Importance in the activities of the enterprise

The stability of the enterprise directly depends on the level of provision with material assets. The production process and positive financial results are the main criteria for assessing the availability of resources.

Here it is important to understand what the structure of material assets consists of and what is the share of each individual type in the total value of assets.

There is a calculation formula: Kma = MA: A, where MA is the book value of tangible assets, A is the book value of all assets.

Using this formula, you can understand the level of material assets in the total property of the enterprise.

How is asset accounting carried out at an enterprise?

Depending on the type of activity, there are different types of accounting. Also, financial analysis depends on the taxation system applied to the enterprise. In small companies, the director himself often keeps records; it is not uncommon to turn to specialists who work on an ad hoc basis for help.

Recently, outsourcing services have become popular. Specialists in this field clearly and promptly monitor various changes in legislation and, therefore, are aware of all innovative introductions. This means that such a specialist will be able to provide high-quality and qualified support for accounting for production assets or taking into account the material assets of other enterprise resources.

Even large companies do not neglect outsourcing services, since a regular employee does not always have time to attend all advanced training courses or relevant seminars.

When the work is in the hands of professionals, the manager can be sure that documentation is in order at his enterprise. This means that he can effectively plan his day and react to weaknesses in time.

Structure and types

The following types of MA characteristics are distinguished:

- by degree of reproducibility:

- reproducible (fixed assets, inventories, inventory);

- irreproducible (earth and its subsoil);

- by turnover:

- non-current (out of circulation: fixed assets);

- current (involved in turnover: inventories);

- by degree of liquidity:

- highly liquid (money);

- medium-liquid (accounts receivable less than 12 months);

- low-liquidity (reserves);

- illiquid (fixed assets).

What assets are intangible on the balance sheet?

At first glance, the answer lies on the surface. Intangible assets include intangible assets themselves, as well as intangible search assets. Here and further in our consultation, in order to distinguish the term “Intangible assets” applied to assets accounted for in account 04 “Intangible assets” in accordance with PBU 14/2007, the spelling of assets with a capital letter (Intangible assets) will be used. And for assets in general that do not have a tangible form (which also includes Intangible Assets), lowercase letters will be used.

Let us recall that Intangible assets are the results of intellectual activity and other objects of intellectual property that the organization intends to use in the production of products (performance of work, provision of services) or for its management needs for a period of more than 12 months. One of the criteria for recognizing an object as an intangible asset is precisely the absence of a tangible form (clause “g”, clause 3 of PBU 14/2007). We talked in more detail about the organization’s intangible assets in a separate article.

And intangible exploration assets include the costs of searching, evaluating mineral deposits and exploring mineral resources in a certain subsoil area, which do not relate to the acquisition or creation of an object that has a tangible form (clauses 2, 6 of PBU 24/2011) .

However, the list of intangible assets is not limited to these two types. Intangible assets and intangible search assets, reflected in the balance sheet on lines 1110 and 1130, respectively, are rather the most obvious of them.

But the absence of a tangible form is also typical for other types of enterprise assets.

Such assets include, for example:

- financial investments;

- Deferred tax assets;

- VAT on purchased assets;

- accounts receivable and others.

Fixed assets

Non-current assets are part of the company’s property that has been involved in turnover for more than 1 year and transfers part of its value to finished products.

What applies to non-current assets:

- investments in material assets (rental property);

- fixed assets (equipment, real estate, transport);

- material search assets (transport, equipment for search and exploration work, various structures);

- other (fixed assets to be installed, construction in progress).

Accounting for the costs of searching for various natural resources

MPA, or tangible prospecting assets, are needed to carry out prospecting work and processes for assessing natural resources (places of fossil deposits and others). The funds spent on the search are of a material nature (expression):

- various systems of structures (pipelines);

- special equipment (drilling rig, pump, tank, etc.);

- transport.

In accounting, tangible search assets have a separate line (balance sheet) where they are recorded. There is also a separate account for non-current assets (their investments). The firm determines the types of search costs. The remaining tangible and intangible assets are accounted for as normal activities. Non-current assets relate to a separate subsoil area for which there is a license, and are hereinafter referred to as “exploration assets”.

Search costs are attributed to the creation (purchase) of an object and are called MPA, and all others are intangible search economic resources:

- the right to carry out prospecting work, evaluate and conduct exploration of deposits;

- topography;

- exploration results from drilling and sampling;

- various other geological information about the subsoil;

- assessment of the commercial feasibility of a mining project.

Tangible and intangible funds related to search funds are accounted for in different subaccounts. The accounting unit that takes into account tangible and intangible assets of search directions is determined taking into account fixed assets and intangible resources, respectively.

Accounting for tangible assets

In the balance sheet they are reflected in the subsections “Non-current assets” (by line codes 1140, 1150–1152, 1160, 1190) and “Current assets” (by line codes 1210–1213, 1260).

Accounting for them is kept on accounts 01, 03, 08, 10, 41, 43. All accounts are active, receipts are reflected in debit, and disposals are reflected in credit.

A financial assessment of an enterprise's activities can be obtained from the balance sheet. To do this, you need to correctly and reliably transfer information from accounting accounts.

How are they taken into account?

Accounting for intangible assets follows the principle of current and non-current assets. Negotiable assets are endowed with a property that implies their constant use in the production process or other activities of the enterprise. Non-current assets are reflected in accounting documents, even if they have already been removed from the economic management of the enterprise (turnover). Material assets are accounted for by specially trained people - accountants. They see where the funds were spent, on what and what profit the company received from it.

Basic standard entries for accounting for tangible assets

Purchase:

- Dt 10 Kt 60 – materials were purchased from the supplier;

- Dt 19 Kt 60 – VAT from the supplier is reflected;

- Dt 08 Kt 60 – OS purchased from the supplier;

- Dt 19 Kt 60 – VAT from the supplier is reflected;

- Dt 01 Kt 08 – fixed asset put into operation;

- Dt 60 Kt 51 – the supplier was paid for materials and fixed assets.

Received free of charge:

- Dt 08 Kt 91 – property was accepted for accounting;

- Dt 01 Kt 08 - the property was included in the list of fixed assets.

Depreciation: Dt 20 Kt 02 - depreciation of fixed assets used in production has been accrued.

Repair:

- Dt 10 Kt 71 – the accountable person purchased spare parts for repairs;

- Dt 71 Kt 50 – money was issued from the cash register to the accountable person for spare parts;

- Dt 23 Kt 10 – spare parts transferred for repair;

- Dt 23 Kt 70, 69 – wages and contributions of repairmen;

- Dt 20 Kt 23 - repair work is included in the costs of the main production.

Sale:

- Dt 62 Kt 91 – sale of fixed assets to the buyer;

- Dt 91 Kt 68 – VAT is charged upon sale;

- Dt 51 Kt 62 – payment received from the buyer;

- Dt 91 Kt 99 – profit from the sale of property.

Valuation of tangible assets

When assessing material economic assets, the method of calculating net value (balance sheet) is used. It is the simplest, but has its drawbacks. There are other methods.

To obtain a net value that takes into account tangible production assets, all short-term and long-term liabilities of the company are subtracted from the currency value on the balance sheet. Thus, the cost of equity capital of the company is included. This is the net worth value.

The main drawback in this calculation is the lack of reflection of the potential profit that can be obtained from the assets. In the presence of a high inflation rate, the result of this technique quickly ceases to be realistic. In addition, when valuing fixed assets using this method, the initial cost of tangible assets becomes less by the amount of depreciation. This analysis of the value of funds on the balance sheet, which is taken into account and called residual value, differs significantly from the market value.

Another drawback is revealed when accounting for tangible assets using this method - the book value also includes assets with a high valuation. This is due to their repeated revaluation. At the same time, liquidity is small, since assets are difficult to sell or their sale is impossible. Such economic resources do not have a market valuation, although they are included in the book value of the company.

We described what the assets of an organization are in. Let us recall that assets are economic assets over which an organization gained control as a result of past events and which should bring it economic benefits in the future (clause 7.2 of the Concept of Accounting in the Russian Market Economy). What is the difference between tangible assets and intangible assets, and what belongs to these two groups?

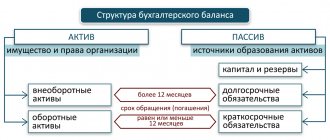

Enterprise assets

From a business perspective, assets are assets that can generate income. In an enterprise, these are: buildings, equipment, raw materials in warehouses, money in accounts, vehicles and much more. In the company's balance sheet, their value is indicated as an asset. The liability contains the sources of formation of this property: bank loans, authorized capital, borrowings, and the like.

The assets of an enterprise are divided into groups based on valuation methods.

Tangible, intangible and financial assets

By form, assets are divided into tangible, intangible and financial. Tangible assets are physical property: equipment, fuel, furniture, buildings, tools, and so on.

Intangible assets are intangible but have value and economic value. This is for example:

- patents, trademarks, intellectual property rights;

- the right to use subsoil;

- licenses and permits;

- formulas, software products, technologies and other similar inventory items.

Financial assets are money and cash equivalents, such as deposits in accounts with financial institutions, loans issued, shares and bonds of other organizations.

The company uses all types of property. At the same time, the role of the intangible component has increased due to the influence of information technology and information in general on business success. The more intangible assets a company uses, the more high-tech product it produces.

Current and non-current assets

Depending on the turnover and the nature of participation in business processes, assets are divided into current and non-current.

The first include those types of property that are fully used during one production or commercial cycle. A striking example of current assets is raw materials for production, which, after processing, turn into finished and by-products. Current assets also include money in the company’s account, which is used to pay wages to employees, purchase raw materials, pay financial obligations, and so on.

Non-current assets do not change shape and are not consumables. They work over several production cycles, gradually transferring cost to the finished product. One type of non-current assets is fixed assets. This is property that has been supporting the production process for a long time:

- buildings and structures;

- cars and other mobile equipment;

- production equipment;

- expensive and long-term used tools, equipment, etc.

Non-current assets also include most intangible assets, long-term loans (issued), leased equipment, securities, deposits and other financial instruments.

Production and non-production assets

If we are talking about an industrial enterprise, then part of the property is directly involved in the production process. This is, for example, a workshop building, a production line, equipment used in production, fuel, raw materials, tools and other similar assets. At the same time, such a company has an administrative building and service units.

Anything that does not physically participate in the production process is called non-productive assets. These include office equipment and furniture, cars, industrial canteen or laundry equipment.

This division of assets is used to calculate direct and indirect costs. The cost of production assets is easy to transfer to finished products, since they are consumed directly in the manufacturing process. To take into account the cost of non-productive assets, formulas are used to calculate indirect costs, and then they are transferred to the cost of finished products.

Own and attracted assets

In the process of work, the company can use both purchased and leased property. Assets purchased with the company's money are called proprietary assets. The assets involved are leased property and cash loans, including leasing.

Attracted assets are inextricably linked with liabilities. The company needs to pay off loans, pay rent and service debt securities. If we talk about rent with subsequent purchase, then after the company pays off its obligations to the lessor, the property moves from the category of attracted assets to its own.

Other types of assets

When assessing assets, they are also divided depending on liquidity:

- absolutely liquid (money);

- highly liquid (short-term receivables and deposits with a short repayment period);

- medium-liquid (finished products, goods, accounts receivable);

- weakly liquid (financial instruments with a long maturity, some types of intangible and non-current assets);

- illiquid (bad receivables, defects, loss).

Based on the sources of formation, the concepts of “gross assets” and “net assets” are used. Gross property includes all types of property, regardless of the means with which they were purchased.

Net assets were acquired using personal funds not raised by the company. To calculate the net asset value, the amount of liabilities is subtracted from the total amount of the company's assets. This indicator characterizes the financial independence of the company and is calculated according to the balance sheet. It displays the actual amount of the organization's own funds.

Understanding the classification of assets and their characteristics allows for a detailed and thorough assessment of the activities of a commercial organization in specific economic indicators. Based on the data from such analysis, management decisions are made, including regarding further business development.

The company's material assets are that part of its own resources that has a material and property form. Such objects have a monetary value, are repeatedly used in activities or are intended for sale in an unchanged form. For example, these are buildings, sites, structures, working machines/equipment, inventory, transport, inventories, finished products and other objects. Let us consider in detail the regulatory features of accounting for tangible assets and typical entries for recording transactions.