Certificate 2-NDFL is a document that is annually submitted to the tax authority by companies and entrepreneurs who have employees and act as tax agents. The role of a tax agent implies that the employer withholds personal income tax from payments to the employee and transfers it to the budget. All this information is indicated in the certificate and submitted to the tax authority. But what should a tax agent do when he did not make payments to his employees during the tax period? Whether in this case a zero 2-NDFL certificate is submitted, we will consider in this article.

Help 2-NDFL

Each organization and individual entrepreneur with employees must act as a tax agent and withhold tax from the employee’s paid income, and then transfer it to the budget. It should be remembered that there is a list of income exempt from personal income tax. These include various benefits (except sick leave) and compensation payments. That is, the following types of payments are not subject to taxation:

- in connection with dismissal, except for compensation for unused vacation;

- related to travel expenses.

But for certain travel expenses, restrictions are set on the possibility of being fully taken into account. For example, daily allowances of up to 700 rubles for trips within the Russian Federation and up to 2,500 rubles for trips abroad are exempt from taxation.

Depending on the status of the employee, the following tax rates are provided for him:

- for residents of the Russian Federation – 13% and 35%;

- for non-residents – 13%, 15% and 30%.

| 13% tax rate is used | 35% tax rate is used |

| For all income related to the performance of labor functions (including vacation pay) and paid by the employer For the income of entrepreneurs who pay personal income tax instead of income tax In case of receiving income from the sale of certain types of property Upon receipt of dividends | In case of payment of winnings, the amount of which exceeds 4000 rubles In case of obtaining economic benefits by saving on interest For interest income on deposits |

What income should be taxed?

The Tax Code defines a list of income that is subject to taxation. These include:

- remuneration for work performed or services provided;

- interest and dividends received by an individual;

- income from property rental;

- income from the sale of property.

The list of income can be supplemented, as it is open.

The following income is not subject to personal income tax:

- financial assistance, the amount of which does not exceed 4,000 rubles per year;

- financial assistance paid at the birth of a child, if its amount does not exceed 50,000 rubles;

- maternity benefits;

- gifts worth no more than 4,000 rubles per year;

- compensation to workers for work in dangerous and harmful conditions;

- reimbursement of interest for using a loan for employees who took out a loan for the purchase or construction of housing.

It should be understood that income can only be an economic benefit that can be assessed. For example, if an employee is compensated for travel expenses on a business trip, this amount cannot be classified as income

The procedure for submitting a 2-NDFL certificate to the tax office

The provision of form 2-NDFL by tax agents occurs in the following cases:

- The certificate is provided in accordance with clause 5 of Art. 226 of the Tax Code of the Russian Federation, when it is not possible to withhold tax.

- The certificate is a confirmation of the income of an individual and is provided in accordance with clause 2 of Art. 230 Tax Code of the Russian Federation.

By submitting a certificate to the tax authority, employers thereby inform about what income each employee has. The billing period indicated in the certificate is one year. The employer submits information for the past calendar year in the 2-NDFL certificate to the Federal Tax Service by April 1 of the year following the reporting year. If this deadline is violated, the employer will be held accountable.

Who must submit reports in the form of 2-NDFL

The Tax Code gives a clear definition of this issue - the following organizations are required to submit a certificate on this form:

- registered on the territory of the Russian Federation;

- individual entrepreneurs;

- privately practicing notaries;

- lawyers (founders of the relevant offices);

- divisions of foreign enterprises in Russia (separate).

At the same time, they need to act as a tax agent, that is, by cooperating with them, an individual must receive income.

Zero certificate 2-NDFL

In the course of a company’s business activities, situations may arise when, at the end of the tax period, a loss was incurred and payments to employees were simply not made. This forces employers to send their employees on leave without pay. In this case, the company accountant may have a question about the need to submit a zero certificate 2-NDLF for this period. If we turn to the current legislation and the opinion of tax authorities, we can conclude that if the employee has no income, the employer no longer acts as a tax agent, and therefore there is no need to submit a 2-NDFL certificate. However, in order to avoid misunderstandings, many accountants try to inform the tax authority about this by drawing up a zero certificate 2-NDFL and attaching an explanatory note to it. In the explanation, they describe the current situation and explain the reason for the lack of payments to employees.

Of course, organizations that do not operate for quite a long time and do not pay wages to employees attract the attention of the tax authorities . And this leads to unscheduled desk and field tax audits. In this case, the tax authorities will require the company to provide documents confirming the loss incurred in the course of its activities. This way they can determine how realistic the picture described by the taxpayer is.

Can a manager not pay himself a salary?

Many organizations have a single employee on their staff - the director. This can happen if the company has just been formed and has not yet had time to recruit a full staff of employees. Also, this situation often arises during periods of financial crises, when the organization’s income does not allow it to support employees. In order to avoid making contributions to various funds, managers often do not pay their own salaries. How legal is this?

Tax inspectors argue that it is necessary to pay the manager’s work even in such conditions. He is obliged to calculate and pay himself a salary. However, the tax service does not have legislative measures to influence companies in which wages have not been accrued for an entire year or more. As a rule, inspectors invite managers to conversations where recommendations are given on how to pay them for their work at the minimum wage provided for in the region. If the director does not listen to the opinion of the government representative, the company may face a complete financial audit by the Federal Tax Service.

The official’s opinion is based on the following arguments:

- the director of the enterprise is obliged to conduct activities;

- he must maintain documentation;

- They must submit reports to regulatory authorities.

How to fill out a 2-NDFL certificate

Help 2-NDFL is presented in five sections, which contain information:

- An organization that acts as a tax agent, withholds tax from the employee’s income and transfers it to the budget.

- About an individual from whose income personal income tax is withheld.

- About income paid to an individual, from which tax is withheld at different personal income tax rates.

- About deductions provided for various reasons to an individual.

- About the total amount of income of an individual and the total amount of personal income tax.

The procedure for filling out the 2-NDFL certificate is as follows:

| Help sections 2-NDFL | Filling procedure |

| First section | The year for which the certificate is being filled out, the serial number of the document, and the tax code for which the certificate is being submitted are indicated. The “Sign” field indicates whether personal income tax was withheld (1) or whether it is impossible to do so (2). Provide information about the organization (name, tax identification number). |

| Second section | Information about the individual to whom the company paid income. His TIN and status are indicated (for residents - 1, for non-residents - 2). Information about the employee's citizenship, country code and passport information is displayed. |

| Third section | Data on an individual's income is provided, broken down depending on the tax rate. Income for each month is reflected separately. |

| Fourth section | Indicate information about tax deductions of an individual. If he has the right to receive a property deduction, then the 2-NDFL certificate reflects information about the corresponding notification from the tax authority. |

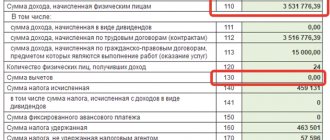

| Fifth section | Generalized information about income, deductions provided and transferred to the personal income tax budget is reflected. |

The 2-NDFL certificate is signed by the head of the company. As for the seal on the document, you should remember that according to Law 82-FZ, companies currently have the right to work without a seal. The 2-NDFL certificate form also no longer contains this detail (“M.P.”, place of printing). This field is no longer provided. Thus, if the company has retained the seal and applies it, then it puts the seal on the certificate and no fine will be charged for this. However, even without a stamp, the certificate will be considered valid.

Important! According to the requirements of the law, if the employer does not have the function of a tax agent (the employees were not paid salaries, there was no activity), the company does not have the obligation to generate and submit a 2-NDFL certificate to the Federal Tax Service.

Correctly filling out the 2-NDFL form with a sample

To correctly formulate the calculation, use information from tax accounting registers.

Income and deduction figures are reflected to the nearest kopeck; income tax amounts are indicated in “whole” numbers in accordance with rounding rules.

Declaration 2 of personal income tax for each employee contains 5 sections, which reflect:

- Information about the business entity where the income tax was withheld and reflected;

- information about physical the person who received the income;

- information about the types of profits that are subject to income tax at “different” rates;

- the amount of deductions applied in the reporting period that are involved in the “procedure” for calculating tax;

- information about the amount of profit and accrued income tax.

The declaration is completed as follows:

- The first part indicates the period for presenting the indicators. In addition, the reporting number and code of the fiscal authority to which the declaration will be submitted.

- In the “Sign” cell, you should mark, respectively, with number 1 or 2 whether income tax has been withheld or whether it is impossible to do so.

- Then enter information about the business entity, name according to the statutory acts, TIN. To submit a report to physical. persons indicate passport information.

Filling out the second part of the report:

- Fill out information about physical the person to whom the profit was accrued in the reporting year, indicating the TIN and status. If the employee does not have resident status, enter the number 2 in the required column; for a resident, enter 1.

- It also contains information about the employee’s citizenship, country code and passport information.

Part 3 of personal income tax certificate 2 reflects the profit of individuals. persons broken down by month and by income tax rate.

In the 4th part of the calculation, information about tax deductions applied in the reporting period is generated. If the employee submitted an application and notification for receiving a property benefit, and also if confirmation of this right was issued by the fiscal authorities, the personal income tax declaration 2 reflects this information and indicates information about the tax inspectorate that issued the notification.

In the 5th part, the amounts of accrued profit for individuals are formed. person, deductions provided and information about income tax transferred to the treasury.

Declarations 2 of personal income tax are approved by the head of the business entity and certified by a seal.

Almost every employee requires a certificate in form 2-NDFL. How to fill it out correctly and within what time frame to submit it if the employee had no income or works in a separate department? How to calculate standard tax deductions with zero income? Let's consider these situations in detail.

The 2-NDFL certificate is drawn up by the employer for submission to the tax office when submitting reports, as well as for issuance to the employee upon his application (clause 3 of Article 230 of the Tax Code of the Russian Federation).

An employer has no right to refuse to issue a certificate to an employee. But there are no deadlines for issuing a certificate or liability for refusal to issue it in the legislation. If you refuse, you can only be brought to administrative liability on the basis of Art. 5.27 and 5.39 Code of Administrative Offenses of the Russian Federation.

The 2-NDFL certificate form was approved by order of the Federal Tax Service of Russia No. MMV-7-3 / [email protected] dated November 17, 2010.

– when changing jobs, if this happened during the year, and not from January of the current year (paragraph 2, paragraph 3, article 218 of the Tax Code of the Russian Federation);

– when receiving a loan from a bank;

– when filling out a declaration form 3-NDFL (for receiving deductions, when selling property, training, purchasing medicines, charity, etc.);

– in other cases at the request of the employee.

This can happen if a woman was on maternity leave, and, as you know, benefits for it are not subject to personal income tax (clause 1 of Article 217 of the Tax Code). And, since the 2-NDFL certificate reflects only income subject to personal income tax, the benefit amounts are not reflected in it.

Another case with zero income is when the employee was on leave without pay during the entire tax period.

For example, typist Petrenko I.P. On May 21, 2013, she returns to work from maternity leave, which she was on until May 20, 2013. She writes an application asking for a 2-NDFL certificate to receive a loan. Is it necessary for Petrenko I.P. issue a 2-NDFL certificate and how to fill it out?

A certificate in form 2-NDFL is issued to citizens with zero income, but it will be filled out as follows. Since there was no income, only the details of the employer, information about the employee are filled in, and the employer’s signature and seal are affixed. All other fields will remain empty.

In addition, in addition to the 2-NDFL certificate, the employee may need a certificate stating that she worked for this employer, but wages for such and such a period were not accrued due to the employee being on maternity leave (or without pay) . It is written in any form.

In May 2013, employee Petrenko I.P. goes back to work after completing child care. She has a three-year-old girl. She wrote an application for a child deduction in June 2013. From when should she be granted a child deduction: from May, when she went to work, from June, when the application was written, or from the beginning of the year?

For personal income tax, the tax period is defined as a year (Article 216 of the Tax Code of the Russian Federation).

Providing the employee with standard tax deductions on the basis of clause 3 of Art. 210 and art. 218 of the Tax Code of the Russian Federation is possible for each month of the tax period only for income taxed at a rate of 13%.

– on whether the employee had income in individual months or not (if there is an employment contract) (clause 1 of Article 218 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia No. 03-04-05/8-36 dated 01/19/2012);

Personal income tax, by law, is calculated on an accrual basis from the beginning of the year, therefore, all deductions are summed up by adding for all months from the beginning of the year (starting from January), even for those when there was no income (it was equal to zero) (clause 1, article 218 , clause 3 of article 226, clause 3 of article 210 of the Tax Code of the Russian Federation).

- from the moment at which the application for a deduction for children was submitted with supporting documents - in the first month of the tax period or later (letter of the Ministry of Finance of Russia No. 03-04-06/8-118 dated 04/18/2012).

According to our example, the employee should be provided with child deductions from January 2013, despite the fact that until May her income was zero. She applied in June. Thus, when calculating her earnings for May, there were no child deductions (since the accounting department did not have documents confirming the deduction). And in June she has the right to receive a child deduction in the amount of 1400 × 6 = 8400 rubles.

When an employee reaches an income of more than 280,000 rubles, child deductions are not provided (paragraph 17, paragraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

Employee Ugolkov I.P. works in a separate division, which, according to general rules, has neither a current account nor a balance sheet. Where can he get a 2-NDFL certificate and who will issue it?

In separate divisions that do not have a current account and balance sheet, the parent organization calculates and pays personal income tax from employees and provides certificates to employees (letter of the Ministry of Finance of Russia No. 03-04-06-01/224 o dated August 28, 2009).

The employee should contact the parent organization (its office or accounting department), since all personal income tax accounting is kept there.

The deadline for issuing a 2-NDFL certificate is three working days from the date of application by the employee and is defined in Article 62 of the Labor Code of the Russian Federation.

See and download the details of filling out the 2-NDFL certificate and the certificate form here

In order to correctly draw up a 2-NDFL certificate, you should use the information from tax registers for income tax accounting. Indicators of income received by taxpayers, as well as the amount of tax deductions, are reflected in the certificate in rubles and kopecks. While tax amounts must be indicated in full rubles according to the rules of mathematical rounding.

Certificates made in form 2-NDFL are required to be submitted to the tax office to each employer who acts as a source of income for his subordinates. Sometimes employees themselves request such a document. Therefore, it is important to know how to fill out the certificate correctly, when and why it may be needed, and what nuances you need to keep in mind when submitting it.

The previous form of the document, approved by order of the Federal Tax Service of Russia No. ММВ-7–3 / [email protected] dated November 17, 2010, was valid only until the end of 2015. Currently, you should use the form that is Appendix No. 1 to the order of the Federal Tax Service of Russia No. ММВ-7–11 / [email protected] dated 10/30/2015. Detailed instructions for the correct preparation of the certificate are set out in Appendix No. 2. The main nuances of filling out each part are given below.

- Field “Attribute”: the number “1” is placed in the case of generating a document on income and withheld tax, “2” - if it is impossible to collect the latter.

- Field “Adjustment number”: “00” is entered during the initial preparation of the certificate; “01”, “02” and so on - when making corrections; “99” - when submitting the cancellation form.

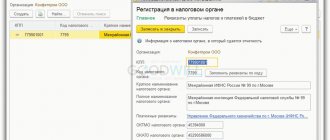

- Field “Tax Inspectorate Code”: to find out the corresponding value, you need to go to the page for determining the details of tax inspectorates.

- Field “OKTMO Code”: to find the required combination of numbers, you should use a special service on the website of the Federal Tax Service.

- Field “Tax Agent”: a legal entity is required to enter the name of the company, and an entrepreneur - the last name, first name and patronymic.

- Fields “TIN” and “KPP”: the necessary information is entered in accordance with the documents on the basis of which the individual entrepreneur or organization carries out its activities.

- Fields “Last name”, “First name”, “Patronymic”. Filling out this line usually does not cause problems. But there is one caveat: if during the time that has passed since the last submission of the 2-NDFL form, the employee has changed, for example, his last name, then a new one is entered into the document and a copy of the passport is attached to the report.

- Field "Taxpayer Status". The number “1” is used when the specialist is a citizen of Russia. “2” is entered if we are talking about the income of a foreign employee. “3” is entered when the employee is a citizen of another state, but has privileges that are provided for highly qualified specialists. “4” is indicated if the employee is one of those participating in the voluntary resettlement program for compatriots. “5” is given if the foreign worker is officially a refugee. And “6” indicates that a specialist from another state works on the basis of a patent.

- Field "Citizenship (country code)". In the income certificate of an individual from the Russian Federation, “643” is indicated. Combinations corresponding to other countries can be found in the All-Russian Classifier of Countries of the World (OCSM).

- Field “Identity document code”. The passport of a Russian citizen is indicated by the combination “21”. "12" symbolizes residence permit. In the case of a temporary identity card for a citizen of the Russian Federation, “14” is entered. Code “10” is entered to indicate a foreigner’s passport. If an employee from another state is working, accepted on the basis of a birth certificate, then “23” is entered.

- Field “Residence address in the Russian Federation”. This part provides information about the permanent registration of a specialist. When the document refers to a foreigner, the address of his stay in Russia is entered.

- The “Country of Residence Code” and “Address” fields are filled in if a certificate of income is drawn up for an employee from another state.

Tax Agent Responsibility

Important! If the tax agent does not have the opportunity to withhold personal income tax from the income of employees, then they are obliged to inform the tax authority about this, as well as notify the employee himself. Failure to provide such information may result in fines for the company ranging from 200 to 500 rubles.

For the past calendar year, the 2-NDFL certificate is submitted to the tax authority by the employer before April 1 of the year following the reporting year. For example, certificates for 2022 must be submitted to the tax office by April 1, 2022 . If this deadline is violated, the employer will be held accountable. For each document not submitted, he will face a fine of 200 rubles for the organization. Thus, if certificates are not provided in large quantities, the amount of the fine for the company can be impressive. As for officials, the fine for them ranges from 300 to 500 rubles.

Should I fill out blank certificates?

Organizations that are tax agents for personal income tax are required to annually submit certificates in form 2-NDFL to the inspectorate. They reflect the amounts of accrued, as well as actually received, income by people. The certificates indicate information about the amounts of tax: calculated, withheld and paid to the treasury. Thus, certificate 2-NDFL contains information about the calculation of tax for individuals.

If an organization has not transferred income to a person, it is not a tax agent. This means there is no need to transfer information and submit zero certificates. In addition, there is no need to submit an empty 2-NDFL with sign 2. As a result, the 2-NDFL with zero income does not need to be filled out. Also see “No need to submit 6-NDFL zero calculation”, “SZV-M zero in 2016: sample and example of filling out”.

Online magazine for accountants

Do I need a sample for filling out a zero report? As we have already found out, you do not need to submit zero 6-NDFL reporting, so you do not need a sample for filling it out. The preparation of reports for income payments arising during the reporting year follows fairly simple rules (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). According to them, section 2 shows data from the last quarter of the reporting period:

- in specific figures, if payments and tax accrued on them take place;

- putting a zero instead of a digital value if there is no information about payments and tax accruals for these payments (clause 1.8 of the Procedure for filling out form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/).

Section 1 is filled in with data that includes values corresponding to the entire reporting period.

Do I need to submit zero 6-personal income tax reporting?

- It is compiled quarterly and includes data on an accrual basis. Moreover, section 1 in 6-NDFL forms data for the period from the beginning of the year, and section 2 - only data from the last quarter of the reporting period (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650).

- Contains generalized figures of accruals in relation to employee income and related personal income tax.

Employers who have employees to whom they pay income must submit it, as well as 2-NDFL reporting (clause