What it is?

In 1999, the Federal State Statistics Service, by Resolution No. 20, approved a package of primary documents necessary for carrying out accounting activities at an enterprise. One of these documents is an invoice in form MX-18 for the transfer of finished products to storage places.

All enterprises that carry out production activities are required to maintain a document flow that will provide the accounting service with all the necessary information.

Form MX-18 records the movement of products by production departments to warehouses. That is, this form is an internal document of the organization.

general information

Despite the fact that the MX-18 form is unified (approved by the Post. Goskomstat of Russia dated 08/09/1999 No. 66), working with it has been optional since 2013. An enterprise has the right to use its own forms, securing them in its accounting policies, if they contain all the necessary details. You can take the MX-18 form as a basis. In fact, organizations use this particular form because it is convenient and there is no need to be afraid that the inspection authorities will have questions about the guidelines for using certain forms.

The employee who is responsible for receiving goods into the warehouse must check the quantity and condition of the products against the invoice. Then the document is certified by both parties to the procedure (the financially responsible person delivering the products and the warehouse employee to whose storage the goods are delivered).

The purpose of the document is to record the fact of transfer of finished products to the warehouse. The completed form is sent to the accounting department, where a specialist reflects the movement of finished products in the organization’s records.

Attention! Form MX-18 is used to record the movement of products within one enterprise. It should not be confused with the invoice in the TORG-12 form. This form is required to transfer goods (finished products) to a third party.

What is it used for?

Form MX-18 is usually used in production , since trade organizations, as well as those working in the service sector, do not need such a document - the invoice is used to move manufactured products.

A manufacturing enterprise is required to confirm all its business transactions with primary accounting records, and the goods it produces go through many stages before ending up in the warehouse.

At the moment when the products are produced and can be moved within the enterprise, for example, to other divisions, or to warehouses for further sale, the document in question is drawn up.

In what form is it compiled?

The MX-18 form is unified, that is, standard and complies with all legal requirements. The form has OKUD code 0335018 .

However, since 2013, unified forms are not mandatory; each enterprise has the right to independently choose the form of the invoice, but it must meet all the necessary requirements.

The document used to transfer finished products must contain the following columns:

- Date and document number.

- Sender - the department that transfers the products.

- Recipient - the department receiving the products.

- Corresponding account.

- A tabular section with the name, quantity and other characteristics of the transferred products.

- Signatures of the transmitting and receiving parties.

Unified form No. MX-18 - form and sample

Therefore, you need to create a write-off act form on your own or use a ready-made template.

For each object used in an activity, in one situation or another, it may be necessary to write it off, for example, into creation. Before you draw up an act for writing off a product, you should always do it accurately. The purpose of the portal is to collect and summarize, as well as analyze, all information posted on the Internet and in other sources related to documents.

If necessary, an act is drawn up with the role of a representative of sanitary or other supervision. In practice, there is an unlimited number of forms for accounting documents, such as reports, acts, income and expense books, certificates, expenses, cash books, receipts and almost everything else.

, , , ,

Next:

September 11, 2022

No comments yet!

Popular articles:

Latest materials:

Compilation and design

Responsible person

It is necessary to draw up a document in form MX-18 to the person responsible for the transfer of products in the transferring unit, that is, the financially responsible person.

How many copies do you need?

The invoice for the transfer of finished products must be drawn up in two copies:

- one copy remains in the department from which the products will be transferred, after which the accounting department will write off;

- the second is transferred to the department receiving the products, where the receipt is posted.

Filling

The header states:

- Full name of the enterprise.

- Information about the organization.

- OKPO.

- OKDP.

- Number and date.

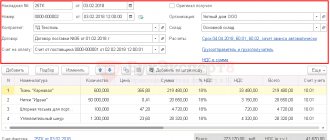

The following is a tabular section containing information such as:

- Name of the transmitting unit with OKDP code.

- Name of the receiving unit with OKDP code.

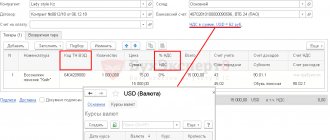

- Accounting entries: subaccount and analytics code.

- Product characteristics:

- Product name.

- Product characteristics.

- The units in which products are measured, as well as the OKEI code.

- Type of packaging.

- Number of products.

- Weight of transferred products.

- Registration prices for products - both per unit of goods and the total amount.

- Quantity and cost of products in words.

- All necessary signatures.

Particular attention should be paid to the header of the document, the name and quantity of products, as well as the signatures of the responsible persons.

If the document is not filled out completely, you may encounter problems during fiscal audits.

Signing the document

The invoice in the MX-18 form must be signed on both sides : by the financially responsible person of the department transferring the product, and by the financially responsible person of the department receiving the product.

Otherwise, if a controversial situation arises, there will be no person who can be held responsible for what happened.

Some organizations also have a person assigned supervisory responsibilities for such transactions. In such cases, this employee also leaves his signature on the document.

The signature is made in the form: indication of position, signature and transcript of the signature. Please note that an invoice without all the required signatures is considered invalid .

Placing stamps

Since 2015, affixing stamps on the primary document has been an optional feature. And if with an external transfer/sale it is better to play it safe and affix stamps, then there is no need to do this in internal documents, such as MX-18.

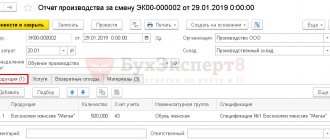

Invoice MX-18: sample filling

In the header of the MX-18 form, be sure to indicate:

- company name and address,

- number and date of document preparation,

- information about where products are transferred from and to,

- information about the product: name, characteristics, quantity, etc.

There is no need to print on the invoice. Form MX-18 must be signed by both financially responsible employees: the one who accepted and the one who received.

A complete example of filling out the MX-18 form can be viewed.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

Filling out the document is not difficult, but sometimes questions still arise. We have answered the main ones.

Who signs the MX-18?

The invoice is signed by financially responsible persons who release and accept finished products.

Do we have to use the unified MX-18 form or can we develop our own?

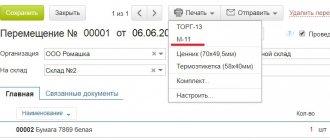

You can make your own invoice template. But in practice, they mainly use the standard MX-18 printing form. You can download it.

Is it necessary to put a stamp on the MX-18 form?

No. There is no space for printing in the document.

Do we need to issue a new sample of the MX-18 consignment note if we made a mistake when filling it out? Or can it be corrected directly in this instance?

Errors in this form can be corrected. Carefully cross it out and write next to it: “Believe the corrected.” The invoice will be considered valid. Please refer to the MX-18 sample form to ensure that no corrections are made.

Can we take into account the movement of materials using the MX-18 form?

No. To move various inventory items (goods, materials, etc.) TORG-13 is used. And only when it is necessary to formalize the movement of finished products, form MX-18 is filled out. (excel) is possible.

You will also find it useful:

TORG-2

TORG-12

Other forms of documents

How long to store?

MX-18 is primary accounting documentation , according to this, like all other primary documents, it should be stored for at least five years.

There are different types of invoices for accounting; we suggest you learn about goods invoices, demand invoices, transport, consignment notes, expenditure and receipts, expenditure and receipts, returns and for the release of goods.

Form MX-18 is the easiest and most accurate way to reflect the movement of finished products within the organization. Filling it out is not difficult, however, it, like filling out any primary documentation, should be treated responsibly in order to avoid further problems.

Invoice for transfer of finished products to storage locations

Based on Federal Law No. 129, the transfer of finished products to warehouse storage may be accompanied by other primary documents that meet legal requirements. For example, acceptance acts, delivery notes, product transfer sheets, etc. can be used.

The main thing is that the form of the document used is approved in the accounting policy of the organization. Form MX-18 fully meets the requirement to contain mandatory details, since it is unified. In addition, it allows you to accurately display the content of the operation being carried out to move manufactured products to the warehouse.

In this regard, its use is most appropriate and will not cause complaints when checked by regulatory authorities.