, Fire Department and Armed Forces of the Russian Federation (regardless of the region) - 4,128,677 rubles;

- Rosgvardia (regardless of the region) - 3,695,354 rubles;

Insurance payments (regardless of region)

- Ministry of Internal Affairs, Fire Service - 2,752,451 rubles;

- Military personnel in the RF Armed Forces (contract) – 2,752,451 rubles;

- Military personnel in the RF Armed Forces (on conscription) – 1,376,225 rubles;

- Russian Guard - 2,562,112 rubles.

Important!

If the funeral was carried out at the expense of the state, the relatives of the deceased do not have the right to claim social benefits.

Amounts from the employer

Current regulations do not establish any restrictions on the amount of payment at work upon the death of a close relative for the employer. The amount is determined based on the financial capabilities of the employer.

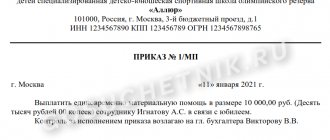

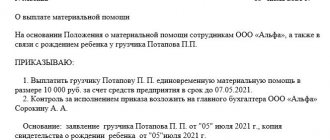

The amount of financial assistance should be fixed in the local documents of the enterprise. For example, in the regulations on remuneration, in a collective and (or) employment contract, in accounting policies. It is permissible to determine the maximum amount of payments in a special order, for example, to approve it by a separate order for the current year.

How to get

The employee needs to apply for financial assistance in connection with the death of his father or other relative. A written request is the basis for transferring money.

In addition to the application, you will have to prepare certain documents. The list of required documentation depends on the circumstances. If an employee’s relatives have died, the following will be required:

- death certificate from the registry office, but only the original;

- marriage certificate (copy) - in case of death of one of the spouses;

- birth certificate if a child or parent has died;

- passport or other document that confirms the identity of the applicant;

- a document confirming relationship with a deceased employee of the enterprise.

If the funeral is carried out by a stranger, then payment documents confirming the funeral expenses will be required. Please note that it is not necessary to confirm such expenses, as they are not established by current legislation.

Use free instructions from ConsultantPlus experts to arrange for the provision of financial assistance to an employee in connection with the death of a family member.

Benefits and privileges for the families of deceased employees of the Russian Armed Forces and law enforcement agencies

Federal legislation also provides for other types of assistance to disabled relatives of a deceased serviceman or law enforcement officer who are dependent on him. They can apply for social assistance due to family members of participants in armed hostilities and veterans: in addition to monthly material support, they are entitled to social benefits in the form of discounts on utility bills, preferential vouchers to sanatoriums and other resort and health organizations, as well as special conditions for joining cooperatives.

If the deceased belonged to one of the honorary categories of employees, the state at the legislative level guarantees him a solemn funeral with the participation of a funeral orchestra, an honor guard and an escort, and bears all the costs of organizing it. These categories include:

- Military personnel of the Russian Armed Forces and Navy with a service life of more than 20 years;

- Citizens awarded the titles Hero of the USSR or Hero of the Russian Federation;

- Full Knights of the Order of Glory;

- Russians who have special services to the Fatherland;

- Veterans of wars or other hostilities;

- Civil servants of the Russian Federation.

March 3, 2022

Taxation of financial assistance

According to the rules, taxation and contributions for financial assistance for funerals are not provided. And in full. But this rule applies only to this category of financial assistance (clause 8 of Article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated April 18, 2012 No. 03-04-06/8-118).

If an employee asks to pay him money for organizing the funeral of a stranger or distant relatives, then financial assistance is not subject to personal income tax only in the amount of 4,000 rubles. If payments exceed 4,000 rubles, then income tax will have to be withheld from this difference.

IMPORTANT!

Personal income tax is not withheld from benefits paid from the state budget in any case. That is, regardless of the degree of relationship. The regulations do not establish whether the difference is paid if the funeral contract is completed for 4,000 rubles, but according to legislative logic, the state allocates a certain amount in the established amount. There is no need to return the difference.

Since this money cannot be attributed to remuneration for labor, there is no need to charge insurance premiums for financial assistance. Such definitions are given in paragraphs. 3 p. 1 art. 20.2 125-FZ and paragraphs. 3 p. 1 art. 422 of the Tax Code of the Russian Federation.

How to report

Not every material is provided with special codes and ciphers in the income certificate. In particular, if we are talking about the death of an employee or a close relative, financial assistance is not reflected in the report, and neither is the funeral benefit. If a relative who is not considered a close relative dies, income code 2760 and deduction code 503 will be used.

These values should be indicated when calculating materials at the expense of the employer. Specify the codes in the calculation of the amounts of personal income tax calculated and withheld by the tax agent (6-NDFL), and in the certificate of income and tax amounts of an individual (KND 1175018).

Is the employer obligated to provide financial assistance to the relatives of a deceased employee?

The law establishes only one case when an employer must unconditionally pay the relatives of a deceased employee a certain amount as financial assistance.

We are talking about the death of persons sent to work in Russian diplomatic missions abroad. Family members of the deceased have the right to count on an amount of 50% of the salary of the Ambassador of the Russian Federation (subparagraph “d”, paragraph 5 of the Rules for Providing Guarantees..., approved by Decree of the Government of the Russian Federation of December 20, 2002 No. 911). Otherwise, employers are obliged to provide financial assistance in the situation in question only if it is specified in one of the following documents:

- employment contract;

- collective agreement;

- local act.

In this case, it is possible to establish conditions for making payments: a certain length of service of the employee at the enterprise, the availability of free funds from the employer, etc.

The company may not officially undertake the corresponding obligations. But this does not mean that the family members of her deceased employee cannot count on financial assistance in such a difficult situation: with the consent of the employer, this is possible.

Important! Recommendation from ConsultantPlus When terminating an employment contract due to the death of an employee, consider the following features. We recommend that you fill out all the documents (order, work book if it is maintained, etc.), as well as fill out information about your work activity on the day when... (all details are in the Ready-made solution from K+).

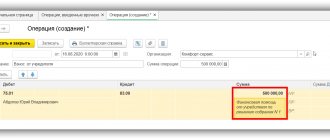

How to charge in 1C

Many accountants often ask the question: how to reflect in 1C:Enterprise financial assistance to an employee in connection with the death of a relative? The answer depends on the version of the special 1C software product.

For example, in 1C: Salary and personnel management, accrual is carried out using a special document “One-time benefit”. Find it by pressing the F1 button and bringing up the search window. In the search bar that appears, enter the letter query “burial.”

Or select the “Salary” section, then “All documents”, click the “Create” button. Select “One-time benefit” from the list provided.