What applies to intangible assets in the public sector?

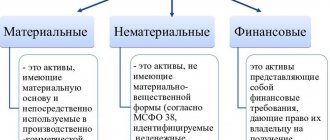

Accounting for intangible assets in a budgetary organization is regulated by Order of the Ministry of Finance of the Russian Federation No. 157n dated December 1, 2010. This type of non-financial assets is intended for reusable or permanent use and meets certain conditions set out in clause 56 of Instruction No. 157n. Special Features:

- have no physical or material expression;

- intended to make a profit in the future;

- it is possible to take into account as an independent unit, separating it from other types and units of accounting;

- the estimated period of use is more than one year;

- no further sale, transfer or sale is planned;

- the organization’s right to use intangible property is documented;

- actual availability is recorded in the relevant documents.

Inventory of intangible assets in an institution should be carried out systematically. The procedure and frequency of control activities should be established in the accounting policy in accordance with current legal requirements.

An exhaustive list of intangible property is presented in paragraph 57 of Instruction No. 157n. According to this legal norm, intangible assets are accounting objects:

- work of development departments or completed scientific tests, developments and research that did not achieve the planned results;

- objects that are taken into account as the results of intellectual research and labor;

- unfinished scientific research or under development, but unaccounted for due to the lack of appropriate documentation.

The accounting features of such objects in non-profit organizations are established in PBU 14/2007 “Accounting for intangible assets”.

Accounting procedure from January 1, 2022

For public sector employees, accounting for intangible assets in accounting and tax accounting in 2021 is carried out in a new way. From 01/01/2021, the Federal Accounting Standards Intangible Assets, approved by Order of the Ministry of Finance No. 181n dated 11/15/2019, came into force.

IMPORTANT!

According to the new rules, intangible assets include exclusive and non-exclusive rights of use. All intangible assets must be placed on the balance sheet. Those assets that were previously accounted for off-balance sheet in account 01 must be transferred to balance sheet accounting.

When adding intangible assets to the balance sheet, each object should be assigned an individual inventory number and a card should be created. Form No. NMA-1 was approved by Decree of the State Statistics Committee of the Russian Federation No. 71a dated October 30, 1997. When forming the initial cost, it is necessary to take into account all financial costs of development, creation or purchase.

Please note that the procedure for determining the initial cost is slightly different, depending on the method of receipt of the non-financial asset by the institution.

We also changed the invoice analytics for intangible assets. In addition, a new sub-account 111 60 “Rights to use intangible assets” was introduced. Now the accounting of intangible assets is carried out as follows:

- if an institution owns exclusive rights to intangible assets, account 102 “Intangible assets” is used to record it (clauses 56–69 of Instruction No. 157n);

- if the organization has non-exclusive rights to use intangible assets, then the asset is reflected in account 111 60.

The date of acceptance of intangible property for accounting should be considered the date of emergence of the organization’s exclusive rights, confirmed by documents. Relocation and disposal are carried out on the basis of a decision of a specially created commission. Intangible assets with a non-exclusive right to use intangible assets are accepted according to the current general procedure (clause 34 of Instruction No. 157n) The basis for acceptance is the decision of the commission. The conditions for recognition of intangible assets are as follows (clause 7 of the Federal Accounting Standards):

- the institution predicts the receipt of useful potential, economic benefits from the use of the right;

- the initial cost of the object has been formed.

Purchasing objects

The receipt of intangible assets at the disposal of the institution must be formalized by f. 0504101 - act of acceptance and transfer of NFA objects. The new FSBU explains what is included in intangible assets - an NFA object that is used in the activities of the institution for more than 12 months (clause 6 of the FSBU). In addition, the standard defines the procedure for recognizing objects for accounting.

When purchasing intangible assets for a fee, it is necessary to take into account all associated costs to form the initial cost of the object. Such expenses in accounting should include:

- The actual cost of the object, that is, the amounts paid to the copyright holder for the alienation of rights to the results of intellectual property or to a means of individualization.

- Costs of consulting or information services from third parties associated with the purchase of intangible assets.

- Registration, duties, patent or other types of fees, payments that are directly related to the acquisition of a new NFA. For example, paying for a domain when registering a website on the Internet.

- Fees that the acquirer pays to intermediary companies involved in the registration, sale, and resale of objects.

- Other types of costs that the acquirer bears when receiving intangible assets into ownership.

All of the above costs should be collected on account 0 106 00 000 “Investments in intangible assets”. When the cost is fully formed, that is, all types of expenses of the institution associated with the purchase have been taken into account and recorded, then all expenses are written off from the credit of account 0 106 00 000 to the debit of account 0 102 00 000 “Intangible assets”.

IMPORTANT!

If an intangible asset was acquired through subsidies (a subsidy for a government task, a subsidy for other purposes, etc.), then the founder has the right to classify this property as particularly valuable property, by analogy with fixed assets. The procedure for classifying property as particularly valuable is enshrined in Government Decree No. 538 of July 26, 2010.

Accounting for the costs of forming the initial cost of non-exclusive rights to intangible assets is carried out in account 106 60 “Investments in the rights to use intangible assets”. This account is used if the initial cost includes the purchase price and other actual expenses for acquiring the non-exclusive right to use the asset. The costs of acquiring user rights to the results of intellectual activity are charged to KOSGU 226.

In which accounts should intangible assets be recorded?

The accounting account for an intangible asset depends on the right under which it was obtained.

| Right | Account | Example |

| Exclusive right | 0 102 XN 000 “Scientific research (research development)” 0 102 XR 000 “Experimental design and technological development” 0 102 XI 000 “Software and databases” 0 102 XD 000 “Other intellectual property” | Exclusive right to software - account 0 102 ХI 000; Exclusive right to a selection achievement - account 0 102 ХN 000; Exclusive right to a trademark - account 0 102 ХD 000; Exclusive right to an invention - account 0 102 ХN 000 |

| Non-exclusive right | 0 111 6N 000 “Rights to use scientific research (research developments)” 0 111 6R 000 “Rights to use experimental design and technological developments” 0 111 6I 000 “Rights to use software and databases” 0 111 6D 000 “Rights to use other objects of intellectual property" | Non-exclusive right to antivirus - account 0 111 6I 000; Non-exclusive right to a utility model - account 0 111 6N 000; Non-exclusive right to an electronic archive - account 0 111 6I 000; Non-exclusive right to a literary work - account 0 111 6D 000. |

Objects of intangible assets are grouped according to clause 37 of Instruction No. 157n. That is, objects received under exclusive right are accounted for in the corresponding account 102 00, where X can take the value 2 “Especially valuable movable property of the institution”, 3 “Other movable property of the institution” or 9 “Property in concession”.

More on the topic: Help on consolidated settlements (f. 0503125): innovations in the formation

For example, on account 102 91 “Software and databases in concession” information about programs for electronic computers, databases, information systems and (or) sites on the Internet or other information and telecommunication networks that are the objects of concession agreements is subject to reflection. which includes such computer programs and (or) databases, or about the totality of these objects, as well as about operations that change them.

The grouping by type of property, designated by the letters N, R, I or D, corresponds to the subsections of the classification established by OKOF *(3) (clause 67 of Instruction No. 157n, letter of the Ministry of Finance of Russia dated September 17, 2020 No. 02-07-10/81813). Namely, OKOF provides for the following groups of intellectual property objects (OKOF code 700):

- scientific research and development (OKOF code 710);

- software and databases (OKOF code 730);

- other objects of intellectual property (OKOF code 790).

For example, multimedia applications are named in the “Software and Databases” group - OKOF code 732.00.10.08. Consequently, the exclusive right to this object, related to other movable property, is taken into account in account 102 3I. And if an institution has a non-exclusive right to multimedia applications, then it will be reflected in account 111 6I.

Creating an Asset

If an intangible asset is created in an institution, then the initial cost of the property should include:

- Remuneration of workers involved in the creation of the facility. Please note that not only accrued wages are taken into account, but also insurance premiums and other deductions from wages.

- Costs of payment for work, services, goods purchased to create intangible assets. Including under author's order agreements or GPC agreements.

- Institutional expenses for maintenance, repair and operation of equipment used in the creation of intangible property.

- Other categories of expenses of the organization.

It is unacceptable to include the following expenses in the initial cost:

- General business expenses, except for costs directly related to the development of intangible assets.

- The organization's expenses for research, technological and development work of previous reporting periods, which have already been recognized as income and expenses.

- Expenses directly related to the creation of samples of new products accepted into the NFA of the institution only based on the results of technological, research and development work.

Charge the costs to accounting account 0 106 00 000 in the same manner.

Account 04: examples of reflecting transactions

The main operations with intangible assets include their acquisition, creation and write-off. Let's look at each of these operations using an example.

Account 04. Purchase of intangible assets

Flagman LLC acquired from Egida LLC the exclusive right to an invention that allows optimizing the production process. According to the patent assignment agreement, the cost of the right to the invention was 67,500 rubles. When registering with Rospatent, Flagman LLC paid a state fee in the amount of 3,800 rubles.

The following entries were made in the accounting of Flagman LLC:

| Debit | Credit | Description | Sum | Document |

| 60 | 51 | Flagman LLC transferred funds to Egida LLC in payment for the patent | 67,500 rub. | Payment order |

| 08 | 60 | The cost of the patent is reflected as part of investments in intangible assets | 67,500 rub. | Agreement |

| 08 | 60 | The cost of the state duty is reflected as part of investments in intangible assets | RUB 3,800 | Receipt for payment of state duty |

| 04 | 08 | Intangible assets accepted for accounting (RUB 67,500 + RUB 3,800) | 71,300 rub. | NMA-1 registration card |

Read about the accounting accounts used in accounting in the articles: account 60 (accounting for settlements with suppliers and contractors), account 08 (investments in non-current assets).

Account 04. Creation of intangible assets on your own

Monolit LLC created its own trademark, recognized as an intangible asset. The process of developing the sign took 1 month, during which the employees of Monolit LLC were paid salaries and accrued insurance contributions:

- salary – 67,000 rubles;

- mandatory insurance premiums – 20,100 rubles. (RUB 67,000 * (22% + 2.9% + 5.1%));

- insurance against accidents and occupational diseases – 134 rubles. (RUB 67,000 * 0.2%).

Upon completion of the development process, Monolit LLC received a certificate of exclusive right to the mark, having paid a state fee of 28,800 rubles.

The following entries were reflected in the accounting of Monolit LLC:

| Debit | Credit | Description | Sum | Document |

| 08 Creation of intangible assets | 70, 69 | The expenses for paying salaries (and insurance premiums) to development employees are reflected (RUB 67,000 + RUB 20,100 + RUB 134) | RUB 87,234 | Payroll sheet |

| 76 | 51 | Payment of the state duty amount | RUB 28,800 | Payment order |

| 08 Creation of intangible assets | 76 | The cost of the state duty is reflected as part of investments in intangible assets | RUB 28,800 | Certificate for a trademark |

| 04 | 08 Creation of intangible assets | The trademark is included in the intangible assets (RUB 87,243 + RUB 28,800) | RUB 116,043 | NMA-1 registration card |

Read about the accounting accounts used in accounting in the articles: account 70 (payroll accounting), account 69 (social insurance calculations), account 76, account 51 (current account).

Account 04. Write-off of intangible assets

Globus LLC owns the exclusive right to a technical invention. This invention is registered as an intangible asset. As of 02/01/2016:

- initial cost of intangible assets – 132,000 rubles;

- the amount of accrued depreciation (account 05) is 43,500 rubles.

According to the agreement, Globus LLC will exercise the exclusive right to the invention of Breeze LLC at a price of 118,300 rubles.

Operations to write off intangible assets in connection with the sale were reflected in the accounting of Globus LLC with the following entries:

| Debit | Credit | Description | Sum | Document |

| 76 | 91.1 | The amount of income from the sale of intangible assets is taken into account | RUB 118,300 | Patent assignment agreement |

| 05 | 04 | The amount of depreciation accrued on the sold intangible asset was written off | RUB 43,500 | Patent assignment agreement, registration card NMA-1 |

| 91.2 | 04 | The residual value of the sold intangible assets is written off | RUB 88,500 | Patent assignment agreement, registration card NMA-1 |

| 51 | 76 | Funds have been credited from Breeze LLC as payment for the right to the invention | RUB 118,300 | Bank statement |

| 91.9 | 99 | The amount of the financial result is taken into account (RUB 118,300 – RUB 88,500) | RUB 29,800 | Turnover balance sheet |

Read about the accounting accounts used in accounting in the articles: account 91.1 and 91.2 (exchange differences), account 99 (accounting for financial results).

Free admission

The institution has the right to accept intangible assets under a gift or donation agreement from legal entities and individuals. There are exceptions (Article 576 of the Civil Code of the Russian Federation).

An asset is accepted for accounting at its original cost, equal to the sum of its current estimated value (as of the date of acceptance for accounting) and costs associated with registering rights to property and costs associated with arranging the operating conditions of intangible assets.

Let us recall that the current assessed value is defined as the amount of money that the institution will receive upon the sale (sale) of the object, as of the date of acceptance for accounting. The current estimated value must be documented or determined by experts.

Initial cost of a gratuitous non-exclusive right to an intangible asset:

- the cost indicated in the transfer documents;

- fair value at the acquisition date, determined by the market price method (current).

If the transfer documents do not contain information about the value of the non-exclusive right to use an intangible asset, the current value is determined based on the price on the date of acceptance for accounting of a gratuitously received asset for the same or similar intangible asset. All information about current prices is confirmed by documents or experts.

IMPORTANT!

If there is no information on prices for similar or similar rights of use, intangible assets are recorded on account 111 60 at a conditional cost - one object, one ruble. Once the institution receives price information, the commission will reconsider the fair value of the property.

Please note that patent and/or registration costs incurred during the operation of an intangible asset can no longer be taken into account as part of the original cost. Such expenses should be included in the operating expenses of the organization.

Account 004 “Goods accepted for commission”

Types of business transactions that are reflected in account 004

Account 004 “Goods accepted for commission” is off-balance sheet, i.e. reflection of completed business transactions is carried out without double entry.

So, for example, the receipt of assets is reflected in the debit of account 004 without any correspondence with other accounting accounts, and the disposal (alienation, write-off) of assets is reflected in the credit of account 004 also without any correspondence with other accounting accounts.

Off-balance sheet account 004 summarizes information on the availability and movement of goods accepted for commission in accordance with the commission agreement (clause 82 of the Instructions on the procedure for applying the standard chart of accounts, approved by Resolution of the Ministry of Finance of the Republic of Belarus dated June 29, 2011 No. 50 (hereinafter referred to as Instruction No. 50 )).

Thus, in accordance with the requirements of Instruction No. 50, this account is used by commission agents.

Please note that Instruction No. 50 contains a closed list of transactions, information about which is reflected in account 004.

At the same time, the sale of goods can also be carried out within the framework of other types of business contracts, for example, an agency agreement, the fundamental difference of which from a commission agreement is that under an agency agreement the attorney makes transactions on behalf of the principal and the rights and obligations under the transaction made by the attorney arise directly from the principal (clause 1 of Article 861 of the Civil Code of the Republic of Belarus (hereinafter referred to as the Civil Code)), while under a commission agreement the commission agent acts on his own behalf and under a transaction concluded by the commission agent with a third party, the commission agent acquires rights and becomes obligated, although the principal was named in the transaction or entered into direct relations with a third party for the execution of the transaction (clause 1 of Article 880 of the Civil Code).

The agency agreement is aimed at achieving the same goals as the commission agreement; only the legal grounds for their execution are different.

One of the main tasks of accounting and reporting is to provide, when an organization carries out business transactions, internal and external users with timely information on the presence and movement of assets and liabilities, as well as on the use of material, labor and financial resources in accordance with approved norms, standards and estimates (Article 4 of the Law of the Republic of Belarus dated October 18, 1994 No. 3321-XII “On Accounting and Reporting”).

Based on the above, the receipt and sale of goods under agency contracts in accordance with legal requirements should also be reflected in the analytical accounting registers.

Due to the fact that Instruction No. 50 does not provide for a separate off-balance sheet account for such business transactions, the organization also has the right to reflect the facts of receipt and return of such assets in account 004.

Typical accounting entries for account 004

| Contents of a business transaction | Account correspondence | |

| debit | credit | |

| The receipt of goods by the commission agent from the principal is reflected | 004 | |

| The shipment of goods by the commission agent to customers is reflected | 004 | |

| The return of goods by the commission agent to the principal in the event of termination of the contract, receipt of low-quality goods, their return by customers and other similar cases is reflected. | 004 | |

| The write-off by the commission agent of goods received from the principal in cases not related to their alienation (shortage, damage, etc.) is reflected. | 004 | |

| The settlement of regrading of consignment goods is reflected | 004 | 004 |

The procedure for analytical accounting of objects on account 004

Analytical accounting for off-balance sheet account 004 in accordance with clause 82 of Instruction No. 50 is carried out by type of goods and principals.

Thus, maintaining analytical accounting for account 004 should be organized in such a way as to ensure the possibility of obtaining the following information:

1) information about the principal (legal entity or individual from whom the organization received goods for sale on a commission basis);

2) information about goods received on commission (their name, cost, quantity and other characteristics).

If necessary, the organization has the right to introduce additional characteristics of analytical accounting (for example, location, financially responsible person, etc.) if such information is needed for management purposes.

The cost of goods received on commission, reflected on account 004

Goods accepted for commission are accounted for in off-balance sheet account 004 at the cost indicated in the primary accounting documents (clause 82 of Instruction No. 50).

The basis for writing off inventory items from the consignor and capitalizing them at the consignee, as well as for warehouse, operational and accounting, are commodity transport or invoices (clause 2 of the Instructions for filling out standard forms of primary accounting documents TTN-1 “Commodity transport invoice" and TN-2 "Consignment note", approved by Resolution of the Ministry of Finance of the Republic of Belarus dated December 18, 2008 No. 192). Goods arriving from outside the Republic of Belarus are accepted for registration on the basis of documents issued by the shipper (these may be invoices, CMR waybills and other documents).

Conclusion. Business transactions are reflected on account 004 based on their value indicated in the goods or invoices.

At the same time, please note that goods received for sale under commission agreements from non-resident principals (the value of which is determined in foreign currency) are subject to reflection on account 004 both in foreign currency and in the equivalent of Belarusian rubles.

In this case, to determine the equivalent cost of goods in Belarusian rubles, the exchange rate on the date of receipt of the goods is used (reflected in the debit of account 004).

Grounds for recording business transactions on account 004

Business transactions for receiving goods on commission are reflected on the date of actual receipt of goods on the basis of primary accounting documents confirming their receipt (consignment notes or invoices).

In this case, a prerequisite for reflecting such goods on account 004 is the presence of a concluded commission agreement, since otherwise the goods will not have the status of a commission item, but will be equated to goods accepted for safekeeping until their further fate is clarified.

The basis for writing off goods from account 004 will be primary accounting documents confirming:

- shipment of goods to customers (commodity or waybills);

- return of goods to the consignor (commodity or waybills);

- shortage, damage, theft, destruction of goods received on commission, in cases not related to their alienation (inventory lists, matching statements).

Practical examples of recording business transactions on account 004

Example 1

On December 17, 2012, the parties entered into a commission agreement, within the framework of which on January 3, 2013, the principal shipped 100 car tires worth 1.5 rubles to the commission agent. each.

On January 16, 2013, 70 car tires were shipped to a wholesale buyer.

In the accounting registers of the commission agent, these business transactions will be reflected as follows:

| date | the name of the operation | Wiring | Amount, rub. | Calculation |

| 03.01.2013 | The receipt of car tires for sale within the framework of the concluded commission agreement is reflected | D-t 004 | 150 000 000 | 100 pieces. × 1.5 million rub. |

| 16.01.2013 | The shipment of consignment goods to the buyer is reflected | Kit 004 | 105 000 000 | 70 pcs. × 1.5 million rub. |

Example 2

On December 17, 2012, the parties entered into a commission agreement, within the framework of which, on January 3, 2013, the principal shipped 50 laptops to the commission agent at a cost of $700 each.

On January 16, 2013, 30 laptops were shipped to a wholesale buyer.

In the accounting registers of the commission agent, these business transactions will be reflected as follows:

| date | the name of the operation | Wiring | Amount, rub. | Calculation |

| 03.01.2013 | The receipt of laptops for sale within the framework of the concluded commission agreement is reflected | D-t 004 | 299 950 000 | 50 pcs. × $700 × 8,570 |

| 16.01.2013 | The shipment of consignment goods to the buyer is reflected | Kit 004 | 179 970 000 | 30 pcs. × $700 × 8,570 |

Example 3

On December 17, 2012, the parties entered into a commission agreement, within the framework of which on January 3, 2013, the principal shipped 100 car tires worth 1.5 rubles to the commission agent. each.

On January 16, 2013, 70 car tires were shipped to a wholesale buyer.

On January 31, 2013, during the inventory of the warehouse, it was established that there were a shortage of 10 car tires received on commission.

These business transactions will be reflected as follows (reflection of business transactions on other accounts is not considered in this example):

| date | the name of the operation | Wiring | Amount, rub. | Calculation |

| 03.01.2013 | The receipt of car tires for sale within the framework of the concluded commission agreement is reflected | D-t 004 | 150 000 000 | 100 pieces. × 1.5 million rub. |

| 16.01.2013 | The shipment of consignment goods to the buyer is reflected | Kit 004 | 105 000 000 | 70 pcs. × 1.5 million rub. |

| 31.01.2013 | The fact of shortage of consignment goods is reflected | Kit 004 | 15 000 000 | 10 pieces. × 1.5 million rub. |

Viktor Statkevich, auditor

Viktor Statkevich, auditor

Depreciation

The depreciation of intangible assets in accounting has changed significantly: assets with an indefinite useful life are no longer depreciated. Previously, such objects had a ten-year useful life. In 2022, it is required to revise the SPI for these intangible assets. If the commission classifies them as objects with an indefinite life, then depreciation on them stops.

IMPORTANT!

Do not adjust the depreciation amount from previous years. In the NFA accounting card in form 0504031, it is necessary to change the information about the useful life and the depreciation procedure (Letter of the Ministry of Finance No. 02-07-07/25218 dated 04/02/2021).

Depreciation is charged only on assets with a certain SPI. If the cost of the object does not exceed 100,000 rubles, 100% depreciation is charged when recognizing the object as part of the intangible assets group. There are no special rules for calculating depreciation on intangible assets with a non-exclusive right of use.

Amortization of intangible assets

Data for calculating depreciation are established upon acceptance for accounting in 1C 8.3. The calculation of depreciation amounts occurs when closing the month using the routine operation Depreciation of intangible assets and writing off R&D expenses: Operations – Closing the month:

In 1C 8.3, you can view transactions or a report on the calculation of depreciation amounts for intangible assets by using the menu by clicking on the link to the routine operation:

Changing the depreciation parameters of intangible assets

To change parameters in 1C 8.3, create a document Depreciation parameters for intangible assets using the Create button, item OS and intangible assets:

- Development of intangible assets – the document registers the amount of work to calculate depreciation for intangible assets;

- Changing the depreciation rate - to register a reduction factor;

- Changing depreciation reflection – allows you to change depreciation accounting accounts. For example, when exercising use rights:

Change in reflection of amortization of an intangible asset

When using this document in 1C 8.3, the following nuances must be taken into account:

- Calculate depreciation according to old data, before creating a changing document;

- The changes come into effect from next month:

Filling out the document Changing the reflection of depreciation of intangible assets:

- Date – set the last day of the month;

- Method – a new depreciation account and its analytics are indicated;

- The table indicates a list of assets for which changes are made. To enter intangible assets, you can use the selection button.

Depreciation report

The amount of accumulated depreciation is reflected in the account balance sheet report - when you select account 05, and for a more detailed report you can use the Depreciation Calculation Help.

Disposal of intangible assets

Accrual of 100% depreciation is not a basis for writing off intangible assets from accounting. Objects are retired only if they become completely obsolete, that is, further exploitation of an intangible asset is simply impractical and irrational.

Intangible assets become unusable for other reasons. For example, as a result of a natural disaster or emergency. In this case, the costs should be written off to accounting account 0 401 20 273 “Extraordinary expenses for transactions with assets.”

Deregistration of a retiring asset should be reflected in f. 0504104 - act on write-off of a non-financial asset. A similar mark is placed on the inventory card of the intangible asset (f. 0504031).

Accounting in accounting entries

Let's present the main entries for accounting for intangible assets in the budget in the form of a table:

| Operation | Debit | Credit |

| Formation of the initial cost: | ||

| Purchase | 0 106 X2 320 | 0 302 32 730 |

| Registration costs | 0 106 X2 320 | 0 302 32 730 |

| The object has been accepted for registration | 0 102 X0 320 | 0 106 X2 320 |

| Depreciation | 0 401 20 271 | 0 104 X9 320 |

| Acceptance of non-exclusive rights to use intangible assets into account at the purchase price in accordance with the agreement | 0 111 6Х 35Х | 0 302 26 73Х |

| Acquisition of non-exclusive rights to use intangible assets: | ||

| Purchase price under the license agreement | 0 106 6Х 35Х | 0 302 26 73Х |

| Other actual acquisition costs | 0 106 6Х 35Х | 0 302 2Х 73Х |

| Acceptance of non-exclusive rights into account by decision of the commission | 0 111 6Х 35Х | 0 106 6Х 35Х |

| Free receipt of non-exclusive rights of use | 0 111 6Х 35Х | 0 401 10 19Х |

| Depreciation accrued on non-exclusive rights of use | 0 401 20 226 | 0 104 6Х 452 |

| Transfer to the balance sheet of non-exclusive rights of intangible assets from the previous year with private investment for more than 12 months (if the private investment does not exceed 12 months, then write off the balance from account 401 50 to the financial result) | Decrease in off-balance sheet account 01 | |

| 0 106 6Х 352 | 0 401 50 226 | |

| 0 111 6Х 352 | 0 106 6Х 352 | |

| Internal movement between departments of the institution | 0 102 X0 320 | 0 102 X0 320 |

| Deregistration: | ||

| Depreciation written off | 0 104 X9 420 | 0 102 X0 320 |

| The residual value of intangible assets is written off | 0 401 10 172 | 0 102 X0 320 |

| Write-off of the non-exclusive right to use intangible assets with zero residual value | 0 104 6Х 452 | 0 111 6Х 452 |

| Write-off of the non-exclusive right to use intangible assets with residual value: | ||

| Depreciation of the right to use intangible assets is written off | 0 104 6Х 452 | 0 111 6Х 452 |

| The residual value of the right to use intangible assets has been written off | 0 302 ХХ 83Х | 0 111 6Х 45Х |

Account 04 in accounting. Accounting for transactions with intangible assets

To reflect generalized information about transactions with intangible assets (receipt, depreciation, liquidation, etc.), accounting account 04 is used.

An intangible asset accounted for on the balance sheet of an organization can be created on its own, or exclusive rights to it can be acquired from another enterprise.

In the case of purchasing intangible assets from a third party, payment transactions can be reflected in the following records:

| Debit | Credit | Description | Document |

| 04 | 50 | Payment for intangible assets was made in cash | Account cash warrant |

| 04 | 51 | Funds were transferred to pay for the intangible asset | Payment order |

| 04 | 52 | Payment of expenses for the acquisition of intangible assets in foreign currency was made | Currency order |

| 04 | 55 | Funds were debited from a special bank account to pay for intangible assets | Bank statement |

If an organization creates an intangible asset object on its own, then such operations are reflected by postings:

| Debit | Credit | Description | Document |

| 08 Creation of intangible assets | 60 (10, 68, 69, 70, 76…) | The costs of creating an intangible asset are included in investments in intangible assets | Salary statements, certificates of work performed, etc. |

| 04 | 08 Creation of intangible assets | The created object is reflected in the intangible assets | NMA-1 registration card |

Depreciation charges, which must be reflected monthly for intangible assets, are accumulated on account 05. The main operations for calculating depreciation on intangible assets are carried out as follows:

| Debit | Credit | Description | Document |

| 08 | 05 | Depreciation charges for intangible assets used to create a new intangible asset are taken into account | Depreciation statement |

| 44 | 05 | Depreciation charges for intangible assets used in retail trade are taken into account | Depreciation statement |

| 91.2 | 05 | Depreciation charges for an intangible asset used in the social sphere are taken into account | Depreciation statement |

| 20 | 05 | The amount of depreciation charges for an intangible asset used in the main production is taken into account | Depreciation statement |

| 23 | 05 | The amount of depreciation charges for an intangible asset used in auxiliary production is taken into account | Depreciation statement |

| 29 | 05 | The amount of depreciation charges for an intangible asset used in service production is taken into account | Depreciation statement |

When recording operations to liquidate intangible assets, the residual value of the object can be written off with the following entries:

| Debit | Credit | Description | Document |

| 58.4 | 04 | The residual value of intangible assets was written off (transferred as a contribution under a simple partnership agreement) | NMA-1 registration card |

| 91.2 | 04 | The residual value of intangible assets is written off (transferred free of charge) | NMA-1 registration card |

| 58.1 | 04 | The residual value of intangible assets is written off (transferred as a contribution to the authorized capital of another organization) | NMA-1 registration card |