Moral injury

We will find the definition of the term in the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 20, 1994 No. 10 “Some issues of application of legislation on compensation for moral damage” (clause 2). Moral harm is understood as moral or physical suffering caused by actions (inaction) that encroach on intangible benefits belonging to a citizen from birth or by force of law, or that violate the personal non-property or property rights of a citizen. Thus, the concept of moral damage does not apply to legal entities. It only has a business reputation (clause 11 of Article 152 of the Civil Code of the Russian Federation).

A common property of intangible goods is their inalienability. Intangible benefits include life and health, personal dignity, personal integrity, honor and good name, business reputation, inviolability of private life and home, personal and family secrets, freedom of movement, freedom to choose a place of stay and residence (clause 1 of Article 150 of the Civil Code RF).

Moral harm, in particular, may consist of moral feelings in connection with the loss of relatives, the inability to continue an active social life, loss of a job, disclosure of family or medical secrets, dissemination of untrue information discrediting the honor, dignity or business reputation of a citizen, temporary restrictions or deprivation of any rights, physical pain associated with injury, other damage to health, or due to illness suffered as a result of moral suffering. Please note: moral damage is not limited to damage to health.

Compensation for moral damage is provided for by both labor and civil legislation. Let's look at each of these areas.

Notes on the law

In accordance with paragraph 1 of Article 213 of the Tax Code, in the process of clarifying the tax base for personal income tax, those types of profits that were received by an individual in the form of any insurance payments accrued in accordance with the norms of current legislation are not taken into account. In this regard, taking into account the instructions of this paragraph, any types of profit in the form of insurance payments are not taken into account. At the same time, in accordance with Law No. 2300-1, compensation for moral damage does not fall into the category of “insurance payments”, and therefore does not fall under this law.

Moral damage that was caused to the consumer by the manufacturer due to a violation of his legal rights must be compensated by the person who caused the specified damage if there is guilt in this situation.

Article 213. Features of determining the tax base for insurance contracts

The amount of compensation for moral damage in this case is established in accordance with current legislation. Thus, if a legal entity causes moral damage to an individual, the latter must receive an appropriate compensation payment, which will not be subject to personal income tax.

The fines that are imposed for non-compliance with established legal requirements are not specified in paragraph 3 of Article 217 of the Tax Code, and therefore income taxes are already collected from them.

Compensation in labor relations

Based on Article 3 (Part 4) of the Labor Code of the Russian Federation, persons who believe that they have been discriminated against in the world of work have the right to apply to the court for compensation for material damage and compensation for moral damage. Generally speaking, Article 164 (Part 2) of the Labor Code characterizes compensation as a method of reimbursement of costs. But is it legitimate to equate moral and physical suffering with costs? On this basis, we doubt that payments for moral damages are compensation in the generally accepted sense.

Article 237 of the Labor Code establishes:

- moral damage caused to an employee by unlawful actions or inaction of the employer is compensated to the employee in cash in amounts determined by agreement of the parties to the employment contract;

- in the event of a dispute, the fact of causing moral damage to the employee and the amount of compensation for it are determined by the court, regardless of the property damage subject to compensation.

It follows from these provisions that compensation for moral damage can be carried out without going to court - by agreement between the employee and the employer.

However, in cases of dismissal without legal grounds or in violation of the established procedure for dismissal or illegal transfer to another job, it is the court that collects in favor of the employee monetary compensation for moral damage caused to him by these actions. This is stated in Article 394 (Part 9) of the Labor Code.

The court determines the amount of compensation for moral damage based on the specific circumstances of each case - taking into account the volume and nature of moral or physical suffering caused to the employee, the degree of guilt of the employer, other circumstances worthy of attention, as well as the requirements of reasonableness and fairness (clause 63 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated 03/17/2004 No. 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”). It is logical to extend this approach to cases of voluntary payment of compensation.

Answers to common questions about how to keep accounting records for compensation for moral damages

Question #1:

Is the concept of “moral damage” applicable to legal entities?

Answer:

No, moral damage can only relate to individuals. For legal entities, only business reputation may suffer.

Question #2:

A civil contract was concluded with the employee. A situation occurred in which an employee suffered moral harm, and the employer voluntarily paid him compensation. The size was agreed upon by the parties to the GPA. Then the injured citizen went to court demanding compensation. How can an employer prove that compensation has already been paid?

Answer:

The fact is that, according to paragraph 2 of Art. 1101 of the Civil Code of the Russian Federation, the amount of compensation for moral damage caused within the framework of civil law relations can be determined exclusively by the court. If the employer voluntarily paid the money, the law does not recognize the payment as compensation. Therefore, if the fact of causing moral damage is proven in court, the court will make a decision to collect compensation from the employer. This was stated in the Letter of the Federal Tax Service of the Russian Federation dated May 16, 2012 No. ED-4-3/8057.

Question No. 3: Can an employee of an enterprise demand payment of compensation for moral damage due to delayed wages?

Answer: Yes. Similar claims have already been satisfied several times.

Civil compensation

In civil law relations, compensation for moral damage is also carried out in cash (clause 1 of Article 1101 of the Civil Code of the Russian Federation). But its size is determined exclusively by the court (clause 2 of Article 1101 of the Civil Code of the Russian Federation, letter of the Federal Tax Service of Russia dated May 16, 2012 No. ED-4-3/8057). Consequently, if compensation is paid to a citizen by agreement of the parties - for example, in the manner of pre-trial settlement of a dispute (clause 7, part 2, article 131 of the Code of Civil Procedure of the Russian Federation), then formally such an amount does not fall into the category of compensation established by the legislation of the Russian Federation. Take note of this.

How much can an injured citizen expect? Article 1101 (clause 2) of the Civil Code of the Russian Federation explains: the amount of compensation is determined depending on the nature of the physical and moral suffering caused to the victim, as well as the degree of guilt of the harm-doer in cases where guilt is the basis for compensation for harm. When determining the amount of compensation for harm, the requirements of reasonableness and fairness must be taken into account. The nature of physical and moral suffering is assessed by the court, taking into account the actual circumstances in which moral harm was caused and the individual characteristics of the victim.

Please note: moral damage caused to the consumer as a result of violation of his rights by the manufacturer (performer, seller, authorized organization or authorized individual entrepreneur, importer) is compensated according to the rules of Article 15 of the Law of the Russian Federation of 02/07/1992 No. 2300-1 “On the Protection of Consumer Rights”. This article expressly stipulates that the amount of compensation is determined by the court. Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 28, 2012 No. 17 “On the consideration by courts of civil cases in disputes regarding the protection of consumer rights” (clause 45) explains: a sufficient condition for satisfying a claim is the established fact of a violation of consumer rights. Thus, the consumer does not have to specifically prove the presence of suffering. At the same time, the amount of monetary compensation collected for moral damages cannot be made dependent on the cost of the goods (work, service) or the amount of the penalty to be collected.

Who and in what situations can count on compensation for moral damage? Well, for example, a tourist who has suffered from the actions of a travel company (Article 6 of the Federal Law of November 24, 1996 No. 132-FZ “On the Fundamentals of Tourism Activities in the Russian Federation”). The insured person (Article 8 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”). A citizen about whom the media has disseminated information that does not correspond to reality (Article 62 of the Law of the Russian Federation of December 27, 1991 No. 2124-1 “On the Mass Media”). Finally, any citizen as a subject of personal data (Article 8 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases”).

Common mistakes

Error:

The store offers to compensate for the moral damage caused to the consumer by paying him double the cost of the defective product he purchased.

A comment:

If moral damage was caused to the consumer, that is, his rights were violated by the store seller, the performer, the manufacturer himself, individual entrepreneur, importer or an authorized organization, the procedure for compensation for damage is determined exclusively in court, in accordance with the provisions of Art. 15 of the Federal Law of 02/07/1992 No. 2300-1 “On the Protection of Consumer Rights”. Moreover, compensation cannot be determined by comparing its amount with the cost of the goods or the amount of the penalty. The consumer is not required to prove the existence of moral suffering - the very admission of a violation on the part of the seller or performer is sufficient grounds for satisfying the claim and collecting a compensation amount.

Error:

The company offered the consumer (gym visitor) a free swimming pool membership as compensation for moral damages.

A comment:

The procedure for payment and the amount of compensation to consumers is determined exclusively in court, in accordance with the Law “On Consumer Rights”. Compensation can only be provided in monetary form.

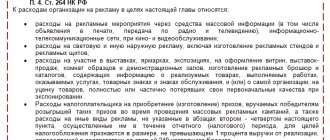

Income tax expenses

In connection with the assignment of compensation, the company causing moral damage bears costs. Do such expenses generate expenses for tax purposes?

This question must be answered in the negative. After all, such costs are generated by a violation of the constitutional rights and freedoms of man and citizen (Chapter 2 of the Constitution of the Russian Federation), that is, they are immoral in nature. Consequently, they do not meet the criteria of paragraph 1 of Article 252 of the Tax Code, although they were incurred in the course of carrying out activities aimed at generating income. This basis is specifically provided for in paragraph 49 of Article 270 of the Tax Code of the Russian Federation.

We emphasize: compensation for moral damage cannot be equated to compensation for damage caused. Consequently, subparagraph 13 of paragraph 1 of Article 265 of the Tax Code of the Russian Federation does not apply to it. This position is presented in letters of the Ministry of Finance of Russia dated March 19, 2010 No. 03-03-06/4/22 and the Federal Tax Service of Russia dated May 16, 2012 No. ED-4-3/8057.

note

An employee has the right to demand compensation for moral damage even for delayed wages (clause 63 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2, appeal ruling of the Sverdlovsk Regional Court dated November 22, 2016 in case No. 33-20855/2016).

The fact is that the legislation connects damage with the presence of expenses for the injured party (clause 13 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 23, 2015 No. 25 “On the application by courts of certain provisions of Section I of Part One of the Civil Code of the Russian Federation”). In the case of moral damage, such is not seen. Moreover, the legislator specifically stipulates: compensation for moral damage is made regardless of the property damage subject to compensation (part 2 of article 237 of the Labor Code of the Russian Federation, paragraph 3 of article 1099 of the Civil Code of the Russian Federation).

True, the resolution of the Arbitration Court of the East Siberian District dated June 4, 2015 No. F02-1262/2015 in case No. F02-1612/2015 presents the opposite conclusion. The arbitrators found that subclause 13 of clause 1 of Article 265 of the Tax Code of the Russian Federation does not specify what kind of damage is subject to compensation - material or moral, and does not contain a prohibition on including the costs of compensation for moral damage in non-operating expenses. Although this resolution was supported by the ruling of the Supreme Court of the Russian Federation dated August 27, 2015 No. 302-KG15-9847, the latter did not examine the issue of recognition of compensation for moral damage in expenses.

A similar conclusion is presented in the resolution of the Arbitration Court of the Ural District dated July 30, 2015 No. F09-5159/15.

In this regard, let us ask ourselves: is there an official term “moral damage”? Yes. In particular, it is presented in the Law of the Russian Federation dated July 21, 1993 No. 5485-1 “On State Secrets” (Article 7) and in the Decree of the President of the Russian Federation dated June 14, 2012 No. 851 “On the procedure for establishing levels of terrorist danger...” But specific situations, which regulate these sources of law are not typical for the activities of commercial organizations. At the same time, this example shows: you can try to claim a violation of your rights even in doubtful cases. The inconsistency of your position may go unnoticed.

So, on the issue of accounting for compensation in expenses, we are on the side of the Russian Ministry of Finance, and do not share the position of the above-mentioned arbitration courts. But for personal income tax it’s the other way around.

Personal income tax

According to the author, the issue of calculating personal income tax on the amount of compensation for moral damage has not been properly studied. Let's try to fill this gap.

Taxable income of an individual is recognized as economic benefit in cash or in kind, taken into account if it is possible to evaluate it and to the extent that such benefit can be assessed (clause 1 of Article 41 of the Tax Code of the Russian Federation). Does compensation for moral damage generate economic benefits? The court answered this question in the negative (clause 7 of the Review of the practice of courts considering cases related to the application of Chapter 23 of the Tax Code of the Russian Federation, approved by the Presidium of the Supreme Court of the Russian Federation on October 21, 2015). The judges did not provide a detailed argument. But let’s think about it: in essence, this compensation is a “payment” for suffering. To classify it as an economic benefit to an individual is immoral. The victim receives a sum of money not due to economic relations with the harm-doer.

Meanwhile, regulatory authorities consider this compensation as income that can be exempt from taxation on the basis of paragraph 3 of Article 217 of the Tax Code of the Russian Federation - as a compensation payment established by the current legislation of the Russian Federation. Officials interpret compensation for moral damage either as compensation for harm caused to health (letters from the Ministry of Finance of Russia dated November 11, 2016 No. 03-04-06/66353, Federal Tax Service of Russia dated March 5, 2018 No. GD-4-11 / [email protected] ), or as payment related to the performance of labor duties (letter of the Ministry of Finance of Russia dated November 11, 2016 No. 03-04-05/66167). At the same time, they invariably emphasize that only compensation ordered by the court is exempt from personal income tax.

We cannot agree with these approaches. Our objections are as follows.

First of all, moral harm is not equivalent to harm to health. Federal Law of November 21, 2011 No. 323-FZ “On the fundamentals of protecting the health of citizens in the Russian Federation” defines health as a state of physical, mental and social well-being of a person, in which there are no diseases, as well as disorders of the functions of organs and systems of the body. The rules for determining the severity of harm caused to human health were approved by Decree of the Government of the Russian Federation dated August 17, 2007 No. 522. Based on the Rules (clauses 1-3), harm to health is understood as a violation of the anatomical integrity and physiological function of human organs and tissues as a result of exposure to physical, chemical, biological and mental environmental factors. Harm caused to health is determined based on the results of a forensic medical examination depending on the degree of its severity (severe harm, moderate harm and minor harm). However, this approach does not apply to claims for compensation for moral damage. However, officials insist on the “medical” nature of “moral” compensation even in relation to payments made in accordance with decisions of the European Court of Human Rights (letter of the Ministry of Finance of Russia dated October 3, 2013 No. 03-04-07/41151, Article 41 of the Convention on protection of human rights and fundamental freedoms).

On the other hand, the position according to which only compensation for moral damage caused to employees is exempt from taxation is discriminatory. It violates the basic principles of the legislation on taxes and fees (clauses 1, 2, article 3 of the Tax Code of the Russian Federation). The degree of suffering does not depend on the circumstances under which it was caused - within the framework of labor or civil law relations.

note

In cases where the interests of a citizen require it, intangible benefits belonging to him can be protected, in particular, by the court recognizing the fact of violation of his personal non-property right, publishing a court decision on the violation, as well as by suppressing or prohibiting actions that violate or create a threat of violation personal non-property right or encroaching or creating a threat of encroachment on an intangible benefit (clause 2 of article 150 of the Civil Code of the Russian Federation).

For the same reasons, exemption from personal income tax cannot be made dependent on who exactly awarded the compensation - the court or the employer (even though the latter is permitted by law). Moreover, by resolution of the Federal Antimonopoly Service of the West Siberian District dated June 13, 2006 No. F04-3386/2006 (23325-A27-31), compensation for moral damage paid to the relatives of deceased workers by agreement of the relatives with the employer was exempt from personal income tax.

We noted above that the concept of compensation implies reimbursement of material costs. But in connection with moral damage there are none. As a result, it seems that the term “compensation for moral harm” should be considered as indivisible and integral, without tearing out the concept of “compensation” from it. In our opinion, the problem deserves a legislative settlement or, as a preliminary option, a decision at the level of the Constitutional Court of the Russian Federation. In the meantime, irremovable doubts and ambiguities in tax legislation should be interpreted in favor of the taxpayer and the tax agent, without punishing the latter (Clause 7, Article 3, Article 123 of the Tax Code of the Russian Federation).

Please note: the unregulated taxation of compensation for moral damage allows employers to pay injured employees (based on an agreement of the parties) amounts limited only by the financial capabilities of the company (!). How can tax inspectors not worry?