How to deal with operation codes?

Taxpayers who submit VAT returns to the inspectorate are often faced with the need to reflect the codes of certain transactions.

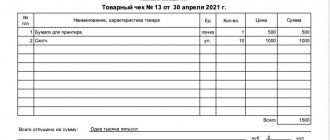

Codes are required to complete sections 2, 4-7. Find out what sections these are in the picture:

Codes are sets of 7 digits, each of which represents a specific operation. All codes are divided into 5 groups and are described in Appendix No. 1 to the Procedure for filling out a VAT return, approved. by order of the Federal Tax Service dated October 29, 2014 No. MMB-7-3/ [email protected]

Important! From the report for the 3rd quarter of 2022, the VAT declaration must be completed on a new form, as amended by the Federal Tax Service order No. ED-7-3 dated March 26, 2021 / [email protected] The changes are related to the introduction of a goods traceability system.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial access to the system can be obtained for free.

The figure below shows:

- the name of each group of operation codes;

- the range of codes provided for each group;

- link to the article of the Tax Code of the Russian Federation.

The list of codes valid in 2022 can be downloaded in this material.

What happens if you don’t put the transaction code in the declaration? It will not pass logical control, and the controllers will not accept it. Therefore, it is necessary to understand the codes and correctly reflect them in the declaration, if the need arises.

Next we will tell you more about individual codes.

Explanation of terms with links to legal regulations for code 1010292

What legal acts do you need to know in order to correctly reflect transactions under code 1010292 in the declaration:

- subp. 15 clause 3 art. 149 of the Tax Code of the Russian Federation - determines that loan transactions, including interest on them, are not subject to VAT on the territory of the Russian Federation;

- pp. 44.2-44.5 Procedure for filling out a VAT return - decipher the procedure for reflecting information in the lines of section 7, dedicated to non-taxable transactions.

- The Civil Code of the Russian Federation and other legal acts - regarding the definition of the terms “money loan”, “securities loan”, “loan interest”, “repo operation”.

Scheme for using code 1010292

Let's consider the scheme for using code 1010292, concentrating in it the necessary information for filling out the declaration:

Based on this diagram, we will fill out section 7 using the example data.

PJSC "Spring Wind" entered into a loan agreement with a domestic company. Its amount is 3,400,250 rubles. In the 3rd quarter, accrued interest on the loan amounted to RUB 38,253. When filling out section 7, please note that:

- for the lender (PJSC "Spring Wind"), issuing loans is not the main activity;

- The lender has no general business expenses for non-taxable transactions.

What the completed section 7 of the VAT return with transaction code 1010292 looks like, see below:

When filling out column 2, you should take into account that it is not the “loan body” that is entered, but the amount of accrued interest (letter of the Federal Tax Service dated April 29, 2013 No. ED-4-3/7896).

Relationship between codes 1010292 and 1010256

The relationship is as follows: code 1010256 in the VAT return, just like code 1010256, is reflected in the same section (section 7). Both of these transactions belong to the group of non-taxable (exempt from taxation).

What else do these codes have in common? If there are the specified codes in section 7, tax authorities, when conducting desk audits, try to request additional documents from the taxpayer. Which? We are talking about documentary evidence of the legality of reflecting non-VAT-taxable transactions in the declaration. Moreover, the controllers justify their demands by the fact that the exemption of these operations from VAT is in the nature of a tax benefit.

However, the judges do not agree with them - the taxpayer manages to prove in court that the obligation to submit documents along with the declaration is contrary to clause 88 of the Tax Code of the Russian Federation (decrees of the Supreme Arbitration Court of the Russian Federation dated January 31, 2014 No. VAS-497/14, Supreme Arbitration Court of the Russian Federation dated November 12, 2012 No. VAS-6809/12).

We will tell you more about when you need to enter code 1010256 in section 7 of the VAT return in the next section.

Transaction code in the VAT return

- Section 2 – it is formed only by persons who are tax agents;

- 4th, 5th and 6th sections - it must be filled out by companies and entrepreneurs who carried out export transactions during the reporting period;

- Section 7 – it is formed by those firms and entrepreneurs that are not recognized as VAT payers and are exempt from the obligation to pay this tax.

In some sections of the VAT return there is a need to reflect the code of the transaction being performed. Such sections are the second, as well as sections from four to seven. Read about which transaction codes are reflected in the VAT return in the following article.

Implementation according to code 1010256 (topologies of integrated circuits, industrial designs, etc.)

Code 1010256 is entered in the VAT return if exclusive rights to the results of intellectual activity are realized during the reporting period.

An exclusive right is the right of a person to use protected objects (including the right to prohibit their use).

What is meant by the term “results of intellectual activity”? The basic concepts are deciphered below:

So:

- Realization of exclusive rights to the specified objects under subparagraph. 26 clause 2 art. 149 of the Tax Code of the Russian Federation is not subject to VAT.

- When such transactions are reflected in section 7 of the declaration, code 1010256 is entered.

A medical institution is entitled to VAT relief

Services for physical therapy and sports medicine are also not directly mentioned in the list of diagnostic, prevention and treatment services. At the same time, the institution has the right to take advantage of benefits in relation to these services, often provided as part of pre-medical care). Physical therapy services relate to activities in the field of health care and correspond to the list of medical services for diagnosis, prevention and treatment. At the same time, the Resolution of the Federal Antimonopoly Service of the Moscow Region dated February 15, 2008 N KA-A41/488-08 does not take into account the argument of the tax authorities about the inconsistency of the services listed in the license with the wording contained in OKUN *(1) and OKVED *(2), since this is not refutes neither the fact of provision of preferential services nor the right to apply the specified benefit. Also exempt from VAT are medical nutrition and drug treatment, which are classified as medical services (Resolution of the Tenth Arbitration Court of Appeal dated November 27, 2006 N 09AP-13927/2006-AK). At the same time, from the benefits provided by paragraphs. 2 p. 2 art. 149 of the Tax Code of the Russian Federation, an institution that has a license does not have the right to refuse, as this can be done in accordance with paragraph 5 of Art. 146 of the Tax Code of the Russian Federation in relation to the operations named in paragraph 3 of Art. 149 of the Tax Code of the Russian Federation, for example, in relation to the services of sanatorium and health resort organizations. But should the benefit be abandoned, especially by a budgetary institution that is not at all interested in increasing tax obligations to the budget? It is better to take care of the license and provide tax-exempt medical services.

Please note => Real estate included in the list by cadastral value for the Samara region for 2019

Features of using code 1010256

From the previous section we found out that the implementation of exclusive rights to intellectual property is not subject to VAT. A single rule applies to all the objects considered: if such a sale occurred in the reporting quarter, this operation is subject to reflection in section 7 of the VAT return with code 1010256.

This is a general approach that may have interpretations in the course of business activities.

For example, a Russian organization acquired from a foreign company the rights to use the results of a production secret (know-how). The transfer of rights to the results of intellectual activity is a service. The question arises: what will be recognized as the place of sale of the service in this situation? According to sub. 4 paragraphs 1 art. 148 of the Tax Code of the Russian Federation is the territory of the Russian Federation if the buyer operates in our country. And the operation to exercise exclusive rights to a production secret is not subject to VAT (for the position of officials of the Ministry of Finance, see letter dated November 18, 2016 No. 03-07-08/68105).

Check whether you are using the codes correctly in your VAT return with the help of explanations from ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Who is entitled to VAT benefits?

VAT benefit codes refer to the budget classification of taxes, fees and non-tax payments paid to the budget. They are a combination of seven numbers. Each type of tax benefit has its own code. Let's give an example of several VAT tax incentive codes.

- Postal products (postcards, envelopes, stamps, with the exception of copies of philatelic value).

- Medical products included in the list of the Government of the Russian Federation. It includes prosthetic and orthopedic products and raw materials for their production; goods intended for preventive measures or used for the rehabilitation of people with disabilities; any type of corrective optics (lenses, glasses, frames).

- Coins made from any precious metal that are considered official means of payment in the Russian Federation or abroad, except for specimens of numismatic value.

- Products of folk crafts of artistic value, except those that fall under the category of excise goods.

- Maintenance and repair services for household appliances and medical devices, including spare parts and other consumables required to restore functionality, during the warranty period at no additional charge.

- All types of repair and restoration, scientific research and archaeological field work aimed at preserving historical monuments and buildings belonging to religious organizations.

- A set of scientific, research, experimental, technological and design work carried out with budgetary funds, including those aimed at creating new types of products/technologies.

- Precious metals, including ore, scrap, production waste. Precious stones, including rough diamonds.

- Products produced by canteens of medical institutions, schools, kindergartens or catering organizations that sell their products in such institutions.

- Services of medical institutions, except for organizations providing services in the sanitary and epidemiological field, cosmetology and veterinary medicine.

- Transportation of citizens by sea, river, and railway motor transport within urban and suburban transport, excluding taxi services, including minibuses, subject to the implementation of activities at current tariffs, including all provided benefits.

- Works and/or services in the field of fighting forest fires.

- Maintenance and air navigation services for air traffic vessels provided within Russian airports.

- All types of work/services, including survey and classification, for servicing sea, river and mixed types of vessels at moorings in the port or during pilotage.

- Sale of subscriptions and entrance tickets to organizations that operate in the field of physical education and sports services, as well as rental of sports grounds for specialized events.

- Providing residential space for use and selling it, regardless of the form of ownership and division into shares, including the transfer of shares when selling apartments in apartment buildings.

- Implementation of inventions, technological models, databases, software products, microcircuits and other intellectual goods and know-how.

- Sales of scrap metal of any type.

- Transfer of goods/services for the purpose of subsequent advertising, costing no more than 100 rubles.

Please note => Find out your debt for traveling abroad for free

When do technical inspection services fall into section 7 of the VAT return with code 1010203?

Section 7 of the VAT return reflects a wide variety of transactions that are not subject to VAT. Thus, code 1010203 is intended to reflect a VAT-free transaction for the sale of technical inspection services (subclause 17.2, clause 2, article 149 of the Tax Code of the Russian Federation). However, such a service will not be taxed only under certain conditions - they are specified in the Law “On Technical Inspection...” dated July 1, 2011 No. 170-FZ. What are these conditions?

VAT is not assessed on technical inspection if it is carried out by a company or individual entrepreneur (including a dealer) duly accredited to conduct technical inspection (subclause 7 of Article 1 of Law No. 170-FZ). They are called inspection operators. At the same time, the rules for accreditation of operators are strictly regulated (approved by order of the Ministry of Economic Development of Russia dated November 28, 2011 No. 697). Only in this case will the taxpayer who provided the service legally fill out code 1010203 in section 7 of the declaration.

If a technical inspection service is provided by a company or individual entrepreneur that has not been accredited, such services are subject to VAT, and this operation should not be reflected in section 7 with code 1010203 (letter of the Ministry of Finance of Russia dated 04/05/2012 No. 03-07-11/101).

Completing section 7 if separate accounting is not maintained in the program

The legislation does not define the procedure for maintaining separate accounting, so if the operation is one-time, and there is no other non-VAT-taxable activity, then the calculations can be performed outside the program using your own methodology - so as not to complicate further work in 1C by connecting separate accounting in the settings.

In this case:

Step 1. Reflect loan transactions in accordance with the algorithm from the article

Step 2. The presence of direct costs for loan issuance operations is unlikely in practice.

Distributable expenses may include, for example, office rent and other office expenses.

If the 5% rule applies, calculate the share of expenses for VAT-free transactions

Step 3. If the 5% rule does not apply or is not met, calculate the portion of VAT that can be deducted using the formula:

The cost of services for providing an interest-bearing loan is equal to the amount of accrued interest (clause 4, clause 4.1, article 170 of the Tax Code of the Russian Federation). If an interest-free loan is issued, the cost of these services is zero.

Then in the documents Invoice received for receipt of distributed expenses, uncheck the box Reflect VAT deduction in the purchase book by date of receipt .

Then include the portion of VAT that cannot be deducted for each receipt in the cost of these expenses using the VAT Write-off document (Operations - VAT Regular Operations).

Click the Add or Fill to add the required receipt documents to the Purchased valuables .

Make adjustments in the table section:

- Amount - reset the column to zero;

- VAT - indicate the amount of VAT to be included in the cost of services.

On the Write-off account , specify the same VAT write-off parameters that are indicated for the expenses themselves (clause 2 of article 170 of the Tax Code of the Russian Federation).

To deduct the remaining share of VAT, fill out the document Formation of purchase ledger entries in the usual manner.

Create the document Generating sales ledger entries as a mandatory step before filling out a VAT return.

Step 4. Fill out Section 7 manually in the VAT return (Reports - Regulated reports - Create - VAT return):

- Column 1 - 1010292 “Loan operations in cash and securities, REPO operations”;

- Column 2 - the amount of accrued interest for the quarter;

- Column 4 - the amount of VAT on expenses related to loan issuance operations.

See also:

- Is it necessary to submit an updated VAT return if the interest on the loan was not reflected in Section 7 of the VAT return?

- If you do not include separate VAT accounting in 1C, then section 7 of the VAT return and the register for confirmation of VAT benefits must be filled out manually?

- Is it necessary to indicate in section 7 of the VAT return the amount of interest on a loan agreement that our organization issued to another?

- How to fill out section 7 of the VAT return if the 5% rule is met?

- 5 percent rule for maintaining separate accounting of incoming VAT

- Auto-filling of the register of documents for section 7 of the VAT return

- Completing section 7 for transactions not recognized as taxable objects

- [04/16/2021 entry] VAT return for the 1st quarter of 2022 in 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Application of cash register systems when issuing and repaying loans You do not have access to view To gain access: Complete a commercial…

- When giving a gift to an employee, a cash receipt is not needed. If the employer paid his employee money under a gift agreement,...

- Do I need to punch a cash receipt when issuing or receiving a loan? The Ministry of Finance in Letter dated September 18, 2019 N 03-01-15/71891 confirmed that the issuance...

- Accounting policy for accounting for loans and credits received...

No license: will codes be needed?

Lack of a license for certain types of activities specified in Art. 149 of the Tax Code of the Russian Federation (transactions not subject to VAT), deprives companies and individual entrepreneurs of this benefit.

For example, one of the types of transactions that must be reflected in section 7 of the VAT return is gambling services (code 1010226). However, gambling organizers have the right to use the VAT exemption only if they have a special license (Clause 6, Article 149 of the Tax Code of the Russian Federation). Mandatory licensing of this activity is provided for in clause 31, part 1, art. 12 of the Law “On Licensing of Certain Types of Activities” dated 04.05.2011 No. 99-FZ.

If there is no such license, VAT must be calculated and paid in the general manner (clause 11 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33).

The same rule equally applies to other operations exempt from VAT (if a license is required). For example:

publication will introduce you to a complete list of transactions not subject to VAT .

Transactions exempt from taxation

Agreements for services provided that were not previously submitted; invoices; payment documents confirming payment for services provided (in the absence of payment documents, indicate how payment is made for services for the provision of residential premises for use); documents confirming that the residential premises provided for use belong to the company (if previously submitted, indicate the number and date); other documents confirming the legality of using the above VAT benefit The court noted that the taxpayer’s lack of obligation to calculate and pay VAT to the budget on transactions that are not subject to taxation is expressly provided for in Art. 149 of the Tax Code of the Russian Federation. Such sales, which are not recognized as subject to VAT, are not taken into account when forming the tax base for VAT, while tax benefits according to Art. 56 of the Code apply only to certain categories of taxpayers. Therefore, in the opinion of the court, it is necessary to distinguish benefits from cases when the object of taxation does not arise and, accordingly, the taxpayer is not obliged to submit documents confirming the legality of reflecting in Section 7 of the specified transactions that are not subject to taxation as part of the desk tax audit.

16 Jan 2022 marketur 1146

Share this post

- Related Posts

- How to find out the owner of a house for free by address

- How to pay for schoolchildren's travel in Moscow

- Citizens equal to labor veterans

- Benefits for large families 2022 Belarus

Let's get acquainted with the code 1011712

In order to correctly reflect transaction code 1011712 in the VAT return, you also need to familiarize yourself with some terms and articles of the Tax Code of the Russian Federation.

This code is entered in section 2 of the VAT return by tax agents. Let's see who tax legislation classifies as tax agents and when they should enter the specified code in the declaration:

Please note that code 1011712 is entered when ordering work or services from a foreigner - not when purchasing goods (when purchasing goods from a foreigner, the transaction code is 1011711).

This is where we encounter the difficulty associated with determining the place where the work or service will be sold. If everything is more or less clear with the goods (the goods were shipped in Russia, which means the Russian Federation is recognized as the place of sale), then services and work are a separate matter.

We will tell you how a tax agent can correctly determine the place of sale of work (services) in the next section.

Transaction code in the VAT return

- Transaction code 22 in the VAT return is used to reflect the fact of changes in the terms of the concluded agreement and, as a consequence, the return of the previously transferred advance.

- Transaction code 18 in the VAT return is intended for operations related to the receipt or generation by a company (IP) of adjustment invoices.

- Transaction code 03 in the VAT return has the meaning of disclosing information about the return of previously transferred goods to the seller.

- Transaction code 21 in the VAT return is used to reflect the fact of transfer of property as a contribution to the authorized capital of the organization.

In addition to the codes that directly reflect in the tax return such indicators as the location of the transaction and the composition of its participants, there are codes that are used in the purchase book to include data on the nature of the transaction itself. Let's look at some of them:

Nuances of using code 1011712

What might be difficult? The fact is that it will be necessary to fulfill the duties of a tax agent of a Russian company or individual entrepreneur only if a transaction with a foreigner (for the purchase of works or services) took place on the territory of our country. Therefore, before you start preparing section 2 of the VAT return, make sure of this (Article 148 of the Tax Code of the Russian Federation). The diagram below will help us understand this circumstance:

As you can see, difficulties in determining the place where the service is provided (the work is performed) are quite possible. An incorrect assessment of this circumstance may affect the correct completion of section 2 of the VAT return and the reasonable application of code 1011712.

Transaction code in the VAT return

If a company or individual entrepreneur is recognized as a VAT tax agent, then they must fill out section 2 of the VAT return. Tax agent operations are presented in section 4 and are combined by coding 1011700, as well as the provisions of Article 161 of the Tax Code. In such cases, codes may be used, such as, for example, code 1011711 - sale of goods of foreign persons who are not registered as taxpayers in the Russian Federation and sale of works and services of these foreign persons using non-cash forms of payment or code 1011703 - provision by government agencies authorities and management for lease of federal property, property of constituent entities of the Russian Federation or municipal property. The next group of codes - 1010400 or section 3 of the table - are export transactions taxed at a tax rate of 0 percent based on various paragraphs of Article 164 of the Tax Code. If a company or individual entrepreneur committed them during the reporting period, then the relevant information will be indicated in sections 4-6 of the VAT report.

Results

Transaction codes are entered in sections 2, 4-7 of the VAT declaration. They encode transactions that are not recognized as subject to VAT, are not subject to taxation (exempt from taxation), transactions at a 0% rate, etc. If you do not put them in the declaration, it will not pass logical control, and the tax authorities will not accept such a report.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Transaction code in the VAT return

If a company or individual entrepreneur is recognized as a VAT tax agent, then they must fill out section 2 of the VAT return. Tax agent operations are presented in section 4 and are combined by coding 1011700, as well as the provisions of Article 161 of the Tax Code. In such cases, codes may be used, such as, for example, code 1011711 - sale of goods of foreign persons who are not registered as taxpayers in the Russian Federation and sale of works and services of these foreign persons using non-cash forms of payment or code 1011703 - provision by government agencies authorities and management for lease of federal property, property of constituent entities of the Russian Federation or municipal property. The next group of codes - 1010400 or section 3 of the table - are export transactions taxed at a tax rate of 0 percent based on various paragraphs of Article 164 of the Tax Code. If a company or individual entrepreneur committed them during the reporting period, then the relevant information will be indicated in sections 4-6 of the VAT report.