Setting up personal income tax accounting

Setting up registration with the tax authority

This is the most important setting; without it, you will not be able to submit reports to regulatory authorities. Let's go to the "Organizations" directory (menu "Main" - "Organizations"). Having selected the desired organization, click the “More...” button. From the drop-down list, select “Registration with tax authorities”:

You must carefully fill out all the details.

Setting up payroll accounting

These settings are made in the “Salary and Personnel” section – “Salary Settings”.

Let’s go to “General Settings” and indicate that accounting is maintained in our program, and not in an external one, otherwise all sections related to personnel and salary accounting will not be available:

Next, click on the link “Salary Accounting Procedure”.

In the window that opens, click on the link “Set up reports and taxes”:

On the “Personal Income Tax” tab, you need to indicate in what order standard deductions are applied:

On the “Insurance Premiums” tab, you need to indicate at what rate insurance premiums are calculated:

Any accruals to individuals are made according to the income code. For this purpose, the program has a reference book “Types of personal income tax”. To view and, if necessary, adjust the reference book, you need to return to the “Salary Settings” window. Let’s expand the “Classifiers” section and click on the “NDFL” link:

The personal income tax calculation parameters settings window will open. The reference book is located on the corresponding tab:

To set up personal income tax taxation for each type of accrual and deduction, you need to expand the “Salary calculation” section in the “Salary settings” window:

In most cases, these settings are enough to start accounting for salaries and personal income tax. I will only note that the directories can be updated when the program configuration is updated, depending on changes in legislation.

How to set up accounting for personal income tax registers

Even before payroll is calculated, accounting policies for personal taxes and insurance premiums that will be paid should be determined. This will be reflected in the personal income tax settings in 1C ZUP. The data will be displayed in the appropriate registers (for salary taxes and personal income tax in general).

In order for the accounting policy to reflect all aspects of taxation, the following actions will need to be taken:

- go to the “Main” section and click on the “Accounting Policy” line. A new tab will open;

- in the accounting policy settings window, enter the name of your company and select the line “Setting up taxes and reports” with the cursor. Another tab will open;

- click “NDFL” in the window that appears;

- O;

- in the settings section, again click on the personal income tax settings line in 1C: ZUP and then o.

After you complete this procedure, the tax registers will take into account the system of deductions based on the amount of employees' salaries. Data is collected over a period of one year.

In the “Insurance Premiums” tab, you will also need to select the tariff at which they will be paid. The rate for accidents should be specified separately. These data must be entered taking into account the indicators of the Social Insurance Fund.

Once you have completed setting up your accounting policies, you can proceed to reflecting the taxation of individuals in the appropriate registers.

Entering data on employee tax deductions

In order to correctly calculate the tax of individuals - company employees, it is necessary to enter data for each of them, taking into account deductions for children, property and social payments. To enter information, follow these steps:

- select the “Salaries and Personnel” window and click on the “Employees” line;

- in the directory that opens, select the desired employee of your organization;

- opposite the line “Income tax” in the window that opens, click on the link “Standard deductions are provided”;

- Click “Enter a new application...”. After this, a new tab will open on the screen. A new tax deduction application form will appear, which you will need to fill out;

- click “Add”, and then click on the line “Check and close” in those deduction items that correspond to the work of your company.

After this, the amount of deductions for each staff unit of the enterprise will be automatically determined. This way, you can keep your accounting records in strict accordance with the law.

If you need a personal income tax application form (for deductions for employees’ children), you can download it for free on the Internet.

Setting up payroll and tax calculations

To set up the procedure for calculating wages for certain employees, click on the line “All accruals” in the “Salaries and Personnel” section. In the window that appears on the screen, you can create a new accrual. To correctly record information about salary and personal income tax, setting up in 1C will require the following actions:

- Click "Create" in this tab. Then click the cursor on the line “Payroll”.

- in the new window, click “Fill”. The document will contain information about accruals for each employee.

- Click the “Record” button and then “Pass”.

Next, you will be able to track the transactions made by the accounting department - to do this you will need to click “DtKt”. In the tax calculation window, entries in registers for personal income tax will be visible. At this stage, the personal income tax setup in 1C related to payroll accounting is completed.

Personal income tax accounting in 1C: accrual and deduction

Personal income tax is calculated for each amount of income actually received separately for the period (month).

The amount of personal income tax is calculated and accrued using documents such as “Payroll”, “Vacation”, “Sick leave” and so on.

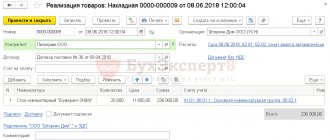

As an example, let’s take the “Payroll” document:

On the “Personal Income Tax” tab we see the calculated tax amount. After posting the document, the following personal income tax transactions are created:

The document also creates entries in the “Accounting for Income for Calculating Personal Income Tax” register, according to which reporting forms are subsequently filled out:

In fact, the tax withheld from the employee is reflected in the accounting when posting documents:

- Cash withdrawal;

- Debiting from the current account;

- Personal income tax accounting operation.

Unlike accrual, the tax withholding date is the date of the posted document.

Separately, you should consider the document “Personal Income Tax Accounting Operation”. It is provided for calculating personal income tax on dividends, vacation pay and other material benefits.

The document is created in the “Salaries and Personnel” menu in the “Personal Income Tax” section, link “All documents on personal income tax”. In the window with a list of documents, when you click the “Create” button, a drop-down list appears:

Almost all documents that in one way or another affect personal income tax create entries in the register “Calculations of taxpayers with the budget for personal income tax.”

As an example, let’s consider the formation of tax accounting register entries using the document “Write-off from current account.”

Let’s add the document “Statement to the Bank” (menu “Salaries and Personnel” - link “Statements to the Bank”) and based on it we will create a “Write-off from the current account”:

After this, let’s look at the postings and movements in the registers that the document generated:

Setting up work with personal income tax in 1C 8.3 Accounting 3.0

We propose to consider the nuances of calculating and withholding personal income tax in the 1C 8.3 program. And how to properly prepare for reporting on forms 2-NDFL and 6-NDFL.

An important point is the setting in 1C “Registration with the tax authority”, which is responsible for submitting reports to the tax service. Go to the “Main” menu tab and select “Organizations”.

We go to our organization, click “More” and in the drop-down list select the item “Registration with the tax authority”:

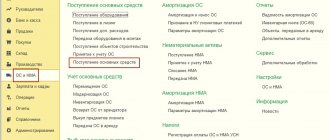

The next important setting is “Salary Settings” in the “Salaries and Personnel” section.

Go to the “General Settings” section and indicate in the item “Payroll and personnel records are kept” - “In this program” so that the corresponding sections are available.

Then follow the link “Salary accounting procedure”:

And then follow the link at the bottom of the “Setting up taxes and reports” window:

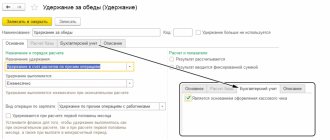

Here we go to the “Personal Income Tax” tab, in which we indicate the procedure for applying standard deductions “On a cumulative basis during the tax period”:

Next, go to the “Insurance Premiums” tab. We put the designations in the points:

- Tariff of insurance premiums - “Organizations using SOS, except agricultural producers.”

- Accident contribution rate – indicate the rate as a percentage.

All accruals made are based on the income code for individuals, which can be viewed in the built-in directory “Types of personal income tax”.

This reference book can be adjusted; to do this, return to “Salary Settings”, expand the “Classifiers” section and follow the “Personal Income Tax” link:

Then the “Personal Income Tax Calculation Parameters” window opens and go to the desired tab “Types of Personal Income Tax”:

To set up personal income tax taxation based on accruals and deductions, in the “Salary Settings” window, expand the “Salary Calculation” section:

To start accounting for wages and personal income tax, the established parameters are sufficient. But do not forget to update the configuration to the current one.

Personal income tax is accrued and calculated for each actual income received monthly at the end of the reporting period (month) according to the documents “Payroll”, “Vacation”, “Sick Leave” and others. Let's look at the document “Payroll”.

The tax amounts for each employee will be reflected on the “Personal Income Tax” tab:

The same information can be viewed in transactions:

Based on the document, an entry is created in the register “Accounting for income for calculating personal income tax” and reporting forms are filled out:

- Expenditure cash order for the issuance of cash DS;

- Debiting from the current account;

- Personal income tax accounting operation.

The document posting date will be the tax withholding date.

Let us pay attention to the document “Personal Tax Accounting Operation”. It is used to calculate personal income tax on dividends, vacation pay and other material benefits. To create a document, you need to go to the “Salaries and Personnel” tab, the “Personal Income Tax” section and click the “All documents on personal income tax” link.

We get into the magazine. To create a new document, click “Create” and select the desired option from the drop-down list:

An entry in the register “Settlements of taxpayers with the budget for personal income tax” forms almost every document that affects personal income tax.

Let's look at the example of the document “Write-off from a current account.” Let’s go to the “Salaries and Personnel” tab and open the “Bank Statements” item:

Let's create this document. And based on this we will write off from the account:

Let's check the wiring:

And also movements by registers:

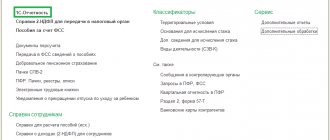

The registers described above generate the main 2-NDFL reports for employees and for transmission to the Federal Tax Service. Located on the “Salaries and Personnel” menu tab, the “Personal Income Tax” section:

To create, click the “Create” button and fill out a certificate for a specific employee:

No postings are generated based on the document; it is only needed to display the printed form.

Reporting on 6-NDFL is regulated. Located on the “Salaries and Personnel” menu tab, the “Personal Income Tax” section, as well as on the “Reports” tab, the “Reporting-1C” section, the “Regulated Reports” item:

To check the correctness of accrued and paid taxes to the budget, we use the “Universal Report”. You can find the “Standard Reports” section on the “Reports” menu tab.

In the top panel we find “Calculations of taxpayers with the budget for personal income tax.” In the form that opens, click “Show settings”. At the top, select the register by which we will build the report. On the “Grouping” tab add:

- Organization.

- Registrar.

- Resident tax rate.

- Individual.

Click “OK”:

Then indicate the period and click “Generate”:

The report shows all accrual and deduction amounts individually for each employee.

If some amount is not closed, then go to the document directly from the report and correct it.

Formation of personal income tax reporting

Above, I described the main registers that are involved in the generation of basic personal income tax reports, namely:

- Certificate 2-NDFL (for employees and the Federal Tax Service). Formed in the “Personal Income Tax” section, “Salaries and Personnel” menu:

In the window with a list of documents, click the create button and fill out the employee certificate:

The document does not generate transactions and entries in registers, but is only used for printing.

- 6-NDFL data (section 2):

The report relates to regulated reporting. You can also proceed to its registration from the “Personal Income Tax” section, the “Salaries and Personnel” menu, or through the “Reports” menu, the “1C Reporting” section, “Regulated Reports”.

An example of filling out the second section: