Order No. 103n dated June 15, 2020[1] will amend the Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n, which approved the forms of primary accounting documents and accounting registers used by state (municipal) institutions, and guidelines for their application (hereinafter - orders No. 103n, No. 52n, Guidelines).

What should an accountant of an autonomous institution take into account when these changes come into force?

In particular:

- the procedure for registration and preparation of documents, including in electronic form, is clarified;

- new forms of documents and the procedure for filling them out are being introduced;

- Changes are being made to the procedure for filling out existing document forms.

Procedure for registration and preparation of documents

In order to reflect in accounting information about accounting objects that arise during the implementation of facts of economic life, each fact is subject to registration with a primary accounting document (consolidated primary accounting document).

Data contained in primary accounting documents are subject to timely registration and accumulation in accounting registers.

According to the additions made to Section. 1 “General Provisions” of the Methodological Instructions (Appendix 5 to Order No. 52n), the formal part of the document must contain:

- signatures (with transcript) of officials responsible for the execution of a fact of economic life (transaction, operation), for its execution and those responsible for the data contained in the document (for the compliance of the data contained in the document with the facts of economic life), as well as officials who are entrusted with maintaining budgetary (accounting) accounting, in cases where the signature is provided for in the form of the document (signature of the chief accountant (accountant), a person authorized by him), or in cases where the primary accounting document provides for the reflection of data contained in the accounting registers. The named officials sign the primary accounting documents indicating the date of signing the document;

- position of the performer, signatures (with transcript) and contact information (contact phone number (if available), email address).

Primary accounting documents and accounting registers are compiled:

- in the form of an electronic document signed with a qualified electronic signature or, in cases provided for by the Methodological Instructions, with a simple electronic signature (hereinafter referred to as the electronic primary accounting document, electronic register, together - electronic documents);

- on paper - if it is not possible to generate and store them in the form of electronic documents and (or) if federal laws or regulations establish a requirement for the need to compile (storage) a document exclusively on paper.

If it is necessary to submit to another person or a government body (upon request) a document on paper that was generated electronically, the institution is obliged, at its own expense, to make copies of the electronic primary accounting document, the electronic register. Copies of the electronic document are certified in the manner established in the accounting policy of the institution.

The primary accounting document is accepted for accounting provided that it reflects all the details provided for in the unified form of the document, and if the primary accounting document is signed by the head of the accounting entity or persons authorized by him.

Documents whose forms are not unified are accepted for accounting if they are prepared in accordance with the forms established by the accounting policy of the institution, and provided that such documents contain the mandatory details provided for in clause 25 of the GHS “Conceptual Framework” [2].

Similar provisions are also introduced into the specified standard (Order of the Ministry of Finance of the Russian Federation dated June 30, 2020 No. 130n).

The unified forms of electronic documents established by Order No. 52n are used by the institution for the purpose of maintaining its accounting records, subject to the consolidation of such requirements in its accounting policies.

Electronic documents provided for by Order No. 52n are used by accounting entities in accordance with the adopted accounting policies and to the extent of their organizational and technical readiness, but no later than 01/01/2021 (clause 2 of Order No. 103n).

An institution has the right to provide in its accounting policy for the formation on paper of primary accounting documents using unified forms of electronic documents in the absence of the technical ability to generate and store them in the form of electronic documents. At the same time, an electronic sample of such a document must be submitted to the accounting service in order to ensure the integration of information systems and implement the principle of one-time data entry.

Accounting notes on the acceptance of an object for accounting or on its disposal, other fields of the unified form of the document provided for reflecting accounting records, in the case of execution by the person responsible for committing the fact of economic life, an electronic primary accounting document signed with a qualified electronic signature (hereinafter referred to as EDS) , are not filled.

An institution has the right to include in the primary accounting document generated on the basis of unified forms of documents (electronic documents), additional details (data) provided that the information compatibility of state (municipal) information systems and information resources is ensured, by means of which the formation and exchange of information and documents in electronic form (in the form of electronic documents).

When producing blank products based on unified forms of primary accounting documents and accounting registers, it is permissible to change (narrow, expand) the sizes of columns and lines, taking into account the values of indicators, as well as the inclusion of additional lines and the creation of loose-leaf sheets for ease of placement and processing of information.

If the exchange of information in the form of electronic documents involves the transfer of scanned copies of primary accounting documents containing handwritten signatures (generated on paper), responsibility for the compliance of the scanned copy with the original document rests with the person responsible for documenting the fact of economic life with the specified document and (or) for the formation and (or) transmission of such a scanned copy.

The transfer of a scanned copy of the primary accounting document is carried out subject to its signing with an electronic digital signature by the official responsible for the compliance of such a scanned copy with the original document.

Inventory card for accounting of non-financial assets - form 0504031

The card in question is filled out on both sides. Card information:

- form number;

- Date of preparation.

- opening, closing date;

2.

On the front side are fixed: 1.

Information about the institution:

- institution code according to OKPO (All-Russian Classifier of Enterprises and Organizations).

- name of the institution, its branch;

3.

General information about the accounting object:

- accounting account number;

- brand, project,

- location of the accounting object;

- number assigned to the asset;

- information about financially responsible employees;

- unit of measurement of the asset according to OKEI (All-Russian Classifier of Units of Measurement);

- information about the manufacturer of the accounting object (supplier), organization code according to OKPO;

- name, type, purpose of the accounting object, its number according to OKOF (All-Russian Classifier of Fixed Assets);

New forms of primary accounting documents

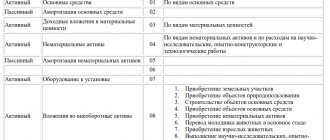

| Form code | Form name |

| 0504512 | Decision on a business trip to the territory of the Russian Federation |

| 0504513 | Changing the decision on a business trip to the territory of the Russian Federation |

| 0504515 | Decision on a business trip to the territory of a foreign state |

| 0504516 | Changing the decision on a business trip to the territory of a foreign state |

| 0504517 | Decision on compensation for travel and baggage costs for persons working in the Far North and equivalent areas |

| 0504518 | Application justification for the purchase of goods, works, services of small volume |

| 0504520 | Accountable person's expense report |

Appendix 5 provides for the procedure for filling out these forms, which notes that these documents are prepared electronically.

Form 0504103 sample filling

Next, the table is filled in.

The first section contains information about the work contract (number, date and deadlines).

The second section contains information about the state of the object.

It is necessary to indicate the name, inventory, register or serial number, book value and actual service life of this object. The third section contains information about the types of repair or reconstruction work being performed. Each object, type of work and its cost are indicated separately for each item.

In the seventh column it is necessary to record the cost of the object upon completion of the work and in the eighth - the period of use of this object. Fresh materials

New forms of accounting registers

| Form code | Form name |

| — | Log of operations for correcting errors of previous years |

| — | Journal of inter-reporting period transactions |

| 0504093 | Journal of registration of incoming and outgoing cash orders |

| 0504094 | List of additional income of individuals subject to personal income tax and insurance premiums |

The procedure for filling out these registers is also provided. Corresponding additions are made to Appendices 3, 4, 5 to Order No. 52n.

Form 0504230.

The act contains a conclusion drawn up and signed by all members of the commission. At the end of the form there is a note from the accounting department about the account numbers and amount. All information about repairs, modernization or reconstruction must be entered into the inventory card of the facility.

Act on write-off of inventories

The latter chooses its chairman and is responsible for checking the fact of write-off of tangible assets and the nuances of this write-off. When a document is received by the accounting department, various write-off procedures can be carried out through it, namely:

- Write-off of inventories into production, for which special accounting must be carried out. Paragraph 107.

- Write-off for production. Paragraph 98 of the same order.

- Write-off due to disposal. This is provided for in paragraphs 124 to 126 of Order No. 119n of the Ministry of Finance of December 28, 2001.

The act of writing off inventories has two pages in the form.

In addition to her, a financially responsible person (for example, a storekeeper) must be present during write-off. His name is indicated at the very beginning of the act.

Changes in the procedure for filling out individual primary documents

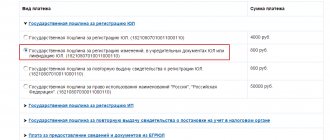

Act on write-off of soft and household equipment (f. 0504143). In order to fill out this document, it is clarified that it is drawn up by the institution’s commission for the receipt and disposal of assets when making a decision to write off soft equipment, dishes and similar items of industrial and household equipment worth more than 3,000 rubles. up to 100,000 rub. (before making changes - from 3,000 rubles to 40,000 rubles) inclusive per unit and serves as the basis for reflecting the disposal of the specified accounting objects in the accounting records of the institution.

Request-invoice (f. 0504204). According to the amendments, this document is not used to formalize transactions for the delivery to the warehouse of residual materials resulting from disassembly and disposal of fixed assets.

Such transactions will need to be formalized with a receipt order (f. 0504207).

Statement of issuance of material assets for the needs of the institution (f. 0504210). In order to fill out this document, it is clarified that it is used to formalize the issuance of material assets for use for economic, scientific and educational purposes, as well as the transfer for operation of fixed assets worth up to 10,000 rubles. (before changes are made - up to RUB 3,000) inclusive per unit.

Payroll (f. 0504402). In order to fill out this document, it has been added that this document is used to reflect accruals on wages of employees during the month and amounts due for payment upon final settlement, scholarships, allowances, and other payments made on the basis of agreements (contracts) with individuals, and also reflecting deductions from accrued amounts (taxes, insurance contributions, deductions under writs of execution and other deductions).

Payroll (f. 0504403). According to the amendments, this form is used in cases of calculating wages and other payments with the preparation of a payroll (f. 0504402).

Note-calculation on the calculation of average earnings when granting leave, dismissal and in other cases (f. 0504425). The procedure for filling out this form has been clarified in relation to filling out the data in column 9. In the current procedure, instead of column 9, column 12 is erroneously indicated.

Advance report (f. 0504505). In order to fill out this document, it has been added that it is used to record settlements with accountable persons, subject to execution on paper.

Cash book (f. 0504505). The procedure for generating this form in electronic form has been updated. In particular, entries in the electronic cash book are made at the time the cashier signs the digital signature of each incoming cash order, outgoing cash order or scanned copies of these documents containing handwritten signatures. A receipt for a cash receipt order generated electronically is signed with an electronic digital signature by the chief accountant or an authorized person and the cashier. The electronic cash book is generated daily, including business days on which cash transactions were not carried out.

Children's attendance sheet (f. 0504608). In order to fill out this report card, it is clarified that the days the child visits the institution are not noted in the report card, unless otherwise provided by the accounting policy. Days of non-attendance are noted in the appropriate column as follows:

- "On weekends;

- “NU” - failure to appear for a good reason;

- other letter designations provided for by the accounting policy (for example, “NB” - absence due to illness; “NYA” - absence without a good reason (for missed days subject to payment according to the terms of the contract).

Notice (f. 0504805) . The procedure for filling out this form is set out in the new edition, according to which it is used:

- when preparing an accounting document in order to ensure timely reflection of accounting records in accordance with the primary accounting document for interrelated transactions between accounting entities (in particular, for settlements arising from transactions of acceptance and transfer of property, assets and liabilities between accounting entities, including interdepartmental and interbudgetary settlements, settlements between state (municipal) budgetary and autonomous institutions and founders, settlements between bodies providing cash services for receipts (disposals) to the budget (from the budget));

- when drawing up a primary accounting document in order to reflect interrelated transactions between accounting entities (emerging accounting objects (their changes) for which unified forms of primary accounting documents (forms of electronic primary accounting documents) have not been established - in particular, transactions arising when providing interbudgetary transfers with conditions for the transfer of assets, including operations that form calculations for the return of unused interbudgetary transfer funds; provision with conditions for the transfer of assets to budgetary and autonomous institutions of subsidies (grants) from the budgets of the budget system of the Russian Federation, budgetary (autonomous) institutions, including operations that form the calculations for return the specified subsidies (grants).

Accounting certificate (f. 0504833). The procedure for using this certificate is set out in the new edition, according to which it is used:

- when generating a primary accounting document in order to reflect transactions carried out in the course of business activities, for the reflection of which unified forms of primary accounting documents (forms of electronic primary accounting documents) are not established, transactions that do not require submission by the payer (individual, legal entity) primary accounting document for committing a fact of economic life;

- when generating an accounting document to reflect accounting records on the basis of a primary accounting document in the event that the person responsible for processing the facts of economic life transfers primary accounting documents in the form of electronic documents signed with an electronic digital signature, if it is not possible to fill out the section “Acceptance Note” in the issued primary accounting document to accounting" (when transferring powers to maintain accounting records and generate reports to a centralized accounting department), when reflecting in accounting operations related to the correction of errors identified by the subject of accounting, the inspection body.

The procedure for filling out the certificate is also established depending on the fact of economic life in respect of which it is drawn up.

Filling out the report card according to form 0504421 for budgetary institutions in 2022

We will consider the procedure for filling out this form in the article below. Below is a sample form and form 0504421, current for 2017;

Important: the accounting sheet must be signed by the head of the enterprise at the end of the month for further transmission to the accountant.

The direct purpose of this timesheet is to record working time, but at the same time it has the name “Accounting for the use of working time”; the document fully reflects the operating mode of a budgetary institution. It sometimes contains entries like this:

- Study leave;

- Substitution in an extended day group.

- Study days off;

Related:

You can place a link to our website:

All forms and forms on filling-form.ru

filling-form.ru

Based on Article 165 of the Budget Code of the Russian Federation (Collected Legislation of the Russian Federation, 1998, No. 31, Art. 3823; 2005, No. 1, Art. 8; 2006, No. 1, Art. 8; 2007, No. 18, Art. 2117; N 45, Art. 5424), paragraphs 4 and 5 of the Decree of the Government of the Russian Federation of April 7, 2004 N 185 “Issues of the Ministry of Finance of the Russian Federation” (Collected Legislation of the Russian Federation, 2004, N 15, Art. 1478; N 49, Art. 4908; 2007, N 45, Art. 5491; 2008, N 5, Art. 411) and in order to establish a uniform accounting procedure for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies sciences, state (municipal) institutions I order:

1. Approve the List of unified forms of primary accounting documents used by government bodies (state bodies), local government bodies, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions in accordance with Appendix No. 1 to this order.

2. Approve the forms of primary accounting documents for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions (class 05 “Unified system of accounting, financial, accounting and reporting documentation of the public sector management" OKUD) in accordance with Appendix No. 2 to this order.

3. Approve the List of accounting registers used by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions in accordance with Appendix No. 3 to this order.

4. Approve the forms of accounting registers used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions (class 05 “Unified system of accounting, financial, accounting and reporting documentation of the sector State Administration" OKUD) in accordance with Appendix No. 4 to this order.

5. Approve the Guidelines for the use of forms of primary accounting documents and the formation of accounting registers by public authorities (state bodies), local government bodies, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions in accordance with Appendix No. 5 to this order .

When to start applying Order No. 52n

On the one hand, it should be applied when developing accounting policies starting from 2015, that is, from the moment of registration of Order No. 52n with the Ministry of Justice of Russia. Moreover, from this very moment Order No. 173n ceases to apply. On the other hand, instructions on which primary document should be used in which case are prescribed by Instruction No. 174n, which has not yet been changed and still contains instructions on the forms of primary documents from group 03 for OKUD. Moreover, the procedure for applying the primary documents established by Order No. 52n for new forms is often different from the cases in which Instruction No. 174n prescribes the use of their old counterparts. Instructions on the purpose of using new forms in accordance with Order No. 52n do not cover all types of business transactions that occur in practice and are described in Instruction No. 174n. Thus, we believe that changes to the forms of primary documents and accounting registers that previously existed and were specified in Instruction No. 174n should be applied from the moment of registration of Order No. 52n, but new forms of primary documents will be fully legitimate only after they will be prescribed for use in the new edition of Instruction No. 174n, which will be duly registered with the Ministry of Justice of Russia.

New primary documents

As stated earlier, most of the new forms of primary documents are intended to replace the primary documents of section 03 OKUD. These are primary documents for accounting for non-financial assets (fixed assets, intangible assets and legal acts), as well as several primary documents for accounting for inventories. The old forms, the names of which directly mentioned “fixed assets”, were also extended by Instruction No. 174n to document transactions with intangible assets and non-relevant legal assets. In the names of the new forms, instead of “fixed assets”, “non-financial assets” appear. On the one hand, this is logical, on the other hand, material inventories are also classified as non-financial assets, and the forms, according to the instructions for use, are not intended for material inventories. New documents, as a rule, are not completely similar to the old ones. Some optimization has been made both in quantity (for example, the old three different acts of acceptance and transfer were replaced with one new one) and in the composition of the details. In some documents, details not related to accounting have been removed. Also, in all new documents, a block of details has been added to indicate accounting entries and a note from the accounting department about the reflection of documents in accounting. Although, of course, the new documents are far from ideal. There is duplication of data, there are details of unknown purpose. For a number of new primary documents, the scope of their application is not completely clear, because in the methodological instructions it is described in too general terms, even with contradictions. Let's look at the new forms in more detail.

Act on acceptance and transfer of non-financial assets (form 0504101)

This form is intended to replace three at once: – Certificate of acceptance and transfer of fixed assets (except for buildings, structures) (f. 0306001); – Certificate of acceptance and transfer of a building (structure) (f. 0306030); – Act on the acceptance and transfer of groups of fixed assets (except for buildings and structures) (f. 0306031).

Purpose

The purpose of this form is as follows: The transfer and acceptance certificate (f. 0504101) is drawn up when transferring non-financial assets between institutions, institutions and organizations (other legal holders). The acts that were used previously, by name, referred only to fixed assets, but were also prescribed for intangible assets and legal acts. Now the name itself indicates that the Acceptance and Transfer Act (f. 0504101) is intended for all types of NFA in general, including investments in real estate (that is, those not completed by construction). It is not clear whether this form should be used to document the receipt and transfer of inventories. This will be clear after new editions of the accounting instructions are approved. There is one significant exception to the use of this form: it is not intended for documenting the acquisition of property for state (municipal) needs (the needs of budgetary (autonomous) institutions), or the sale of state (municipal) property. This is quite logical, since in many cases the seller will not have this property as a fixed asset, but simply as a commodity. Now in such cases, the institution is obliged, in addition to the supplier’s documents, to also draw up a unilateral Acceptance and Transfer Certificate, because this is required by the instructions. When new editions of the instructions are approved, obviously, this requirement will be removed. The new form, Acceptance and Transfer Certificate (f. 0504101), allows you to register the acceptance and transfer of both one and several objects of non-financial assets, thus replacing several forms of primary documents. Order No. 52n gives institutions the right, as part of the formation of accounting policies, to extend the scope of application of the Acceptance and Transfer Act (f. 0504101) to transactions for the acquisition, gratuitous transfer, and sale of non-financial assets.

Composition of form indicators

In general, the new form can be considered very successful. The necessary details were preserved, most of the unnecessary data was removed, and significant and important additions were made. Changes in the format and location of details are quite logical and correspond to the purpose of the form - to reflect the reception and transmission of several objects.

A cap

The header contains information about the sending and receiving parties, including TIN and checkpoint codes. The heading “Type of property (real estate, especially valuable movable, other movable)” means that one document can formalize the transfer of only one type of property. The “Legal basis” requisite is provided, obviously, for cases of transfer of real estate. Many institutions supplemented the block of details “I approve” (before the headers of the acceptance and transfer acts) with an authorized body for property management and (or) the founder in addition to the receiving and transferring parties. This addition was justified by the fact that public law often establishes a procedure for property management, in which every movement of fixed assets, intangible assets and legal acts requires approval. As will be indicated below, in the footer of the new form there are details where you can give a link to the corresponding approval document, but there is no provision for a mark of approval directly in the act itself.

Table sections

Table section “1. Information about the transferred objects of non-financial assets" contains data of the transferring party: name, numbers, data on the actual service life, initial (book) value and accrued depreciation. In comparison with the content of a similar section of previously used forms, unnecessary data has been removed (residual value, which can be easily determined by subtraction, standard useful life, which the receiving party is obliged to establish independently). Table section “2. Brief individual characteristics of the object(s)" contains data on the components, fixtures, accessories, as well as the content of precious metals. The same data was in the forms that were used earlier. Table section “3. Information on accepted objects of non-financial assets” reflects how the receiving party reflected the objects in its accounting. This section also contains “initial cost”, as in section 1. Why? After all, when transferring between institutions, the value should not “disappear” anywhere. Maybe the form developers simply, without thinking, copied the details of the old form? But other unnecessary details have been removed. The only thing that comes to mind about this is that it is possible that the number of objects on the sending side and on the receiving side will be different. For example, the transferring party transfers a “three-piece set of upholstered furniture” (this is incorrect record keeping), and the receiving party receives three different objects: a “sofa”, an “armchair” and another “chair”. Or vice versa. According to the accounting policy of the institution, a computer complex should be considered as an inventory item, and the transferring party transfers separately monitors and separately system units. But in this case, it is necessary to divide (combine) not only the book value, but also depreciation, it is necessary to indicate the names of new objects - there is no column for either depreciation or names. This means that it remains to be recognized that column 1 in section 3 simply duplicates the data in column 9 of section 1. Section 3 also includes data from the basement of the old form of the act: “Accounting department’s note on the opening of an inventory card.”

Basement

The additions made to the basement of the new form of the Acceptance and Transfer Act should be noted as very important and successful. Thus, the ability to indicate the book value in currency has been added (only for one object, the attribute is not tabular). Added details to indicate “Name, date and number of the document on approval /if necessary/” and “Name, date and number of the document on registration of rights /if necessary/”. This applies to real estate (approval and state registration) and especially valuable movable property (approval). The list of documents attached to the act includes “Copies of inventory cards.” This once again reminds institutions that when transferring fixed assets, intangible assets and legal acts, copies of inventory cards must be transferred so that the receiving party has detailed information about the operating history of the fixed asset. In the footer of the Act there are two tabular sections in which the transferring and receiving parties must indicate the accounting records associated with write-off and acceptance for accounting. Please note: the receiving party is not required to record non-financial assets in the same accounts as the transferring party (except in the case of a transfer within the institution and its branches)!

The receiving party is obliged to reflect in its accounting the accepted NFAs in accordance with the law and its accounting policies.