Income tax: payment order in 2022

All organizations carrying out entrepreneurial activities are required not only to report to the tax office on the profits received, but also to make timely payments to the relevant budgets. To report, you must provide the Federal Tax Service with a calculation in the form of a tax return for income tax and explanations for it (if necessary).

The settlement document for payment, as in previous years, is a payment order (or simply “payment order”). Although the tax is at the federal level, it should be paid according to different budgets:

- federal;

- regional.

IMPORTANT!

In 2022, 17% is transferred to the regional budget, and 3% to the federal budget, provided that the organization does not have benefits for the use of reduced rates (Article 284 of the Tax Code of the Russian Federation).

To pay, the organization must fill out two settlement documents: one to the federal budget, and the second to the regional budget. The main differences in the details are the purpose of payment and the budget classification code, which are determined by Order of the Ministry of Finance of Russia No. 132n.

It is necessary to check payment orders in 2022

It is necessary to indicate new details of the Federal Treasury. Although I didn't notice any changes in the details.

You need to fill out detail “15” of the payment order - the account number of the recipient’s bank, which is part of the single treasury account (STA).

The details can be checked using the service of the Federal Tax Service website.

A payment order or payment document is a document to the bank on behalf of the owner (client) of the current account: transfer money to another account (pay for a product or service, pay taxes or insurance premiums, transfer money to the account of an individual entrepreneur or pay a dividend to the founder, transfer wages to employees, etc. .everything is below)

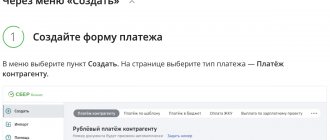

A payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs because... it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote. Payments can also be generated using online accounting.

Where can I get a payment order for free? How to fill out a payment order? What types of payment orders are there? I will post here samples of filling out payment slips in Excel for 2016-2017, made using the free Business Pack program. This is a fast and simple program. In addition to payment slips, it also contains a bunch of useful documents. I recommend to all! Especially useful for small organizations and individual entrepreneurs who want to save money. Some additional functions in it are paid, but for payment orders it is free.

Last dates for payment of income tax

The deadlines and procedure for payment are specified in the Tax Code in Articles 287 and 289. The last date depends on the methods for calculating advances.

If the organization carries out monthly calculations, then the deadline is until the 28th day of the month following the reporting month.

For quarterly - until the 28th day of the month following the reporting quarter.

For the final tranche for the year, the payment deadline is March 28 of the year following the reporting year.

If the deadline falls on a holiday or weekend, then the obligations are fulfilled on the next working day. This feature is established in paragraph 7 of Art. 6.1 Tax Code of the Russian Federation.

How to fill out a payment order

Here are instructions on how to fill out the fields of a payment order for income tax, and what you should pay special attention to.

| Payment field number | Meaning |

| 3 and 4 “Document number and date” | Prepare the document no later than the tax payment deadline to avoid penalties from the Federal Tax Service. Set the numbering in a chronological manner, otherwise the bank will return the payment document. |

| 6 and 7 “Document amount” | Enter the amounts in words in field 6 and in numbers in field 7. To transfer tax payments to the Federal Tax Service, follow the rounding rule, in accordance with clause 6 of Art. 52 of the Tax Code of the Russian Federation and letter of the Federal Tax Service dated May 19, 2016 No. SD-4-3/8896. That is, if the amount is less than 50 kopecks, we do not take it into account; 50 kopecks or more, we round up to the full ruble. Example: 1000.49 rub. — payable 1000 rubles, 1000.51 rubles. — payment is 1001 rubles. |

| 8-12 “Information about the payer” | Fill in the name of the organization, INN and KPP, current (personal) account, name of the bank (credit organization), details (bank, credit organization). |

| 13-17 “Information about the recipient” | Enter the same data as the recipient, in our case the details of the Federal Tax Service. |

| 21 "Sequence" | Set the value to 5, in accordance with Art. 855 of the Civil Code of the Russian Federation. |

| 22 "UIN" | Record 0 because this is a current payment and there is no special value set for it. |

| 24 “Purpose of payment” | Write down:

|

| 101 “Payer status” | Indicate 01, since the organization is a direct taxpayer of payments administered by tax authorities (based on Appendix No. 5 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013). |

| 104 “Budget classification code” | In accordance with the order of the Ministry of Finance dated July 1, 2013 No. 65n, set the following indicators:

|

| 105 "OKTMO" | Here, indicate OKTMO, determined by the location of the Federal Tax Service, to which the taxpayer is attached. |

| 106 “Basis of payment” | Reflect the current payment using the “TP” code, determined according to clauses 7 and 8 of Appendix No. 2 of Order No. 107n of the Ministry of Finance dated November 12, 2013. |

| 107 “Tax period” | Set the indicator taking into account the method of transferring tax payments:

|

| 108 “Basic document” | Enter 0 as this is a current payment. |

| 109 “Date of foundation document” | For annual calculation, indicate the date of preparation of the declaration; for monthly or quarterly advance calculation - 0. |

| 110 "Information" | There is no data to fill out field 110, leave the field blank. |

Sample payment slip

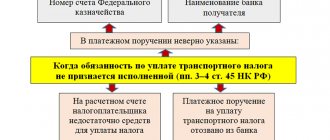

From 2022, tax contributions can be clarified if the bank name and the recipient's account are correct. The remaining contributions must be returned and paid again (subclause 4, clause 4, article 45 of the Tax Code of the Russian Federation).

Taxes, unlike contributions, are calculated and paid rounded to whole rubles.

Purpose of payment: Corporate income tax (except for consolidated groups of taxpayers) based on the results of 2016, credited to the federal budget (payment amount - 100,000 rubles)

Payer status: Payer status: 01 - for organizations.

TIN, KPP and OKTMO should not start from scratch.

Starting from 2022, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed. This is 01 for organizations and 09 for individual entrepreneurs.

From February 6, 2022, in tax payment orders, organizations in Moscow and Moscow Region will have to enter new bank details; in the “Payer’s bank” field, you need to put “GU Bank of Russia for the Central Federal District” and indicate BIC “044525000”.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

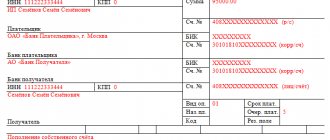

Rice. .

Fig. Sample of filling out a payment order for the payment of Income Tax in Business Pack.

Step-by-step filling out the income tax payment form

Let's look at how to correctly fill out a payment order for income tax using an example.

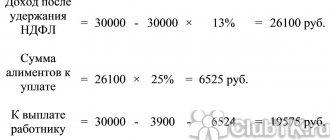

GBOU DOD SDYUSSHOR "ALLUR" for the first quarter of 2022 received a profit in the amount of 50,000.00 rubles. When calculating income tax, organizations should transfer to the budget:

- federal - 1,500.00 rubles (50,000.00 × 3%);

- regional - 8,500.00 rubles (50,000.00 × 17%).

We generate payment orders for each budget level (amount). We fill out the payment order step by step:

Step 1. Fill in the date and number of the payment order, observing the chronological order, then set the payer status.

Step 2. Enter the payer's details and amounts (in numbers and words).

Step 3. We enter the details of the payee of the Federal Tax Service in the payment order.

Step 4. Fill in the tax fields, order of payment, UIN, payment purpose.

For the federal budget.

For the regional budget.

Sample payment order for the federal budget:

Sample payment order for the regional treasury:

Payment terms for advances on profits

The first important question is: how often do you need to make advances on profits? Payment of advances on income tax for the 2nd quarter of 2022 occurs at different times depending on the method used by the company.

Let us briefly recall the legally established general methods and frequency of payment of “profitable” advances (Article 286, Article 287 of the Tax Code of the Russian Federation):

The first two methods of paying the APNP can be used by any organization, and the third is available only to those companies whose sales revenue for the previous 4 quarters on average did not exceed the established limit, or to newbies with revenue of no more than 5 million rubles. per month or 15 million rubles. for the quarter (clause 3 of article 286, clause 5 of article 287 of the Tax Code of the Russian Federation).

The average quarterly limit for 2022 increased from 15 to 25 million rubles. But in 2022 everything returned to the previous rules.

In accordance with paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation, payment deadlines that fall on weekends, holidays or non-working days are shifted to the next working day.

Taking this into account, the timing of payment of advances on profits for the 2nd quarter of 2021 will be as follows:

| Payment | Payment deadline |

| Income tax (regular monthly and quarterly advances) | |

| Advance income tax for April 2022 | 28.04.2021 |

| Advance income tax for May 2022 | 28.05.2021 |

| Advance income tax for June 2022 | 28.06.2021 |

| Advance income tax for the 2nd quarter (half year) of 2021 | 28.07.2021 |

| Income tax (advances on actual profit) | |

| Advance income tax for April 2022 | 28.05.2021 |

| Advance income tax for May 2022 | 28.06.2021 |

| Advance income tax for June 2022 | 28.07.2021 |

Responsibility for failure to pay taxes on time

Tax authorities distinguish between the types of violations for which penalties are provided. If obligations are not paid in full or there is no payment, the organization will be fined 20% of the amount not received to the relevant budget. The fine will be issued on the basis of clause 1 of Art. 122 of the Tax Code of the Russian Federation.

If Federal Tax Service employees discover an understatement of the base for calculating payments between interdependent companies, the fine will be 40% of the underestimated tax amount, but not less than 30,000 rubles. Grounds - clause 1 of Art. 129.3 Tax Code of the Russian Federation.

If an organization forgets to include income from a controlled foreign company in the tax base, it will be fined 20% of the unaccounted tax liability, but not less than 100,000 rubles (Article 129.5 of the Tax Code of the Russian Federation).

For deliberate understatement of income, a fine will be imposed under paragraph 3 of Article 122 of the Tax Code of the Russian Federation - in the amount of 40% of the unpaid tax.

The tax agent will be fined for failing to withhold and transfer taxes to the budget, for example on dividends. A fine will be issued on the basis of Article 123 of the Tax Code of the Russian Federation - in the amount of 20% of the amount of the unwithheld tax liability.

How to fill out a payment order for payment of advance payments for income tax

The procedure for filling out a payment order for the payment of advance payments for income tax is similar to the rules for filling out a payment order when transferring taxes. But there are features of filling out some fields depending on what kind of advance payments you make - monthly advance payments during the quarter, quarterly or monthly advance payments based on actual profit.

How to fill out a payment order for payment of monthly advance payments for income tax during the quarter

When filling out a payment order for payment of monthly advance payments of income tax during the quarter, please pay attention to filling in the following fields.

Field 107 “Tax period” must be filled in as follows (clause 8 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n):

- in the 1st and 2nd digits, indicate the monthly payment code “MS”, since the tax is paid per month;

- in the 4th and 5th digits reflect the number of the month based on the results of which the advance payment is transferred;

- In the 7th – 10th digits indicate the year for which the payment is being made.

In the 3rd and 6th characters you need to put dividing points.

For example: “MS.04.2018”.

In field 24 “Purpose of payment” it is necessary to make a textual explanation that will allow you to determine the payment as accurately as possible (clause 13 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n, Appendix No. 1 to Bank of Russia Regulation N 383-P).

For example, “Monthly advance payment of income tax paid to the federal budget of the Russian Federation in February.”

The remaining fields are filled in in the general order.

How to fill out a payment order for payment of quarterly advance payments for income tax

When filling out a payment order for the payment of quarterly advance payments for income tax, pay attention to filling in the following fields.

Field 107 “Tax period” must be filled in as follows (clause 8 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n):

- in the 1st and 2nd digits, indicate the quarterly payment code “KV”, since the advance payment is paid per quarter;

- in the 4th and 5th digits reflect the number of the quarter based on the results of which the advance payment is transferred;

- In the 7th – 10th digits indicate the year for which the payment is being made.

In the 3rd and 6th characters you need to put dividing points.

For example: “KV.01.2018”.

In field 24 “Purpose of payment” it is necessary to make a textual explanation that will allow you to determine the payment as accurately as possible (clause 13 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n, Appendix No. 1 to Bank of Russia Regulation N 383-P).

For example, “Advance payment of income tax for the first quarter of 2018, credited to the budget of a constituent entity of the Russian Federation.”

The remaining fields are filled in in the general order.

How to fill out a payment order for monthly advance payments based on actual profit

When filling out a payment order for monthly advance payments based on actual profit, pay attention to filling in the following fields.

Field 107 “Tax period” must be filled in as follows (clause 8 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n):

- in the 1st and 2nd digits, indicate the monthly payment code “MS”, since the tax is paid per month;

- in the 4th and 5th digits reflect the number of the month based on the results of which the advance payment is transferred;

- In the 7th – 10th digits indicate the year for which the payment is being made.

For example: “MS.05.2018”.

In field 24 “Purpose of payment” it is necessary to make a textual explanation that will allow you to determine the payment as accurately as possible (clause 13 of Appendix No. 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n, Appendix No. 1 to Bank of Russia Regulation N 383-P).

For example, “Advance payment of income tax based on the actual profit received for payment for May 2022, credited to the federal budget.”

The remaining fields are filled in in the general order.