Compilation Act of reconciliation of mutual settlements It is usually necessary in the case when two legal entities need to certify transfers made between each other. Most often, such reconciliations are made for specific contracts or invoices; reconciliations are also possible for contracts for a certain time period. It is worth noting that despite the fact that this document is not binding and is created only by mutual agreement of the parties, it is widespread in all areas of activity and is used by most organizations.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

How is reconciliation carried out?

This procedure can be carried out only for one of the following items: name or number of the product, contract, specific delivery, certain period of time. For this document to be reliable, it should be drawn up either after the last transfer or from the moment of delivery. In addition, it is convenient to carry out reconciliation during the annual inventory of the company’s funds and property. Quite often, the results of such checks reveal debts: receivables or payables. If such facts are confirmed, you need to immediately make a reconciliation report and send it to the partner organization.

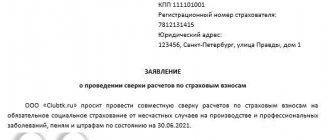

Application for a tax reconciliation report

In case of reconciliation with the Federal Tax Service Inspectorate (IFTS), a request for sending a reconciliation report is also required. If the contents of the reconciliation report correspond to the accounting data of the enterprise, the tax authority is obliged to send the report within 10 days. Often, the organization receives a reconciliation report with the Federal Tax Service within 24 hours via communication channels. If there are discrepancies regarding taxes, penalties and fines, then a reconciliation report is issued within 15 working days with the note “Agreed with discrepancies”.

Rules for drawing up the act

There is no unified, standard form for drawing up an act, so it can be written in free form or according to a template developed at the enterprise. A regular A4 sheet is suitable for filling.

The act must be printed in two copies - one for each of the interested parties.

Both signed and completed copies are sent to the counterparty, whose specialists compare the information from the sent report with the data they have. If there are no objections to the financial transfers specified in the act, all the information matches, then the counterparty signs the documents and returns one copy and keeps the second one.

If necessary, the act can be certified with a seal, but since 2016, the presence of a seal for legal entities is not a legal requirement (however, without a seal, in the event of legal proceedings, the document may be considered invalid).

To ensure that the process of signing the reconciliation report does not drag on, when sending the document you should indicate the time frame within which it must be returned.

Why do you need an act of reconciliation of settlements with counterparties?

A timely and correctly executed act of reconciliation of settlements with counterparties allows you to eliminate errors in accounting and tax accounting.

If the debt reflected in the reconciliation report coincides according to the organization’s data and the counterparty’s data, this means that all business transactions with the specified counterparty are reflected in the accounting records correctly and in a timely manner, including operations for the shipment of goods, provision of services, performance of work, receipt and transfer of funds. funds are not missed or “doubled”.

Thus, the reconciliation act allows not only to identify errors in accounting, but also to avoid disagreements with counterparties.

In addition, if a debtor of an organization signs a document, then he agrees with the state of settlements and expresses his readiness to repay his debt.

The act of reconciling settlements with counterparties also serves as the basis for writing off bad debts after the expiration of their statute of limitations.

The act of reconciliation of settlements with counterparties can be used when going to court in order to collect debt from the counterparty for goods supplied or services provided.

Purpose of drawing up the act

If the information in the document drawn up by the initiator of the reconciliation does not coincide with that available from its counterparty, then the existing discrepancies should be recorded at the end of the document. The same applies to debts: if such facts are revealed, it is necessary to indicate the period during which they should be repaid. Otherwise, the court, if a claim arises, will not be able to take into account the argument regarding the violation of the terms of money transfers.

According to the law, an act of reconciliation of mutual settlements may be grounds for interrupting the three-year limitation period. That is, in cases where the debtor signs a reconciliation report within three years, he is considered to have recognized his debt obligations and is obliged to repay them within the established time frame.

It happens that during the period that has elapsed since the signing of the contract and the fulfillment of obligations, the counterparty has been declared bankrupt. In such situations, accounts payable after a certain time can be written off as expenses of the organization.

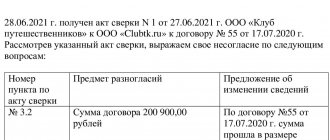

How to draw up and sign a reconciliation report with disagreements

A reconciliation report with disagreements is drawn up if the other party does not agree with the information in the reconciliation report. An example of this is the presence of errors (intentional or not).

The act of disagreement (or protocol of disagreement) is drawn up in free form or according to a template previously established in the organization. At the same time, you can issue the paper in both printed and paper versions. It is important to reflect the key points of the document and sign it.

How to draw up an act of disagreement:

- Write in the header the name and number of the document, indicate the date of preparation, and provide information about the original reconciliation report to which there is an objection.

- Provide information about the parties (names of companies, authorized persons).

- Indicate points with which the company does not agree. You can arrange the main part in the form of a table.

Using the example of the organization Moonlight LLC:

| Item number according to the reconciliation report No. 3 dated March 26, 2019 | Subject of disagreement | Proposal to change information |

| clause 1.2 | Delivery amount 185,000 rub. | According to the accounting data of Moonlight LLC, the delivery amount is 184,500 rubles. |

| clause 2.1 | The amount of receipts to the account is 75,000 rubles. | The amount of receipts according to the accounting data of Moonlight LLC is 73,568 rubles. |

It is allowed to attach contracts, invoices and other documents proving the fact of disagreement to the act.

Protocol of disagreements to the act

The act of disagreement to the act of reconciliation is the same protocol of disagreements. Such a document is drawn up in a similar way. If the company has installed a paper template, a document on disagreements regarding the reconciliation report is drawn up in the prescribed manner. In other cases, the documentation is drawn up in free form indicating:

- information about the initial reconciliation report;

- information about counterparties;

- key information about discrepancies found in amounts and other information;

- signatures of the manager and accountant.

Such a report must be completed (if there are discrepancies) by the accounting accountant assigned to this area of work.

How to correctly sign a reconciliation report with discrepancies

If some discrepancies are found in the received settlement reconciliation report, you can proceed as follows:

- fill out the right part according to your accounting data;

- indicate disagreements below or immediately draw up a protocol of disagreements;

- indicate the final and opening balances in the period under review, the results of calculations, in whose favor the debt exists;

- sign such an act.

You can also indicate discrepancies in the text (some documents are missing, the wrong period of time is covered, or all contracts are not taken into account).

You can separately draw up a protocol of disagreements.

Also an accountant:

- may sign if the discrepancies are minor;

- or vice versa - do not sign at all, but immediately draw up a protocol of disagreements.

In any case, it is necessary to contact the accountant of the second company, identify inaccuracies and errors, and, if necessary, exchange missing documents. Next, when everything is decided, a correct reconciliation act is drawn up (no matter which party) and submitted for signature.

Is a stamp required on the reconciliation report?

Filling out the act requires stamps from each party, but due to the fact that since 2016 such an attribute is not mandatory in the activities of companies, there may be no seals on the act.

However, when considering cases in court, documentation with signatures and seals will be legally significant. Therefore, if it is available in the organization, it is better to put a stamp on the signed acts.

Instructions for filling out the reconciliation report

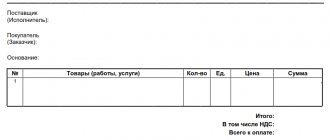

In the “header” you need to enter information about the period for which the reconciliation report is being carried out, and also indicate the agreement that served as the basis for the creation of this document. Here you should enter the name of the companies in accordance with the constituent documents (you can without such details as KPP, INN, OGRN, etc.).

The second part of the document includes a table in which each party enters information contained in its accounting records for transfers under the agreement in question or for a certain period of time. They must match completely. Under the table, each company enters its existing debt. This data must also be the same. If there are no debts, this must be noted in writing.

In conclusion, the document must be signed by the heads of the enterprises, with the obligatory indication of positions and a transcript of the signatures. A document drawn up in accordance with all the rules of office work, if signed by the directors of the enterprises, acquires legal force.

When is a reconciliation report drawn up?

The regulatory documents contain only an indirect indication that it is necessary to draw up a statement of reconciliation of calculations. Thus, paragraph 27 of the Regulations on accounting, approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n, states that before drawing up annual financial statements, it is necessary to carry out an inventory of settlements with all counterparties. Obviously, we are talking about counterparties with whom there were relationships over the last year, as well as those with whom there were no transactions, but there are balances of settlements.

If a reserve for doubtful debts is created in tax accounting, then an inventory of receivables must be carried out at the end of each reporting (tax) period, that is, quarterly or even monthly (clause 4 of Article 266 of the Tax Code of the Russian Federation).

In addition, the inventory of payments can be established by the parent. Deadlines for mandatory reconciliation of settlements may also be included in the agreement with the counterparty.

Settlements reconciliation statement signed by both parties

, is the most reliable confirmation of the balance of settlements with the counterparty. Moreover, if the accounting and reporting reflects a significant amount that is not confirmed by the reconciliation report, then the auditor is unlikely to recognize it.

What is a statement of reconciliation of accounts and how to draw it up?

An act of mutual settlements is an accounting document that falls into the category of optional documents. In it, as the name suggests, both parties to the transaction (for example, the supply of goods or the purchase and sale of other assets) provide their data regarding the total cost of the transaction. If the values for each position (usually in a debit-credit pair) are the same, no further clarification is required; otherwise, either of the counterparties or both at the same time can initiate large-scale proceedings, up to and including filing a claim in court.

The act of mutual settlements is an optional document drawn up at the request of one of the parties to the transaction

Important : there is no single form for the statement of reconciliation of calculations; Unlike documents that are more significant from a legal point of view, for example, a power of attorney to represent the interests of a legal entity, the paper can be drawn up completely arbitrarily. The act can be filled out on a computer and printed (and a ready-made sample can be found at the links below) or written by hand; the main requirement is the readability of the document and the correspondence of the data entered into it with the real state of affairs.

Currently, organizations and private entrepreneurs have the right not to certify the accounting documents compiled by them with seals and stamps: the signatures of the responsible persons (chief accountant, head of department, director of the enterprise, etc.) are sufficient.

See also: OKOGU code - what is it and how to find it out by TIN?

Typically, a statement of reconciliation of calculations is drawn up by a specialist in the accounting department; if the structure does not provide for one (this is especially true for individual entrepreneurs), the form can be filled out and certified by any authorized employee, including those from the list above.

Important : there is no law, decree or regulation requiring “symmetry” of the signatories of the document. Consequently, on the one hand, this may be the chief accountant, and on the other, the managing director; provided that their signatures are authentic, the document will have legal force.

The latter, however, may be called into question during legal proceedings if both or one of the counterparties nevertheless decide not to affix seals or stamps on the document. There is no established judicial practice on this issue: it may well happen that the parties to the dispute, already forced to waste time trying to prove their case, will in addition have to challenge the court’s decision regarding the legal validity of the presented act of mutual settlement. There is no need to spare any effort: a timely impression will help speed up the process in the future.

There are no requirements for the format of the sheet on which the act will be drawn up. It is most rational to use standard A4: in this case, all the headings of the form (you can download it from the link below) and the entered data will be clearly visible; In addition, the standard format gives the parties the opportunity to put a full, legible signature.

Features of document design and use:

- The act of mutual settlements is drawn up in two copies - one for each party. As you might guess, upon completion of the reconciliation, each party retains its own copy with the signature of the counterparty.

- Once completed, the act is printed, signed by an authorized person and sent to the other party of the contact. She, in turn, makes calculations based on the data she has and, if the results match, signs both copies, after which she returns one to the compiling organization.

- In order to speed up the process, the legal entity that is the author of the document can indicate in the cover letter the deadlines within which it must be returned.

- A correctly executed and signed by representatives of both parties (even better - certified by seals) act of reconciliation of calculations can serve as a basis for interrupting the limitation period of three years. If during this time one of the counterparties sent the specified document to the other, and he signed it, the statute of limitations begins to count again.

See also: What is a contract extension (examples of wording and sample)

The procedure for filling out the mutual settlement act:

- The title must indicate:

- name of the document (“Reconciliation Act”, “Settlement Act” and so on);

- reporting period (week, month, year, etc.; for example, “October 30, 2022 - November 30, 2022”);

- full names of counterparties (if necessary, official abbreviated names can be used), usually in the sequence service provider - consumer;

- number and date of conclusion of the agreement that became the basis for drawing up the act.

- The following data is entered into the columns of the table, divided into two equal parts for each side:

- date of the incoming and outgoing transaction (not reconciliation);

- debit and credit (naturally, for counterparties they are in opposite cells);

- total turnover for the specified period (one number);

- balance.

Important: all specified data must match exactly; otherwise, the counterparty who has not received the funds may insist on additional verification or immediately file an application with the court.

- Under the table you need to indicate the current debt according to the results of each party - of course, these values must also be identical. If there is no debt, an appropriate entry must be made.

- The final section is the signatures of responsible persons and, if possible, seals or stamps of counterparty organizations.

Advice : to give the document greater legal force from the point of view of domestic legal proceedings, it must be signed by company leaders (directors, managers, etc.). This condition is not mandatory, but can simplify further proceedings between the parties.

How the act is drawn up

There is no single approved form for the settlement reconciliation act, but you can agree with the counterparty and use any free form that will indicate the details of the primary accounting document provided for in Art. 9 of the Federal Law “On Accounting”. This form can be fixed in an agreement with the counterparty or you can use a free form, for example, from an accounting program.

Particular attention should be paid to signing the act. If the act is not signed by the manager on behalf of the counterparty, then he must have the appropriate authority to do so, confirmed by a power of attorney or other similar document. However, an exception is possible: the authority to sign the act may be apparent from the situation. For example, judicial practice recognizes a reconciliation act as properly executed if it is signed by the chief accountant, whose signature is certified by the organization’s seal (Decision of the Supreme Court of the Russian Federation dated November 30, 2016 in case No. A27-13820/2015). If the act of reconciliation of payments is signed by an unauthorized person, then it will not entail any consequences at all. In particular, it will not serve as evidence of recognition of debt.

See the cheat sheet for drawing up a reconciliation report with recommendations for reflecting information.